Nitheesh NH

Crocs

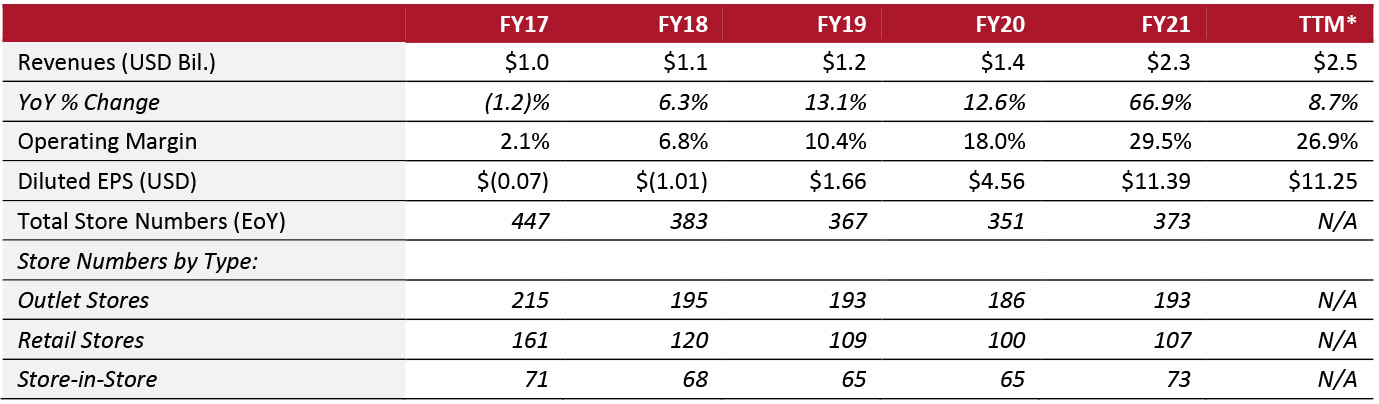

Sector: Apparel and footwear Countries of operation: Sells products in Australia, Canada, China, the UK and the US and over 85 other countries Key product categories: Accessories and footwear Annual Metrics [caption id="attachment_148701" align="aligncenter" width="700"] Fiscal year ends on December 31

