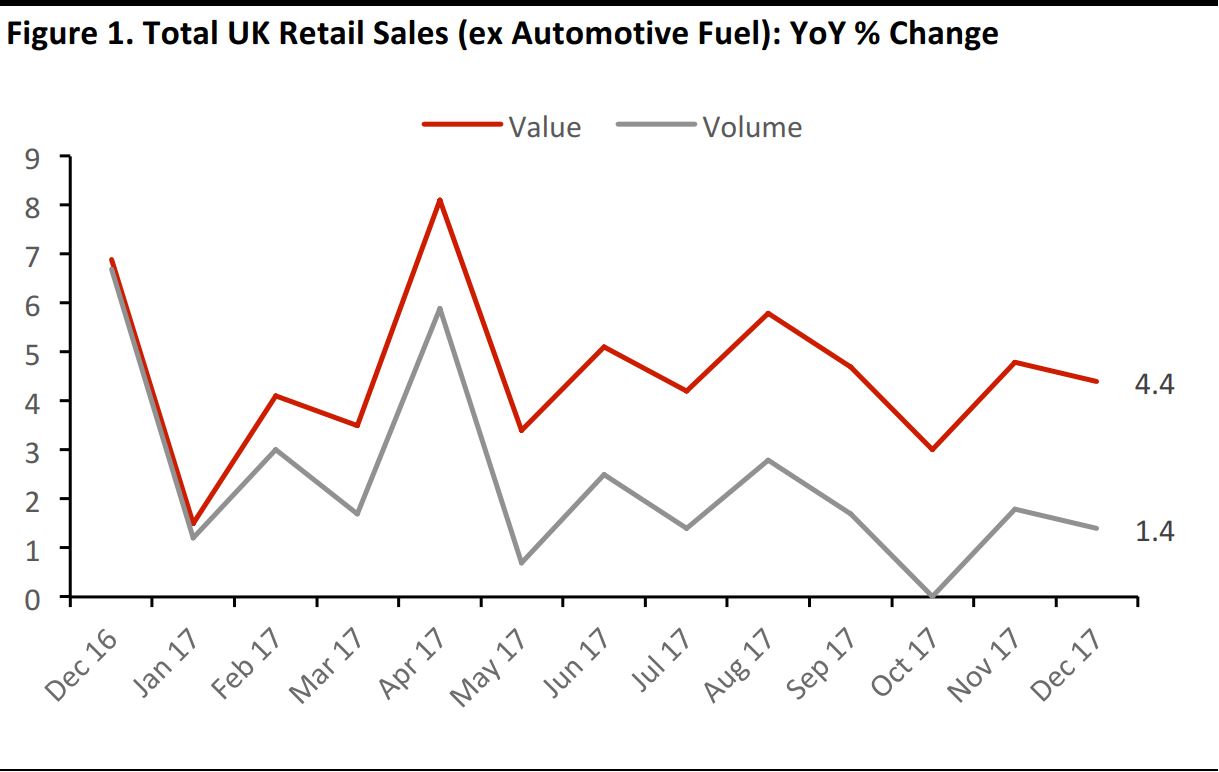

December Retail Sales Grow by 4.4%

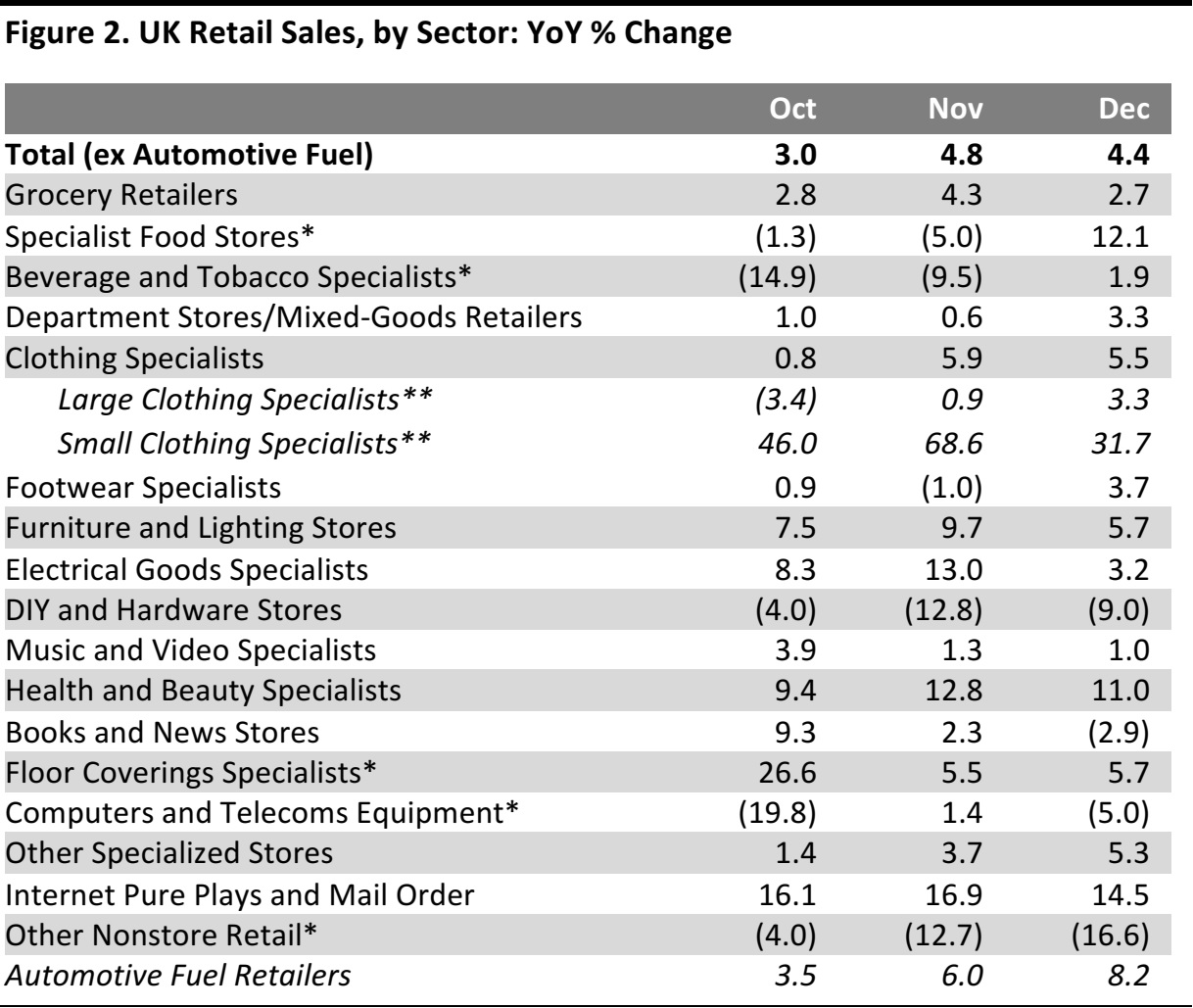

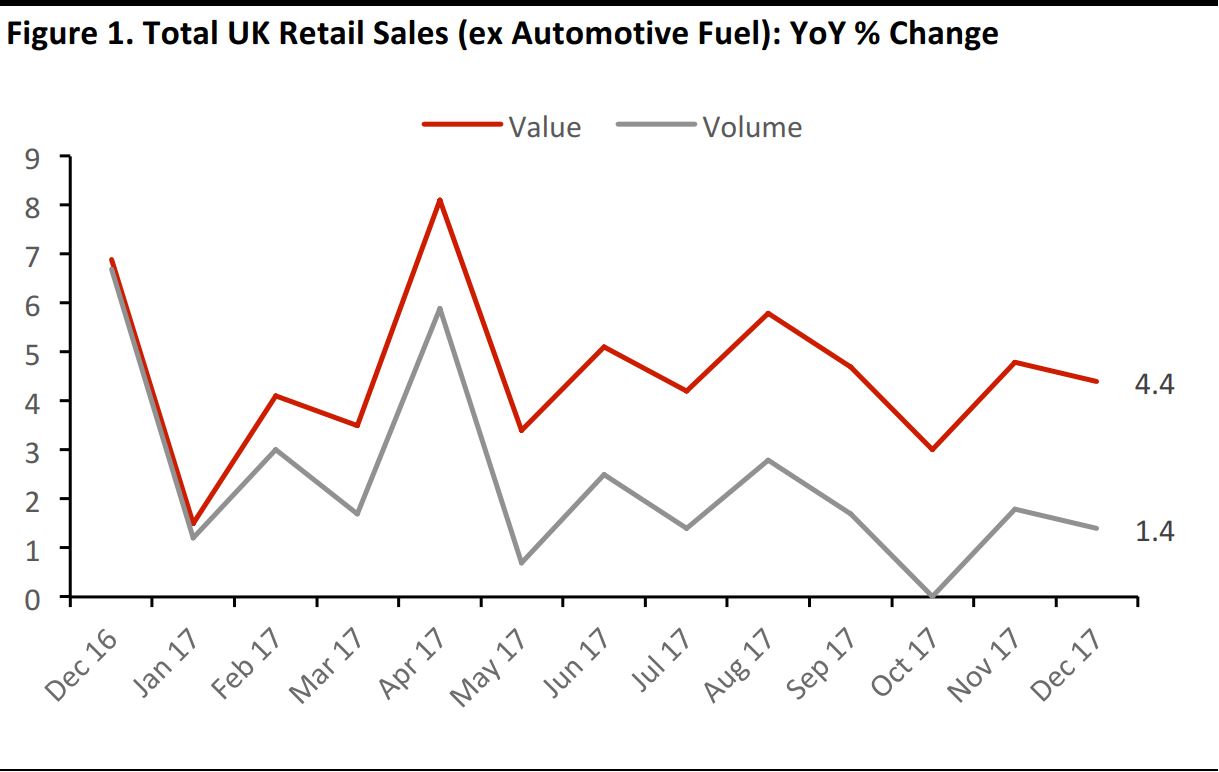

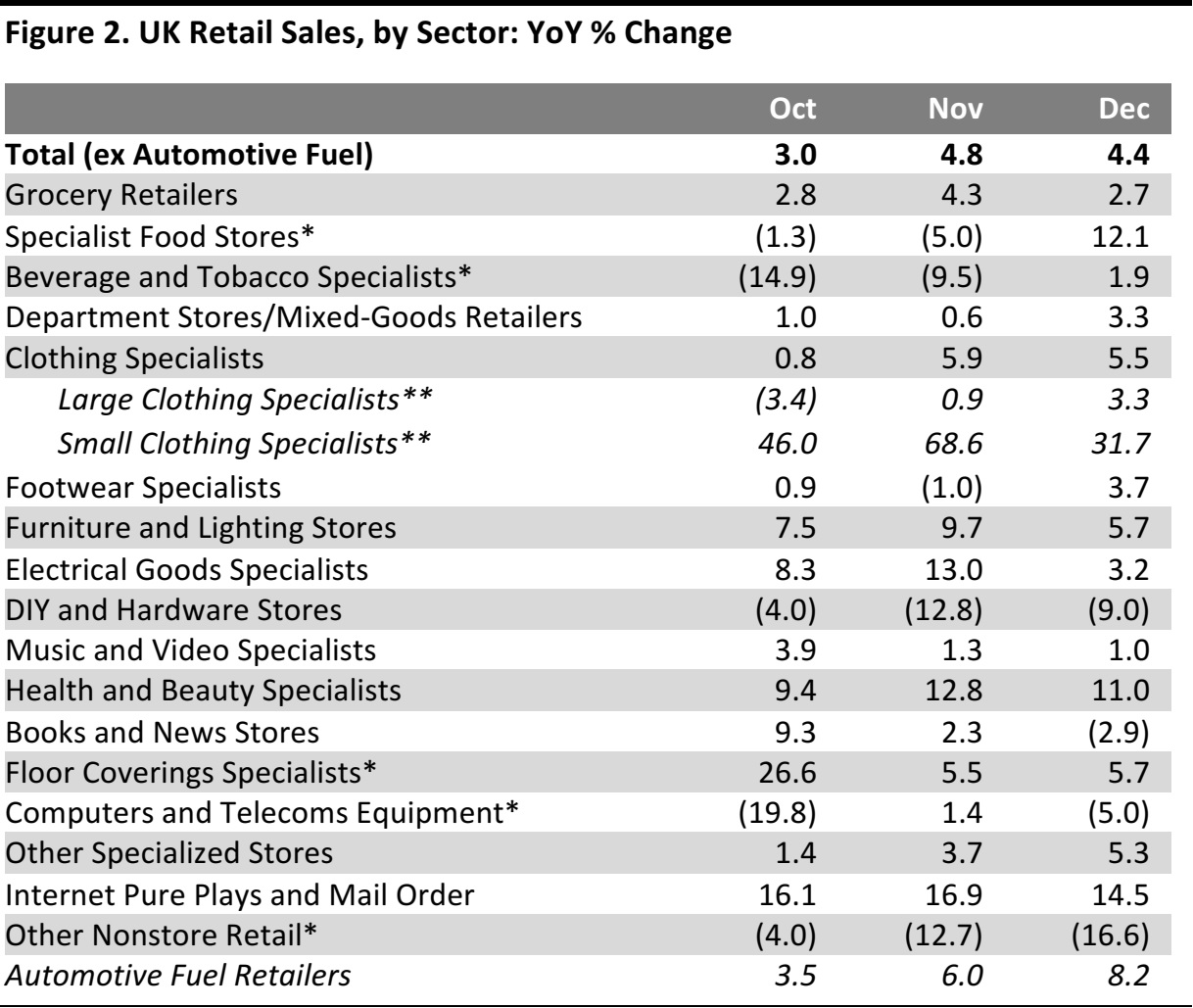

UK retail sales climbed by a solid 4.4% year over year in December 2017, according to the Office for National Statistics (ONS), supported by clothing stores and department stores/mixed-goods retailers.

Total, weighted November and December sales growth of 4.6% year over year was in line with

FGRT’s holiday forecast of approximately 5% growth. Grocery sector growth across November and December was in line with our forecast of 3.3%. Growth at nonfood retailers and Internet pure play retailers came in a little shy of our expectations, as discretionary spending softened over the period.

The industry achieved this sales growth against demanding comparatives from a very strong holiday 2016 period.

Shop-price inflation stood at 2.9% in December, down from 3.0% in November. In December, prices were up 3.6% year over year at food retailers and up 2.4% year over year at nonfood retailers.

