DIpil Das

We discuss selected findings and compare them to those from prior weeks: June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

Base: US Internet users aged 18+

Base: US Internet users aged 18+

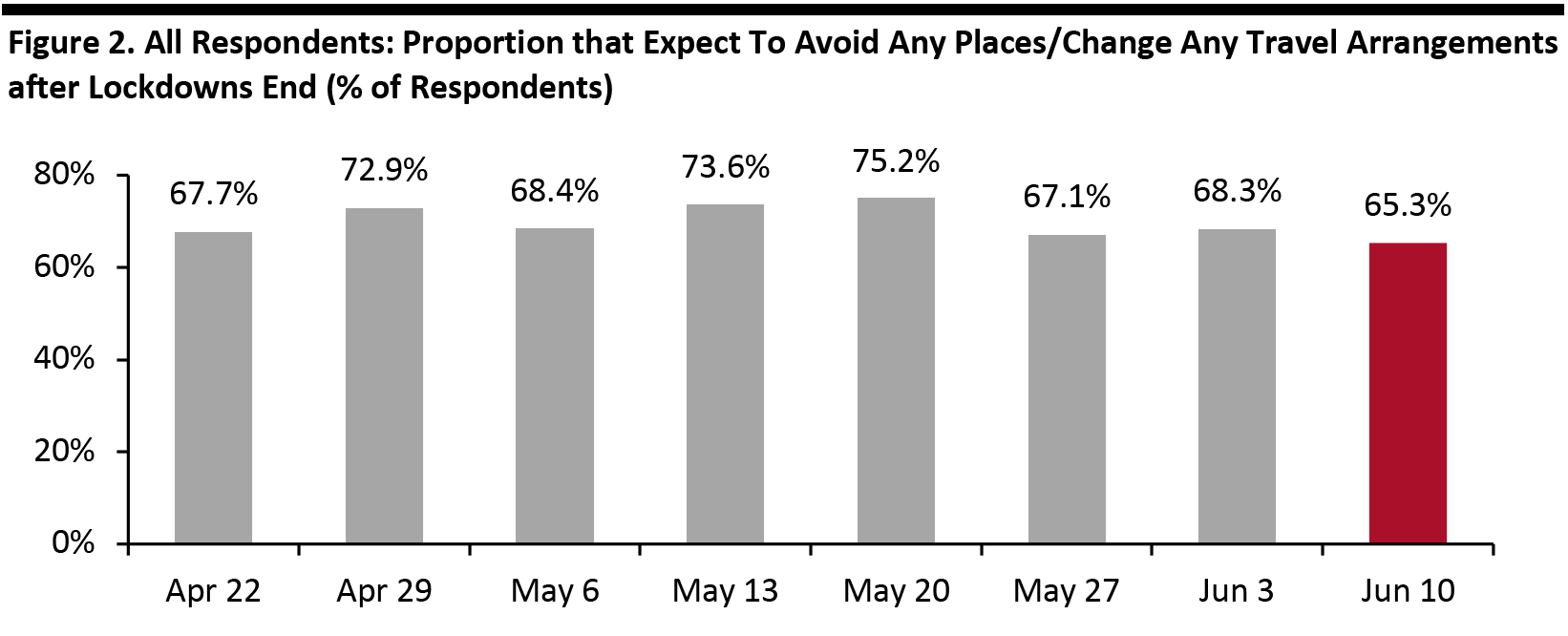

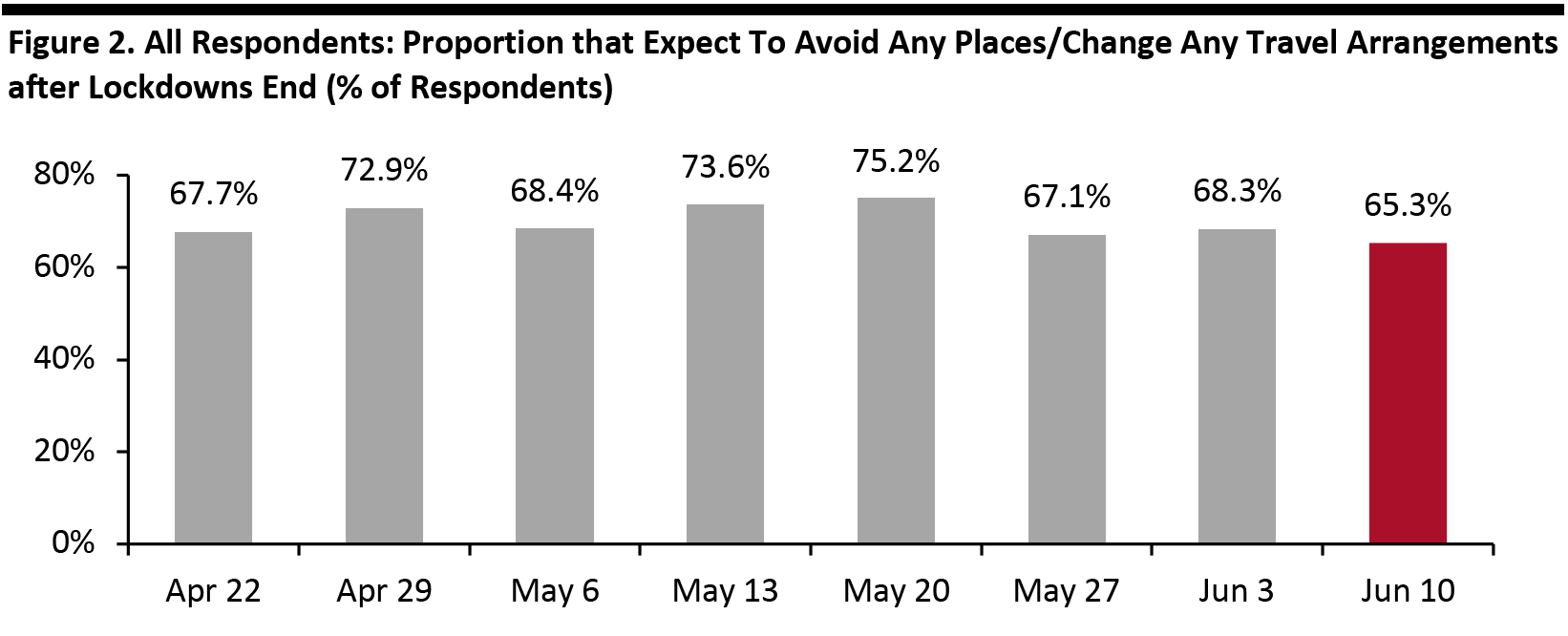

Source: Coresight Research [/caption] 2. Less than Two-Thirds of Respondents Expect To Avoid Public Places after Lockdowns End Consumers’ concern about returning to public places eased after a slight increase last week: 65.3% of all respondents now anticipate avoiding some kind of public place or travel after lockdowns end, versus 68.3% last week. This week’s figure is the lowest proportion of respondents since we started asking the question. While the proportion of respondents expecting to avoid shops in general increased slightly this week, we have seen a declining trend in the expected avoidance of shopping centers/malls since the week of May 20. Some 43% of all consumers now expect to avoid shopping centers/malls. [caption id="attachment_111442" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

