DIpil Das

Introduction

This report presents the results of Coresight Research’s latest weekly survey of US consumers on the coronavirus outbreak, undertaken on June 17. This report explores the trends we are seeing from week to week, following prior surveys on June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.Online Grocery Is Past Its Peak

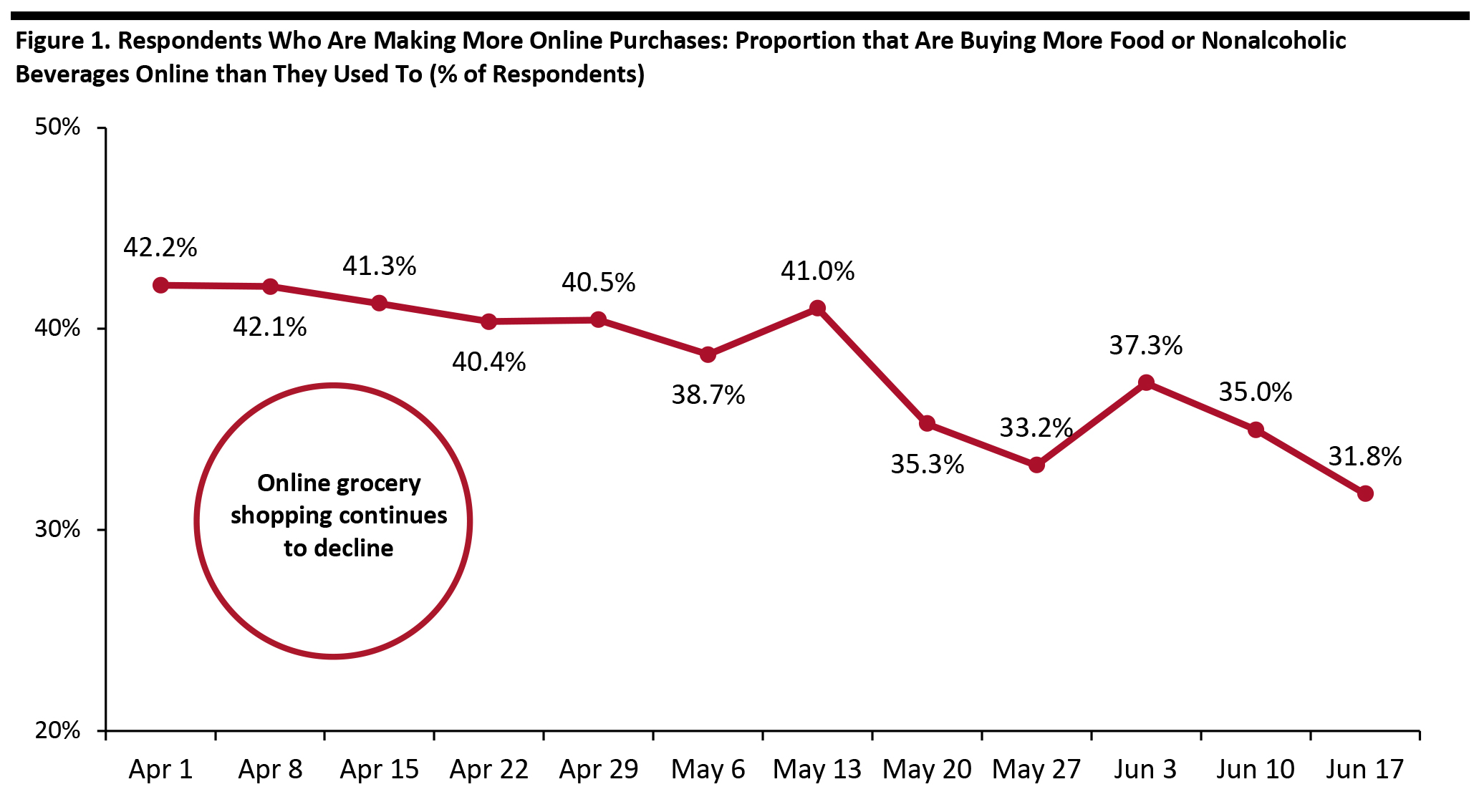

Online grocery has boomed in recent months, as lockdowns and fear of Covid-19 infection have driven consumers to shift their shopping online. We are now seeing signs that this trend is slowing, with a relatively steady downward trend in the proportion of respondents making more online purchases buying groceries through this channel. When we began asking what categories consumers are buying more of online in early April, among the respondents making more purchases online, 42.2% were purchasing food online. This proportion has fallen fairly consistently in subsequent weeks and hit 31.8% on June 17, the lowest since we began asking the question—representing around a 10-percentage-point decline. [caption id="attachment_111820" align="aligncenter" width="700"] Base: US Internet users aged 18+ who make more purchases online than they did before the coronavirus outbreak

Base: US Internet users aged 18+ who make more purchases online than they did before the coronavirus outbreak Source: Coresight Research [/caption] We also asked consumers what they have done in the past two weeks and what they expect to do in the next two weeks:

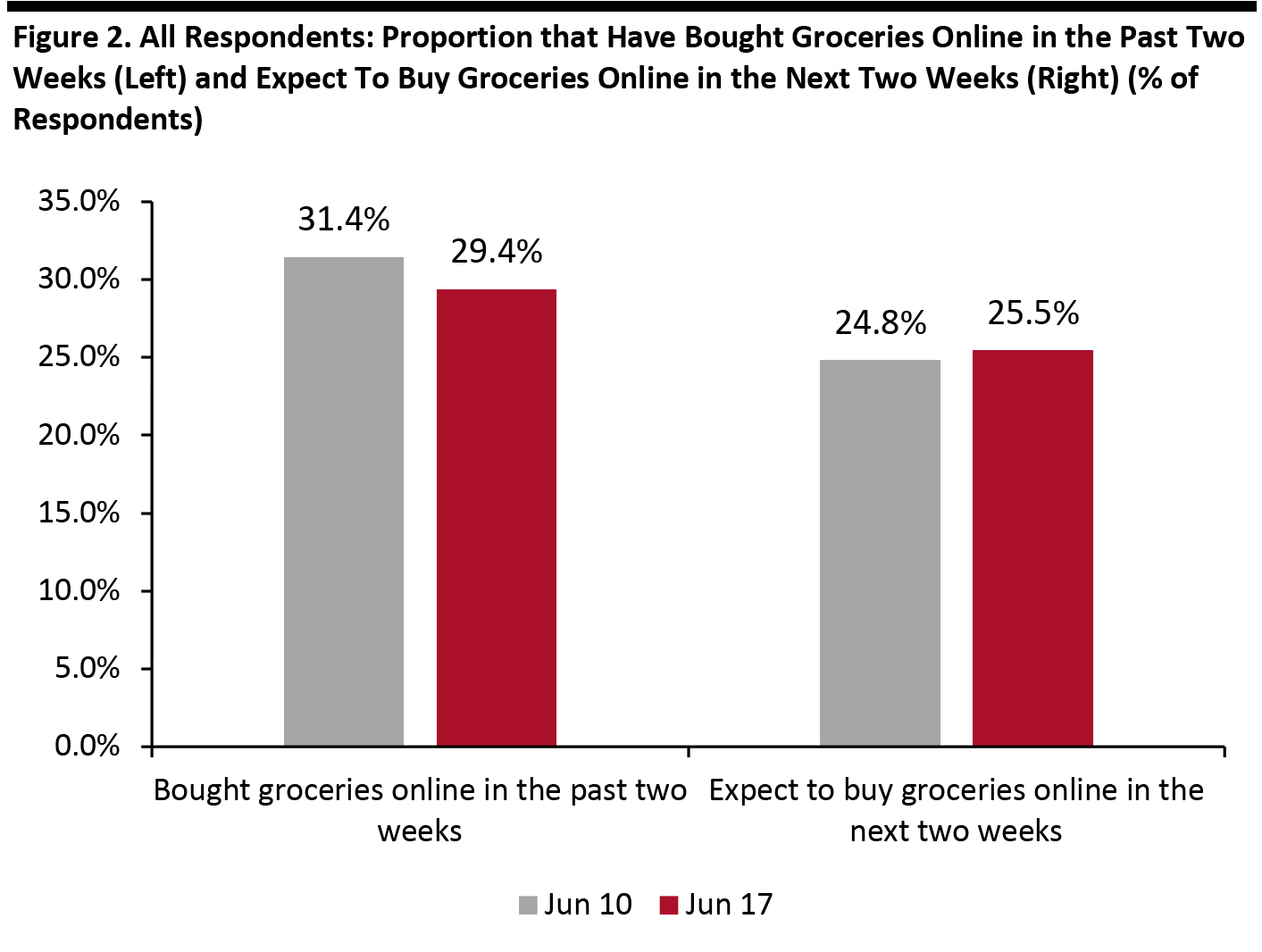

- Aligning with last week’s findings, online grocery shopping ranked the second highest in the spending-related activities that respondents had undertaken in the past two weeks—and the number-one activity that they expect to do in the next two weeks.

- However, we saw a week-over-week decline in the proportion of respondents who have bought groceries online in the past two weeks, from 31.4% to 29.4%—reinforcing that online grocery is past its peak.

- Furthermore, expectations of buying groceries online in the next two weeks are around four percentage points lower than actual behavior in the past two weeks (as shown in Figure 2).

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

Life Beyond Lockdown

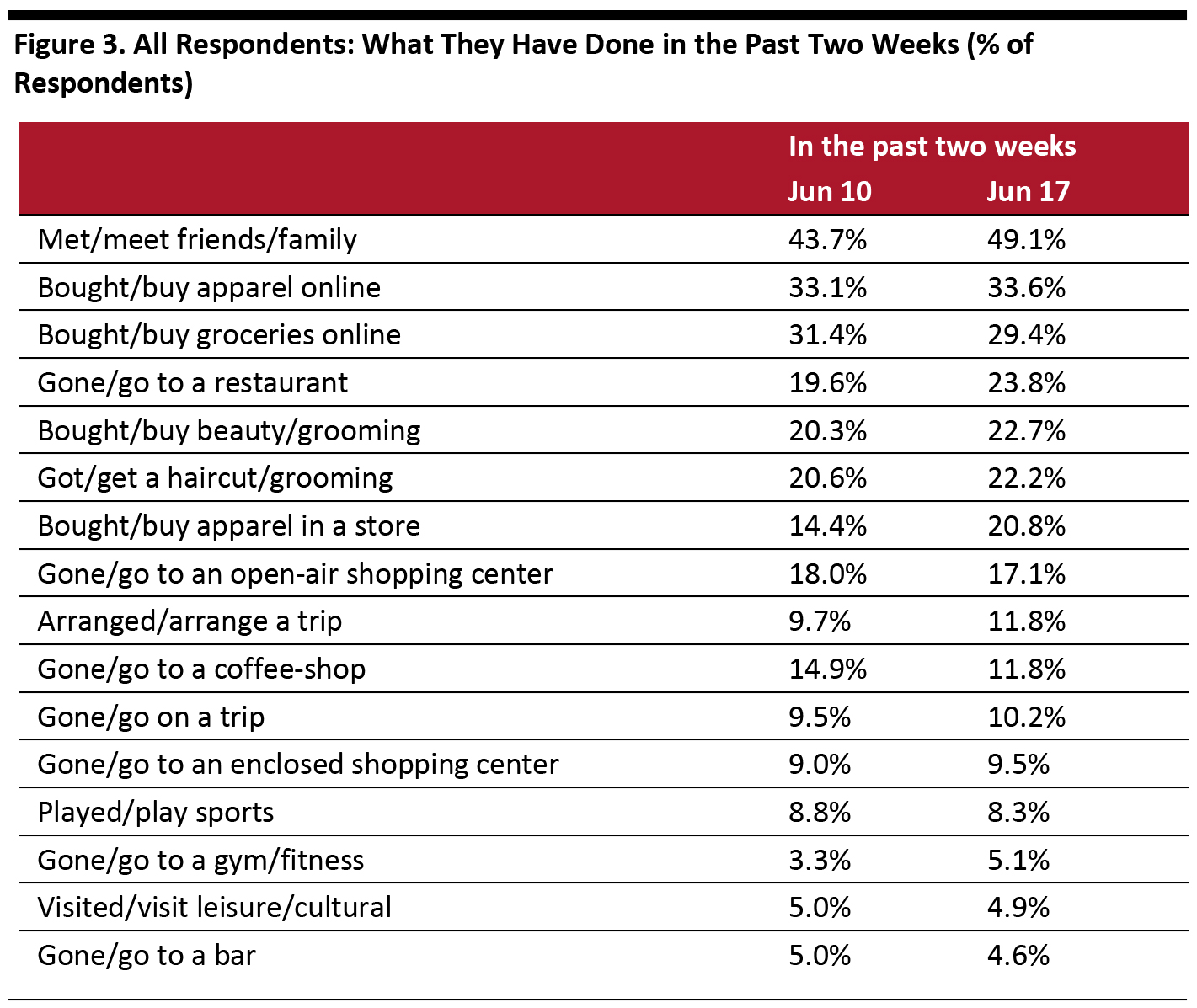

Online Apparel Shopping Was the Top Spending Activity in the Past Two Weeks We saw increases in the proportion of respondents for 10 of the 16 options we provided for activities done in the past two weeks. Among the activities specifically related to spending, making online purchases of apparel was again the top option, with one-third of all respondents saying they have done so in the past two weeks. The proportion of respondents who have bought apparel in store in the previous two weeks, though still lower than the online figure, increased to 20.8% from 14.4% last week. Dining in a restaurant jumped into the top four activities that consumers have done in the past two weeks, with almost one-quarter reporting that they have done so, versus one-fifth when we asked the question last week. [caption id="attachment_111822" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

