A Bumper Holiday Period

It was the bumper festive season that we expected. We were the only retail research firm to publicly forecast a strong Christmas period, and data from the Office for National Statistics (ONS) have joined a slew of trading updates to confirm the strength of holiday trading.

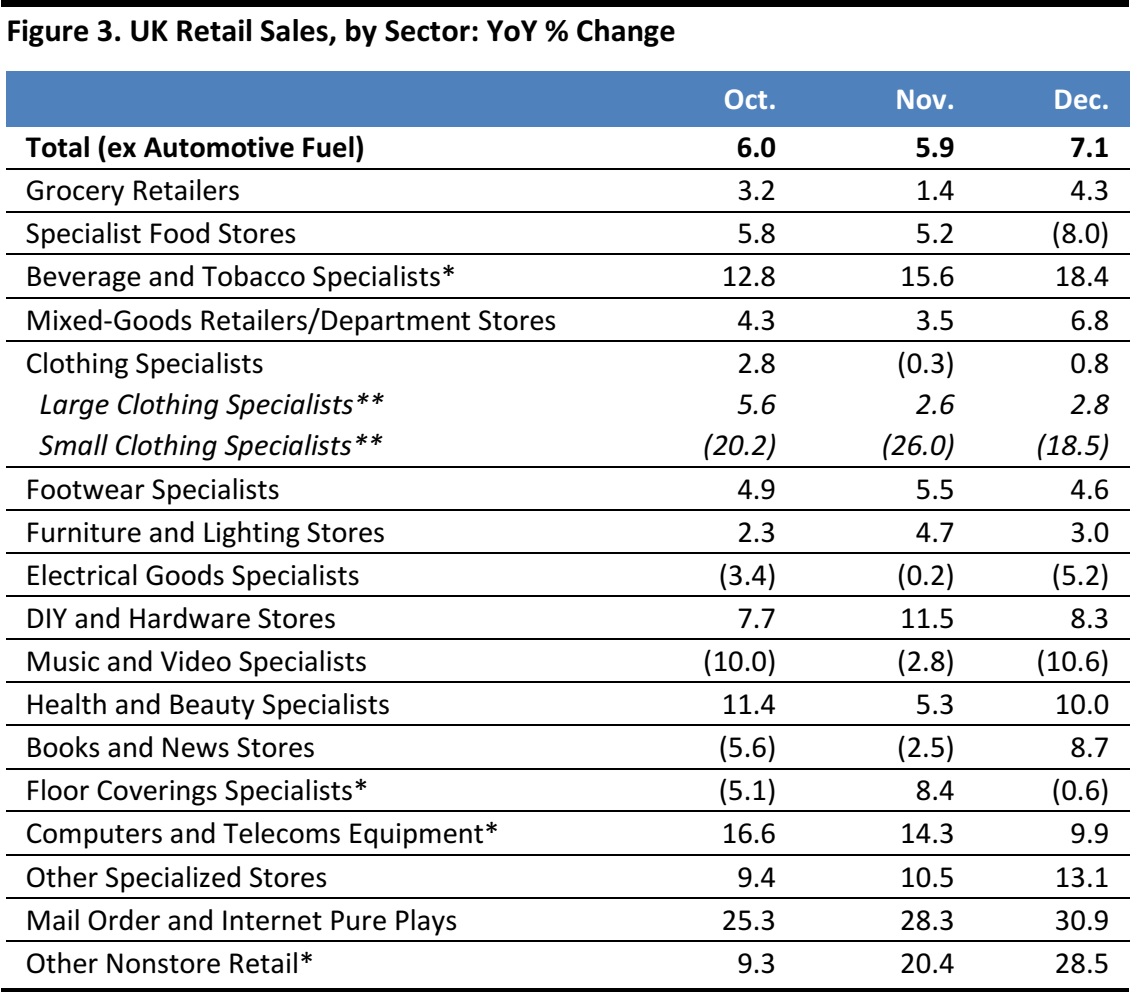

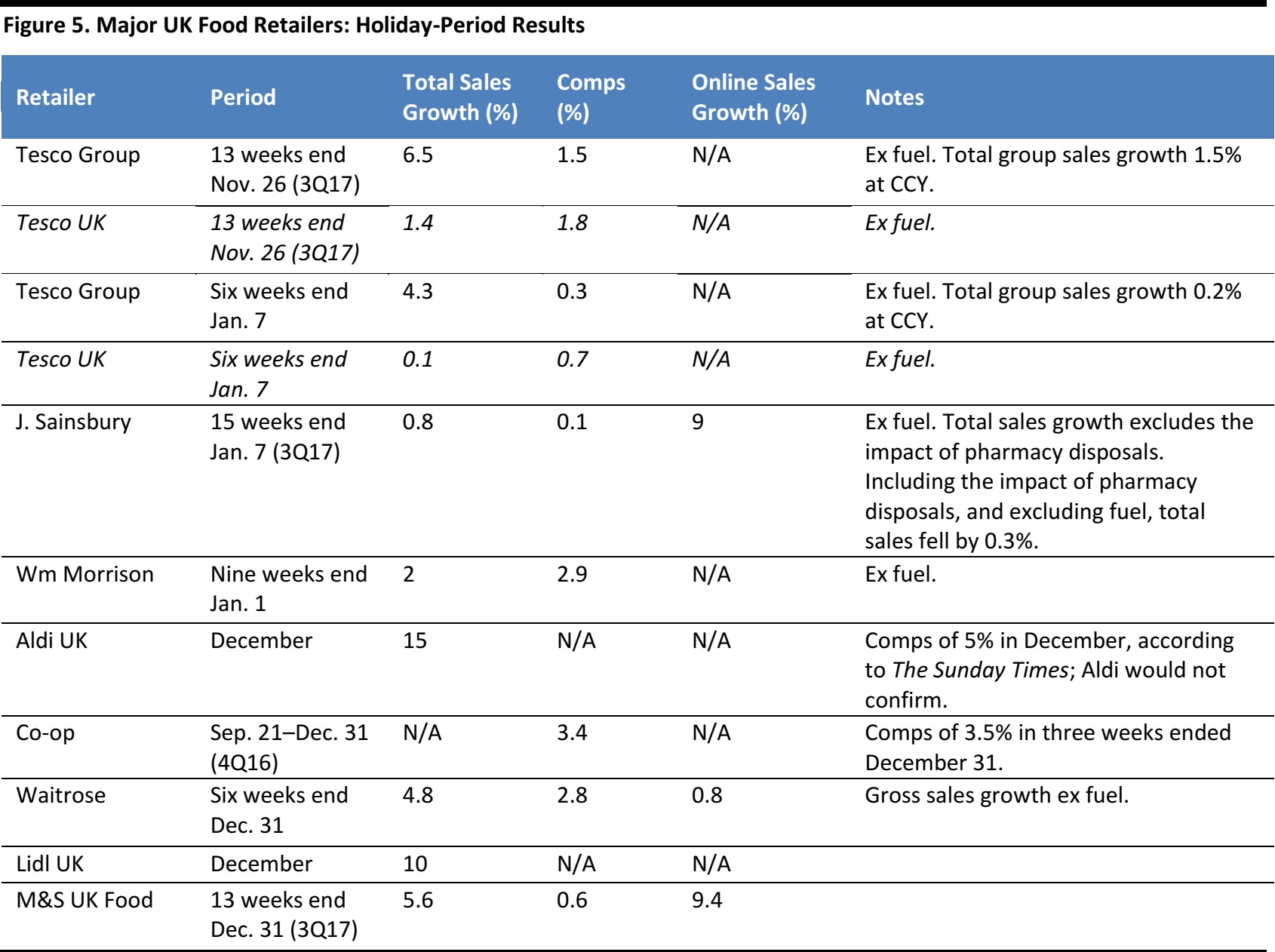

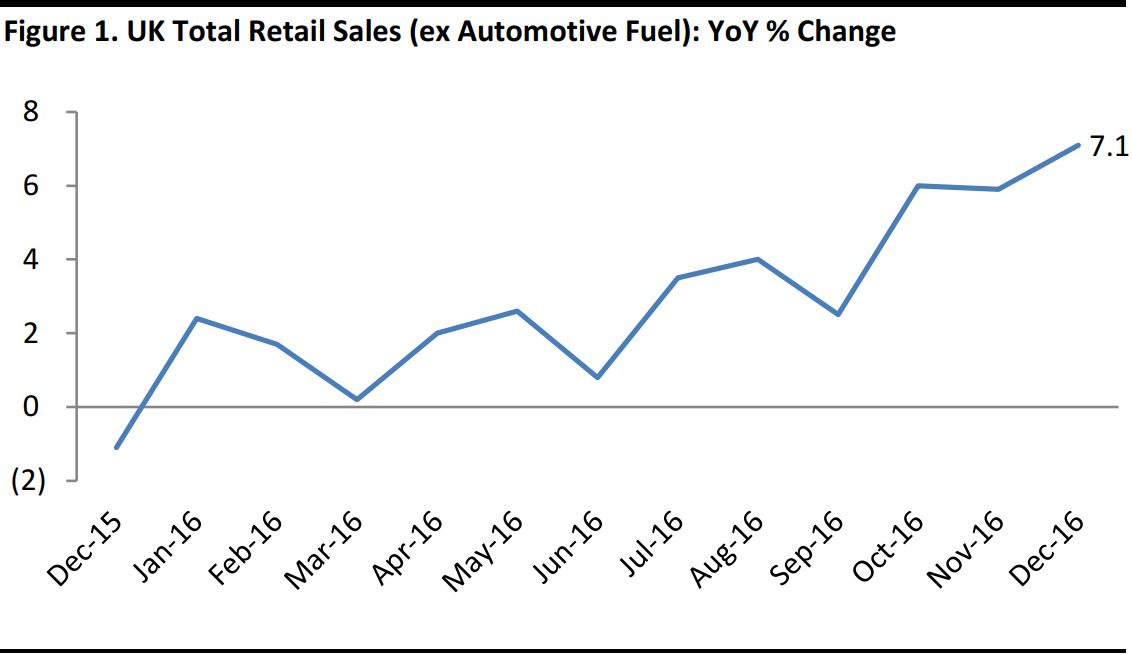

