DIpil Das

What’s the Story?

Collaboration among all parties within the supply chain is more important than ever, with the Covid-19 pandemic having accelerated the need for digital transformation and communication. Today’s supply chains are interconnected, and sharing data among all parties is key. Retailers and brands can derive significant benefits from collecting and analyzing internal and external data. Consumer data in particular is essential in informing trend forecasting to anticipate demand, optimize inventory and influence new-product development. Moreover, heightened demand for personalized and customized products makes consumers key participants in the supply chain. This report is part of Coresight Research’s series of roundtable discussions and research reports, entitled The New Age of Customer-First Supply Chains, in which we present key insights into strategic areas in which brands and retailers can take action to build a resilient and profitable supply chain. Read our first two reports in the series:- Introduction—Four Pillars for Building a Resilient and Profitable Supply Chain

- Intelligent Demand Forecasting and On-Demand Manufacturing

Why It Matters

With the pandemic-led e-commerce surge and changing consumer preferences and market conditions, retailers are under immense pressure to meet customer needs, estimate demand for products, manage supply chains and drive sales and revenue. One of the ways to overcome these challenges is through effective collaboration with suppliers, business partners and consumers, sharing data across the supply chain for improved forecasting and product development. Successful collaboration helps to fulfill customer needs, reduce out-of-stocks and yield leaner and more profitable supply chains by eliminating unnecessary costs. Moreover, consumer data such as product reviews, product searches and social media posts are also critical for retailers in informing product optimization, new product development and demand forecasting.Customer-Centric Commercial Collaboration: Coresight Research Analysis

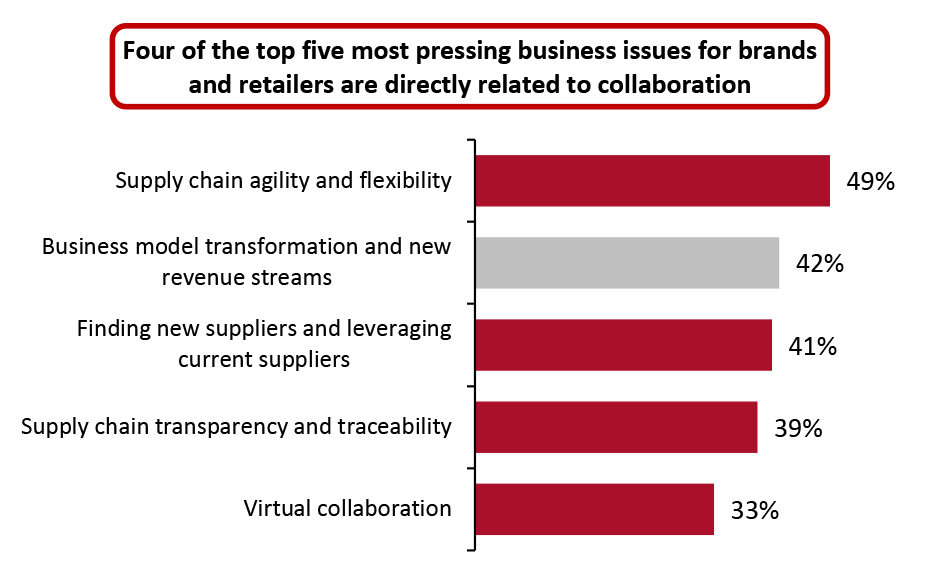

The Current Environment Necessitates Improved Collaboration Pandemic-led disruptions in travel and shipping are forcing retailers to fundamentally change how they manage their supply chain and interact with their network of business partners—highlighting the importance of agility and flexibility. According to a May 2020 Coresight Research survey, nearly half of all US retailers and direct-to-consumer (DTC) brands cited supply chain agility and flexibility as their most pressing business issue over the next 12‒24 months. With many corporate offices still closed and international (and domestic) travel remaining under restrictions, the current environment presents huge challenges for traditional sourcing methods, with buyers unable or unwilling to travel internationally to meet with suppliers and visit factories. Although brands and retailers have turned to online technology platforms for communication, true collaboration is difficult to achieve this way. MEPs, on the other hand, foster collaboration by connecting all supply chain parties, from manufacturers to buyers to retailers to service providers. Manufacturers and buyers can collaborate on new product ideas, view virtual samples and visit virtual showrooms to view products, for example. According to our May 2020 survey, four of the top five most pressing business issues for brands and retailers over the next 12–24 months are directly related to collaboration—with one-third of all respondents specifying that virtual collaboration is a priority going forward (see Figure 1).Figure 1. US Brands and Retailers: Top Five Most Pressing Business Issues over the Next 12–24 Months (% of Respondents) [caption id="attachment_132707" align="aligncenter" width="725"]

