albert Chan

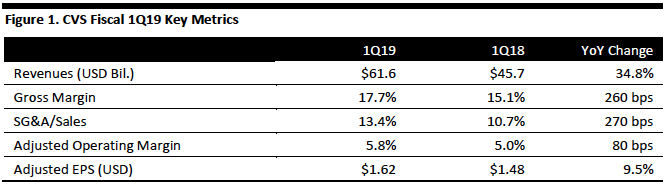

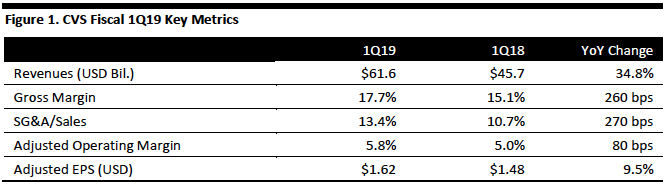

[caption id="attachment_86158" align="aligncenter" width="664"] Effective this quarter, CVS realigned the composition of its segments to correspond with changes to its operating model: The adjusted operating income and EPS reflect this and exclude the impact of amortization of intangible assets and other exceptional items

Effective this quarter, CVS realigned the composition of its segments to correspond with changes to its operating model: The adjusted operating income and EPS reflect this and exclude the impact of amortization of intangible assets and other exceptional items

Source: Company reports/Coresight Research[/caption] 1Q19 Results CVS reported revenues of $61.6 billion in the first quarter ended March 31, up 34.8% year over year and above the $60.4 billion consensus estimate recorded by S&P Capital IQ. CVS completed the acquisition of health insurance firm Aetna in November 2018, so this is the first full quarter of combined operations. Revenue growth adjusted for exceptional items related to the Aetna acquisition was 34.9%. Revenue growth was driven by the Aetna acquisition, in addition to increased volume and brand name drug price inflation, partially offset by continued price compression in the company’s pharmacy services segment, reimbursement pressure in the retail pharmacy/longterm care (LTC) segment and a higher generic dispensing rate. The impact of the Aetna acquisition, higher operating expenses in the retail/LTC segment and increased acquisition-related integration costs prompted a 68% jump in operating expenses. This led SG&A as a percentage of revenues to expand by 270 basis points. Operating margin and EPS have been adjusted to reflect integration costs related to the acquisition, amortization of intangible assets and a realignment in the composition of the company’s reporting segments. Operating expenses and adjusted operating expenses grew 67.9% and 60.6%, respectively. Apart from costs related to the Aetna acquisition, expenses increased due to a $135 million store rationalization charge, mainly related to write-downs in connection with the planned closure of 46 underperforming retail pharmacy stores in the second quarter of 2019. Adjusted EPS was $1.62, up 9.5% year over year and above the $1.51 consensus estimate. Segment Breakdown

Effective this quarter, CVS realigned the composition of its segments to correspond with changes to its operating model: The adjusted operating income and EPS reflect this and exclude the impact of amortization of intangible assets and other exceptional items

Effective this quarter, CVS realigned the composition of its segments to correspond with changes to its operating model: The adjusted operating income and EPS reflect this and exclude the impact of amortization of intangible assets and other exceptional itemsSource: Company reports/Coresight Research[/caption] 1Q19 Results CVS reported revenues of $61.6 billion in the first quarter ended March 31, up 34.8% year over year and above the $60.4 billion consensus estimate recorded by S&P Capital IQ. CVS completed the acquisition of health insurance firm Aetna in November 2018, so this is the first full quarter of combined operations. Revenue growth adjusted for exceptional items related to the Aetna acquisition was 34.9%. Revenue growth was driven by the Aetna acquisition, in addition to increased volume and brand name drug price inflation, partially offset by continued price compression in the company’s pharmacy services segment, reimbursement pressure in the retail pharmacy/longterm care (LTC) segment and a higher generic dispensing rate. The impact of the Aetna acquisition, higher operating expenses in the retail/LTC segment and increased acquisition-related integration costs prompted a 68% jump in operating expenses. This led SG&A as a percentage of revenues to expand by 270 basis points. Operating margin and EPS have been adjusted to reflect integration costs related to the acquisition, amortization of intangible assets and a realignment in the composition of the company’s reporting segments. Operating expenses and adjusted operating expenses grew 67.9% and 60.6%, respectively. Apart from costs related to the Aetna acquisition, expenses increased due to a $135 million store rationalization charge, mainly related to write-downs in connection with the planned closure of 46 underperforming retail pharmacy stores in the second quarter of 2019. Adjusted EPS was $1.62, up 9.5% year over year and above the $1.51 consensus estimate. Segment Breakdown

- Retail pharmacy/LTC was the fastest growing segment yet again, with revenues up 3.3% year over year to $21.1 billion. The growth reflects increased prescription volume and branded drug price inflation, partially offset by continued downward reimbursement pressure and the impact of recent generic introductions.

- Pharmacy services revenues grew 3.1% to $33.6 billion. Price compression and a higher generic dispensing rate partially offset growth from increased pharmacy claims volume and branded drug price inflation. Pharmacy claims processed rose 2.8% on a 30-day equivalent basis.

- Health care benefits is a new segment that CVS introduced last quarter to replace Aetna’s health care segment. The health care benefits segment offers a full range of insured and self-insured medical, pharmacy, dental and behavioral health products and services. In the first quarter, revenues in the segment were $17.9 billion, an increase of $16.6 billion compared to revenues in the prior year.

- Revenue growth, from 28.4-30.7% to 29.1-30.7% or from $249.9-254.3 billion to $251.2-254.4 billion.

- Adjusted EPS of $6.75-6.90, reflecting growth of (4.7)-(2.5)% versus $6.68-6.88 or (5.6)-(2.8)% previously.