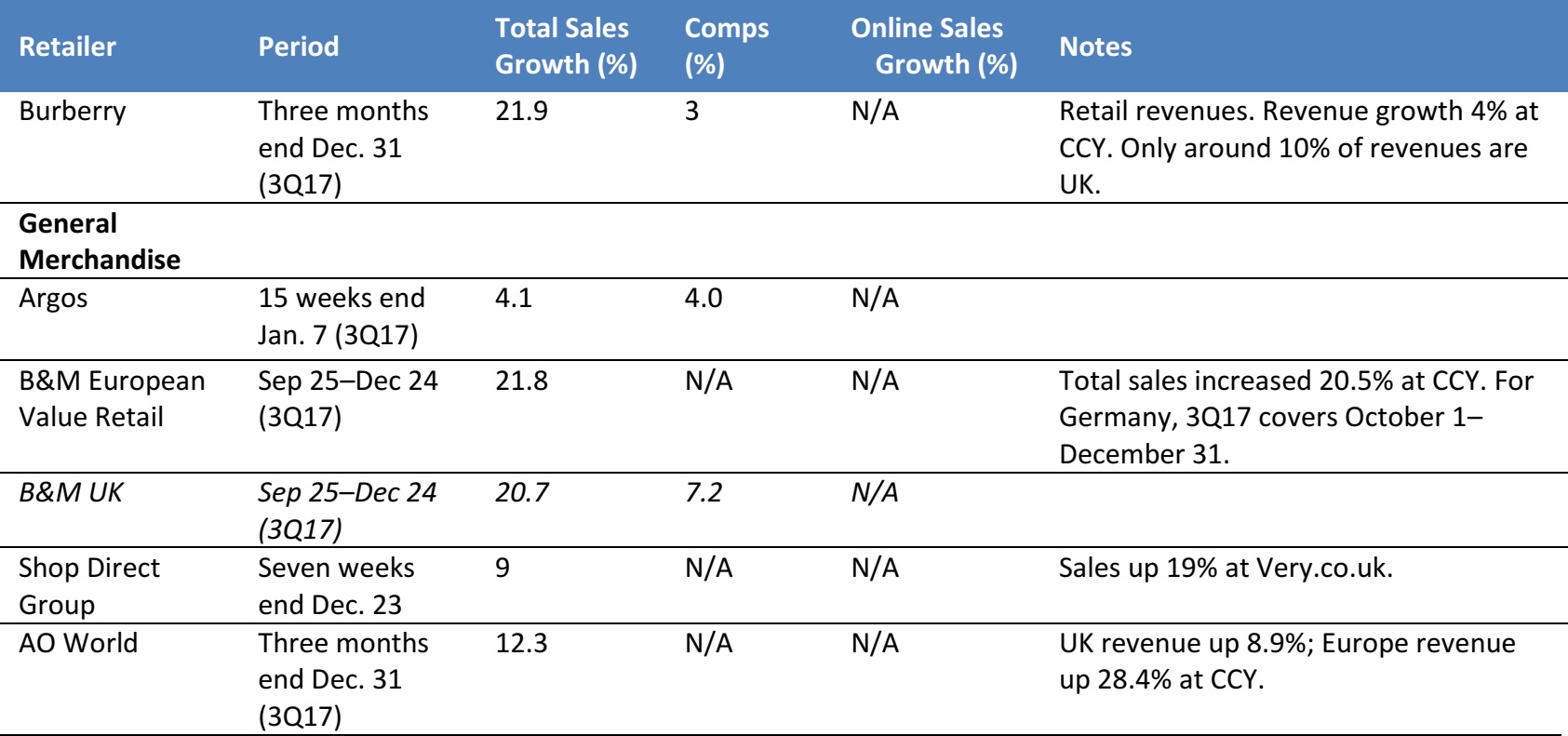

Total retail sales (ex automotive fuel) rose by 7.1% in December. This came on top of 5.9% growth in November. Weighted average growth of 6.6% across November and

December exceeded even our bullish forecasts.

This report wraps up holiday retailing in two sections: Reviewing Retail Sales and Reviewing Retailer Performances.

Reviewing Retail Sales

Note: All data in this report are nonseasonally adjusted.