Respondents could select multiple options

Respondents could select multiple options Base: 118 US retailers and brands, surveyed in May 2020

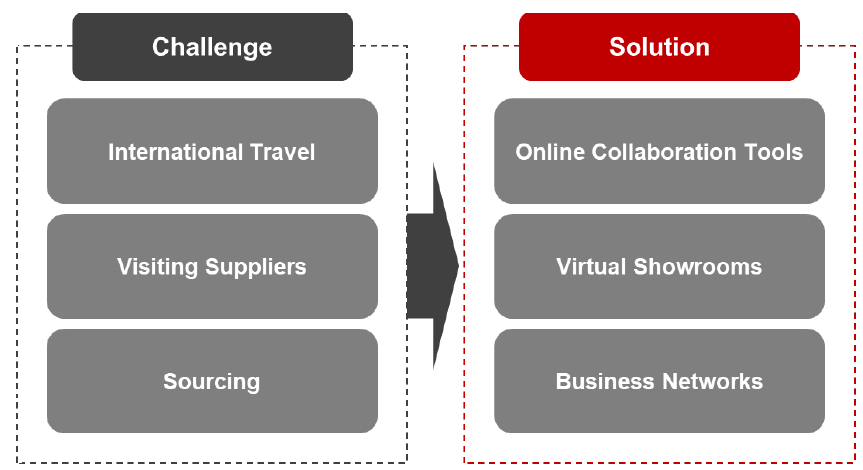

Source: Coresight Research [/caption] In a heightened competitive environment, disconnected systems are a hinderance to supply chain agility. Digital collaboration technologies such as online collaboration tools, virtual showrooms and business network digitalization are becoming a must-have for supply chain efficiency.

Figure 2. Supply Chain Collaboration: Current Challenges and Solutions [caption id="attachment_132708" align="aligncenter" width="723"]

Source: Coresight Research[/caption]

Collaboration Between All Supply Chain Parties: Modern Supply Chains Are Interconnected

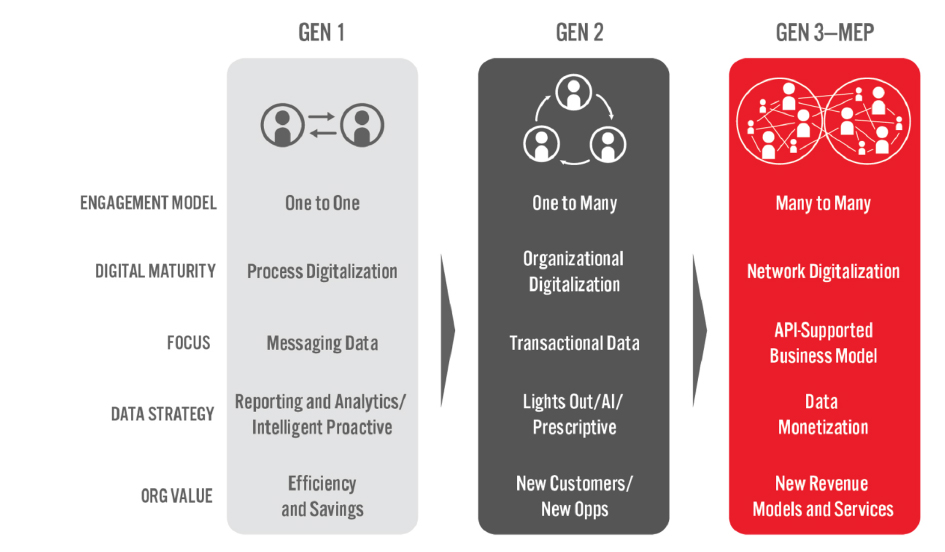

Maintaining data consistency is critical to achieving agility and flexibility in supply chains. Supply chains have evolved over time from the first iteration of the digitalization of the supply chain, Gen 1—moving messages from phone/fax to email and digitalizing data on a one-to-one basis—to Gen 2, where the retailer became the hub that connects with all relevant business partners in various departments, office locations and geographies on a one-to-many basis.

Gen 3 represents the latest evolution of supply chain digitalization via a multi-enterprise platform (MEP). An MEP supports the ability to communicate, collaborate, partner or transact on a many-to-many basis, which can be transformational. An MEP enables collaboration around data to happen on one platform—the data are constantly cross-validated by all partners on the platform, enhancing its quality. An MEP improves decision-making across an organization and its business partners through improved data sharing, leading to better efficiency, lower costs and enhanced sustainability.

