albert Chan

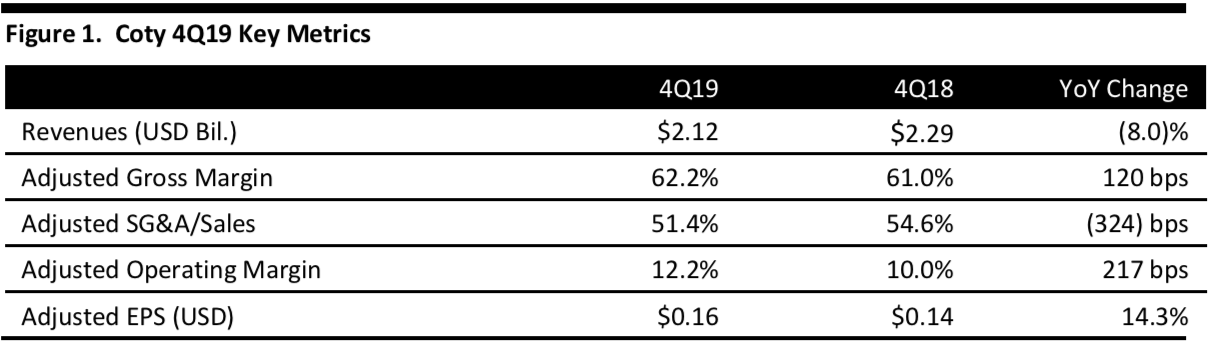

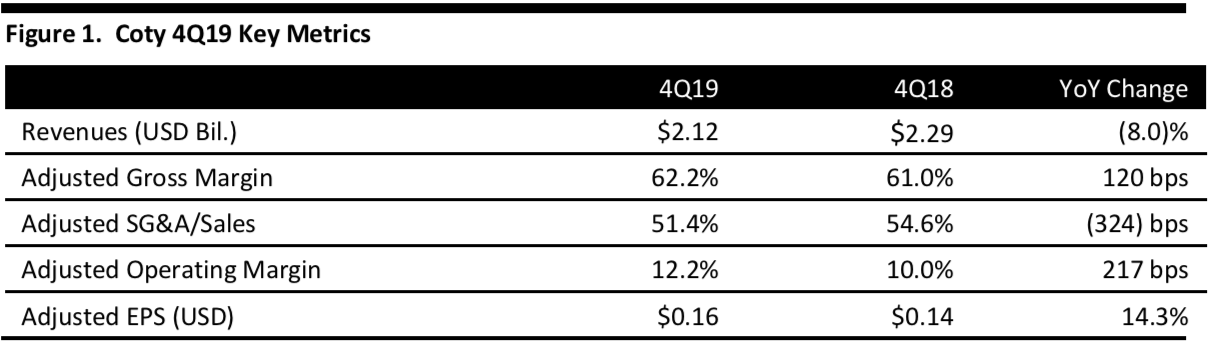

[caption id="attachment_95471" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

4Q19 Results

Coty’s fiscal 4Q19 revenues declined 8% to $2.12 billion, meeting the consensus estimate. Adjusted EPS was $0.16, up 14.3% and in line with the consensus estimate.

Coty CEO Pierre Laubies said the company has largely achieved its goal of stabilizing its business operationally and resolving supply chain disruption during FY19.

By division, luxury (the largest division) posted a 5.8% sales increase, offset by an 11.5% decline in the consumer beauty division and a 3.1% drop in professional beauty revenues.

Comps in the luxury division rose 5.8% in the fourth quarter. Growth contributors included strength in the Asia, Latin America, the Middle East, Africa and Australia region (ALMEA); strength in Europe; and, solid performance in travel retail. The company also reported strength in the brands Burberry, Calvin Klein and Gucci, supported by launches of Burberry Her, Gucci Guilty Revolution, and Gucci’s Alchemist Garden Collection.

For FY19, luxury e-commerce rose 30% to reach over 10% of total luxury revenues, or approximately $330 million.

In 4Q19, the consumer beauty segment declined 11.5%. Coty reported its sell out performance remained consistent over the course of the year, declining high single digits as its brands faced share losses and the mass beauty category continued to experience weakness in North America and Europe. Revenues and sell out in ALMEA grew in the low single digits, supported by strength and share gains in Brazil.

Management provided a high-level summary of the consumer beauty categories’ performance in FY19:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Coty’s fiscal 4Q19 revenues declined 8% to $2.12 billion, meeting the consensus estimate. Adjusted EPS was $0.16, up 14.3% and in line with the consensus estimate.