Data in this report are not seasonally adjusted.

Source: ONS

Online retail sales were up 9.4% year over year in December versus 10.4% in November.

December sales were solid, and certainly well ahead of many doom-laden forecasts that had called for weak holiday sales. Improved growth at large clothing retailers, which comprise the bulk of the clothing sector, contributed to the strength of total retail sales.

Black Friday is still a relatively new event in the UK, and it appeared to pull further discretionary sales from October and December into November. Sales at Internet pure plays and mail order retailers grew at a double-digit pace in December, but more slowly than in previous months. Big-ticket sectors such as furniture and electrical goods saw a sequential softening of growth in December. Grocery store growth slowed, too.

*A relatively small or fragmented sector, where reported figures have traditionally proved volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60

million or less per year; all others are large retailers.

Source: ONS

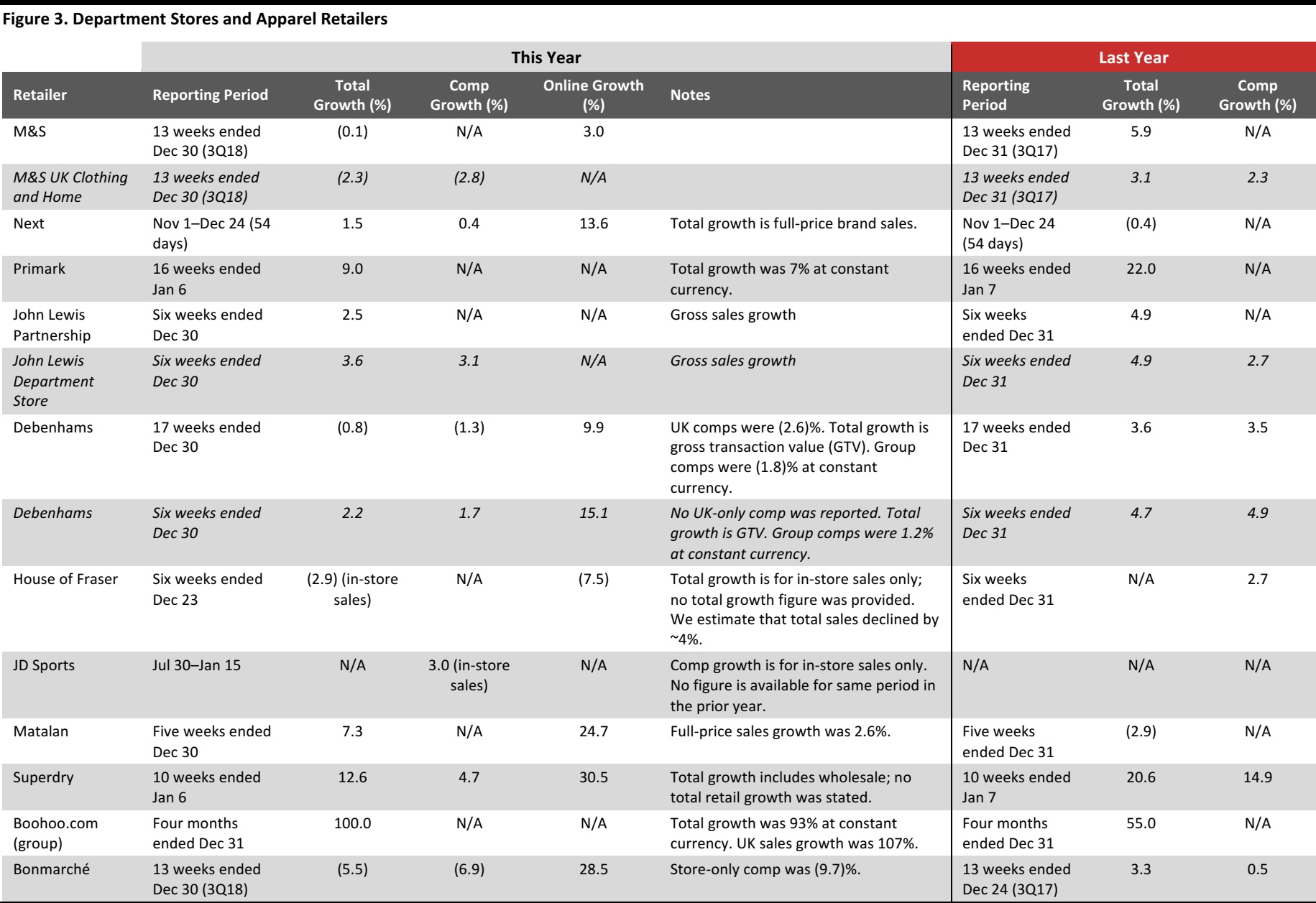

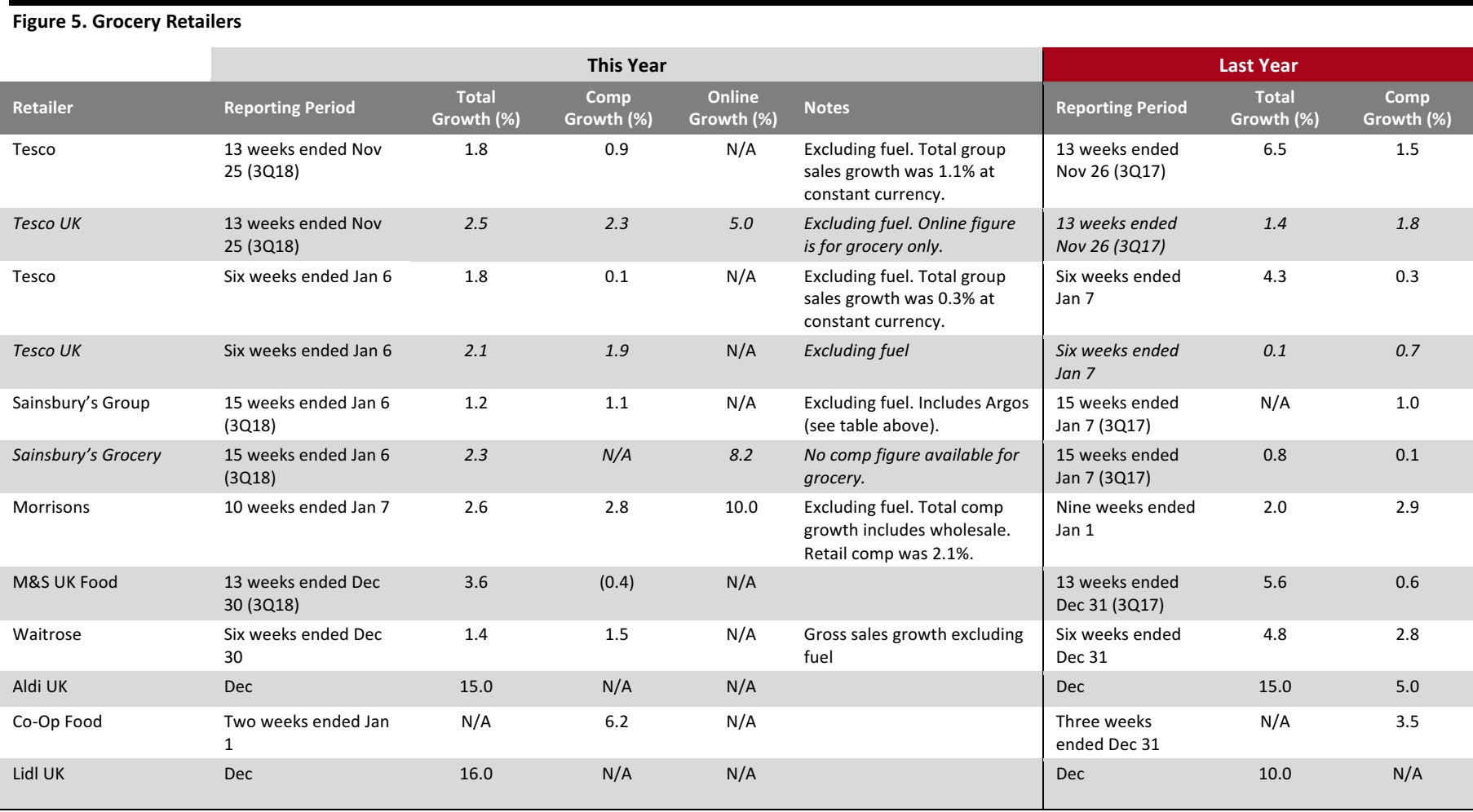

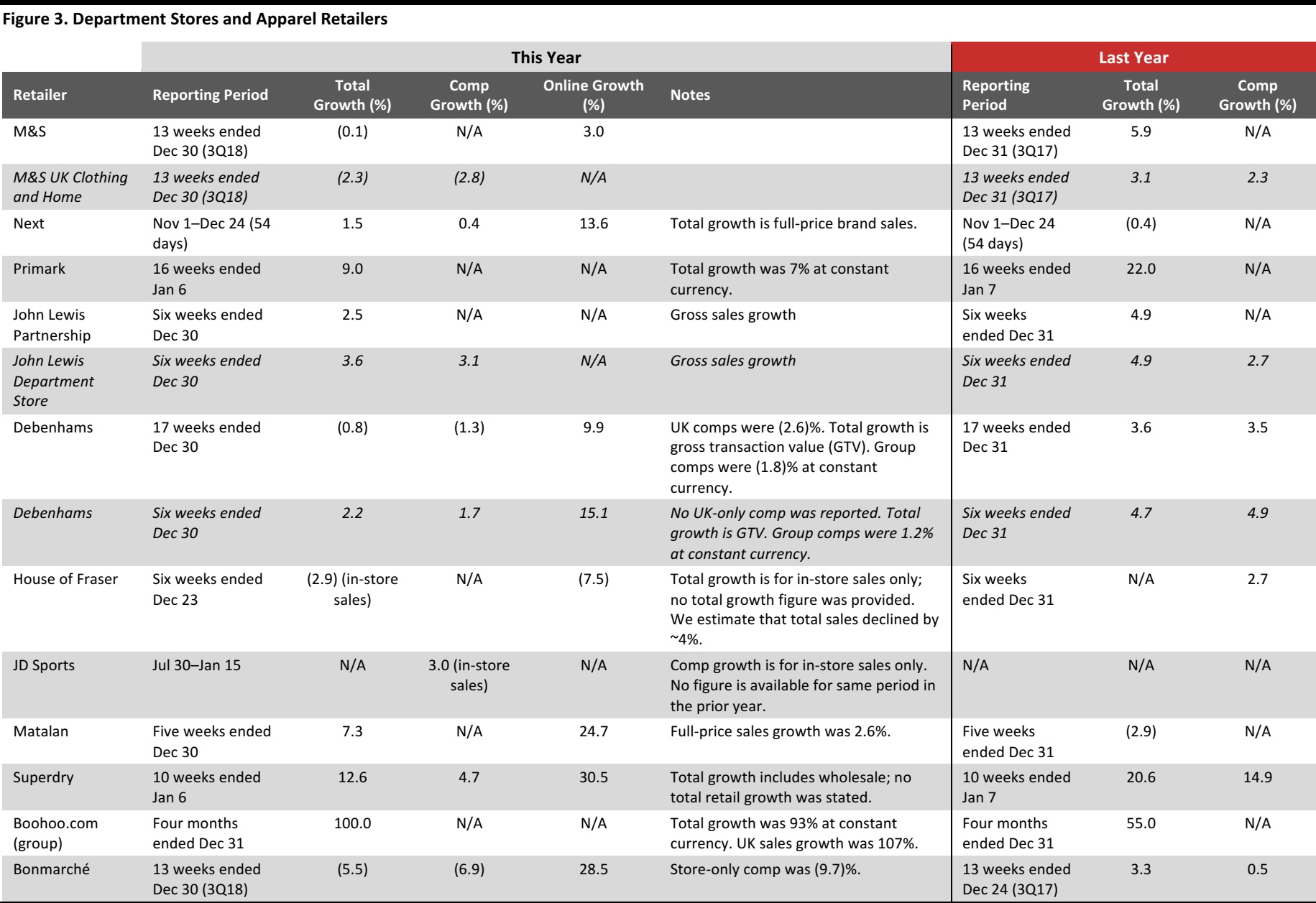

Retailers’ Trading Updates Suggest Structural Winners Are Accelerating Their Gains

Coverage of Christmas trading in the UK has been dominated by gloomy headlines of certain retailers’ weak top-line growth and profit warnings from Debenhams, Mothercare and Carpetright. However, this narrative focuses on legacy, midmarket generalists that are

