Nitheesh NH

Concern over the coronavirus outbreak in the US led to widespread store closures, starting from mid-March. On March 20, the “New York State on PAUSE” executive order was enacted, which closed schools and all non-essential businesses on March 22. The closures have now been extended three times are likely to continue until the end of May at the earliest. While grocery stores and retailers offering staples have remained open, retailers with closed stores furloughed their employees, with nearly 1 million employees furloughed in one week alone at the end of March.

Many government leaders and citizens have opposed this type of shutdown, leading to policies that vary state by state. Government and business leaders recognize the dramatic economic damage caused by closures and are discussing plans to reopen businesses as soon as practicable. Although a vaccine or cure is likely many months away, businesses could reopen once the number of coronavirus cases declines enough that healthcare systems will no longer be overwhelmed.

This report discusses three scenarios for reopening, the effect on retail sales and measures that retailers can take in each scenario.

Recent Developments

There are signs that US state governments are already developing plans and timelines to restart the economy once the outbreak lessens, yet the details vary significantly by state:

Source: Coresight Research[/caption]

Shutdown

The shutdown of US retail occurred in two stages: first, shutdowns and then worker furloughs.

The shutdowns were led by Apple on March 14. Macy’s then announced store closures on March 17, and other large retailers soon followed suit. We estimated that major retailers had closed 60,000 stores as of early April—although total closures including independents and small chains is likely to be several times this number: from Census Bureau data, we estimate the US has a little over 600,000 stores in discretionary sectors (all sectors apart from food retail, drug retail and mass merchandisers/warehouse clubs).

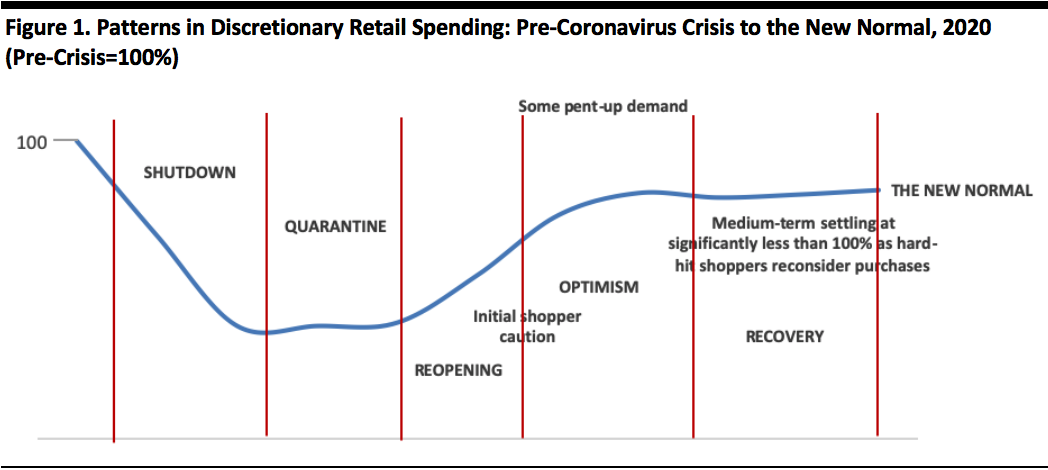

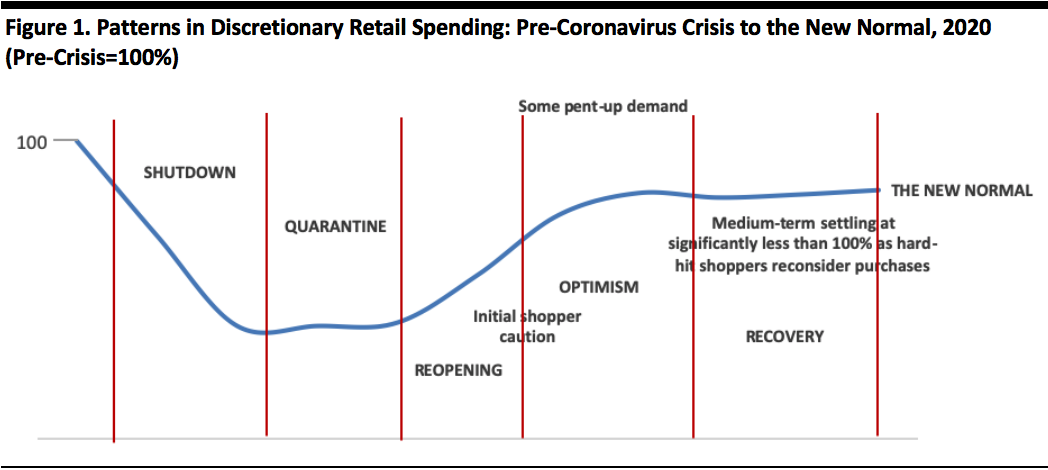

In Figure 1, we estimate that by the time the quarantine period in the US began, consumer discretionary spending had fallen as much as 60% from pre-coronavirus levels.

Quarantine

We are currently in the quarantine stage, with discretionary retail stores remaining closed.

Retailers whose stores have stayed open are posting strong results in the staples categories. For example, Target reported a surge in sales starting in mid-March that continued through late April: Month to date through April 23, comps increased 5%, in-store comps declined in the mid-teens, and digital sales increased 275%. By category, comps increased 12% in essentials and food and beverages, more than 30% in hardlines and by high teens in home. On the other hand, Target saw a decline of more than 40% in apparel and accessories.

We estimate that total retail sales will be down by approximately one-third but possibly as much as 40%, year over year, in April and any subsequent periods in which nonessential retail is fully shut down. Our assumptions factor in an approximate 60+% decline in discretionary nonfood retail sales.

