DIpil Das

We review UK retail sales and trading updates from major retailers. The data points suggest that it was a weak holiday period overall, with beneficiaries of shifts to e-commerce and discount channels being the exceptions.

Weak Holiday Retail Sales

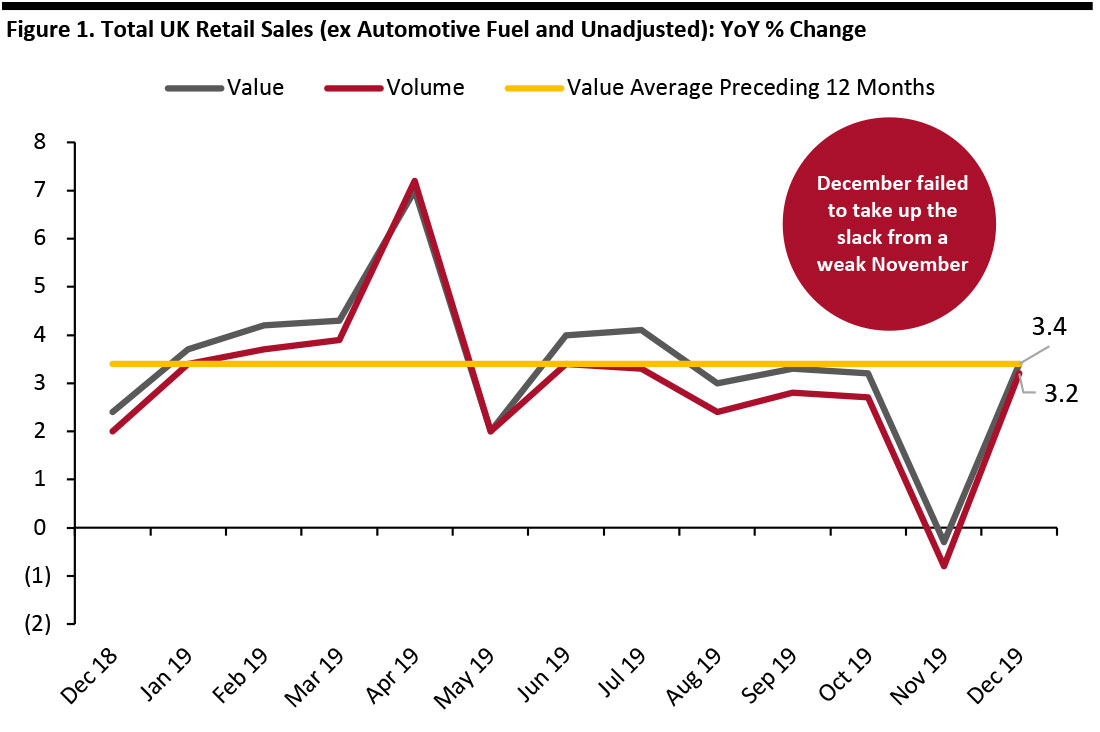