Coty CEO Pierre Laubies said the company has largely achieved its goal of stabilizing its business operationally and resolving supply chain disruption during FY19.

By division, luxury (the largest division) posted a 5.8% sales increase, offset by an 11.5% decline in the consumer beauty division and a 3.1% drop in professional beauty revenues.

Comps in the luxury division rose 5.8% in the fourth quarter. Growth contributors included strength in the Asia, Latin America, the Middle East, Africa and Australia region (ALMEA); strength in Europe; and, solid performance in travel retail. The company also reported strength in the brands Burberry, Calvin Klein and Gucci, supported by launches of Burberry Her, Gucci Guilty Revolution, and Gucci’s Alchemist Garden Collection.

For FY19, luxury e-commerce rose 30% to reach over 10% of total luxury revenues, or approximately $330 million.

In 4Q19, the consumer beauty segment declined 11.5%. Coty reported its sell out performance remained consistent over the course of the year, declining high single digits as its brands faced share losses and the mass beauty category continued to experience weakness in North America and Europe. Revenues and sell out in ALMEA grew in the low single digits, supported by strength and share gains in Brazil.

Management provided a high-level summary of the consumer beauty categories’ performance in FY19:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Coty’s fiscal 4Q19 revenues declined 8% to $2.12 billion, meeting the consensus estimate. Adjusted EPS was $0.16, up 14.3% and in line with the consensus estimate.

Coty CEO Pierre Laubies said the company has largely achieved its goal of stabilizing its business operationally and resolving supply chain disruption during FY19.

By division, luxury (the largest division) posted a 5.8% sales increase, offset by an 11.5% decline in the consumer beauty division and a 3.1% drop in professional beauty revenues.

Comps in the luxury division rose 5.8% in the fourth quarter. Growth contributors included strength in the Asia, Latin America, the Middle East, Africa and Australia region (ALMEA); strength in Europe; and, solid performance in travel retail. The company also reported strength in the brands Burberry, Calvin Klein and Gucci, supported by launches of Burberry Her, Gucci Guilty Revolution, and Gucci’s Alchemist Garden Collection.

For FY19, luxury e-commerce rose 30% to reach over 10% of total luxury revenues, or approximately $330 million.

In 4Q19, the consumer beauty segment declined 11.5%. Coty reported its sell out performance remained consistent over the course of the year, declining high single digits as its brands faced share losses and the mass beauty category continued to experience weakness in North America and Europe. Revenues and sell out in ALMEA grew in the low single digits, supported by strength and share gains in Brazil.

Management provided a high-level summary of the consumer beauty categories’ performance in FY19:

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Coty’s fiscal 4Q19 revenues declined 8% to $2.12 billion, meeting the consensus estimate. Adjusted EPS was $0.16, up 14.3% and in line with the consensus estimate.

Coty CEO Pierre Laubies said the company has largely achieved its goal of stabilizing its business operationally and resolving supply chain disruption during FY19.

By division, luxury (the largest division) posted a 5.8% sales increase, offset by an 11.5% decline in the consumer beauty division and a 3.1% drop in professional beauty revenues.

Comps in the luxury division rose 5.8% in the fourth quarter. Growth contributors included strength in the Asia, Latin America, the Middle East, Africa and Australia region (ALMEA); strength in Europe; and, solid performance in travel retail. The company also reported strength in the brands Burberry, Calvin Klein and Gucci, supported by launches of Burberry Her, Gucci Guilty Revolution, and Gucci’s Alchemist Garden Collection.

For FY19, luxury e-commerce rose 30% to reach over 10% of total luxury revenues, or approximately $330 million.

In 4Q19, the consumer beauty segment declined 11.5%. Coty reported its sell out performance remained consistent over the course of the year, declining high single digits as its brands faced share losses and the mass beauty category continued to experience weakness in North America and Europe. Revenues and sell out in ALMEA grew in the low single digits, supported by strength and share gains in Brazil.

Management provided a high-level summary of the consumer beauty categories’ performance in FY19:

- Color cosmeticsbrands accounted for close to half of net revenues and declined in the low teens, which reflects pressure on mass cosmetics in the category.

- Retail hair coloraccounted for a mid-teen percentage of net revenues, declining by high single digits. This reflected stable performance of Wella Retail and declines in Clairol.

- Body Careaccounted for a mid-teen percentage of total consumer beauty revenues. Body care grew moderately in FY19, fuelled by local Brazilian brands.

- Mass fragrancesaccounted for approximately 10% of revenues and declined.

- Younique, a direct sales business, accounted for approximately 10% of the division with continuing declines in sponsorships.