Reopening

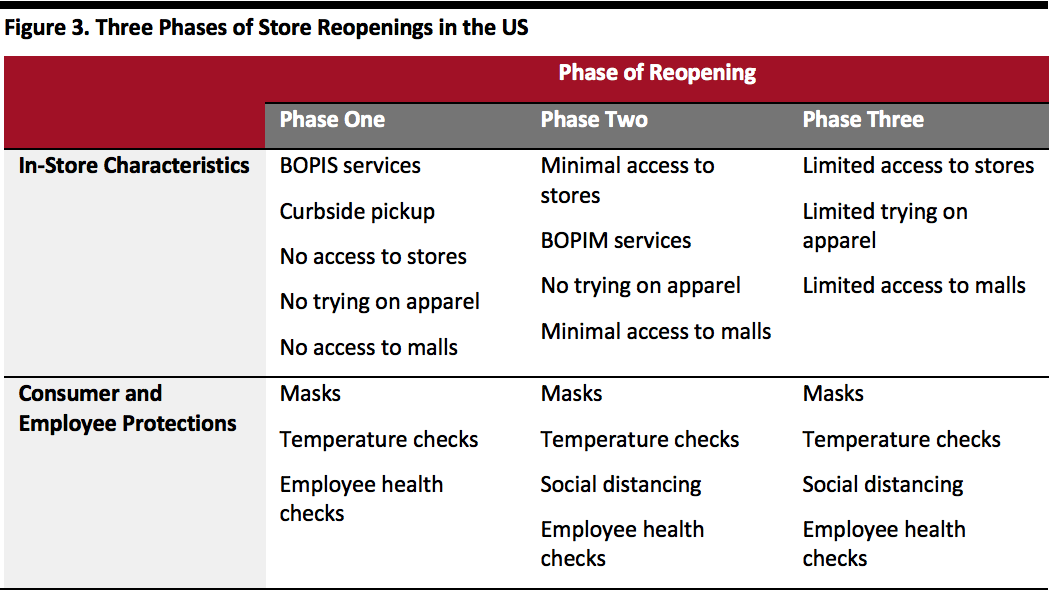

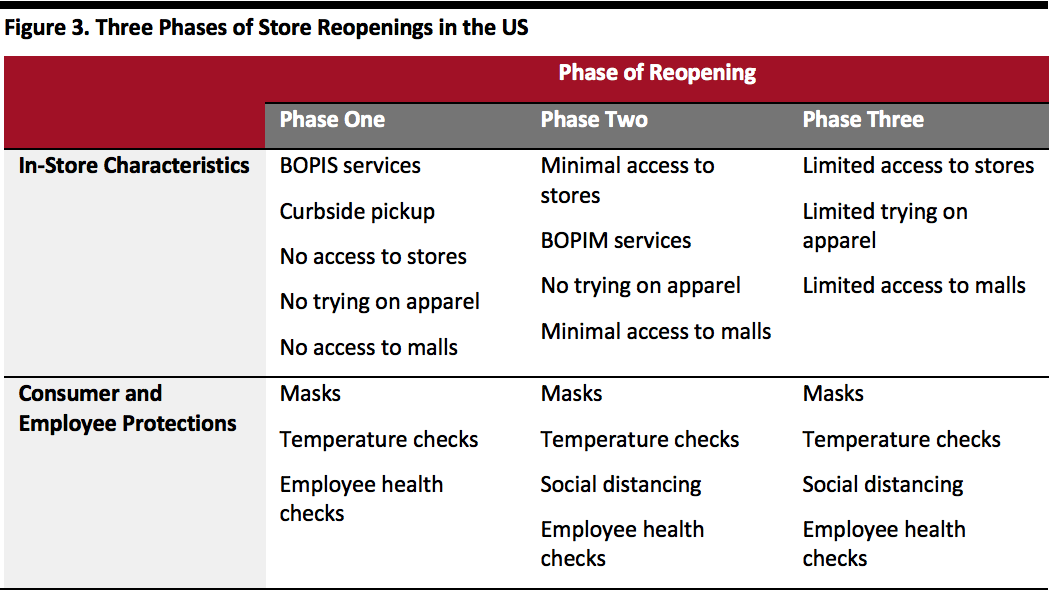

The timing of the reopening of discretionary retail is at the mercy of the coronavirus pandemic’s progress and the orders of government officials. Any reopening of stores would have to minimize or greatly reduce the risk to store employees and customers of contracting the virus, and as the coronavirus is new, it is very unclear which measures are effective.

Still, retailers can consider several options, including the following:

Source: Coresight Research[/caption]

Shutdown

The shutdown of US retail occurred in two stages: first, shutdowns and then worker furloughs.

The shutdowns were led by Apple on March 14. Macy’s then announced store closures on March 17, and other large retailers soon followed suit. We estimated that major retailers had closed 60,000 stores as of early April—although total closures including independents and small chains is likely to be several times this number: from Census Bureau data, we estimate the US has a little over 600,000 stores in discretionary sectors (all sectors apart from food retail, drug retail and mass merchandisers/warehouse clubs).

In Figure 1, we estimate that by the time the quarantine period in the US began, consumer discretionary spending had fallen as much as 60% from pre-coronavirus levels.

Quarantine

We are currently in the quarantine stage, with discretionary retail stores remaining closed.

Retailers whose stores have stayed open are posting strong results in the staples categories. For example, Target reported a surge in sales starting in mid-March that continued through late April: Month to date through April 23, comps increased 5%, in-store comps declined in the mid-teens, and digital sales increased 275%. By category, comps increased 12% in essentials and food and beverages, more than 30% in hardlines and by high teens in home. On the other hand, Target saw a decline of more than 40% in apparel and accessories.

We estimate that total retail sales will be down by approximately one-third but possibly as much as 40%, year over year, in April and any subsequent periods in which nonessential retail is fully shut down. Our assumptions factor in an approximate 60+% decline in discretionary nonfood retail sales.

Reopening

The timing of the reopening of discretionary retail is at the mercy of the coronavirus pandemic’s progress and the orders of government officials. Any reopening of stores would have to minimize or greatly reduce the risk to store employees and customers of contracting the virus, and as the coronavirus is new, it is very unclear which measures are effective.

Still, retailers can consider several options, including the following:

Source: Coresight Research[/caption]

Defining a Recovery—The “New Normal”

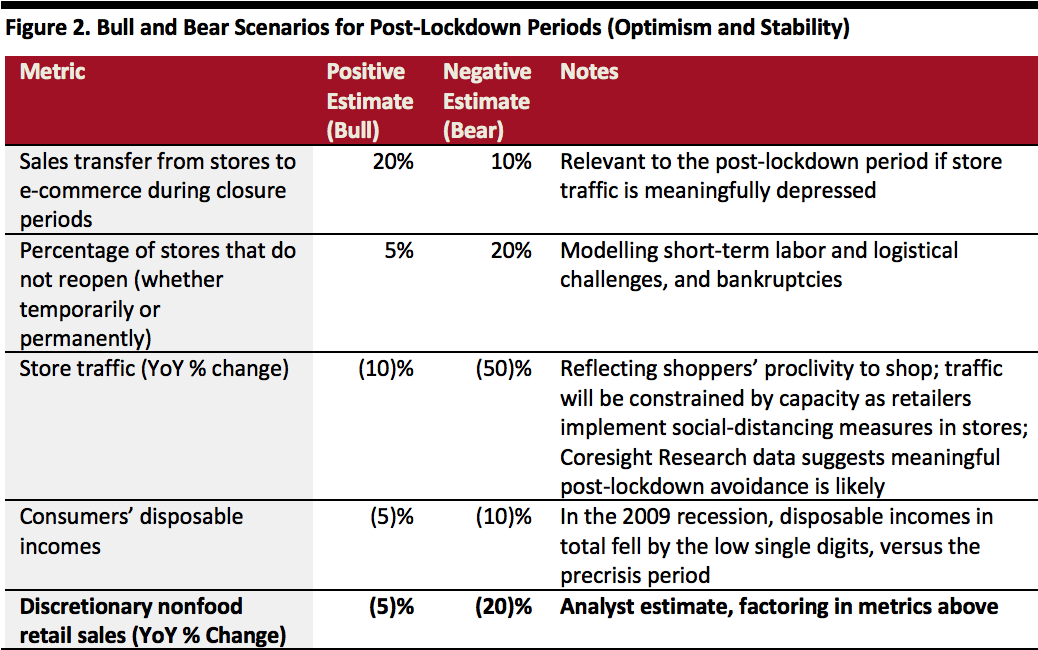

Even assuming that the coronavirus is able to be contained or managed, the shutdowns and furloughs made a considerable dent in consumer income and spending ability, and were devastating for employees in retail, travel and hospitality. It will take time for consumers to recover from this impact, and the subsequent steady-state level will likely remain below the spending levels of 2019.