Source: ONS/Fung Global Retail & Technology

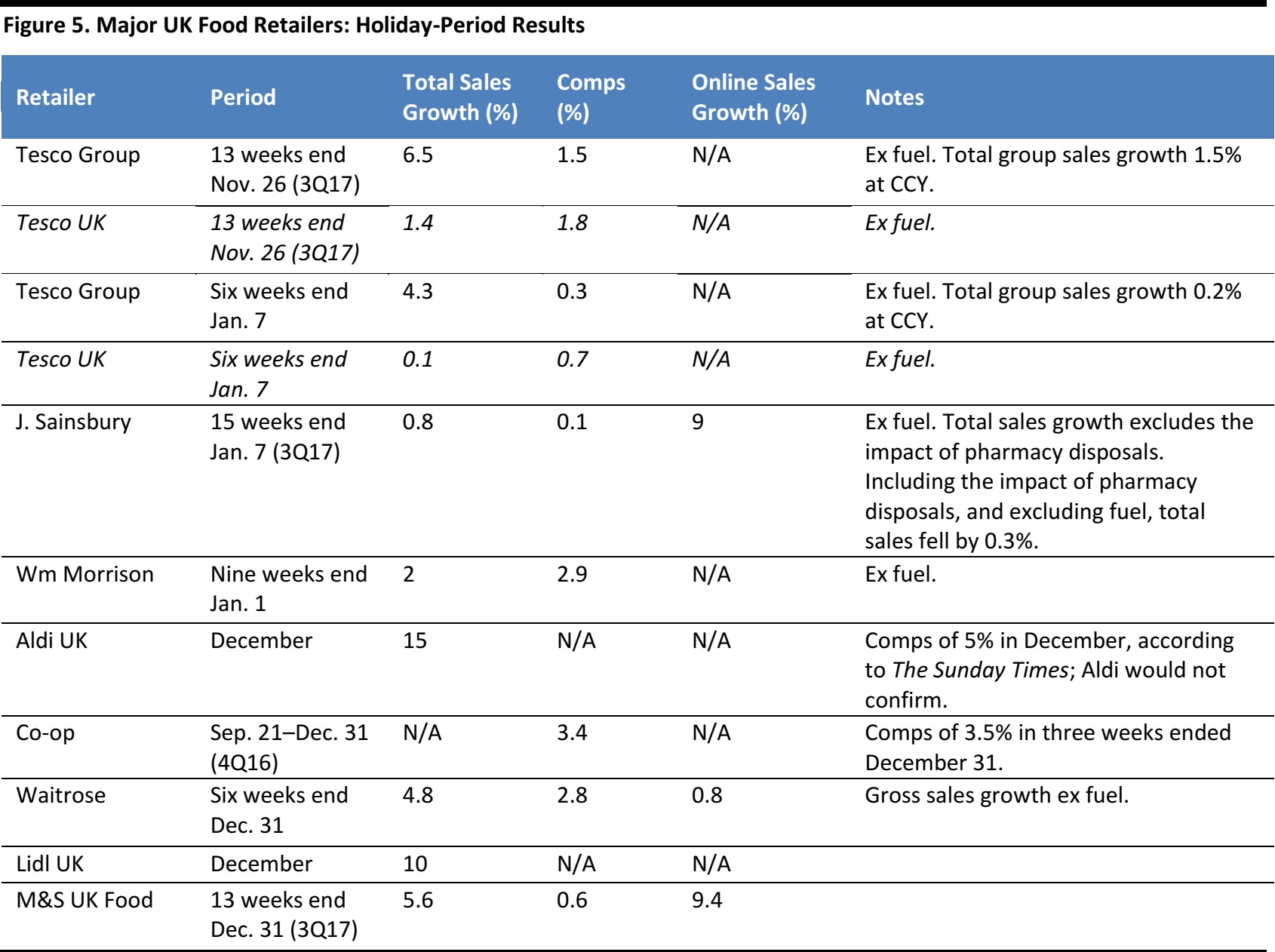

Notable Winners and Losers

Source: ONS/Fung Global Retail & Technology

Source: ONS/Fung Global Retail & Technology

Retail in Detail

Growth of 7.1% made it the strongest December for retail since the current run of ONS data began, in 1989 (that year comes closest, incidentally, with 7.0% growth in December). This was against undemanding comparatives from last year, which was the weakest December for retail in a quarter of a century.

