albert Chan

China vs. US: Where Is the US on the Coronavirus Timeline?

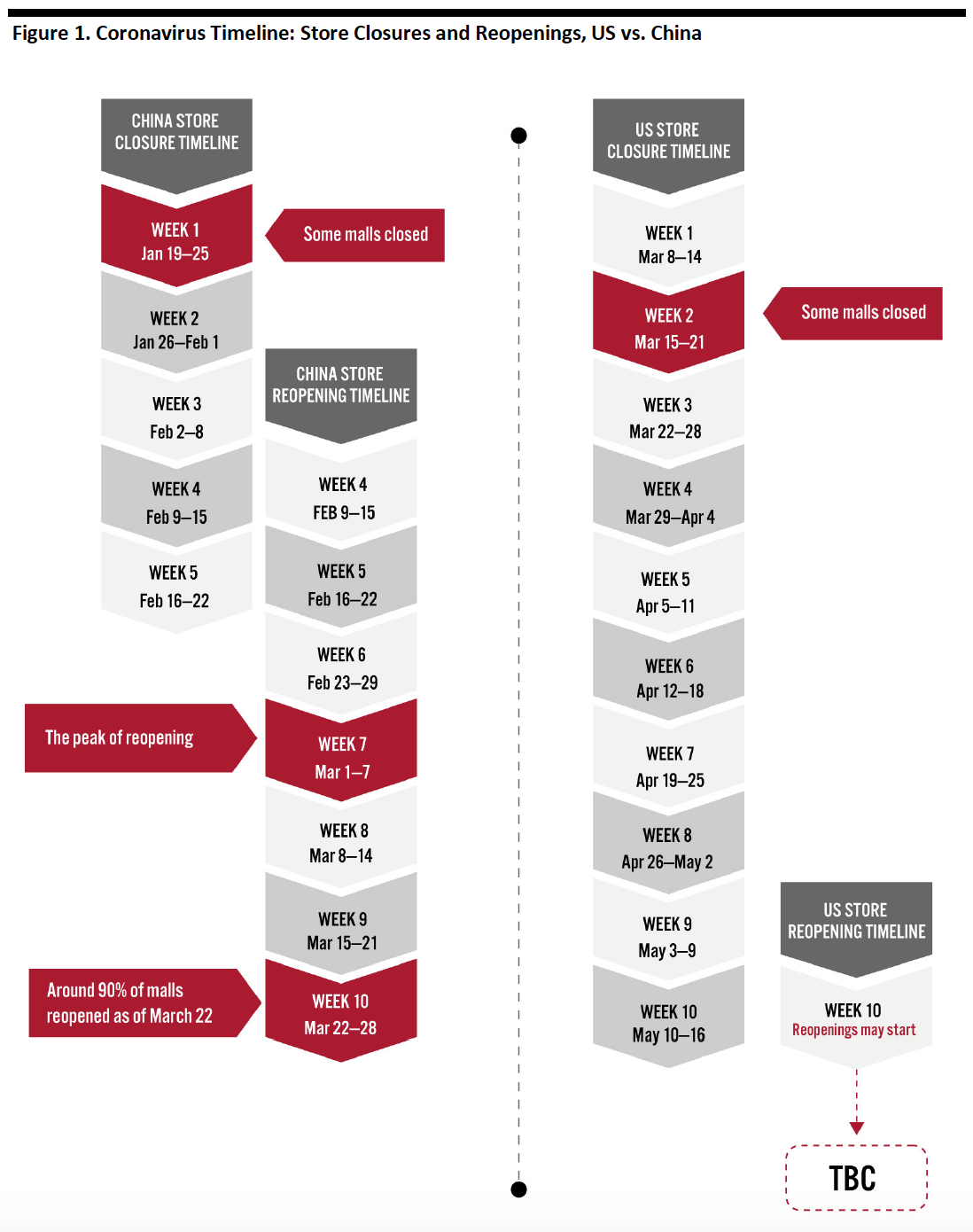

China’s store closures started around the week of January 19 and lasted about five weeks—ending around February 22. By comparison, store shutdown in the US started in the second week of March and has now entered its sixth week. The shutdown is therefore continuing for longer in the US than it did in China.