Source: Coresight Research[/caption]

Collaboration Between All Supply Chain Parties: Modern Supply Chains Are Interconnected

Maintaining data consistency is critical to achieving agility and flexibility in supply chains. Supply chains have evolved over time from the first iteration of the digitalization of the supply chain, Gen 1—moving messages from phone/fax to email and digitalizing data on a one-to-one basis—to Gen 2, where the retailer became the hub that connects with all relevant business partners in various departments, office locations and geographies on a one-to-many basis.

Gen 3 represents the latest evolution of supply chain digitalization via a multi-enterprise platform (MEP). An MEP supports the ability to communicate, collaborate, partner or transact on a many-to-many basis, which can be transformational. An MEP enables collaboration around data to happen on one platform—the data are constantly cross-validated by all partners on the platform, enhancing its quality. An MEP improves decision-making across an organization and its business partners through improved data sharing, leading to better efficiency, lower costs and enhanced sustainability.

Figure 3. Digital Platform Evolution to MEP [caption id="attachment_132709" align="aligncenter" width="724"]

Source: Bamboo Rose/Coresight Research[/caption]

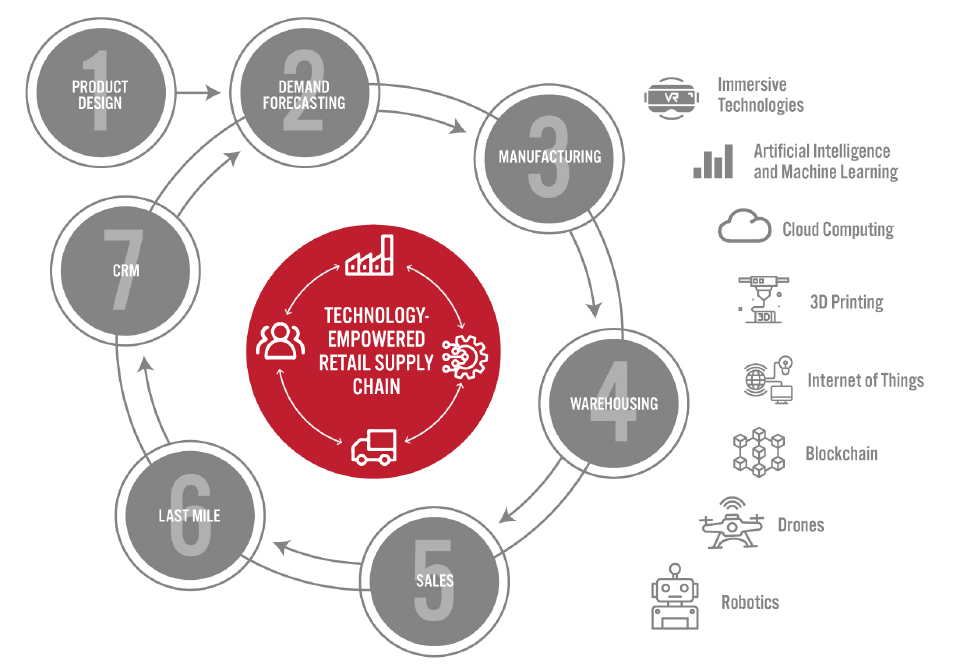

We believe that a majority of retailers are using platforms in a Gen 1 and Gen 2 manner and not reaping the full benefits that an MEP provides. Supply chains are no longer unidirectional and need to share data across the network for everyone’s mutual benefit. The figure below shows the modern supply chain, which takes the form of a virtuous circle, in contrast to unidirectional supply chains of the past. The key difference is that information and data are shared among all supply chain functions—including demand forecasting, manufacturing and warehousing—leading to better forecasting and improved decision-making for product design and development.

Source: Bamboo Rose/Coresight Research[/caption]

We believe that a majority of retailers are using platforms in a Gen 1 and Gen 2 manner and not reaping the full benefits that an MEP provides. Supply chains are no longer unidirectional and need to share data across the network for everyone’s mutual benefit. The figure below shows the modern supply chain, which takes the form of a virtuous circle, in contrast to unidirectional supply chains of the past. The key difference is that information and data are shared among all supply chain functions—including demand forecasting, manufacturing and warehousing—leading to better forecasting and improved decision-making for product design and development.