For consumers to shop and employees to work again, they need to feel safe in browsing and working in retail stores. However, the perception of safety for many in visiting these venues could be permanently impaired. Moreover, the savings and earning power of many consumers will have received significant damage during the initial phases. As unemployment may still be high, spending power is likely to be weaker than before. We call this phase the “new normal,” and estimate that consumer discretionary spending could be as much as 20% below pre-coronavirus levels.

We define a recovery as the majority of stores being reopened (those of surviving retailers) in some fashion, with measures in place to help ensure full access to products by consumers and employees. This could be accomplished through BOPIS and BOPIM services or an arrangement where consumers can access only selected parts of the store (for example, the ground floor) to view and purchase products.

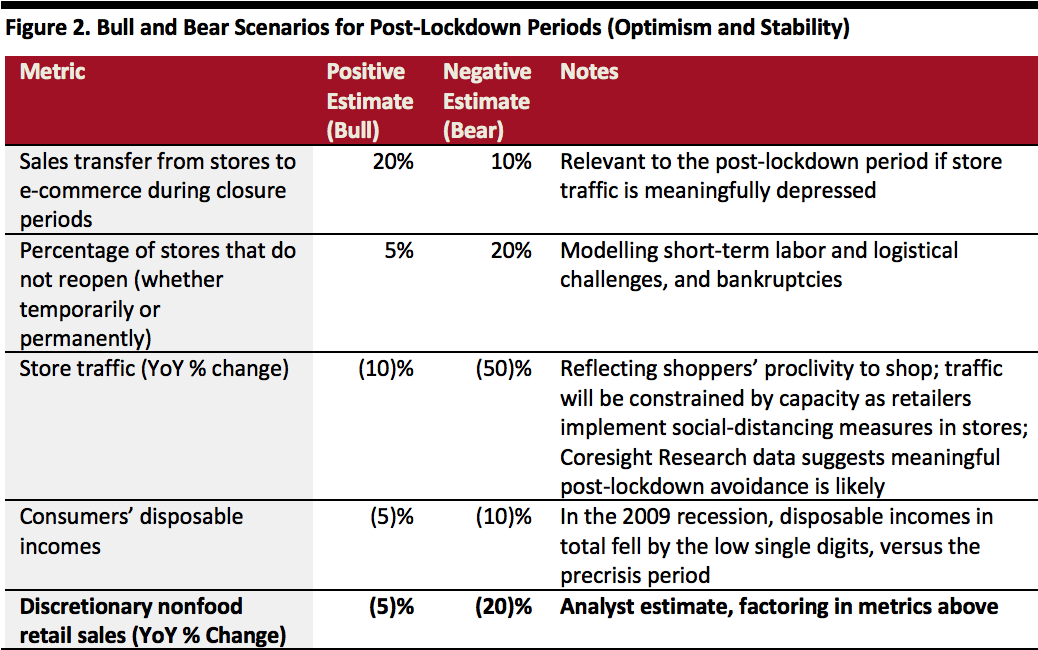

“Recovery” Scenarios

Economists typically use letters of the alphabet to describe the shape of economic downturns typically with letters of the alphabet, in increasing severity. Below, we look at three possible recovery scenarios:

Source: Coresight Research[/caption]

Defining a Recovery—The “New Normal”

Even assuming that the coronavirus is able to be contained or managed, the shutdowns and furloughs made a considerable dent in consumer income and spending ability, and were devastating for employees in retail, travel and hospitality. It will take time for consumers to recover from this impact, and the subsequent steady-state level will likely remain below the spending levels of 2019.

For consumers to shop and employees to work again, they need to feel safe in browsing and working in retail stores. However, the perception of safety for many in visiting these venues could be permanently impaired. Moreover, the savings and earning power of many consumers will have received significant damage during the initial phases. As unemployment may still be high, spending power is likely to be weaker than before. We call this phase the “new normal,” and estimate that consumer discretionary spending could be as much as 20% below pre-coronavirus levels.

We define a recovery as the majority of stores being reopened (those of surviving retailers) in some fashion, with measures in place to help ensure full access to products by consumers and employees. This could be accomplished through BOPIS and BOPIM services or an arrangement where consumers can access only selected parts of the store (for example, the ground floor) to view and purchase products.

“Recovery” Scenarios

Economists typically use letters of the alphabet to describe the shape of economic downturns typically with letters of the alphabet, in increasing severity. Below, we look at three possible recovery scenarios:

Source: Coresight Research[/caption]

Hurdles to a Retail Recovery

Even if all retail stores were completely reopened in short order, what could keep consumers from wanting or being able to return to prior buying habits? This section explores consumers’ ability and willingness to shop, given a coronavirus recovery.

Consumers’ Ability to Shop

Consumers’ ability to shop is related to income (driven by employment) and their confidence. While many workers have been furloughed or have received salary reductions, taxpayers meeting certain income requirements have also received $1,200 stimulus checks due to the US CARES Act, in addition to receiving supplemental unemployment benefits that run through July 31.

