DIpil Das

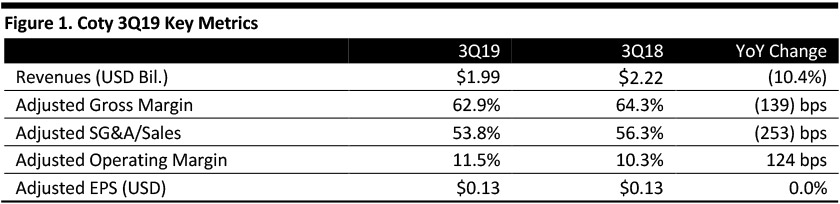

[caption id="attachment_87507" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

Coty reported 3Q19 revenues of $1.99 billion, down 10.4% year over year and lower than the consensus estimate of $2.06 billion. The company reported 3Q19 adjusted EPS of $0.13, even with the year ago period and beating the consensus estimate of $0.12. Management said two major impacts negatively affected its revenues: The company changed its revenue recognition accounting and there were moderate supply chain headwinds.

The company reported the supply chain issues it experienced in the first half of the year that disrupted shipments have abated.

Consumer beauty sales slid 17.8% on a reported basis and 10.0% on a like-for-like basis in the third quarter to $840 million on a like-for-like basis. The company said its revenue recognition policy change and supply chain disruptions impacted revenues by approximately 3%. Coty reported that some of its mass beauty brands are facing share losses and weakness, particularly in the US and in Europe.

Management said its Younique brand revenues and profits declined during 3Q19, driven by lower sponsorships. Younique’s customizable skincare line, Youology, was launched during the quarter and is off to a solid start.

Professional beauty sales declined 6.1% on a reported basis and 0.6% on a like-for-like basis in the third quarter to $421.1 million. Professional beauty was impacted modestly by weakness in North America and lingering impacts from Coty’s supply chain disruptions, plus trade inventory reductions at key customers. The company reported that it has restored service levels for OPI, which had been affected by warehouse issues. Management also reported it is building momentum with the launch of “ghd Glide Hot-brush” in the third quarter.

Luxury beauty sales declined 3.1% on a reported basis and increased by 2.8% on a like-for-like basis in the third quarter to $729.2 million. The company estimated that the revenue recognition accounting change and supply chain disruptions negatively impacted luxury revenues by 1%. Coty management said it saw strength in Burberry, Gucci, and Calvin Klein, and return to growth in Hugo Boss as supply chain disruptions subsided. The company also renewed its March Jacobs fragrance license and launched a new Gucci lipstick collection – the company’s first step in the re-launch of the Gucci makeup line.

Revenues in Europe, Coty’s largest region, accounted for 42% of revenues of $837.9 billion, declining 14% on reported basis and 5% on a like-for-like basis. Management said the decline was a result of weakness in its consumer beauty segment, which was offset by growth in the luxury segment in Germany, the UK and Spain, in addition to growth in professional beauty in the UK and Russia.

North America accounted for 30.7%, or $541.0 million of the company’s total net revenue and decreased 14% on an as reported basis and 13% on a like-for-like basis. Management said its revenue recognition accounting change primarily affected North America and negatively impacted revenues by 3%. The decline was due to weakness in consumer beauty, shelf space loss in several brands and pressure on the Younique brand.

Asia, Latin America, the Middle East, Africa and Australia (ALMEA) accounted for 27.2% or $541.0 million of the company’s total net revenues. Growth was up 1% compared to last year as reported and up 11% on a like-for-like basis. The company said growth was driven by consumer beauty with favorable comparable sales in Brazil and strong growth in luxury in China and the Middle East.

Outlook

The company did not provide quantitative EPS and revenue guidance for FY19. However, management said the company expects fiscal 2019 constant-currency adjusted operating income will be moderately below FY18, implying a solid profit performance in 4Q19 despite expected continued weakness in the top line. The company said it expects to report positive free cash flow for FY19.

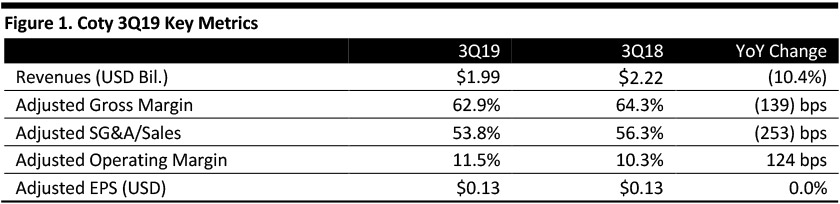

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Coty reported 3Q19 revenues of $1.99 billion, down 10.4% year over year and lower than the consensus estimate of $2.06 billion. The company reported 3Q19 adjusted EPS of $0.13, even with the year ago period and beating the consensus estimate of $0.12. Management said two major impacts negatively affected its revenues: The company changed its revenue recognition accounting and there were moderate supply chain headwinds.