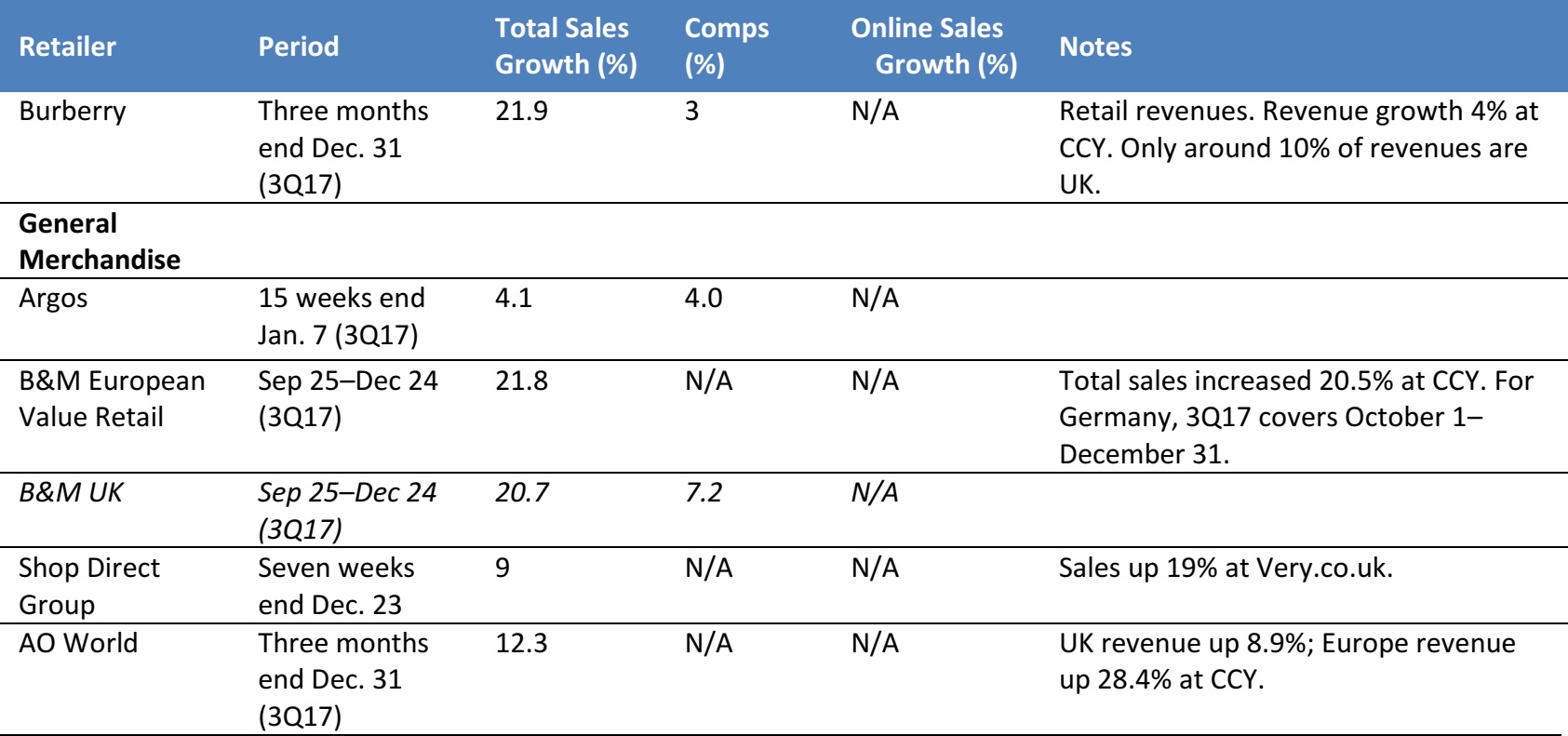

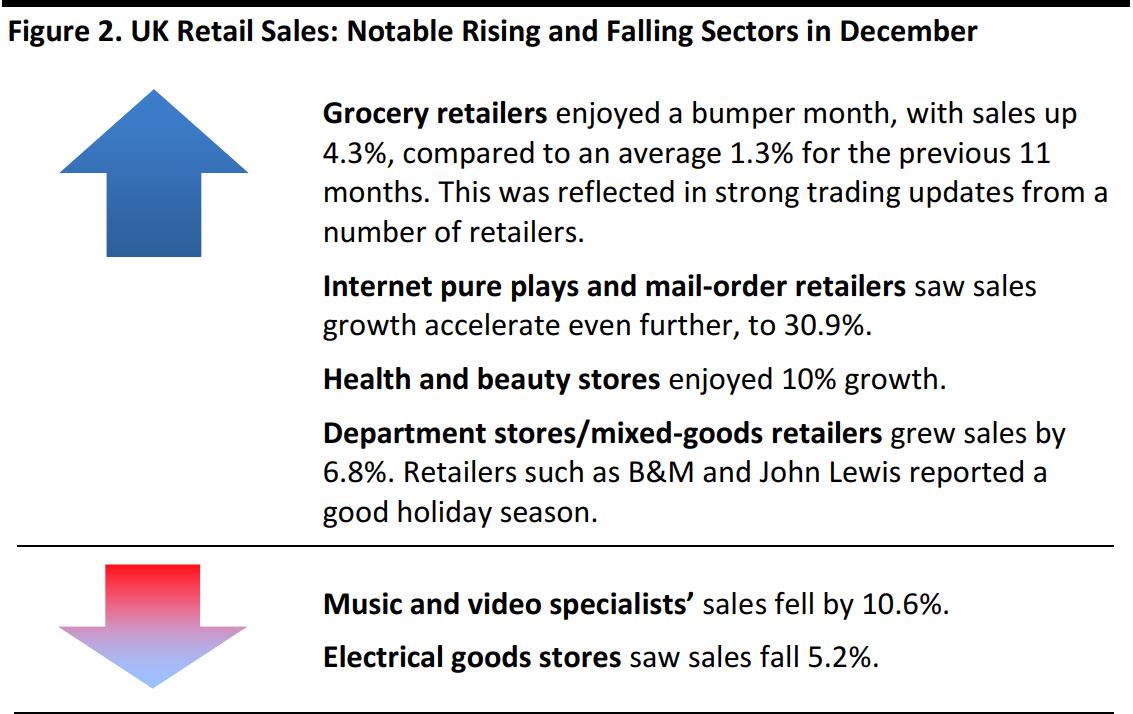

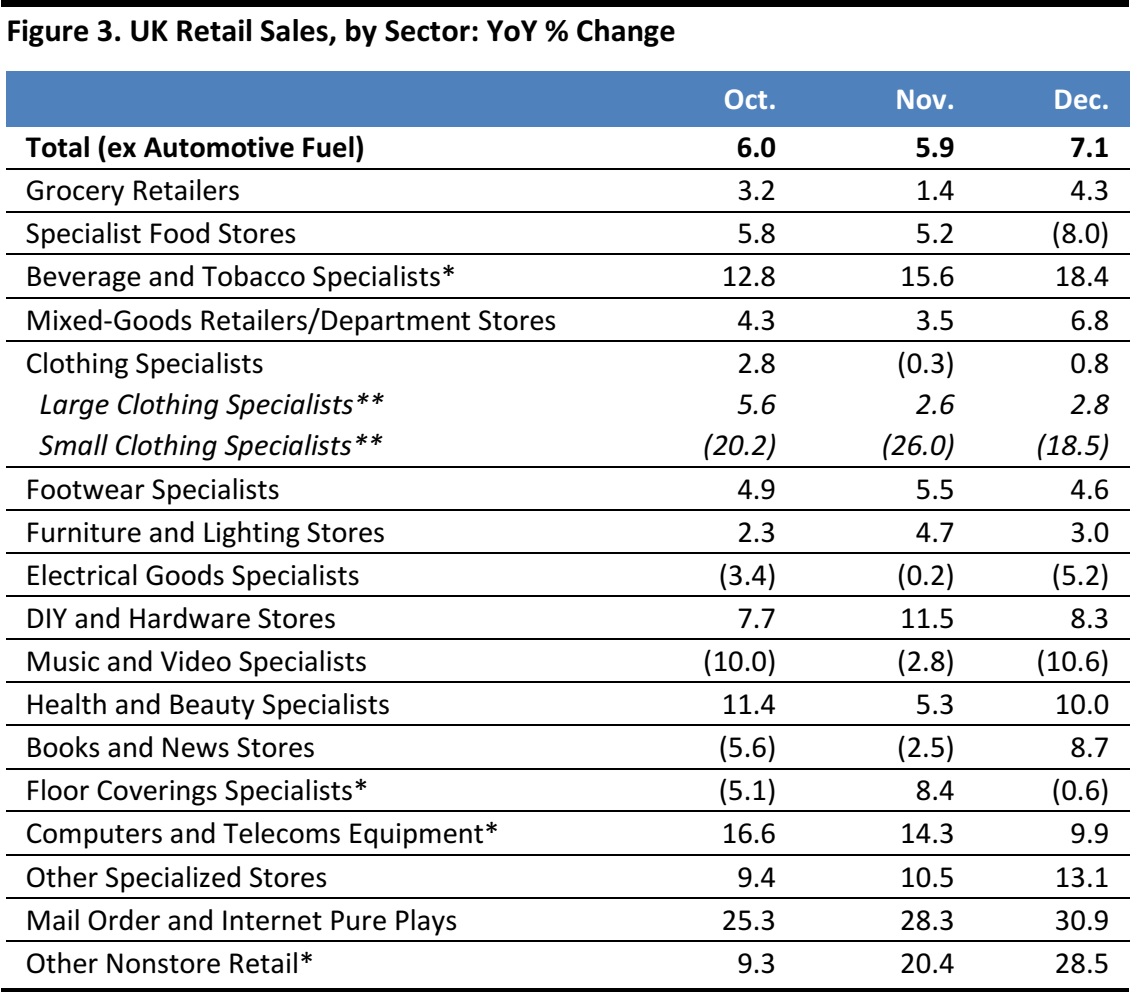

Growth was supported by a very robust performance at

grocery stores. This was reflected in Tesco, Sainsbury’s and Morrisons beating expectations and Aldi and Lidl maintaining double-digit growth (see our wrapup of company results later in this report).

Internet pure plays were the star of the show, growing sales by 30.9%, an acceleration from the already-very-strong growth of previous months. This was reflected in updates from Internet-only retailers such as ASOS and boohoo.com.

Department stores and mixed-goods retailers enjoyed solid 6.8% growth. B&M Bargains was a standout retailer in this sector, reporting 20.7% UK sales growth in its holiday quarter.

Clothing stores saw tepid growth of 0.8%, but at least it was positive: nine of the preceding 11 months saw negative growth in the sector.

Electrical goods specialists saw a 5.2% fall in sales, likely driven by smaller players. The leading specialist Dixons Carphone is set to report on January 24.

