DIpil Das

Overwhelming response

Costco opened its first store in China to huge crowds on August 27. Demand was so strong the store was forced to close early due to overcrowding.

After that experience, the store implemented traffic control measures to limit 2,000 customers in the store at one time. Lines were forming before the store opened at 9:00 am, but was much more organized compared to the first day. The Coresight Research team arrived at 8:30 am and got in when the store opened 30 minutes later, but wait times grew to two hours later in the afternoon.

[caption id="attachment_95749" align="aligncenter" width="700"] Lines outside the Costco store before opening.

Lines outside the Costco store before opening.

Source: Coresight Research [/caption] Business Model and Product Assortment of the Store Costco continues its simple warehouse store model in China, with minimal design. According to Linkshop and Sohu news, total SKUs are 3,400 and approximately 40% are imported products. Luxury goods and electronics are placed close to the entrance of the store to capture customer attention as they enter. Food and consumables continued to be the most popular section, with lines for roasted chicken. We saw croissants (box of 12), roasted chicken, Swellfun wine and Kirkland laundry detergent were some of the most popular products in shoppers’ baskets. [caption id="attachment_95750" align="aligncenter" width="700"] Entrance area and people lining up for roasted chicken

Entrance area and people lining up for roasted chicken

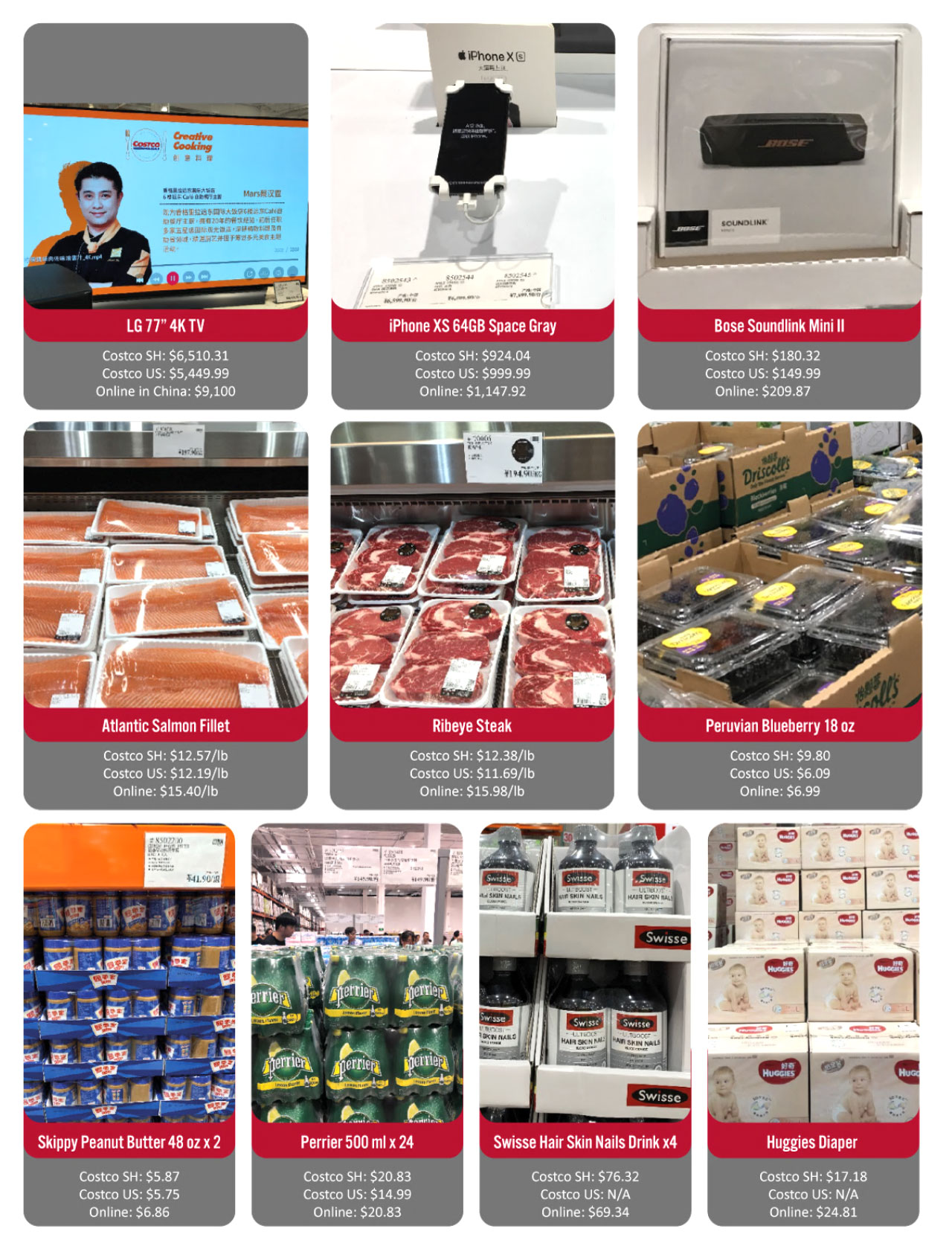

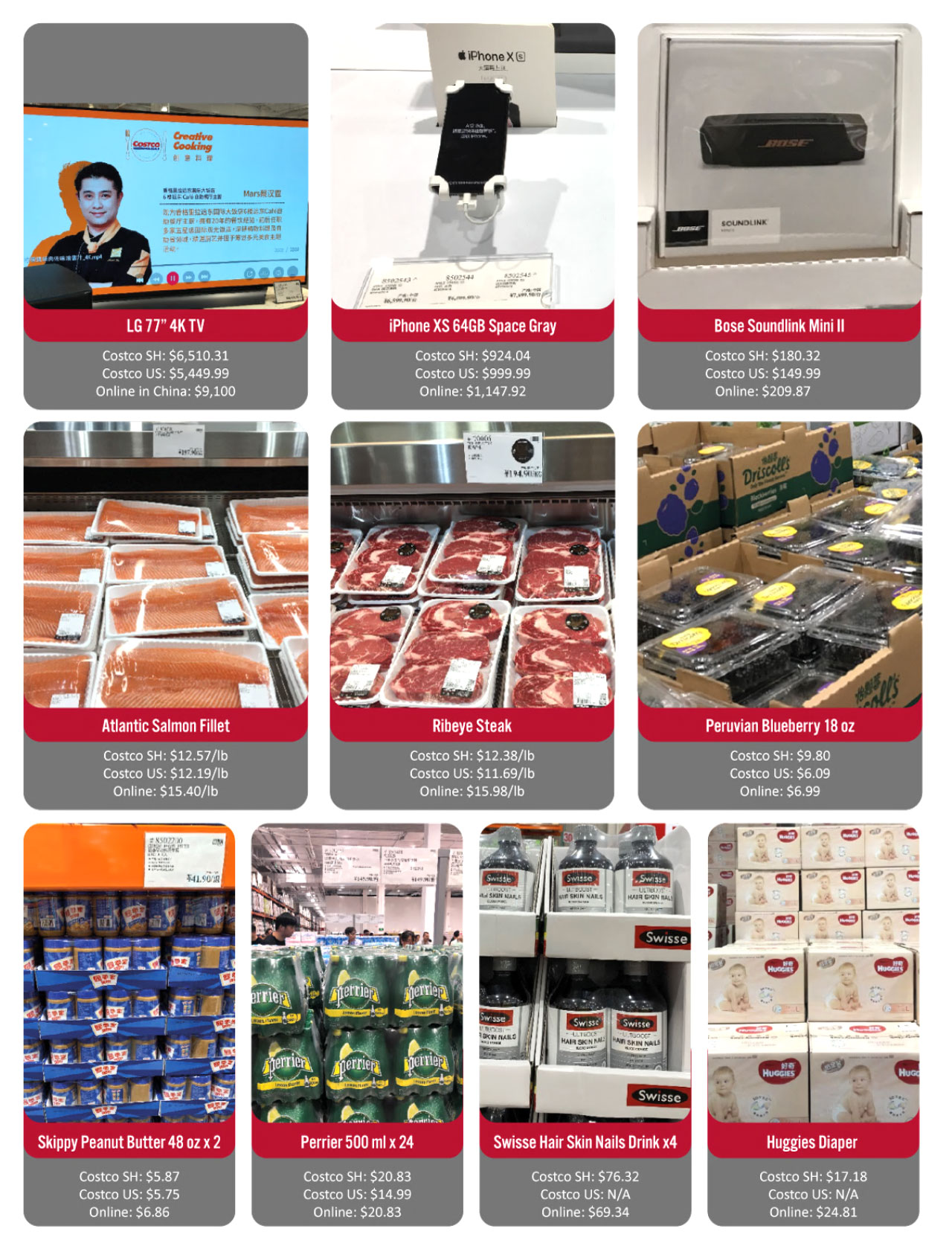

Source: Coresight Research [/caption] Pricing compared to Costco US and online Costco representatives claimed that prices for consumables are 10-20% lower than average market prices in China – and 30-60% lower for non-consumables. Below, we compare prices of several products in Costco’s Shanghai store with those in Costco’s US stores and online in China on Tmall and JD.com. Costco has the most pricing advantage in electronics. In consumables, Costco offers lower prices in meat compared than it does online, but almost the same or higher prices in fruits. [caption id="attachment_95751" align="aligncenter" width="700"] Source: Tmall.com/JD.com/Costco.com/Coresight Research[/caption]

Why Costco chose Shanghai

Costco first entered China in 2014 through the Tmall Global site and launched an online flagship store on Tmall in 2017. According to Sina News, the majority of Costco Tmall shoppers are from eastern China, especially from Shanghai, making Shanghai an obvious choice for a first physical store. The store is located in the Western Minhang district, a suburb area of Shanghai, close to Hongqiao International Airport and Hongqiao railway station. There are also six international schools in the surrounding area, reflecting Costco’s target consumers: the up and coming middle class. The store has a shopping area of about 14,000 square meters (150,700 square feet) with a 1,200-space parking lot.

Intense competition

Costco created buzz with its store opening, and seems to be off to a great start – but China has shown itself to be a tough proving ground for western retailers, who have enjoyed mixed success:

Source: Tmall.com/JD.com/Costco.com/Coresight Research[/caption]

Why Costco chose Shanghai

Costco first entered China in 2014 through the Tmall Global site and launched an online flagship store on Tmall in 2017. According to Sina News, the majority of Costco Tmall shoppers are from eastern China, especially from Shanghai, making Shanghai an obvious choice for a first physical store. The store is located in the Western Minhang district, a suburb area of Shanghai, close to Hongqiao International Airport and Hongqiao railway station. There are also six international schools in the surrounding area, reflecting Costco’s target consumers: the up and coming middle class. The store has a shopping area of about 14,000 square meters (150,700 square feet) with a 1,200-space parking lot.

Intense competition

Costco created buzz with its store opening, and seems to be off to a great start – but China has shown itself to be a tough proving ground for western retailers, who have enjoyed mixed success:

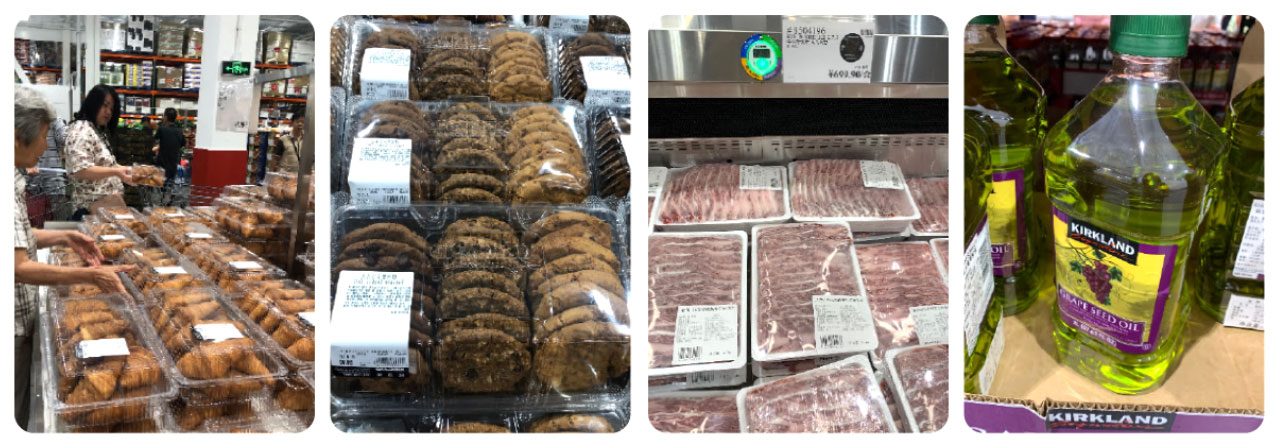

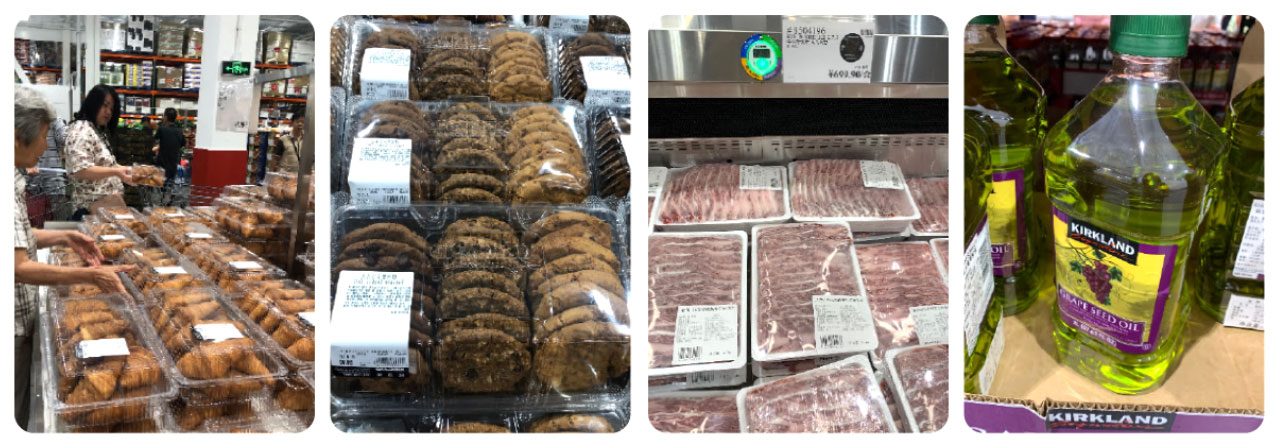

Bulk-sized products in Costco

Bulk-sized products in Costco

Source: Coresight Research [/caption] The impact of trade tensions With 40% of Costco products coming from overseas, the ongoing trade tensions with the US may pose a threat to the company’s prospects in China. China unveiled a new round of retaliatory tariffs on $75 billion worth of US imports, many of which take effect September 1. Key Insights Costco’s store continued to be packed on the third day after opening, reflecting strong demand among Chinese consumers for value products. China’s grocery market is expanding quickly, but to succeed in China’s increasingly competitive market Costco will have to offer products that resonate with Chinese consumers, and attract and maintain members.

Lines outside the Costco store before opening.