The company reported the supply chain issues it experienced in the first half of the year that disrupted shipments have abated.

Consumer beauty sales slid 17.8% on a reported basis and 10.0% on a like-for-like basis in the third quarter to $840 million on a like-for-like basis. The company said its revenue recognition policy change and supply chain disruptions impacted revenues by approximately 3%. Coty reported that some of its mass beauty brands are facing share losses and weakness, particularly in the US and in Europe.

Management said its Younique brand revenues and profits declined during 3Q19, driven by lower sponsorships. Younique’s customizable skincare line, Youology, was launched during the quarter and is off to a solid start.

Professional beauty sales declined 6.1% on a reported basis and 0.6% on a like-for-like basis in the third quarter to $421.1 million. Professional beauty was impacted modestly by weakness in North America and lingering impacts from Coty’s supply chain disruptions, plus trade inventory reductions at key customers. The company reported that it has restored service levels for OPI, which had been affected by warehouse issues. Management also reported it is building momentum with the launch of “ghd Glide Hot-brush” in the third quarter.

Luxury beauty sales declined 3.1% on a reported basis and increased by 2.8% on a like-for-like basis in the third quarter to $729.2 million. The company estimated that the revenue recognition accounting change and supply chain disruptions negatively impacted luxury revenues by 1%. Coty management said it saw strength in Burberry, Gucci, and Calvin Klein, and return to growth in Hugo Boss as supply chain disruptions subsided. The company also renewed its March Jacobs fragrance license and launched a new Gucci lipstick collection – the company’s first step in the re-launch of the Gucci makeup line.

Revenues in Europe, Coty’s largest region, accounted for 42% of revenues of $837.9 billion, declining 14% on reported basis and 5% on a like-for-like basis. Management said the decline was a result of weakness in its consumer beauty segment, which was offset by growth in the luxury segment in Germany, the UK and Spain, in addition to growth in professional beauty in the UK and Russia.

North America accounted for 30.7%, or $541.0 million of the company’s total net revenue and decreased 14% on an as reported basis and 13% on a like-for-like basis. Management said its revenue recognition accounting change primarily affected North America and negatively impacted revenues by 3%. The decline was due to weakness in consumer beauty, shelf space loss in several brands and pressure on the Younique brand.

Asia, Latin America, the Middle East, Africa and Australia (ALMEA) accounted for 27.2% or $541.0 million of the company’s total net revenues. Growth was up 1% compared to last year as reported and up 11% on a like-for-like basis. The company said growth was driven by consumer beauty with favorable comparable sales in Brazil and strong growth in luxury in China and the Middle East.

Outlook

The company did not provide quantitative EPS and revenue guidance for FY19. However, management said the company expects fiscal 2019 constant-currency adjusted operating income will be moderately below FY18, implying a solid profit performance in 4Q19 despite expected continued weakness in the top line. The company said it expects to report positive free cash flow for FY19.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Coty reported 3Q19 revenues of $1.99 billion, down 10.4% year over year and lower than the consensus estimate of $2.06 billion. The company reported 3Q19 adjusted EPS of $0.13, even with the year ago period and beating the consensus estimate of $0.12. Management said two major impacts negatively affected its revenues: The company changed its revenue recognition accounting and there were moderate supply chain headwinds.

The company reported the supply chain issues it experienced in the first half of the year that disrupted shipments have abated.

Consumer beauty sales slid 17.8% on a reported basis and 10.0% on a like-for-like basis in the third quarter to $840 million on a like-for-like basis. The company said its revenue recognition policy change and supply chain disruptions impacted revenues by approximately 3%. Coty reported that some of its mass beauty brands are facing share losses and weakness, particularly in the US and in Europe.

Management said its Younique brand revenues and profits declined during 3Q19, driven by lower sponsorships. Younique’s customizable skincare line, Youology, was launched during the quarter and is off to a solid start.

Professional beauty sales declined 6.1% on a reported basis and 0.6% on a like-for-like basis in the third quarter to $421.1 million. Professional beauty was impacted modestly by weakness in North America and lingering impacts from Coty’s supply chain disruptions, plus trade inventory reductions at key customers. The company reported that it has restored service levels for OPI, which had been affected by warehouse issues. Management also reported it is building momentum with the launch of “ghd Glide Hot-brush” in the third quarter.

Luxury beauty sales declined 3.1% on a reported basis and increased by 2.8% on a like-for-like basis in the third quarter to $729.2 million. The company estimated that the revenue recognition accounting change and supply chain disruptions negatively impacted luxury revenues by 1%. Coty management said it saw strength in Burberry, Gucci, and Calvin Klein, and return to growth in Hugo Boss as supply chain disruptions subsided. The company also renewed its March Jacobs fragrance license and launched a new Gucci lipstick collection – the company’s first step in the re-launch of the Gucci makeup line.

