Source: Company reports, Fung Global Retail & Technology

4Q16 Results

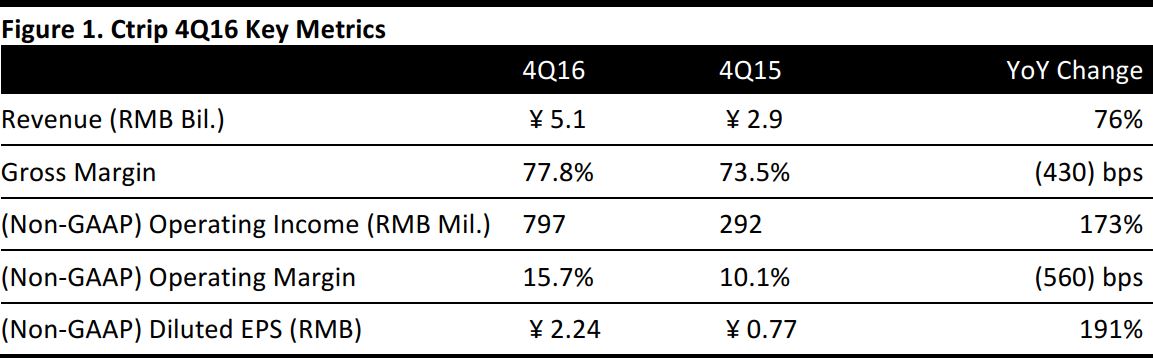

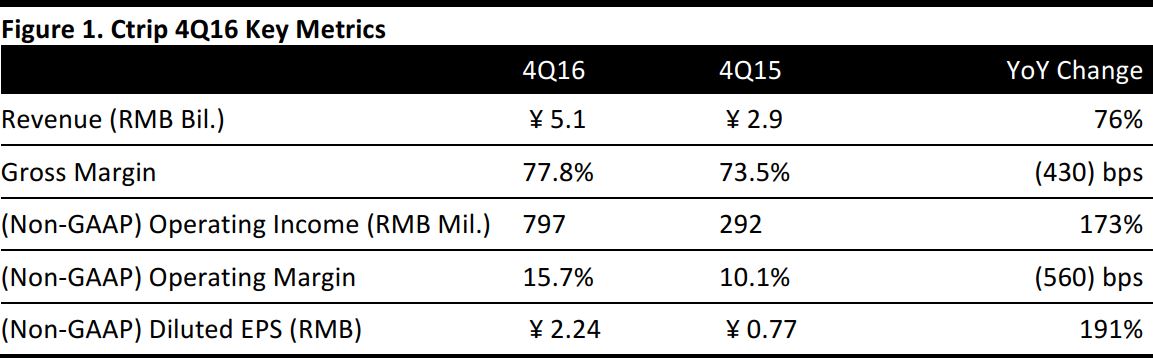

Ctrip reported 4Q16 revenue of ¥5.1 billion, up 76% year over year, beating consensus by 1.6%. The revenue increase is primarily due to the consolidation of the financial results of Qunar since December 31, 2015 as well as solid organic growth.

Expansionary Acquisition

Ctrip completed its acquisition of Skyscanner, an English-language travel search engine, to strengthen its international air ticketing business. Skyscanner, with significant market share in Europe and Asia Pacific, will continue to operate as an independent brand. The consolidation of Skyscanner from December 31, 2016 is expected to bring Ctrip about 6%–7% in additional revenue. It should also drive up Ctrip’s consolidated operating margin with its own EBITDA margin of 20%–25%. Benefiting from synergies from the acquisition, Ctrip expects to extend its international business from 10%–20% of the entire business currently to 40% or above in the long run. Skyscanner recorded revenues of£120 million in 2015.

Source: Company reports/Fung Global Retail & Technology

China Travel Industry

- Domestic: China’s domestic travel market grew to ¥4.4 billion in 2016. With strong support from government policies, market momentum should continue and is expected to grow at an 11% CAGR over the next five years to reach ¥6.7 billion by 2020. As a well-known, one-stop travel platform in China, we believe Ctrip is in a strong position to benefit from this secular trend.

- International: Outbound travel offers significant untapped market potential. Although there are signs of slowing growth in the outbound travel market, Ctrip’s outbound business still experienced more than 50% year-over-year growth in the fourth quarter.