Figure 4. The Technology-Powered Retail Supply Chain: Major Functions and Supporting Technologies [caption id="attachment_132710" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Collaboration Between Retailers and Suppliers: Key Advantages

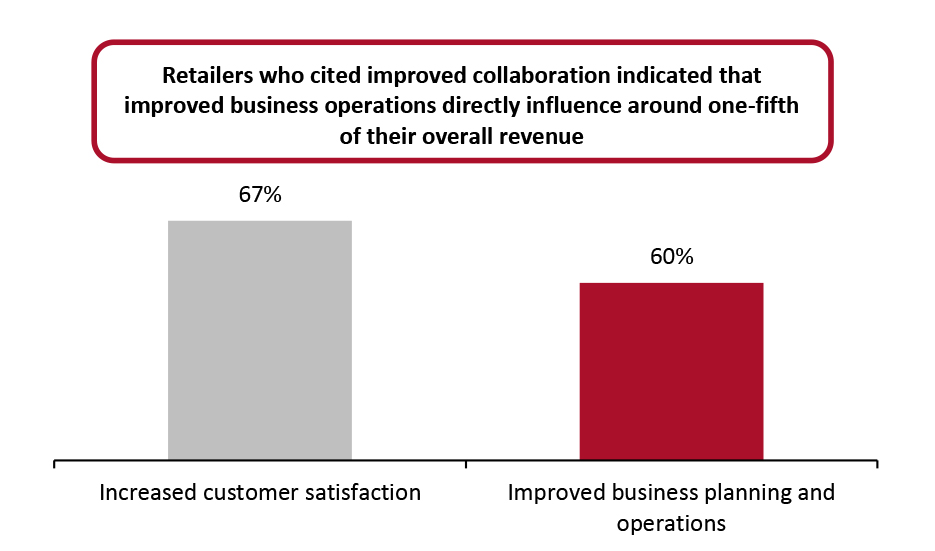

A Coresight Research survey of global grocery/drug retailers and CPG suppliers conducted in March 2020 found that collaboration has improved over the past two years for the majority of respondents. The figure below shows two key benefits that retailers are realizing from improved collaboration with suppliers.

Source: Coresight Research[/caption]

Collaboration Between Retailers and Suppliers: Key Advantages

A Coresight Research survey of global grocery/drug retailers and CPG suppliers conducted in March 2020 found that collaboration has improved over the past two years for the majority of respondents. The figure below shows two key benefits that retailers are realizing from improved collaboration with suppliers.

Figure 5. Grocery/Drug Retailers: Benefits Derived from Improved Collaboration with Suppliers (% of Respondents) [caption id="attachment_132711" align="aligncenter" width="701"]

Base: 89 grocery/drug retailers that stated their collaboration had improved over the past two years, surveyed in March 2020

