albert Chan

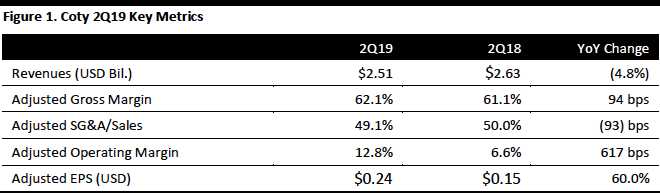

[caption id="attachment_74709" align="aligncenter" width="660"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

Coty reported 2Q19 revenues of $2.51 billion, down 4.8% year over year and beating the consensus estimate of $2.47 billion. The company reported 2Q19 EPS of $0.24, up 60% from the year ago period and beating the consensus estimate of $0.22.

The company said supply chain disruption impacted all three divisions, resulting in approximately $150 million less in net revenues in the first half of the year. Disruptions included shipment backlogs in its luxury warehouse in Germany, consolidation of the Professional Beauty Center in the U.S., the ramp-up of the Consumer Beauty planning hub and manufacturing plant in the U.K, and shortages from component and pump suppliers that affected the luxury division. The company reported it expects these supply chain issues will be solved by year end with a more moderate impact on revenues in the second half of the year.

By division, luxury sales increased 7% to $1.0 billion compared to the prior year, driven by the addition of Burberry. The company reported strong results across its top brands, including Gucci, Marc Jacobs, Calvin Klein, Chloe and Tiffany. Hugo Boss revenues declined due to supply chain disruptions.

Consumer beauty sales declined 15% in the second quarter to $967 million. By category, the company experienced mid-single-digit declines in color cosmetics and high-single-digit declines in retail hair. The company noted its brands were pressured by continued weakness in the mass beauty market, particularly in the U.S. and Europe, although the rate of market share loss slowed. The consumer beauty division was affected by indirect impacts of supply chain disruptions, including customer penalties and increased promotions, which reduced net revenues. The company noted its Wella Retail brand is gaining share with strength in styling in developed markets and hair color in emerging markets, while its Younique brand remained under pressure due to a decline in product sales and presenter sponsorship as the company refines its product offerings.

Professional beauty sales declined 4% in the second quarter to $529 million. Professional beauty was impacted by supply chain disruptions in its North America warehouse, with OPI nail care being disproportionately affected. Adjusting for these supply chain disruptions, which impacted revenues by over 2%, the company estimated that professional beauty had low single digit underlying net revenue growth. The company reported it sees no change to the strong customer demand for its brands in North America and to the health of its salon business.

Geographically, North America accounted for 29%, or $742 million, of the company’s total net revenue and growth was flat compared to last year. The company reported that within North America, its luxury category was strong, but that was offset by lower revenues in professional beauty resulting from supply chain disruptions and pressure in the consumer beauty category.

Europe accounted for 48%, or $1.2 billion, of the company’s total net revenues, and declined 7% on a reported basis, driven by weakness in consumer beauty resulting from performance challenges and supply chain disruptions, but this was largely offset by growth in luxury. The company highlighted that on a brand level, the U.K. experienced declines in Bourjois and Rimmel, Eastern Europe experienced declines in mass fragrances, but Western Europe helped partially offset the declines with stronger performances by Burberry and Calvin Klein.

ALMEA accounted for 23%, or $567 million, of the company’s total net revenues, increasing 5% on a reported basis driven by growth in the luxury and profession beauty categories. The company said Wella Professional revenues were higher in Brazil and the rest of Latin America, while Max Factor’s consumer beauty products declined in China and the Middle East.

Outlook

The company did not provide quantitative EPS and revenue guidance for FY19. However, management said the company anticipates a profit trend recovery in the second half of FY19 and expects FY19 constant currency adjusted operating income to be moderately below FY18 but to achieve positive free cash flow for FY19.

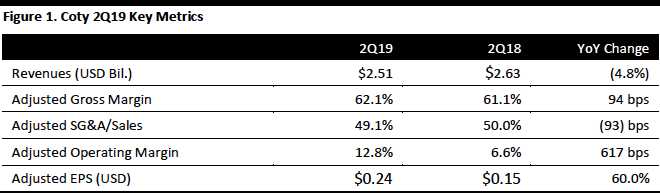

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Coty reported 2Q19 revenues of $2.51 billion, down 4.8% year over year and beating the consensus estimate of $2.47 billion. The company reported 2Q19 EPS of $0.24, up 60% from the year ago period and beating the consensus estimate of $0.22.