We estimate that the shutdown could last for around two to three months, and our base case is around three months, from the week of March 15– 21, which is when most US retailers implemented store closures. We expect to see a slower process to recovery in the US because the nation saw a more gradual shutdown and generally implemented less severe restrictions than China.

As of April 3, Alabama became the 41st state to issue a stay-at-home order, nearly one month after the US suspended all travel from Europe for non-US citizens on March 11. All imposed lockdowns in the US remain in place at the time this report was published. The US has thus seen a delayed lockdown process compared to China, in which shutdowns began on January 23 in Wuhan and four other cities in Hubei province and quickly spread nationwide.

US retailers had originally planned to reopen stores from week four (March 29–April 4), but most have now officially changed this expectation to “until further notice.” We do not believe that any US retailers are going to be reopening stores for several weeks, with all nonessential stores closed across 46 states as of April 4. Given our expectation of a two- to three-month shutdown from mid-March—the peak time of store closures—the US might see stores begin to reopen around week 10, May 10–16. However, we view reopening occurring at week 10 as being on the optimistic side: A shutdown of closer to three months would take reopenings to June. Notably, guidance for closures varies from state to state, so it could be that the rate of reopenings is staggered across the country.

By the end of week 10 in China (March 22–29), 90% of shopping malls had already reopened—six weeks after the first store reopening occurred in week four (February 9–15).

[caption id="attachment_107711" align="aligncenter" width="750"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

A Closer Look at China’s Coronavirus Timeline

[caption id="attachment_107713" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

China’s Store Closures: End of January Was the Peak Time for Closure

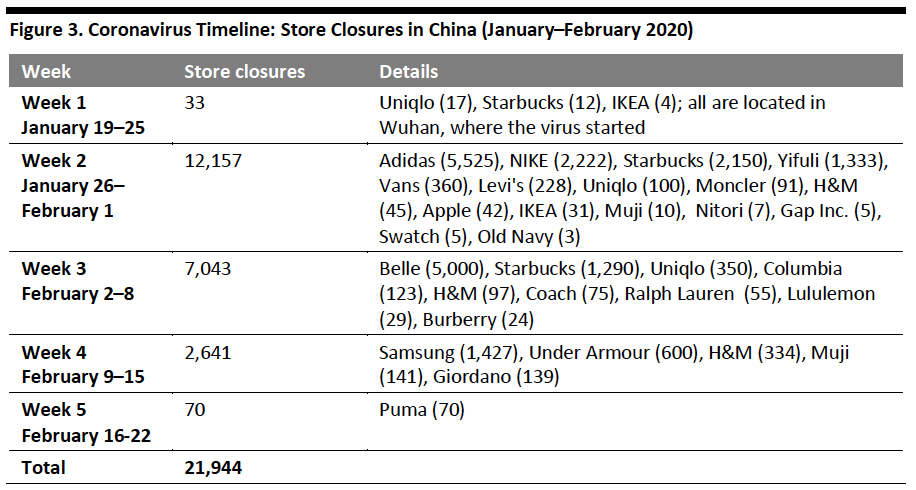

Week one: The first batch of store shutdowns took place in the week of January 19–25 in Wuhan, Hubei province, comprising 33 stores: four IKEA stores, 17 Uniqlo stores and 12 Starbucks coffee shops. These closures were closely linked to the fact that China imposed a strict lockdown in the city on January 23.

Week two: As shown in Figure 3, the peak week for store closures in China was January 26 to February 1, totalling 12,157 across the nation. Retailers that contributed the most to this number were Adidas, which saw around 5,525 stores temporarily shut down, including Adidas-owned stores and franchised stores, and NIKE, which closed 2,222 stores. At this time, the coronavirus was spreading quickly, and China ordered travel agencies to suspend domestic and international tours.