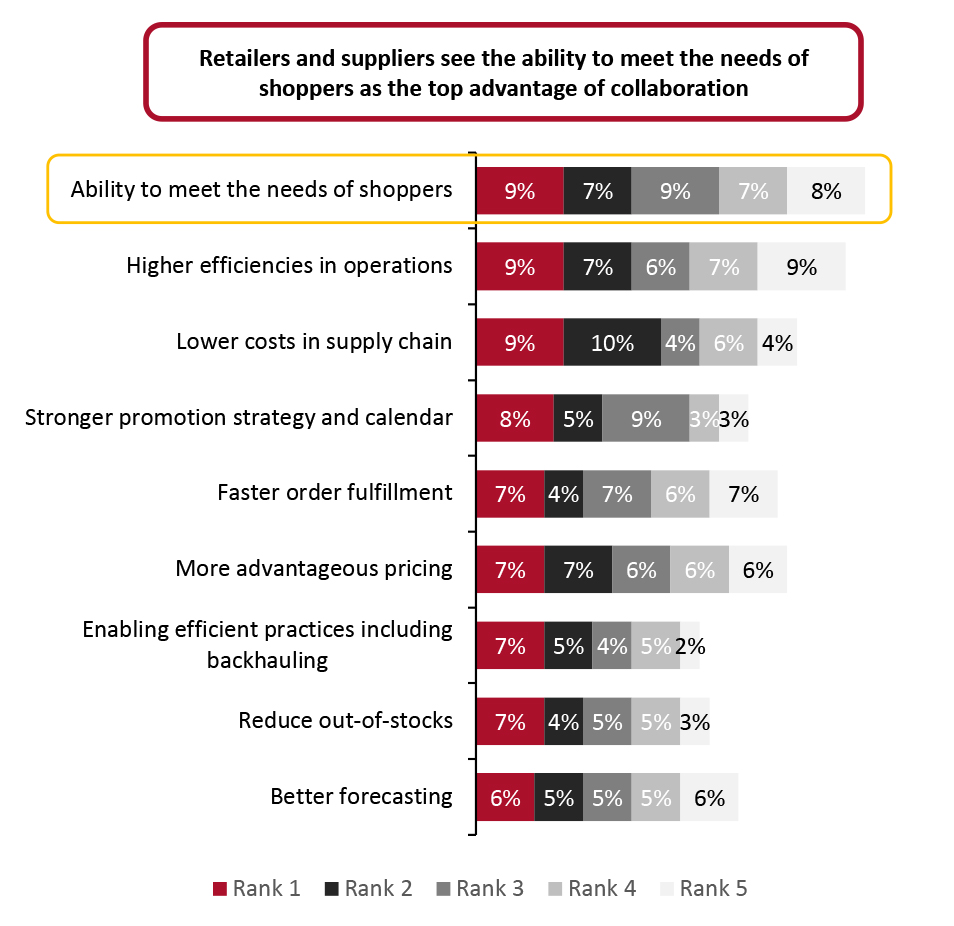

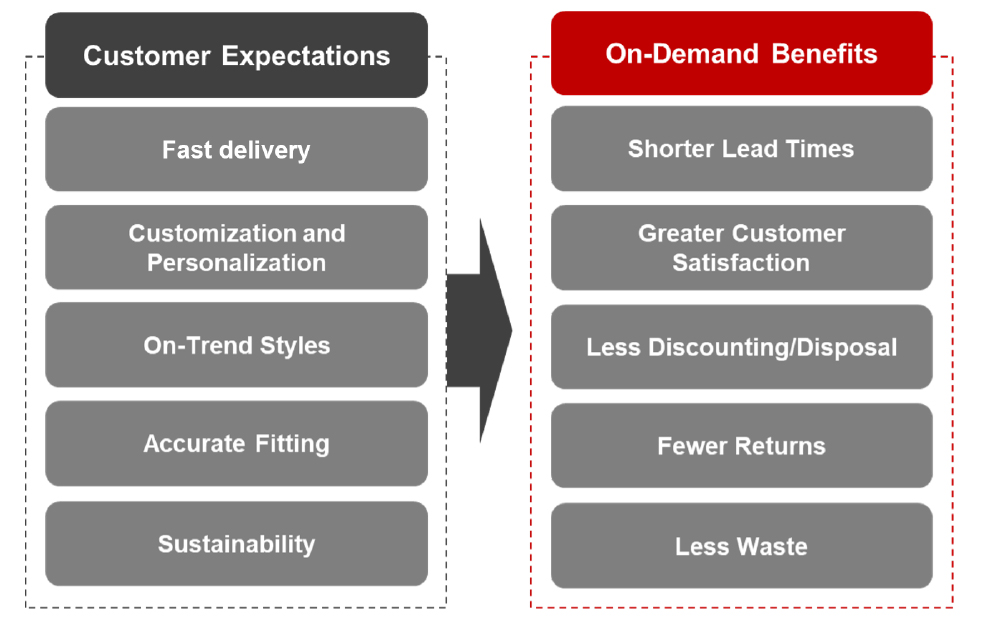

Base: 89 grocery/drug retailers that stated their collaboration had improved over the past two years, surveyed in March 2020 Source: Coresight Research [/caption] The same survey also revealed that although efficiency and cost savings are highly ranked advantages among grocery/drug retailers and CPG suppliers, the ability to meet the needs of shoppers is the top advantage of good retailer-supplier collaboration (see Figure 6). To effectively meet shoppers’ needs, accurate forecasting is critical: Both retailers and suppliers need be willing to share data beyond basic sales and inventory information, extending to data about promotional campaigns, loyalty programs, basket sizes and anonymized customer metrics such as purchase patters. We discuss the benefits of meeting customer expectations in detail in a later section of this report.

Figure 6. Retailers and Suppliers: Key Advantages of Good Retailer-Supplier Collaboration (% of Respondents) [caption id="attachment_132712" align="aligncenter" width="725"]

Base: 210 grocery/drug retailers and CPG suppliers, surveyed in March 2020

Base: 210 grocery/drug retailers and CPG suppliers, surveyed in March 2020 Survey question summary: What are the advantages of good retailer-supplier collaboration? Please select and rank up to five, with “Rank 1” representing the most important.

