DIpil Das

We discuss selected findings and compare them to those from prior weeks: June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

Base: US Internet users aged 18+

Base: US Internet users aged 18+

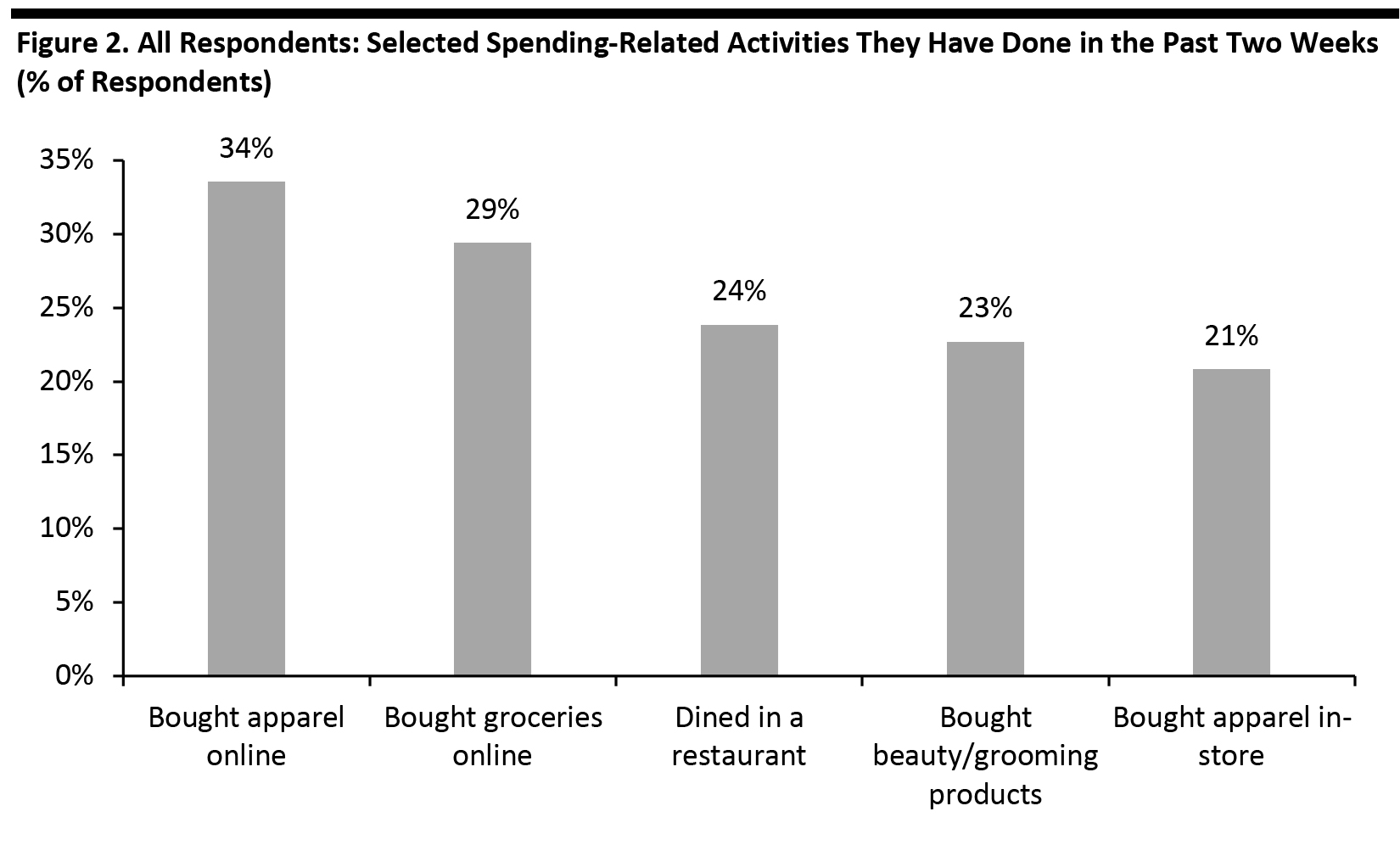

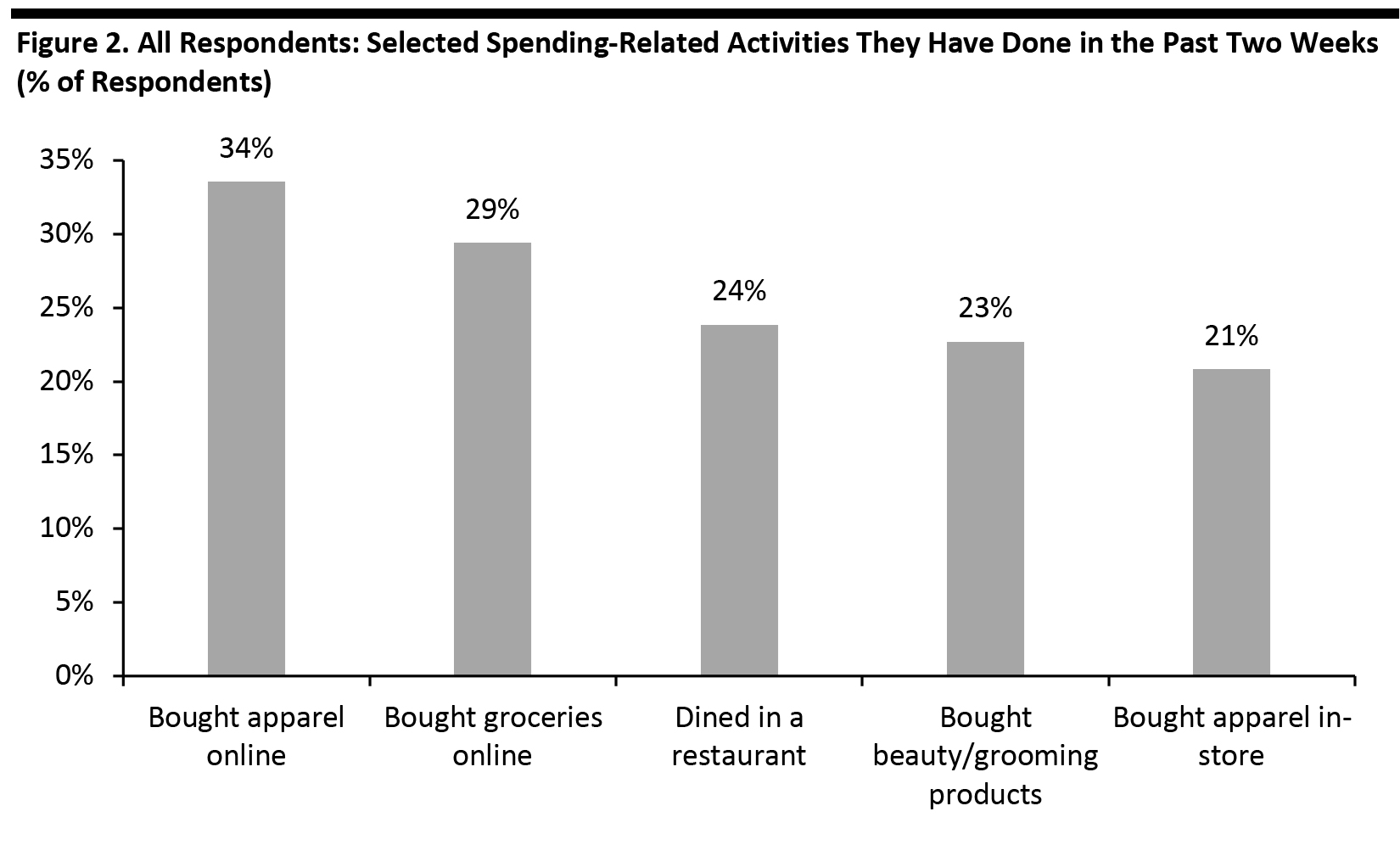

Source: Coresight Research [/caption] 2. Online Apparel Shopping Was the Top Spending Activity in the Past Two Weeks Among the activities specifically related to spending that respondents have done in the past two weeks, making online purchases of apparel remained the top option, with one-third of all respondents stating that they have done so—flat from the proportion we saw last week. Around one-fifth of respondents said they have bought apparel in a store in the past two weeks. Although this figure is lower than the number of consumers who bought apparel online, it represents a six-percentage-point increase week over week. Dining in a restaurant jumped into the top four activities that consumers have done in the past two weeks, with almost one-quarter reporting that they have done so, versus one-fifth when we asked the question last week. For the next two weeks, we noticed decreases in the proportion of consumers expecting to do shopping-related activities compared to actual behavior in the past two weeks. Base: US Internet users aged 18+

