Source: Company reports

2Q16 RESULTS

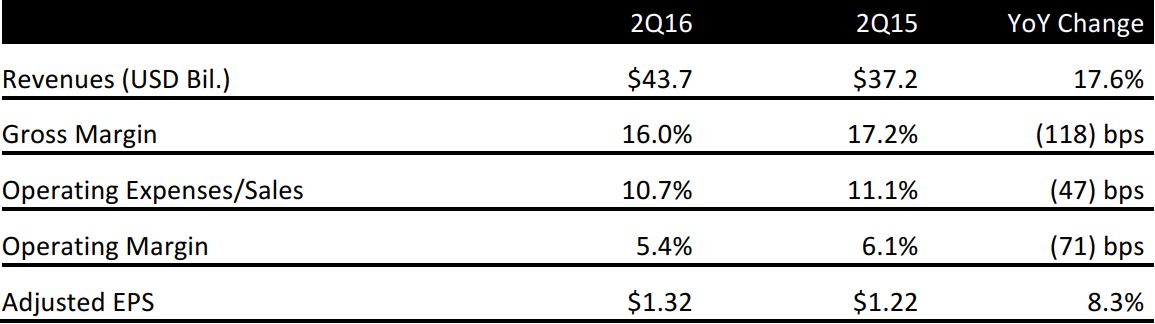

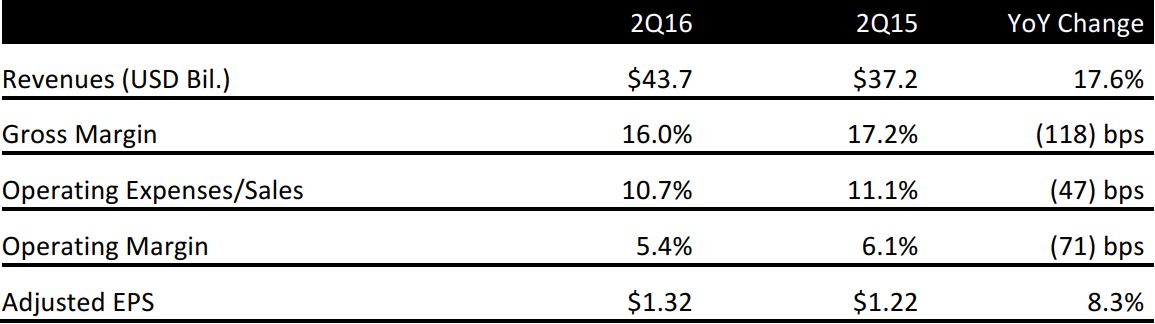

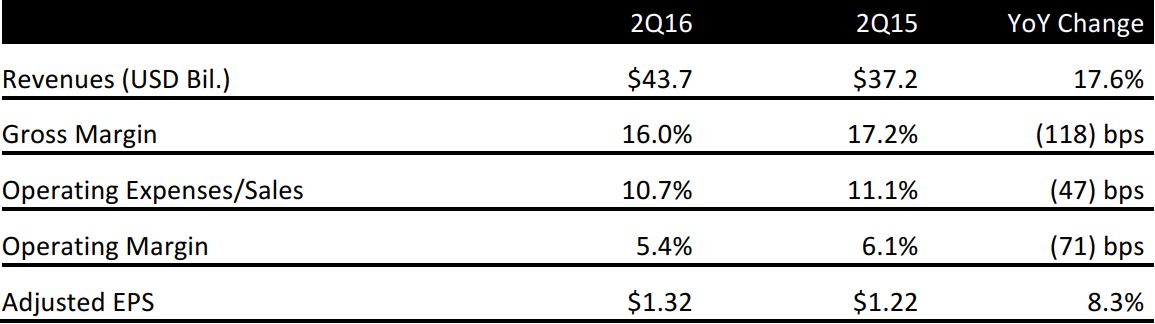

CVS reported 2Q16 adjusted EPS of $1.32, up 8.3% year over year and ahead of guidance of $1.28–$1.31, beating the consensus estimate by two cents.

The company reported revenues of $43.7 billion, up 17.6% year over year but missing the $44.3 billion consensus estimate.

Growth was driven by the Pharmacy Services segment, whose revenues grew by 20.7% year over year, to $29.5 billion, due to higher pharmacy network claim volume and growth in specialty pharmacy. The pharmacy network processed 280.5 million claims in the quarter, up 22.6% year over year, primarily due to the growth in net new business. Mail choice claims processed in the quarter numbered 22.2 million, up 3.9% year over year, driven by continued adoption of Maintenance Choice offerings.

Revenues in the Retail/LTC segment were $20.0 billion, up 16.0% year over year. Segment revenues were primarily driven by the acquisition of Omnicare’s long-term-care pharmacy operations and the acquisition of Target’s pharmacies and clinics; same- store sales growth also contributed. (There were inter segment revenue eliminations of $5.8 billion.)

Same-store sales increased by 2.1% year over year; pharmacy same-store sales increased by 3.9%; and pharmacy same-store prescription volumes increased by 3.5% on a 30-day-equivalent basis. Pharmacy same-store sales were hurt by recent generic drug introductions. Front-store same-store sales decreased by 2.5%, hurt by the timing of the Easter holiday and softer customer traffic, which were partially offset by a higher basket size.

2016 OUTLOOK

CVS raised and narrowed its FY16 adjusted EPS guidance to $5.81–$5.89 from $5.73–$5.88 previously. The company reduced its GAAP EPS guidance to $4.92–$5.00 from $5.24–$5.39 previously, due to debt extinguishment and acquisition-integration costs. Prior to the earnings release, consensus estimates for FY16 called for revenues of $181.6 billion and EPS of $5.82.

For 3Q16, the company expects adjusted EPS of $1.55–$1.58, at or above the consensus estimate of $1.55.