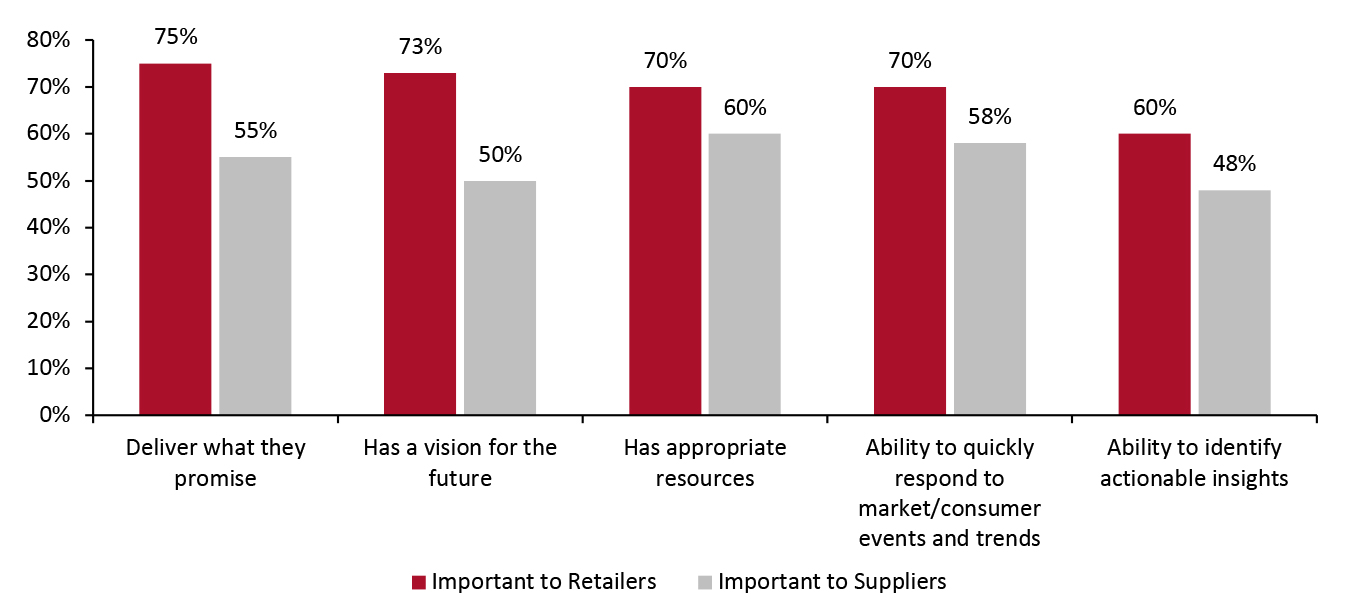

Source: Coresight Research [/caption] Furthermore, for successful collaboration, retailers and suppliers recognize the importance of a partner’s ability to respond to changing market trends and consumer behavior: This was identified as one of the top five key criteria for successful collaboration between grocery drug/retailers and CPG suppliers (see Figure 7).

- For more on this topic, read our separate report, Winning with Retailer-Supplier Collaboration in Grocery and Drug Retail

Figure 7. Retailers and Suppliers: Key Criteria They Look for in Their Partners for Successful Collaboration (% of Respondents Who Cited Criteria as “Important” or “Very Important”) [caption id="attachment_132713" align="aligncenter" width="725"]

Base: 210 grocery/drug retailers and CPG suppliers

Base: 210 grocery/drug retailers and CPG suppliers Survey question: What are the key criteria for success in your collaboration with retailers/suppliers?

