Source: Company reports/FGRT

Fiscal 4Q17 Results

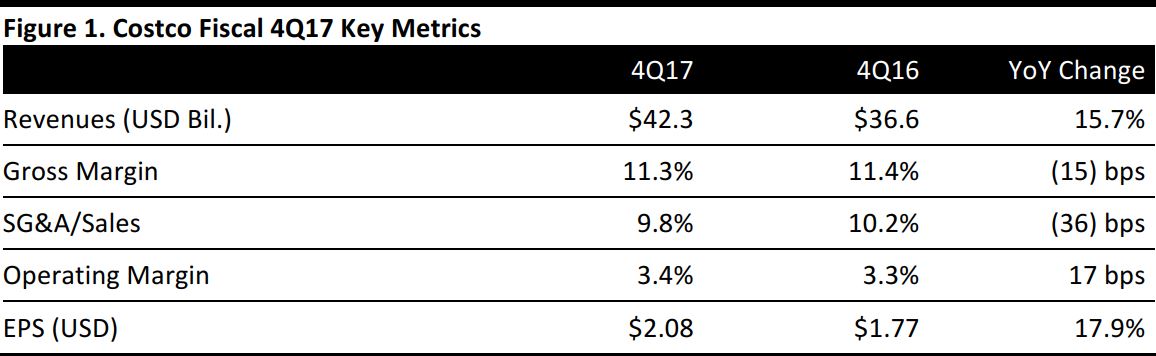

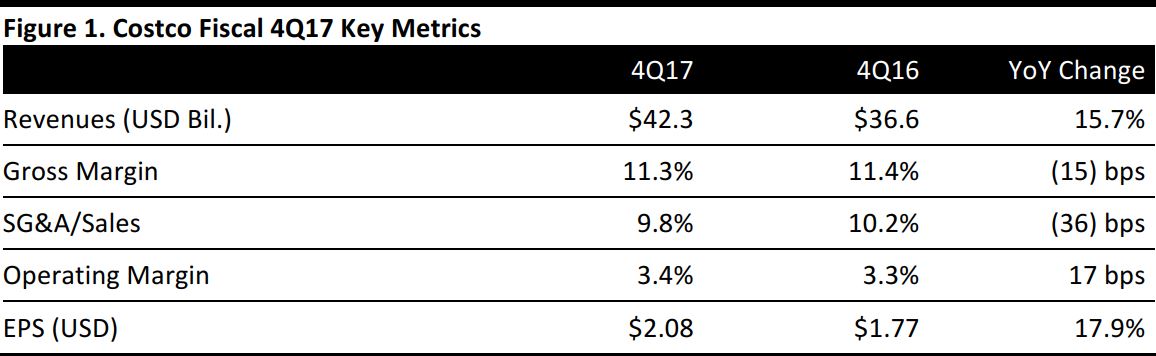

Costco reported fiscal 4Q17revenues of $42.3 billion, up 15.7% year over year and beating the consensus estimate of $41.63 billion.

Comps including gasoline increased by 6.1% year over year;such comps were up 6.5% in the US, up 4.9% in Canada and up 5.6% in other international areas.

Comps excluding gasoline and foreign currency effects increased by 5.7%.

For the first time, the company reported e-commerce revenues, which accounted for 21% of total revenues in the quarter, 13% in the fiscal year and 30% in September.

EPS was $2.08, up 17.9% year over year and beating the consensus estimate of $2.02.

FY17 Results

For the full fiscal year, revenues were $129.1 billion, up 8.7% year over year and beating the consensus estimate of $123.5 billion.

Compsincluding gasoline increased by 4.1% year over year; comps excluding gasoline increased by 3.8%.

EPS was $6.08 for the full year, up 14.0% and beating the consensus estimate of $5.78. EPS was helped by an $82 million ($0.19 per share) tax benefit in connection with the third-quarter special cash dividend and other net benefits of approximately $51 million ($0.07 per share after tax) for nonrecurring net legal and other matters.

Other Details from the Quarter

- 4Q17 consisted of 17 weeks of operations versus 16 weeks in the year-ago quarter.

- The Citi cobranded Visa credit card program raised gross margin by 14 basis points, reduced SG&A expense by eight basis points and net income increased by 22 basis points, adding $0.13 a share to EPS.

- Gas profits added $0.05 a share to EPS in the quarter.

- The company opened 12 new locations in the quarter, six in the US, two in Canada and one each in Australia, Japan, Iceland and France. The stores in Iceland and France are Costco’s first in those countries.

- The company ended the fiscal year with 741 warehouses in operation, including 514 in the US and Puerto Rico, 97 in Canada, 37 in Mexico, 28 in the UK, 26 in Japan, 13 in South Korea, 13 in Taiwan, nine in Australia, two in Spain, one in France and one in Iceland.

- In the quarter, the Midwest, Southeast and Texas regions performed above average. Internationally, the better-performing countries (in local currencies) were Japan, Mexico, and the UK.

- In terms of merchandise categories, food and sundries were up about 4% and spirits, deli and frozen were strong departments. In fresh food, comps were in the mid-single digits and were relatively consistent across meat, bakery, deli and produce.

- Hardlines were up by mid-single digits and the strongest departments were lawn and garden and tires. Toys and consumer electronics were up by high single digits.

- Softlines were up by high single digits overall, with housewares, jewelry and home furnishings showing the best results.

- In ancillary products, gasoline had strong comps in the quarter, aided by higher average sale prices year over year and very strong gallon growth. In addition, hearing aids were up by a mid-teens percentage, followed by optical and food court.

- The US credit card conversion last year had a slightly negative impact on renewal rates. Management expects the conversion to continue to have a mildly negative impact for at least another quarter or two.

- The company ended the year with 90.3 million cardholders, up from 88.9 million a year ago.

- The Business members’ renewal rate was 94% and the Gold Star members’ renewal rate was 89.3%.

Outlook

For FY18, consensus estimates call for revenues of $135.60 billion (up 2.1%) and EPS of $6.44 (up 6.0%).