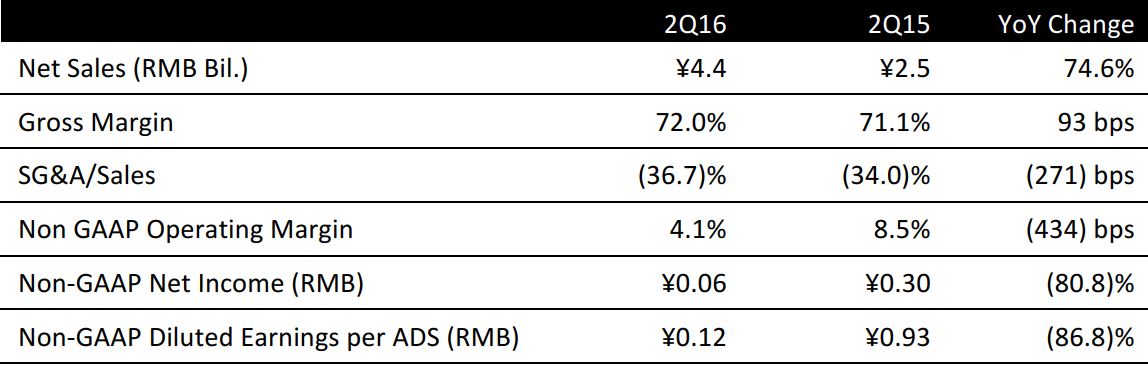

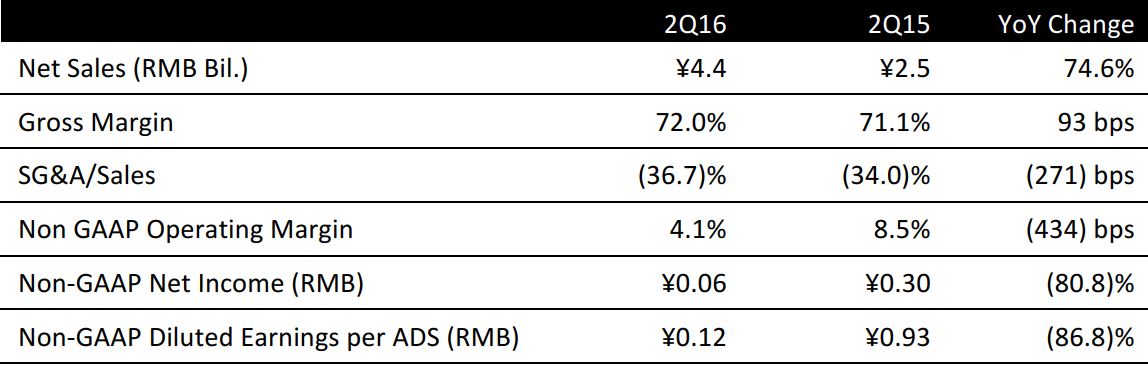

Note: Non-GAAP denotes items that exclude share-based compensation charges incurred following the merger with Qunar.

Source: Company reports/Fung Global Retail & Technology

2Q16 RESULTS

Ctrip’s second-quarter earnings included the consolidation of the financial results of Qunar (QUNR: US), from December 31, 2015. Hence, we focus on non-GAAP reporting which strips out share-based compensation charges incurred as a result of the merger and on quarter-on-quarter trends to gauge sequential changes in underlying operations.

Ctrip reported second-quarter total revenues of ¥4.41 billion (US$0.66 billion), up 75% year over year and broadly in line with the consensus forecast for ¥4.39 billion. Net revenues for the second quarter increased 6% quarter on quarter. Non-GAAP net profit of ¥57 million declined 81% year over year and was down 78% quarter over quarter.

Non-GAAP diluted EPS was ¥0.12, down 87% year over year but beat the consensus forecast of a loss per share of ¥0.13.

SEGMENT OPERATIONS

Ctrip’s three largest segments—transport ticketing, accommodation reservation and packaged tour—collectively accounted for 94% of total revenues. All segments reported large year-over-year increases in revenues due to the consolidation of Qunar. Our analysis focuses on quarter on quarter trends.

Transport ticketing, the largest segment, reported revenue of ¥2.0 billion, up 90% year over year, up 3% quarter on quarter and comprised 44% of total revenue. The quarter-over-quarter increase was due primarily to an increase in ticketing volume.

Accommodation reservation revenue was ¥1.8 billion, up 61% year over year, up 10% quarter on quarter and comprised 39% of total revenue. The quarter-over-quarter increase reflects an increase in accommodation reservation volume and revenue per room night.

Packaged tour revenue of ¥0.5 billion increased 44% year over year, but fell 15% quarter on quarter due to seasonality.

COSTS AND MARGINS

Non-GAAP operating margin was 4% in 2Q16 and improved from the breakeven level seen in the last quarter, but declined from 8% in the year-ago period. Non-GAAP sales, general and administrative (SG&A) expenses were ¥1.6 billion in 2Q16, down from ¥1.7 billion in the last quarter. As a percentage of revenue, non-GAAP SG&A expenses of 37% declined from 41% in the last quarter and reflect a meaningful improvement in operating efficiency in sales and marketing activities.

REVENUE GUIDANCE

The company guided for net revenue growth of approximately 70–75% year over year for the third quarter of 2016.

Consensus estimates are for revenue of ¥19.1 billion for the full year of 2016, implying 75% growth.

OUTLOOK

In the next two to three years, the company expects non-GAAP operating margins to expand meaningfully from 4% in 2Q16. The company plans to achieve this through the following strategic priorities:

- Enhance their one-stop online travel platform and increase user engagement. The merger between Ctrip and Qunar announced in October 2015 created the dominant online travel service in China and this eased price competition.

- Increase incremental travel inventory coverage beyond mainland China to more overseas markets and broaden product offerings. Ctrip will work closely with airlines to execute their marketing strategy and leverage on its strategic partnership with Priceline and China Eastern Airlines.

- Improve operating efficiency by automating business operations. Automated service accounts for almost 40% of ticketing customer service volume.

CHINESE OUTBOUND TOURISM TRENDS

Management also highlighted some key trends in Chinese outbound tourism:

- As Chinese travelers grow more affluent and sophisticated, they are demanding more customized tours to personalize their travel experience. To meet this demand, Ctrip allows customers to select their own tour guides.

- China’s online travel industry is increasingly concentrated. Ctrip processes almost 70% of China’s online travel transactions and has more than 16,000 partners across product categories.

- Chinese customers have been turning to mobile apps to book their travel. More than 70% of Ctrip’s orders are generated from the mobile platform.

Air travel volume to Europe is not as strong as before the events in Nice and Istanbul. This is partially offset by strong demand for travel to North America.