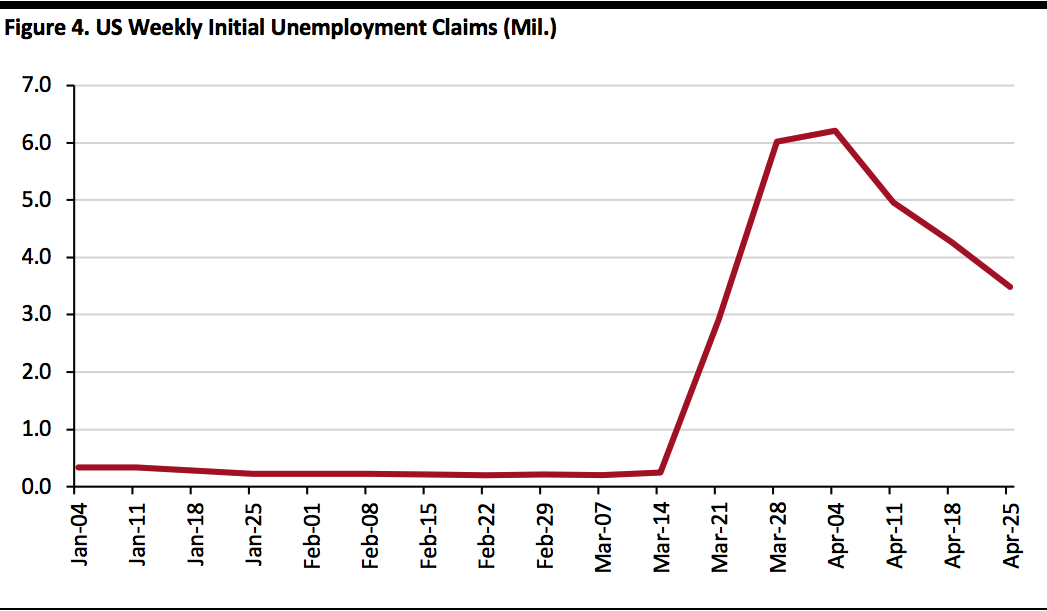

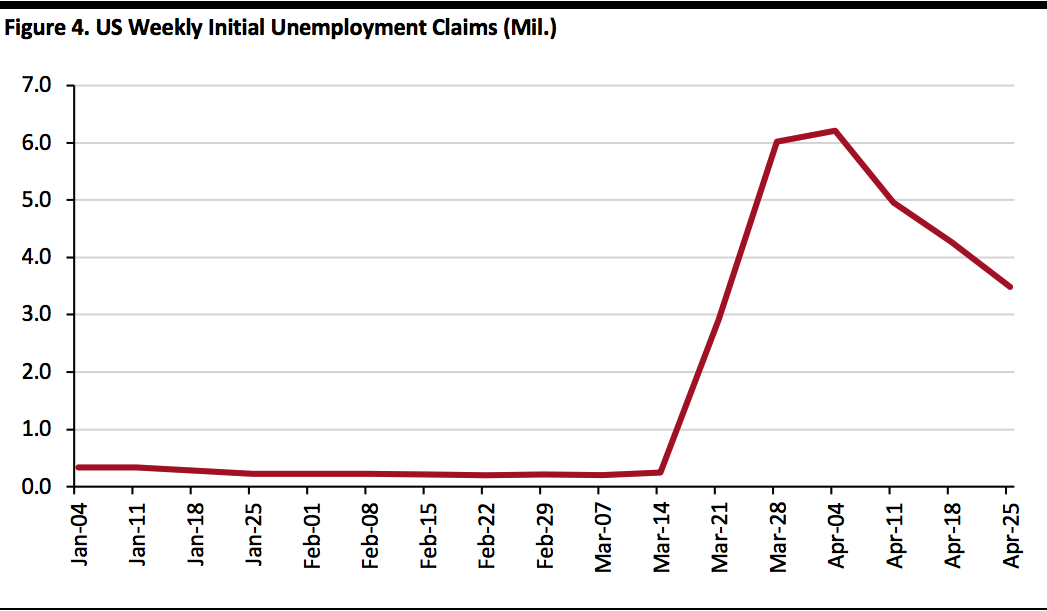

Looking at employment, Figure 3 shows pre-pandemic weekly US unemployment claims of about 250,000 expanding to 6 million in two weeks through March 28, peaking at 6.2 million on April 4 and declining for two weeks to 4.8 million on April 18 and 4.3 million on April 25. As of April 18, the insured unemployment rate stood at 12.4%.

[caption id="attachment_108801" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Hurdles to a Retail Recovery

Even if all retail stores were completely reopened in short order, what could keep consumers from wanting or being able to return to prior buying habits? This section explores consumers’ ability and willingness to shop, given a coronavirus recovery.

Consumers’ Ability to Shop

Consumers’ ability to shop is related to income (driven by employment) and their confidence. While many workers have been furloughed or have received salary reductions, taxpayers meeting certain income requirements have also received $1,200 stimulus checks due to the US CARES Act, in addition to receiving supplemental unemployment benefits that run through July 31.

Looking at employment, Figure 3 shows pre-pandemic weekly US unemployment claims of about 250,000 expanding to 6 million in two weeks through March 28, peaking at 6.2 million on April 4 and declining for two weeks to 4.8 million on April 18 and 4.3 million on April 25. As of April 18, the insured unemployment rate stood at 12.4%.

[caption id="attachment_108801" align="aligncenter" width="700"] Note: Non-seasonally adjusted data

