Source: Company reports/Fung Global Retail & Technology

Fiscal 2Q17 Results

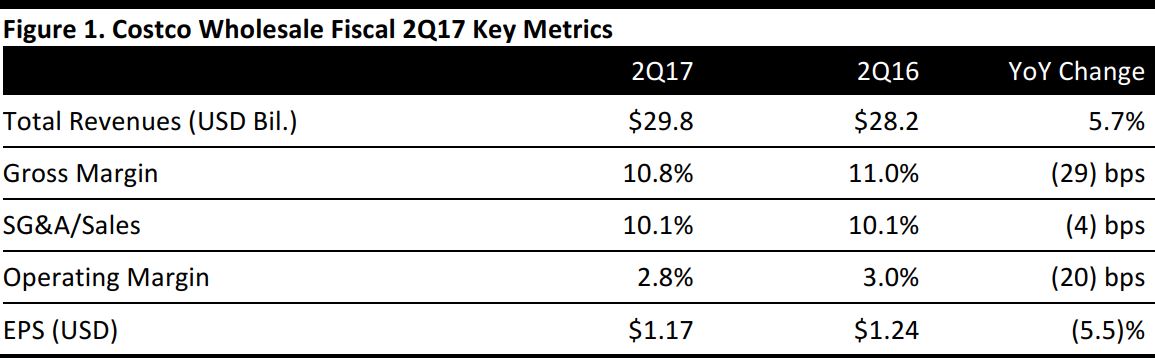

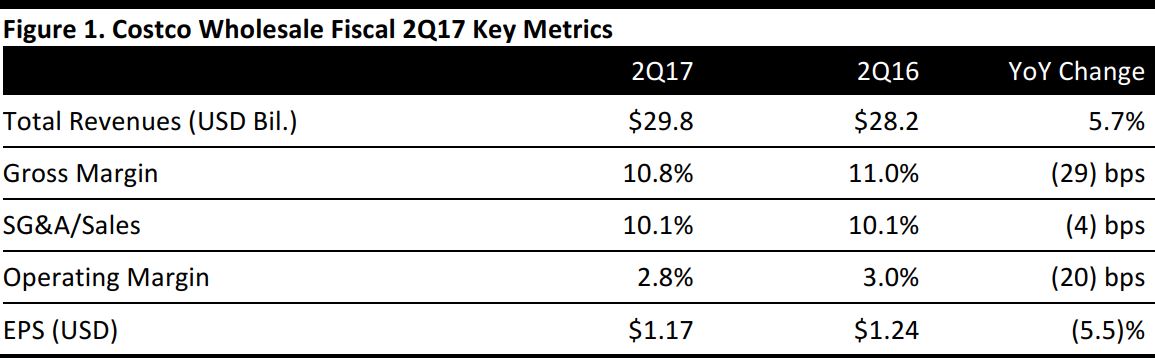

Costco reported fiscal 2Q17 total revenue of $29.8 billion, down 5.7% year over year and roughly in line with the consensus estimate. Membership fee income was $636 million, below the $641 million consensus estimate.

Total comps were up 3%, below the 3.5% consensus estimate, comprising an increase of 3% in the US, an increase of 8% in Canada and a decrease of 2% in other international regions.

Excluding fuel and foreign exchange, total comps were up 3%; comps were up 3% in the US, up 2% in Canada and up 3% in other international regions.

EPS was $1.17, versus $1.24 in the year-ago quarter and missing the $1.36 consensus estimate. The transition to the VISA credit card helped EPS by $0.16, while lower profits on gasoline sales hurt EPS by $0.06 and IT expenses of $26 million hurt EPS by $0.04.

Highlights from the quarter include:

- The Midwest, Texas and Northwest were the strongest regions, followed by California.

- Internationally, in local currencies, the best-performing countries were Mexico, the UK and South Korea.

- In terms of merchandise, food and sundries comps were flattish year over year, yet liquor and spirits and foods were leaders. Tobacco comps continued to be negative, declining by a high-teens percentage; the majority of the tobacco sales declines are expected to end by the end of June.

- Hardline comps were up by low- to mid-single digits, with strength in tires, hardware, and seasonal categories. Consumer electronics comps were down by low-single digits.

- Softline comps were also up by low- to mid-single digits, with apparel and home furnishings showing the strongest results.

- In fresh foods, comps were up by low- to mid-single digits.

- Deflation in the second quarter was in the range of 1.5%–2.0%.

Membership Fee Increase

The company also announced that, as of June 1, it will raise membership fees as follows:

- Membership fees for US and Canada Goldstar (individual), Business and Business add-on members will increase by $5, to $60.

- Membership fees for Executive members will increase by $10, to $120. The maximum annual 2% reward associated with the Executive membership will increase to $1,000 from $750.

The fee increases are expected to impact around 35 million members, of which roughly half are Executive members.

Outlook

During fiscal 2017, the company plans to open 29 net new locations, i.e., it plans 17 additional openings during the third and fourth quarters of fiscal 2017. Of the 29 new stores, 14 will be in the US, eight will be in Canada, and one each will be in Japan, South Korea, Taiwan, Mexico, and Australia. The company will also open its first store in France and its first in Iceland, most likely in later May.

FY17 consensus estimates (which are likely to be reduced following the EPS miss) call for revenues of $134.1 billion, up 5.7%, and for EPS of $6.57, up 10.8%.