Introduction

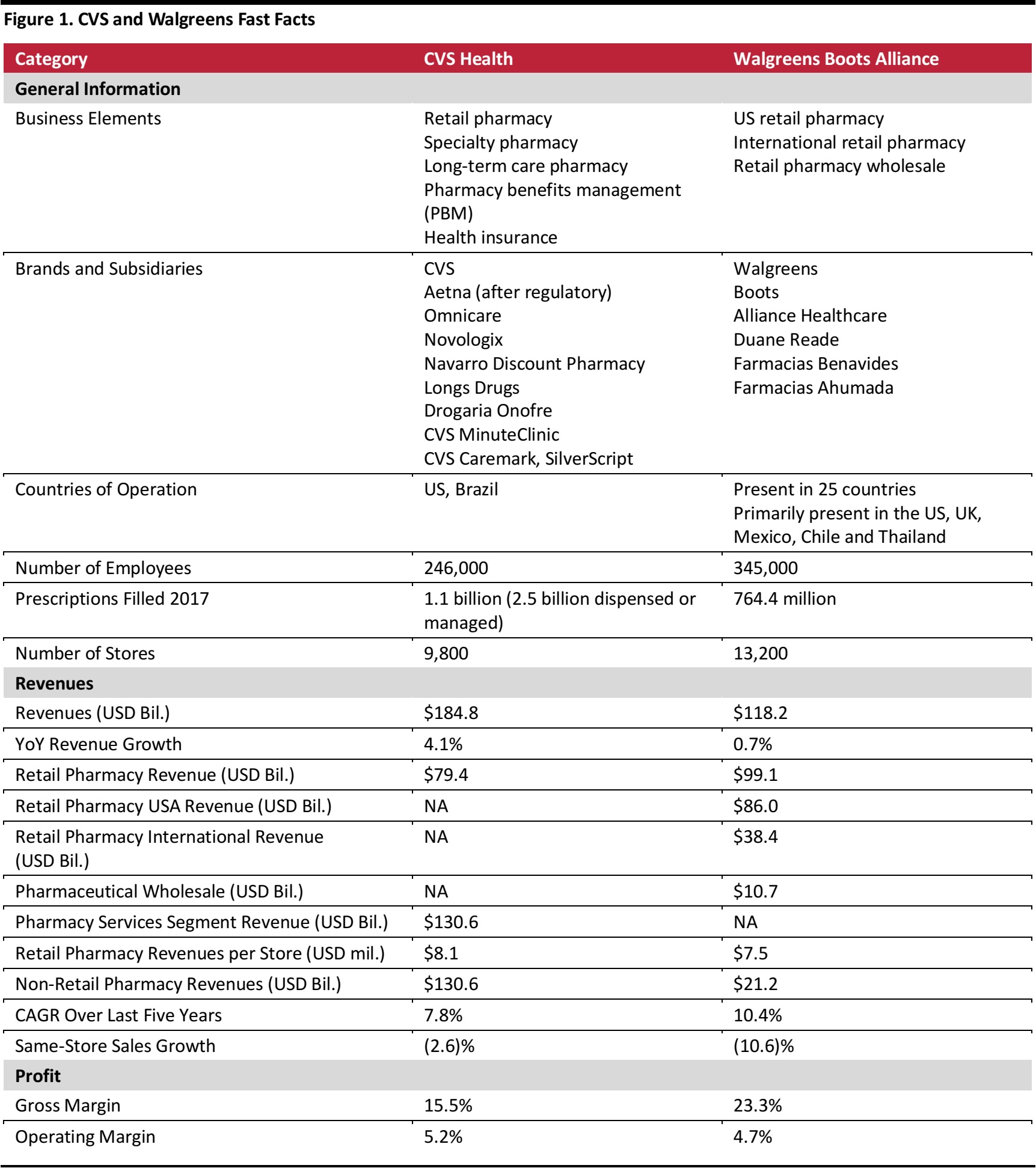

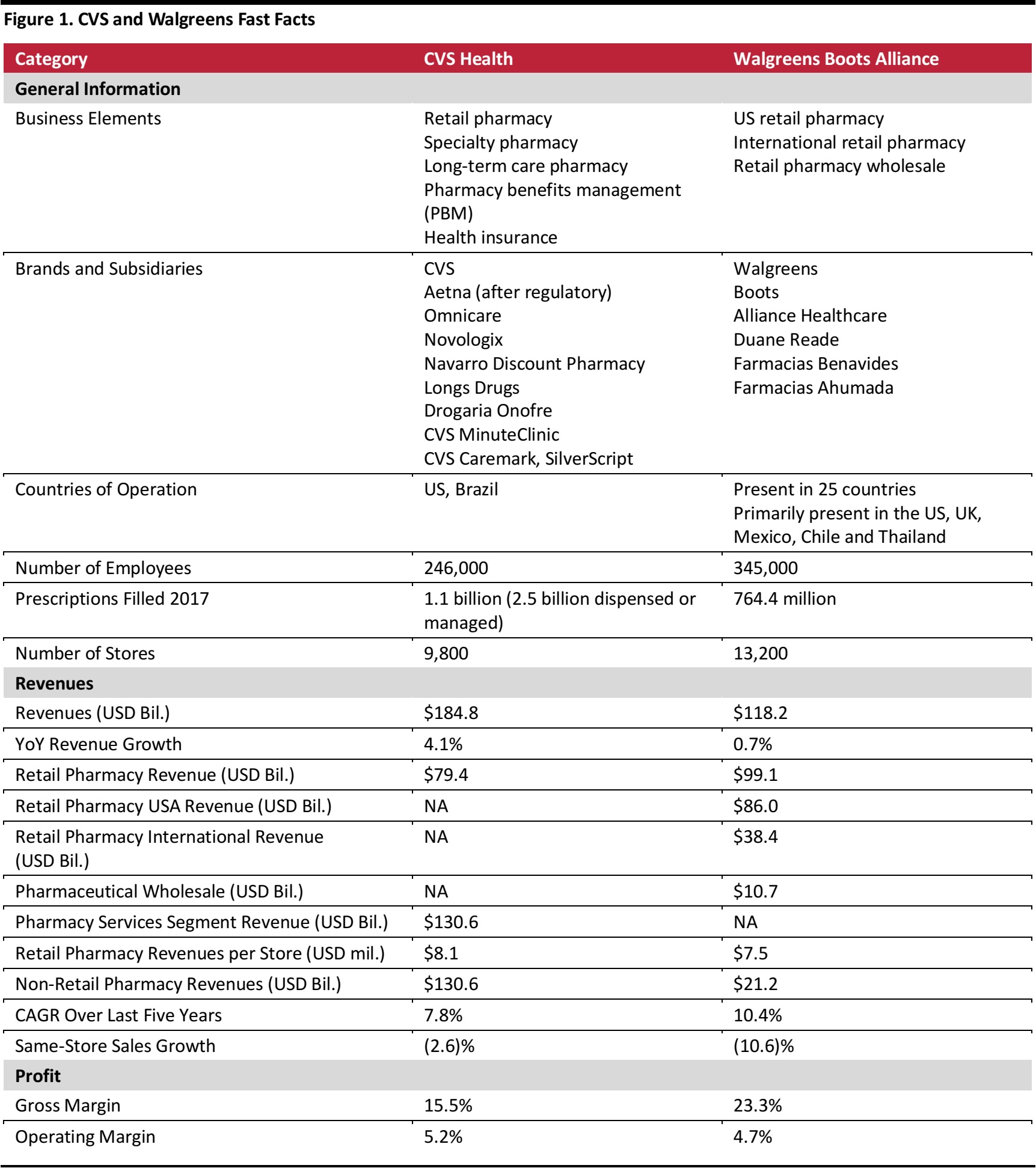

CVS and Walgreens are likely the two most ubiquitous names in pharmacy in the US. Both companies operate thousands of retail pharmacies in 49 of the 50 states, and each company reported revenues of over $100 billion in 2017. To many consumers, there is likely little distinction between the two pharmacy giants. However, despite their similar retail offerings and breadth of locations within the US, CVS Health and Walgreens Boots Alliance (WBA), the parent companies of the two pharmacy chains, have significantly different approaches to their businesses. In this report we look at the current pharmacy industry landscape, including market size, growth and potential competitors to CVS Health and WBA. We also focus on one key difference and one key similarity between CVS Health and WBA’s strategies:

1. Diversify vs. Fortify

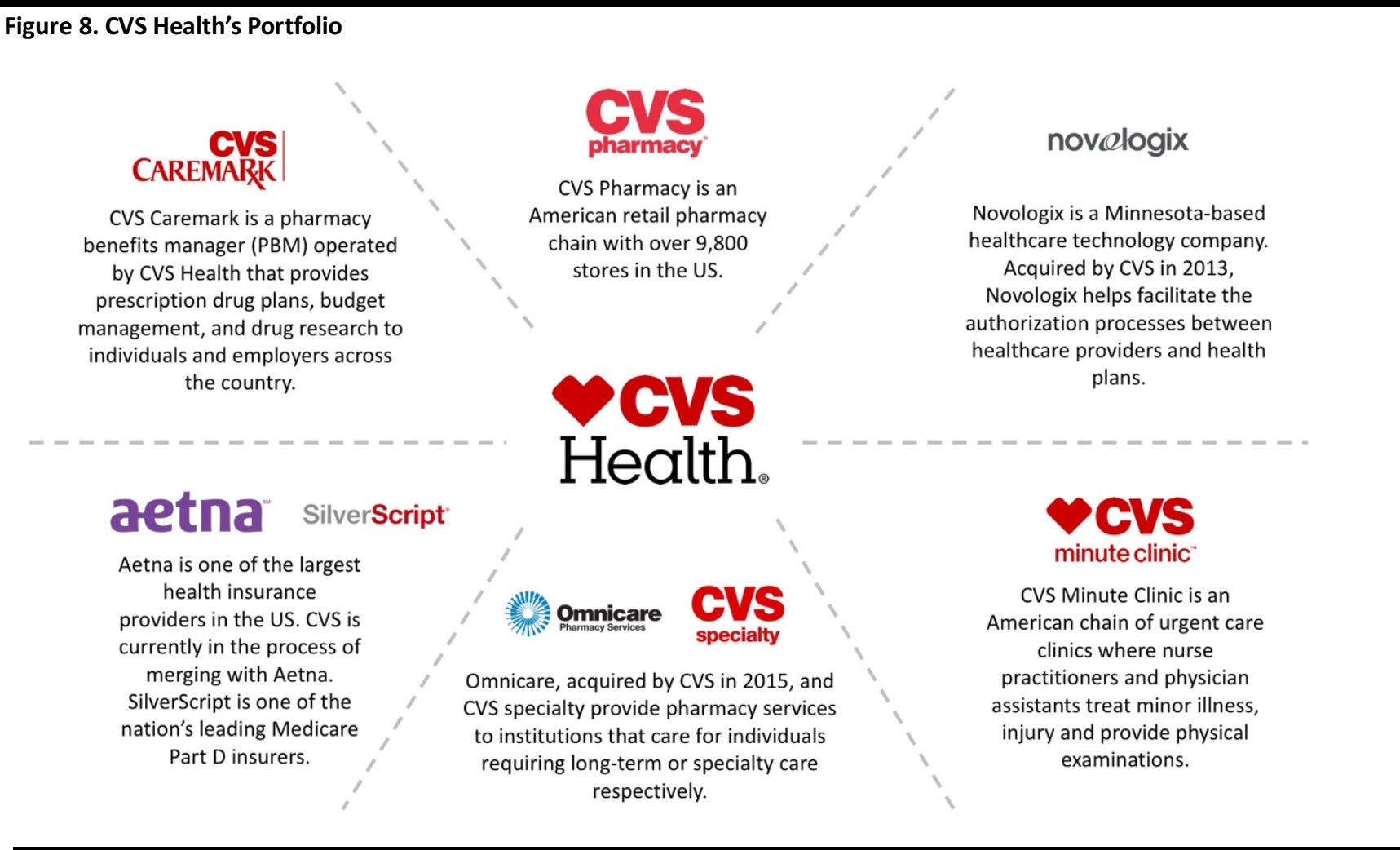

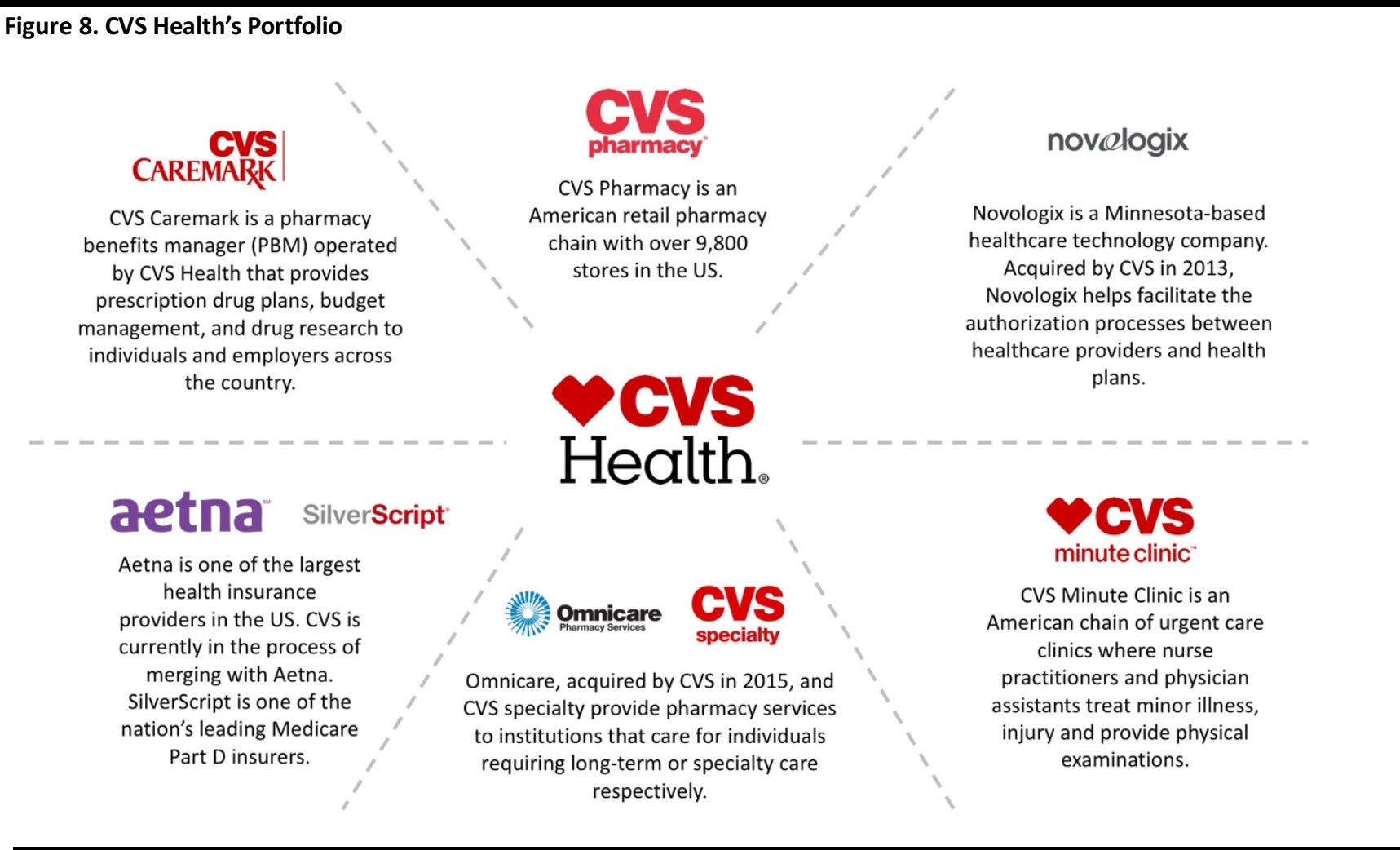

CVS Health: In recent years, CVS Health has widened its range of health services in the US beyond retail pharmacies and into a growing pharmacy benefits management business, large specialty and long-term pharmacy segments, and a presence in the health insurance market through the company’s planned acquisition of Aetna, the fourth-largest health insurance company in the US.

