albert Chan

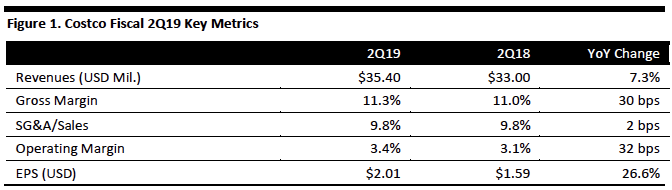

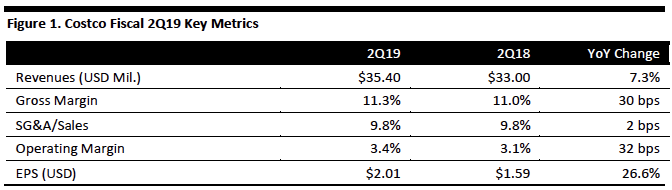

[caption id="attachment_79975" align="aligncenter" width="672"] Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Costco reported fiscal 2Q19 revenues of $35.40 billion, up 7.3% year over year and slightly below the $35.65 billion consensus estimate.

Membership fee income was $768 million, up 7.3%, up 8.5% excluding currency effects.

Comps (excluding gasoline and other items) increased 6.7%, and e-commerce comps increased 25.5%.

EPS was $2.01, up 26.6% year over year and handily beating the $1.69 consensus estimate.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Costco reported fiscal 2Q19 revenues of $35.40 billion, up 7.3% year over year and slightly below the $35.65 billion consensus estimate.

Membership fee income was $768 million, up 7.3%, up 8.5% excluding currency effects.

Comps (excluding gasoline and other items) increased 6.7%, and e-commerce comps increased 25.5%.

EPS was $2.01, up 26.6% year over year and handily beating the $1.69 consensus estimate.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Costco reported fiscal 2Q19 revenues of $35.40 billion, up 7.3% year over year and slightly below the $35.65 billion consensus estimate.

Membership fee income was $768 million, up 7.3%, up 8.5% excluding currency effects.

Comps (excluding gasoline and other items) increased 6.7%, and e-commerce comps increased 25.5%.

EPS was $2.01, up 26.6% year over year and handily beating the $1.69 consensus estimate.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

Fiscal 2Q19 Results

Costco reported fiscal 2Q19 revenues of $35.40 billion, up 7.3% year over year and slightly below the $35.65 billion consensus estimate.

Membership fee income was $768 million, up 7.3%, up 8.5% excluding currency effects.

Comps (excluding gasoline and other items) increased 6.7%, and e-commerce comps increased 25.5%.

EPS was $2.01, up 26.6% year over year and handily beating the $1.69 consensus estimate.

Details from the Quarter

- Comps by region:

o US: 7.4% (7.2% ex gas, currency and other items).

o Canada: negative 0.3% (positive 6.0% ex items).

o Other international: 0.7% (positive 4.8% ex items).

- Traffic in the quarter increased 4.9% worldwide and 5.2% in the US.

- Foreign exchange hurt sales by 140 basis points.

- Gasoline price deflation hurt sales by 50 basis points.

- Revenue recognition helped sales by 55 basis points.

- Adverse weather hurt comps by half a percentage point.

- Cannibalization hurt sales by 70 basis points.

- Average ticket was 0.4% and up 1.8% ex items.

- More than half of the $52 million increase in membership fee income was due to fee increases in the US and Canada in June 2017. The benefit from these fee increases will be lower in Q3 and lower than that in Q4.

- The renewal rate in the US and Canada was 90.7% in the quarter, up from 90.5% in fiscal Q1. The worldwide renewal rate was 88.3%, up from 88.0% in fiscal Q1.

- There were 52.7 million members at the end of the quarter, up from 52.2 million at the end of the prior quarter.

- There were 96.3 million Costco credit-card holders, up from 95.4 million at the end of the prior quarter.

- At the end of the quarter, there were 20 million executive members, up 341,000 from the end of the prior quarter, which equates to an increase of 28,000 per week. This figure includes the introduction of an Executive Membership in Korea, the fifth country offering this category. Management commented that Korea accounted for more than half of the increase.

- The company recently launched a new three-year employee agreement, which raises starting wages from $14.00/$14.50 to $15.00/$15.00 per hour in the U.S. and Canada. Costco is also raising wages for supervisors and introducing paid bonding leave.

- During the quarter, Costco opened one new club in Coral Springs, Florida, and relocated one club in Miami.

- During the fiscal third quarter, Costco plans to open three clubs, including one just opened in Bayonne, New Jersey, and one club in Korea in April and an 11th location in Australia in May.

- In fiscal Q4, Costco plans to open 12 new clubs, plus two relocations, including the first company’s opening in the Minhang district of Shanghai, China, and a third club in Spain.

- Top growth categories in the quarter included grocery, consumer electronics, hardware, health and beauty aids, tires and automotive, seasonal toys and apparel.

- Costco celebrated the anniversary of its launch of grocery delivery in October, and same-day grocery delivery is now available within a short drive in 99% of the company’s U.S. locations, and two-day grocery is available anywhere throughout the Continental U.S. Costco offers grocery shipment to all 50 states.

- Costco is offering a broader assortment of Apple products, including MacBooks and iMacs.

- New brands offered include Living Proof shampoo and conditioner, Keith Somervell items, and NordicTrack.

- Costco expanded its buy online, pick up in store to include an expanded offering of jewelry, electronics and handbags and continues to test pickup lockers at 10 locations.

- This calendar year, Costco will begin e-commerce operations in Japan, likely in the early summer, and in the late summer or early fall in Australia.

- Costco currently operates 770 warehouses, including 535 in the United States and Puerto Rico, 100 in Canada, 39 in Mexico, 28 in the United Kingdom, 26 in Japan, 15 in Korea, 13 in Taiwan, 10 in Australia, two in Spain and one each in Iceland and France.