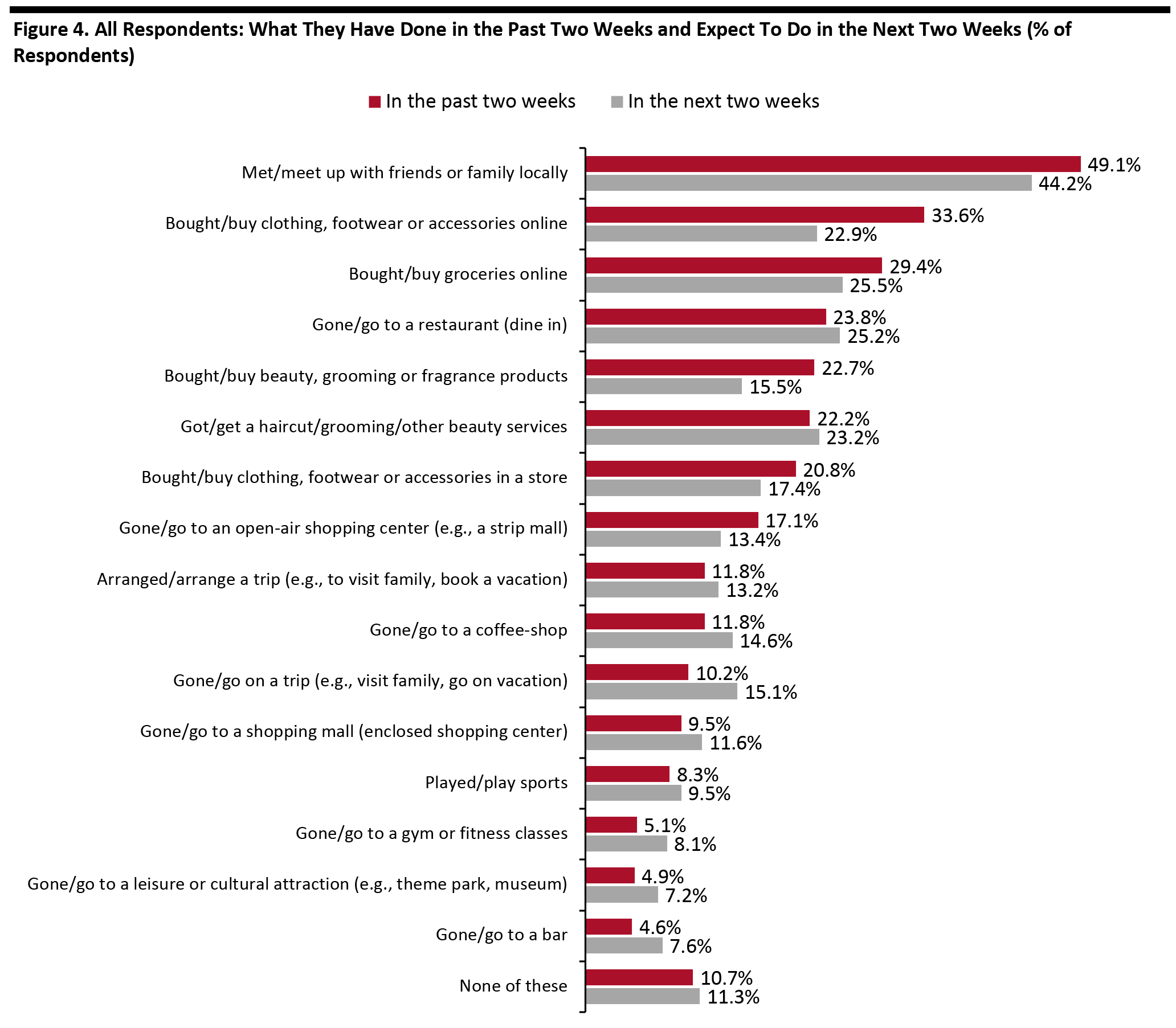

Source: Coresight Research [/caption] Fewer Consumers Expect To Do Shopping-Related Activities in the Next Two Weeks For the next two weeks, we recorded lower levels for expectations to do shopping-related activities than for actual behavior in the past two weeks—although consumers often may not fully know what they will do in the next two weeks.

- Fewer respondents are expecting to buy apparel in the next two weeks: 22.9% stated that they would buy those online—10.6 percentage points lower than actual behavior in the past two weeks, and 17.4% said they would buy those in store, down from 20.8% of those who have done so in the previous two weeks.

- Fewer respondents also expect to buy beauty products and visit an open-air shopping center in the next two weeks than the number of respondents that had done these activities over the prior two weeks. One in six expect to buy beauty products, while 22.7% had done so in the last two weeks.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

