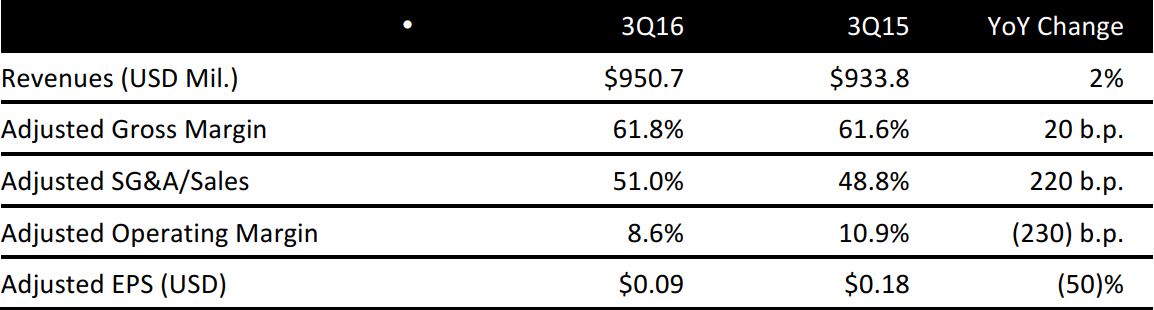

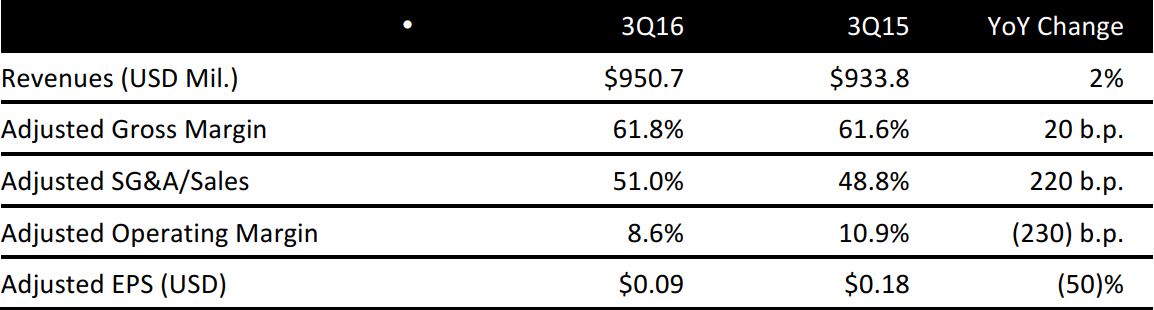

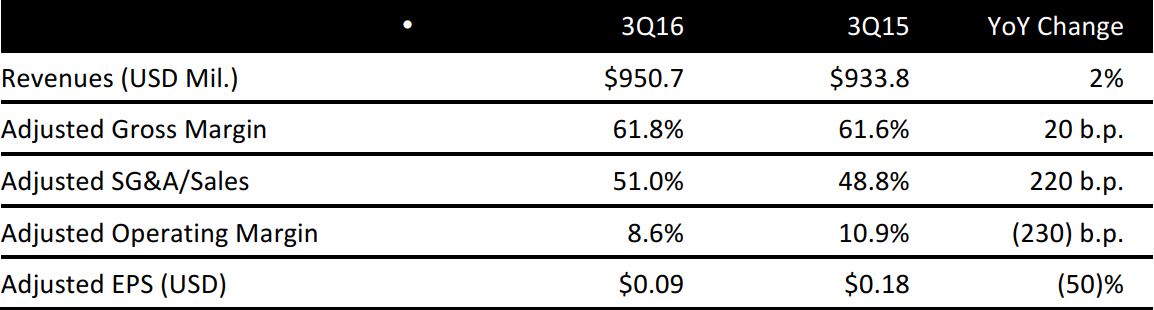

Source: Company reports

By product category, fragrance sales were down 4%. Color cosmetics sales were up 11% on a reported basis, driven by strong growth in Rimmel, while lower Sally Hansen revenues reflected the decline in the US retail nail market. Skin and body care sales were down 12% on a reported basis as continued strength in the Adidas business was offset by a decline in Philosophy and Playboy.

By geography, sales in the Americas declined by 7% on a reported basis, driven by weakness in the US and in travel retail. In the EMEA region, sales increased by 11% on a reported basis, driven by growth in Germany, Eastern Europe and the Middle East that was partially offset by declines in the UK and in regional exports. Sales in the Asia-Pacific region were down 2% on a reported basis, as growth in China, travel retail, Japan and Australia was offset by foreign exchange.

Full-year guidance calls for like-for-like revenue performance to remain consistent with year-to-date trends. Adjusted operating income is expected to be in line with the prior year due to the impact of foreign exchange; high-single-digit growth is expected on a constant-currency basis.

In addition to reporting on earnings, Coty also provided an update on its transaction with Procter & Gamble’s (P&G’s) Beauty Brands division, which is expected to close in October. Coty announced in July 2015 that it will acquire P&G’s fragrance, color cosmetics and hair color business (P&G Beauty Brands) through a Reverse Morris Trust structure. Estimated cost savings have now been increased to approximately $780 million annually, or 16% of acquired revenues, after the next four years, which is a very substantial increase from the estimate provided in July 2015. The P&G Beauty Brands business, supported by the total expected synergies, is expected to add approximately 600 basis points to the Coty stand-alone operating profit margin over the four-year period.