Base: US Internet users aged 18+

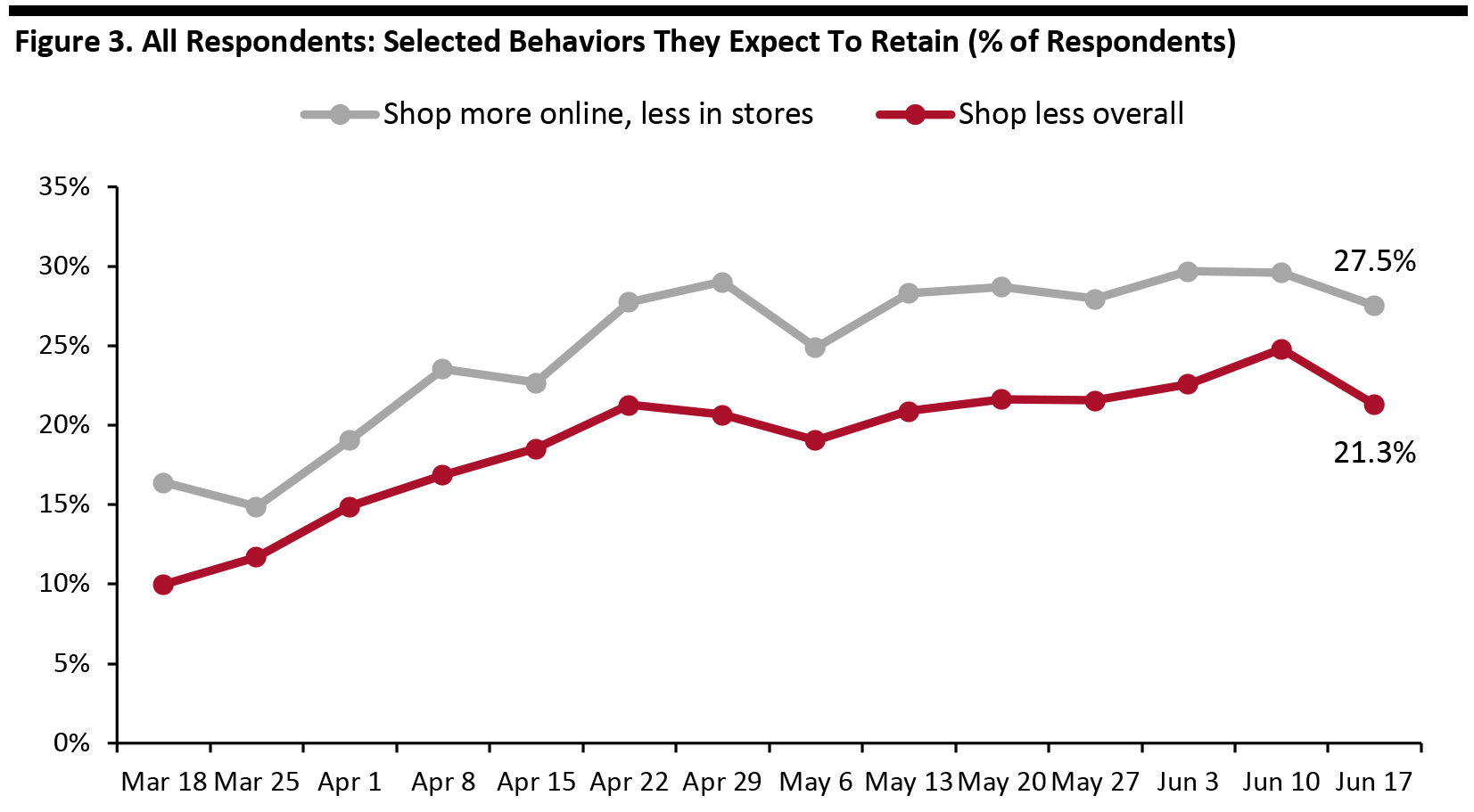

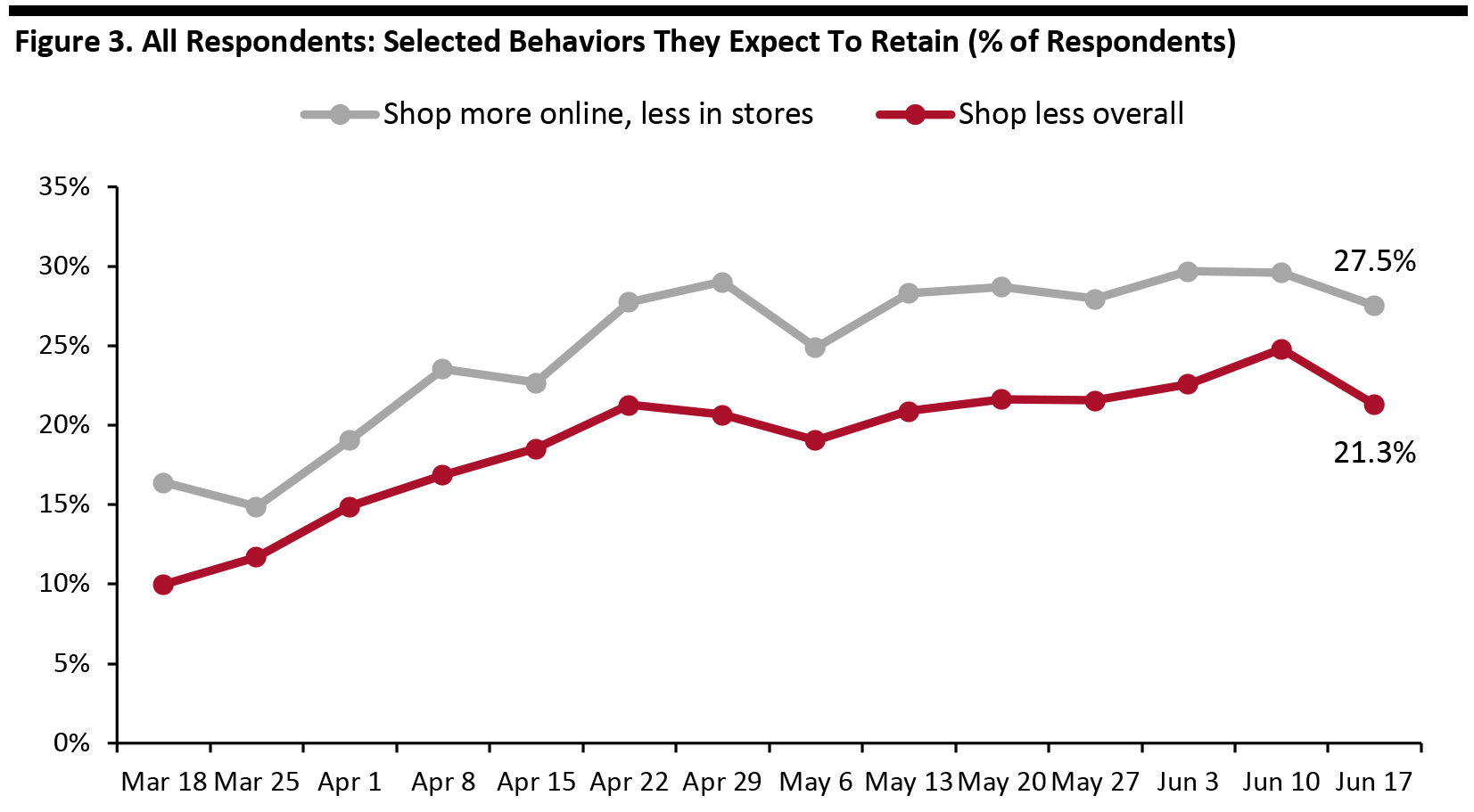

Source: Coresight Research [/caption] 3. Six in 10 Respondents Expect To Retain Changed Behaviors Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. This week, around six in 10 respondents expect to retain some changed behaviors over the long terms, down from two-thirds last week. We have seen consistent or near-consistent upward trends in expectations to focus more on health and wellbeing and wear masks/gloves in the past couple of weeks, with around one-third of respondents expecting to do each this week. In addition, we saw slight decreases in expectations to shop less overall and shop more online (although the changes are both within the margin of error). Around one-fifth of respondents expect to shop less overall, versus one-quarter last week. Some 27.5% of respondents expect to switch their shopping to the e-commerce channel, compared to one in three last week. [caption id="attachment_111841" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

Source: Coresight Research [/caption]

