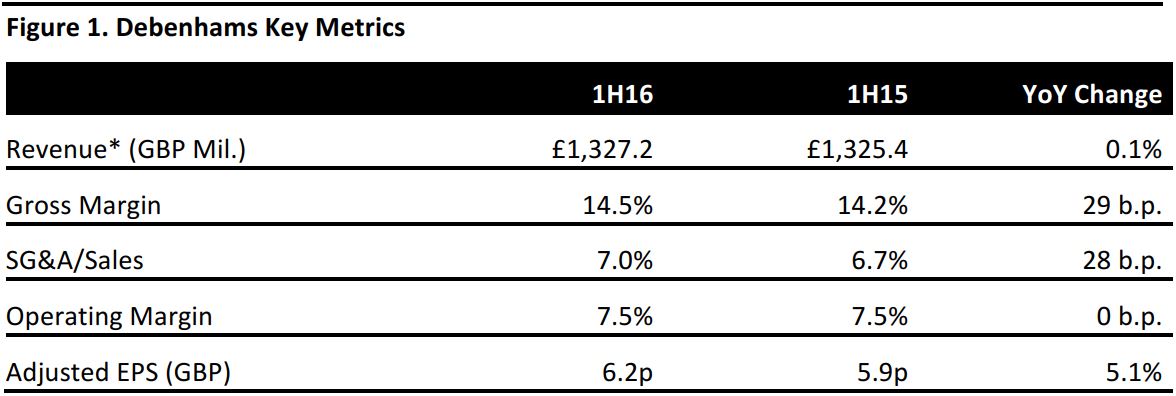

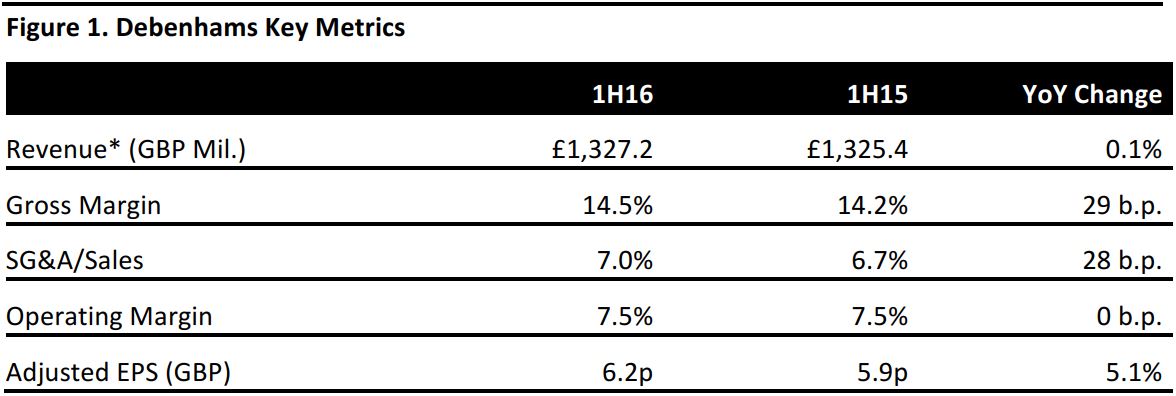

*Statutory revenue, not GTV

Source: Company reports

1H16 RESULTS

British department store chain Debenhams reported revenue of £1,327 million in 1H16, (ended February 2016), up 0.1% from 1H15. GTV, which includes sales by third-party concessions, grew by 1.6% year over year, to £1,629 million, broadly in line with consensus of £1,634 million.

The company’s gross margin rose by 29 basis points, from 14.2% in 1H15 to 14.5% in 1H16. The SG&A/sales ratio increased by 28 basis points, from 6.7% in 1H15 to 7.0% in 1H16.

The company stated that its efforts to reduce individual promotions (which began in spring 2014) led to a 5.1% increase in full-price sales in the half year. It added that its overall inventory levels were reduced by 1.9% in the half year, with a “materially greater” reduction in weather-sensitive products. This led to less stock being pushed into the post-Christmas sale period, which contributed a reduction of 90 basis points in half-year markdowns.

The operating margin was 7.5% in 1H16, unchanged from the same period last year. The basic and diluted EPS was 6.2 pence, up 5.1% from 5.9 pence in 1H15 and in line with consensus.

SALES BREAKDOWN BY SEGMENT

- Year over year, Debenhams’ sales in the UK rose by 1.0%, to £1,109.7 million, in 1H16. UK GTV increased by 2.9% year over year to £1,336.5 million.

- In the international segment, revenue decreased by 4.2% year over year, to £217.5 million. International GTV fell by 3.7%, from £303.5 million in 1H15 to £292.2 million in 1H16. The company noted that a weaker euro and Danish krone exchange rates had both negatively impacted GTV. On a constant-currency basis, international GTV grew by 3.2%.

- Total online sales increased by 10.0%, to £246 million. E-commerce accounted for 15.1% of total sales for the period, up from 14.0% in 1H15. Management noted that mobile is the fastest-growing sales channel, and that mobile conversion rates rose by 30% after the company made significant technological improvements to its mobile site.

COMPARABLE SALES BREAKDOWN

- Debenhams noted that comparable sales for the group grew by 2.4% in constant currency and by 1.1% in reported currency.

- Comparable sales for stores in the UK grew by 0.1%.

- UK online comparable sales grew by 1.2%.

- In the international segment, comparable sales grew by 1.1% in constant currency.

GUIDANCE

Management outlined five key priorities for the rest of the year:

- To continue the company’s focus on its approach to promotions.

- To enhance the efficiency of its online business, in particular on improving the mobile experience.

- To drive a better return from UK stores through tech-enabled changes—such as installing mobile payment entry devices in all stores for contactless payments—and through continuing space optimization activities. Management stated that Debenhams will introduce more food concession counters, since customers who eat in the store spend at least 40% more than those who do not.

- To expand the brand internationally and accelerate growth in its key markets of France, China, Australia and the Middle East through new partnerships and the introduction of new shopping channels.

Management noted that the company is hoping to restructure its supply chain by 2019, and that it will make specific investments to extend category buying and further automate warehouse management. Further, a new organization structure will be in place to support multi-channel integration, aligning the UK and international operational teams. About 40% of FY16 capex will be dedicated to multi-channel integration.

Debenhams reiterated its FY16 guidance of gross margin growth of flat–50 basis points, 2%–4% total cost growth and approximately £130 million in capex. Management added that the company expects full-year results to be in line with market expectations.

The company confirmed that Sharp will be stepping down as CEO this year. He will remain in office until a successor is confirmed and the handover is complete.