The company said supply chain disruption impacted all three divisions, resulting in approximately $150 million less in net revenues in the first half of the year. Disruptions included shipment backlogs in its luxury warehouse in Germany, consolidation of the Professional Beauty Center in the U.S., the ramp-up of the Consumer Beauty planning hub and manufacturing plant in the U.K, and shortages from component and pump suppliers that affected the luxury division. The company reported it expects these supply chain issues will be solved by year end with a more moderate impact on revenues in the second half of the year.

By division, luxury sales increased 7% to $1.0 billion compared to the prior year, driven by the addition of Burberry. The company reported strong results across its top brands, including Gucci, Marc Jacobs, Calvin Klein, Chloe and Tiffany. Hugo Boss revenues declined due to supply chain disruptions.

Consumer beauty sales declined 15% in the second quarter to $967 million. By category, the company experienced mid-single-digit declines in color cosmetics and high-single-digit declines in retail hair. The company noted its brands were pressured by continued weakness in the mass beauty market, particularly in the U.S. and Europe, although the rate of market share loss slowed. The consumer beauty division was affected by indirect impacts of supply chain disruptions, including customer penalties and increased promotions, which reduced net revenues. The company noted its Wella Retail brand is gaining share with strength in styling in developed markets and hair color in emerging markets, while its Younique brand remained under pressure due to a decline in product sales and presenter sponsorship as the company refines its product offerings.

Professional beauty sales declined 4% in the second quarter to $529 million. Professional beauty was impacted by supply chain disruptions in its North America warehouse, with OPI nail care being disproportionately affected. Adjusting for these supply chain disruptions, which impacted revenues by over 2%, the company estimated that professional beauty had low single digit underlying net revenue growth. The company reported it sees no change to the strong customer demand for its brands in North America and to the health of its salon business.

Geographically, North America accounted for 29%, or $742 million, of the company’s total net revenue and growth was flat compared to last year. The company reported that within North America, its luxury category was strong, but that was offset by lower revenues in professional beauty resulting from supply chain disruptions and pressure in the consumer beauty category.

Europe accounted for 48%, or $1.2 billion, of the company’s total net revenues, and declined 7% on a reported basis, driven by weakness in consumer beauty resulting from performance challenges and supply chain disruptions, but this was largely offset by growth in luxury. The company highlighted that on a brand level, the U.K. experienced declines in Bourjois and Rimmel, Eastern Europe experienced declines in mass fragrances, but Western Europe helped partially offset the declines with stronger performances by Burberry and Calvin Klein.

ALMEA accounted for 23%, or $567 million, of the company’s total net revenues, increasing 5% on a reported basis driven by growth in the luxury and profession beauty categories. The company said Wella Professional revenues were higher in Brazil and the rest of Latin America, while Max Factor’s consumer beauty products declined in China and the Middle East.

Outlook

The company did not provide quantitative EPS and revenue guidance for FY19. However, management said the company anticipates a profit trend recovery in the second half of FY19 and expects FY19 constant currency adjusted operating income to be moderately below FY18 but to achieve positive free cash flow for FY19.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Coty reported 2Q19 revenues of $2.51 billion, down 4.8% year over year and beating the consensus estimate of $2.47 billion. The company reported 2Q19 EPS of $0.24, up 60% from the year ago period and beating the consensus estimate of $0.22.

The company said supply chain disruption impacted all three divisions, resulting in approximately $150 million less in net revenues in the first half of the year. Disruptions included shipment backlogs in its luxury warehouse in Germany, consolidation of the Professional Beauty Center in the U.S., the ramp-up of the Consumer Beauty planning hub and manufacturing plant in the U.K, and shortages from component and pump suppliers that affected the luxury division. The company reported it expects these supply chain issues will be solved by year end with a more moderate impact on revenues in the second half of the year.

By division, luxury sales increased 7% to $1.0 billion compared to the prior year, driven by the addition of Burberry. The company reported strong results across its top brands, including Gucci, Marc Jacobs, Calvin Klein, Chloe and Tiffany. Hugo Boss revenues declined due to supply chain disruptions.

Consumer beauty sales declined 15% in the second quarter to $967 million. By category, the company experienced mid-single-digit declines in color cosmetics and high-single-digit declines in retail hair. The company noted its brands were pressured by continued weakness in the mass beauty market, particularly in the U.S. and Europe, although the rate of market share loss slowed. The consumer beauty division was affected by indirect impacts of supply chain disruptions, including customer penalties and increased promotions, which reduced net revenues. The company noted its Wella Retail brand is gaining share with strength in styling in developed markets and hair color in emerging markets, while its Younique brand remained under pressure due to a decline in product sales and presenter sponsorship as the company refines its product offerings.

Professional beauty sales declined 4% in the second quarter to $529 million. Professional beauty was impacted by supply chain disruptions in its North America warehouse, with OPI nail care being disproportionately affected. Adjusting for these supply chain disruptions, which impacted revenues by over 2%, the company estimated that professional beauty had low single digit underlying net revenue growth. The company reported it sees no change to the strong customer demand for its brands in North America and to the health of its salon business.