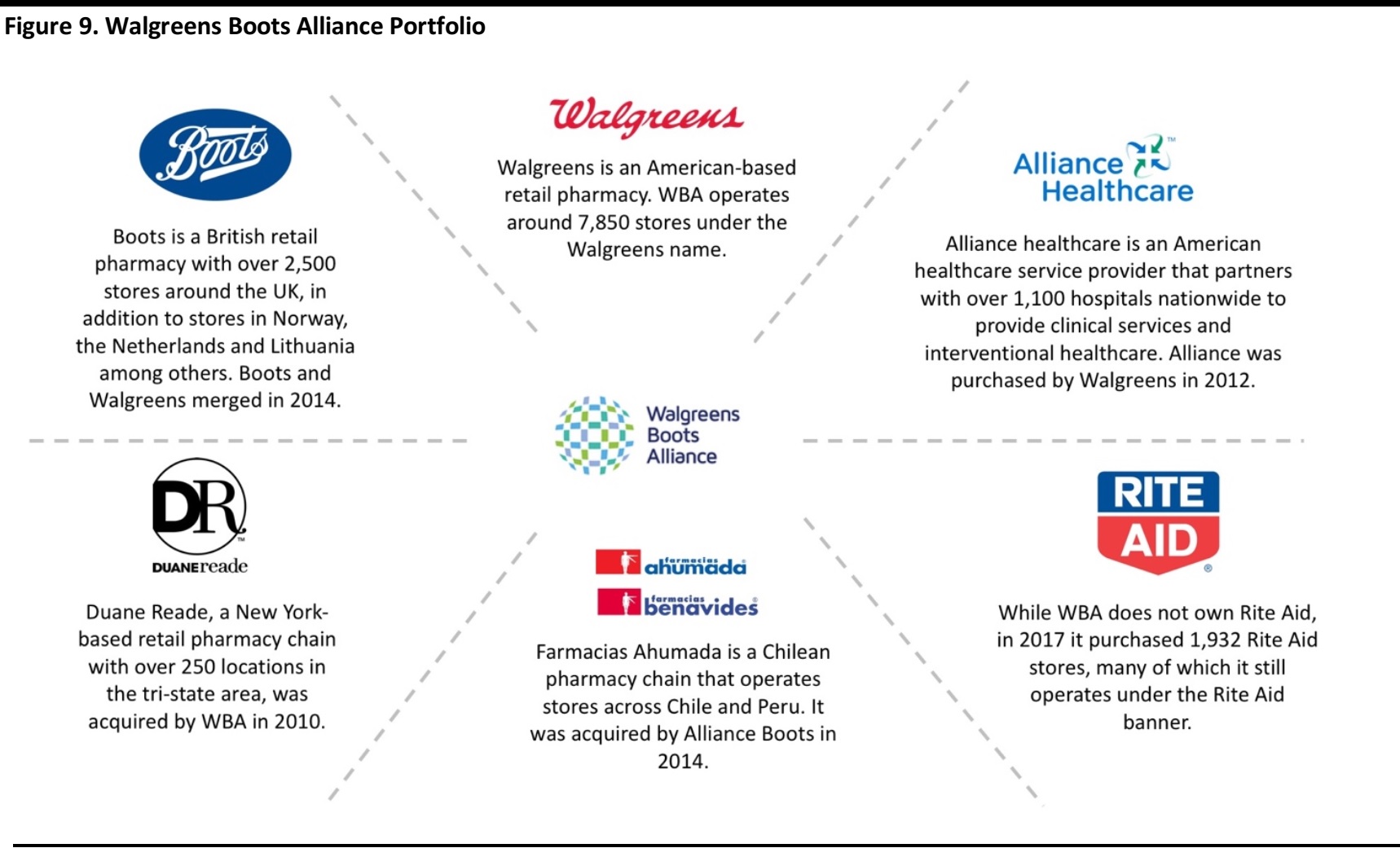

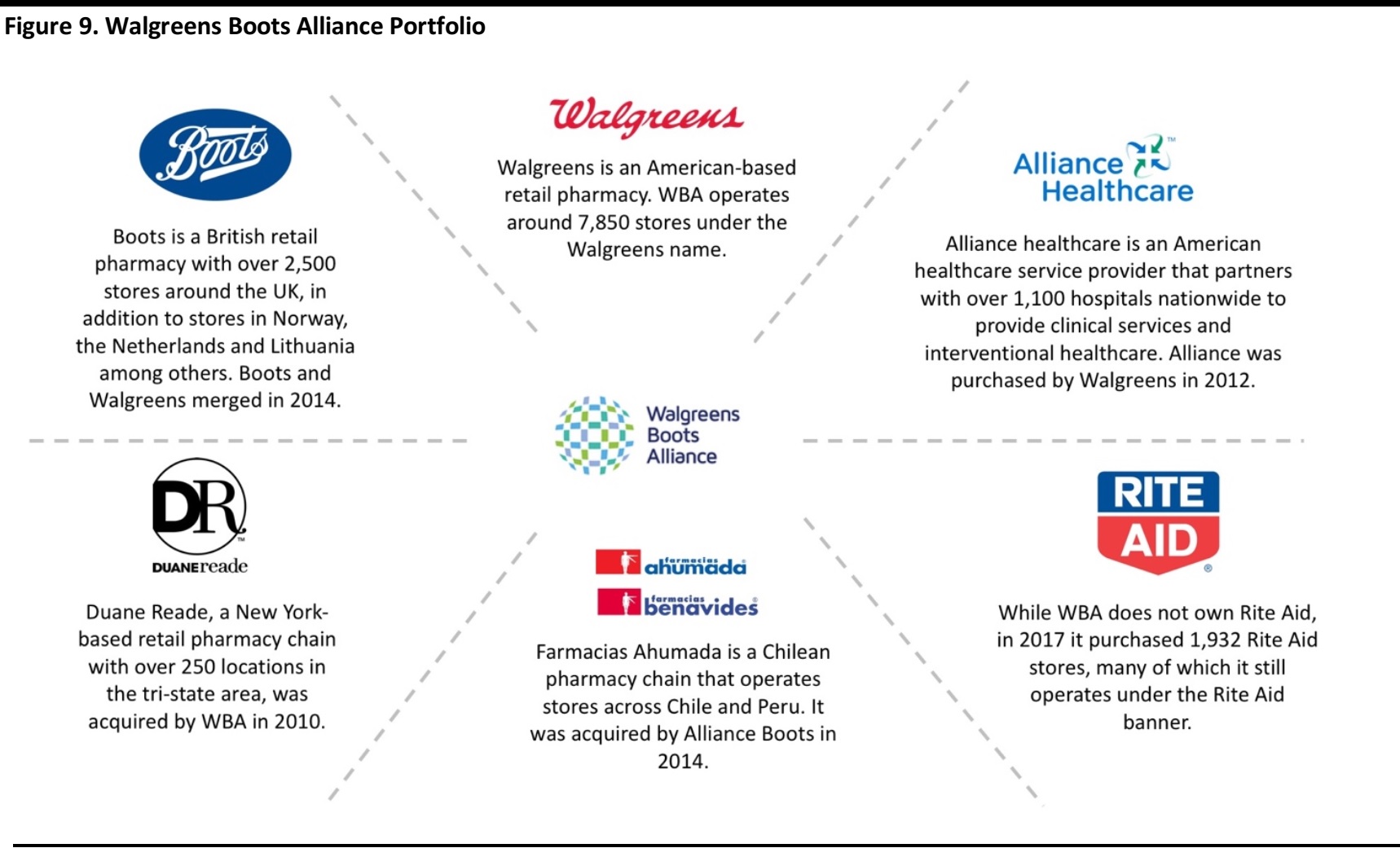

WBA: Conversely, WBA has further committed to the retail pharmacy business. Walgreens merged with Boots Alliance in 2014 to form WBA and greatly expand the international reach of the company’s retail locations. Additionally, the company has acquired stores from various pharmacy chains both domestically and abroad in the past 10 years to expand its retail presence.

2. Continuing to Focus on the Internet

Both companies are focused on continuing their success in the Internet age, using apps and home-delivery services to compete with potential competitors from younger, online-focused pharmacy companies.

CVS Health and Walgreens Boots Alliance at a Glance

*All figures from fiscal 2017.

Source: Company Reports

*All figures from fiscal 2017.

Source: Company Reports

Company Overviews

CVS Health

CVS Health, measured by either revenue or prescription drug market share, is the largest pharmacy company in the US. In 2017, the company reported revenues of $184.8 billion and a gross profit of $28.5 billion. CVS Health operates two segments of business: retail/long-term care (LTC) and Pharmacy Services. CVS Health’s Retail segment is composed of its network of almost 10,000 retail stores across the US, as well as over 1,000 retail urgent-care health clinics and 145 long-term care pharmacies that operate under the Omnicare brand. CVS’s pharmacy services segment entails its pharmacy benefits management (PBM) services, insurance subsidiaries and specialty pharmacy business.

The company was founded in 1963 in Massachusetts, and has since expanded its presence to 49 states, Puerto Rico and Brazil.

Source: Bloomberg

Source: Bloomberg

Walgreens Boots Alliance

WBA is the second-largest pharmacy company in the US, as well as one of the largest pharmacies in the UK. The company was formed in 2014 through the merger of Walgreens and Boots Alliance. In 2017, the company reported $118.2 billion in revenues and a gross profit of $29.2 billion. WBA operates in three segments: Retail Pharmacy USA, Retail Pharmacy International and Pharmaceutical Wholesale. The company operates its Retail Pharmacy USA branch primarily through the “Walgreens” brand, while its Retail Pharmacy International segment is mainly operated through the “Boots” brand. The company’s non-retail pharmacy offerings include healthcare services provided by Alliance Healthcare, and pharmacy benefits management (PBV) through AllianceRx.

Source: Bloomberg

Source: Bloomberg

Industry Background

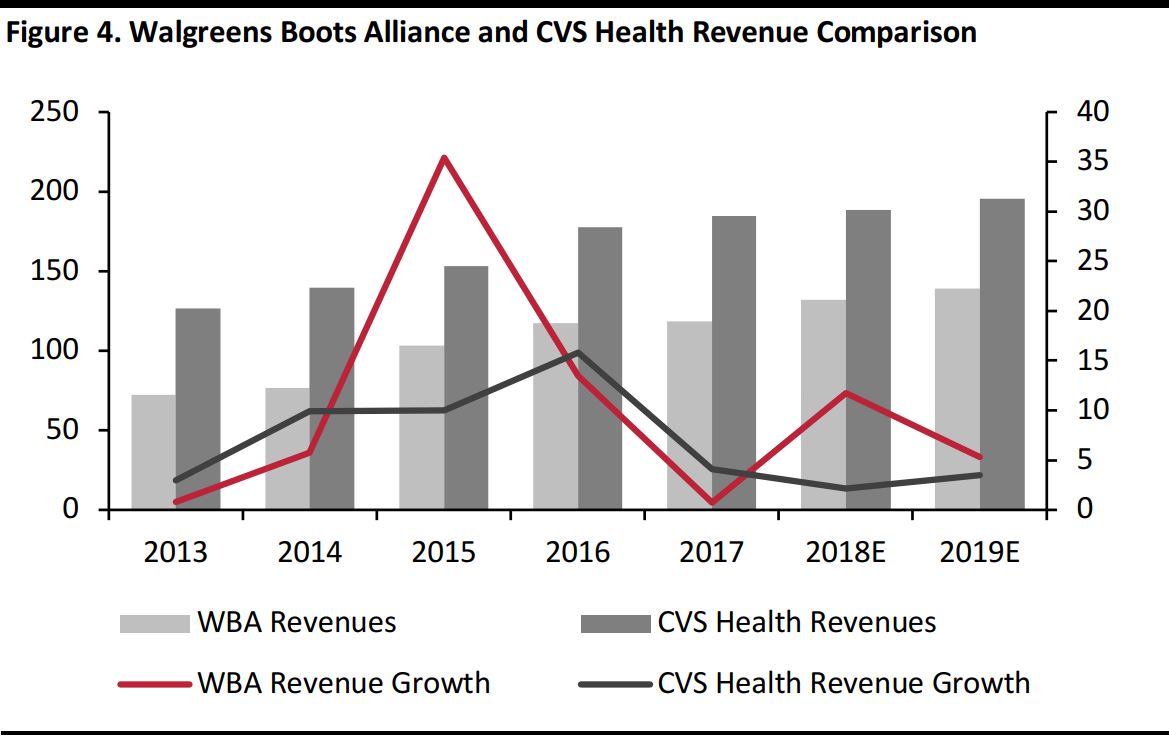

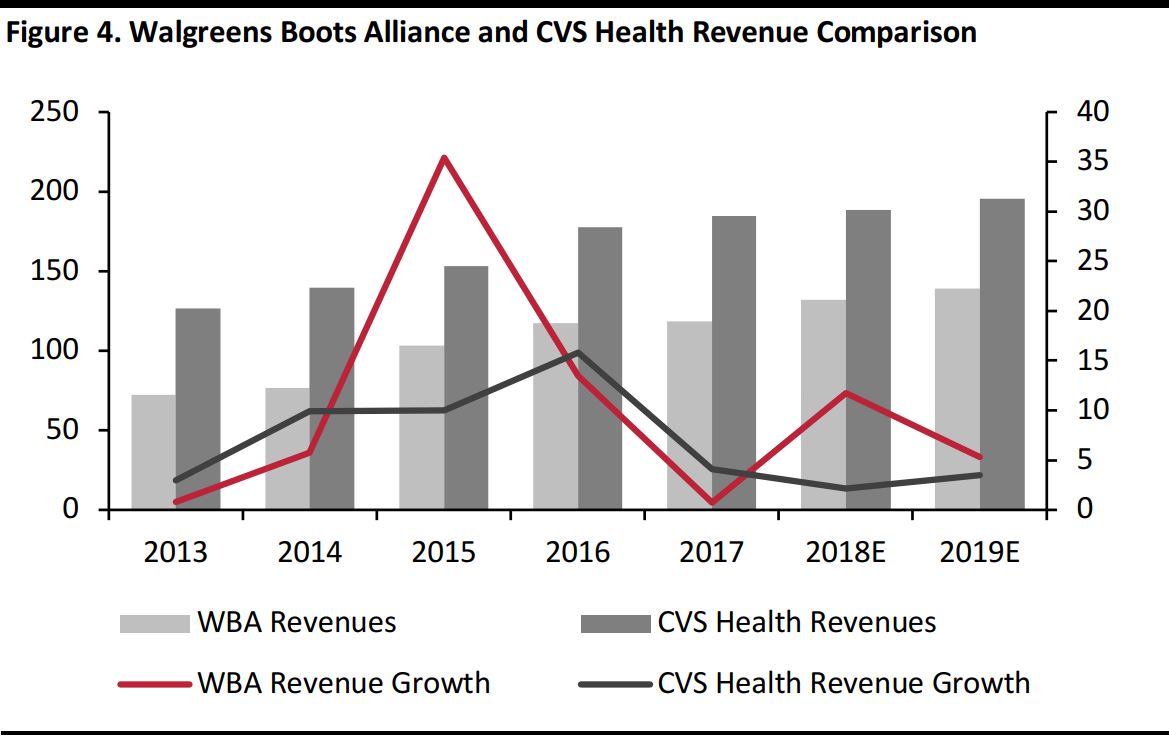

Stagnating Growth

Revenue growth for both CVS Health and WBA has decelerated over the past three years, and been relatively stagnant over the past five years. Although WBA has recorded spikes in growth—in 2015 and in 2018 projections—these increased rates are the results of Walgreens’ merger with Boots Alliance and the acquisition of 1,932 Rite Aid stores, respectively. The following figure illustrates the two companies’ revenue growth since 2013.

Note: Walgreens and Boots merged in fiscal 2015.Walgreens purchased 1,932 Walgreens stores at the beginning of fiscal 2018. Revenues figures from before 2015 is Walgreens revenue data.

†Note: WBA fiscal year ends August 31, CVS Health fiscal year ends December 31.

Source: Bloomberg

Note: Walgreens and Boots merged in fiscal 2015.Walgreens purchased 1,932 Walgreens stores at the beginning of fiscal 2018. Revenues figures from before 2015 is Walgreens revenue data.

