Source: Company reports/FGRT

2Q17 Results

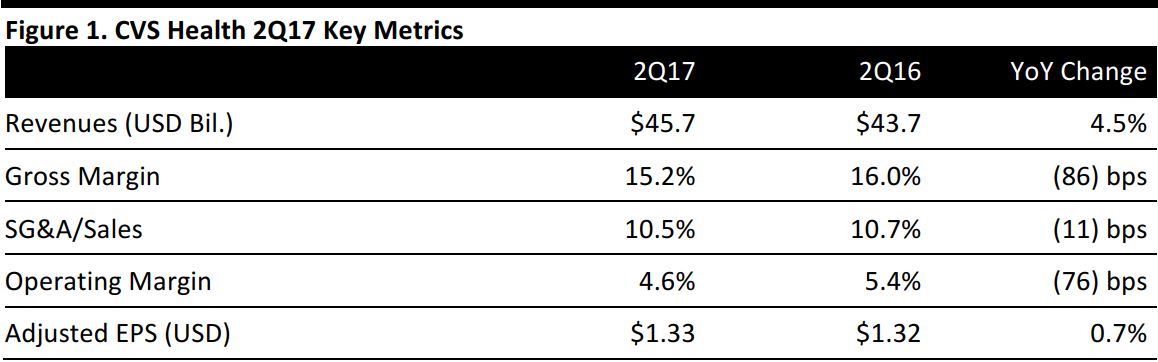

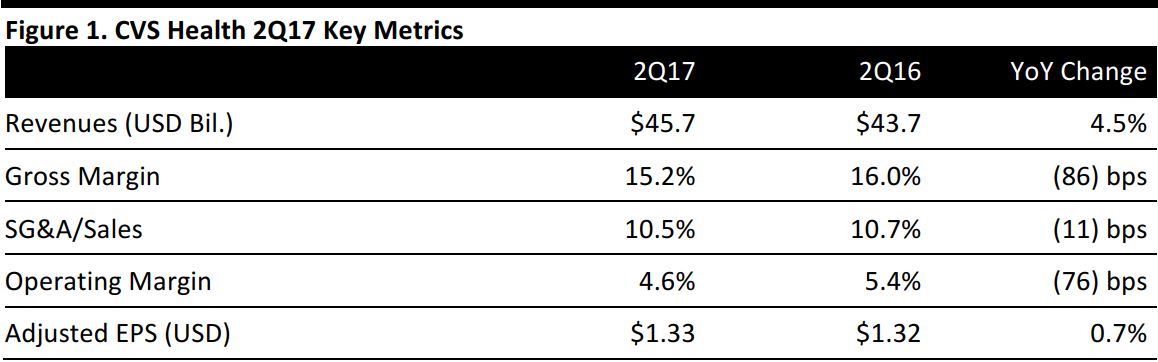

CVS reported 2Q17 revenues of $45.7 billion, up 4.5% year over year and beating the $45.35 billion consensus estimate.

Adjusted EPS was $1.33, up 0.7% year over year and beating the $1.31 consensus estimate. GAAP EPS from continuing operations was $1.07, compared with $0.86 in the year-ago quarter.

Management commented that the company is on pace to hit its full-year targets and that operating profit in the Retail/LTC profit segment was in line with expectations, while operating profit in Pharmacy Services exceeded expectations. Management expressed its desire to return the company to healthy earnings growth.

Pharmacy Services Segment

The Pharmacy Services segment grew revenues by 9.5% year over year, to $32.3 billion, which was above the consensus estimate of $32.2 billion. The increase was primarily driven by growth in pharmacy network claim volume as well as by brand inflation and specialty pharmacy volume, and was partially offset by increased generic dispensing and price compression.

- Pharmacy network claims processed during the quarter increased by 10.3% year over year, to 376.0 million, owing to growth in net new business.

- Mail choice claims processed during the quarter increased by 5.2%, to 65.6 million, driven by the continued adoption of the company’s Maintenance Choice offerings and an increase in specialty pharmacy claims.

Retail/LTC Segment

Revenues in the Retail/LTC segment declined by 2.2%, to $19.6 billion. The total was above the $19.3 billion consensus estimate and revenues were driven by a 2.6% decrease in same-store sales, an increase in the generic dispensing rate and continued reimbursement pressure.

Pharmacy same-store sales declined by 2.8%, hurt by approximately 410 basis points due to recent generic introductions. Pharmacy same-store prescription volumes were flat due to previously announced restricted networks that exclude CVS Pharmacy.

Front-store same-store sales decreased by 2.1% due to the shift in timing of the Easter holiday, softer customer traffic and efforts to rationalize promotional strategies, which were partially offset by an increase in average basket size.

In the quarter, the generic dispensing rate increased by approximately 130 basis points, to 87.2%, in the Pharmacy Services segment and it increased by approximately 150 basis points, to 87.6%, in the Retail/LTC segment.

Outlook

FY17

The company narrowed its 2017 adjusted EPS guidance range upward, to $5.83–$5.93 from $5.77–$5.93. CVS reduced its full-year GAAP EPS guidance to $4.92–$5.02 from $5.02–$5.18.

3Q17

For the third quarter, CVS expects adjusted EPS of $1.47–$1.50, below the consensus estimate of $1.63.The company expects 3Q17 GAAP EPS of $1.20–$1.23.