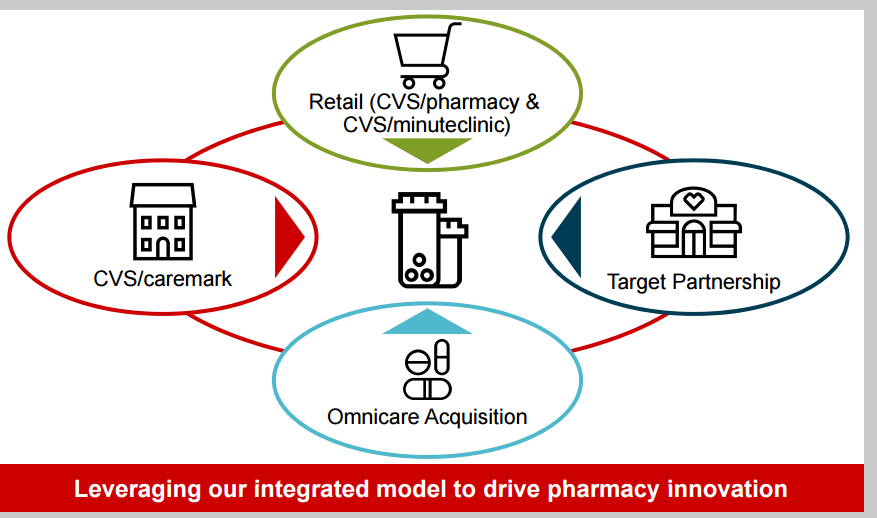

LEVERAGING THE INTEGRATED MODEL

CVS Health held an Analyst Day in New York today. In attendance from the company were President and CEO Larry Merlo, EVP and CFO Dave Denton, President of CVS/caremark Jon Roberts, EVP of CVS/Specialty Pharmacy Alan Lotvin, President of CVS/pharmacy Helena Foulkes and President of Omnicare Rocky Kraft.

Prior to the meeting, CVS raised the low end of its annual guidance. Adjusted EPS is now $5.73–$5.88 versus $5.68–$5.88 previously and versus consensus of $5.82. That is based on net revenue growth of 17%–18.5%. Free cash flow is expected to be $5.3–$5.6 billion, which includes approximately $500 million in acquisition-related cash outflows. Operating cash flow is expected to be $7.6–$7.9 billion. EPS guidance assumes approximately $4 billion in share repurchases during 2016.

Sales in the retail/long-term care (LTC) segment are expected to increase by 14.25%–15.5% for the year, driven by same-store sales growth of 2.75%–4.0%. Sales in the pharmacy benefits management (PBM) segment are expected to grow by 20.25%–21.75%, with total adjusted claims of 1.33–1.35 billion.

The company also provided fiscal-year first-quarter guidance for adjusted EPS of $1.14–$1.17 versus consensus of $1.27. The company noted that EPS growth in the first quarter will be challenging due to “timing factors.” That is based on net revenue growth of 17%–18.5%, consistent with full year guidance and retail same-store sales growth of 4.5%–6.0%.

Earnings growth is expected to be weighted toward the second half of the year in 2016, given that front store strategies will benefit the back half of the year, Medicare Part D, and generic introductions and breakouts will be weighted toward the second half. In addition, the PBM business is growing faster than the retail business is, which will compress the margin rate the focus should move to margin dollars.