†Note: WBA fiscal year ends August 31, CVS Health fiscal year ends December 31.

Source: Bloomberg

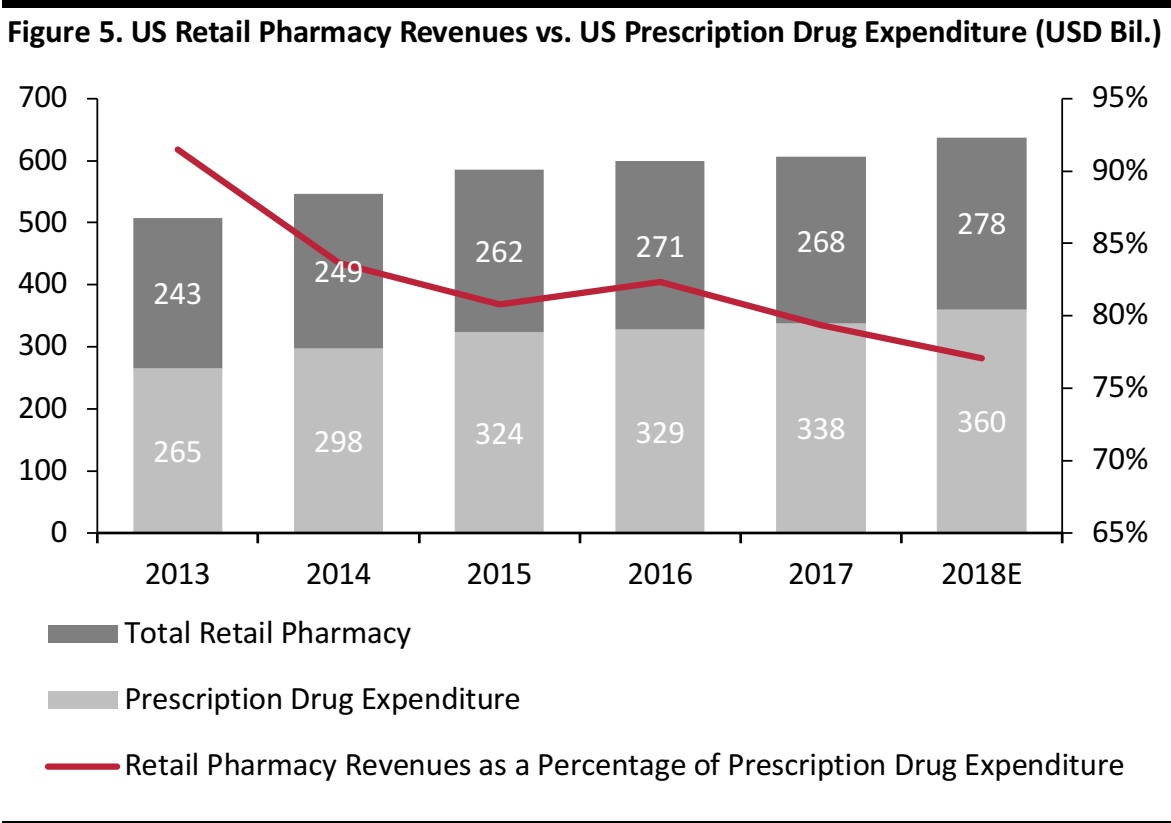

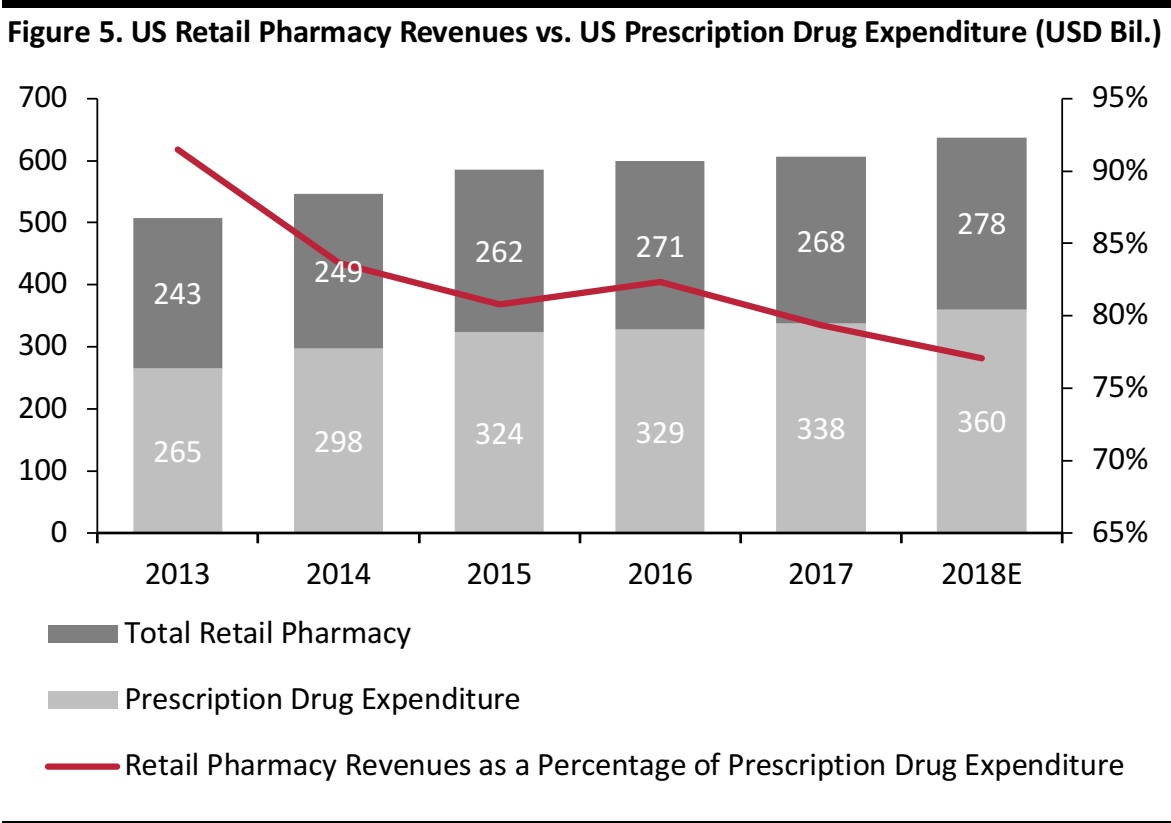

The unremarkable revenue growth of CVS Health and WBA over this time is unsurprising; the worldwide retail pharmacy market has grown by less than 1% since 2014, according to data from Euromonitor. In the US, prescription drug expenditure, a main source of revenues for CVS Health and WBA, has been growing quickly in recent years, with a compound annual growth rate of 2.2% since 2013. However, retail pharmacies have been unable to capitalize on this rapidly-expanding industry: since 2013, retail pharmacy sales have decreased from 91% to 77% of prescription drug expenditure in the US. This trend is illustrated in the following figure.

Increased competition from other types of prescription drug providers, mainly home-delivery pharmacies like Amazon’s newest subsidiary, PillPack, have increasingly disrupted brick-and-mortar retail pharmacies’ grip on the prescription drug industry.

