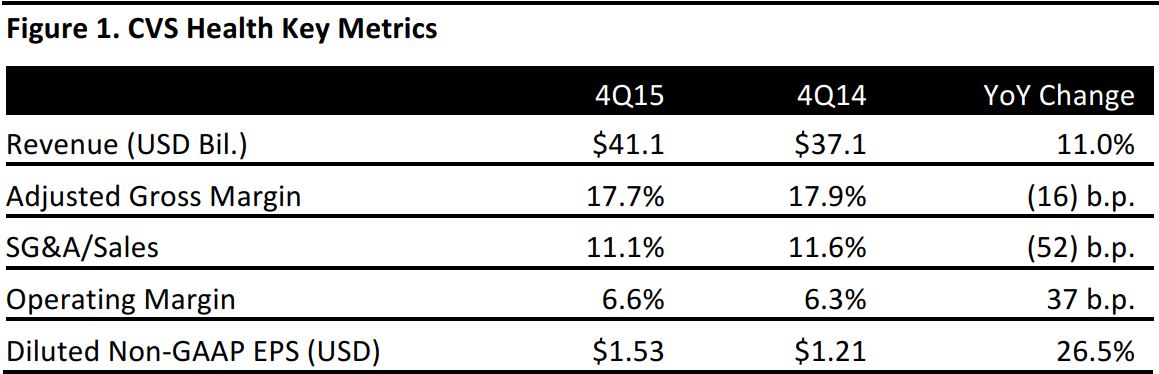

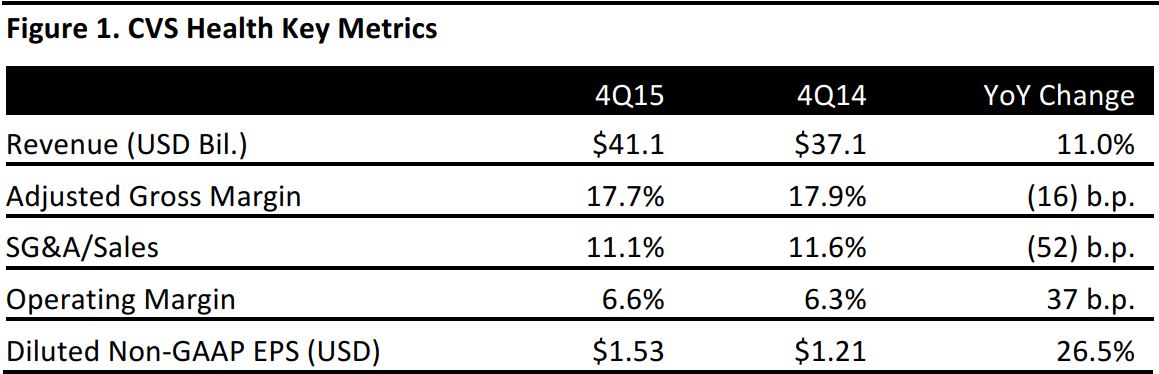

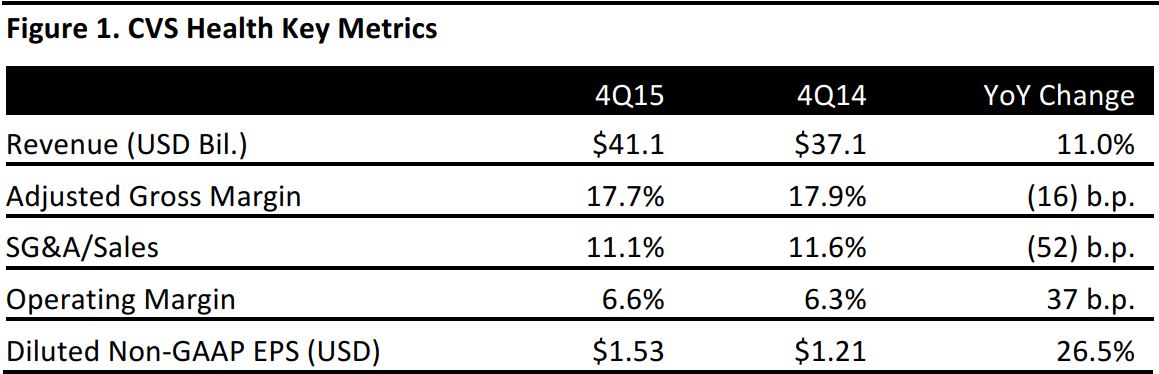

Source: Company reports

Results include the benefit of two recent acquisitions that allow CVS to cover more patients: Omnicare, which dispenses drugs to assisted living, long-term care facilities, hospital and other care providers; and Target’s pharmacy business, which gives CVS nearly 1,700 more locations.

Revenues in the retail segment rose by 12.5%, to $19.9 billion, ahead of the consensus estimate of $19.4 billion. About half, or $1.1 billion, of that growth stemmed from the company’s recent, $10 billion acquisition of pharmaceutical distributor Omnicare.

In the quarter, CVS’s same-store retail sales rose by 3.5%, beating the consensus of 2.1%, with pharmacy same-store sales up 5.0% and front store-same store sales down 0.5%. Front store sales edged downward on softer traffic and the discontinuation of tobacco products, but these decreases were partially offset by an increase in basket size. Pharmacy same-store prescription volumes rose by 5.0%, but recent generic introductions negatively impacted pharmacy same-store sales by 470 basis points.

Revenues in the Caremark and other pharmacy-services segment increased by 11.1% to $26.5 billion. This increase was primarily driven by growth in specialty pharmacy, which includes the impact of Omnicare and pharmacy network claims. Claims processed increased by 7.2%, primarily due to net new business.

CVS reported 4Q net income of $1.5 billion, or $1.34 a share. Net income was up 13%, or $1.14 a share, from the year-ago quarter. Excluding special items, EPS was $1.53.

During the quarter, the company booked $20 million in acquisition-related charges, some of which were related to the Omnicare deal and to CVS’s acquisition of Target’s pharmacy and clinics business.

For the year, net sales increased by 10.0%, to a record $153.3 billion. Non-GAAP EPS was $5.16, an increase of 14.8%.

CVS also saw growth from its pharmacy benefit management company, which is hired by employers to handle their workers’ prescription benefits. Management indicated the 2016 retention rate remains at approximately 98%

Guidance

The company reaffirmed its FY16 guidance of non-GAAP EPS of $5.73–$5.88, in line with consensus of $5.82. CVS expects earnings growth to pick up more in the second half of FY16. The company also reaffirmed guidance for free cash flow of $5.3–$5.6 billion and cash flow from operations of $7.6–$7.9 billion.

CVS expects to grow its market share of retail pharmacies, especially from Medicare Part D programs that have “preferred physicians in a variety of national and regional plans.”

For 1Q, CVS expects non-GAAP EPS of $1.14–$1.17, slightly below the consensus estimate of $1.18.