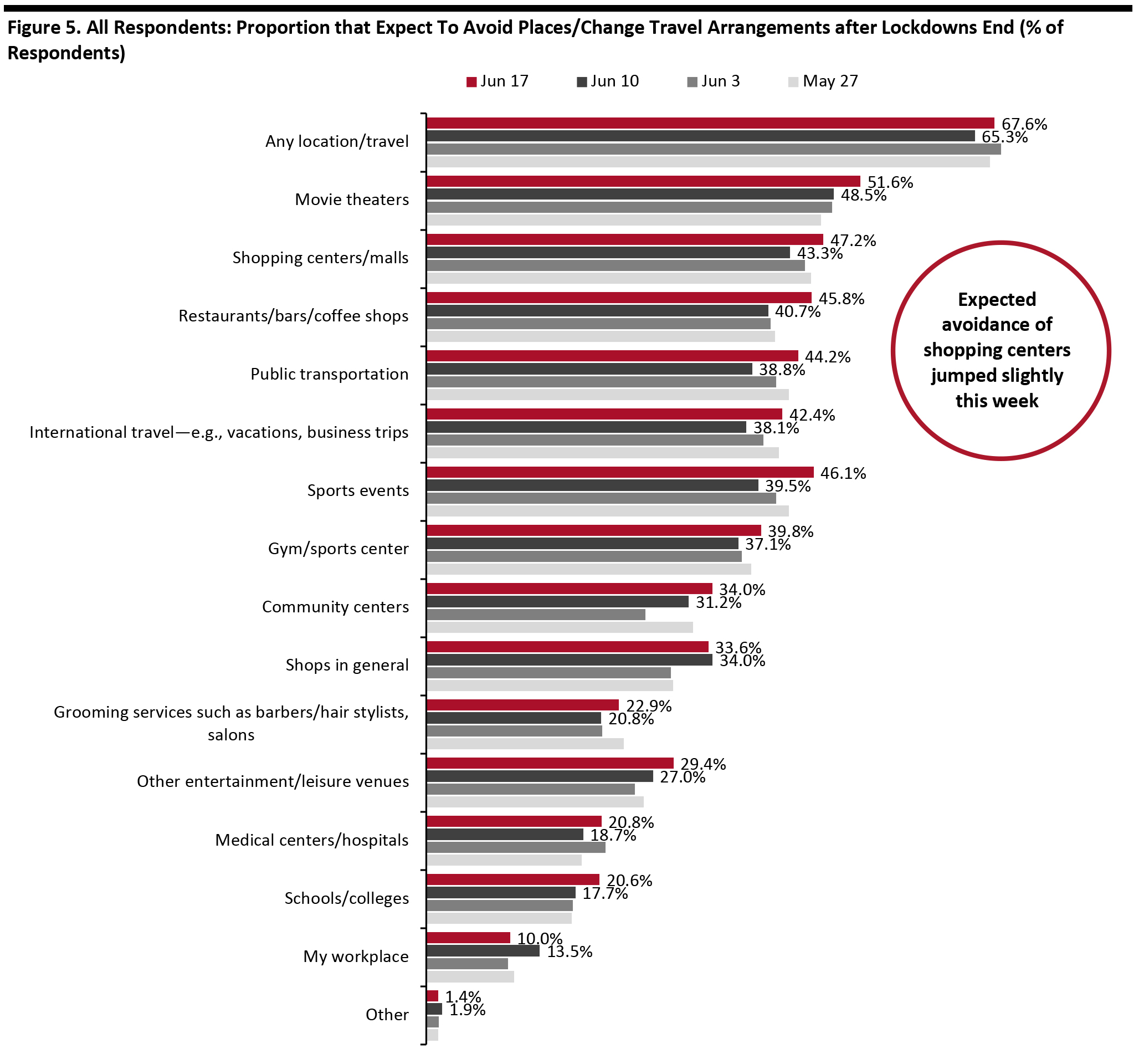

Source: Coresight Research [/caption] A Little Under Half of Consumers Expect To Avoid Shopping Centers Consumers’ concerns about returning to public places increased a little after reaching a new low last week: 67.6% of all respondents now anticipate avoiding some kind of public place or travel after lockdowns end, versus 65.3% last week and 68.3% two weeks ago. We saw increases of avoidance in most of the 14 options we provided, although most are within the margin of error. Expected avoidance of shopping centers/malls raised slightly this week following a declining trend in the past three weeks. Some 47.2% of respondents now expect to avoid shopping centers/malls, versus 43.3% last week. Expected avoidance of dining locations also increased after continued dips in the past couple of weeks. [caption id="attachment_111824" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