Performance by Segment

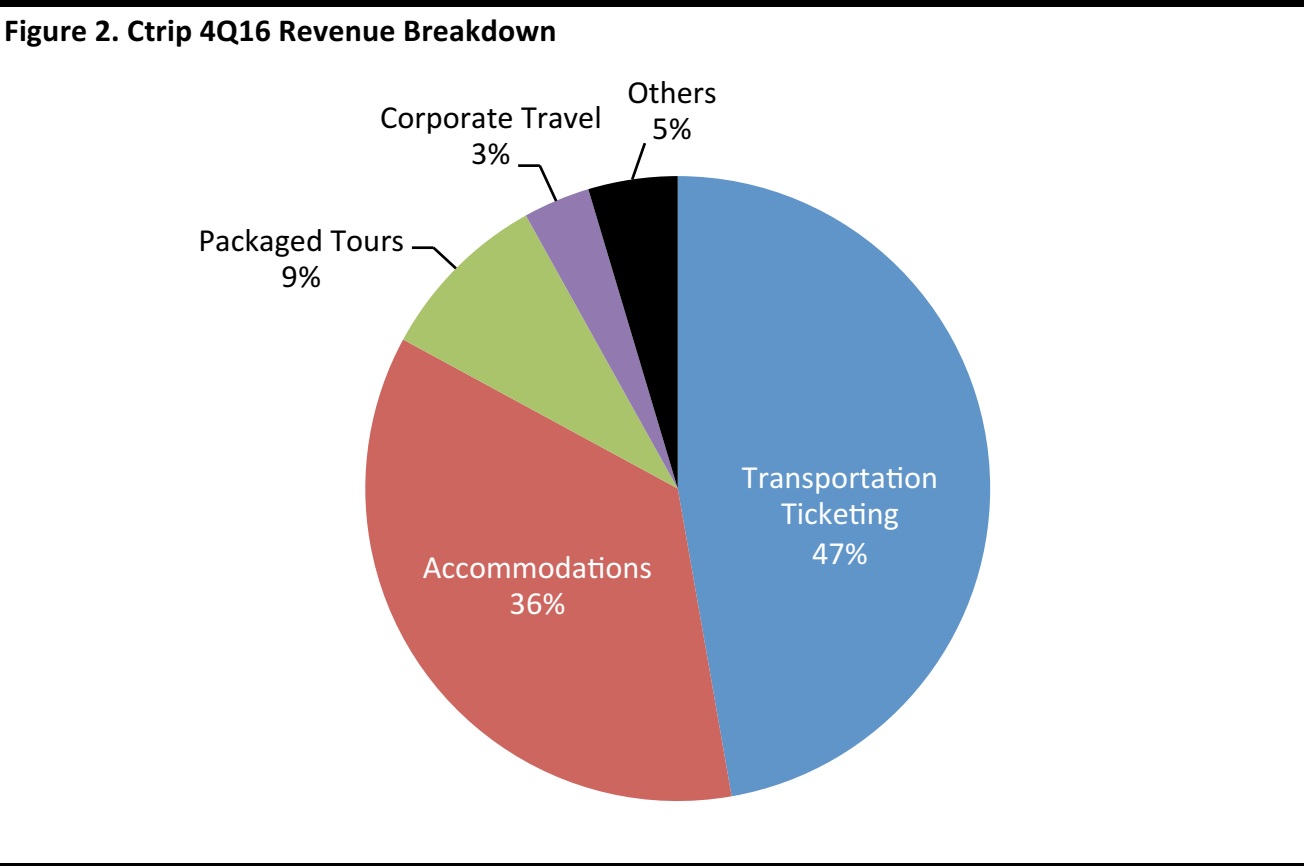

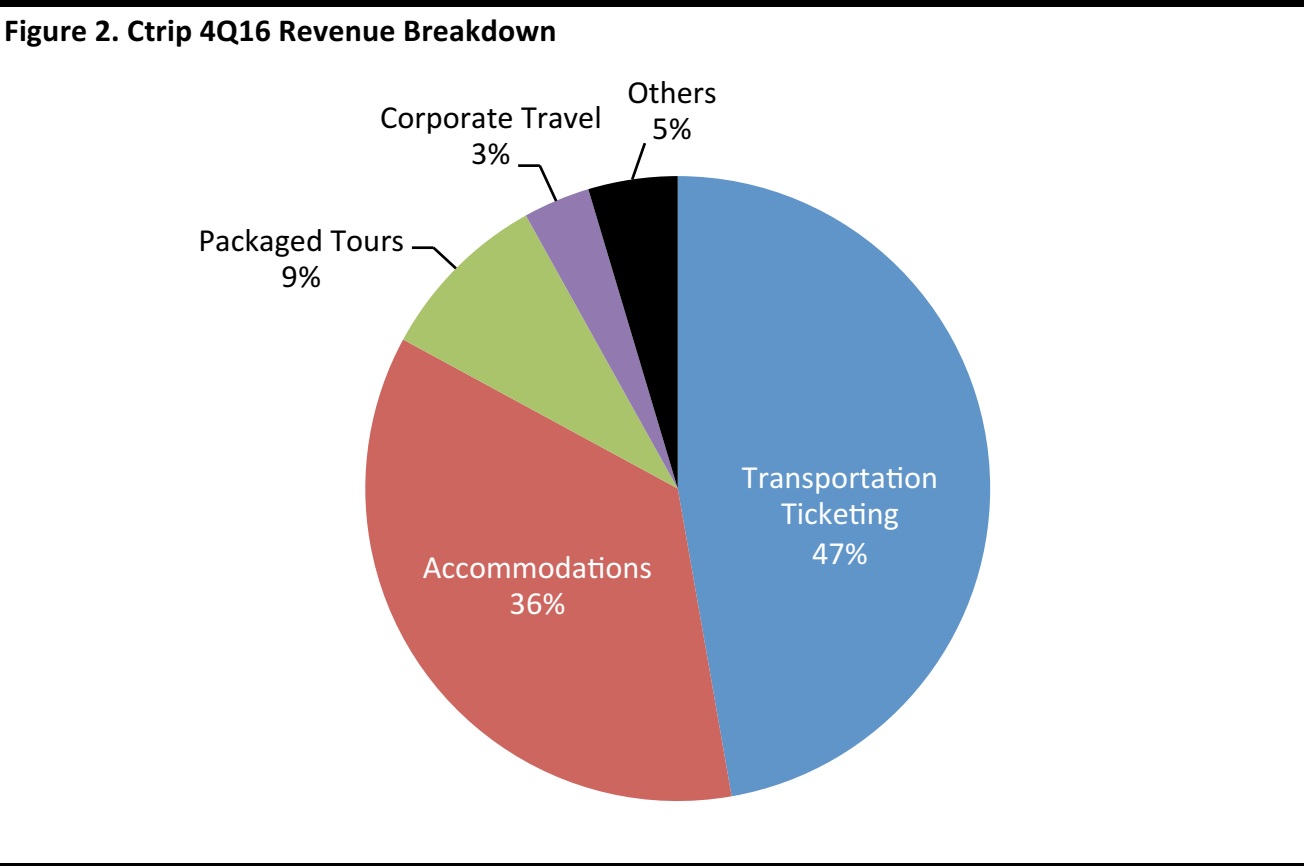

- Hotel and other accommodations: Total hotel revenues grew 56% year over year, due to growth in volume and the inclusion of Qunar, another major travel services platform in China. Ctrip continues to expand its hotel network coverage, with over 1.2 million hotels around the world as of the end of 2016.

- Transportation ticketing service: Transportation ticketing revenues grew by 97% year over year in 4Q16, while international air ticketing revenue grew by over 50%. We expect Ctrip to experience faster growth in FY17 following the acquisition of Skyscanner.

Outlook

Ctrip forecasts that growth of the travel market will be double that of GDP growth in 2017, and that based on past performance, it could even double or triple the industry growth. As such, the company guides for 1Q17 net revenue growth of approximately 40%–45% year over year and non-GAAP operating profit of about ¥750–¥800 million, representing a non-GAAP operating margin of 12%–13%. Despite the expected 5%–10% VAT impact, the company guides for accommodation reservations to grow about 20%–30% and transportation ticketing revenues about 45%–55% year over year.