Nitheesh NH

Costco Global Comps Accelerate; Online Comp Growth Decelerates

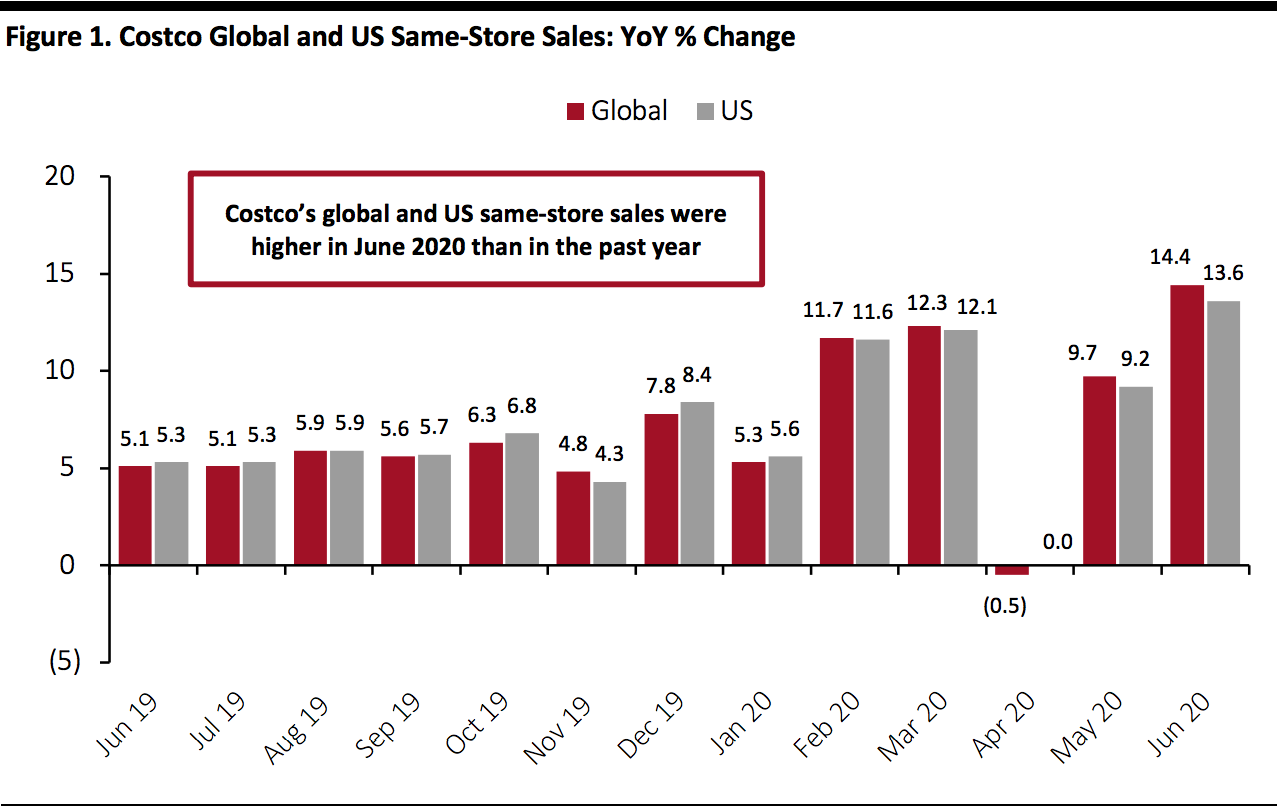

In June 2020 (specifically, the five weeks ended July 5), Costco’s merchandise sales were strong, while its ancillary business continued to underperform. The company’s sales in the optical and hearing-aid departments improved significantly from May, as those departments were operational and Costco continued to make progress in building up service levels.- Global: Same-store sales grew 11.5% in June, versus May’s 5.4% growth. Excluding the impact from changes in gasoline prices and exchange rates, global comps were up 14.4% in June, the highest in the past year and increasing from 9.7% growth in May (as shown in Figure 1). Excluding currency effects, Costco’s global online comparable sales experienced 86.7% growth in June, compared to May’s 108.1% growth. The slowing of e-commerce growth reflects the easing of lockdowns (although warehouse clubs in the US were allowed to remain open during the lockdown period).

- US: Same-store sales grew 11% in June, compared to May’s 5.5% growth. Excluding gasoline price changes, Costco’s comparable sales were up 13.6% in June (as shown in Figure 1), versus May’s 9.2% growth.

Global same-store sales exclude the impact from changes in gasoline prices and exchange rates; US same-store sales exclude the impact from changes in gasoline prices

Global same-store sales exclude the impact from changes in gasoline prices and exchange rates; US same-store sales exclude the impact from changes in gasoline pricesSource: Company reports[/caption] The coronavirus pandemic continued to impact Costco’s sales and comp traffic at its warehouses in June. Comparable traffic for the month was down 1.6% worldwide but up 0.4% in the US. The average transaction was up 13.3%, including negative impacts from currency fluctuations and gasoline deflation. In June, currency fluctuations negatively impacted overall comps by about 0.7%. Same-store sales in Canada were negatively impacted by around 2.7%, while Costco’s “Other International” segment was hurt by about 2.9%. Gasoline price deflation negatively impacted total comps by a little more than 2% in June, with the overall average selling price decreasing to $2.29 per gallon this year from $2.93 last year. In the US, the regions with the strongest results were the Northeast, Southeast and Texas. Internationally, Costco saw the strongest results in Australia, Japan and the UK.

Performance by Segments

- In the merchandise segment, excluding currency effects, comparable growth for food and sundries was positive, in the high teens in percentage terms: Frozen foods, deli and liquor showed the strongest results. Hardlines posted positive comps in the low 20s in percentage terms: Consumer electronics, hardware, and health and beauty performed better than other departments. Softlines were positive, in the mid-teens in percentage terms: Home furnishings showed the strongest results.

- Fresh-food comparable sales were up, in the mid-20s in percentage terms, with meat and produce performing better than other departments.

- The ancillary businesses were down, in the high teens in percentage terms, as a result of low photo and food court sales. As of July 8, 2020, the company operated 788 warehouses (548 in the US), versus 776 warehouses (539 in the US) on July 10, 2019.