Nitheesh NH

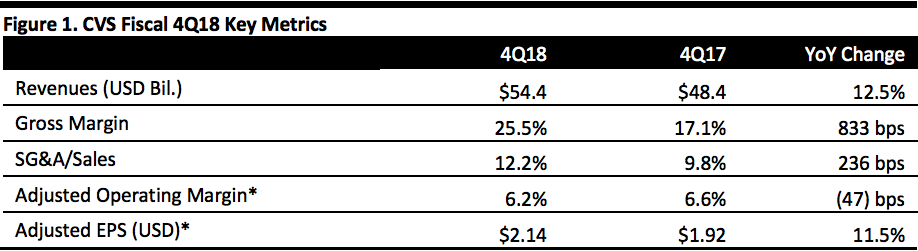

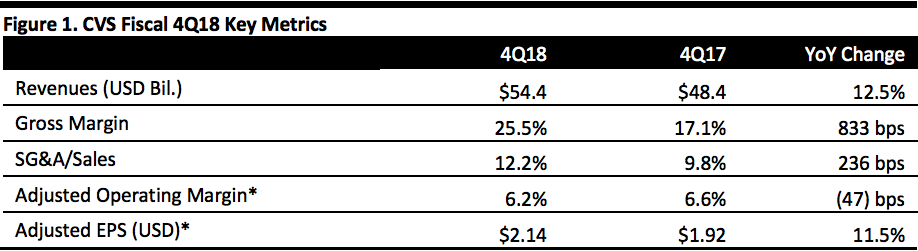

[caption id="attachment_77389" align="aligncenter" width="620"] *Adjusted operating margin and adjusted EPS include adding back amortization of intangible assets and integration costs related to the acquisition of Aetna.

*Adjusted operating margin and adjusted EPS include adding back amortization of intangible assets and integration costs related to the acquisition of Aetna.

Source: Company reports/Coresight Research[/caption] 4Q18 Results CVS reported revenues of $54.4 billion, up 12.5% year over year and above the $53.4 billion consensus estimate, in the fourth quarter ended December 31. CVS completed the acquisition of health insurance firm Aetna on November 28. Operating margin and EPS have been adjusted to reflect integration costs related to the acquisition and amortization of intangible assets. Adjusted EPS was $2.14, up 11.5% year over year and beat the $2.06 consensus estimate. Retail pharmacy/longterm care was the faster growing segment, with revenues up 5.4% year over year to $22 billion. Increased prescription volume and branded drug price inflation, partially offset by continued reimbursement pressure and the impact of helped growth in this segment. Prescription volume, on a 30-day basis, grew 8.6% during the quarter thanks to the continued adoption of patient care programs and collaborations with pharmacy benefit managers (PBMs). Revenues in the pharmacy services segment grew 2.2% to $34.9 billion. Pricing pressure partially offset growth in total pharmacy claims volume and brand inflation. Pharmacy claims processed rose 5.6% on a 30-day equivalent basis driven by network expansion and continued adoption of offerings in the CVS Maintenance Choice program for customers with 90-day prescriptions. FY18 Results In the fiscal year 2018, CVS grew revenues by 5.3% to $194.0 billion and adjusted operating income by 2.5% to $10.3 billion. Management said adjusted EPS of $7.08 came in “at the top end of (the) previous guidance range” and that the company also delivered on other financial expectations: free cash flow of $7 billion and over $2 billion in dividends paid to shareholders. New Segment from Aetna’s Business: Health Care Benefits CVS has introduced a new segment, called Health Care Benefits, in place of the Health Care segment at Aetna. The Health Care Benefits segment offers a full range of insured and self-insured medical, pharmacy, dental and behavioral health products and services. CVS includes some divisions of Aetna’s business for which the company no longer seeks or accepts new customers, such as large case pensions and long-term care products. For the period from November 28 to December 31, 2018, the segment earned $5.6 billion in revenues and $276 million in operating income. Outlook For FY19, CVS expects revenue growth of 28.4-30.7% to $249.9-254.3 billion and adjusted EPS of $6.68-6.88, implying growth of (2.8)% to (5.6)% year over year. The company expects net synergies of $300-350 million and incremental investment spending of $325-350 million. CEO Larry Merlo stated, “2019 will be a year of transition as we integrate Aetna and focus on key pillars of our growth strategy. We are fully aware of the need to address the impact of certain headwinds that are having a disproportionate impact in 2019 compared to prior years.” For FY19, consensus calls for revenue growth of 29.7% year over year and flat adjusted EPS.

*Adjusted operating margin and adjusted EPS include adding back amortization of intangible assets and integration costs related to the acquisition of Aetna.

*Adjusted operating margin and adjusted EPS include adding back amortization of intangible assets and integration costs related to the acquisition of Aetna.Source: Company reports/Coresight Research[/caption] 4Q18 Results CVS reported revenues of $54.4 billion, up 12.5% year over year and above the $53.4 billion consensus estimate, in the fourth quarter ended December 31. CVS completed the acquisition of health insurance firm Aetna on November 28. Operating margin and EPS have been adjusted to reflect integration costs related to the acquisition and amortization of intangible assets. Adjusted EPS was $2.14, up 11.5% year over year and beat the $2.06 consensus estimate. Retail pharmacy/longterm care was the faster growing segment, with revenues up 5.4% year over year to $22 billion. Increased prescription volume and branded drug price inflation, partially offset by continued reimbursement pressure and the impact of helped growth in this segment. Prescription volume, on a 30-day basis, grew 8.6% during the quarter thanks to the continued adoption of patient care programs and collaborations with pharmacy benefit managers (PBMs). Revenues in the pharmacy services segment grew 2.2% to $34.9 billion. Pricing pressure partially offset growth in total pharmacy claims volume and brand inflation. Pharmacy claims processed rose 5.6% on a 30-day equivalent basis driven by network expansion and continued adoption of offerings in the CVS Maintenance Choice program for customers with 90-day prescriptions. FY18 Results In the fiscal year 2018, CVS grew revenues by 5.3% to $194.0 billion and adjusted operating income by 2.5% to $10.3 billion. Management said adjusted EPS of $7.08 came in “at the top end of (the) previous guidance range” and that the company also delivered on other financial expectations: free cash flow of $7 billion and over $2 billion in dividends paid to shareholders. New Segment from Aetna’s Business: Health Care Benefits CVS has introduced a new segment, called Health Care Benefits, in place of the Health Care segment at Aetna. The Health Care Benefits segment offers a full range of insured and self-insured medical, pharmacy, dental and behavioral health products and services. CVS includes some divisions of Aetna’s business for which the company no longer seeks or accepts new customers, such as large case pensions and long-term care products. For the period from November 28 to December 31, 2018, the segment earned $5.6 billion in revenues and $276 million in operating income. Outlook For FY19, CVS expects revenue growth of 28.4-30.7% to $249.9-254.3 billion and adjusted EPS of $6.68-6.88, implying growth of (2.8)% to (5.6)% year over year. The company expects net synergies of $300-350 million and incremental investment spending of $325-350 million. CEO Larry Merlo stated, “2019 will be a year of transition as we integrate Aetna and focus on key pillars of our growth strategy. We are fully aware of the need to address the impact of certain headwinds that are having a disproportionate impact in 2019 compared to prior years.” For FY19, consensus calls for revenue growth of 29.7% year over year and flat adjusted EPS.