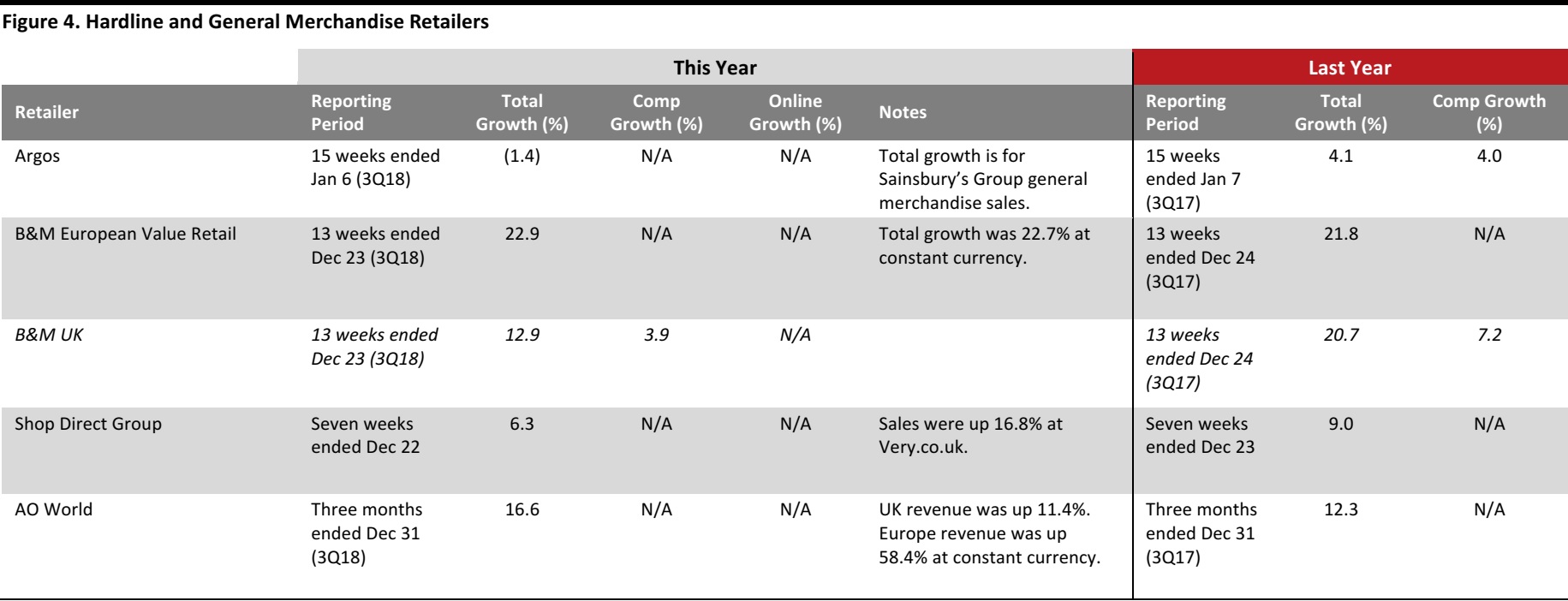

losing sales to an abundance of more sharply positioned rivals. In fact, Christmas trading updates suggest that a number of structural winners—particularly in the discount and e-commerce segments—are accelerating their gains even as they mature, a process that should, in theory, prompt a slowing of growth:

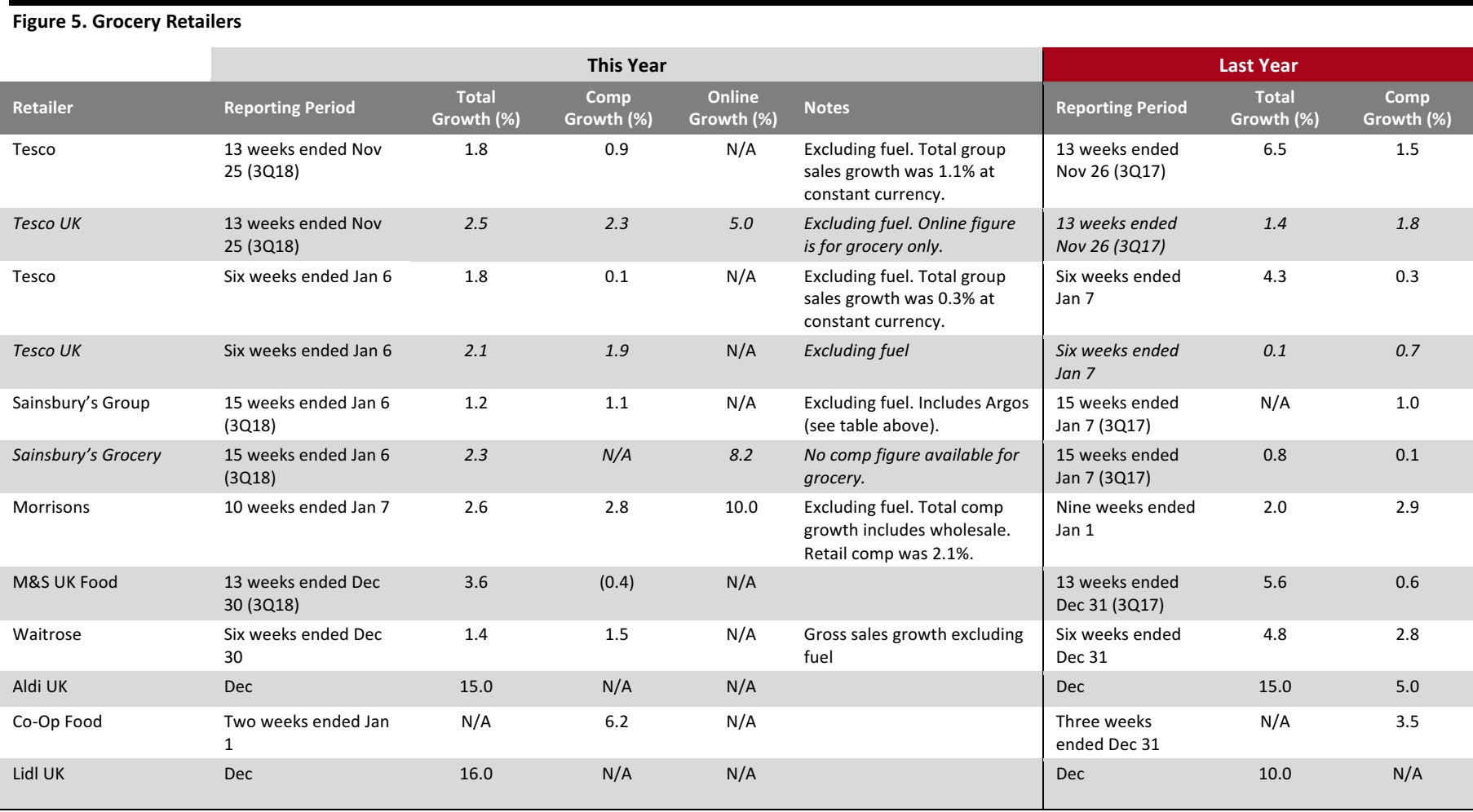

- Lidl reported that its December 2017 sales were up 16% year over year versus 10% in the prior-year period. Aldi said that it increased its sales by 15% year over year in December 2017, in line with its reported growth in December 2016—although market-share measurement service Kantar Worldpanel reported that year-over-year sales growth at both Aldi and Lidl strengthened meaningfully over the holiday period.