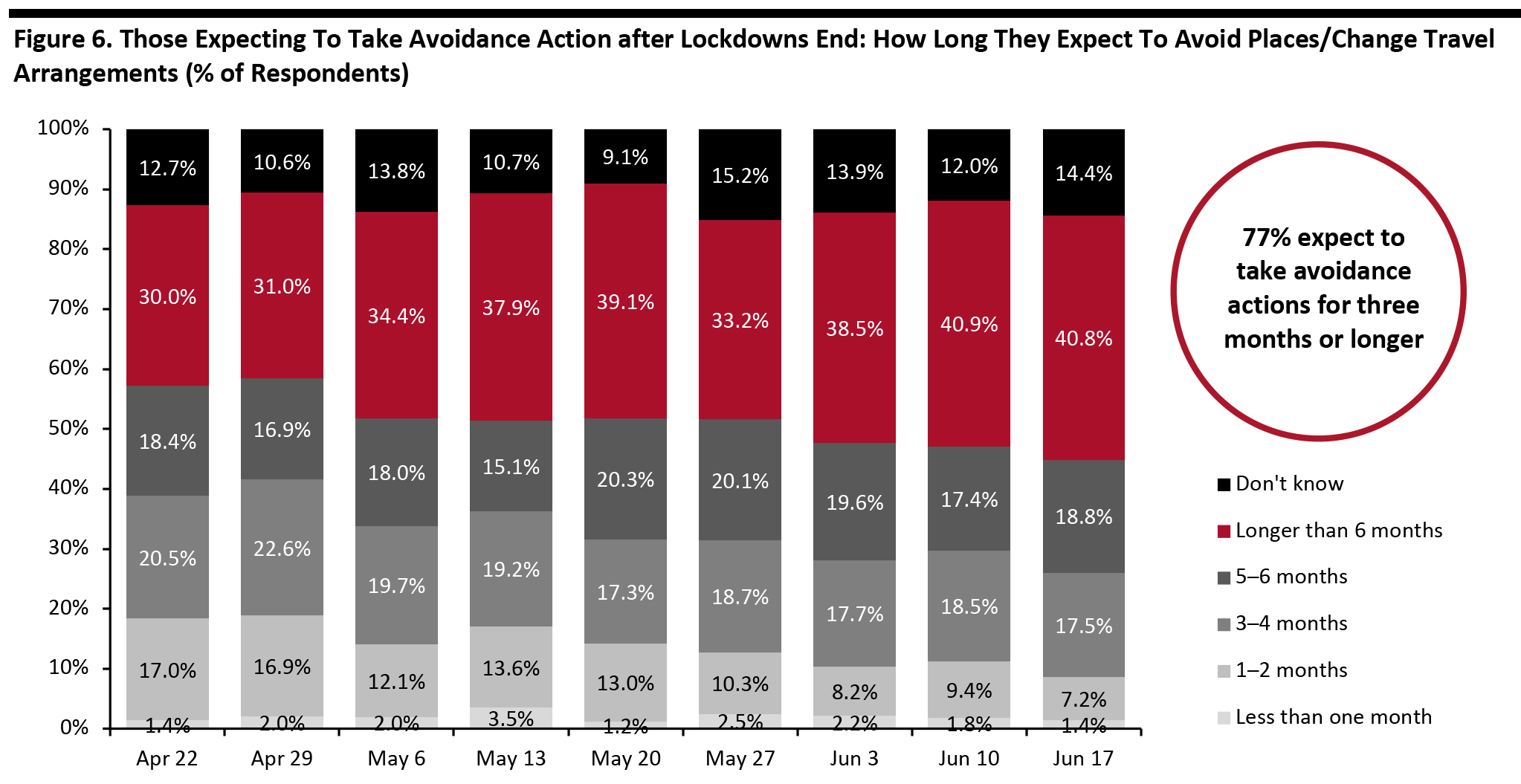

Source: Coresight Research [/caption] Four in 10 Expect To Avoid Public Places for More than Six Months Avoidance actions over the long term remained stable this week. Among respondents expecting to avoid public places or travel after lockdowns end, 40.8% expect to do so for more than six months. This suggests that consumers’ avoidance actions would continue until at least the end of this year. Once again, the proportion of respondents expecting to avoid public places for less than one month was minimal, aligning with the low expected rates of return to regular activities in the next two weeks, shown previously. A total of 77.1% of respondents expect to avoid places for three months or more, slightly up from 76.8% last week. [caption id="attachment_111825" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who expect to avoid places/change travel arrangements after lockdowns end

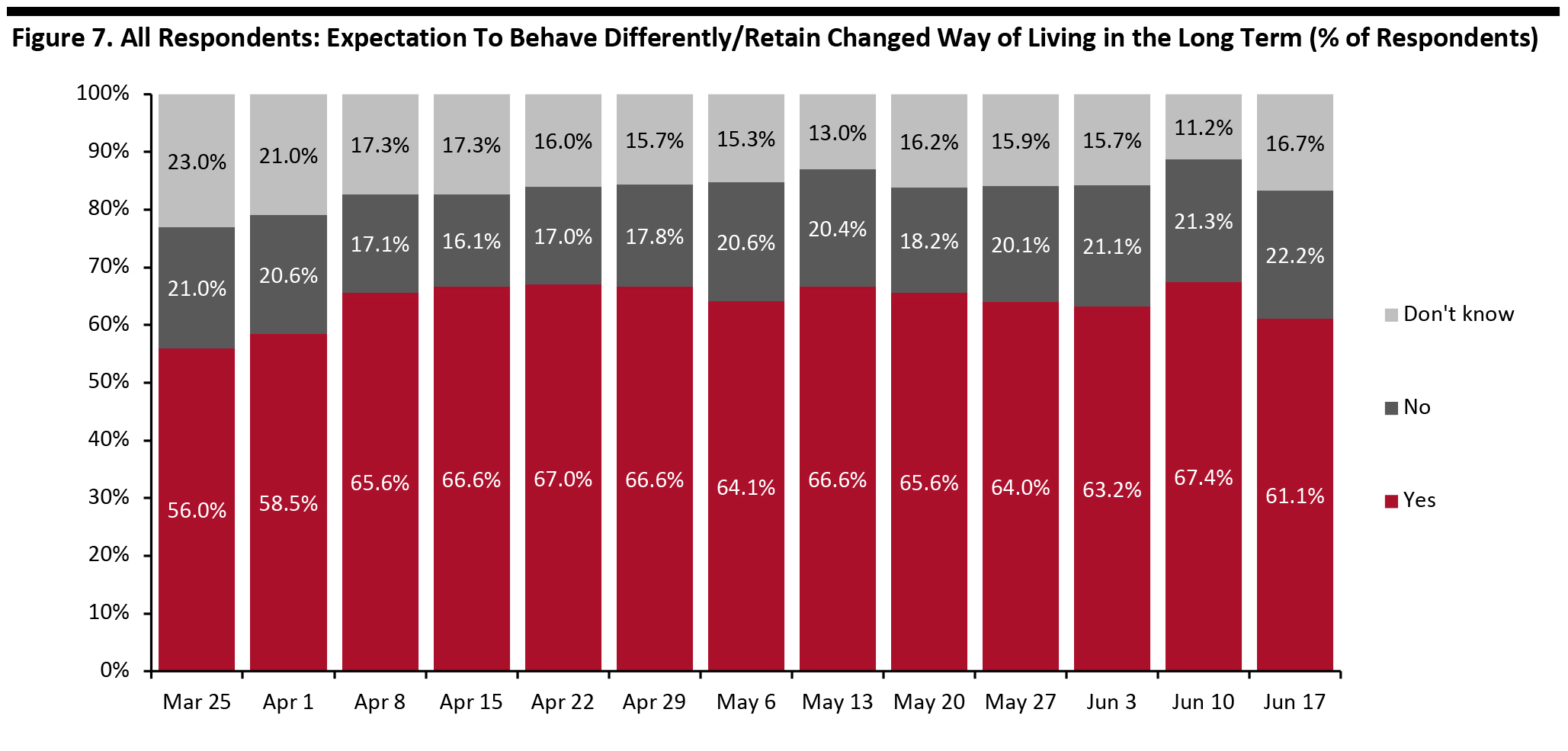

Base: US Internet users aged 18+ who expect to avoid places/change travel arrangements after lockdowns end Source: Coresight Research [/caption] Six in 10 Expect To Retain Changed Behaviors over the Long Term Each week, we ask respondents whether they think they will keep some of the behaviors they have adopted during the coronavirus crisis. This week, some 61.1% of respondents expect to retain some changed behaviors over the long term, down from 67.4% in last week. Although just a one-week change, the six-percentage-point decline could hint that US consumers are now slightly more willing to return to their normal life than they used to be. [caption id="attachment_111826" align="aligncenter" width="700"]