Note: Non-seasonally adjusted data

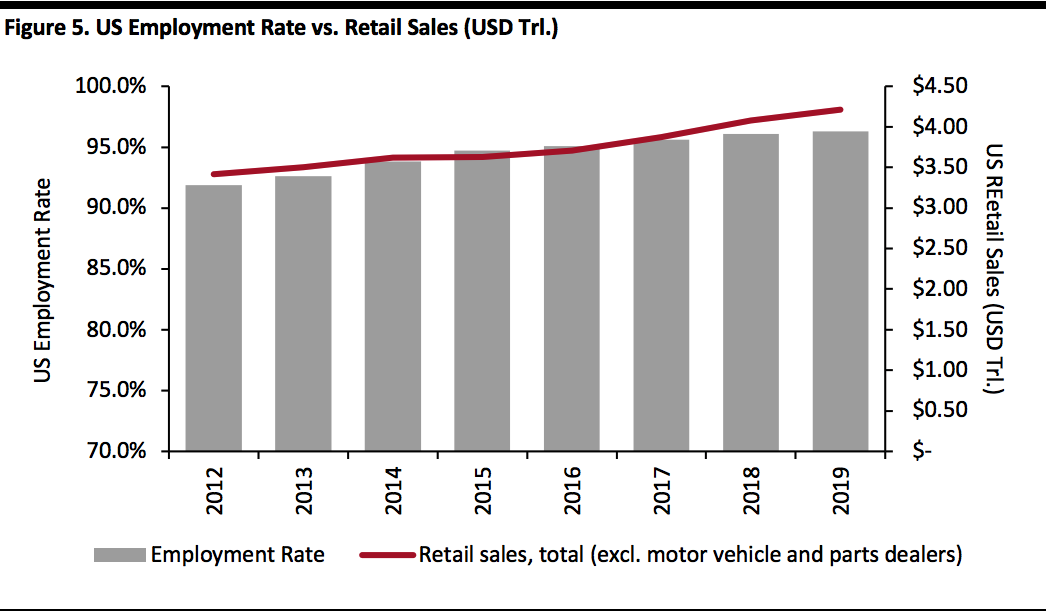

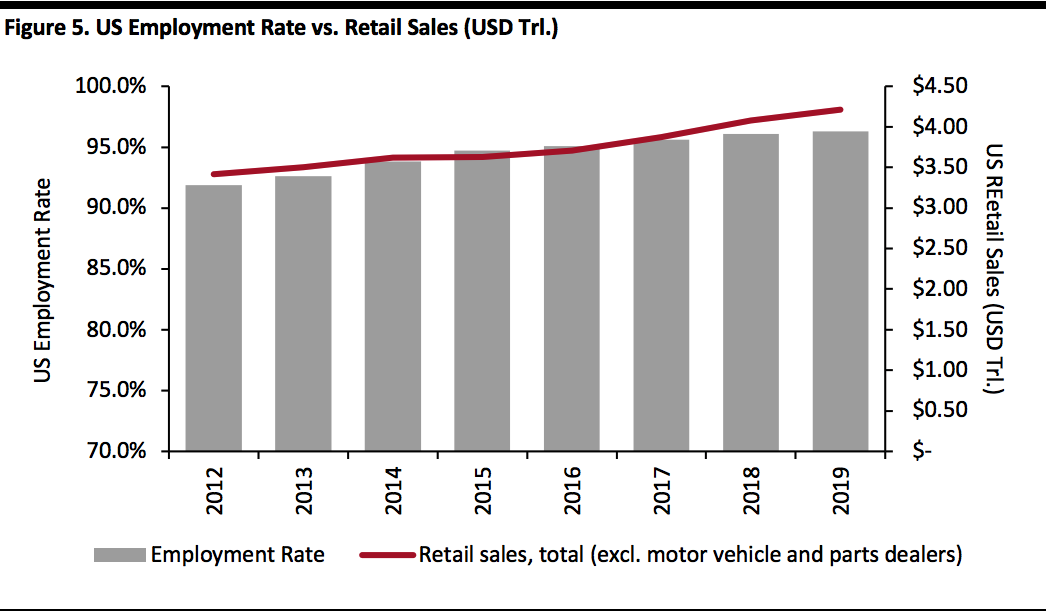

Source: St. Louis Fed[/caption] The figure below shows the tight correlation between US employment and retail sales (excluding motor vehicles and auto parts dealers). The data set below shows a 91.4% correlation between the two. [caption id="attachment_108802" align="aligncenter" width="700"] Source: St. Louis Fed/US Census Bureau/Coresight Research[/caption]