Revenues in Europe, Coty’s largest region, accounted for 42% of revenues of $837.9 billion, declining 14% on reported basis and 5% on a like-for-like basis. Management said the decline was a result of weakness in its consumer beauty segment, which was offset by growth in the luxury segment in Germany, the UK and Spain, in addition to growth in professional beauty in the UK and Russia.

North America accounted for 30.7%, or $541.0 million of the company’s total net revenue and decreased 14% on an as reported basis and 13% on a like-for-like basis. Management said its revenue recognition accounting change primarily affected North America and negatively impacted revenues by 3%. The decline was due to weakness in consumer beauty, shelf space loss in several brands and pressure on the Younique brand.

Asia, Latin America, the Middle East, Africa and Australia (ALMEA) accounted for 27.2% or $541.0 million of the company’s total net revenues. Growth was up 1% compared to last year as reported and up 11% on a like-for-like basis. The company said growth was driven by consumer beauty with favorable comparable sales in Brazil and strong growth in luxury in China and the Middle East.

Outlook

The company did not provide quantitative EPS and revenue guidance for FY19. However, management said the company expects fiscal 2019 constant-currency adjusted operating income will be moderately below FY18, implying a solid profit performance in 4Q19 despite expected continued weakness in the top line. The company said it expects to report positive free cash flow for FY19.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Coty reported 3Q19 revenues of $1.99 billion, down 10.4% year over year and lower than the consensus estimate of $2.06 billion. The company reported 3Q19 adjusted EPS of $0.13, even with the year ago period and beating the consensus estimate of $0.12. Management said two major impacts negatively affected its revenues: The company changed its revenue recognition accounting and there were moderate supply chain headwinds.

The company reported the supply chain issues it experienced in the first half of the year that disrupted shipments have abated.

Consumer beauty sales slid 17.8% on a reported basis and 10.0% on a like-for-like basis in the third quarter to $840 million on a like-for-like basis. The company said its revenue recognition policy change and supply chain disruptions impacted revenues by approximately 3%. Coty reported that some of its mass beauty brands are facing share losses and weakness, particularly in the US and in Europe.

Management said its Younique brand revenues and profits declined during 3Q19, driven by lower sponsorships. Younique’s customizable skincare line, Youology, was launched during the quarter and is off to a solid start.

Professional beauty sales declined 6.1% on a reported basis and 0.6% on a like-for-like basis in the third quarter to $421.1 million. Professional beauty was impacted modestly by weakness in North America and lingering impacts from Coty’s supply chain disruptions, plus trade inventory reductions at key customers. The company reported that it has restored service levels for OPI, which had been affected by warehouse issues. Management also reported it is building momentum with the launch of “ghd Glide Hot-brush” in the third quarter.

Luxury beauty sales declined 3.1% on a reported basis and increased by 2.8% on a like-for-like basis in the third quarter to $729.2 million. The company estimated that the revenue recognition accounting change and supply chain disruptions negatively impacted luxury revenues by 1%. Coty management said it saw strength in Burberry, Gucci, and Calvin Klein, and return to growth in Hugo Boss as supply chain disruptions subsided. The company also renewed its March Jacobs fragrance license and launched a new Gucci lipstick collection – the company’s first step in the re-launch of the Gucci makeup line.

Revenues in Europe, Coty’s largest region, accounted for 42% of revenues of $837.9 billion, declining 14% on reported basis and 5% on a like-for-like basis. Management said the decline was a result of weakness in its consumer beauty segment, which was offset by growth in the luxury segment in Germany, the UK and Spain, in addition to growth in professional beauty in the UK and Russia.

North America accounted for 30.7%, or $541.0 million of the company’s total net revenue and decreased 14% on an as reported basis and 13% on a like-for-like basis. Management said its revenue recognition accounting change primarily affected North America and negatively impacted revenues by 3%. The decline was due to weakness in consumer beauty, shelf space loss in several brands and pressure on the Younique brand.

Asia, Latin America, the Middle East, Africa and Australia (ALMEA) accounted for 27.2% or $541.0 million of the company’s total net revenues. Growth was up 1% compared to last year as reported and up 11% on a like-for-like basis. The company said growth was driven by consumer beauty with favorable comparable sales in Brazil and strong growth in luxury in China and the Middle East.

Outlook

The company did not provide quantitative EPS and revenue guidance for FY19. However, management said the company expects fiscal 2019 constant-currency adjusted operating income will be moderately below FY18, implying a solid profit performance in 4Q19 despite expected continued weakness in the top line. The company said it expects to report positive free cash flow for FY19.