Lines outside the Costco store before opening. Source: Coresight Research [/caption] Business Model and Product Assortment of the Store Costco continues its simple warehouse store model in China, with minimal design. According to Linkshop and Sohu news, total SKUs are 3,400 and approximately 40% are imported products. Luxury goods and electronics are placed close to the entrance of the store to capture customer attention as they enter. Food and consumables continued to be the most popular section, with lines for roasted chicken. We saw croissants (box of 12), roasted chicken, Swellfun wine and Kirkland laundry detergent were some of the most popular products in shoppers’ baskets. [caption id="attachment_95750" align="aligncenter" width="700"]

Entrance area and people lining up for roasted chicken

Entrance area and people lining up for roasted chicken Source: Coresight Research [/caption] Pricing compared to Costco US and online Costco representatives claimed that prices for consumables are 10-20% lower than average market prices in China – and 30-60% lower for non-consumables. Below, we compare prices of several products in Costco’s Shanghai store with those in Costco’s US stores and online in China on Tmall and JD.com. Costco has the most pricing advantage in electronics. In consumables, Costco offers lower prices in meat compared than it does online, but almost the same or higher prices in fruits. [caption id="attachment_95751" align="aligncenter" width="700"]

Source: Tmall.com/JD.com/Costco.com/Coresight Research[/caption]

Why Costco chose Shanghai

Costco first entered China in 2014 through the Tmall Global site and launched an online flagship store on Tmall in 2017. According to Sina News, the majority of Costco Tmall shoppers are from eastern China, especially from Shanghai, making Shanghai an obvious choice for a first physical store. The store is located in the Western Minhang district, a suburb area of Shanghai, close to Hongqiao International Airport and Hongqiao railway station. There are also six international schools in the surrounding area, reflecting Costco’s target consumers: the up and coming middle class. The store has a shopping area of about 14,000 square meters (150,700 square feet) with a 1,200-space parking lot.

Intense competition

Costco created buzz with its store opening, and seems to be off to a great start – but China has shown itself to be a tough proving ground for western retailers, who have enjoyed mixed success:

Source: Tmall.com/JD.com/Costco.com/Coresight Research[/caption]

Why Costco chose Shanghai

Costco first entered China in 2014 through the Tmall Global site and launched an online flagship store on Tmall in 2017. According to Sina News, the majority of Costco Tmall shoppers are from eastern China, especially from Shanghai, making Shanghai an obvious choice for a first physical store. The store is located in the Western Minhang district, a suburb area of Shanghai, close to Hongqiao International Airport and Hongqiao railway station. There are also six international schools in the surrounding area, reflecting Costco’s target consumers: the up and coming middle class. The store has a shopping area of about 14,000 square meters (150,700 square feet) with a 1,200-space parking lot.

Intense competition

Costco created buzz with its store opening, and seems to be off to a great start – but China has shown itself to be a tough proving ground for western retailers, who have enjoyed mixed success:

- In June, Carrefour Group agreed to sell 80% of its China operations to domestic giant retailer Suning.

- In June, Aldi opened its first two stores in Shanghai, after going online in 2017.

- In July, Amazon closed its China domestic marketplace.

- German retailer Metro announced it is in the process of selling its China business to potential local bidders.

- Sam’s Club, which also operates a warehouse club model in China, is still expanding slowly after entering China 20 years ago.

Bulk-sized products in Costco

Bulk-sized products in Costco Source: Coresight Research [/caption] The impact of trade tensions With 40% of Costco products coming from overseas, the ongoing trade tensions with the US may pose a threat to the company’s prospects in China. China unveiled a new round of retaliatory tariffs on $75 billion worth of US imports, many of which take effect September 1. Key Insights Costco’s store continued to be packed on the third day after opening, reflecting strong demand among Chinese consumers for value products. China’s grocery market is expanding quickly, but to succeed in China’s increasingly competitive market Costco will have to offer products that resonate with Chinese consumers, and attract and maintain members.