Consumers’ Willingness to Shop

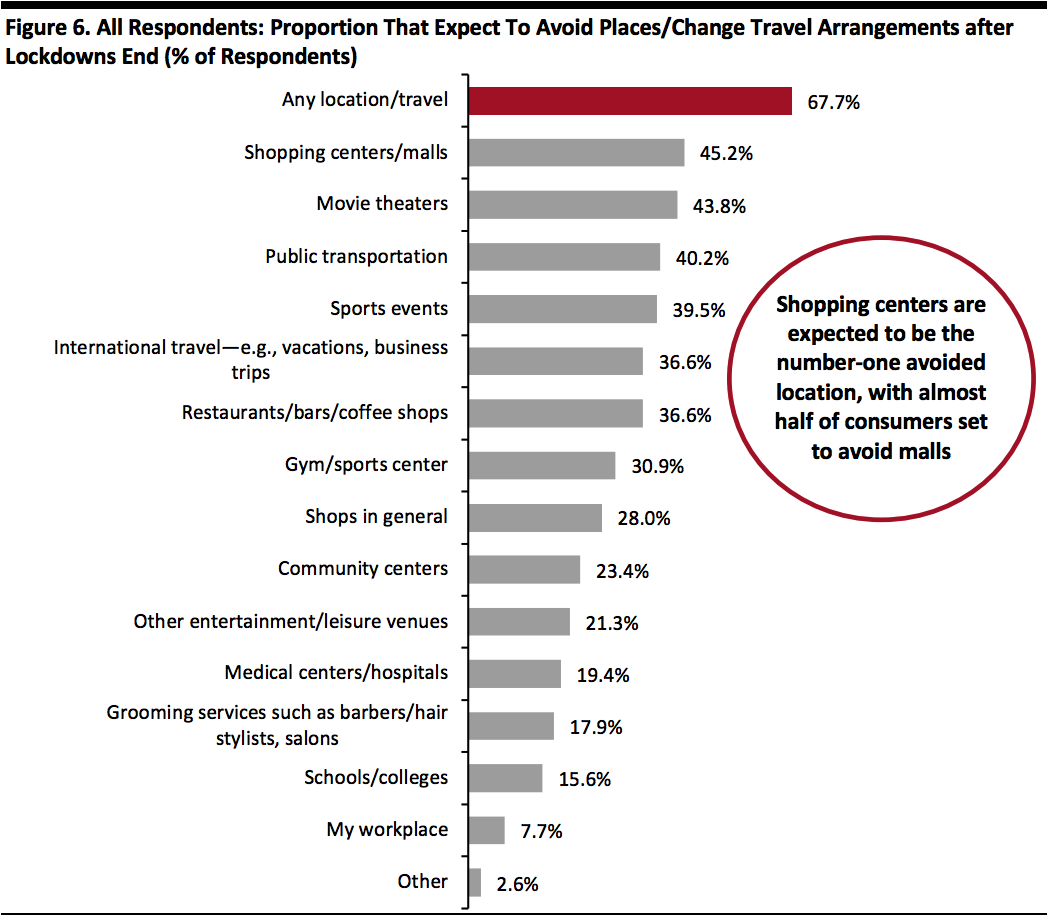

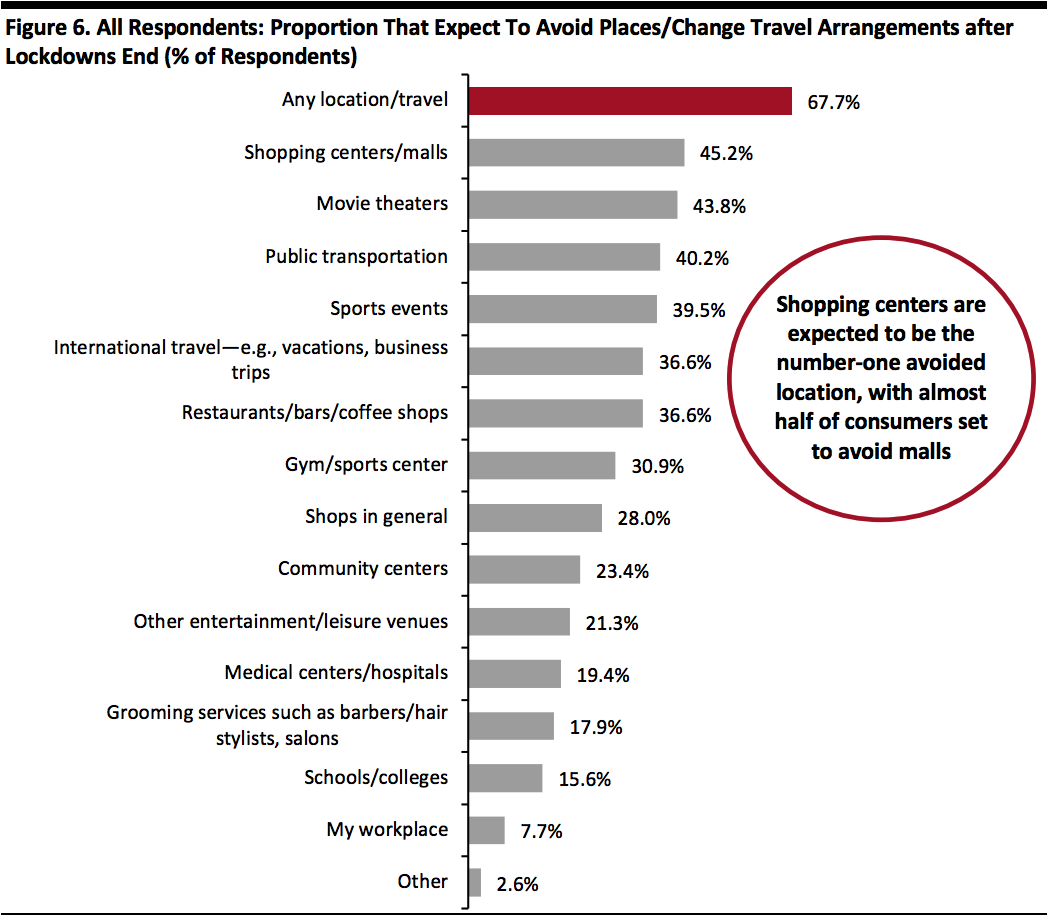

Consumers have largely been staying at home for at least one month now, seeing reports of ever-increasing negative headlines and high numbers of coronavirus patients falling ill. For the most part, they have embraced social distancing and wearing masks in stores and on public transport. Moving on from this reality, consumers will likely be hesitant to enter an enclosed, crowded space, such as a mall, until they are certain that the risk has dissipated—particularly without wearing a face mask.

A Coresight Research survey found shopping centers were the number-one place that those surveyed plan to avoid after lockdowns end (as shown in Figure 6).

[caption id="attachment_108803" align="aligncenter" width="700"]

Source: St. Louis Fed/US Census Bureau/Coresight Research[/caption]

Consumers’ Willingness to Shop

Consumers have largely been staying at home for at least one month now, seeing reports of ever-increasing negative headlines and high numbers of coronavirus patients falling ill. For the most part, they have embraced social distancing and wearing masks in stores and on public transport. Moving on from this reality, consumers will likely be hesitant to enter an enclosed, crowded space, such as a mall, until they are certain that the risk has dissipated—particularly without wearing a face mask.

A Coresight Research survey found shopping centers were the number-one place that those surveyed plan to avoid after lockdowns end (as shown in Figure 6).

[caption id="attachment_108803" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple options

Base: US Internet users aged 18+

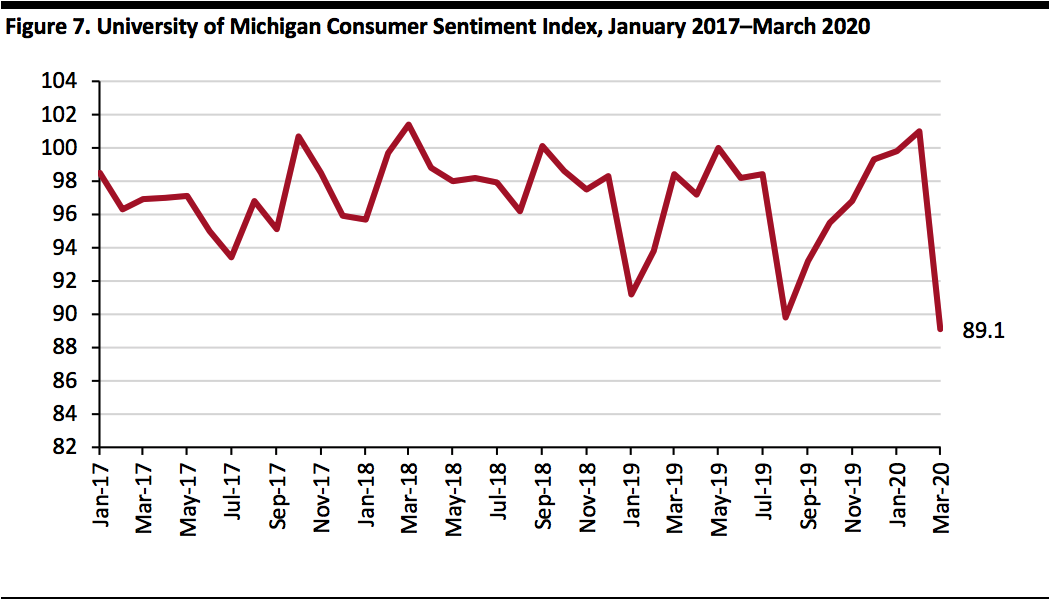

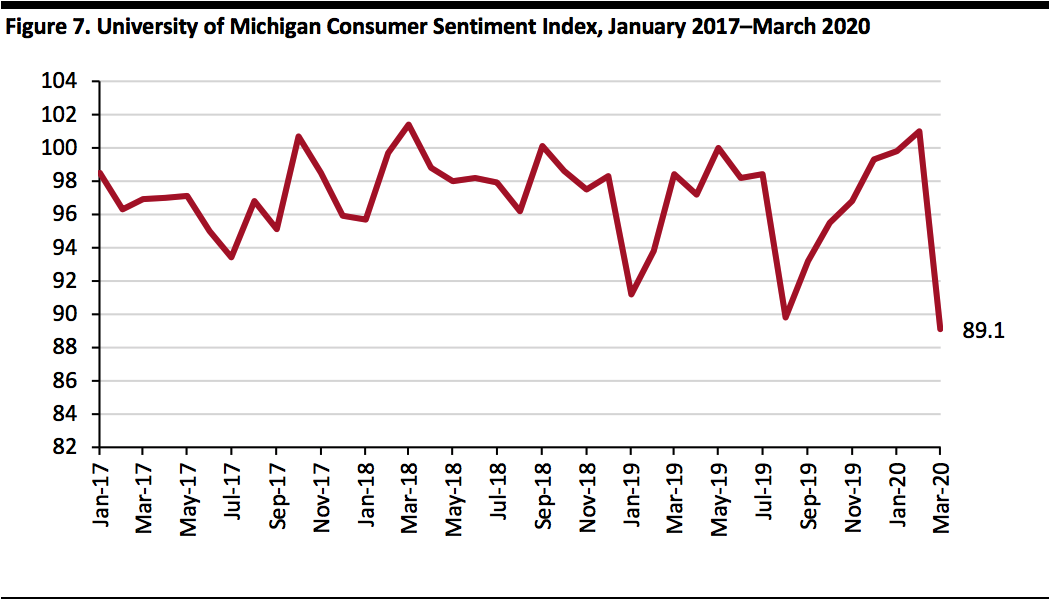

Source: Coresight Research[/caption] We show consumer sentiment since 2017 in Figure 6 below. Considering the index is measured monthly and that store shutdowns and layoffs began mid-March, the sharp drop-off in consumer sentiment is within historical ranges. [caption id="attachment_108804" align="aligncenter" width="700"] Note: Non-seasonally adjusted data

Note: Non-seasonally adjusted data

Source: St. Louis Fed[/caption] Labor Availability Another issue is employee availability. The $2 trillion US CARES Act provides an additional $600 a week to laid-off or furloughed workers through July 31, in addition to the average $378 a week earned from US unemployment benefits. Thus, many laid-off employees are earning more from unemployment than from returning to their prior jobs and have resisted returning. Still-operating retailers such as Amazon and Walmart have been aggressively hiring, looking for 75,000 and 150,000 new employees in the meantime, respectively, reducing the pool of available workers. Other Coresight Research Coronavirus Insights: Retail Playbook—React and Adapt Coronavirus Insights Coronavirus Insights: US Survey Update—First Hints of an Apparel Recovery (Full Report) US Holiday 2020 Retail First Look

- April 17: The US Centers for Disease Control and Prevention propose a three-phased approach for reopening US businesses, aimed at mitigating the risk of resurgence based on several gating criteria.