* Relatively small or fragmented sector, where figures may be distorted by methodological issues such as changes in the survey sample.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

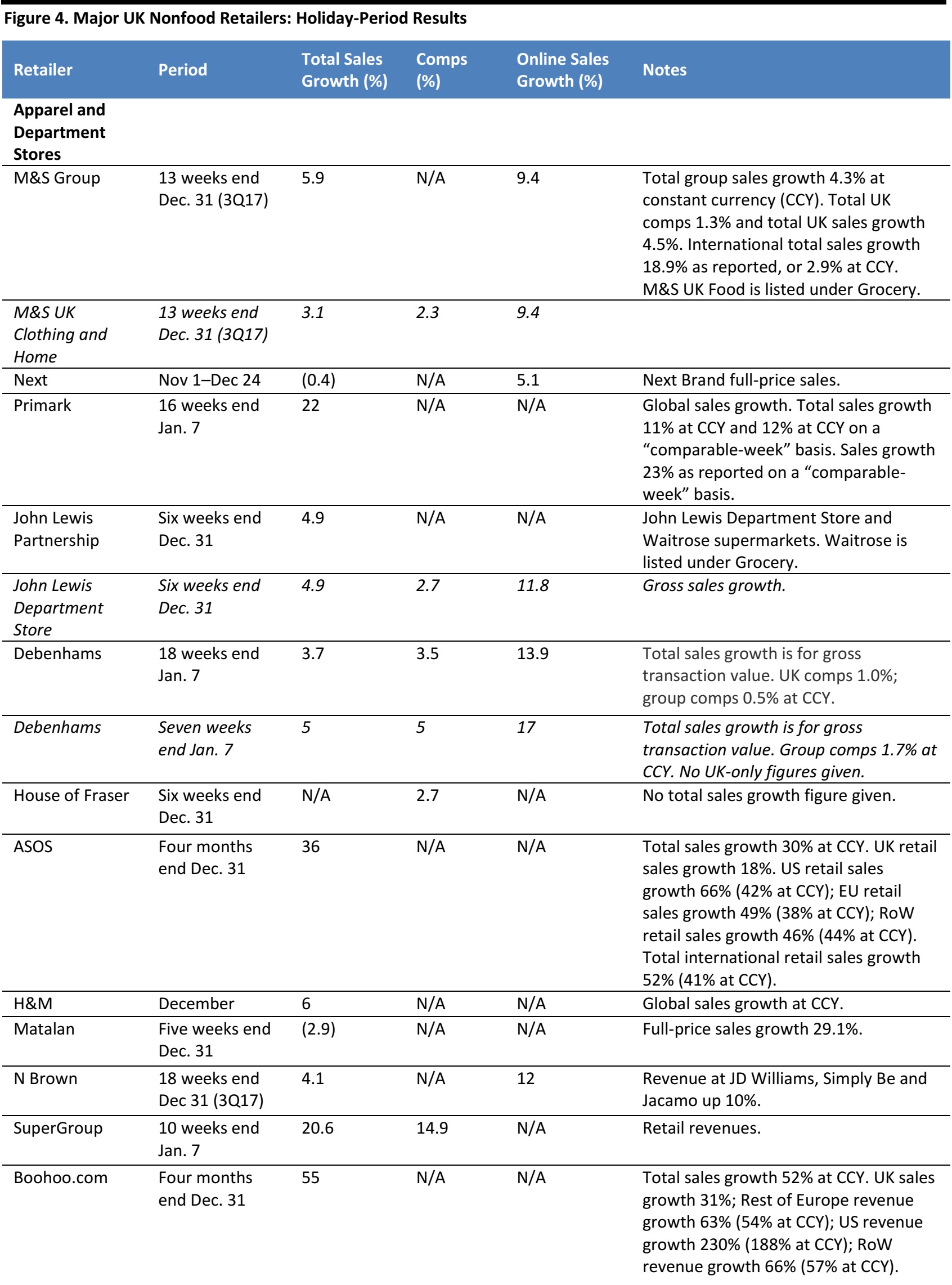

Source: ONS

Our holiday forecast was for growth in November and December in aggregate. We forecast total growth of 3.5%–4.0%, and actual growth across these months came in ahead even of our high expectations, at 6.6%. The major acceleration in growth at Internet-only retailers was a particular boost to actual sector growth versus our advance estimates.

- Our report, UK Christmas 2016 Outlook: A Bumper Brexit Holiday Expected, can be found at bit.ly/FungUKChristmas

Why were sales so strong? First, it is clear that British consumers are shrugging off some economists’ warnings about the possible negative impacts from the Brexit vote. Wages are up, interest rates are lower than ever and consumers are borrowing to spend.

Additionally, retailers have enjoyed a boost from the depreciation of the pound. Retailers such as ASOS and boohoo.com generate a considerable proportion of sales outside the UK, and the weak pound will, therefore, be boosting their reported revenues. Moreover, in some cases, the weak pound may be prompting overseas shoppers to turn to British Internet retailers for cross-border shopping.

Finally, strong tourist spending boosted sales. Payments firm Worldpay reported spending on foreign cards in the UK jumped 22% year over year in December, while the Heart of London Business Alliance said that tourist spending in London’s West End climbed by 25% year over year in the same month.