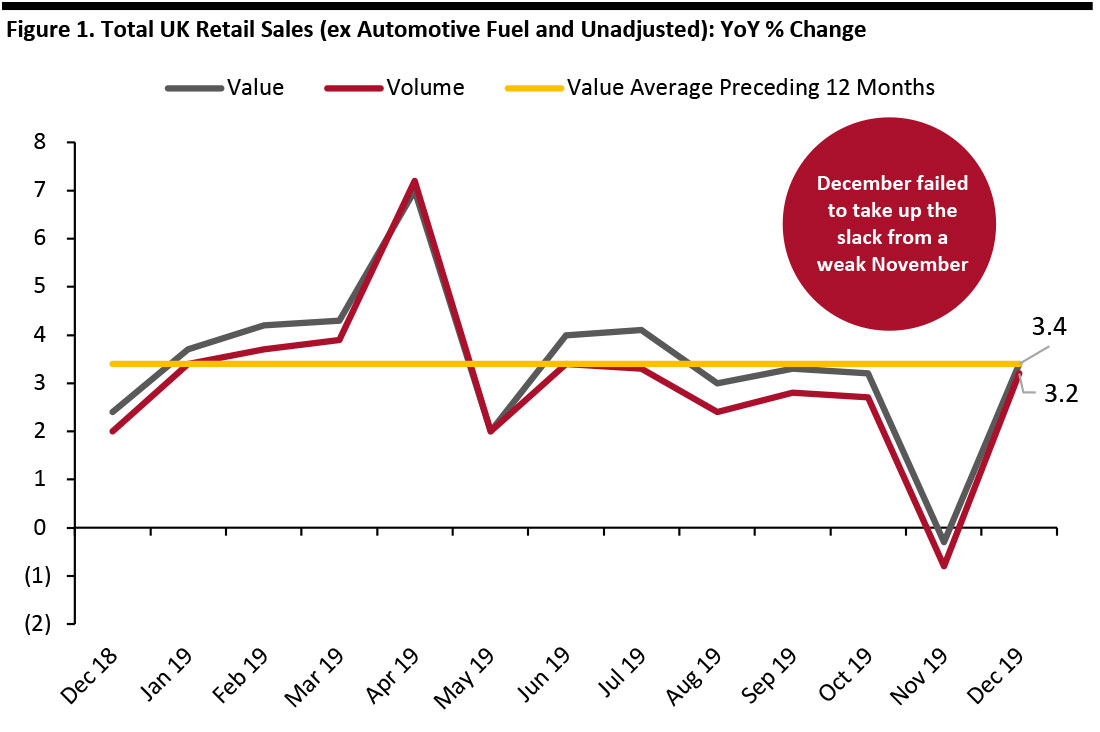

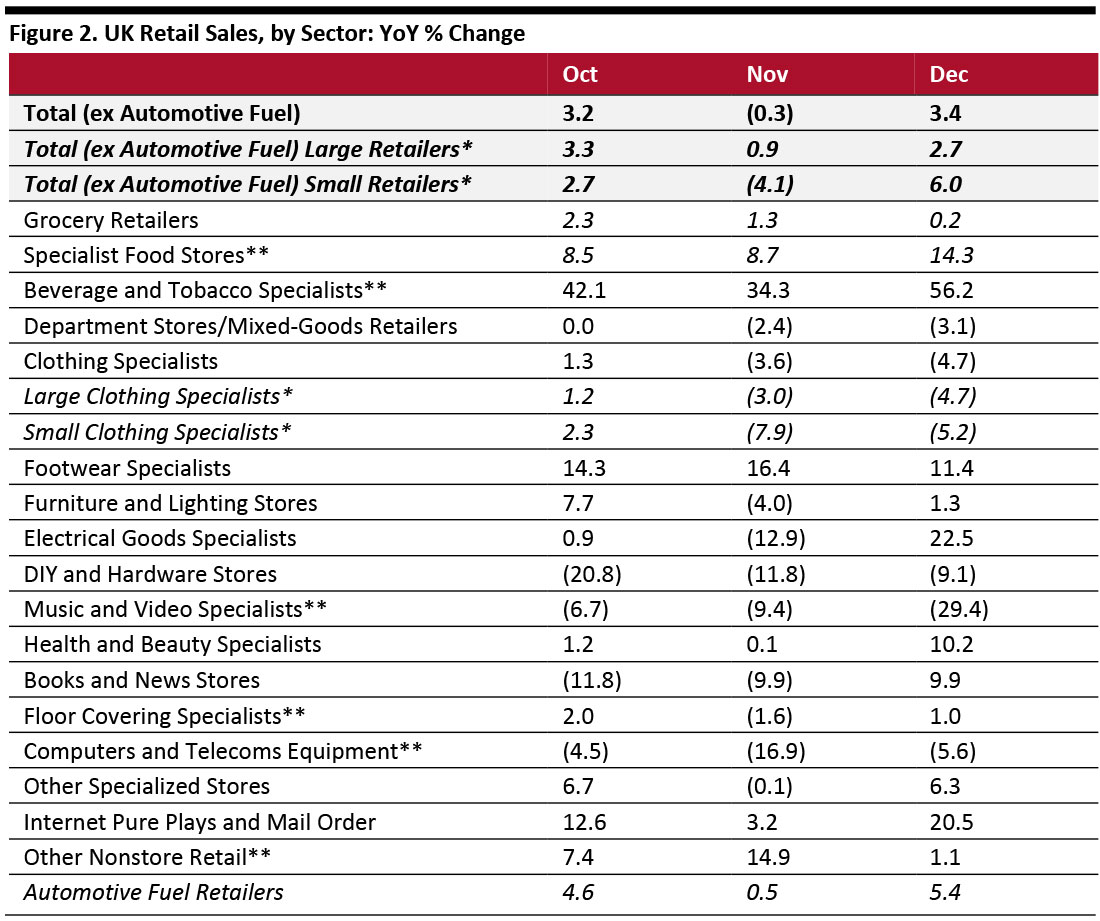

UK retail sales grew 3.4% in December, in line with the average of the preceding 12 months. This followed a very weak November, exacerbated by calendar shifts that pushed Black Friday and Cyber Monday into December according to ONS definitions.

The recovery to average growth in December was not enough to save the holiday season. Total holiday-period growth (November and December in aggregate) came in at a soft 1.9%, versus 3.1% for holiday 2018.

[caption id="attachment_102499" align="aligncenter" width="700"] Data in this report is not seasonally adjusted