- April 18: Minnesota reopens golf courses, public and private marinas, bait shops and outdoor shooting ranges. Beaches in Jacksonville, Florida, are reopened with restricted hours but prohibiting some activities, such as sunbathing.

- April 20: Texas reopens some state parks.

- April 25: Georgia allows fitness centers and esthetic businesses (including massage therapists) to reopen, with its shelter-in-place program set to end on April 30.

- April 27: Governor of New York Andrew Cuomo outlines a rough plan, calling for construction and manufacturing work to restart on May 15.

- April 28: The National Retail Federation releases a “Blueprint for Shopping Safe,” outlining a phased approach for reopening retail.

- May 1: Simon Property Group begins to reopen 49 properties.

Source: Coresight Research[/caption]

Shutdown

The shutdown of US retail occurred in two stages: first, shutdowns and then worker furloughs.

The shutdowns were led by Apple on March 14. Macy’s then announced store closures on March 17, and other large retailers soon followed suit. We estimated that major retailers had closed 60,000 stores as of early April—although total closures including independents and small chains is likely to be several times this number: from Census Bureau data, we estimate the US has a little over 600,000 stores in discretionary sectors (all sectors apart from food retail, drug retail and mass merchandisers/warehouse clubs).

In Figure 1, we estimate that by the time the quarantine period in the US began, consumer discretionary spending had fallen as much as 60% from pre-coronavirus levels.

Quarantine

We are currently in the quarantine stage, with discretionary retail stores remaining closed.

Retailers whose stores have stayed open are posting strong results in the staples categories. For example, Target reported a surge in sales starting in mid-March that continued through late April: Month to date through April 23, comps increased 5%, in-store comps declined in the mid-teens, and digital sales increased 275%. By category, comps increased 12% in essentials and food and beverages, more than 30% in hardlines and by high teens in home. On the other hand, Target saw a decline of more than 40% in apparel and accessories.

We estimate that total retail sales will be down by approximately one-third but possibly as much as 40%, year over year, in April and any subsequent periods in which nonessential retail is fully shut down. Our assumptions factor in an approximate 60+% decline in discretionary nonfood retail sales.

Reopening

The timing of the reopening of discretionary retail is at the mercy of the coronavirus pandemic’s progress and the orders of government officials. Any reopening of stores would have to minimize or greatly reduce the risk to store employees and customers of contracting the virus, and as the coronavirus is new, it is very unclear which measures are effective.

Still, retailers can consider several options, including the following:

Source: Coresight Research[/caption]

Shutdown

The shutdown of US retail occurred in two stages: first, shutdowns and then worker furloughs.

The shutdowns were led by Apple on March 14. Macy’s then announced store closures on March 17, and other large retailers soon followed suit. We estimated that major retailers had closed 60,000 stores as of early April—although total closures including independents and small chains is likely to be several times this number: from Census Bureau data, we estimate the US has a little over 600,000 stores in discretionary sectors (all sectors apart from food retail, drug retail and mass merchandisers/warehouse clubs).

In Figure 1, we estimate that by the time the quarantine period in the US began, consumer discretionary spending had fallen as much as 60% from pre-coronavirus levels.

Quarantine

We are currently in the quarantine stage, with discretionary retail stores remaining closed.

Retailers whose stores have stayed open are posting strong results in the staples categories. For example, Target reported a surge in sales starting in mid-March that continued through late April: Month to date through April 23, comps increased 5%, in-store comps declined in the mid-teens, and digital sales increased 275%. By category, comps increased 12% in essentials and food and beverages, more than 30% in hardlines and by high teens in home. On the other hand, Target saw a decline of more than 40% in apparel and accessories.

We estimate that total retail sales will be down by approximately one-third but possibly as much as 40%, year over year, in April and any subsequent periods in which nonessential retail is fully shut down. Our assumptions factor in an approximate 60+% decline in discretionary nonfood retail sales.

Reopening

The timing of the reopening of discretionary retail is at the mercy of the coronavirus pandemic’s progress and the orders of government officials. Any reopening of stores would have to minimize or greatly reduce the risk to store employees and customers of contracting the virus, and as the coronavirus is new, it is very unclear which measures are effective.

Still, retailers can consider several options, including the following:

- Reducing the number of customers (and employees) in the store (i.e., ensuring social-distancing practices are in place)

- Reopening stores with “buy online, pick up in store” (BOPIS), “buy online, pick up in mall” (BOPIM) or ship-to-the-curb services

- Requiring employees and customers to wear masks and/or gloves

- Taking employees’ and customers’ temperature with handheld thermometer guns

- Frequently sterilizing high-touch surfaces in stores

- Symptoms: A downward trajectory of influenza and Covid-like cases within a 14-day period

- Cases: A downward trajectory of documented cases and positive tests within a 14-day period

- Hospitals: Able to treat all patients without crisis care and a robust testing program for at-risk healthcare workers, including antibody testing

- Ability to spend—affected by unemployment, excursions into savings, salary reductions, and consumer debt levels

- Propensity to spend—affected by consumer confidence, shopping behaviors, debt levels and the availability of retail venues

Source: Coresight Research[/caption]

Defining a Recovery—The “New Normal”

Even assuming that the coronavirus is able to be contained or managed, the shutdowns and furloughs made a considerable dent in consumer income and spending ability, and were devastating for employees in retail, travel and hospitality. It will take time for consumers to recover from this impact, and the subsequent steady-state level will likely remain below the spending levels of 2019.

For consumers to shop and employees to work again, they need to feel safe in browsing and working in retail stores. However, the perception of safety for many in visiting these venues could be permanently impaired. Moreover, the savings and earning power of many consumers will have received significant damage during the initial phases. As unemployment may still be high, spending power is likely to be weaker than before. We call this phase the “new normal,” and estimate that consumer discretionary spending could be as much as 20% below pre-coronavirus levels.

We define a recovery as the majority of stores being reopened (those of surviving retailers) in some fashion, with measures in place to help ensure full access to products by consumers and employees. This could be accomplished through BOPIS and BOPIM services or an arrangement where consumers can access only selected parts of the store (for example, the ground floor) to view and purchase products.

