Source: Company reports/Coresight Research

1H18 Results

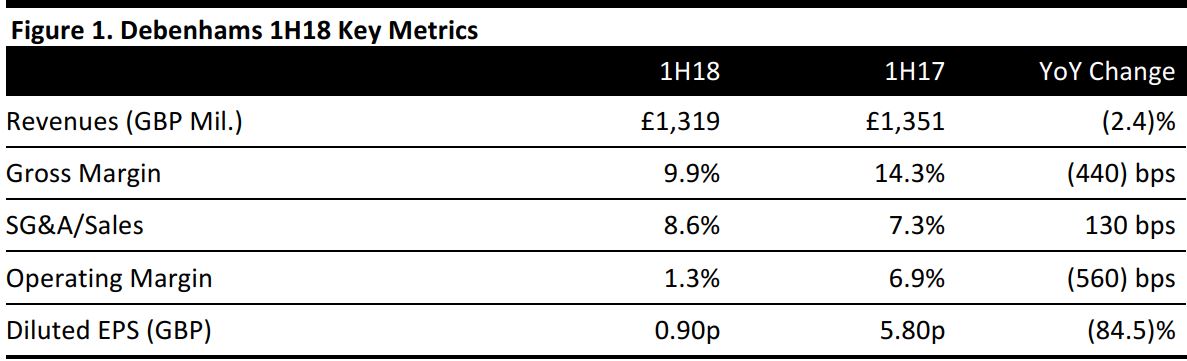

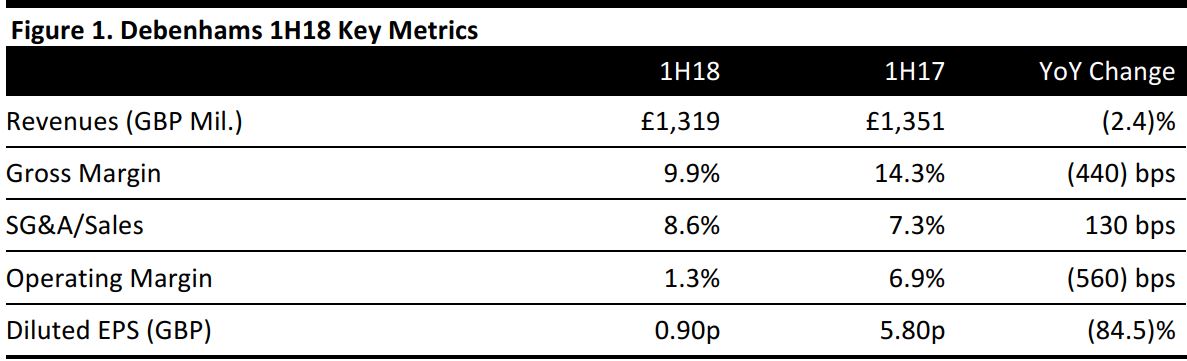

British department store retailer Debenhams reported a decline of 1.6% in group transaction value to £1.7 billion and a fall of 51.9% in underlying PBT to £42.2 million, in the first half ended March 3, 2018. Both are broadly in line with consensus, as recorded by S&P Capital IQ.

Group revenues declined by 2.4% as reported to £1.3 billion. Group comparable sales fell by 2.8% at constant currency and by 2.2% as reported.

Debenhams attributed the poor performance and margin erosion to additional markdowns it implemented during Christmas trading, in response to competitor promotions and to ensure a clean stock position for the new season.

As part of its Debenhams Redesigned strategy, the retailer stated that it is growing its beauty, gifting and concessions categories, but these are dilutive to margins compared to higher-margin own-brand clothing categories. This overhaul in product mix along with additional markdowns led to an overall reduction in profit margins, Debenhams said.

Debenhams also announced the resignation of its CFO Matt Smith who will be leaving to become Finance Director at Selfridges. The retailer has begun a search for a successor. In the meantime, Smith will continue in his role till such time to ensure a smooth handover.

Debenhams provided the following additional details about performance during the period:

- UK revenues fell by 3.7% for the half to £1.1 billion, driven by weaker demand in discretionary categories. Debenhams temporarily closed nearly 100 stores around the end of the half, due to freezing weather and heavy snow. This is estimated to have reduced group comps by around 1.0% during the period.

- International revenues grew by 3.5% as reported to £253.3 million, driven by improved digital sales and overall performance at Magasin du Nord. Stronger euro and Danish krone exchange rates helped reporting numbers; at constant currency, international revenue growth was 1.8%.

- Reported PBT fell by 84.6% and profit for the half fell by 84.9%.

- Exceptional items before taxation, related to strategic review and restructuring under the Debenhams Redesigned program, amounted to £28.7 million.

- Underlying group EBITDA fell by 30.6%, underlying UK EBITDA slid 39.3% and underlying international EBITDA increased by 2.6%.

- PAT before exceptional items fell by 52.5%.

Outlook

In light of the performance in 1H18, Debenhams lowered its guidance for a decline in FY18 gross margin to (100) bps from the previously guided (25) bps. The company now guides for FY18 PBT to be at lower end of the £50–£61 million range from the £55–£65 million range previously.

Consensus estimates were compiled before Debenhams announced the latest results. Analysts expect Debenhams’s FY18 group transaction value to decline by 0.1% and adjusted EPS to fall by 50%. The current consensus estimate for FY18 underlying PBT is £57 million.