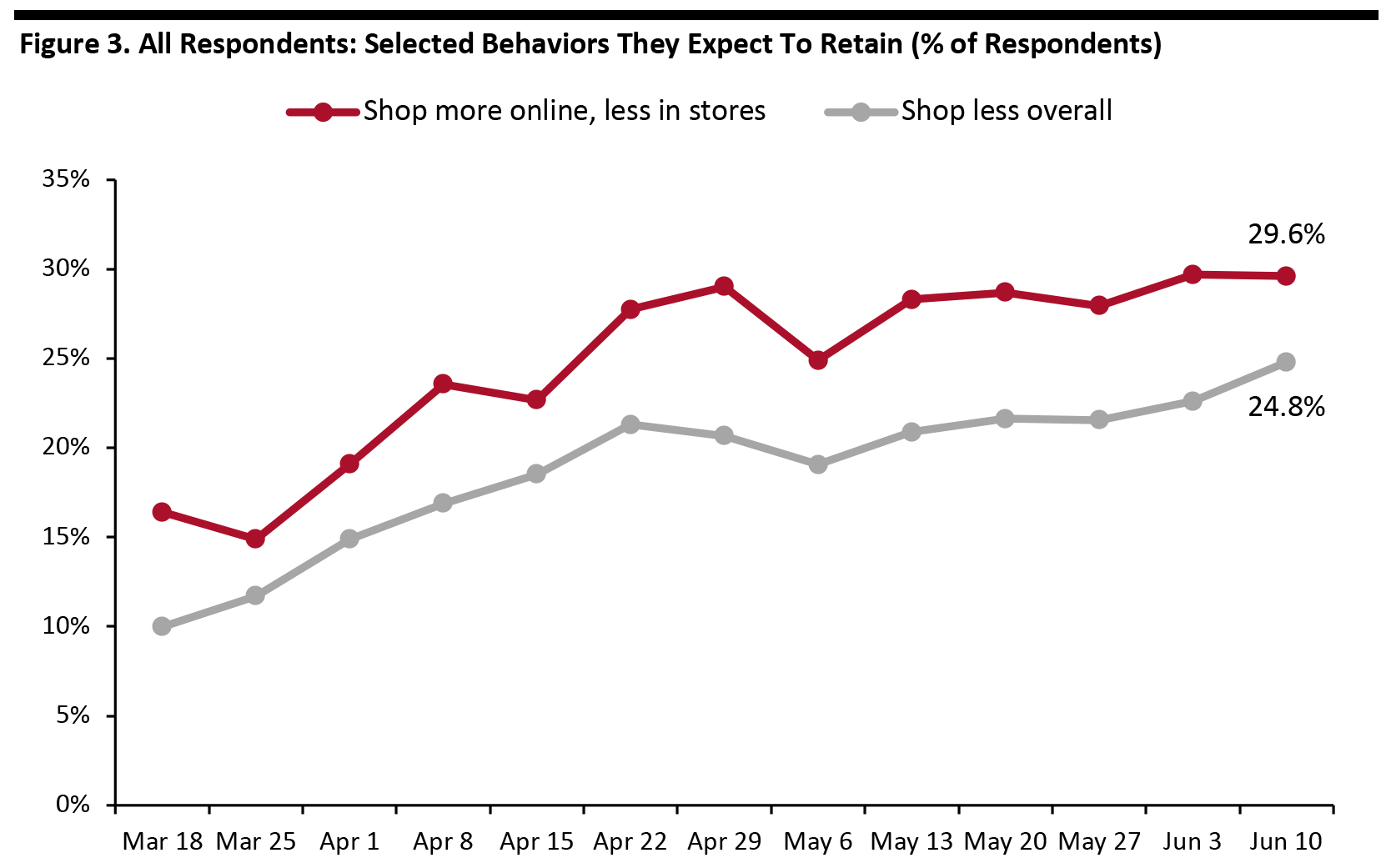

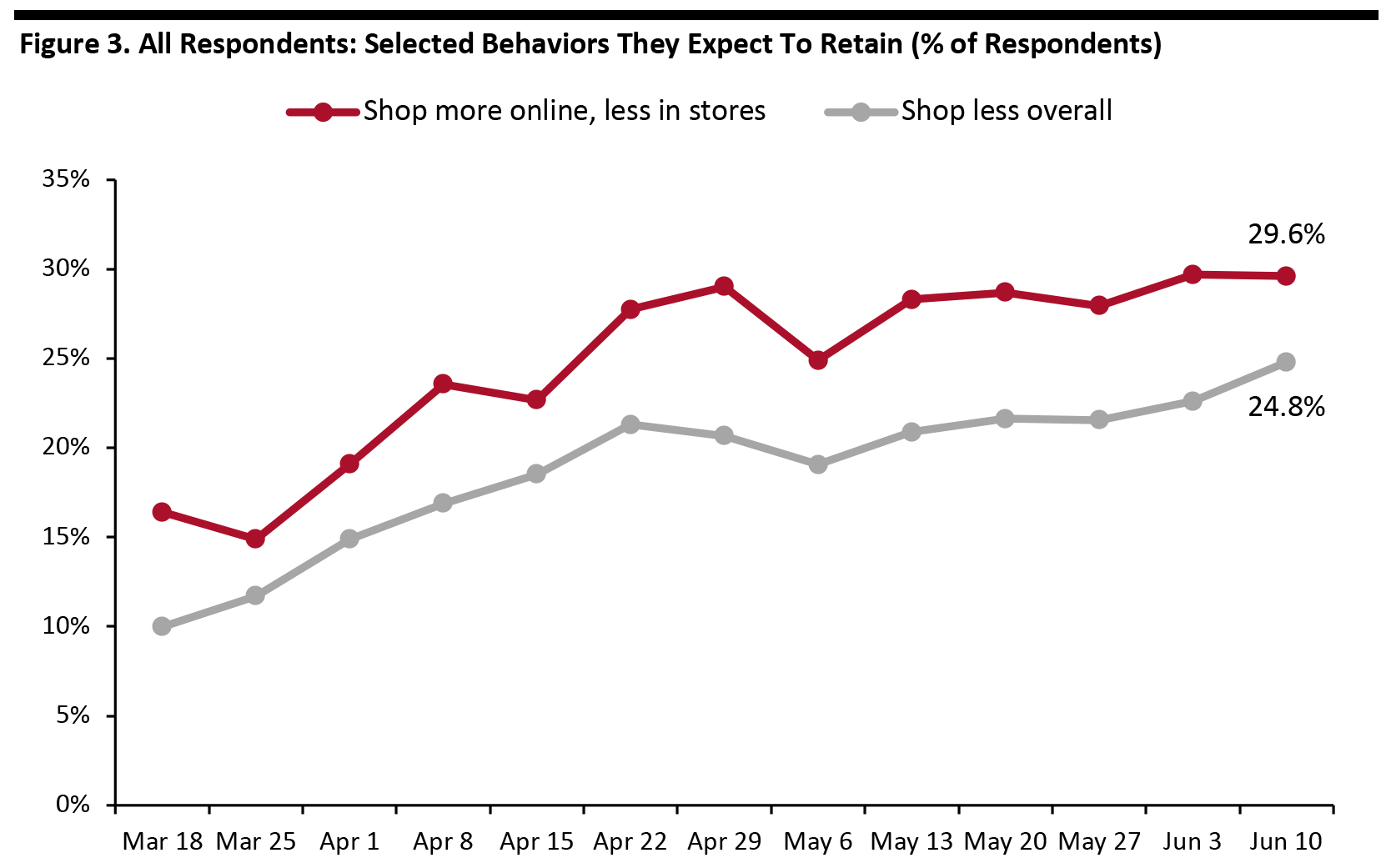

Source: Coresight Research [/caption] 3. Two-Thirds of Respondents Expect To Retain Changed Behaviors Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. Consistently, two-thirds of respondents expect to keep some behaviors over the long term. We have seen an overall upward trend in expectations to shop less overall. One-quarter of respondents expect to shop less overall, versus 22.6% last week. The proportion of respondents expecting to switch their shopping to the e-commerce channel remained stable at three in 10 this week. [caption id="attachment_111443" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

Source: Coresight Research [/caption]