Week three: The rate of closures slowed in the week of February 2–8, although the total was a still significant 7,043 stores. Chinese shoe retailer Belle closed around 5,000 stores, and Starbucks closed 1,290 coffee shops.

Store closures continued for two more weeks, although dropped off to just 70 Puma stores in the week of February 16–22, as shown in Figure 3.

[caption id="attachment_107714" align="aligncenter" width="700"] Note: Week one is when the first store closures were implemented. This table only covers store closures that were reported across news platforms.

Note: Week one is when the first store closures were implemented. This table only covers store closures that were reported across news platforms.Source: Company reports/Coresight Research[/caption]

China’s Mall Shutdowns: A Complex Picture

The closure of shopping centers in China saw mixed approaches, with some malls closing from January 23 (such as K11 Select the Greenland Center in Wuhan) but others only reducing their operating hours. For example, Shin Kong Place in Beijing changed its business hours from 10:00 a.m.–10:00 p.m. to 11:00 a.m.–7:00 p.m. between January 27 and February 7, before closing on February 8.

Mall closures varied among local governments, as some subsidized malls that remained open. In Beijing, the Municipal Bureau of Commerce provided subsidies worth ¥500,000 (around $70,556) to large-scale shopping malls (over 20,000 square meters) to encourage them to operate normally during the pandemic. However, the conditions of these subsidy programs required malls to take steps to reduce or exempt rents for more than 15 days for over 50% of their tenants.

China’s Store Reopenings: Beginning of March Was the Peak Time for Reopening

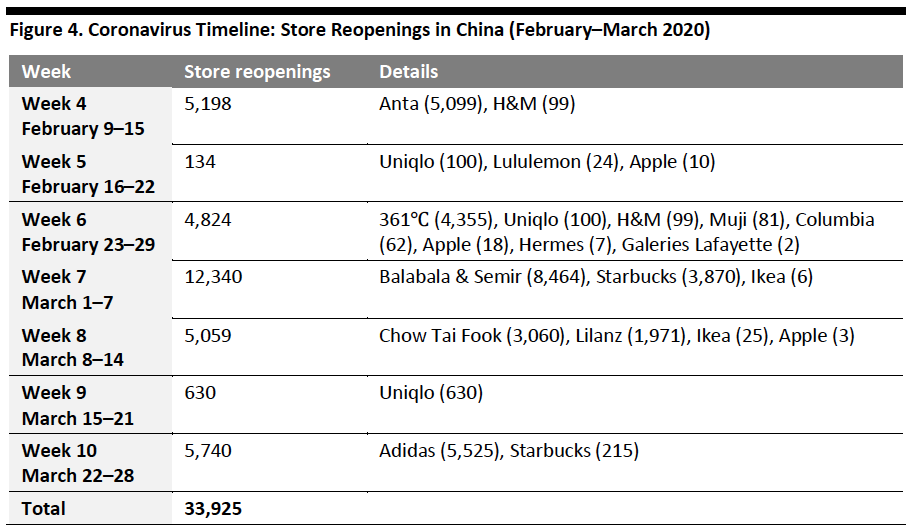

The store-reopening process took around seven weeks in China, starting from week four (February 9–15). The first stores to be reopened were 5,099 locations of sportswear retailer Anta 99 H&M stores.

February 20 represented a turning point in China’s recovery and in the reopening of stores, as the nation successfully rolled out a "Health Code" system that enables provincial governments to track citizens and identify at-risk individuals. Store reopenings then peaked during week seven (March 1–7), totalling 12,340 locations, most of which were Balabala & Semir Chinese fashion retail stores (shown in Figure 4).

[caption id="attachment_107715" align="aligncenter" width="700"] Note: Week one is when the first store closures were implemented. This table only covers store reopenings that were reported across news platforms.