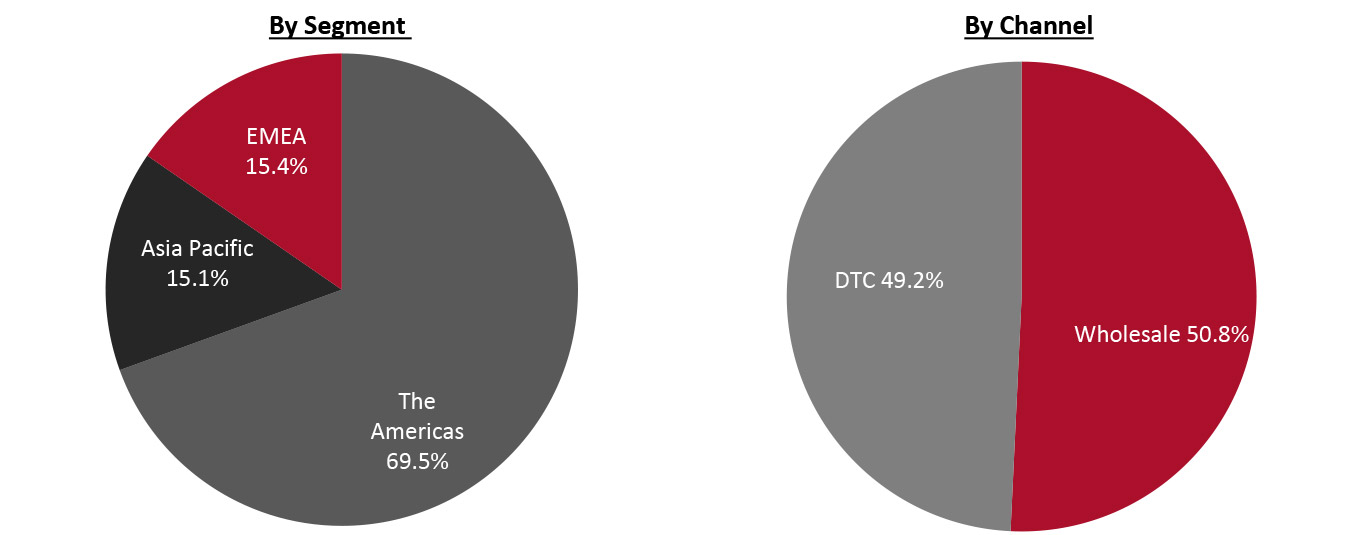

Fiscal year ends on December 31 *Trailing 12 months ended on March 31, 2022 [/caption] Summary Founded in 2002 and headquartered in Broomfield, Colorado, Crocs is engaged in the design, development, marketing, distribution and sale of casual lifestyle accessories and footwear for women, men and children. The vast majority of Crocs shoes are made from Croslite, a proprietary material that gives each pair of shoes its lightweight, non-marking and odor-resistant qualities. As of December 31, 2021, the company owns a total of 373 stores across Americas, Asia Pacific and Europe, the Middle East and Africa (EMEA). In its full fiscal year 2021 (ended December 31, 2021), the company’s digital sales as a percent of total sales was 36.7%. Company Analysis Coresight Research insight: Crocs had a very strong 2021, mainly driven by its key products: clogs, sandals and jibes—which resonated with consumers in a pandemic-affected retail environment, where casualization dominates. has a very clear strategic plan and responds to disruptions rapidly, helping maintain a strong performance. Currently, for example, the company is shifting production capacity to multiple countries and aggressively leveraging air freight to bring in units for 2022, aiming to combat supply chain disruptions, according to its earnings call on February 16, 2022. From a channel perspective, Crocs’ global direct-to-consumer (DTC) revenues, including digital sales, grew rapidly over the past two years—driven by investments in its mobile app, worldwide social platforms and digital talent across the globe. We believe the company’s continued focus on digital, will drive growth globally over the long term. During 2022, we also expect that the company’s revenue will continue growing by a double-digit rate and deliver profitability, while managing supply disruptions effectively.

| Tailwinds | Headwinds |

|

|

- Focus on expanding its sandal business in Asia, especially China, India and Southeast Asia.

- Create more comfortable shoes that center around three pillars: comfort without carbon, comfort for communities and comfort for all people.

- Leverage on-trend color and prints.

- Grow its digital business by creating powerful brand connections to increase customer engagement; for example, launching collaborations with fashion brands and marketing them on social media.

- Use sustainable packaging—currently 80% of Crocs’ products are shipped without a box.

- Focus on product afterlife—enable the resale and reuse of Crocs.

Source: Company reports[/caption]

Company Developments

Source: Company reports[/caption]

Company Developments

| Date | Development |

| May 26, 2022 | Partners with Chumbak, a global home and lifestyle brand, to launch their first Indian collection |

| May 3, 2022 | Publishes its 2021 Crocs Comfort Report, detailing progress and the evolution of milestones surrounding the brand's commitment to becoming a more sustainable and equitable company |

| April 19, 2022 | Welcomes Deanna Bratter as Vice President and Global Head of Sustainability |

| February 17, 2022 | Completes acquisition of casual footwear brand HEYDUDE |

| January 11, 2022 | Files a trademark application in the NFT space for its products and officially enters the metaverse |

| December 23, 2021 | Announces that it will acquire casual footwear brand Hey Dude |

| November 4, 2021 | Launches Clean Out Program with thredUP, giving pre-used items a second life |

| September 14, 2021 | Introduces new bio-based Croslite material to lower its footwear’s carbon footprint |

| July 21, 2021 | Announces a commitment to become a net zero company by 2030 |

| June 10, 2021 | Appoints Tracy Gardner to its Board of Directors |

- Andrew Rees—Chief Executive Officer and Director

- Anne Mehlman—Executive Vice President and Chief Financial Officer

- Rick Blackshaw —Executive Vice President and Brand President for Hey Dude

- Adam Michaels —Executive Vice President and Chief Digital Officer

Source: Company reports