Reviewing Retailer Performances

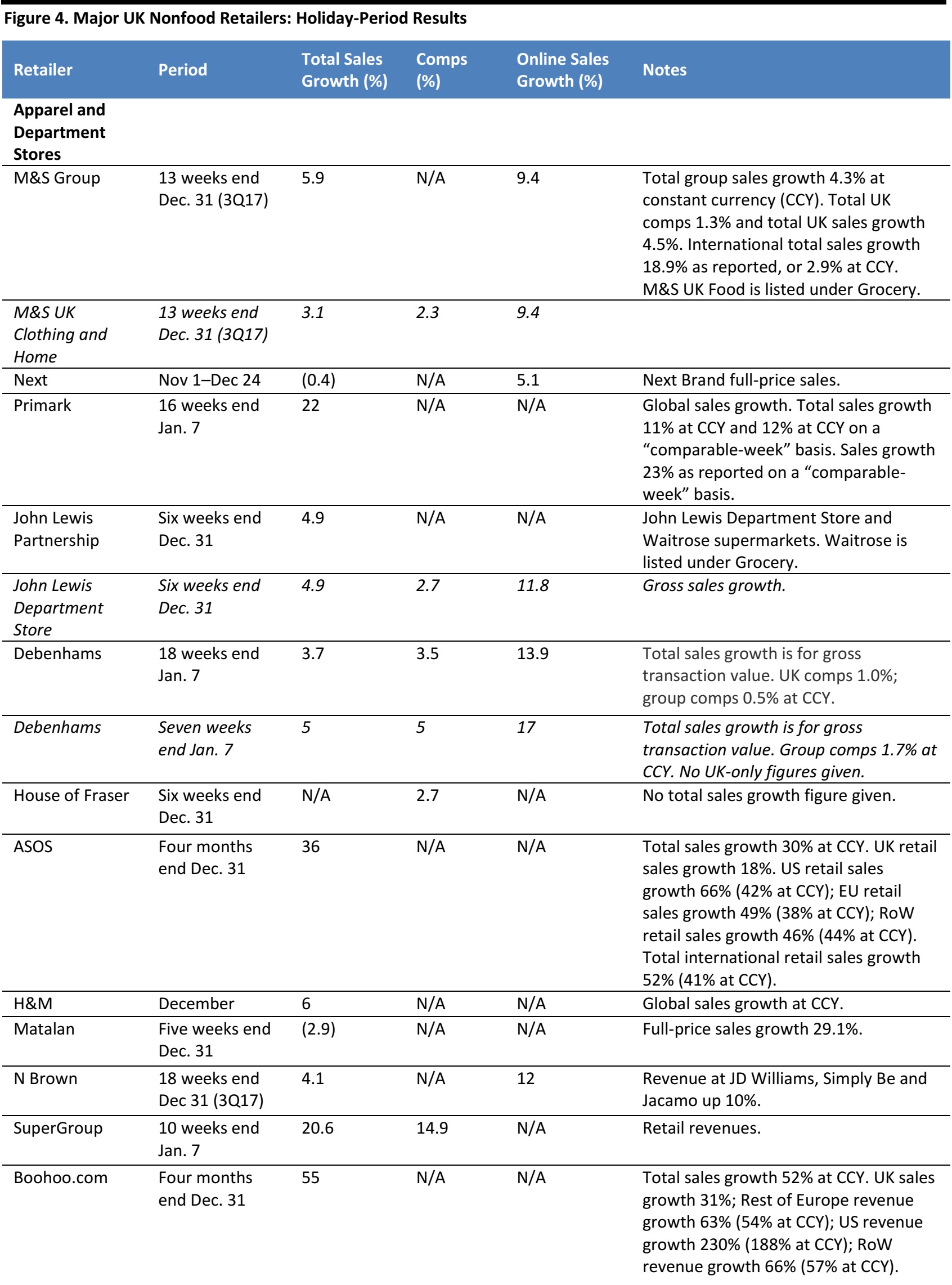

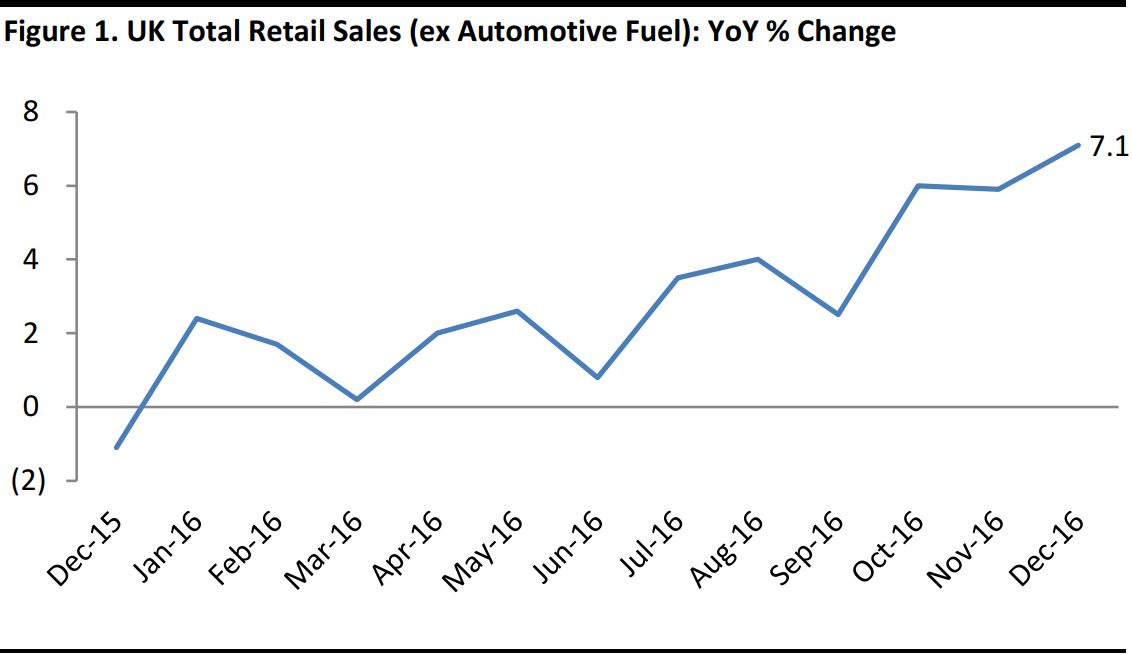

Below, we provide a rundown of top-line results from major UK retailers. These tend to support the view of a bumper Christmas period. Leading midmarket retailers such as M&S, Debenhams, Tesco, Sainsbury’s and Morrisons turned in better-than-expected top-line figures.

