Nitheesh NH

Costco Global Comps Increase; Online Comp Growth Accelerates

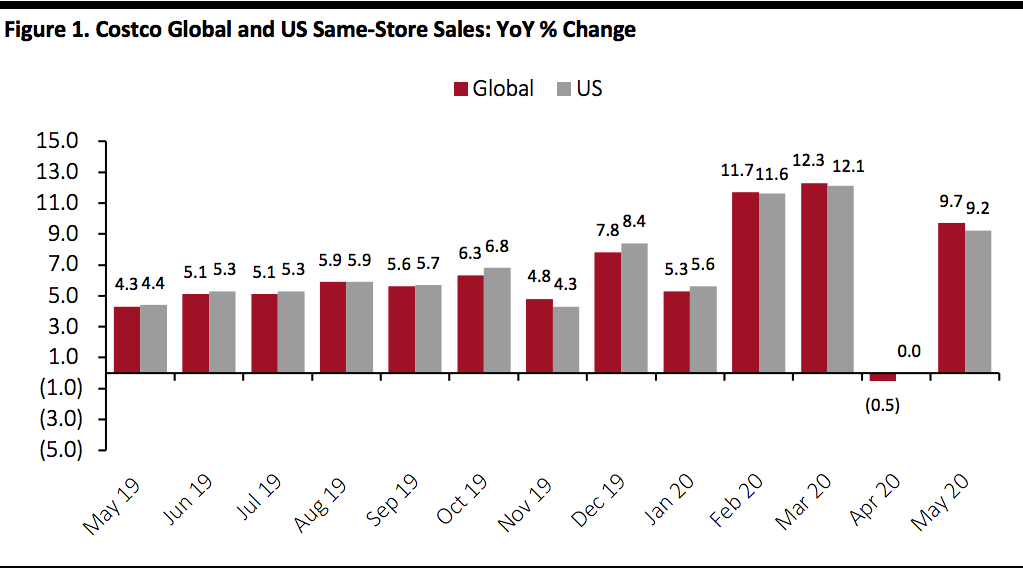

In May (specifically, the four weeks ended May 31), Costco’s nonfood categories saw a rebound in sales. By month-end, around 90% of the company’s operations had resumed due to store reopenings (following temporary closures due to the Covid-19 pandemic), including its optical, hearing aid and photo departments. This supported an improvement in same-store sales.- Global: Same-store sales were up 5.4% in May, versus April’s 4.7% decline. Excluding the impact from changes in gasoline prices and exchange rates, global comps were up 9.7% in May, increasing from a 0.5% decline in April (as shown in Figure 1). Excluding currency effects, Costco’s global online comparable sales grew 108.1% in May, compared to April’s 87.7% growth.

- US: Same-store sales were up 5.5% in May, compared to April’s 3.3% decline. Excluding gasoline price changes, Costco’s comparable sales were up 9.2% in May versus a flat rate in April.

Global same-store sales exclude the impact from changes in gasoline prices and exchange rates; US same-store sales exclude the impact from changes in gasoline prices

Global same-store sales exclude the impact from changes in gasoline prices and exchange rates; US same-store sales exclude the impact from changes in gasoline pricesSoure: Company reports[/caption] The coronavirus pandemic impacted Costco’s sales and comp traffic at its warehouses in May. Comparable traffic for the month was down 7.9% worldwide and 4.8% in the US. The average transaction was down 14.4%, including negative impacts from currency fluctuations and gas deflation. In May, currency fluctuations negatively impacted overall comps by about 1.1%. Same-store sales in Canada were negatively impacted by around 3.7% by exchange rates, while Costco’s “Other International” segment was hurt by about 4.5%. Gasoline price deflation negatively impacted total comps by a little more than 3% in May, with the overall average selling price decreasing to $2.06 per gallon this year from $3.13 last year. In the US, the regions with the strongest results were the Northeast, Southeast and Texas. Internationally, Costco saw the strongest results in Japan, Taiwan and the UK.

Performance by Segments

- In the merchandise segment, excluding currency effects, comparable growth for food and sundries was positive, in the high-teens in percentage terms: Food, frozen foods and liquor showed the strongest results. Hardlines posted positive comps in the low-20s in percentage terms: Consumer electronics, sporting goods and hardware performed better than other departments. Softlines were positive, in the low-single digits in percentage terms: Luggage, apparel and jewelry performed worse than other departments.

- Fresh-food comparable sales were up, in the low-20s in percentage terms, with meat and produce performing better than other departments.

- The ancillary businesses were down, in the high-30s in percentage terms, as a result of low gasoline sales and partial store closures; the retailer continues to reopen its optical, hearing aid and photo businesses.