Data in this report is not seasonally adjusted

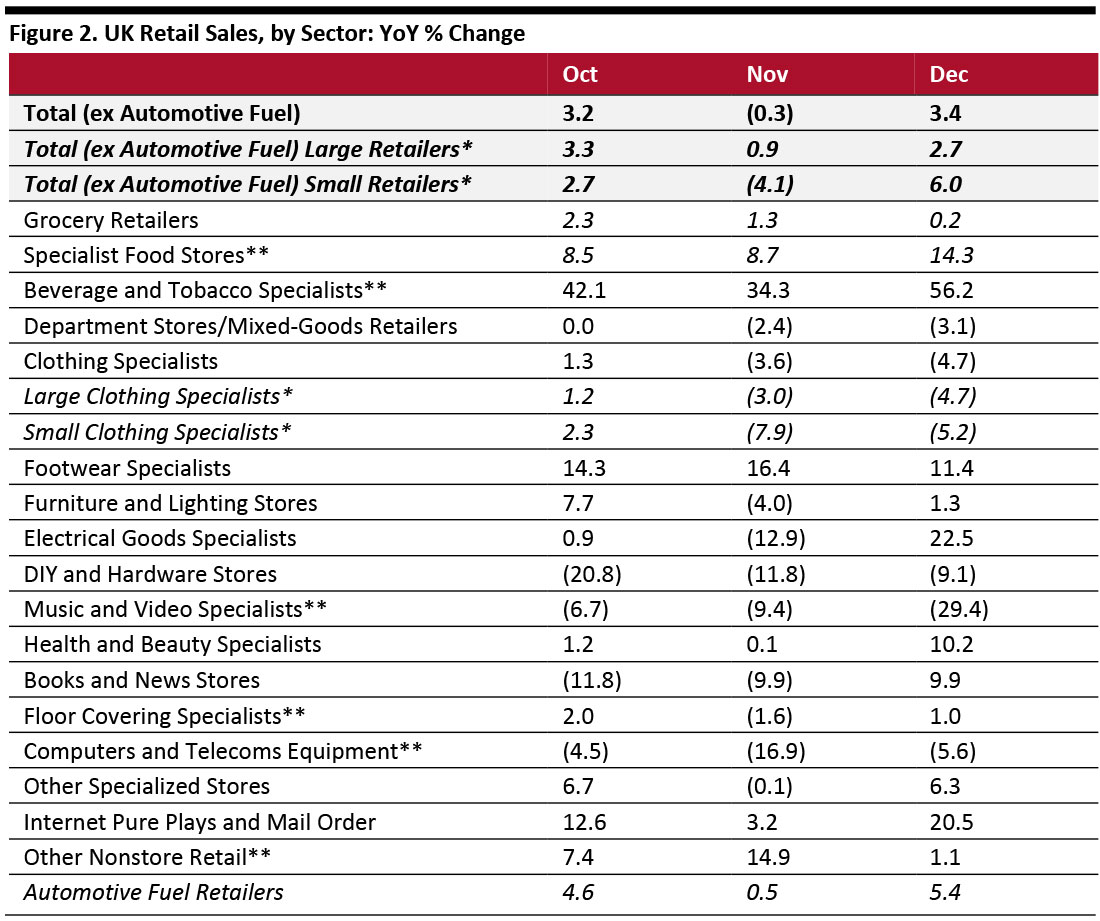

Source: ONS/Coresight Research [/caption] Retail Sales Growth by Sector It was a weak holiday season for several core sectors. Sales fell at department stores and apparel retailers. Store closures by major retailers such as Debenhams and House of Fraser across 2019 may account for a proportion of these year-over-year declines, as sales headed to rival channels (especially online). However, the holiday figures suggest that these structurally challenged sectors saw no relief in the peak holiday period. Even the nondiscretionary grocery sector was weak, and in reporting slower growth in December than in November, the sector bucked the general trend of growth accelerating sequentially. Internet-only retailers were the winners—as we discuss later, this sector comfortably outpaced the total growth in online sales. Health and beauty retailers also saw a strong December, according to the ONS. The electrical-goods sector enjoyed a December boost from Black Friday and Cyber Monday falling in this month (in terms of ONS reporting). Volatility in the ONS data set coupled with structural declines in some sectors continued to be represented in severe falls for some sectors—such as music and video stores and computers and telecoms retailers. We continued to see large rises or falls in the ONS data for fragmented sectors—for example, food and drink specialists and DIY and hardware stores. The ONS recorded shop-price inflation of 0.2% in December, down from 0.5% in November. In December, food-store inflation stood at 1.4%, versus 1.7% in November, and nonfood retailer inflation stood at (0.5)%, versus (0.2)% in October. [caption id="attachment_102500" align="aligncenter" width="700"] *A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

