Nitheesh NH

We review holiday sales for US retail, analyzing US Census Bureau data and comparable sales updates from major US retailers.

Retail Sales

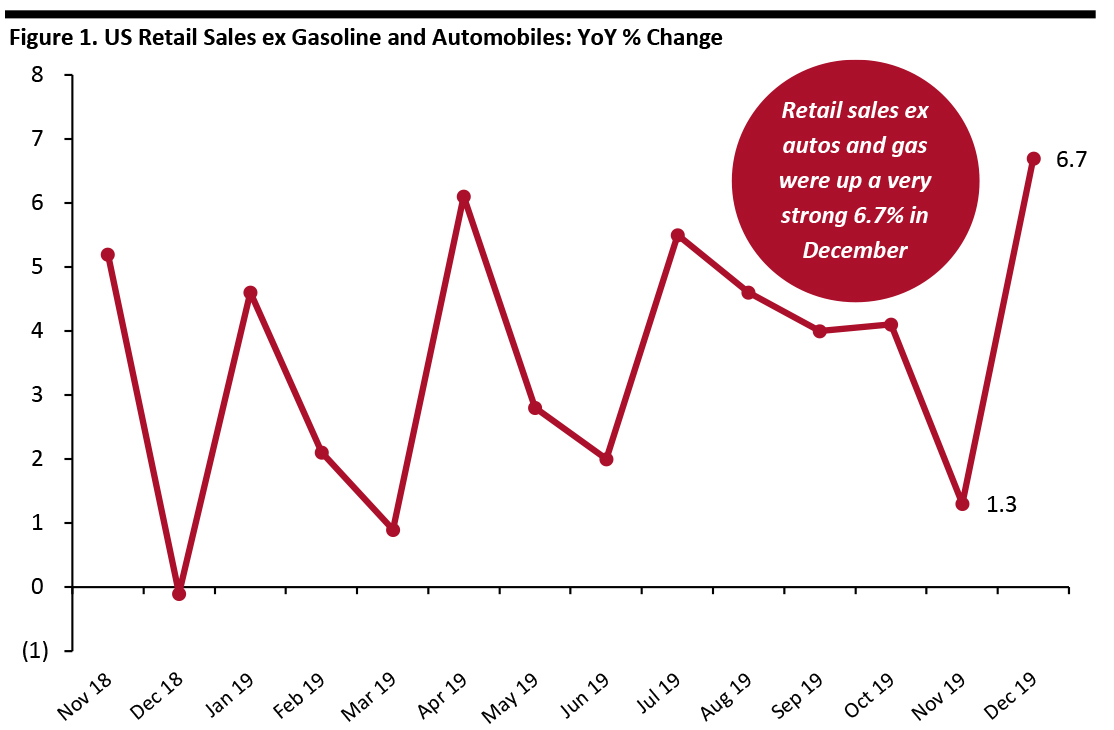

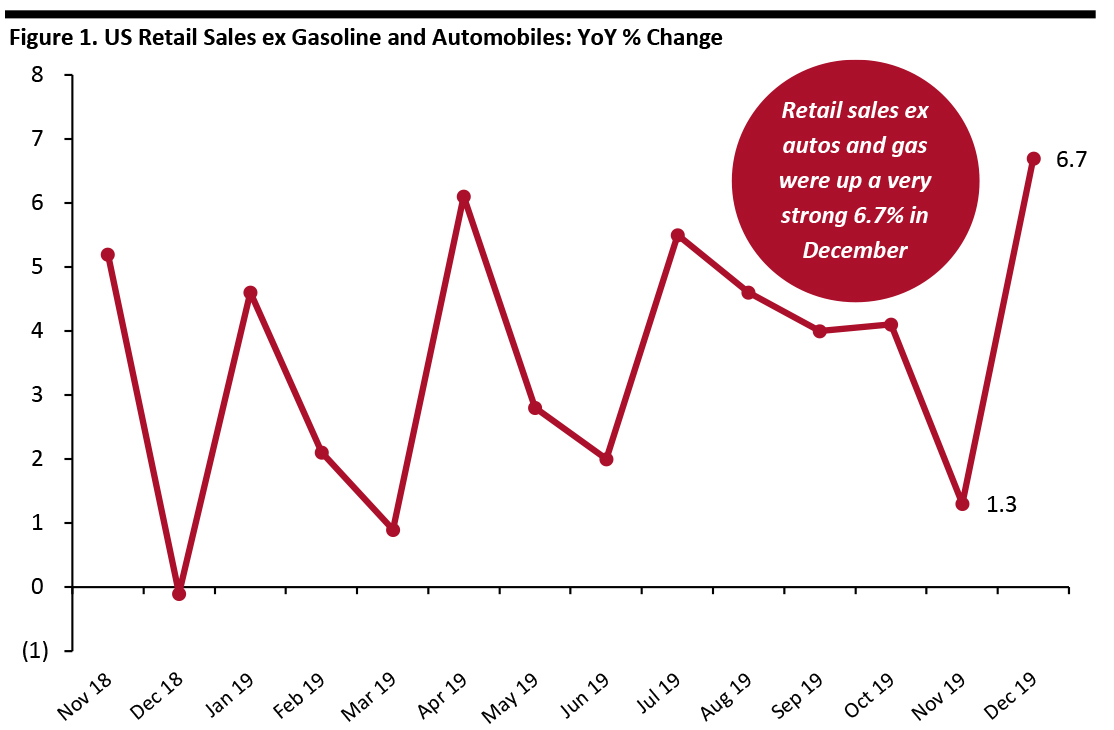

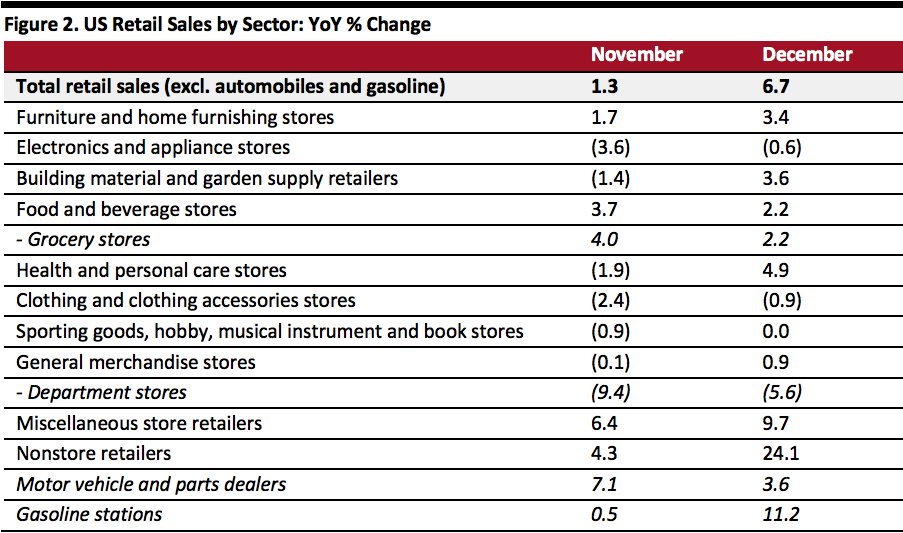

It was a solid holiday season for US retail overall. Retail sales ex automobiles and gasoline climbed 6.7% year over year in December, against undemanding comparatives from a flat December 2018; and this followed a slight, 1.3% rise in November.

In total, holiday-period sales (which we define as November and December) grew 4.1% year over year. This was in line with our expectations of an approximate 4% rise. As ever, gains were not evenly distributed, and we discuss growth by sector later.

[caption id="attachment_102425" align="aligncenter" width="700"] Data is not seasonally adjusted

