FY16 is 52 weeks ended August 27, 2016

Source: Company reports/Fung Global Retail & Technology

FY16 RESULTS

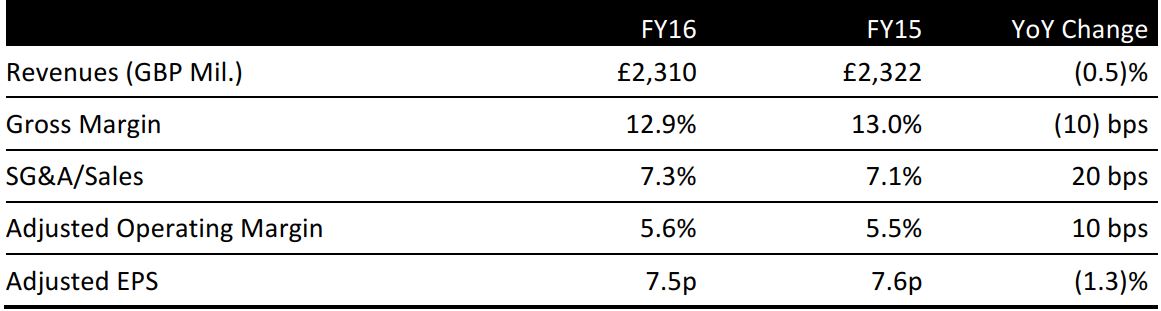

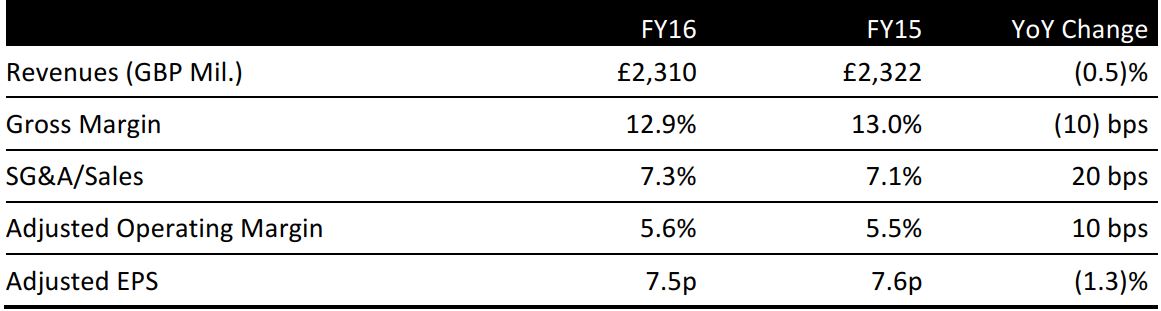

UK-based department-store chain Debenhams reported FY16 statutory revenues of £2,310 billion, down 0.5% year over year for the 52 weeks ending August 27, 2016. Group comparable store sales increased 0.6% year over year in FY16 and 0.7% on a constant-currency basis. Same-store sales were mainly driven by online sales growth of 9.3%, and online sales represented 14.7% of total sales in FY16.

UK-reported revenues declined by 0.8% and international revenues increased 0.9%. UK store comparable sales declined 1.1% in FY16. Debenhams executives remarked that 2H16 saw a weaker apparel market than in 1H16. The company is continuing its strategy to shift the sales mix towards non-apparel categories such as homewares, décor, accessories, gifting, beauty and food. The sales mix of non-apparel categories increased to 52% of total sales, up from 50% last year.

Debenhams reported gross transaction value of £2,939 million for the 53 weeks ended September 3, 2016, slightly above the consensus estimate of £2,902 million. Gross transaction value includes sales by third-party concessionaires.

FY16 gross margin contracted by 10bps to 12.9%, with a 60bps markdown improvement year over year offset by a greater contribution from lower-margin category sales. The planned growth of sales in beauty, gifting and concession categories had a gross margin dilutive impact relative to higher-margin apparel categories. Underlying EPS of 7.5p for the 52 weeks ending August 27, 2016, declined 1.3% year over year from 7.6p in FY15.

Newly hired CEO Sergio Bucher started with the company ten days ago, and will unveil his strategic plans for the business in spring 2017. Bucher previously held the post of Vice President of the Amazon Fashion Europe business.

OUTLOOK

For FY17, the company expects:

- Gross margin of 25bps to (25)bps.

- Total costs to increase 2-4%, including £9 million of National Living Wage cost increases.

- Net finance costs of £14 million.

- Capital expenditures of £130 million.

Debenhams did not provide sales guidance for FY17. FY17 gross transaction value sales consensus estimates stand at £2,952 million, implying annual year-over-year growth of 0.4%. Consensus expects operating profit of £125 million, implying a year-over-year decline of 4.9%. Consensus expects FY17 EPS at 7p, implying a decline of 6.7% year over year.