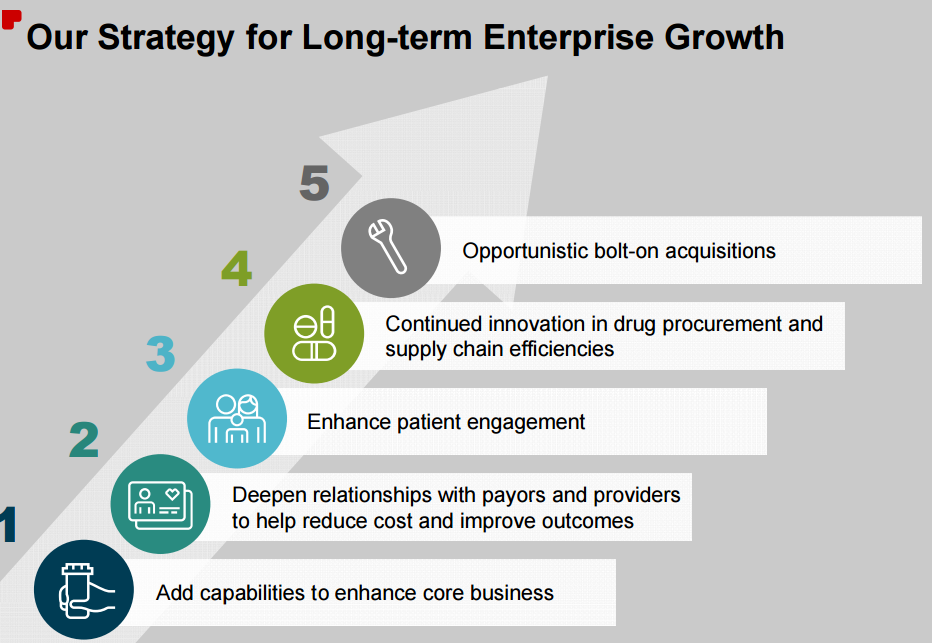

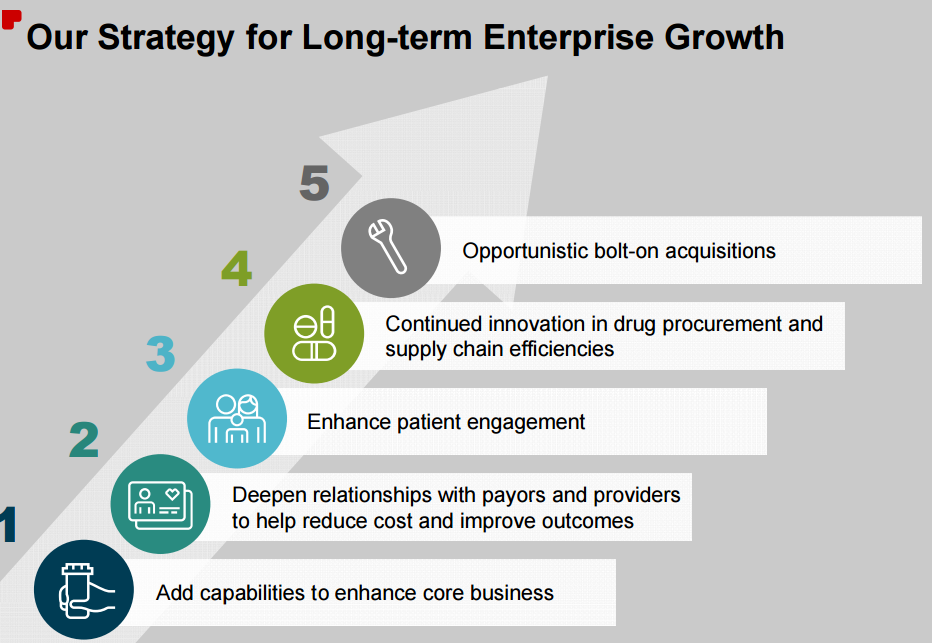

In discussing longer-term targets, management reiterated the company’s five-year growth plan. CVS is currently forecasting 10%–14% annual EPS growth through 2018. Long-term revenue guidance is 9%–13%, while operating profit growth guidance is 7%–9%.

Source: CVS

In terms of capital deployment, CVS raised its quarterly dividend by 21.4%, to $0.425 per share from $0.35, and the company still expects to hit its 35% dividend payout ratio by 2018.