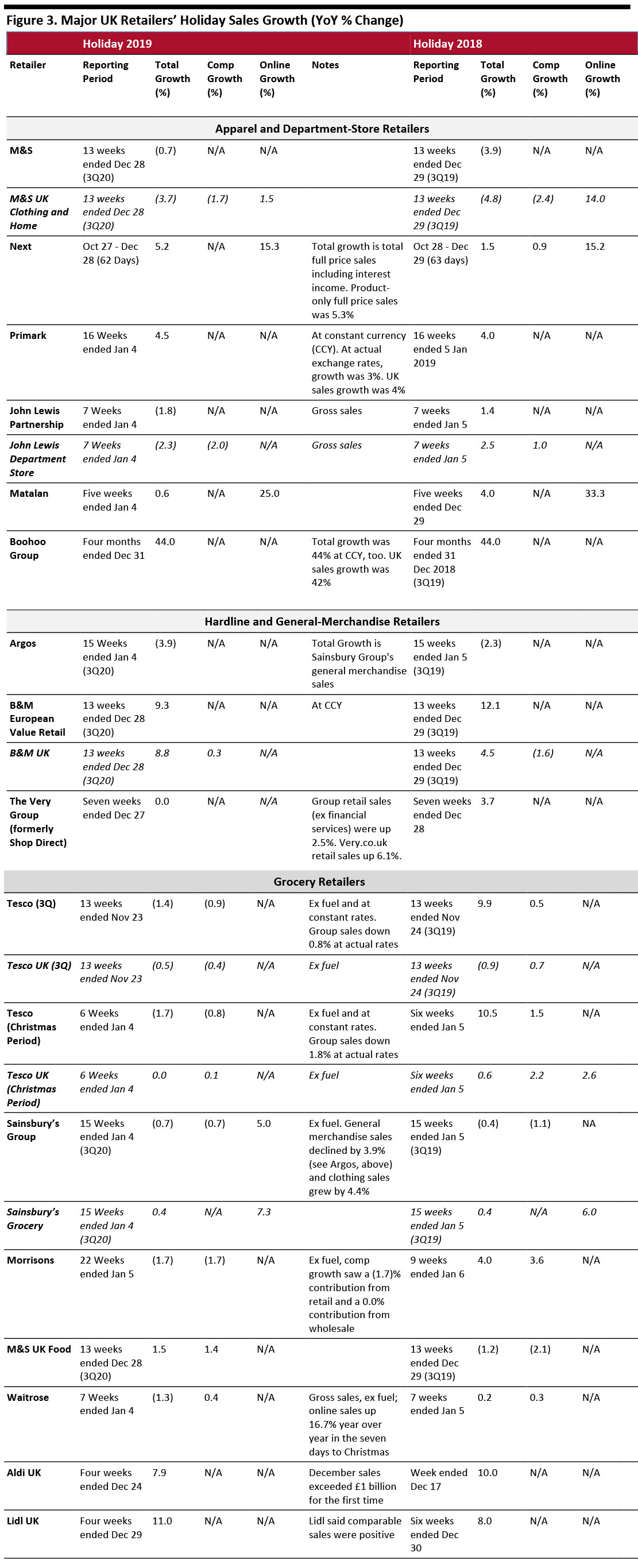

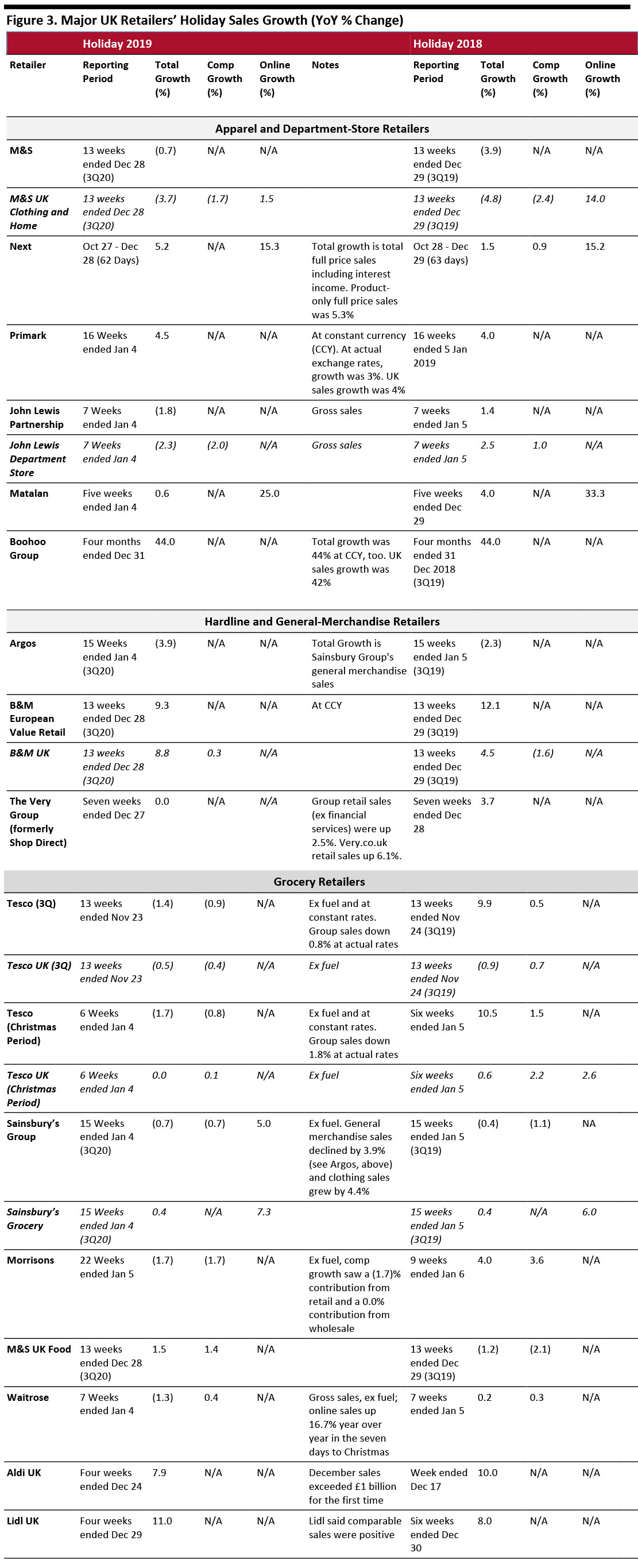

**A relatively fragmented sector, in which reported figures have traditionally been volatile Source: ONS [/caption] Total Internet retail sales were up 11.6% year over year in December, after falling 0.8% year over year in November. In December, Internet sales were down 6.3% at food retailers—the greatest decline for this sector since the ONS began recording online sales (equal with the decline seen in June 2019). Internet sales were up 7.7% at nonfood retailers and up 18.7% at nonstore retailers. This outperformance indicates that Internet pure plays continue to gain share of total online sales. Mixed but Generally Weak Trading Updates Versus 2018, it was a weaker holiday season for a number of nonfood retailers—notably, John Lewis department store, Matalan, Argos, The Very Group (formerly, Shop Direct). Next, Boohoo Group and B&M bucked the trend with strong or improved holiday-season growth. M&S Clothing and Home slowed the decline in its comparable sales, although, given the structural challenges it faces, we are skeptical that this represents a pathway to positive comp growth. Nondiscount grocery was weak, with Tesco hailing a meager 0.1% comp as an outperformance of the market. Sainsbury’s no longer reports comp growth for grocery, and Walmart-owned Asda has yet to report figures. Waitrose’s total sales declined due to store closures, but its comp growth improved slightly versus holiday 2018. M&S Food saw a meaningfully stronger holiday season. Reflecting the structural shifts, e-commerce and discount were the winners. Boohoo Group reported another holiday of 44% growth and raised guidance for full-year revenue growth and