Base: US Internet users aged 18+

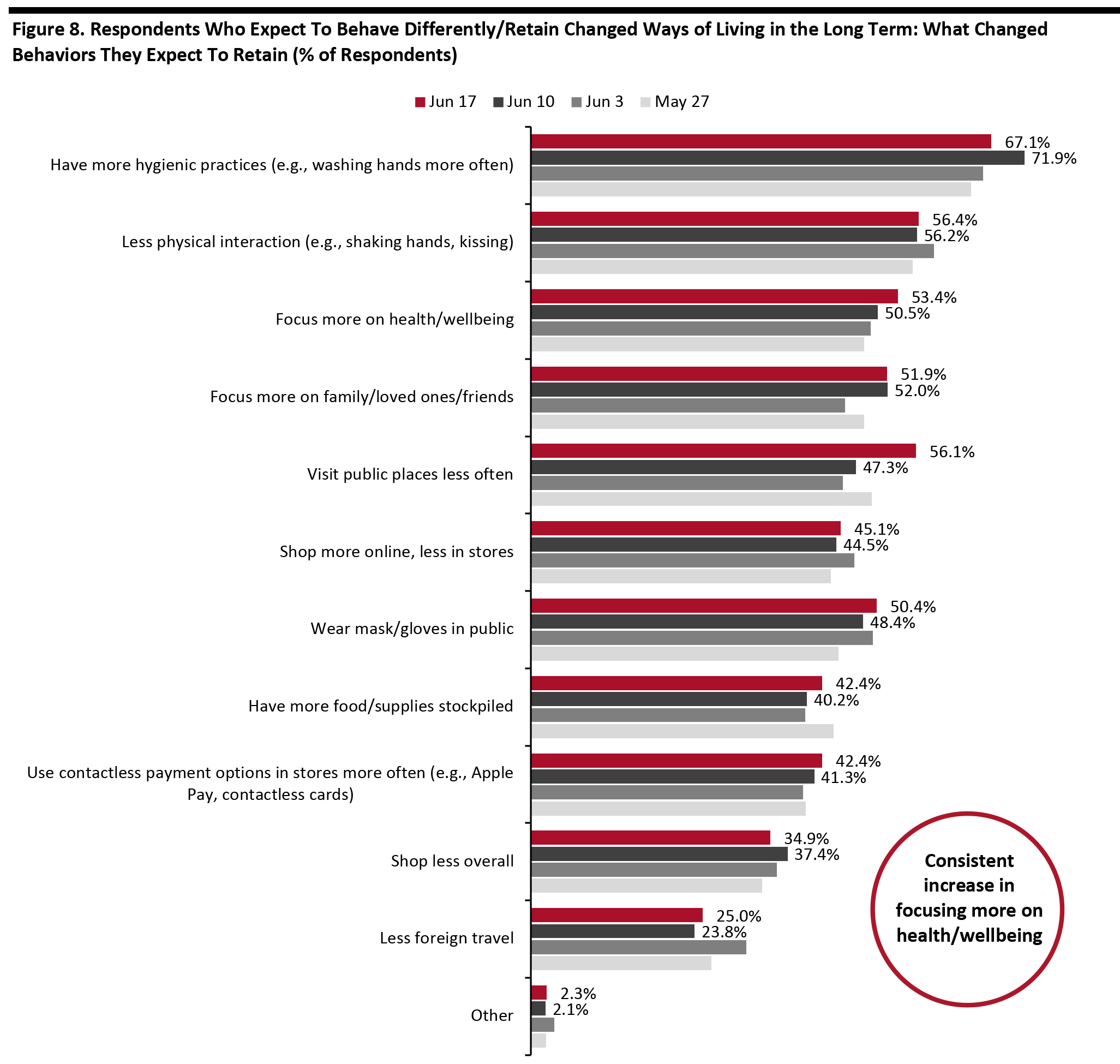

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Among those expecting to retain changed behaviors, we have seen a consistent upward trend over the past couple of weeks in expectations to focus more on health and wellbeing, with over half expecting to retain such behavior this week. We also have witnessed a near-consistent upward trend in the proportion of respondents expecting to wear masks/gloves since we started asking the question. Half of respondents expect to do so in the long term, up 10 percentage points from 40.6% from the May 6 survey. The proportion of respondents expecting to use contactless payment options in stores more often than they did previously remained at around four in 10—representing stability since we asked the question three weeks ago. [caption id="attachment_111827" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