Life Beyond Lockdown: Three Learnings

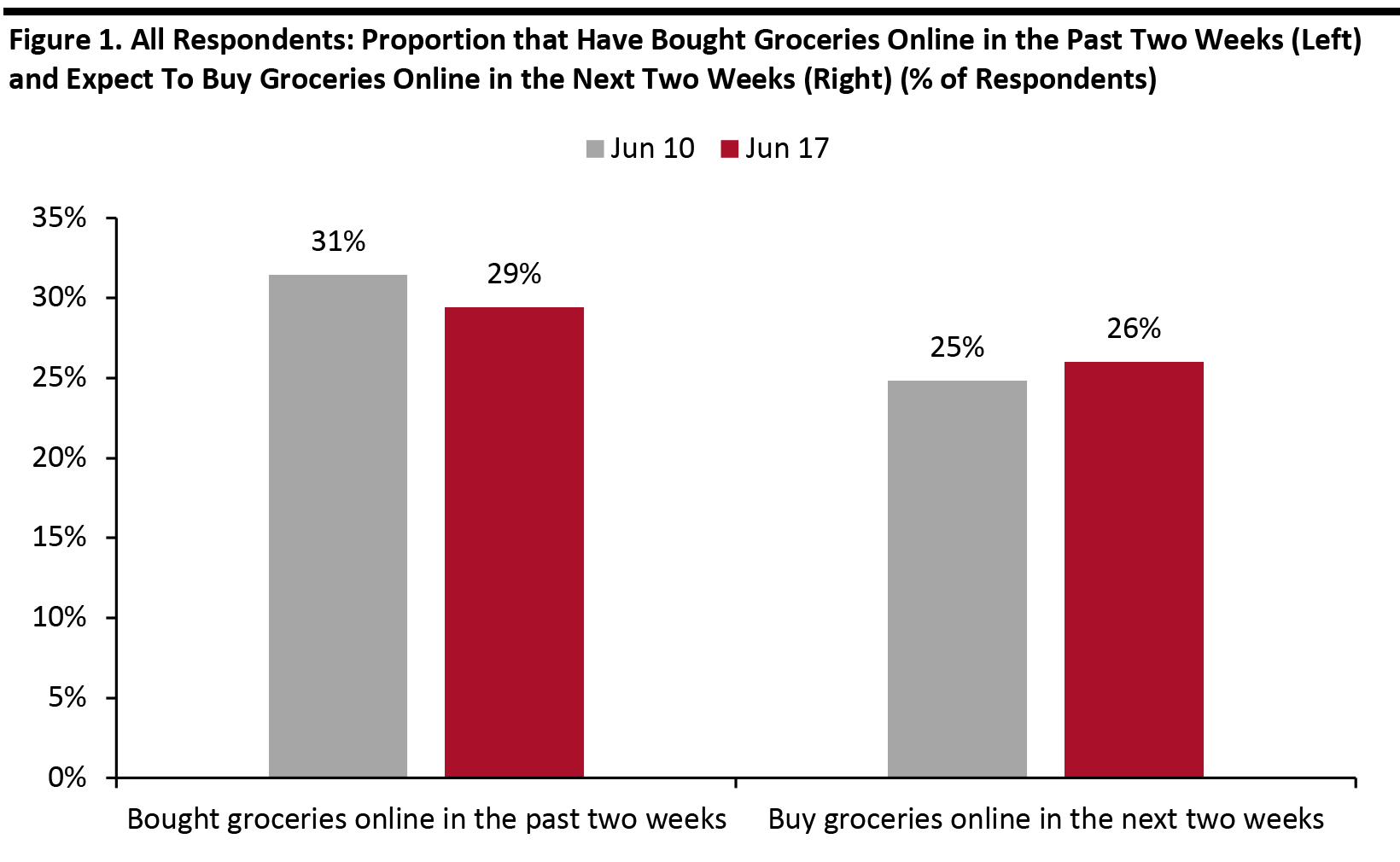

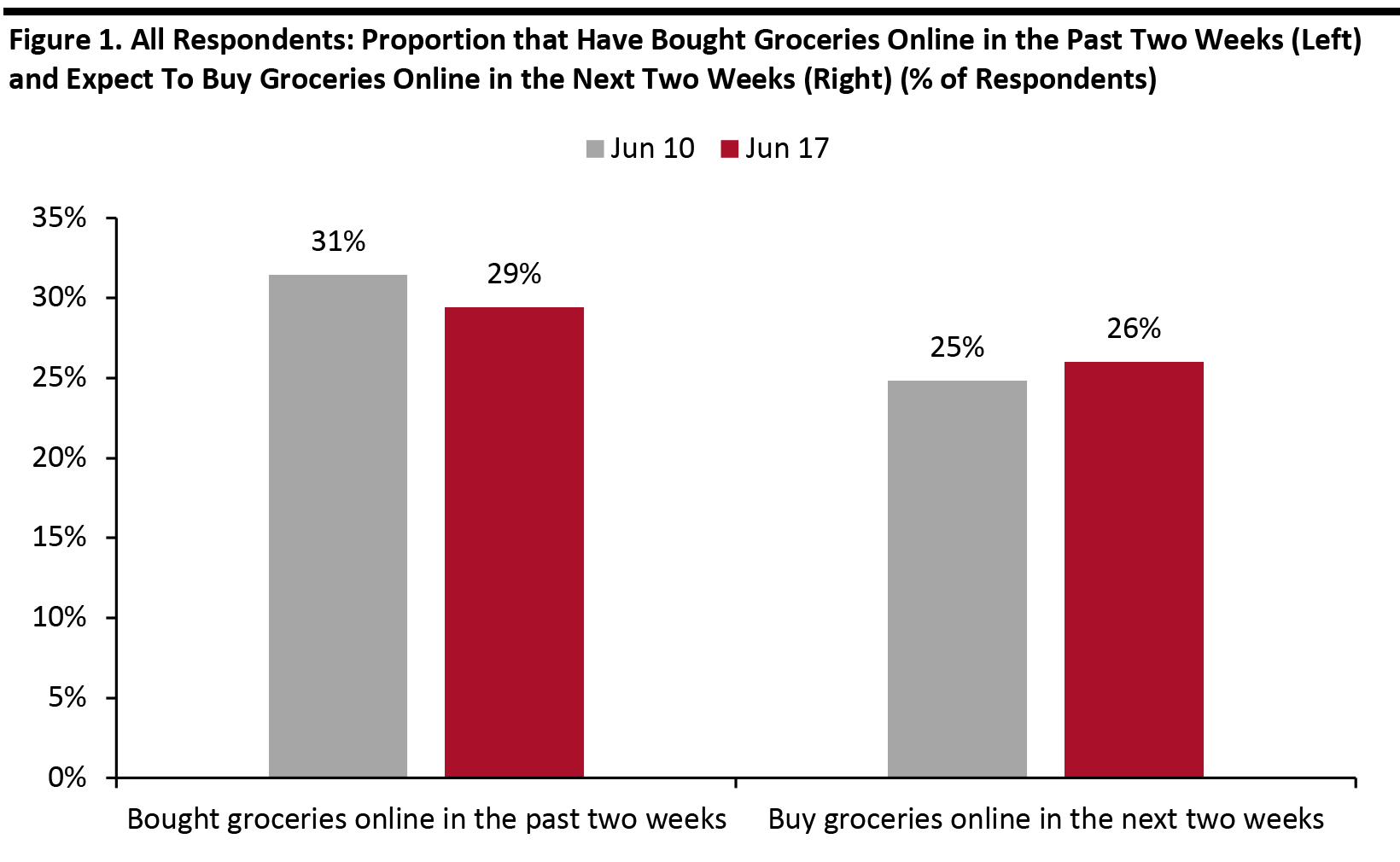

1. Online Grocery Is Past Its Peak The coronavirus has driven consumers to shift their grocery purchases to the online channel in recent months. This week, we saw signs of a slowdown in this trend. When we began asking what categories consumers are buying more of online in the beginning of April, among the respondents making more purchases online, roughly four in 10 were purchasing food online. The proportion has dropped by 10 percentage points, to around three in 10 this week. We also asked about consumers’ activities in the past two weeks and their expectations for the next two weeks: Online grocery shopping stayed in the top three options. However, we saw a week-over-week decline in the proportion of respondents who have bought groceries online in the past two weeks, from 31% to 29%. In addition, expectations of buying groceries online are down by around four percentage points versus actual behavior in the past two weeks (as shown in Figure 1). [caption id="attachment_111846" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 2. Online Apparel Shopping Was the Top Spending Activity in the