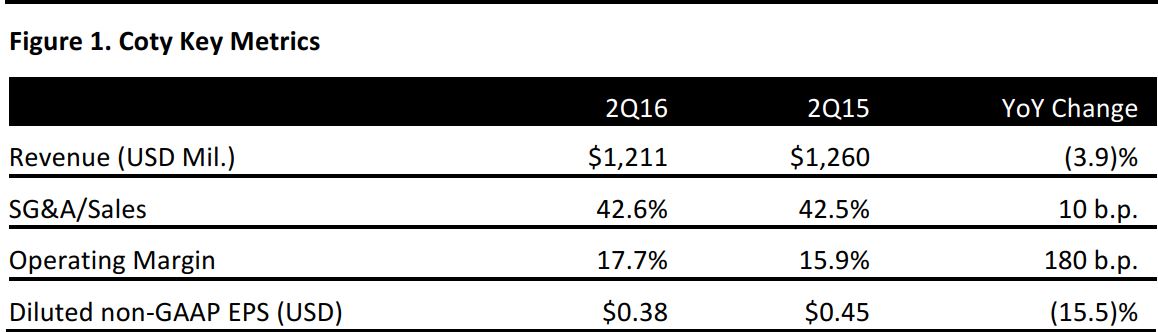

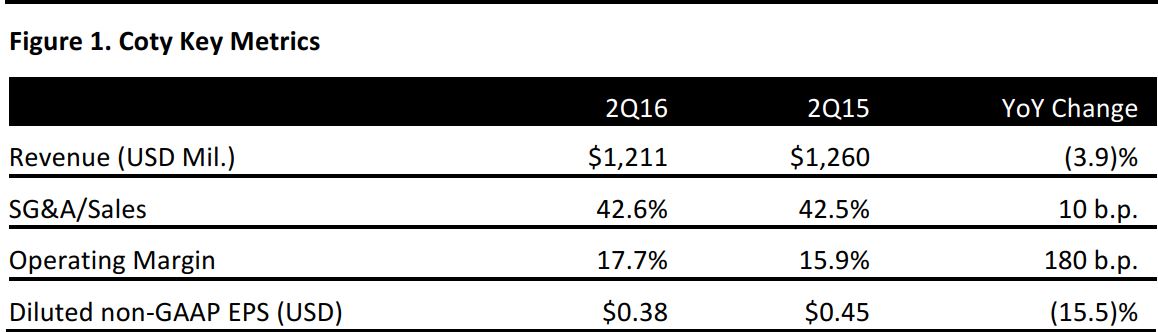

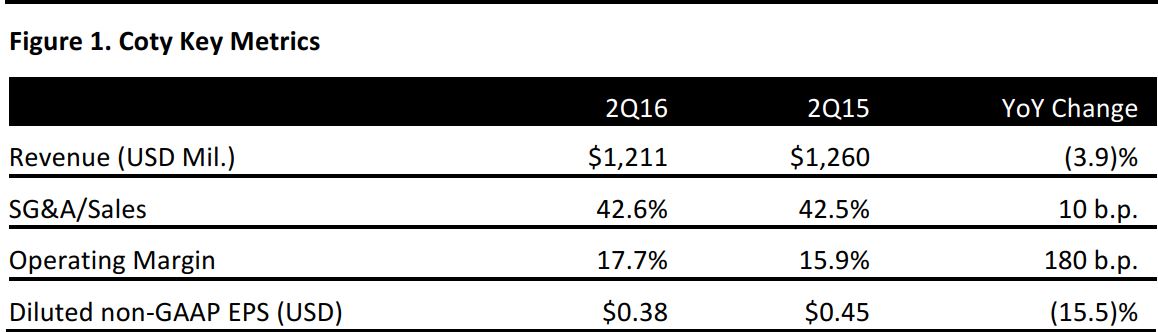

Source: Company reports

Perfume maker Coty reported better-than-expected quarterly sales of $1.21 billion. Solid, 3% like-for-like growth in Color Cosmetics and flat like-for-like performance in Skin & Body Care were partially offset by declines in Fragrances.

The solid like-for-like increase in the

Color Cosmetics segment was driven by brands Sally Hansen and Rimmel, despite a decline in the US nail market. Adjusted operating income for Color Cosmetics increased by 45%, to $58.4 million, from $40.3 million in the prior-year period.

Skin & Body Care revenues on a like-for-like basis were in line with the prior year, reflecting continued growth in adidas, which was offset by a decline in Playboy. Adjusted operating income increased by 82% year over year, to $27.5 million.

Fragrances revenues decreased by 3% like for like, as growth in Calvin Klein and Marc Jacobs could not offset declines in other non-power brands and a slowing fragrance market. Adjusted operating income decreased by 12% year over year, to $128.7 million.

By geography, like-for-like revenue growth increased by 3%, to $146 million, in the Asia-Pacific region. Growth was primarily driven by Australia and Japan, but these gains were partially offset by declines in China. EMEA like-for-like revenue increased slightly, by 1%, to $645 million, driven by growth in Eastern Europe and the Middle East that was partially offset by declines in the UK and Germany. Revenue gains were offset by a 5% like-for-like decline in the US and Latin America, bringing revenue to $420 million.

Coty reported quarterly profit of $89 million, a tumble of 29%, or 25 cents a share. Management indicated that acquisition-related costs of $45.5 million (compared to $1.6 million in the year-ago quarter) were tied to its merger with P&G’s beauty brands. Excluding one-time items, Coty earned 38 cents per share.

Coty confirmed the acquisition of 10 P&G fragrance licenses, including Hugo Boss, Gucci and Lacoste, and said it is on track to close the merger in the second half of 2016. The company announced in September that it would buy P&G’s beauty brands for $13 billion.

On February 1

st, Coty completed its acquisition of the Hypermarcas beauty and personal care business, significantly strengthening its beauty presence in Brazil.

Coty said its board authorized a $500 million share-repurchase program that will allow it to repurchase a total of 24.9 million shares.