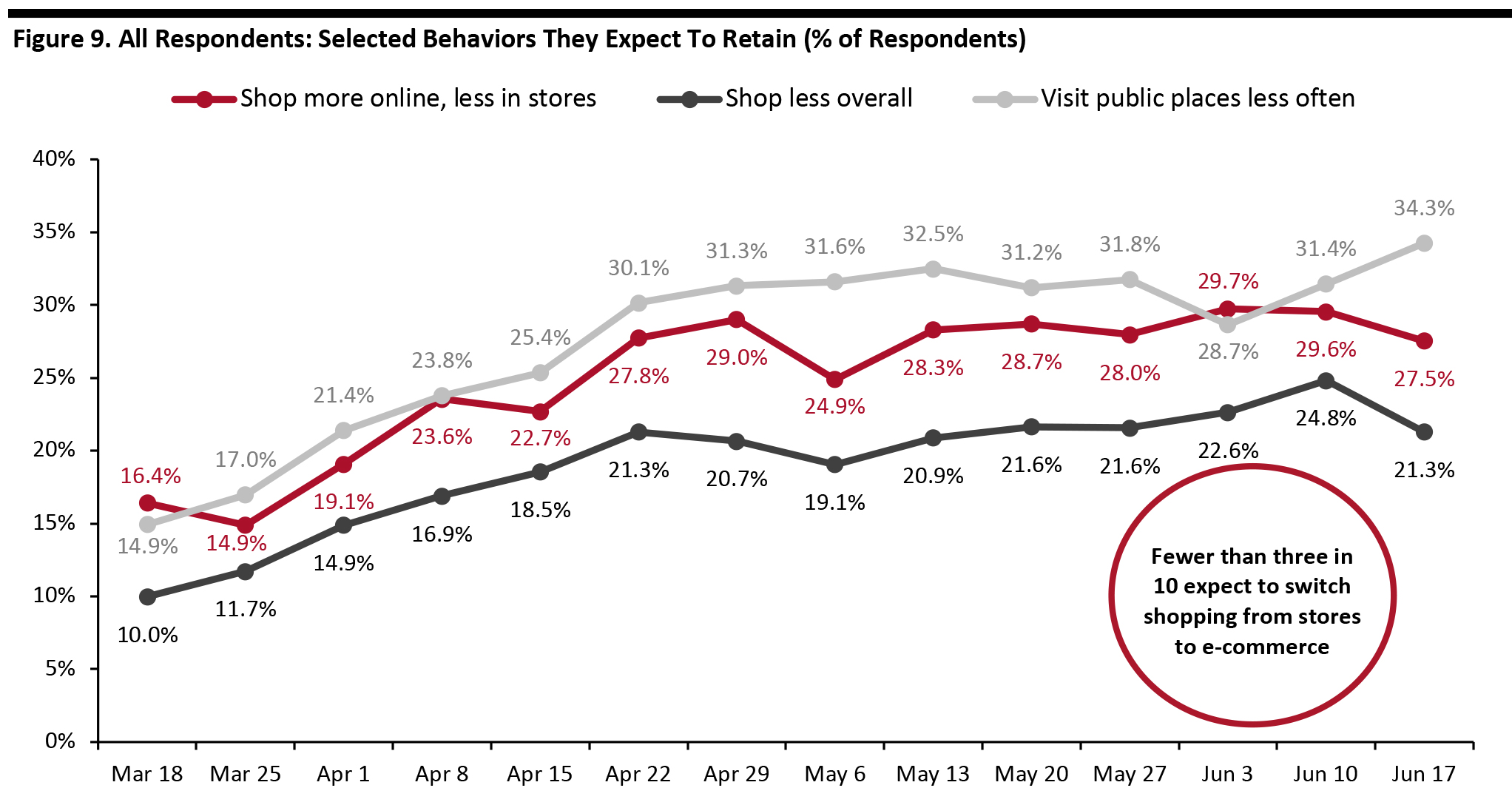

Source: Coresight Research [/caption] In the chart below, we focus on trending data in three of the metrics charted above. We represent these as a proportion of all respondents, to represent consumers overall, rather than as a proportion of those expecting to retain changed behaviors (which is what is charted above). Rebased to all respondents, we saw slight decreases in expectations to shop less overall and shop more online (albeit changes are both within the margin of error). Some 21.3% of respondents expect to shop less overall, versus one-quarter last week. Some 27.5% of respondents expect to switch their shopping to the e-commerce channel, compared to three in 10 last week. The proportion of respondents expecting to visit public places less often continue to jump after an increase last week. Some 34.3% expect to do so, compared to 31.4% last week. [caption id="attachment_111828" align="aligncenter" width="700"]