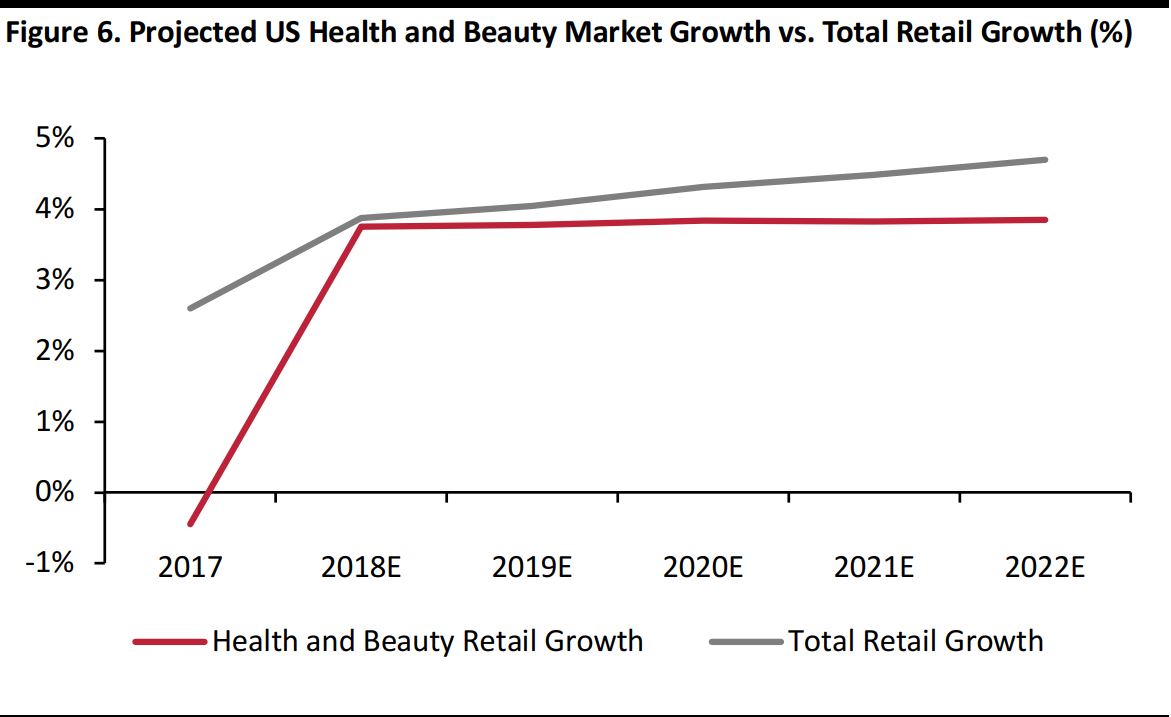

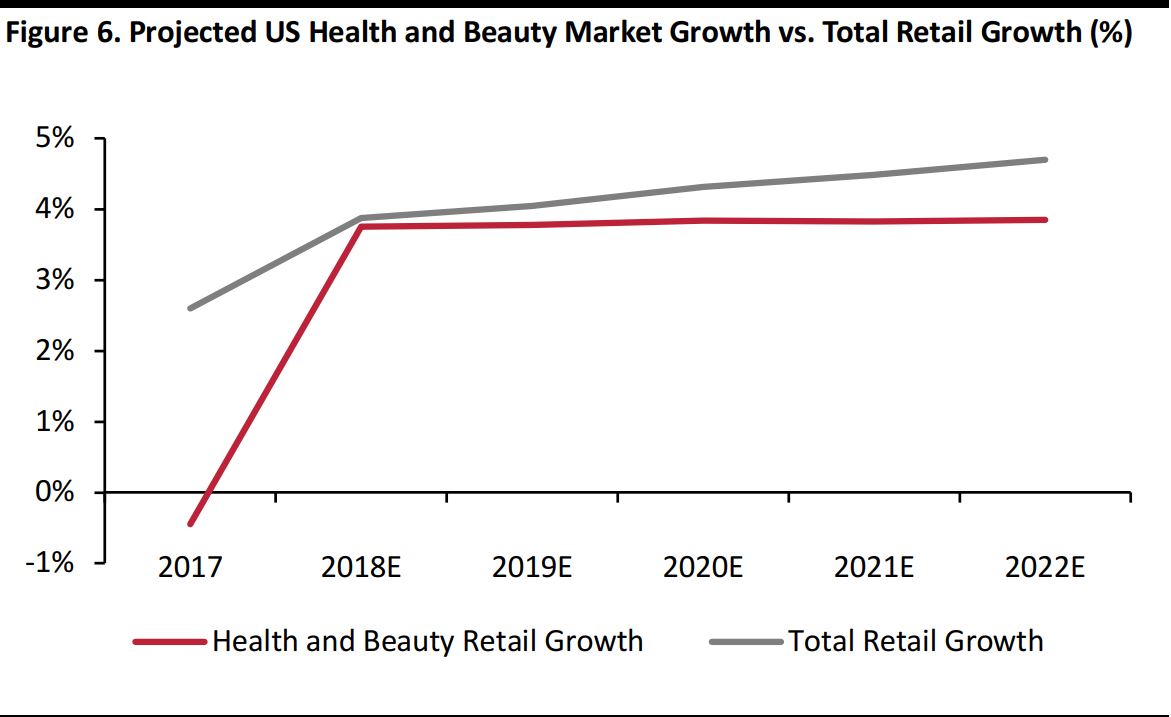

While the prescription drug market in the US has been growing quickly over the past five years, the growth of health and beauty retail sales has been slower than the growth of the US retail market as a whole. After prescription drug sales, health and beauty sales are one of the primary sources of revenues for both CVS Health and WBA. Both companies will face challenges when dealing with the expected continued slow growth of this market in the next several years, shown in the following figure.