Data is not seasonally adjusted

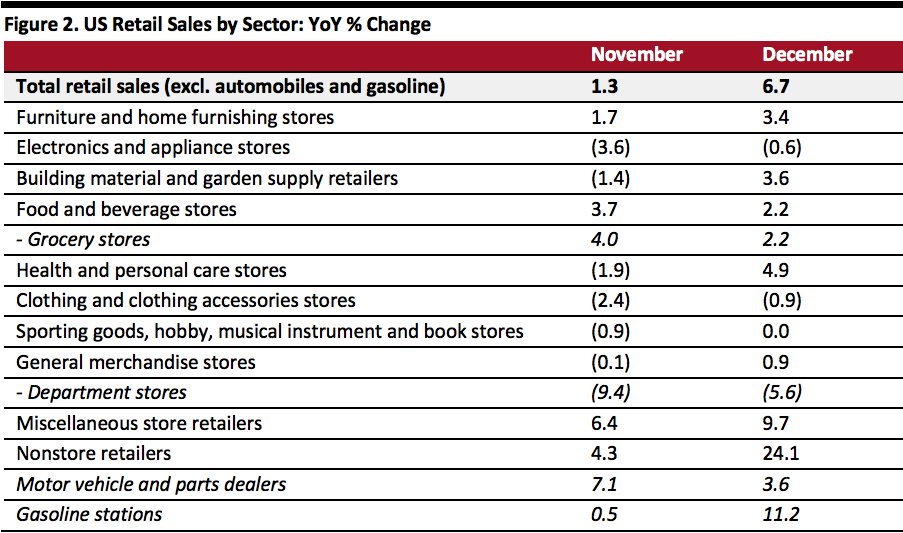

Source: US Census Bureau/Coresight Research[/caption] Retail Sales Growth by Sector Calendar shifts, which pushed Black Friday and Cyber Monday six days later than in 2018, contributed to a sequential acceleration in growth across sectors in December. This uptick was especially evident for nonstore retailers (notably, online-only retailers and mail-order houses) where year-over-year growth of 24.1% in December compared to growth of 4.3% in November. Reflecting structural shifts, it was a much less positive picture for several major store-based sectors: Data is not seasonally adjusted

