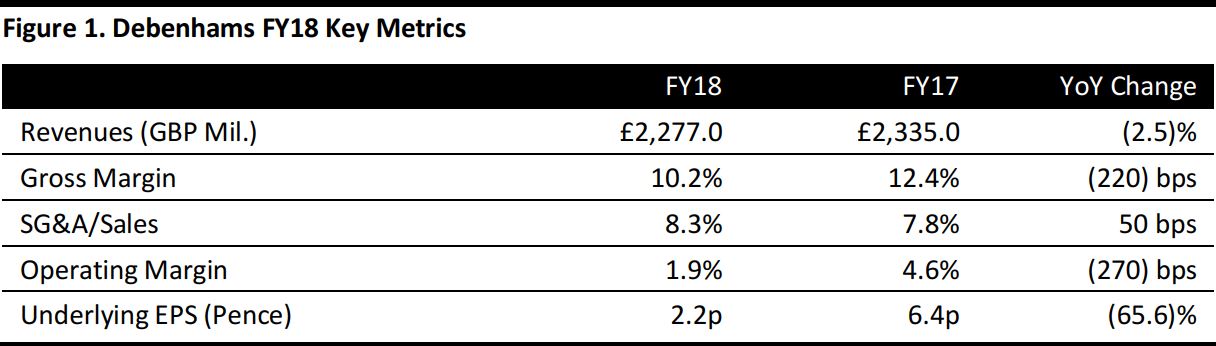

All metrics are calculated before exceptional items for better comparability. Debenhams has recorded an exceptional charge of £525 million in FY18.

Source: Company reports/Coresight Research

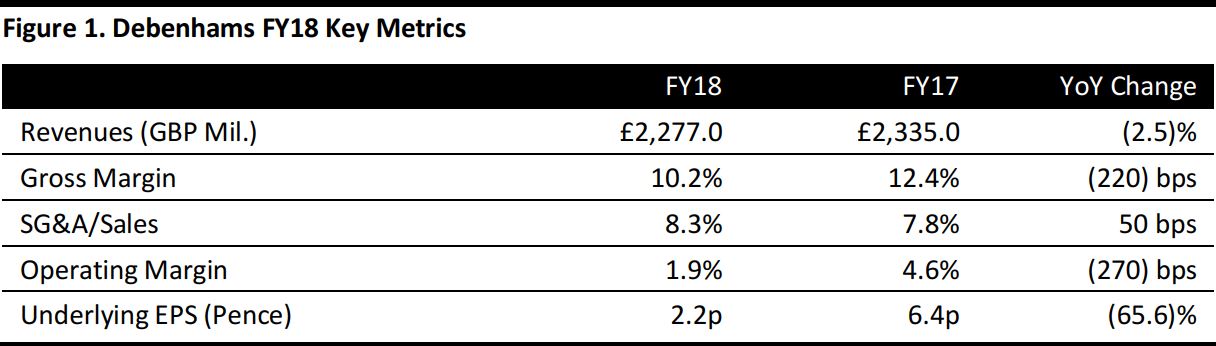

All metrics are calculated before exceptional items for better comparability. Debenhams has recorded an exceptional charge of £525 million in FY18.

Source: Company reports/Coresight Research

FY18 Results

In reporting its FY18 results, British department store chain Debenhams confirmed media speculation that it plans to shut 50 stores in the next three to five years in addition to working on rent reduction plans.

Debenhams reported a year over year decline of 2.5% in its FY18 statutory revenues, taking them to £2,277 million for the year ended September 1, 2018. The company’s UK business registered a revenue decline of 3.2% year over year while international revenues increased marginally, by 0.5%.

Debenhams recorded exceptional costs of £525 million this year, which drove statutory pretax loss of £492 million. Management said that it believes there are profitable stores in its portfolio that are “at risk of becoming unprofitable over time” and has booked a charge of £118 million in this regard. The company also believes that the value of the intangible goodwill asset which was created when it was taken private in 2003 has future economic benefits but the value has depreciated “given the pace of change” in the retail sector and has reduced its growth projections accordingly, booking a charge of £302 million. Debenhams attributed the remaining £105 million of exceptional charges to writing off IT systems and projects, warehouse restructuring and costs related to redundancies, professional fees and store closures.

At constant exchange rates, group comparable store sales declined by 2.7% year over year in FY18 and this decline was driven solely by the company’s core UK business, where management pointed to weak fashion and beauty markets. UK stores-only comparable sales declined by 6.3%. This was partially offset by UK digital sales growth of 10%. International comparable-store sales were up 0.2% at constant currency. Group digital growth was 12%, in line with the growth recorded last year.

Gross margin in FY18 contracted by 220 basis points to 10.2% mainly due to increased promotional activity to clear stocks before transitioning between seasons. On the other hand, the operating margin contracted 270 basis points to 1.9% as the retailer continues to invest in its Debenhams Redesigned strategy which includes corporate restructuring and upgrading select stores while streamlining its portfolio.

Excluding all exceptional items, Debenhams delivered underlying EPS of 2.2 pence, a decline of 65.6% year over year.

Outlook

For FY19, Debenhams announced £30 million in cost savings and expects to incur £70 million in capital expenditure. Management did not issue sales guidance but stated that it plans for digital to account for approximately 30% of its business compared to the current 20%.

For FY19, the consensus estimate for gross transaction value of £2,924 million implies a growth of 0.8% year over year. Consensus calls for operating profit of £50.9 million, implying an increase of 17.3% year over year.

All metrics are calculated before exceptional items for better comparability. Debenhams has recorded an exceptional charge of £525 million in FY18.

Source: Company reports/Coresight Research

All metrics are calculated before exceptional items for better comparability. Debenhams has recorded an exceptional charge of £525 million in FY18.

Source: Company reports/Coresight Research