Source: Euromonitor International/Centers for Medicare and Medicaid Services

Source: Euromonitor International/Centers for Medicare and Medicaid Services

Source: Euromonitor International

Source: Euromonitor International

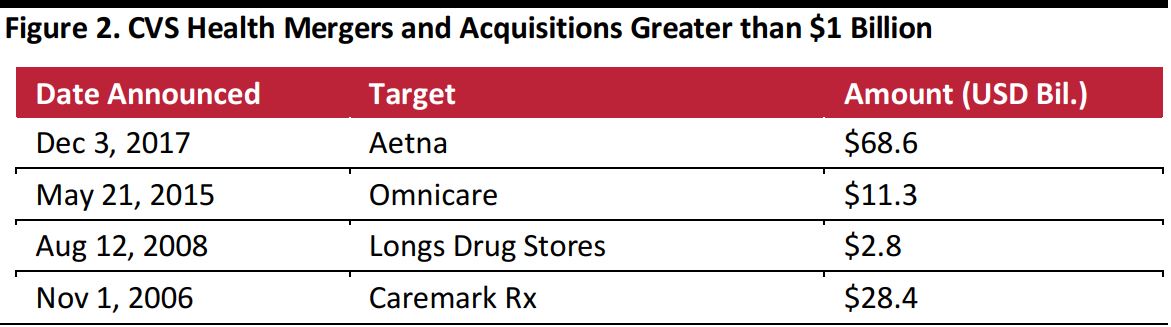

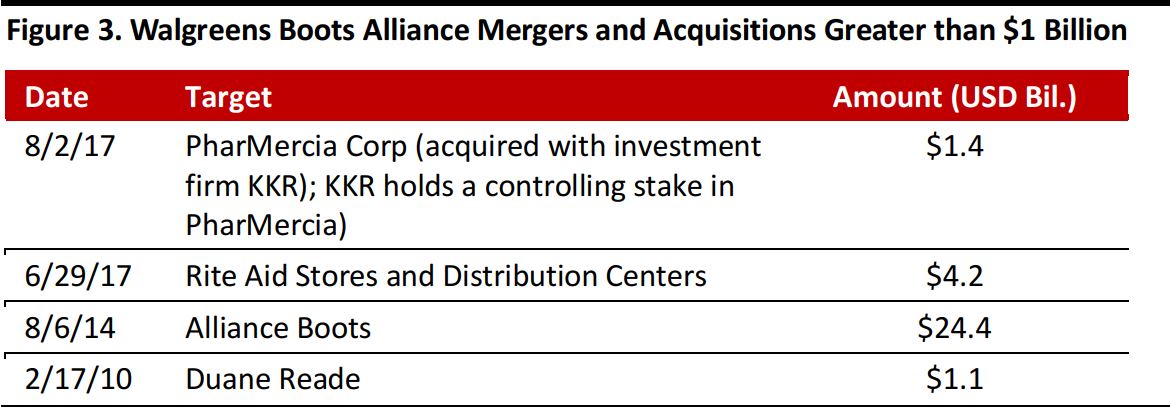

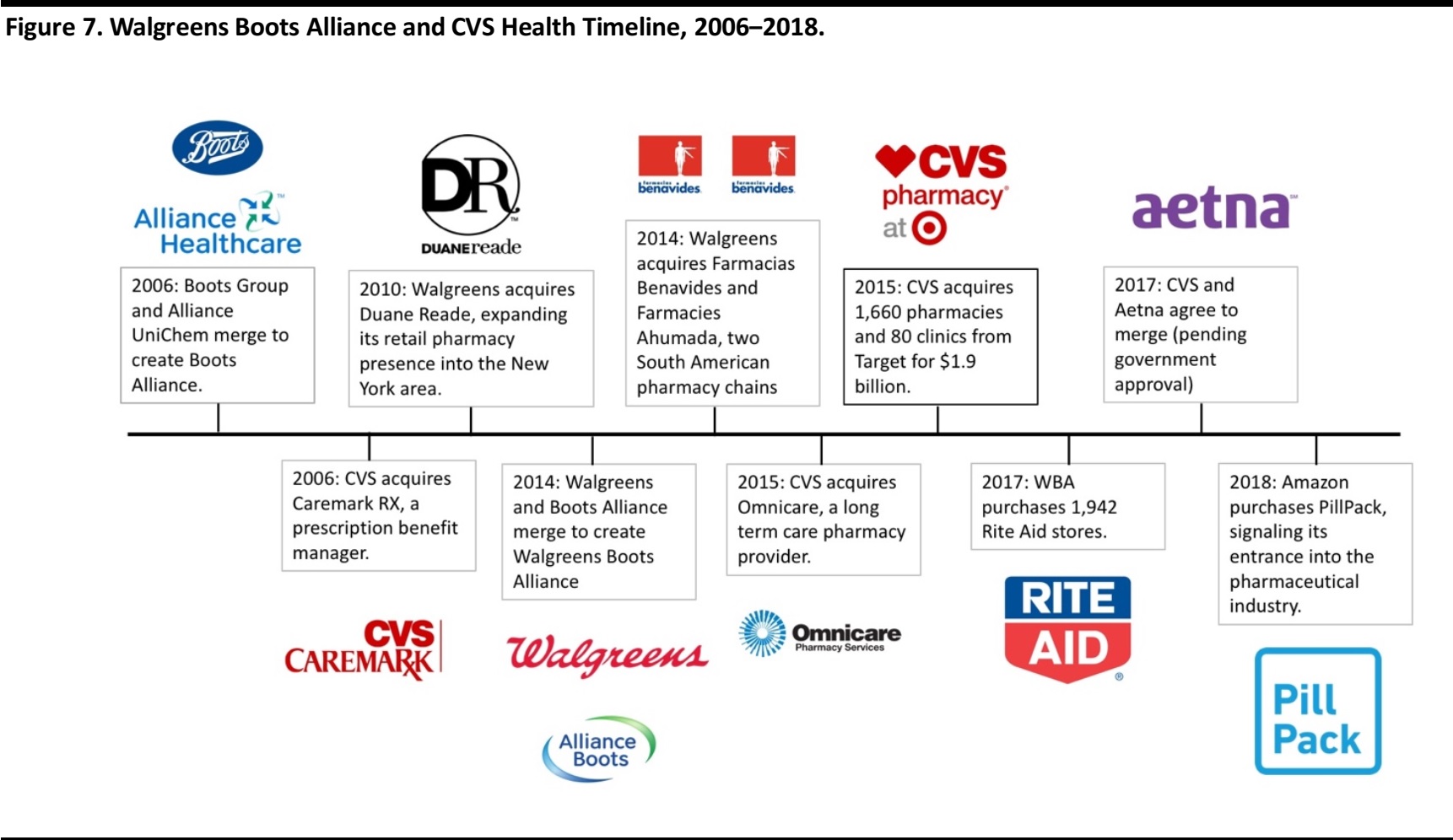

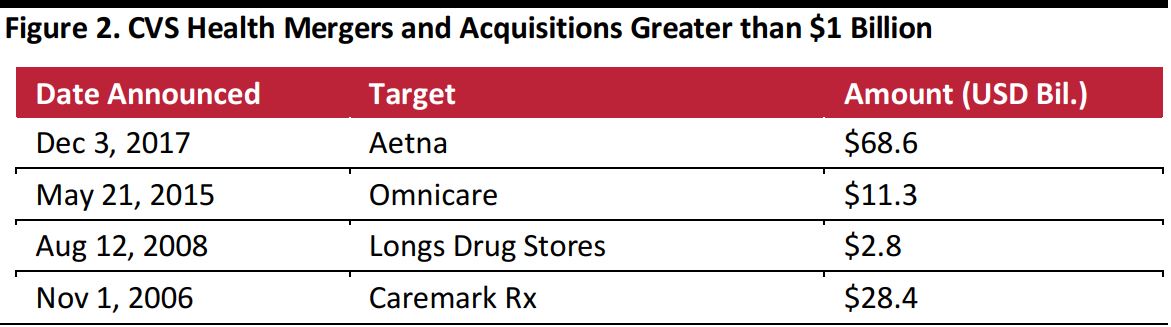

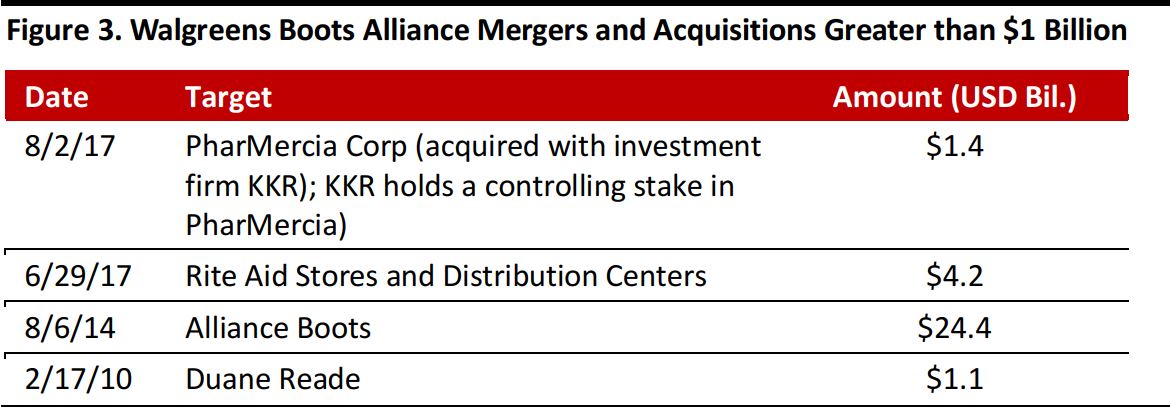

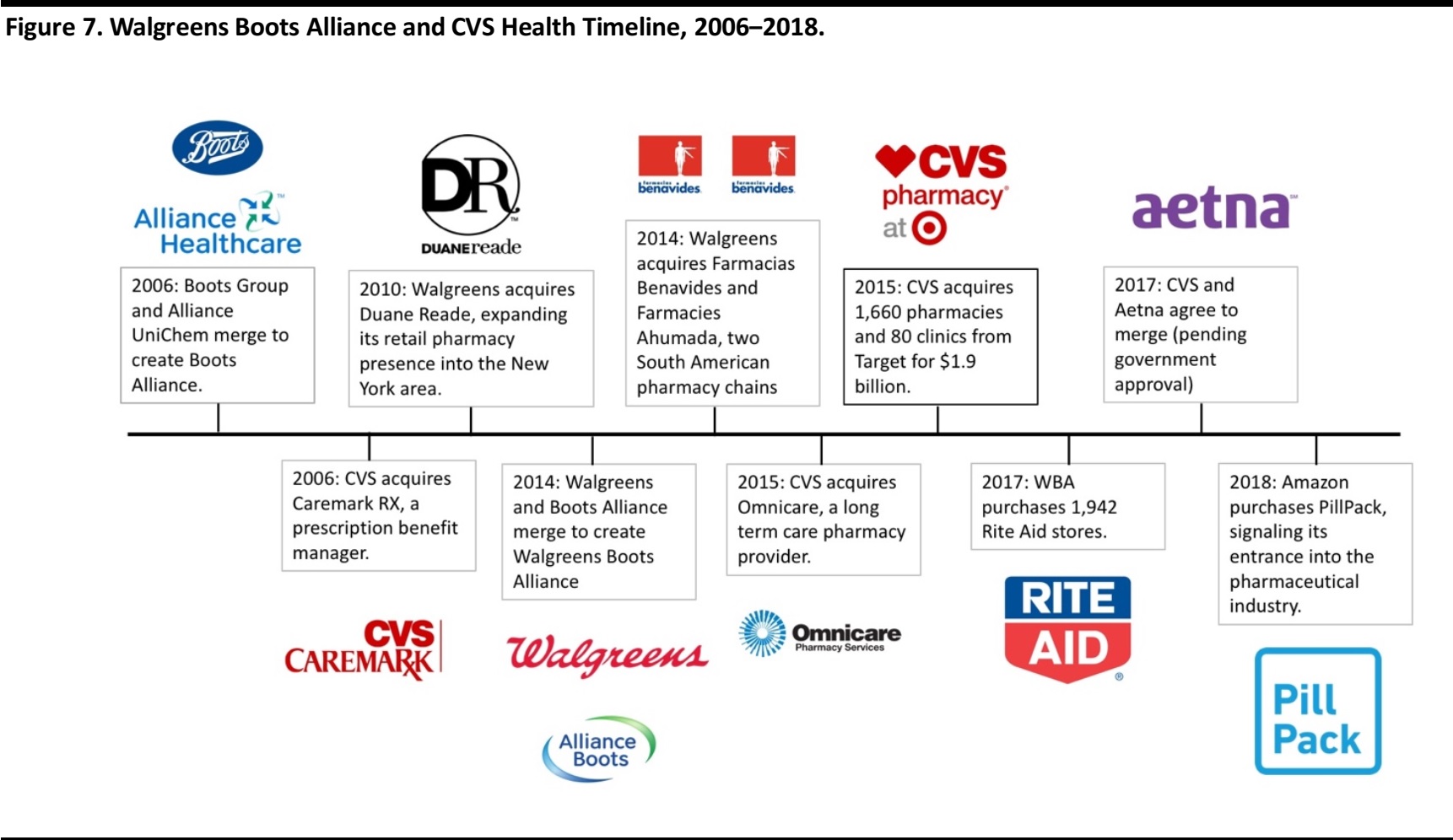

Growth Strategies

In this challenging environment, CVS Health and WBA have taken significantly different approaches to expanding their businesses and fortifying themselves against possible disrupters. A brief overview of each company’s major events over the past 12 years is shown in the following figure.

Source: Company Reports

CVS Health

In recent years, CVS Health has taken major steps to expand its range of pharmacy related offerings. The company has branched out from its trademark retail pharmacy business into several other fields:

- Health Insurance: CVS Health agreed in 2017 to purchase Aetna, the fourth-largest health insurance provider in the US, for $68 billion. The deal would integrate two of the largest businesses in healthcare: prescription drugs and insurance, and would increase CVS Health’s revenues by roughly 30%. CVS already owns SilverScript, a Medicare Part D insurer.

- PBM: Caremark, acquired by CVS Health in 2006, is the company’s PBM arm. Pharmacy benefits managers work with employers and health insurance companies to administer and control costs of prescription drug programs for members.

- Long-term care and specialty pharmacy: CVS’s long-term care and specialty pharmacy divisions, Omnicare and CVS Specialty, respectively, provide drugs and administer programs to people requiring long-term or special treatment.

Source: Company reports

Source: Company reports

Through its entrance into these various markets, CVS Health is generating more and more of its business through non-retail pharmacy channels. In 2017, CVS Health’s CVS Specialty held a 25% market share of the specialty drug pharmacy market in the US—more than double the market share of WBA’s Alliance RX, according to data from the Drug Channels Institute.

Other branches of CVS Health’s pharmacy services segments have also managed to create large customer bases. CVS’s Novologix was involved in managing medical benefits for 65 million people, and CVS Caremark has more than 94 million PBM members.

Walgreens Boots Alliance

WBA has taken steps to strengthen its position in retail pharmacy in the US and around the world. In 2014, Walgreens and Boots merged to form Walgreens Boots Alliance, a merger that added over 4,000 stores to Walgreen’s original offerings, and greatly expanded the company’s international presence. In September 2017, the beginning of WBA’s fiscal 2018, the company acquired 1,932 Rite Aid stores to further expand its retail pharmacy presence in the US. Over the last 10 years, WBA has made other similar purchases of smaller pharmacy chains both in the US and around the world. In 2014, WBA purchased Farmacias Benavides and Farmacias Ahumada, pharmacy chains with hundreds of locations in Mexico and Chile respectively. WBA also purchased Duane Reade, a retail pharmacy chain with over 250 locations in the New York Tri-State area, in 2010.

These mergers and acquisitions have enabled WBA to operate retail pharmacy locations in nearly every town and city in the US. As of 2017, 76% of Americans lived within five miles of a WBA-operated pharmacy.

Source: Company reports

Source: Company reports

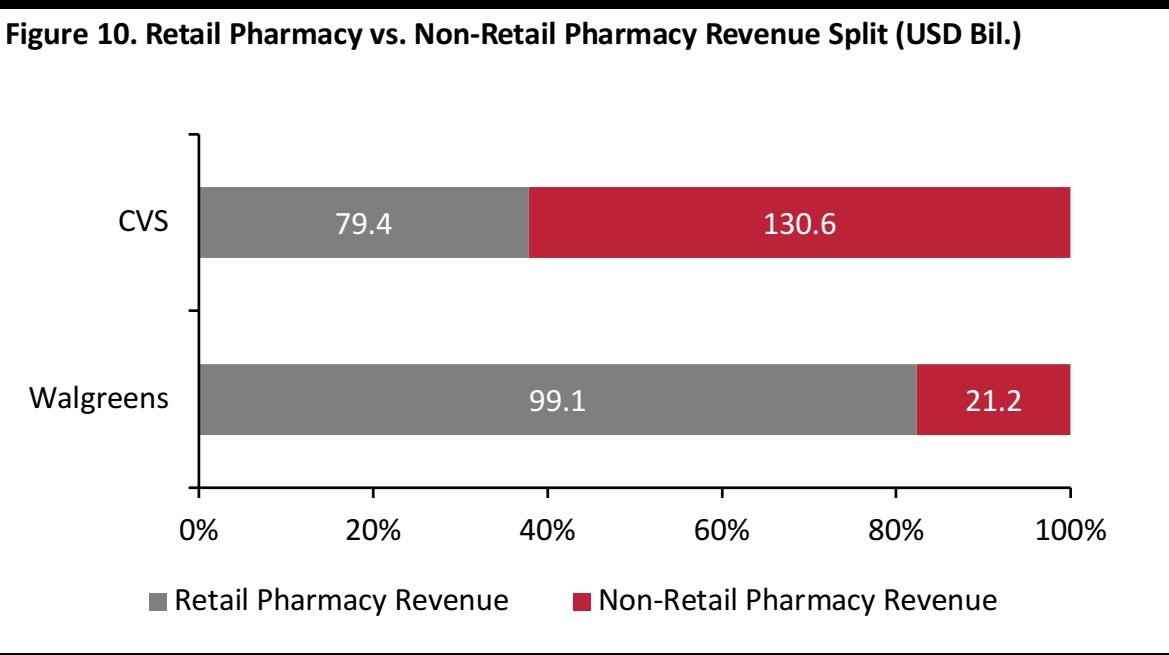

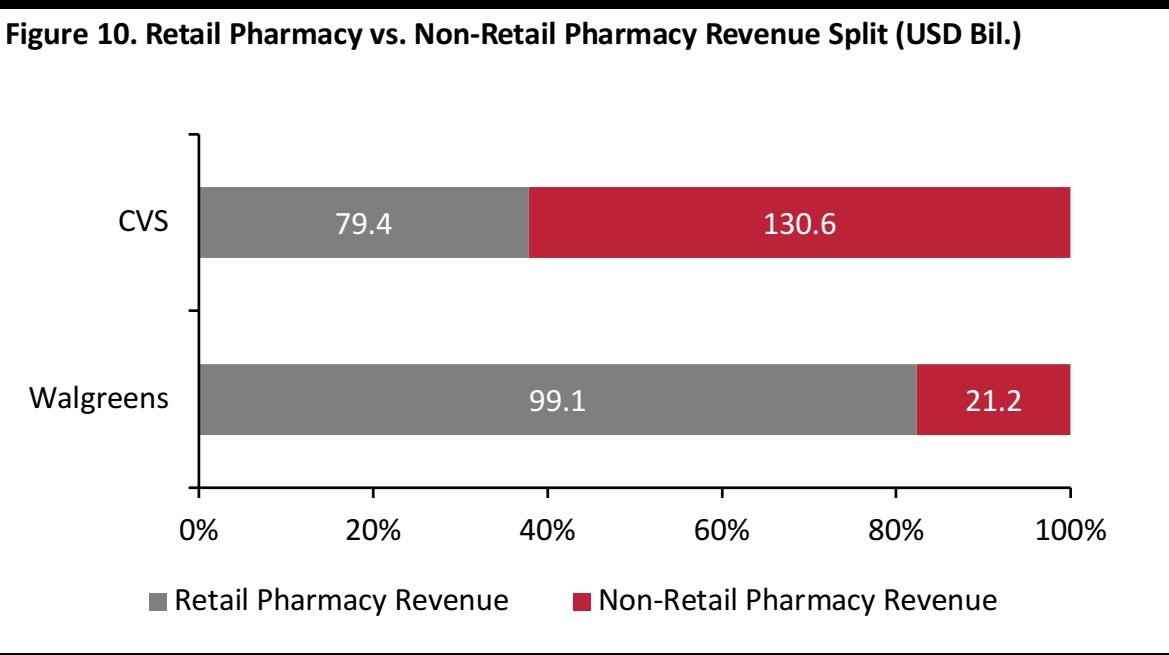

Comparison

While CVS Health has made a clear decision to broaden its range of offerings, WBA appears set on fortifying and expanding its presence in retail pharmacy. The results of these strategies can be seen in the following figure which illustrates each company’s revenue makeup: retail pharmacy sales composed almost 80% of WBA’s total revenues, but less than 40% of CVS Health’s overall revenues.

