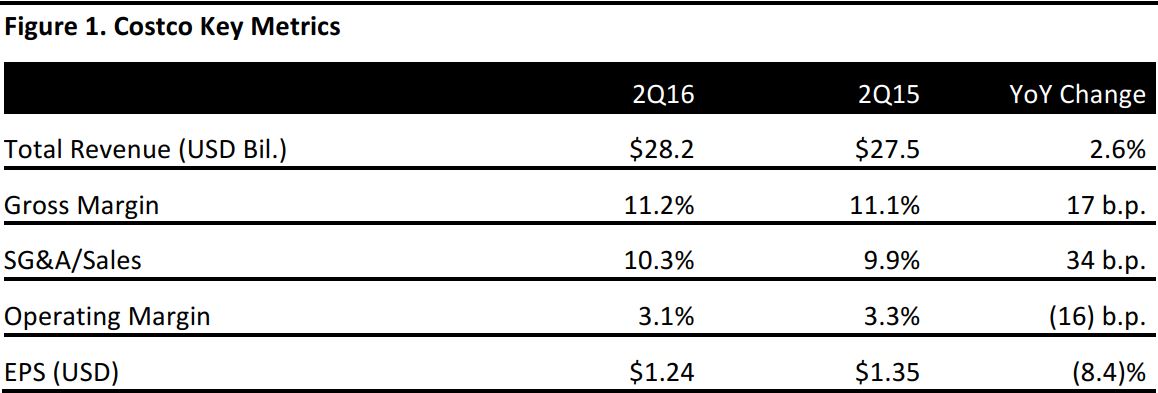

Source: Company reports

2Q16 RESULTS

Costco’s 2Q16 net sales (which exclude membership fees) were $27.6 billion, up 2.6% year over year.

Membership fees totaled $603 million, up 3.6% year over year. Renewal rates were 91% in Canada and in the US, and 88% worldwide. The company ended the quarter with a total of 46.1 million members, up from 45.4 million at the end of fiscal 1Q16. Total cardholders numbered 84.0 million, up from 82.7 million at the end of the prior quarter.

Excluding gasoline sales and foreign exchange, total comps were up 5%: they were up 4% in the US, up 10% in Canada and up 6% in other international.

Costco now has e-commerce operations in six countries, and on a comparable basis, e-commerce revenues were up 18% as reported and up 21% excluding currency effects.

Net income was helped by a $57-million ($0.13-per-share) tax benefit in connection with a special cash dividend received by the company’s 401(k) plan participants. This was offset by a $14-million ($0.03-per-share) tax change, totaling $0.11 per share.

IT modernization increased SG&A by about $10 million, or a penny per share.

Foreign exchange hurt net earnings by about $32 million, or $0.07 per share.

The impact of the company’s transition away from accepting American Express cards hurt pretax earnings by $18 million, or $0.03 per share.

EPS in the year-ago quarter was affected by two disparate tax items that together raised net earnings by $43 million, or $0.10 per share. Excluding these two items, EPS in fiscal 2Q16 would have been $1.25 per share.

FEBRUARY SALES FIGURES

For the four weeks through February 28, 2016, Costco reported net sales of $8.4 billion, an increase of 1% year over year. For the 26-week period ended February 28, 2016, net sales were $58.3 billion, an increase of 2% versus the year-ago period.

OUTLOOK

Consensus estimates for FY16 are for revenues of $121.6 billion (up 6.9%) and EPS of $5.47 (up 1.9%).