Note: Week one is when the first store closures were implemented. This table only covers store reopenings that were reported across news platforms.Source: Company reports/Coresight Research[/caption]

China’s Mall Reopenings: Around 90% Had Reopened by March 22

As of February 21 (week five), around 50% of department stores and shopping malls had reopened for business across China, according to the Ministry of Commerce. Shopper traffic was primarily seen in supermarkets and pharmacies, although this amounted to only 10–15% of the usual traffic.

The reopening rate for malls reached 90% by March 22 (week nine), according to the Ministry of Commerce. Notably, shopping mall operator Wanda Plaza had reopened 321 malls out of its 325 across China as of March 21. At that time, traffic in these malls recovered to an average of 83% of last year’s traffic, and average sales of Wanda Plaza across China recovered to 60% compared to 2019. The remaining four shopping malls in Wuhan reopened on March 30.

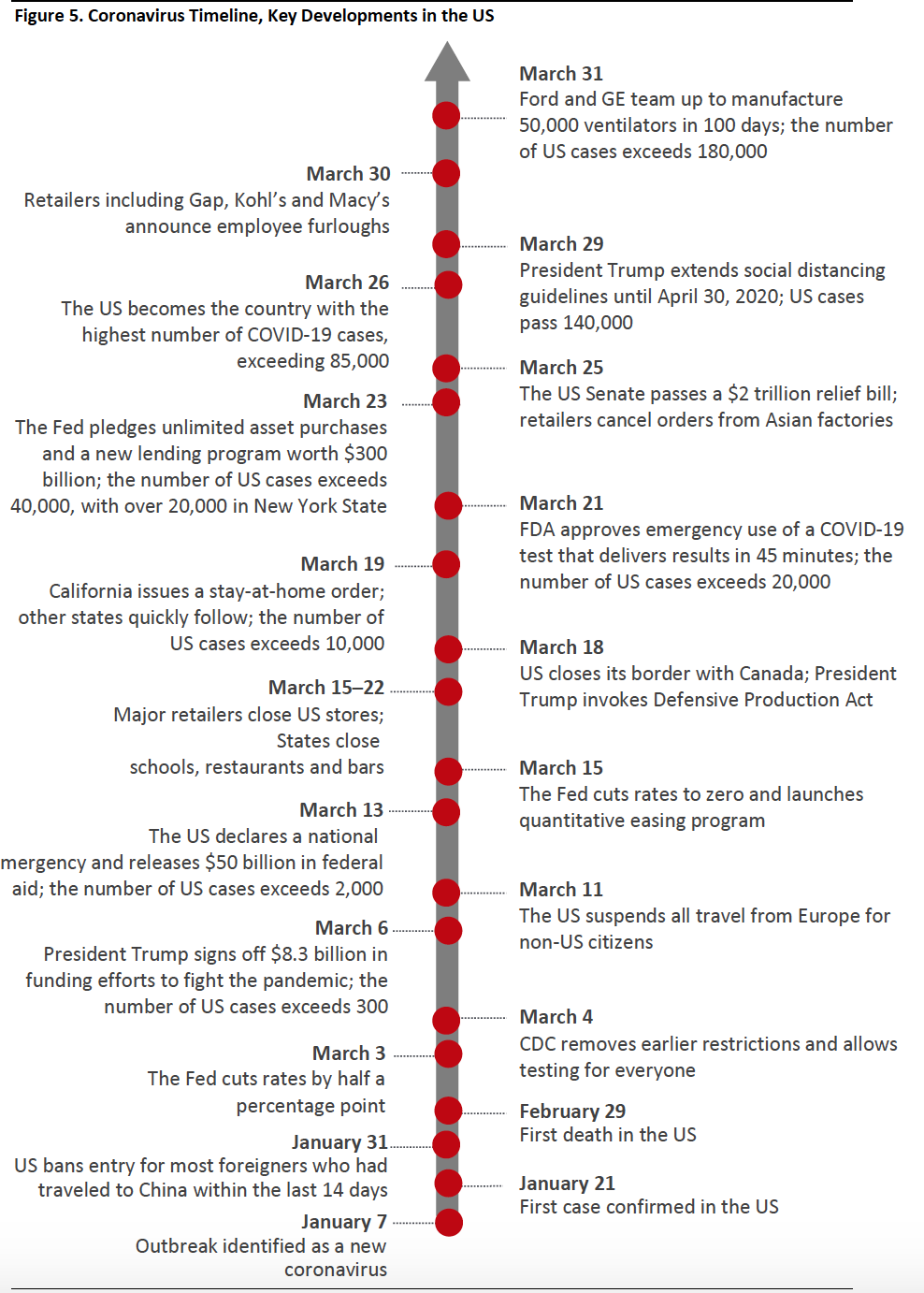

A Closer Look at the US Coronavirus Timeline

[caption id="attachment_107717" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