Apparel saw an end-of-year improvement: M&S posted comparable sales growth in Clothing and Home after six negative quarters; John Lewis reported Fashion segment sales up 7%. Tesco, Sainsbury’s and Morrisons each cited strong clothing sales as a factor in their performance, with sales up 4% at Tesco and 10% at Sainsbury’s (no figure for Morrisons). JD Sports reported “excellent progress” although it did not release specific figures. The major Internet pure plays were very strong, with growth at boohoo.com and ASOS far exceeding online growth at their multichannel competitors and with both companies beating consensus.

Next was the major exception in apparel, missing expectations by a wide margin and turning in mediocre growth, even online.

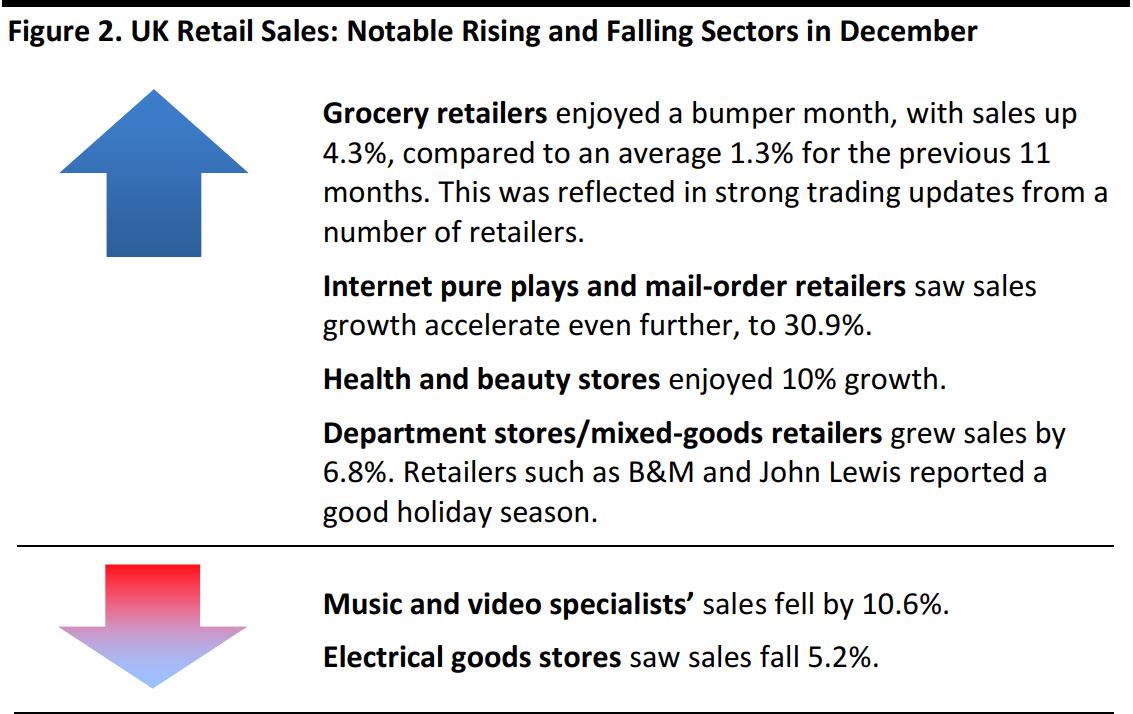

Each of the public nondiscount grocers beat expectations, while Lidl and Aldi maintained double-digit sales growth. Walmart-owned Asda reports its 4Q16 on February 21 and, given the outperformance of its rivals, there looks to be limited scope for a significant improvement from its previous weak performance: comps were down 5.8% in 3Q16.

For manageability, we split our rundown by sector, beginning with nonfood retailers.

Source: Company reports

Source: Company reports

At the time of writing, a few notable retailers had yet to report. In addition to Asda, noted earlier, these include Dixons Carphone (reporting January 24) and Ocado (reporting FY16 results on January 31). Sports Direct does not typically issue a Christmas-period statement, and its next scheduled update is its preliminary FY17 results on July 20. We next hear from JD Sports when it publishes its full-year results on April 11.

Holiday Shopping Themes

In early November, we published our

Holiday Shopping Themes report, identifying five themes that we predicted would be seen in UK Christmas trading. Here is how they measured up:

- Services and experiences are the new gifts: Confirming that shoppers spent freely on experiences, Barclaycard data reported that spending on dining out, cinema tickets and concert tickets surged 7.6% in December, with spending up 10% at pubs and 11% at restaurants.

- Brits’ spending power to enjoy a low-inflation boost: ONS data confirm that groceries were deflationary across November and December, freeing up cash for spending elsewhere and fueling the trading-up trend that is our third theme.

- The “Tesco effect” means trading up looks likely: We had forecast that shoppers would trade up from discount channels to nondiscount retailers, and from standard to premium lines, and a number of datapoints indicate that this happened. A host of nondiscount retailers such as Tesco, Sainsbury’s, Morrisons and M&S reported better-than-expected results. Tesco, which was the flagbearer for this theme, saw its first market-share gains in five years, while Morrisons posted its best comps for seven years. Moreover, retailers from Aldi to Sainsbury’s to Morrisons reported strong year-over-year growth in premium lines, suggesting shoppers traded up versus last year.

- Turning to the Internet means turning to pure plays: ONS data confirm a boom in sales at Internet-only retailers, while trading results from ASOS and boohoo.com were not only very strong, but beat analysts’ expectations.

- Black Friday set to plateau? As we had forecast, some retailers such as M&S opted out of Black Friday this year. And data from analytics firms confirmed that growth slowed considerably: IMRG noted that online sales on Black Friday underpaced expectations, growing 12% compared to the 16% it forecast. Meanwhile, data compiled by analytics firm Springboard showed online purchases rising just 6.7% versus its 25% forecast, and instore footfall increasing just 2%.

- Our Holiday Shopping Themes report can be found at bit.ly/FungHolidayThemes.

Source: ONS/Fung Global Retail & Technology

Source: ONS/Fung Global Retail & Technology