- com almost doubled its revenue growth rate year over year, and it did double its sales (albeit helped by its PrettyLittleThing and Nasty Gal acquisitions).

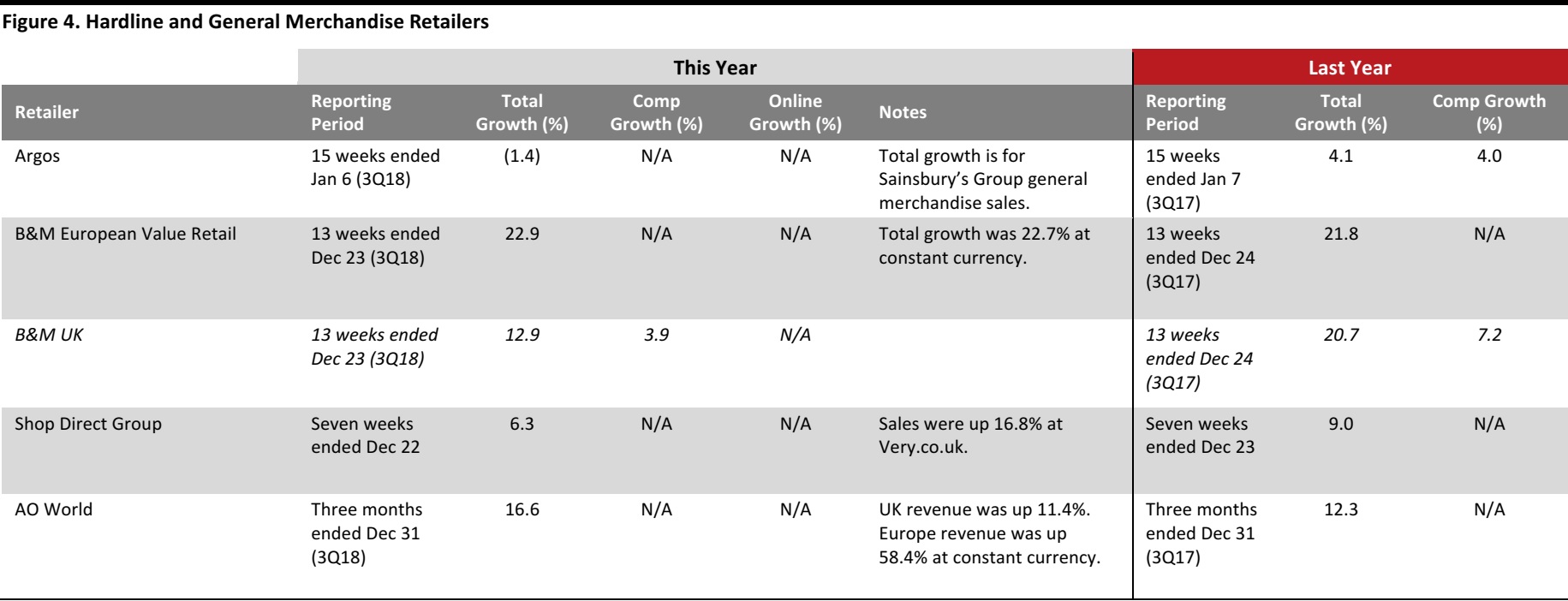

- AO World strengthened its UK holiday sales growth year over year, while B&M European Value Retail and Shop Direct were among those posting very solid figures.

- JD Sports announced a profit upgrade, as it did at the same time in the prior year.

In the grocery sector, all the major retailers except Marks & Spencer (M&S) and Waitrose posted UK holiday sales growth that was ahead of, or in line with, that reported one year earlier, supported by raised food-price inflation.

We round up holiday trading performance for major UK retailers in the tables below. For comparison purposes, we provide figures for the prior holiday season, too. We divide our wrap-up into three tables: department stores and apparel retailers, hardline and general merchandise retailers, and grocery retailers. All figures in the tables are for group revenues including non-UK operations (where relevant), unless otherwise stated.

Retailers still to report at the time of writing include electronics retailer Dixons Carphone (reporting January 23), apparel retailer N Brown (also reporting January 23), fashion retailer ASOS (reporting January 25) and Walmart-owned Asda (reporting February 20).

Source: Company reports

Source: Company reports

Source: Company reports