US Store Closures: Mid-March Was the Peak Time for Closure

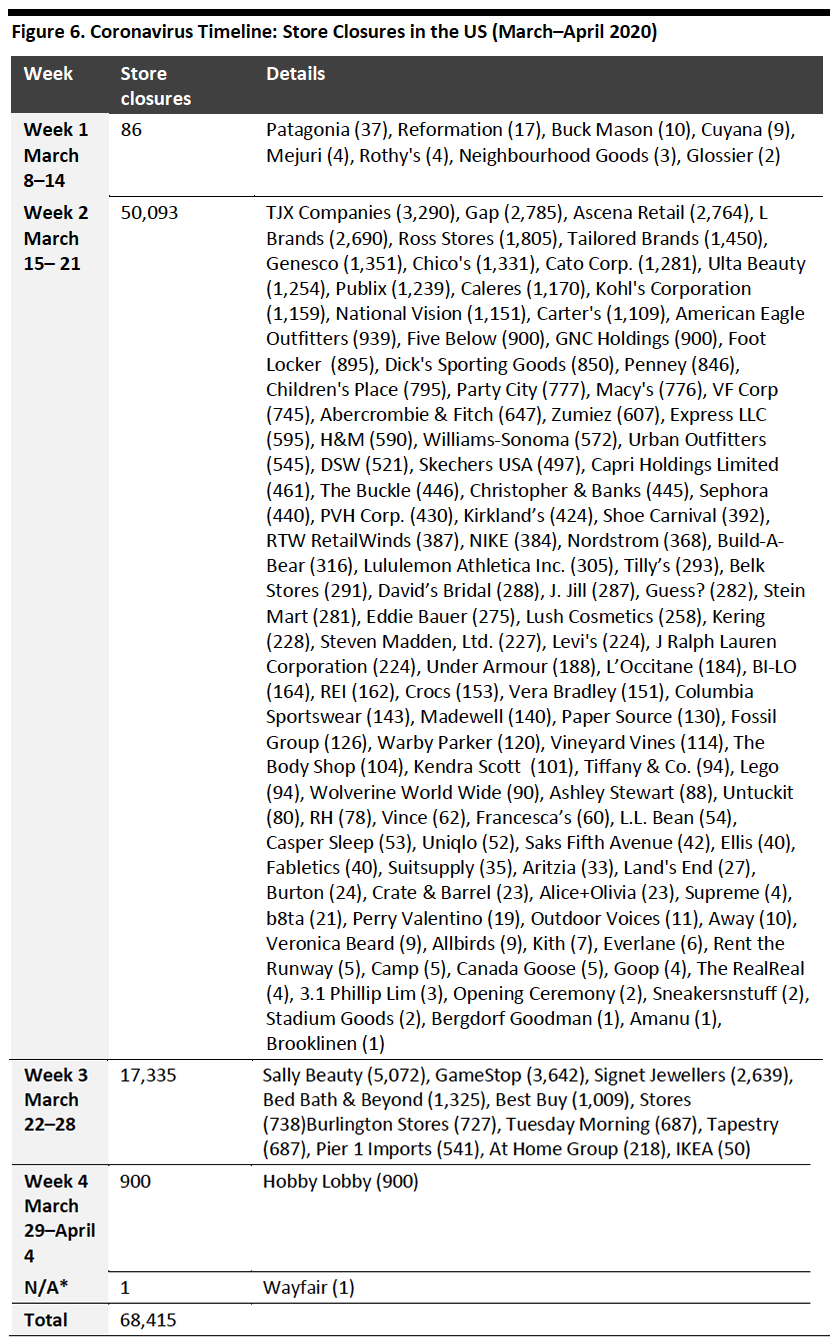

Week one: Coresight Research’s Coronavirus Tracker shows that the first group of store closures in the US were implemented during the week of March 8–14, comprising around 86 shutdowns. This turning point in retail was reflective of the wider situation in the US at the time: The US suspended all travel from Europe for non-US citizens on March 11, and on March 13, it declared a national emergency and released $50 billion in federal aid.

Week two: Store closures peaked the following week (March 15–21), when more than 100 retailers closed about 50,093 stores. Off-price retailer The TJX Companies closed 3,290 stores, followed by Gap with 2,785 closures. Again, the large number of shutdowns was closely connected to the development of the coronavirus situation across the US, with many states issuing stay-at-home orders in week two and the number of confirmed coronavirus cases in the country exceeding 10,000 on March 19.

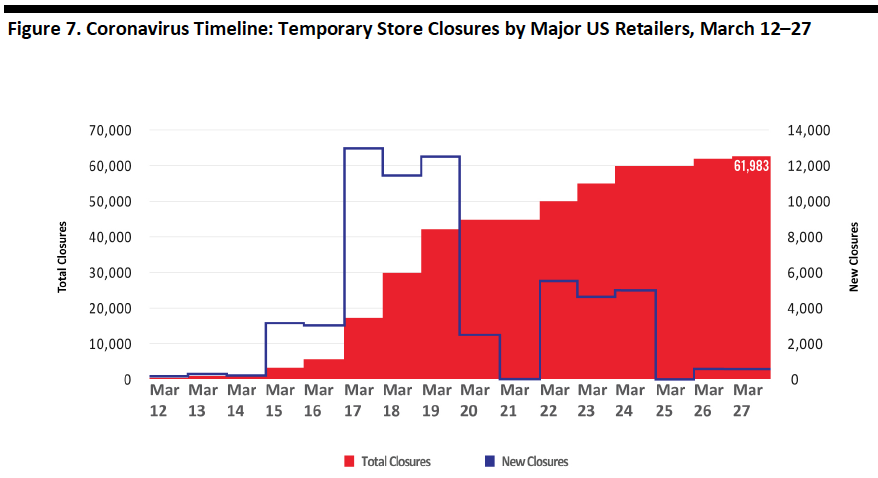

Week three: March 22–28 saw fewer store closures implemented, with 10 retailers closing 17,335 stores. We also broke down the store closure numbers by day between March 12 and 27 to show the rhythm of closures by major US retailers (see Figure 7).

[caption id="attachment_107718" align="aligncenter" width="700"] Note: Week one is when the first store closures were implemented. This table only covers store reopenings that were reported across news platforms. This table is up to date as of April 6.

Note: Week one is when the first store closures were implemented. This table only covers store reopenings that were reported across news platforms. This table is up to date as of April 6.*N/A means the retailer did not specify the closure date.

Source: Company reports/Coresight Research[/caption]

US Mall Shutdowns: Large US Mall Operators Implemented Closures in Late March

Within week two, which saw the largest number of individual store closures, around 250 mall were shut down in the US—those operated by Simon Property Group, the largest mall operator in the country. The company implemented the closures from 7:00 p.m. on March 18 and had planned to reopen them on March 30, but no reopenings had yet occurred as of April 6.