“Recovery” Scenarios

Economists typically use letters of the alphabet to describe the shape of economic downturns typically with letters of the alphabet, in increasing severity. Below, we look at three possible recovery scenarios:

Source: Coresight Research[/caption]

Defining a Recovery—The “New Normal”

Even assuming that the coronavirus is able to be contained or managed, the shutdowns and furloughs made a considerable dent in consumer income and spending ability, and were devastating for employees in retail, travel and hospitality. It will take time for consumers to recover from this impact, and the subsequent steady-state level will likely remain below the spending levels of 2019.

For consumers to shop and employees to work again, they need to feel safe in browsing and working in retail stores. However, the perception of safety for many in visiting these venues could be permanently impaired. Moreover, the savings and earning power of many consumers will have received significant damage during the initial phases. As unemployment may still be high, spending power is likely to be weaker than before. We call this phase the “new normal,” and estimate that consumer discretionary spending could be as much as 20% below pre-coronavirus levels.

We define a recovery as the majority of stores being reopened (those of surviving retailers) in some fashion, with measures in place to help ensure full access to products by consumers and employees. This could be accomplished through BOPIS and BOPIM services or an arrangement where consumers can access only selected parts of the store (for example, the ground floor) to view and purchase products.

“Recovery” Scenarios

Economists typically use letters of the alphabet to describe the shape of economic downturns typically with letters of the alphabet, in increasing severity. Below, we look at three possible recovery scenarios:

- V-shape: This recovery model would see a sharp drop in economic activity, followed by a steep recovery. Given that consumers have been stuck at home for an extended period of time, they are likely very anxious to get back to work, generate income and exercise their rights as consumers again.

- U-shape: This model would see a longer period of downturn than the V-shaped downturn but with a similar rapid recovery. Given that there are many unknowns that must be identified—such as the trajectory of the coronavirus, the measures that government leaders and retailers are willing and able to take and the uncertainty of a corresponding rebound in consumer sentiment—this appears the most likely scenario, as represented by the lumpy U-shape in Figure 1.

- W-shape: This model would see alternating periods of recovery and downturn due to the periodic re-emergence of the coronavirus. Experts have discussed the possibility that the pandemic could spread in South America during the winter in the Southern Hemisphere and return to North America during the typical flu season in the winter.

- Tick/”swoosh” shape: This model would see a rapid downturn followed by a slow, gradual recovery, which is possible due to the dramatic hit to employment and income from the quick closure of stores, restaurants, entertainment venues and other nonessential businesses.

Source: Coresight Research[/caption]

Hurdles to a Retail Recovery

Even if all retail stores were completely reopened in short order, what could keep consumers from wanting or being able to return to prior buying habits? This section explores consumers’ ability and willingness to shop, given a coronavirus recovery.

Consumers’ Ability to Shop

Consumers’ ability to shop is related to income (driven by employment) and their confidence. While many workers have been furloughed or have received salary reductions, taxpayers meeting certain income requirements have also received $1,200 stimulus checks due to the US CARES Act, in addition to receiving supplemental unemployment benefits that run through July 31.

Looking at employment, Figure 3 shows pre-pandemic weekly US unemployment claims of about 250,000 expanding to 6 million in two weeks through March 28, peaking at 6.2 million on April 4 and declining for two weeks to 4.8 million on April 18 and 4.3 million on April 25. As of April 18, the insured unemployment rate stood at 12.4%.

[caption id="attachment_108801" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Hurdles to a Retail Recovery

Even if all retail stores were completely reopened in short order, what could keep consumers from wanting or being able to return to prior buying habits? This section explores consumers’ ability and willingness to shop, given a coronavirus recovery.

Consumers’ Ability to Shop

Consumers’ ability to shop is related to income (driven by employment) and their confidence. While many workers have been furloughed or have received salary reductions, taxpayers meeting certain income requirements have also received $1,200 stimulus checks due to the US CARES Act, in addition to receiving supplemental unemployment benefits that run through July 31.

Looking at employment, Figure 3 shows pre-pandemic weekly US unemployment claims of about 250,000 expanding to 6 million in two weeks through March 28, peaking at 6.2 million on April 4 and declining for two weeks to 4.8 million on April 18 and 4.3 million on April 25. As of April 18, the insured unemployment rate stood at 12.4%.

[caption id="attachment_108801" align="aligncenter" width="700"] Note: Non-seasonally adjusted data

Note: Non-seasonally adjusted dataSource: St. Louis Fed[/caption] The figure below shows the tight correlation between US employment and retail sales (excluding motor vehicles and auto parts dealers). The data set below shows a 91.4% correlation between the two. [caption id="attachment_108802" align="aligncenter" width="700"]

Source: St. Louis Fed/US Census Bureau/Coresight Research[/caption]

Consumers’ Willingness to Shop

Consumers have largely been staying at home for at least one month now, seeing reports of ever-increasing negative headlines and high numbers of coronavirus patients falling ill. For the most part, they have embraced social distancing and wearing masks in stores and on public transport. Moving on from this reality, consumers will likely be hesitant to enter an enclosed, crowded space, such as a mall, until they are certain that the risk has dissipated—particularly without wearing a face mask.

A Coresight Research survey found shopping centers were the number-one place that those surveyed plan to avoid after lockdowns end (as shown in Figure 6).

[caption id="attachment_108803" align="aligncenter" width="700"]

Source: St. Louis Fed/US Census Bureau/Coresight Research[/caption]

Consumers’ Willingness to Shop

Consumers have largely been staying at home for at least one month now, seeing reports of ever-increasing negative headlines and high numbers of coronavirus patients falling ill. For the most part, they have embraced social distancing and wearing masks in stores and on public transport. Moving on from this reality, consumers will likely be hesitant to enter an enclosed, crowded space, such as a mall, until they are certain that the risk has dissipated—particularly without wearing a face mask.

A Coresight Research survey found shopping centers were the number-one place that those surveyed plan to avoid after lockdowns end (as shown in Figure 6).

[caption id="attachment_108803" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption] We show consumer sentiment since 2017 in Figure 6 below. Considering the index is measured monthly and that store shutdowns and layoffs began mid-March, the sharp drop-off in consumer sentiment is within historical ranges. [caption id="attachment_108804" align="aligncenter" width="700"]

Note: Non-seasonally adjusted data

Note: Non-seasonally adjusted dataSource: St. Louis Fed[/caption] Labor Availability Another issue is employee availability. The $2 trillion US CARES Act provides an additional $600 a week to laid-off or furloughed workers through July 31, in addition to the average $378 a week earned from US unemployment benefits. Thus, many laid-off employees are earning more from unemployment than from returning to their prior jobs and have resisted returning. Still-operating retailers such as Amazon and Walmart have been aggressively hiring, looking for 75,000 and 150,000 new employees in the meantime, respectively, reducing the pool of available workers. Other Coresight Research Coronavirus Insights: Retail Playbook—React and Adapt Coronavirus Insights Coronavirus Insights: US Survey Update—First Hints of an Apparel Recovery (Full Report) US Holiday 2020 Retail First Look