Nitheesh NH

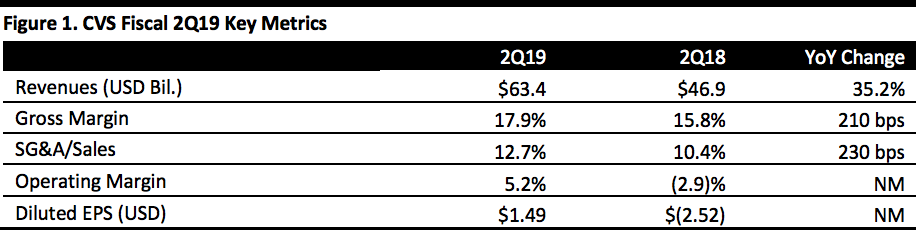

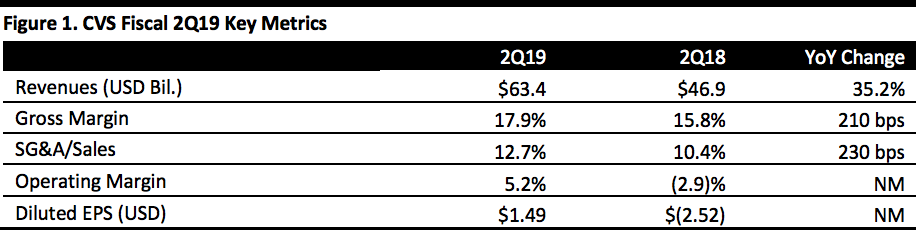

[caption id="attachment_94428" align="aligncenter" width="700"] NM=not meaningful

NM=not meaningful

Source: Company reports/Coresight Research[/caption] 2Q19 Results CVS reported revenue growth of 35.2% year over year to $63.4 billion in the second quarter ended June 30, above the $62.6 billion consensus estimate as recorded by FactSet StreetAccount. CVS completed the acquisition of health insurance firm Aetna in November 2018 so 1Q19 was the first full quarter of combined operations. Revenue growth adjusted for exceptional items as well as transaction and integration costs related to the Aetna acquisition were 35.8%. The Aetna acquisition was the primary growth driver for revenue, along with higher volumes and brand name drug price inflation in both the pharmacy services and retail pharmacy/long-term care (LTC) segments. Operating expenses grew 65.2% and adjusted operating expenses 59.1%. Higher amortization and acquisition-related integration costs prompted the surge in operating expenses, growing SG&A as a percentage of revenues by 230 basis points (bps). Diluted EPS was $1.49, versus a loss per share of $2.52 in 2Q18. Adjusted EPS grew 12.0% to $1.89. Segment Breakdown

NM=not meaningful

NM=not meaningfulSource: Company reports/Coresight Research[/caption] 2Q19 Results CVS reported revenue growth of 35.2% year over year to $63.4 billion in the second quarter ended June 30, above the $62.6 billion consensus estimate as recorded by FactSet StreetAccount. CVS completed the acquisition of health insurance firm Aetna in November 2018 so 1Q19 was the first full quarter of combined operations. Revenue growth adjusted for exceptional items as well as transaction and integration costs related to the Aetna acquisition were 35.8%. The Aetna acquisition was the primary growth driver for revenue, along with higher volumes and brand name drug price inflation in both the pharmacy services and retail pharmacy/long-term care (LTC) segments. Operating expenses grew 65.2% and adjusted operating expenses 59.1%. Higher amortization and acquisition-related integration costs prompted the surge in operating expenses, growing SG&A as a percentage of revenues by 230 basis points (bps). Diluted EPS was $1.49, versus a loss per share of $2.52 in 2Q18. Adjusted EPS grew 12.0% to $1.89. Segment Breakdown

- Pharmacy services revenues increased 4.2% to $34.8 billion, driven by higher pharmacy claim volume and branded drug price inflation. Pharmacy claims processed rose 4.0% on a 30-day equivalent basis, versus 2.8% in 1Q19.

- Retail pharmacy/LTC revenues were up 3.7% year over year to $21.4 billion, driven by increased prescription volume and branded drug price inflation, partially offset by persistent reimbursement pressure and the impact of generic drug introductions. Front store revenues, which represent approximately 22.7% of total segment revenues, increased compared to the prior year and prescription volume grew 5.9% on a 30-day equivalent basis.

- Health care benefits is a new segment that CVS introduced in 4Q18 in place of the health care segment at Aetna. The health care benefits segment offers a full range of insured and self-insured medical, pharmacy, dental and behavioral health products and services. During the quarter, revenues in the segment increased $16.6 billion compared to revenues in the prior year, to $17.4 billion.

- Total revenues increased 35.0% to $125 billion.

- Gross margin expanded 230 bps to 17.8%.

- SG&A as a percentage of sales grew 240 bps to 13.0% and adjusted operating income rose 56% to $7.6 billion.

- Adjusted EPS was $3.51, up 11.1%.

- CVS incurred a store rationalization charge of $135 million related primarily to asset impairment charges linked to the planned closure of 46 underperforming retail pharmacy stores in 2Q19.

- Narrowed the guidance range for revenues to $251.4-254.16 billion from $249.9-254.29 billion.

- Confirmed guidance for consolidated GAAP operating income of $11.8-12.0 billion.

- Narrowed the guidance range for adjusted operating income to $15.2-15.4 billion from $15.0-15.2 billion.

- Narrowed the adjusted EPS guidance range to $6.89-7.00 from $6.75-6.90.