The second-largest mall operator, Brookfield Properties, closed 171 malls from March 24. Real-estate developer Unibail-Rodamco-Westfield also closed its 32 malls from March 19.

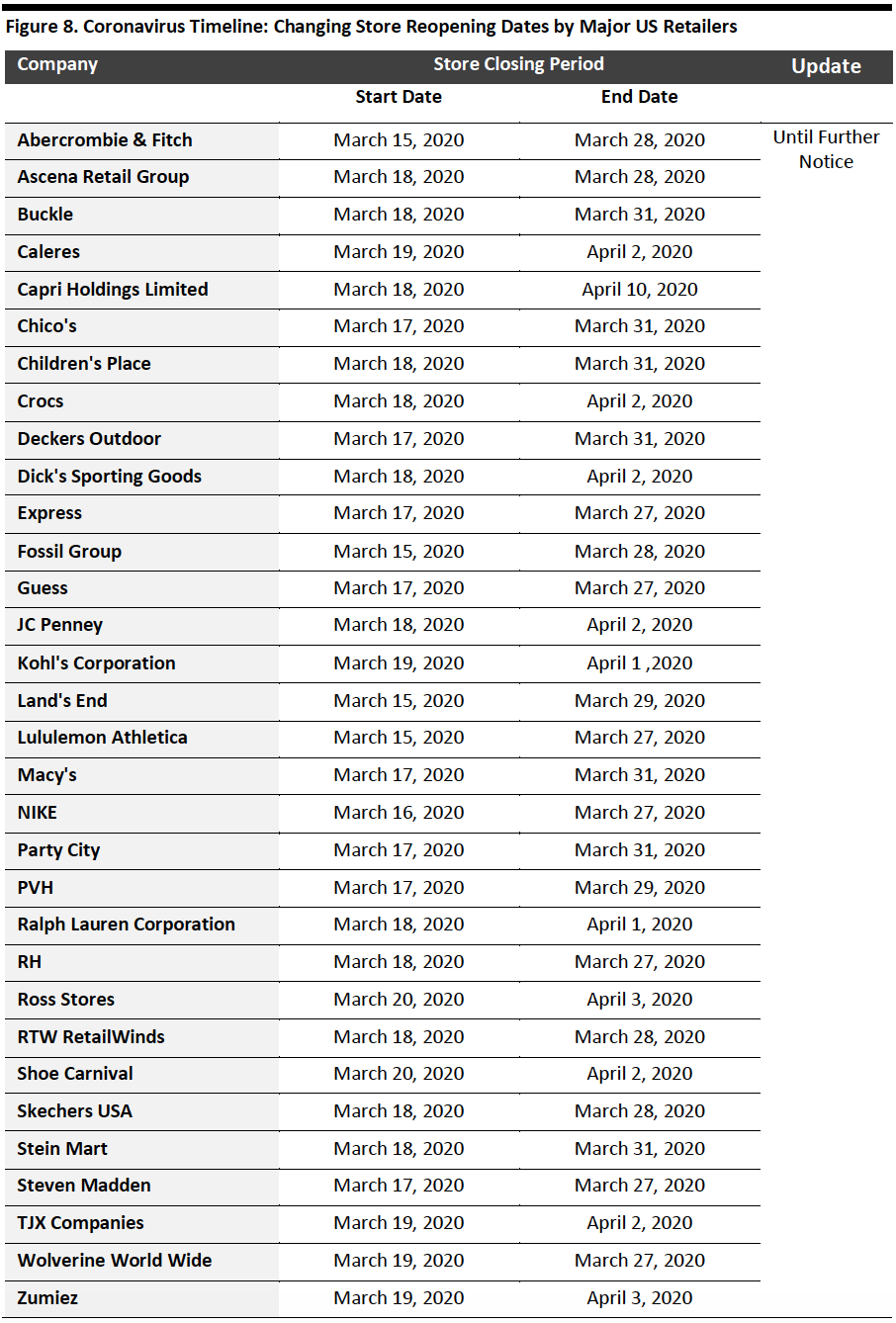

US Store Reopenings: Retailers Keep Extending Reopening Dates

Around 30 retailers have extended the reopening date of their stores from week four (March 29–April 4) to “until further notice.” For example, Nordstrom had originally planned to reopen all of its 368 stores on April 5, two weeks after they were closed on March 17. However, as of April 7, the stores have not reopened. Similarly, Under Armour further extended its reopening date from March 28 to April 4 (closures were implemented on March 16). However, the stores had not reopened as of April 7.

we have previously outlined in this report, we expect the shutdown to last at least two months from mid-March—the peak time of store closures in the US, so the US might see stores begin to reopen around week 10, May 10–16. However, we view store reopening around week 10 is optimistic: A longer shutdown could push reopenings into June.

[caption id="attachment_107719" align="aligncenter" width="700"] Source: Company reports/ Coresight Research[/caption]

US Mall Shutdowns: Large US Mall Operators Implemented Closures in Late March

Within week two, which saw the largest number of individual store closures, around 250 mall were shut down in the US—those operated by Simon Property Group, the largest mall operator in the country. The company implemented the closures from 7:00 p.m. on March 18 and had planned to reopen them on March 30, but no reopenings had yet occurred as of April 6.

The second-largest mall operator, Brookfield Properties, closed 171 malls from March 24. Real-estate developer Unibail-Rodamco-Westfield also closed its 32 malls from March 19.

US Store Reopenings: Retailers Keep Extending Reopening Dates

Around 30 retailers have extended the reopening date of their stores from week four (March 29–April 4) to “until further notice.” For example, Nordstrom had originally planned to reopen all of its 368 stores on April 5, two weeks after they were closed on March 17. However, as of April 7, the stores have not reopened. Similarly, Under Armour further extended its reopening date from March 28 to April 4 (closures were implemented on March 16). However, the stores had not reopened as of April 7.