Source: Company Reports

Source: Company Reports

WBA, although focused on its retail pharmacy business, has made efforts to expand into a wider variety of healthcare fields. The company recently partnered with United Healthcare to offer Medicare Part D plans through Walgreens pharmacies, and has begun to offer urgent care clinics at some locations. The company recently partnered with pharmacy benefits manager Prime Therapeutics to form AllianceRx Walgreens Prime, a specialty pharmacy service. WBA also owns Alliance Healthcare, a healthcare provider that partners with hundreds of hospitals across the US.

Despite these numerous forays into other realms of the healthcare industry, WBA does the large majority of its business via retail pharmacies. While CVS estimates that its PBM revenues will climb to $134 billion in 2018, one of WBA’s largest non-retail pharmacy branch, Alliance Healthcare, has revenues of less than $1 billion.

CVS Health, while focused on diversifying its range of offerings, has not disregarded its retail pharmacy business. In 2013, CVS Health expanded its retail pharmacy presence abroad by acquiring Drogaria Onofre, a chain of pharmacies in Brazil. In 2015 the company acquired 1,660 Target pharmacies, which increased the company’s number of retail stores by almost 20%.

Overall, however, the dichotomous strategies of CVS Health and WBA are clear. While WBA is concentrating on in its staple retail pharmacy business, CVS Health has prepared for disruption by entering a variety of other pharmacy-related healthcare fields.

Adapting to the Modern Marketplace

With consumers increasingly demanding ultimate convenience and relying on online shopping platforms, CVS Health and WBA have both taken similar steps to adapt to new trends in consumer habits. Both companies released mobile apps in the early 2010s that allow users to manage prescriptions, buy convenience goods and locate nearby stores. Walgreens, in particular, has often cited its app, which has been downloaded over 52 million times, as of June 2018, as evidence that it is adapting to and thriving in the age of e-commerce.

Both companies have also expanded their mail-order pharmacy services. Walgreens delivers prescriptions for free in 5–10 business days, or overnight for $19.95 (both after two days of processing), while CVS charges $4.99 for 1–2 day shipping. By the end of 2018, CVS also plans to begin offering same-day delivery in six cities in the US. With the introduction of Amazon’s firepower into the market eminent, both companies will likely focus on improving and expanding their delivery services. Amazon’s PillPack charges no delivery fees for scheduled monthly deliveries or for emergency overnight deliveries. While CVS Health and WBA have emphasized their improved delivery services, they may have to improve delivery times and fees to compete with more delivery-focused companies such as PillPack.

Competitive Landscape

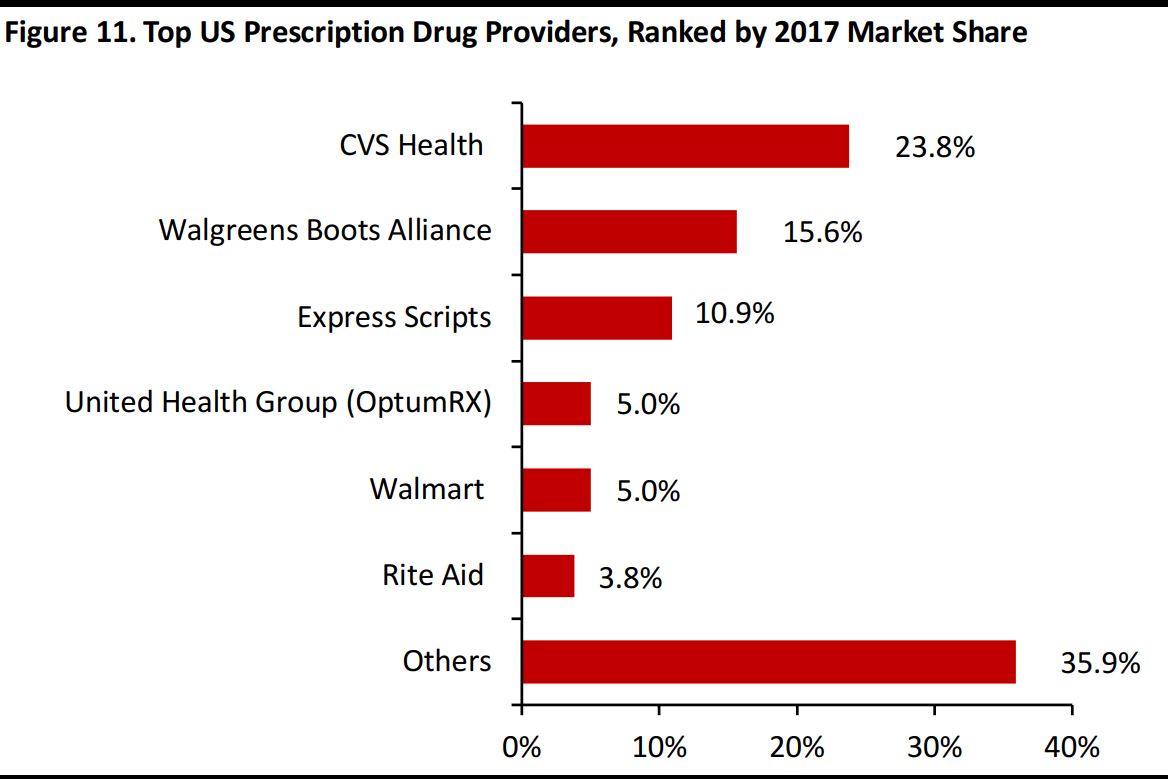

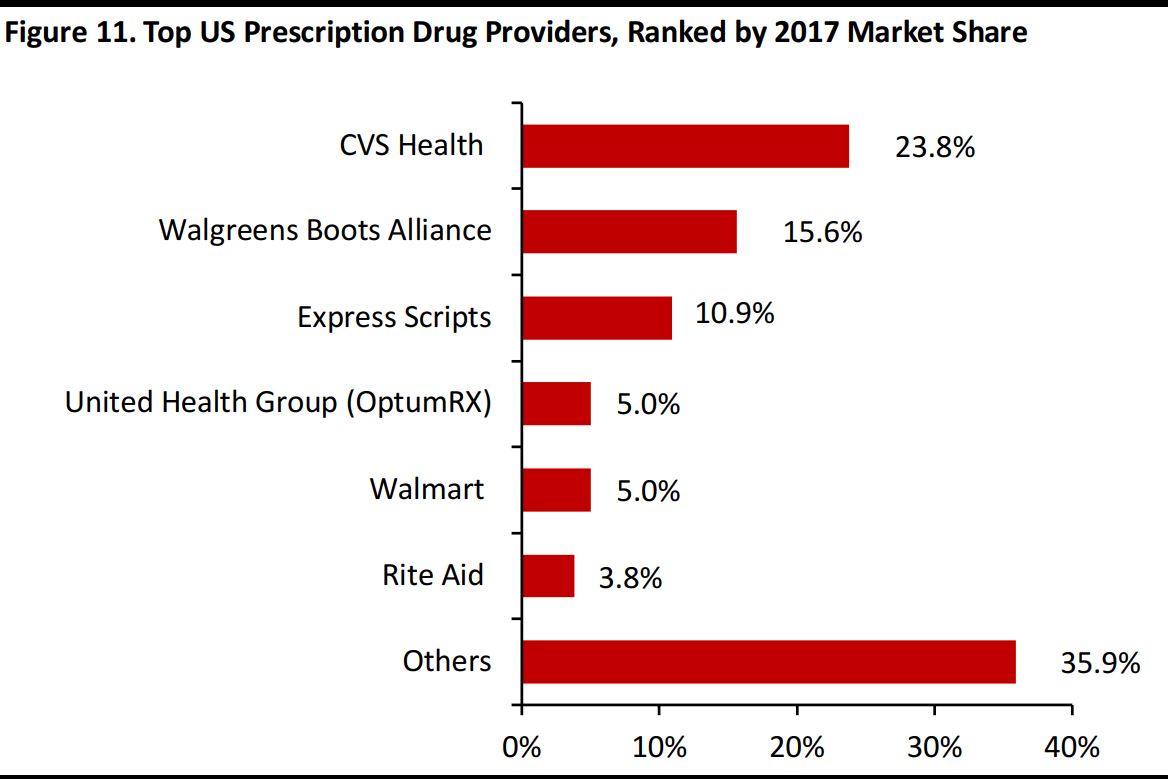

In part due to their aggressive growth strategies, CVS Health and WBA dominate both the prescription drug and health and beauty retail markets in the US. As of 2017, CVS Health and WBA held a combined 39.4% share of the prescription drug market in the US, according to the Drug Channels Institute. While they are the two largest pharmacies in the US, both companies continue to face competition from several other players in the industry. The following figure shows the top pharmacy companies in the US, ranked by their prescription drug market share.

Source: Drug Channels Institute

Source: Drug Channels Institute

Express Scripts

After CVS Health and WBA, Express Scripts holds the next largest share of the prescription drug market share in the US. Unlike CVS Health and WBA, Express Scripts does not operate physical retail pharmacy locations. Instead, the company operates several business segments that do not require brick-and-mortar locations including home-delivery pharmacy services, specialty pharmacy services and other related PBM services. Express Scripts’ total revenues have held steady at around $100 billion. Express Scripts enables its customers to mail or fax prescriptions to the company, which fills and delivers the prescriptions back to customers within 6–11 days. Express Scripts in the process of being acquired by Cigna, one of the largest health insurance providers in the US, for $67 billion.

