Source: Company reports/FGRT

3Q17 Results

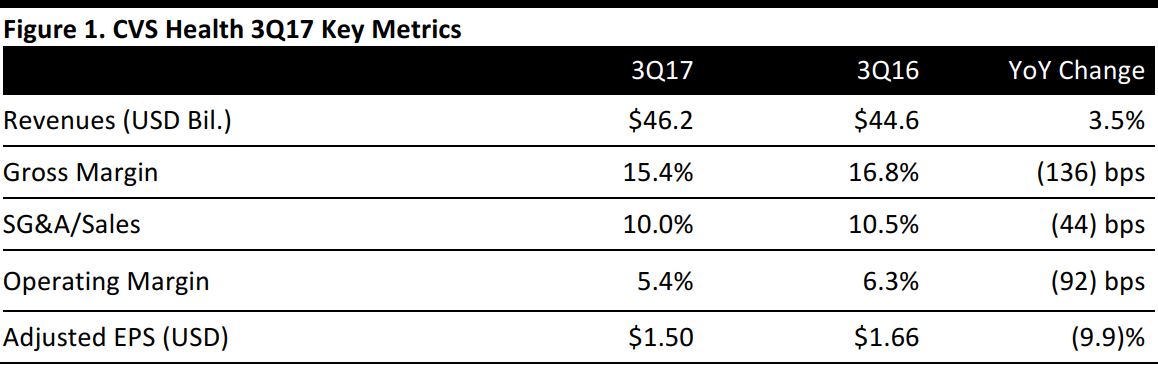

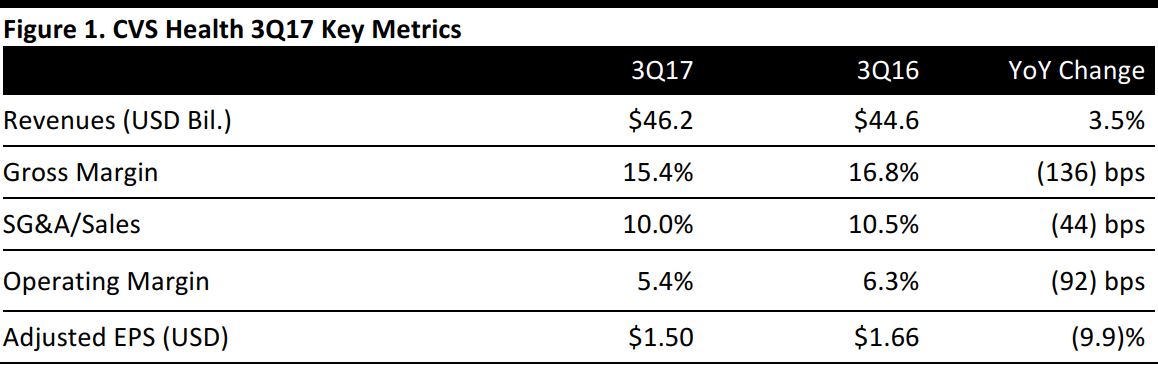

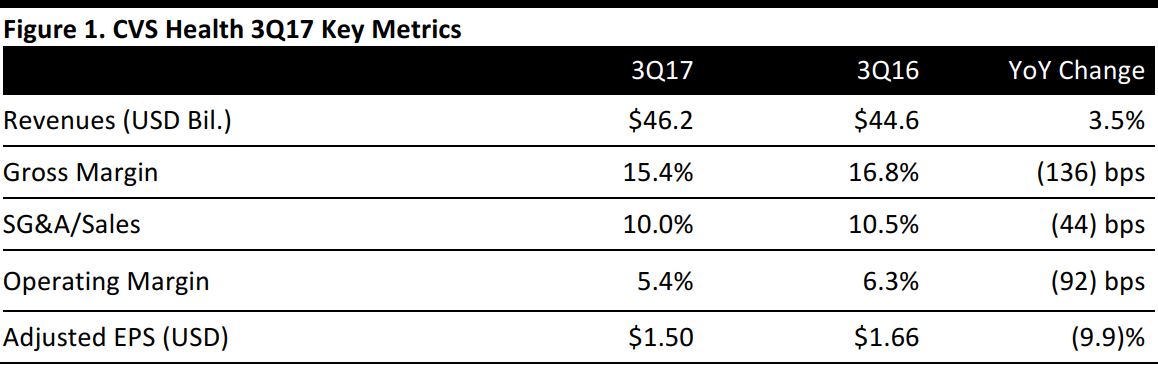

CVS reported 3Q17 revenues of $46.2 billion, up 3.5% year over year and in line with the $46.2 billion consensus estimate.

Adjusted EPS was $1.50, down 9.9% year over year and beating the $1.48 consensus estimate. GAAP EPS from continuing operations was $1.26, compared with $1.43 in the year-ago quarter. The difference between GAAP and adjusted EPS was primarily due to amortization of intangibles and losses on settlements of defined benefit pension plans and the tax effect thereof.

Management commented that the company remains on track to hit its full-year targets. Although operating profit in the Retail/LTC segment was hurt by the recent hurricanes, operating profit in the Pharmacy Services segment was in line with expectations. Management also cited actions such as expanded partnerships and new pharmacy benefit manager offerings as part of its plan to return to healthy earnings growth.

Following the summer hurricanes, approximately 925CVS stores were closed for some period of time, and 11 still remain closed. The financial impact to the company is estimated at about $55 million, most of which will be used to cover insurance deductibles within the Retail/LTC segment. In advance of the storms, CVS’s proprietary messaging platform helped to ensure delivery of specialty and other medications for patients in transition.

Pharmacy Services Segment

The Pharmacy Services segment’s revenues grew by 8.1% year over year, to $32.9 billion, which was below the consensus estimate of $33.2 billion.

Growth was below guidance, primarily due to lower-than-expected volume. However, year-over-year growth was driven by an increase in pharmacy network claims, brand inflation and growth in specialty pharmacy. Growth was hurt by an increase of 100 basis points in the generic dispensing ratio, to 87.0%, as well as by price compression.

Adjusted claims grew by 7.9% year over year, comprising 6.1% growth in adjusted mail choice and 8.3% growth in adjusted pharmacy network claims.

Retail/LTC Segment

Revenues in the Retail/LTC segment declined by 2.7%, to $19.6 billion, which was above the $19.3 billion consensus estimate. The revenue decline was driven by a 3.2% decrease in same-store sales (compared with the consensus estimate of a 4.6% decrease).

Pharmacy same-store sales decreased by 3.4%, with recent generic introductions hurting such sales by approximately 435 basis points. Pharmacy same-store prescription volumes increased by 0.3% despite previously announced decisions to exclude CVS Pharmacy from certain networks.

Front-store same-store sales decreased by 2.8% due to a decision to rationalize promotional strategies by scaling back on mass promotions and reducing circular page count as well as softer customer traffic. These decreases were partially offset by an increase in average basket size.

Outlook

FY17

The company narrowed and raised the midpoint of its FY17 adjusted EPS guidance to $5.87–$5.91 from $5.83–$5.93 previously. CVS also narrowed and raised the midpoint of its full-year GAAP EPS guidance, to $4.98–$5.02 from $4.92–$5.02.

4Q17

For the fourth quarter, CVS expects adjusted EPS of $1.88–$1.92, in line with the consensus estimate of $1.90. The company expects 4Q17 GAAP EPS of $1.75–$1.79.