Data is not seasonally adjusted

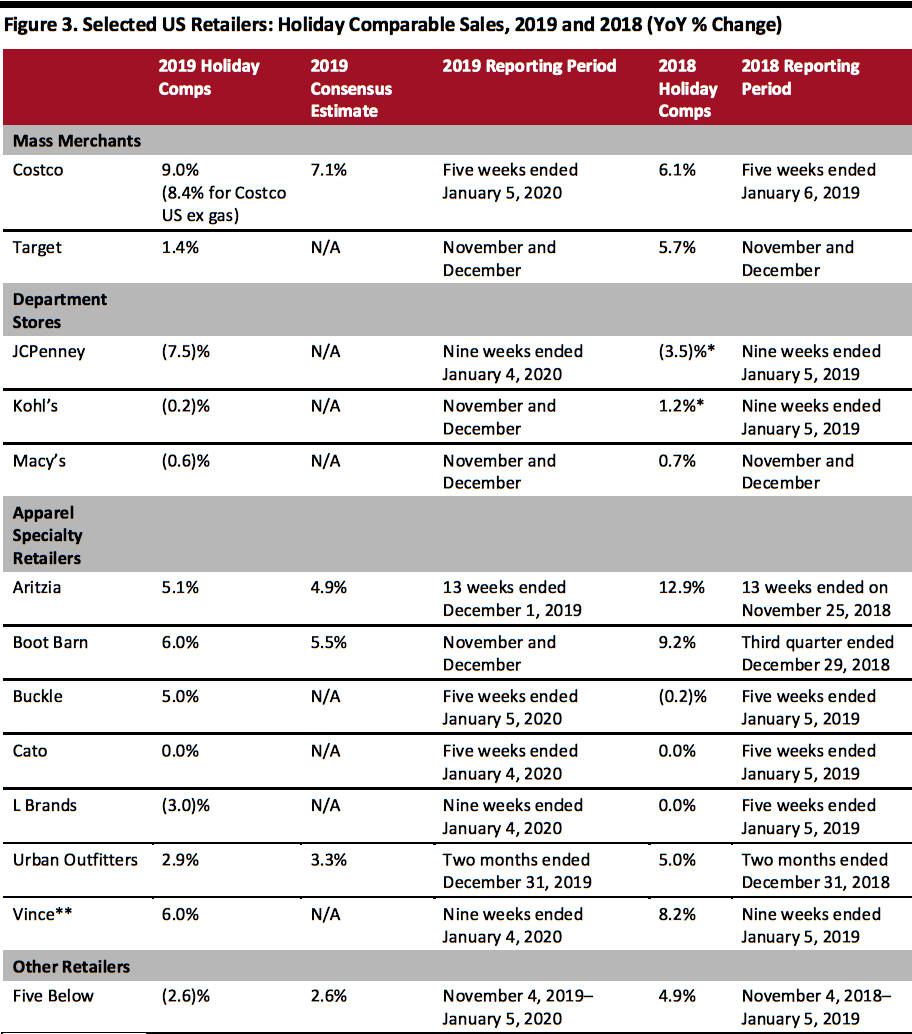

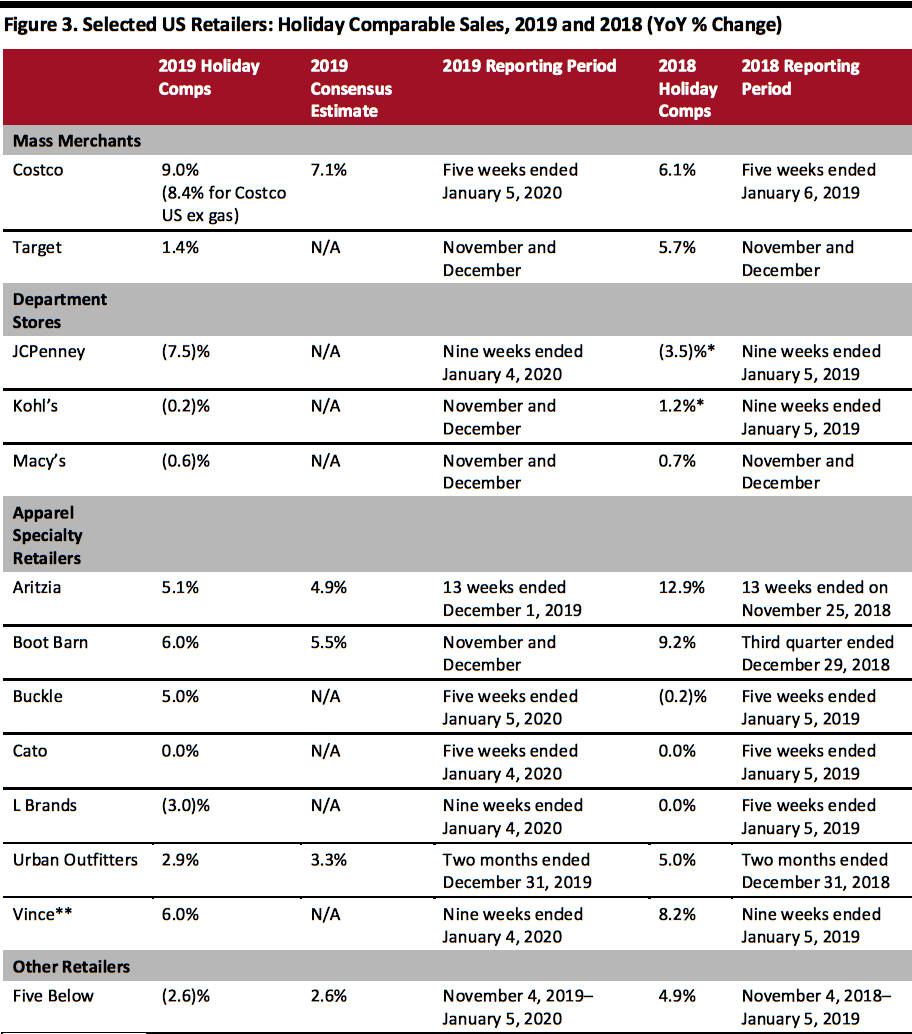

Source: US Census Bureau/Coresight Research[/caption] Major Retailers’ Comparable Sales Growth Among those retailers that have reported sales so far: *On a shifted basis

*On a shifted basis

**Direct-to-consumer

Source: Company reports/Factset[/caption] A number of retailers have not yet reported holiday-period sales: We will publish a fuller wrap-up of retailers’ holiday comps later in January.

Data is not seasonally adjusted

Data is not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Retail Sales Growth by Sector Calendar shifts, which pushed Black Friday and Cyber Monday six days later than in 2018, contributed to a sequential acceleration in growth across sectors in December. This uptick was especially evident for nonstore retailers (notably, online-only retailers and mail-order houses) where year-over-year growth of 24.1% in December compared to growth of 4.3% in November. Reflecting structural shifts, it was a much less positive picture for several major store-based sectors:

- The department-store sector recorded deep year-over-year declines; as we discuss later, three major department-store retailers reported negative comparable sales growth.

- Electronics and appliance stores continued to see sales decline, sustaining a trend seen across 2019.

- Clothing retailers’ sales were negative over the holiday season, as they had been for most preceding months in 2019.

Data is not seasonally adjusted

Data is not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Major Retailers’ Comparable Sales Growth Among those retailers that have reported sales so far:

- Costco posted strong comparable sales growth in December. However, Target saw growth slow, both sequentially and versus last year. Target management noted that its growth was below expectations and pointed to a softer-than-expected performance in categories such as electronics, toys and home.

- We saw further declines at the department stores: JCPenney’s comparable sales slumped 7.5% while comps were down slightly at Kohl’s and Macy’s.

- Specialty retailers such as Aritzia, Boot Barn, Urban Outfitters and Vince showed positive growth, while Aritzia and Boot Barn comps beat consensus.

- Reporting negative comps and acknowledging that sales did not meet its expectations, Five Below management pointed to the shorter holiday season.

*On a shifted basis

*On a shifted basis **Direct-to-consumer

Source: Company reports/Factset[/caption] A number of retailers have not yet reported holiday-period sales: We will publish a fuller wrap-up of retailers’ holiday comps later in January.