OptumRX

Optum RX, a division of United Healthcare, held a 5% share of the prescription drug market in the US in 2017. The company is a pharmacy benefits manager which manages the healthcare plans of both government and private-sector employers. Like Express Scripts, Optum RX does not operate physical pharmacy locations. The company offers free home delivery of medications to its customers and partners with a variety of retail pharmacy locations (including CVS Health and WBA locations) to provide its customers convenient access to prescription drugs.

Walmart

In 2017, Walmart held a 5% market share of the prescription drug market in the US. Unlike Express Scripts and OptumRX, Walmart’s pharmacy business is focused on retail locations inside Walmart stores across the country. Health and Wellness sales, which include health products, over-the-counter drugs and prescription medication, made up 11% of Walmart’s total sales in its fiscal 2017, totaling roughly $34 billion. Walmart also offers Medicare Part D plans, specialty pharmacy services, flu shots and immunizations, and prescription deliveries.

Rite Aid

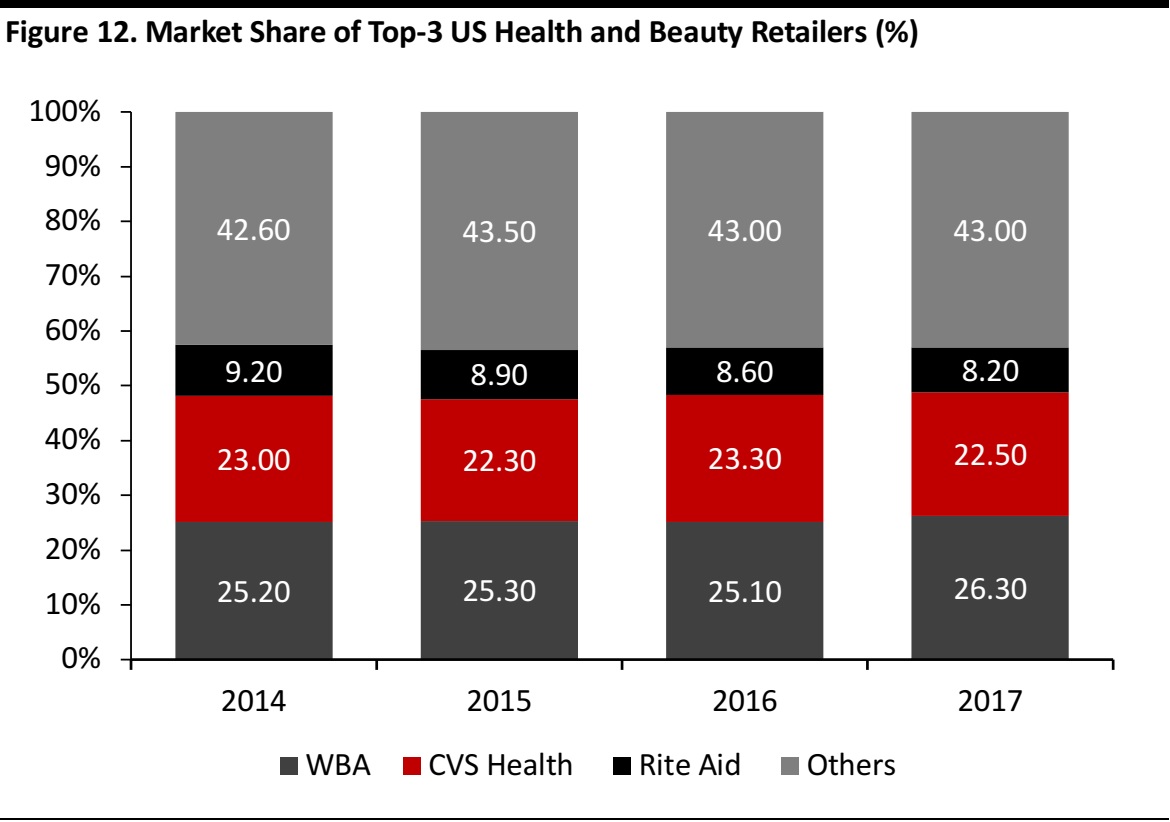

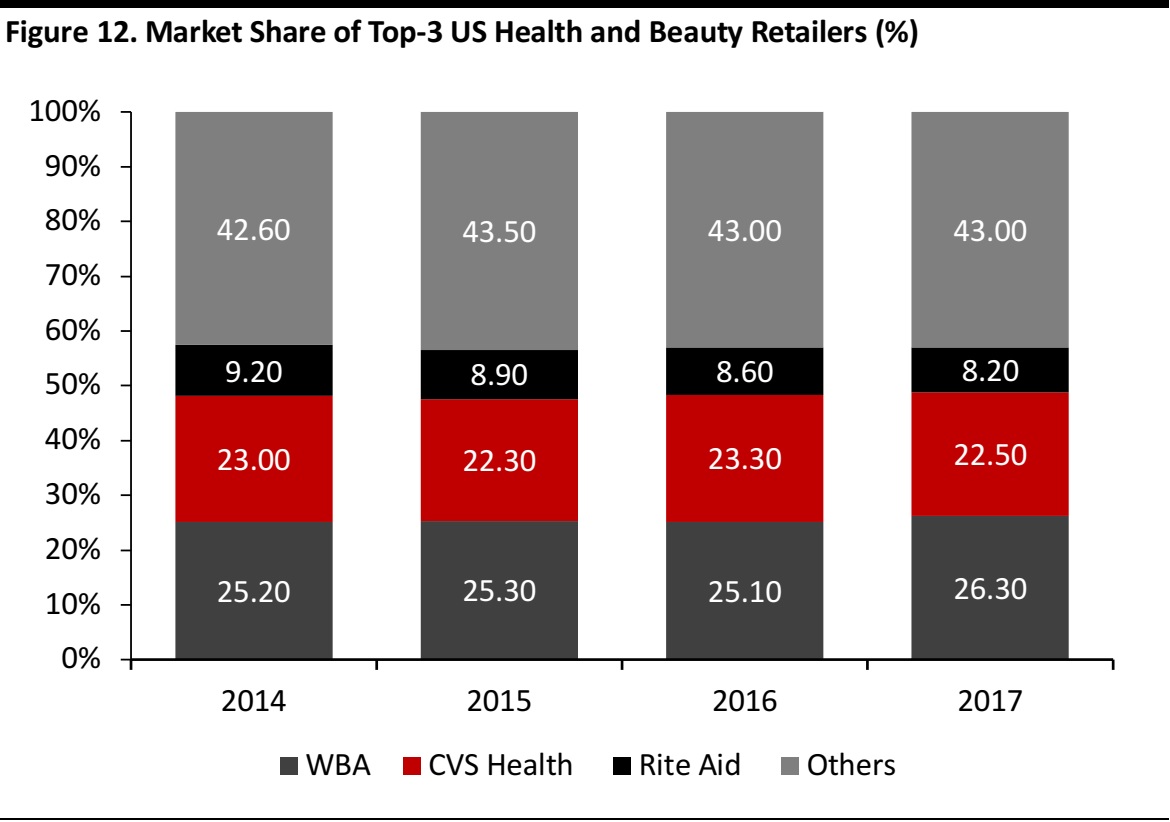

WBA and CVS Health dominate the US health and beauty retail market even more than they do the prescription drug industry. As shown in the figure below, as of 2017, the two companies held a combined 48.8% market share of the health and beauty retail market in the US. Despite its struggles in recent years, Rite Aid remains the two pharmacy giants’ only significant competition in the health and beauty market. As of 2017, Rite Aid was the only other company to hold more than a 2% share of the health and beauty market.

Source: Euromonitor International

Source: Euromonitor International

Aside from its health and beauty sales, Rite Aid held a 3.8% share of the prescription drug market in the US in 2017. The company operates roughly 2,500 retail pharmacies in the US, concentrated on the East and West Coasts. In its fiscal year ending March 3, 2018, Rite Aid accrued total revenues of $21.5 billion. However, the company lost $350 million from continuing operations. As part of downsizing efforts in 2017, Rite Aid agreed to sell 1,932 stores to WBA. Rite Aid also operates a pharmacy services segment, most notably through its pharmacy benefits manager arm EnvisionRxOptions.

Amazon

Amazon is not yet among the top prescription drug providers in the US. However, on June 29, the company purchased online pharmacy company PillPack for a reported $1 billion, enabling the e-commerce giant to enter the $360-billion prescription drug industry for the first time. PillPack offers scheduled monthly deliveries and emergency overnight deliveries, all for no delivery charge. With its new ability to take advantage of Amazon’s logistics network, PillPack may be able to expand its delivery services even further. Considering that Amazon already offers over-the-counter drugs like ibuprofen for cheaper than CVS and Walgreens do, CVS Health and WBA will have to adapt quickly to avoid being undercut in the prescription medication market.

Conclusion

CVS Health and WBA are the two most ubiquitous names in pharmacy in the US, controlling more than 35% of both the prescription drug and health and beauty retail markets. Despite their control of the pharmacy market, both companies face challenges from a market that is seeing sluggish growth and an influx of potential disruptors, including Amazon. Both CVS Health and WBA have taken steps to modernize their businesses, including establishing mobile apps and online prescription delivery services. CVS Health has also focused on expanding into non-retail pharmacy industries, including health insurance and PBM. While WBA has also made efforts to enter these other businesses, the company has largely concentrated on expanding its retail pharmacy business. As retail pharmacies fail to capitalize on the growth of the prescription drug industry in the US, both companies will have to brace for disruption by younger, more delivery-focused pharmacy companies.

*All figures from fiscal 2017.

Source: Company Reports

*All figures from fiscal 2017.

Source: Company Reports Source: Bloomberg

Source: Bloomberg Source: Bloomberg

Source: Bloomberg Note: Walgreens and Boots merged in fiscal 2015.Walgreens purchased 1,932 Walgreens stores at the beginning of fiscal 2018. Revenues figures from before 2015 is Walgreens revenue data.

†Note: WBA fiscal year ends August 31, CVS Health fiscal year ends December 31.

Source: Bloomberg

Note: Walgreens and Boots merged in fiscal 2015.Walgreens purchased 1,932 Walgreens stores at the beginning of fiscal 2018. Revenues figures from before 2015 is Walgreens revenue data.

†Note: WBA fiscal year ends August 31, CVS Health fiscal year ends December 31.

Source: Bloomberg Source: Euromonitor International/Centers for Medicare and Medicaid Services

Source: Euromonitor International/Centers for Medicare and Medicaid Services Source: Euromonitor International

Source: Euromonitor International

Source: Company reports

Source: Company reports Source: Company reports

Source: Company reports Source: Company Reports

Source: Company Reports Source: Drug Channels Institute

Source: Drug Channels Institute Source: Euromonitor International

Source: Euromonitor International