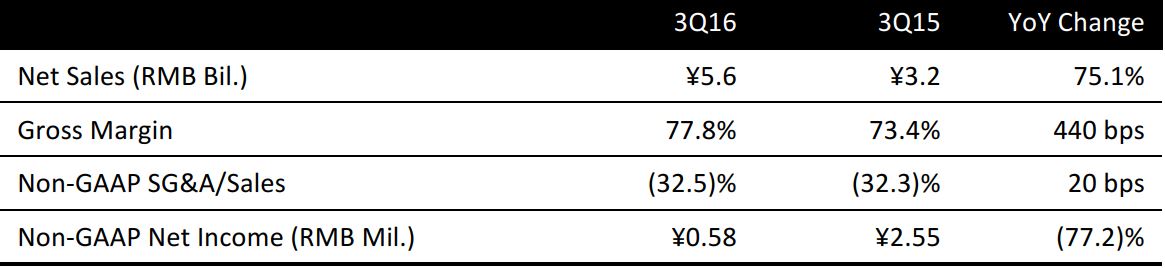

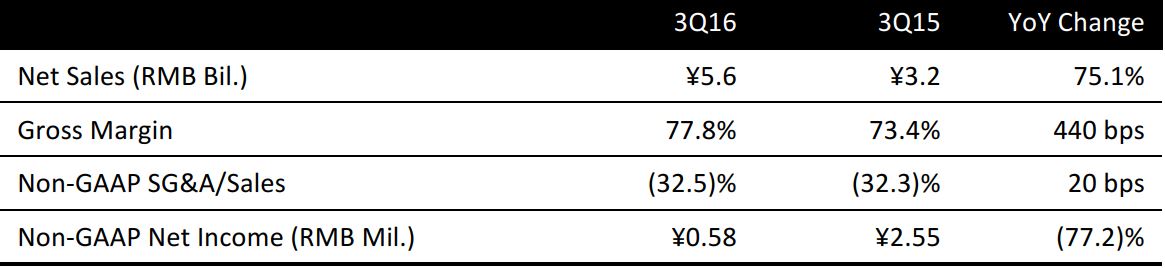

Note: Non-GAAP denotes items that exclude share-based compensation charges.

Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

Ctrip reported total revenues of ¥5.6 billion (US$0.84 billion) for 3Q16, up 75.1% year over year. Non-GAAP net profit of ¥58 million declined 77.2% year over year.

Non-GAAP diluted earnings per ADS was ¥1.15, higher than ¥0.12 last quarter and the consensus forecast of ¥0.80 (US$0.12).

SEGMENT OPERATIONS

Ctrip’s three largest segments—transport ticketing, accommodation reservation and packaged tour—collectively accounted for 93.7% of total revenues. All segments reported large year-over-year increases in revenues, due to the consolidation of Qunar.

Transport ticketing, the largest segment, reported revenue of ¥2.4 billion, up 100.8% year over year and 21.2% quarter on quarter, and comprised 42.8% of total revenue. The quarter-over-quarter increase was due primarily to an increase in ticketing volume and the consolidation of Qunar’s financial results since December 31, 2015.

Accommodation reservation revenue was ¥2.1 billion, up 51% year over year and 17% quarter on quarter, and comprised 36.6% of total revenue. The increase reflects an increase in accommodation reservation volume and the consolidation of Qunar’s financial results.

Packaged tour revenue increased to ¥0.8 billion, up 37.1% year over year and up 72% quarter on quarter, primarily driven by an increase in volume growth of organized and self-guided tours. The quarter-on-quarter surge was largely due to seasonality.

COSTS AND MARGINS

Non-GAAP operating margin increased to 18% in 3Q16, the highest level since 2014, driven by operating efficiency improvements across the board. Non-GAAP sales, general and administrative (SG&A) expenses were ¥1.8 billion in 3Q16, up from ¥1.6 billion in the previous quarter. Non-GAAP SG&A expenses as a percentage of revenue were 32.5%, down from 36.7% in the previous quarter, reflecting an improvement in operating efficiency in sales and marketing activities.

CTRIP ANNOUNCES THE ACQUISITION OF SKYSCANNER

Ctrip announced that it had signed a definitive agreement to acquire Skyscanner, a leading global travel search site headquartered in the UK, for approximately £1.4 billion. The purchase consideration consists mainly of cash, with the remainder to be paid for with Ctrip ordinary shares and loan notes.

REVENUE GUIDANCE

Ctrip guided for net revenue growth of approximately 70–75% year over year for 3Q16. During the earnings call, management stated that a long-term operating income margin of 20-30% is considered as achievable and sustainable, driven by increased efficiency.

Consensus estimates for revenue for full-year 2016 are ¥19.6 billion, implying 69% growth year over year.

OUTLOOK

Ctrip plans to implement the following strategic priorities:

- Develop a more comprehensive global travel ecosystem to better serve both existing and potential customers, and strengthening its positioning on a global scale.

- Leverage the acquisitions of Skyscanner, the metasearch engine for comparisons of flights and hotels, and Travelfusion, a B2B traffic hub for low-cost carriers, to increase the company’s international presence

- Continue to look for potential acquisition targets to extract synergies and grow its global presence. Ctrip targets companies that are dominant players in their markets, with international reach, especially within Asia.