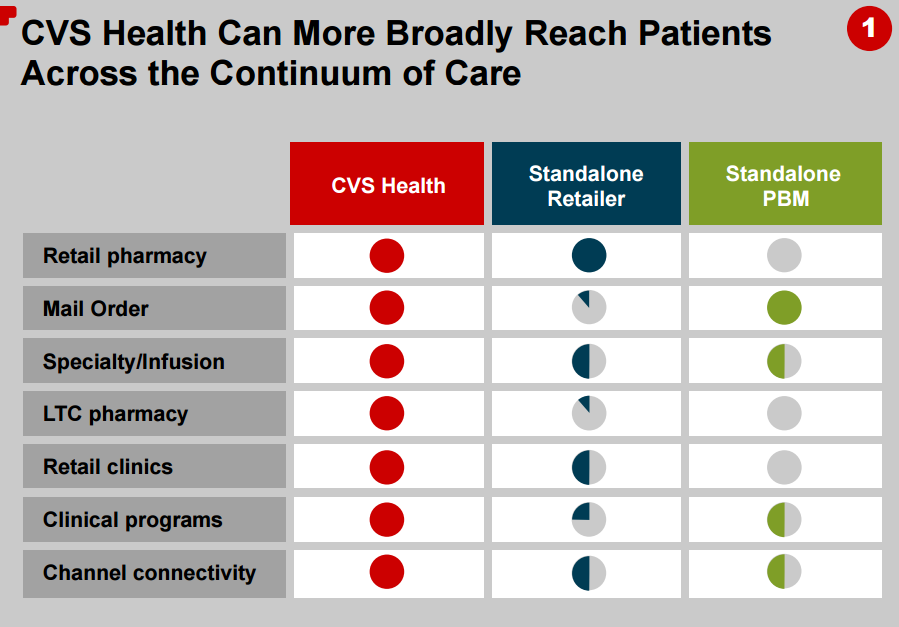

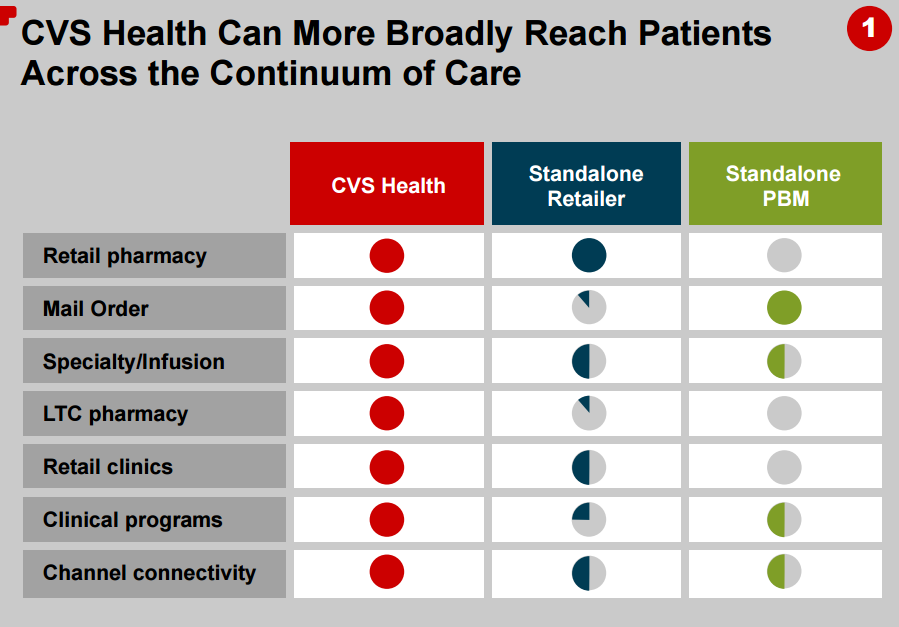

CVS ABLE TO REACH CUSTOMERS MORE BROADLY THAN STAND-ALONE COMPETITORS CAN

Source: CVS

CVS operates more than 7,900 drugstores, more than 1,000 walk-in healthcare clinics, a PBM with more than 70 million members, a senior pharmacy care business serving more than 1 million patients per year, and expanding specialty pharmacy services. The company is unique in that it serves patients, payors and healthcare providers through its various platforms. It has substantial scale across the healthcare spectrum, with 21% market share in the retail pharmacy segment, 25% market share in each of the PBM and specialty pharmacy markets, and 31% share in LTC pharmacy. These interconnected areas of expertise allow CVS to enhance its value offering to patients, payors and providers.