adjusted EBITDA margin. Lidl said it recorded double-digit total sales growth in December, fueled by store openings but with unspecified positive comparable sales growth. We note some selectivity among grocery retailers in the period they chose to report, which makes year-over-year comparisons problematic: Source: Company reports/Coresight Research[/caption]

Outlook for 2020

The holiday figures suggest that structurally challenged sectors such as department stores and apparel retailers saw little relief in the holiday peak. The similarly challenged nondiscount grocery segment was soft. We expect the shift to e-commerce and discount formats to continue apace in 2020, meaning these sectors face no letup in competitive pressures. While the greater certainty post election and Brexit could yield a strengthening of retail demand overall, we expect the biggest beneficiaries to be in big-ticket categories, fueled by the release of pent-up demand for categories such as furniture following the softness we saw 2019.

Source: Company reports/Coresight Research[/caption]

Outlook for 2020

The holiday figures suggest that structurally challenged sectors such as department stores and apparel retailers saw little relief in the holiday peak. The similarly challenged nondiscount grocery segment was soft. We expect the shift to e-commerce and discount formats to continue apace in 2020, meaning these sectors face no letup in competitive pressures. While the greater certainty post election and Brexit could yield a strengthening of retail demand overall, we expect the biggest beneficiaries to be in big-ticket categories, fueled by the release of pent-up demand for categories such as furniture following the softness we saw 2019.

