Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

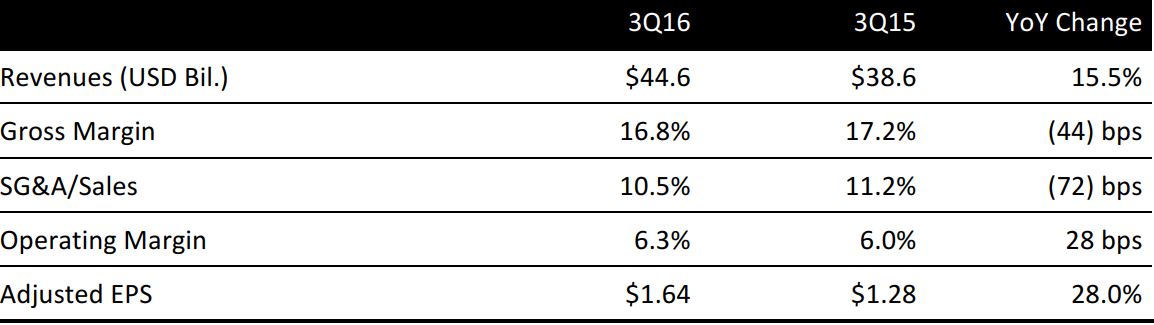

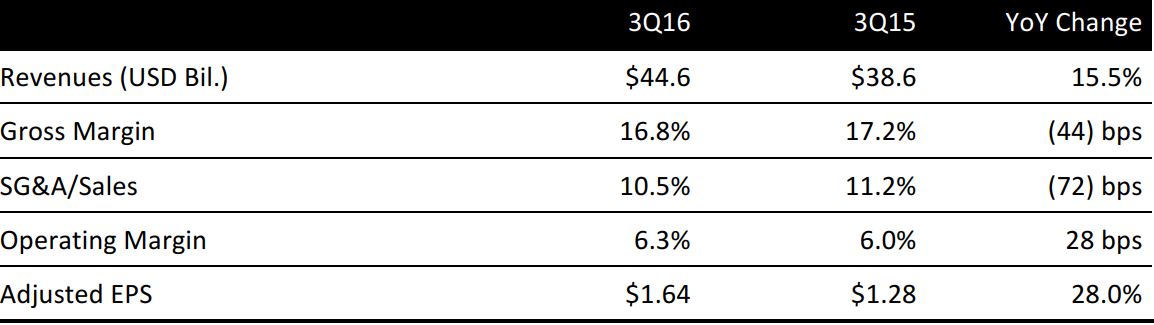

CVS reported 3Q16 revenues of $44.6 billion, up 15.5% year over year and missing the $45.3 billion consensus estimate.

Adjusted EPS was $1.64, up 28.0% year over year and beating the $1.57 consensus estimate. GAAP EPS from continuing operations was $1.43, compared with $1.10 in the year-ago quarter.

PHARMACY SERVICES SEGMENT

Pharmacy Services segment revenues grew by 19.2% year over year, to $30.4 billion, which was below the consensus estimate of $31.0 billion. Growth was primarily driven by increased pharmacy network claim volume and growth in specialty pharmacy. Management commented that the PBM business exceeded expectations in the quarter.

- Pharmacy network claims processed during the quarter increased by 23.3% year over year, to 282.6 million, owing to growth in net new business.

- Mail choice claims processed during the quarter increased by 2.5%, to 22.4 million, driven by the continued adoption of the company’s Maintenance Choice offerings.

RETAIL/LTC SEGMENT

Retail/LTC segment revenues grew by 12.5%, to $20.1 billion, slightly below the $20.2 billion consensus estimate. Segment revenues were driven by the addition of the long-term care pharmacy operations acquired from Omnicare and the addition of Target’s pharmacies and clinics, plus store sales growth. Management commented that the retail business performed at the lower end of expectations in the quarter.

Same-store sales increased by 2.3%.

Pharmacy same-store sales rose by 3.4% and pharmacy, negatively affected by approximately 340 basis points from recent generic drug introductions. Same-store prescription volumes increased by 3.0% on a monthly equivalent basis.

Front-store same-store sales decreased by 1.0%, affected by softer customer traffic that was partially offset by an increase in basket size.

In the quarter, the generic dispensing rate in the Pharmacy Services segment increased by approximately 160 basis points, to 85.4%, and increased by approximately 100 basis points in the Retail/LTC segment, to 85.8%.

OUTLOOK

Full-Year 2016

The company lowered and narrowed its 2016 adjusted EPS guidance to $5.77–$5.83 from $5.81–$5.89. CVS also lowered and narrowed its GAAP EPS guidance to $4.84–$4.90 from $4.92–$5.00.

Management commented that recent pharmacy network changes are expected to cause some retail prescriptions to begin to depart the company’s pharmacies this quarter.

In addition, CVS is currently experiencing slowing prescription growth in the overall market as well as a soft seasonal business. The combination of these factors led the company to reduce the midpoint of its annual guidance for this year by $0.05 per share.

4Q16

For the fourth quarter, the company expects adjusted EPS of $1.64–$1.70, up 7%–10.75% year over year, but below the consensus estimate of $1.79.

Full-Year 2017

CVS provided a preliminary outlook for 2017: the company expects adjusted EPS of $5.77–$5.93, below the consensus estimate of $6.53.

The company continues to target 10% adjusted EPS growth for the longer term.