Geographically, North America accounted for 29%, or $742 million, of the company’s total net revenue and growth was flat compared to last year. The company reported that within North America, its luxury category was strong, but that was offset by lower revenues in professional beauty resulting from supply chain disruptions and pressure in the consumer beauty category.

Europe accounted for 48%, or $1.2 billion, of the company’s total net revenues, and declined 7% on a reported basis, driven by weakness in consumer beauty resulting from performance challenges and supply chain disruptions, but this was largely offset by growth in luxury. The company highlighted that on a brand level, the U.K. experienced declines in Bourjois and Rimmel, Eastern Europe experienced declines in mass fragrances, but Western Europe helped partially offset the declines with stronger performances by Burberry and Calvin Klein.

ALMEA accounted for 23%, or $567 million, of the company’s total net revenues, increasing 5% on a reported basis driven by growth in the luxury and profession beauty categories. The company said Wella Professional revenues were higher in Brazil and the rest of Latin America, while Max Factor’s consumer beauty products declined in China and the Middle East.

Outlook

The company did not provide quantitative EPS and revenue guidance for FY19. However, management said the company anticipates a profit trend recovery in the second half of FY19 and expects FY19 constant currency adjusted operating income to be moderately below FY18 but to achieve positive free cash flow for FY19.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Coty reported 2Q19 revenues of $2.51 billion, down 4.8% year over year and beating the consensus estimate of $2.47 billion. The company reported 2Q19 EPS of $0.24, up 60% from the year ago period and beating the consensus estimate of $0.22.

The company said supply chain disruption impacted all three divisions, resulting in approximately $150 million less in net revenues in the first half of the year. Disruptions included shipment backlogs in its luxury warehouse in Germany, consolidation of the Professional Beauty Center in the U.S., the ramp-up of the Consumer Beauty planning hub and manufacturing plant in the U.K, and shortages from component and pump suppliers that affected the luxury division. The company reported it expects these supply chain issues will be solved by year end with a more moderate impact on revenues in the second half of the year.

By division, luxury sales increased 7% to $1.0 billion compared to the prior year, driven by the addition of Burberry. The company reported strong results across its top brands, including Gucci, Marc Jacobs, Calvin Klein, Chloe and Tiffany. Hugo Boss revenues declined due to supply chain disruptions.

Consumer beauty sales declined 15% in the second quarter to $967 million. By category, the company experienced mid-single-digit declines in color cosmetics and high-single-digit declines in retail hair. The company noted its brands were pressured by continued weakness in the mass beauty market, particularly in the U.S. and Europe, although the rate of market share loss slowed. The consumer beauty division was affected by indirect impacts of supply chain disruptions, including customer penalties and increased promotions, which reduced net revenues. The company noted its Wella Retail brand is gaining share with strength in styling in developed markets and hair color in emerging markets, while its Younique brand remained under pressure due to a decline in product sales and presenter sponsorship as the company refines its product offerings.

Professional beauty sales declined 4% in the second quarter to $529 million. Professional beauty was impacted by supply chain disruptions in its North America warehouse, with OPI nail care being disproportionately affected. Adjusting for these supply chain disruptions, which impacted revenues by over 2%, the company estimated that professional beauty had low single digit underlying net revenue growth. The company reported it sees no change to the strong customer demand for its brands in North America and to the health of its salon business.

Geographically, North America accounted for 29%, or $742 million, of the company’s total net revenue and growth was flat compared to last year. The company reported that within North America, its luxury category was strong, but that was offset by lower revenues in professional beauty resulting from supply chain disruptions and pressure in the consumer beauty category.

Europe accounted for 48%, or $1.2 billion, of the company’s total net revenues, and declined 7% on a reported basis, driven by weakness in consumer beauty resulting from performance challenges and supply chain disruptions, but this was largely offset by growth in luxury. The company highlighted that on a brand level, the U.K. experienced declines in Bourjois and Rimmel, Eastern Europe experienced declines in mass fragrances, but Western Europe helped partially offset the declines with stronger performances by Burberry and Calvin Klein.

ALMEA accounted for 23%, or $567 million, of the company’s total net revenues, increasing 5% on a reported basis driven by growth in the luxury and profession beauty categories. The company said Wella Professional revenues were higher in Brazil and the rest of Latin America, while Max Factor’s consumer beauty products declined in China and the Middle East.

Outlook

The company did not provide quantitative EPS and revenue guidance for FY19. However, management said the company anticipates a profit trend recovery in the second half of FY19 and expects FY19 constant currency adjusted operating income to be moderately below FY18 but to achieve positive free cash flow for FY19.