Life Beyond Lockdown: Three Learnings

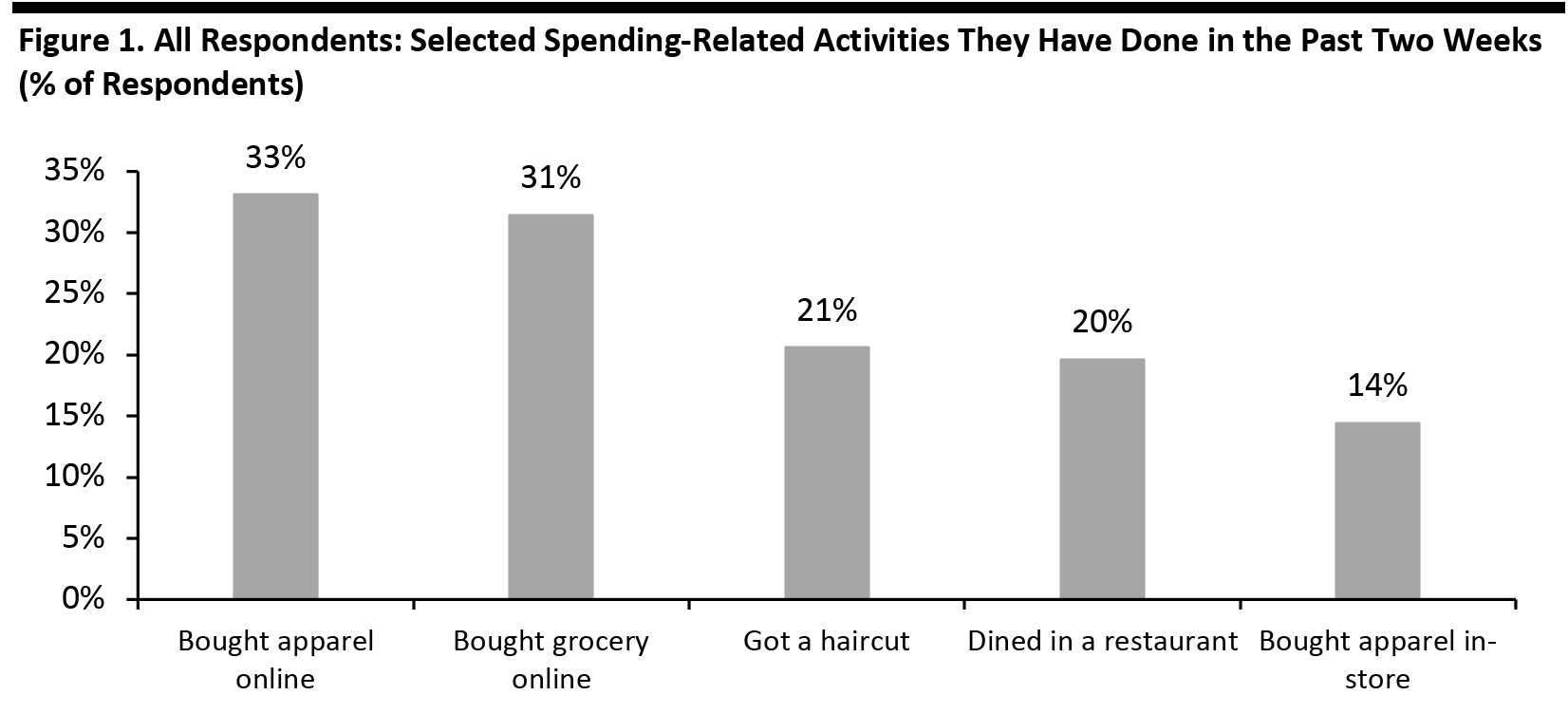

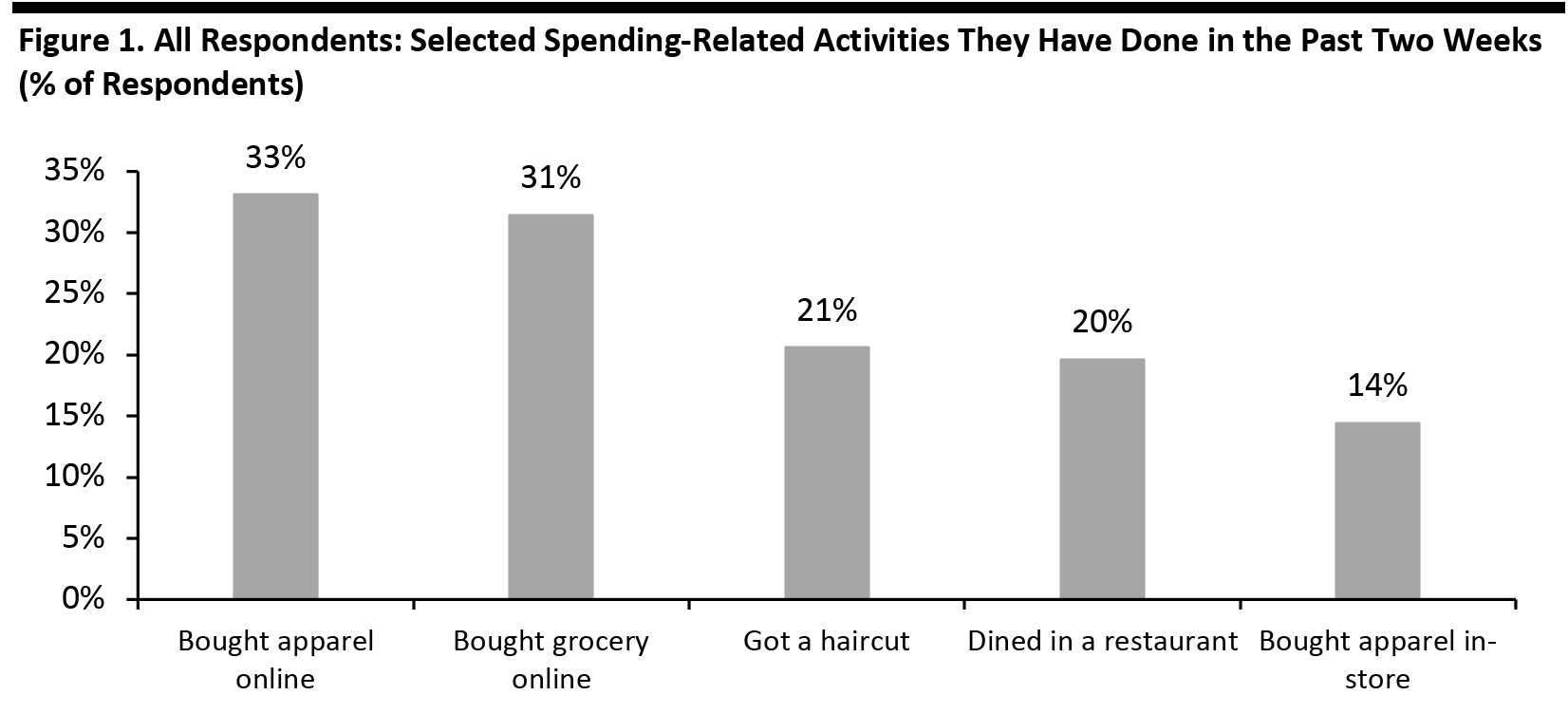

1. Consumers Are Selectively Returning to Regular Activities Post Lockdown This week, we asked what consumers have done in the past two weeks and what they expect to do in the next two weeks, providing them a choice of 16 options (as well as “none”). Among the activities specifically related to spending in the past two weeks, making online purchases of apparel was the top option, with one-third of all respondents stating that they have done so. This was followed by online grocery shopping, with a little less than one-third of consumers having done this in the past two weeks. For the next two weeks, more consumers expect to take part in 12 of the 16 activities we provided as options:- Getting a haircut overtakes purchasing apparel online as the top spending-related activity to do in the next two weeks.

- The absolute percentages remain low, suggesting that consumers are returning to their normal activities selectively and cautiously.

- More respondents expect to buy apparel in store in the next two weeks than bought in store in the last two weeks, while expectations of buying clothing and footwear online are lower than recent actual levels.

- See our full report for details of what consumers expect to do in the next two weeks.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 2. Less than Two-Thirds of Respondents Expect To Avoid Public Places after Lockdowns End Consumers’ concern about returning to public places eased after a slight increase last week: 65.3% of all respondents now anticipate avoiding some kind of public place or travel after lockdowns end, versus 68.3% last week. This week’s figure is the lowest proportion of respondents since we started asking the question. While the proportion of respondents expecting to avoid shops in general increased slightly this week, we have seen a declining trend in the expected avoidance of shopping centers/malls since the week of May 20. Some 43% of all consumers now expect to avoid shopping centers/malls. [caption id="attachment_111442" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 3. Two-Thirds of Respondents Expect To Retain Changed Behaviors Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. Consistently, two-thirds of respondents expect to keep some behaviors over the long term. We have seen an overall upward trend in expectations to shop less overall. One-quarter of respondents expect to shop less overall, versus 22.6% last week. The proportion of respondents expecting to switch their shopping to the e-commerce channel remained stable at three in 10 this week. [caption id="attachment_111443" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]