Data in this report is not seasonally adjusted

Data in this report is not seasonally adjusted Source: ONS/Coresight Research [/caption] Retail Sales Growth by Sector It was a weak holiday season for several core sectors. Sales fell at department stores and apparel retailers. Store closures by major retailers such as Debenhams and House of Fraser across 2019 may account for a proportion of these year-over-year declines, as sales headed to rival channels (especially online). However, the holiday figures suggest that these structurally challenged sectors saw no relief in the peak holiday period. Even the nondiscretionary grocery sector was weak, and in reporting slower growth in December than in November, the sector bucked the general trend of growth accelerating sequentially. Internet-only retailers were the winners—as we discuss later, this sector comfortably outpaced the total growth in online sales. Health and beauty retailers also saw a strong December, according to the ONS. The electrical-goods sector enjoyed a December boost from Black Friday and Cyber Monday falling in this month (in terms of ONS reporting). Volatility in the ONS data set coupled with structural declines in some sectors continued to be represented in severe falls for some sectors—such as music and video stores and computers and telecoms retailers. We continued to see large rises or falls in the ONS data for fragmented sectors—for example, food and drink specialists and DIY and hardware stores. The ONS recorded shop-price inflation of 0.2% in December, down from 0.5% in November. In December, food-store inflation stood at 1.4%, versus 1.7% in November, and nonfood retailer inflation stood at (0.5)%, versus (0.2)% in October. [caption id="attachment_102500" align="aligncenter" width="700"]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers **A relatively fragmented sector, in which reported figures have traditionally been volatile Source: ONS [/caption] Total Internet retail sales were up 11.6% year over year in December, after falling 0.8% year over year in November. In December, Internet sales were down 6.3% at food retailers—the greatest decline for this sector since the ONS began recording online sales (equal with the decline seen in June 2019). Internet sales were up 7.7% at nonfood retailers and up 18.7% at nonstore retailers. This outperformance indicates that Internet pure plays continue to gain share of total online sales. Mixed but Generally Weak Trading Updates Versus 2018, it was a weaker holiday season for a number of nonfood retailers—notably, John Lewis department store, Matalan, Argos, The Very Group (formerly, Shop Direct). Next, Boohoo Group and B&M bucked the trend with strong or improved holiday-season growth. M&S Clothing and Home slowed the decline in its comparable sales, although, given the structural challenges it faces, we are skeptical that this represents a pathway to positive comp growth. Nondiscount grocery was weak, with Tesco hailing a meager 0.1% comp as an outperformance of the market. Sainsbury’s no longer reports comp growth for grocery, and Walmart-owned Asda has yet to report figures. Waitrose’s total sales declined due to store closures, but its comp growth improved slightly versus holiday 2018. M&S Food saw a meaningfully stronger holiday season. Reflecting the structural shifts, e-commerce and discount were the winners. Boohoo Group reported another holiday of 44% growth and raised guidance for full-year revenue growth and adjusted EBITDA margin. Lidl said it recorded double-digit total sales growth in December, fueled by store openings but with unspecified positive comparable sales growth. We note some selectivity among grocery retailers in the period they chose to report, which makes year-over-year comparisons problematic:

- Morrisons reported for 22 weeks ended January 5 this year, versus just nine weeks for 2018.

- Aldi reported for the four weeks ended Christmas Eve for holiday 2019, compared to just one week for holiday 2018.

- Lidl reported for four weeks this year versus six weeks for 2018.

Source: Company reports/Coresight Research[/caption]

Outlook for 2020

The holiday figures suggest that structurally challenged sectors such as department stores and apparel retailers saw little relief in the holiday peak. The similarly challenged nondiscount grocery segment was soft. We expect the shift to e-commerce and discount formats to continue apace in 2020, meaning these sectors face no letup in competitive pressures. While the greater certainty post election and Brexit could yield a strengthening of retail demand overall, we expect the biggest beneficiaries to be in big-ticket categories, fueled by the release of pent-up demand for categories such as furniture following the softness we saw 2019.

Source: Company reports/Coresight Research[/caption]

Outlook for 2020

The holiday figures suggest that structurally challenged sectors such as department stores and apparel retailers saw little relief in the holiday peak. The similarly challenged nondiscount grocery segment was soft. We expect the shift to e-commerce and discount formats to continue apace in 2020, meaning these sectors face no letup in competitive pressures. While the greater certainty post election and Brexit could yield a strengthening of retail demand overall, we expect the biggest beneficiaries to be in big-ticket categories, fueled by the release of pent-up demand for categories such as furniture following the softness we saw 2019.