Past Two Weeks Among the activities specifically related to spending that respondents have done in the past two weeks, making online purchases of apparel remained the top option, with one-third of all respondents stating that they have done so—flat from the proportion we saw last week. Around one-fifth of respondents said they have bought apparel in a store in the past two weeks. Although this figure is lower than the number of consumers who bought apparel online, it represents a six-percentage-point increase week over week. Dining in a restaurant jumped into the top four activities that consumers have done in the past two weeks, with almost one-quarter reporting that they have done so, versus one-fifth when we asked the question last week. For the next two weeks, we noticed decreases in the proportion of consumers expecting to do shopping-related activities compared to actual behavior in the past two weeks.

- Fewer respondents are expecting to buy apparel both online and in store in the next two weeks, with the proportion of respondents who expect to buy apparel online still higher than those who expect to buy in store.

- Buying beauty products and visiting an open-air shopping center also saw fewer consumers expect to do these activities in the upcoming two weeks than the proportion that had done them in the past two weeks.

- See our full report for a complete ranking of what consumers have done in the past two weeks and expect to do in the next two weeks.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 3. Six in 10 Respondents Expect To Retain Changed Behaviors Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. This week, around six in 10 respondents expect to retain some changed behaviors over the long terms, down from two-thirds last week. We have seen consistent or near-consistent upward trends in expectations to focus more on health and wellbeing and wear masks/gloves in the past couple of weeks, with around one-third of respondents expecting to do each this week. In addition, we saw slight decreases in expectations to shop less overall and shop more online (although the changes are both within the margin of error). Around one-fifth of respondents expect to shop less overall, versus one-quarter last week. Some 27.5% of respondents expect to switch their shopping to the e-commerce channel, compared to one in three last week. [caption id="attachment_111841" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]