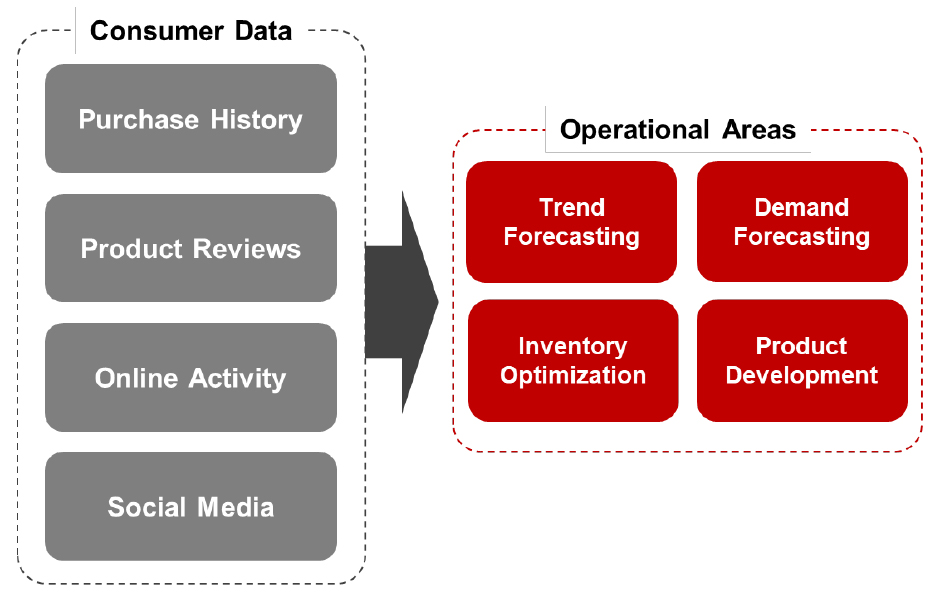

Source: Coresight Research [/caption] Collaboration Between Retailers, Manufacturers and Consumers: Data-Driven Forecasting and Product Development Retailers and brands can derive significant benefits from internal customer data such as product reviews and activity on the company’s website. Retailers can also access data from competitors and via social media. Such data enhance a number of operational areas, as we outline in Figure 8 and discuss in further detail below.

Figure 8. Sources of Consumer Data (Left) and the Operational Areas That Are Enhanced by Data (Right) [caption id="attachment_132714" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Integrating consumer data helps retailers to develop new products that are in line with demand, leading to improved sales, revenue and customer satisfaction, which drives repeat business.

By analyzing consumers’ purchase history, brands and retailers improve product recommendations and curate personalized product offerings.

Source: Coresight Research[/caption]

Integrating consumer data helps retailers to develop new products that are in line with demand, leading to improved sales, revenue and customer satisfaction, which drives repeat business.

By analyzing consumers’ purchase history, brands and retailers improve product recommendations and curate personalized product offerings.

- US luxury department store chain Neiman Marcus gathers data on consumer preferences around sizing, colors, designs, styles and more, based on their previous searches. The retailer uses this data to provide personalized product recommendations from items in its assortment, displaying products that meet the shopper’s profile the next time they visit the online store. The data can also be leveraged to develop new products.