Source: CVS

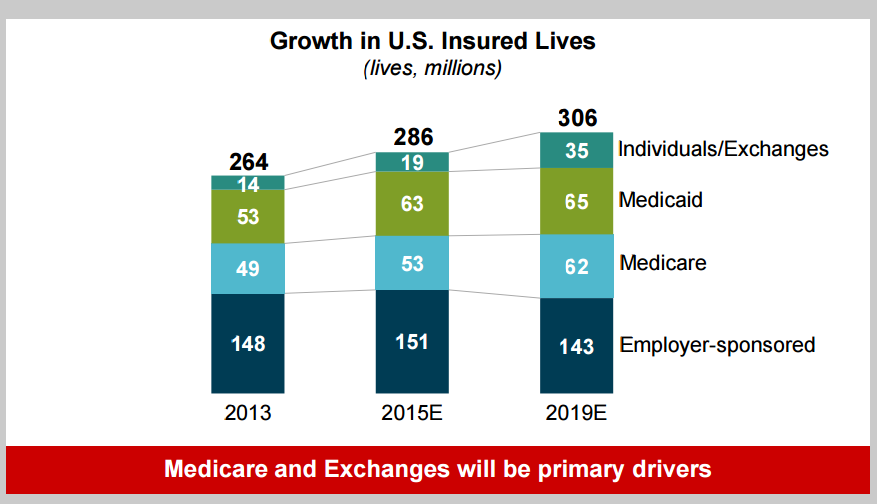

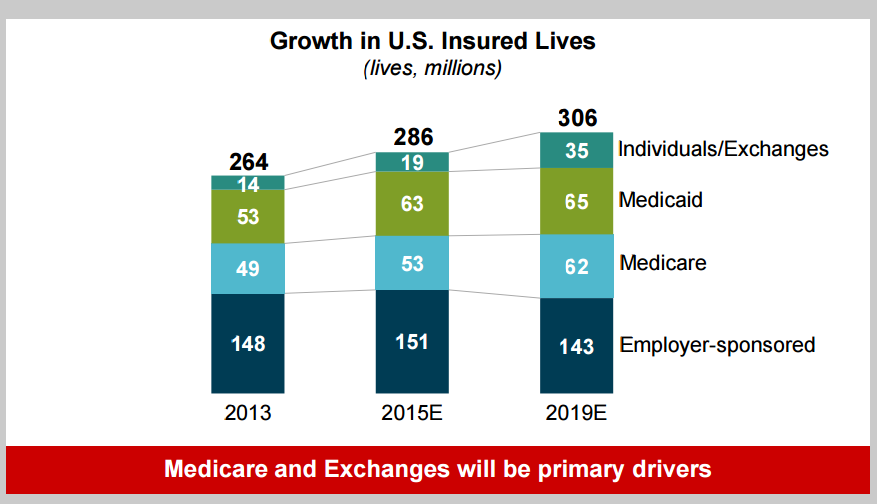

Overall, the number of insured lives has increased in 2015 and is expected to continue to increase by 2019 to over 300 million, from 286 million this year and 264 million in 2013. A large part of that increase has been driven by the Affordable Care Act, which dramatically increased Medicaid. CVS believes employers overall view healthcare as an important driver of employee recruitment and retention.

As the company has discussed over the last several years, it is not merely the quantity of people insured but also the composition of the group that matters. The aging US population will drive increased utilization rates, which will create a secular tailwind for the industry. According to the company, US prescription drug expenditures are expected to increase at a compound annual growth rate (CAGR) of 6% over the next nine years.

For patients with medical conditions such as diabetes or hypertension, utilizing pharmacies and taking their prescription medication is a key way to keep costs in check. The number of people over age 85 is expected to double over the next 20 years, which underscores the need for LTC services, and the recent Omnicare acquisition gave CVS access to this market.

The addressable specialty market is expected to be driven by new medications coming to market at higher prices, and is forecast to grow at a 14% CAGR by 2020. Consumers are taking on a larger portion of their healthcare cost through consumer-directed health plans.

LINES BETWEEN SEGMENTS CONTINUE TO BLUR; CVS VIEWS BUSINESS ON ENTERPRISE BASIS

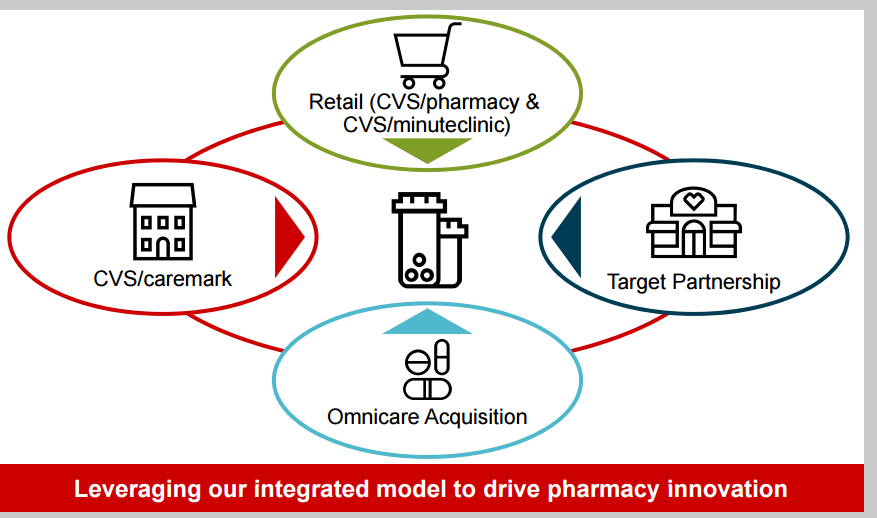

Management remains very focused on expanding its core pharmacy business while also expanding into new channels within the healthcare space.

Source: CVS

The pharmacy segment is the company’s primary focus; it has captured 39% of the prescription growth over the last five years, representing 275 million new prescriptions. The growth in the category has been driven by the aging population, the increase in prescription utilization and the expansion of Medicaid.