we have previously outlined in this report, we expect the shutdown to last at least two months from mid-March—the peak time of store closures in the US, so the US might see stores begin to reopen around week 10, May 10–16. However, we view store reopening around week 10 is optimistic: A longer shutdown could push reopenings into June.

[caption id="attachment_107720" align="aligncenter" width="700"]

Source: Company reports/ Coresight Research[/caption]

US Mall Shutdowns: Large US Mall Operators Implemented Closures in Late March

Within week two, which saw the largest number of individual store closures, around 250 mall were shut down in the US—those operated by Simon Property Group, the largest mall operator in the country. The company implemented the closures from 7:00 p.m. on March 18 and had planned to reopen them on March 30, but no reopenings had yet occurred as of April 6.

The second-largest mall operator, Brookfield Properties, closed 171 malls from March 24. Real-estate developer Unibail-Rodamco-Westfield also closed its 32 malls from March 19.

US Store Reopenings: Retailers Keep Extending Reopening Dates

Around 30 retailers have extended the reopening date of their stores from week four (March 29–April 4) to “until further notice.” For example, Nordstrom had originally planned to reopen all of its 368 stores on April 5, two weeks after they were closed on March 17. However, as of April 7, the stores have not reopened. Similarly, Under Armour further extended its reopening date from March 28 to April 4 (closures were implemented on March 16). However, the stores had not reopened as of April 7.

we have previously outlined in this report, we expect the shutdown to last at least two months from mid-March—the peak time of store closures in the US, so the US might see stores begin to reopen around week 10, May 10–16. However, we view store reopening around week 10 is optimistic: A longer shutdown could push reopenings into June.

[caption id="attachment_107720" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]