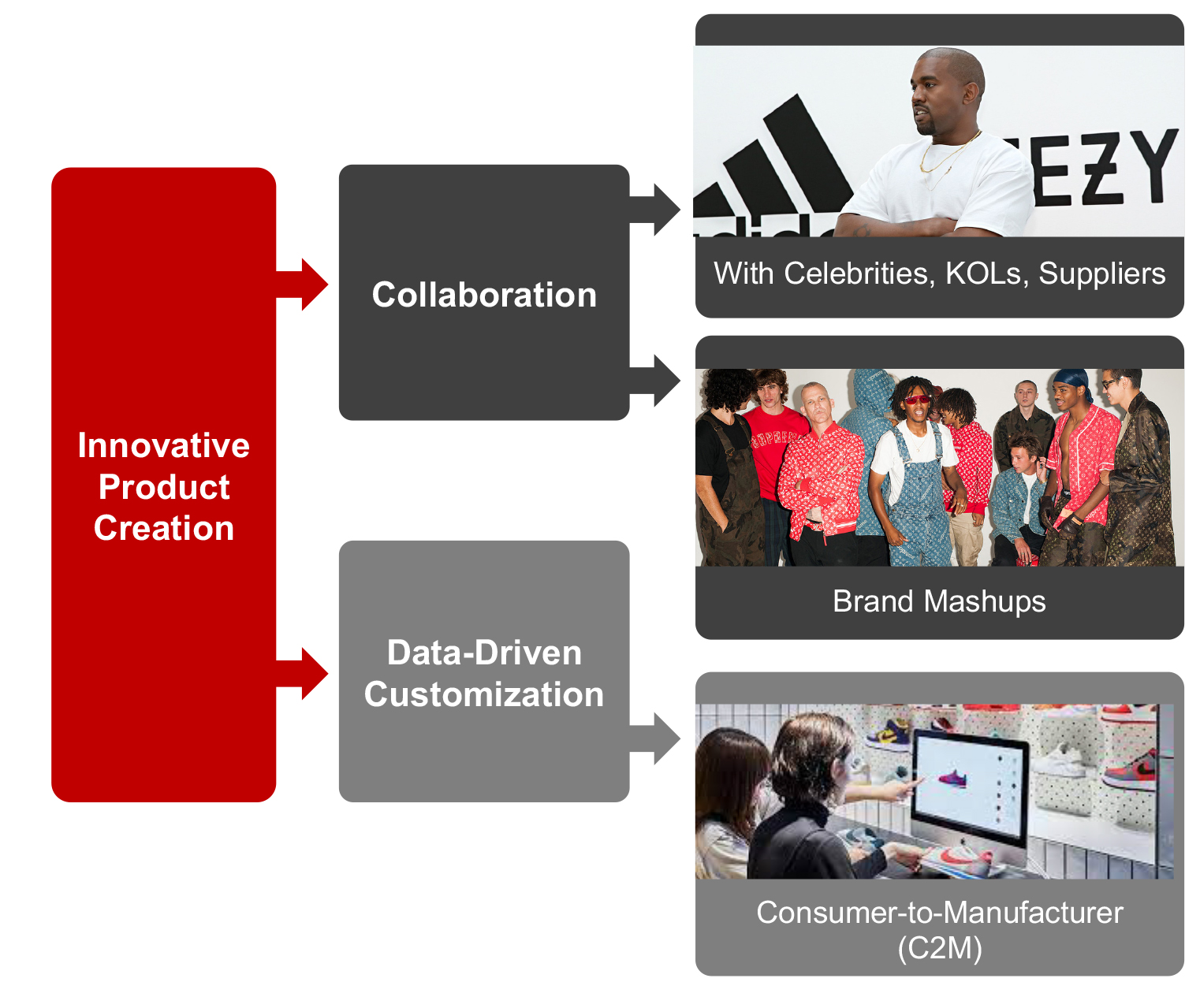

Figure 9. Collaboration-Related Innovative Approaches to Product Creation [caption id="attachment_132725" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

- Celebrity Collaborations and Brand Mashups

- Streetwear fashion brand Supreme—which usually collaborates with designers, artists, photographers and musicians—joined with luxury sports-car brand Lamborghini to launch a clothing line online in April 2020, with product designs centered around the fluorescent colors of Lamborghini’s famous car models, such as the Aventador, Diablo and Murciélago.

- On April 9, 2020, clothing company Levi Strauss & Co. launched a collaborative clothing line featuring one of Nintendo’s most iconic and memorable IP, Super Mario. The collection enables Levi’s to tap into the huge fan base of the video game series and incorporate a fun and youthful vibe into the brand through colorful graphics and prints.

- Product Customization

Figure 10. On-Demand Benefits to Retailers of Meeting Customer Expectations [caption id="attachment_132716" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

What We Think

With pandemic disrupting supply chains and retailers struggling to meet evolving consumer needs, we believe collaboration with suppliers and business partners is key for retailers to optimize their supply chains and stay agile and flexible. It is time for retailers to adopt network digitalization in the supply chain through tools such as MEPs, which ensure data collaboration across the network and inform decision-making. Retailers should also look at online collaboration with business partners due to disruptions in travel and shipping changing. We expect the C2M model to gain traction, enabling brands and retailers to use real-time analytics to understand consumer needs and launch personalized products. We recommend that brands and retailers capitalize on consumers’ desire for customization, while increasing operational efficiency, by implementing on-demand manufacturing. Collaboration between retailers and other supply chain parties is critical in responding to changing market trends and consumer behavior, and improving the customer experience. Implications for Brands/Retailers- Brands and retailers can consider expanding their supply-chain networks through platforms such as MEPs, thereby improving their back-end operations to offer differentiated front-end experiences.

- Celebrity and brand collaborations are set to play an important role in the launch of exclusive products, influencing consumer purchasing decisions in the future. Brands and retailers should look to get involved in brand mashups, which leverage the strength of both partners and increase their visibility to a wider audience as well as creating excitement among consumers about new product launches.

- Successful, appealing products benefit greatly from data-driven customization. Brands and retailers should leverage consumer data derived from multiple consumer touchpoints to provide tailored products that can differentiate their offerings from competition, improving customer loyalty and retention. Leveraging AI/ML technologies can improve the insights derived from consumer data to ensure accurate forecasting.

- Retailers optimizing their inventory and supply chain will require less storage space in stores and warehouses.

- Retailers adopting on-demand manufacturing will encounter fewer returns leading to a reduction in real estate space for fulfillment centres.

- The digitalization of retail supply chains offers opportunities for MEP providers.

- The increased use of AI/ML technologies by retailers for data-driven insights will offer growth opportunities for tech companies, developers, and platform and application providers.