Pharmacy sales represent 72% of CVS’s total retail revenues. Management commented that they view the consumer environment as cautious currently. On the front end of the business, the company sees the health and beauty categories as areas they must win, given that they are most closely tied to pharmacy. In addition, these categories have margins that are 1.7 times higher than those of other general merchandise categories, and they are projected to grow at double the rate of other categories over the next three years.

CVS estimates that the PBM business will generate net revenues of $121.5 billion in 2016, and grow at a 15.6% CAGR over the next five years. The company generated $11.5 billion of new business for 2016, representing a 98% retention rate; 60% of the nonrenewals were related to acquisitions and retirees. Of the total new revenue, 80% ($11.1 billion) is flowing through the retail channel.

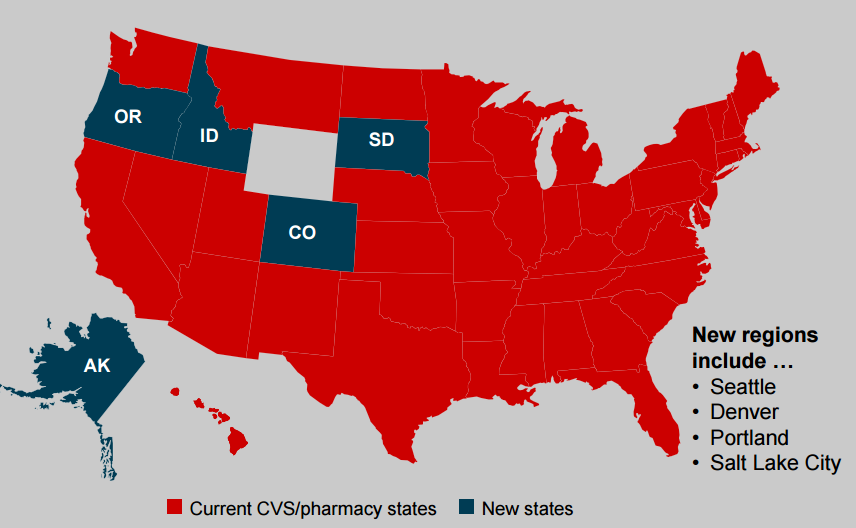

TARGET AND OMNICARE INTEGRATIONS UNDER WAY

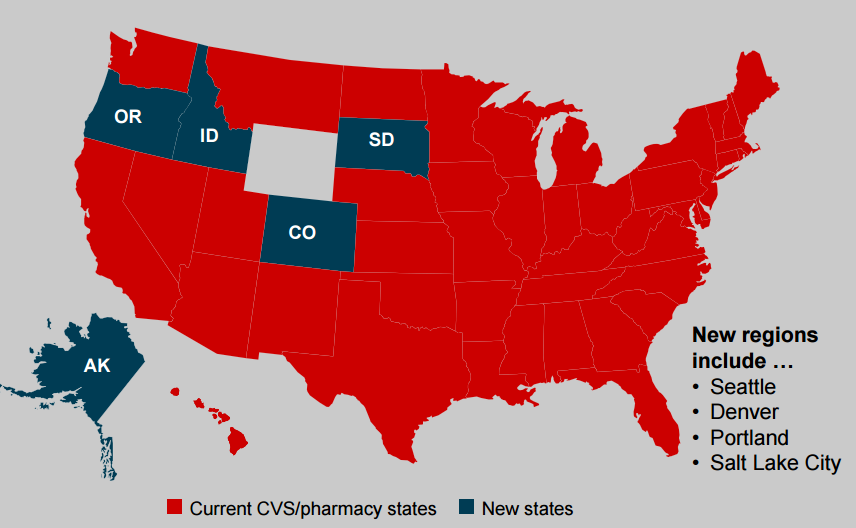

Earlier this morning, CVS announced the completion of its acquisition of Target’s pharmacy and clinic businesses for $1.9 billion, which was first announced in June. The Target pharmacies and clinics will be transitioned to the CVS Health banner and systems within six to eight months. Target pharmacies are expected to be lower volume and thus less profitable than stand-alone CVS stores. But acquisitions enable pharmacy share gains, and Target pharmacies complement CVS’s existing footprint and expand it by 20%, increasing access for patients. New regions for CVS include Seattle, Denver, Portland and Salt Lake City.

Source: CVS

Another recent acquisition, Omnicare, brings a new pharmacy channel to CVS in the form of LTC facilities. The acquisition allows CVS to provide continuity for its patients, particularly as they reach the 85+ age group.