Base: US Internet users aged 18+

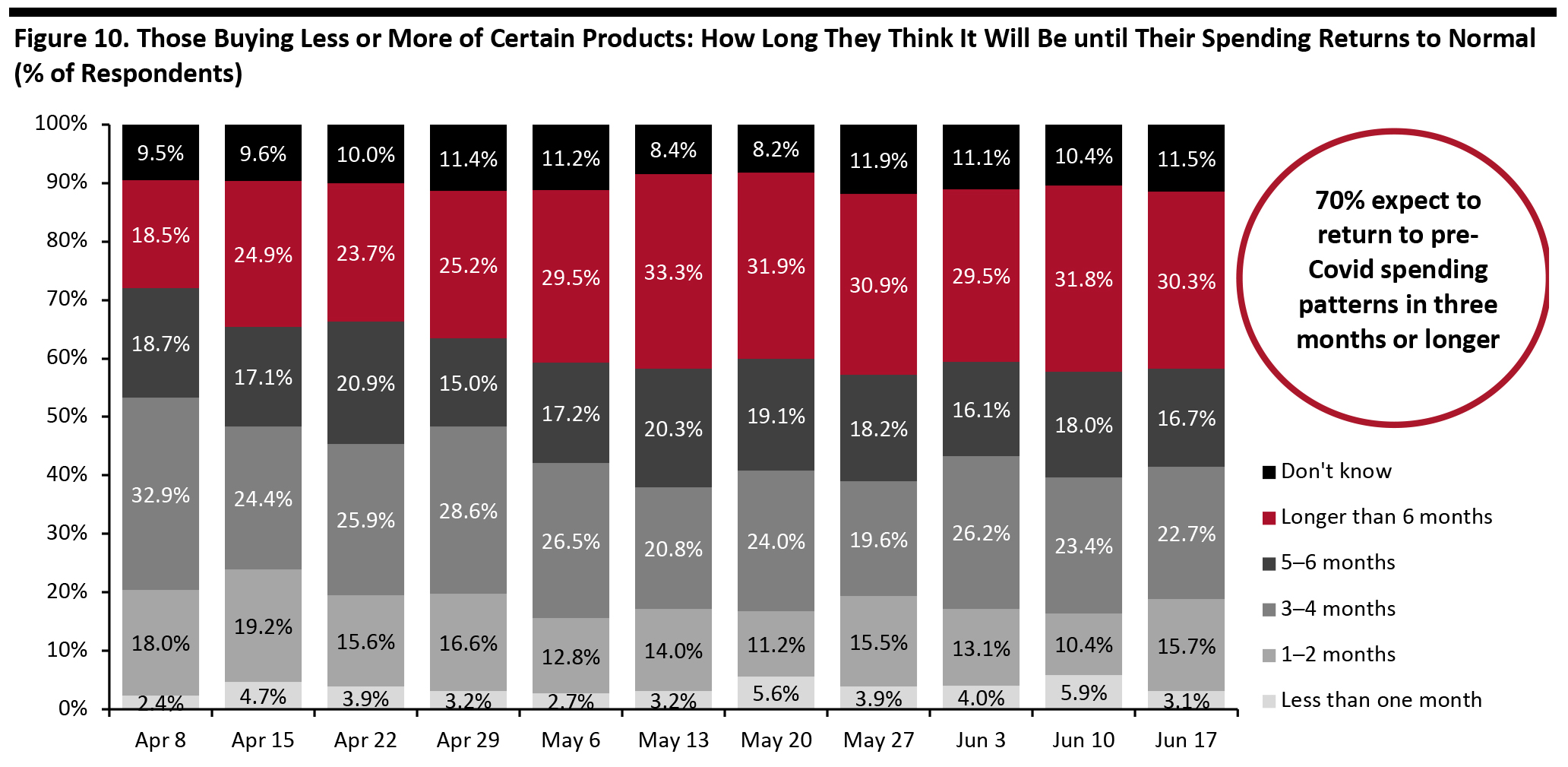

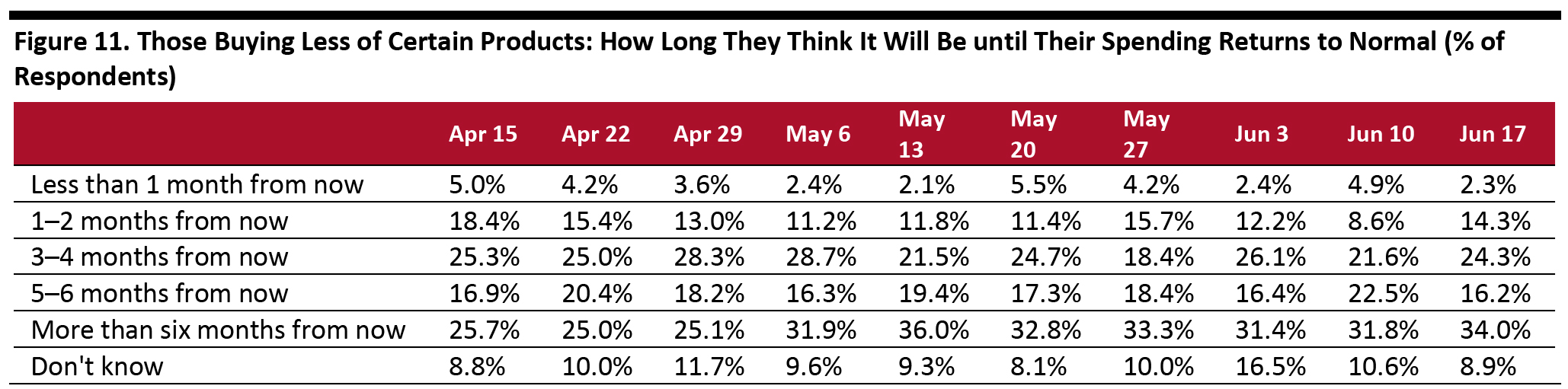

Base: US Internet users aged 18+ Source: Coresight Research [/caption] A Little Below One-Third Expect To Retain Changed Spending Patterns for More than Six Months This week, we saw a slight moderation in the proportion of respondents anticipating longer-term impacts on their spending. Among consumers who have changed their spending levels—by buying more or less of any categories—30.3% expect it to be more than six months from now before their spending patterns return to normal, versus 31.8% last week and 29.5% the week before that (although these changes are both within the margin of error). Focusing only on those buying less of any category, 34.0% expect to return to pre-crisis spending patterns only in more than six months’ time, versus 31.8% last week and 31.4% the week before (Figure 11). A six-month-plus window now takes us up to of the later half of December at the earliest—well into the holiday season, suggesting that weakness in consumer demand could persist into the most crucial period of the year for retailers. A total of 69.7% of respondents expect to keep their changed purchasing behaviors for three months or more, down from 73.2% last week. We saw more people expect to return their spending to normal in one to two months compared to last week.

- We show what consumers are buying more of and less of in a separate section later in this report.

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak Source: Coresight Research [/caption] [caption id="attachment_111830" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who are purchasing any products less, because of the coronavirus outbreak Totals may not sum due to rounding

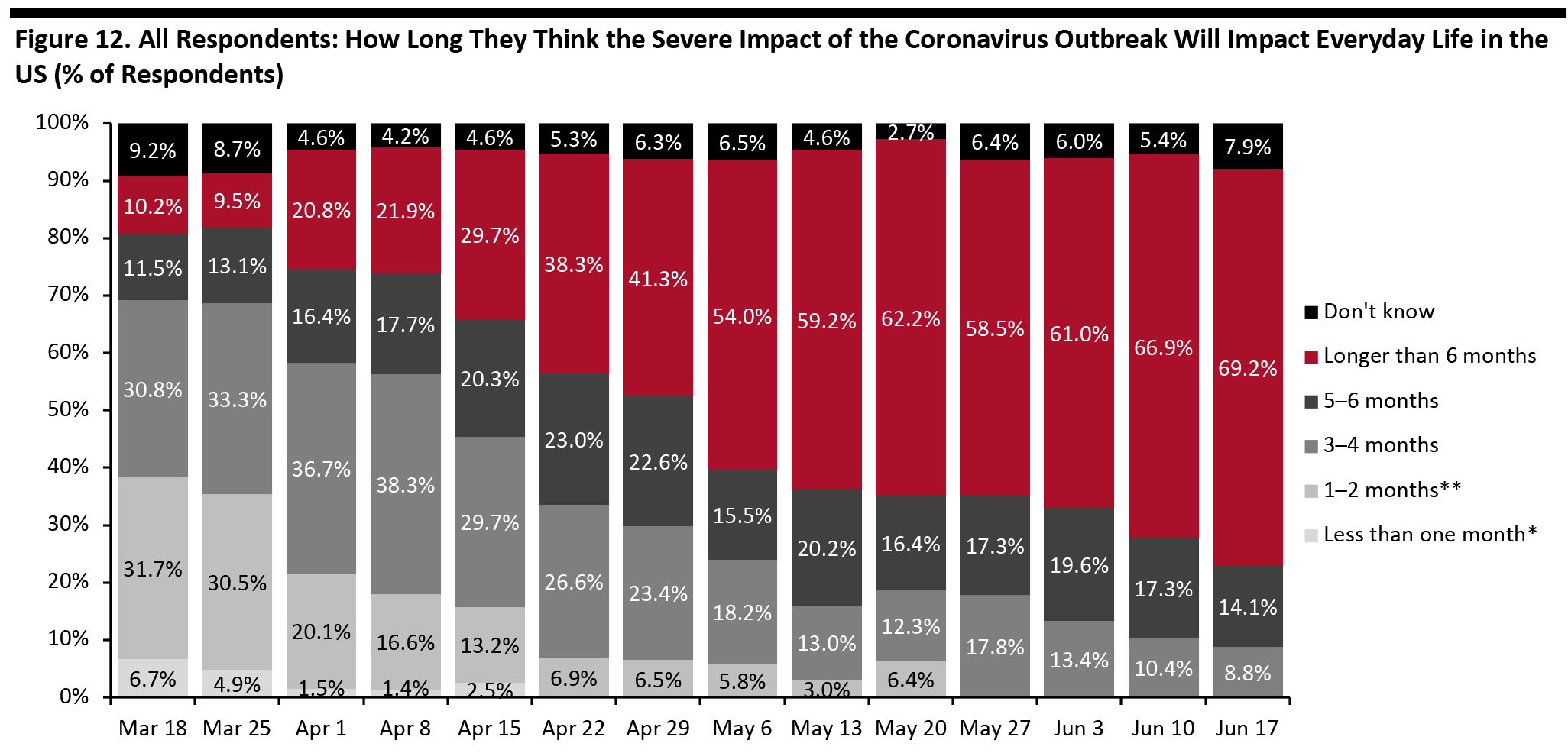

Base: US Internet users aged 18+ who are purchasing any products less, because of the coronavirus outbreak Totals may not sum due to rounding Source: Coresight Research [/caption] One in Seven Consumers Expect the Crisis To Last More than Six Months Consumers’ concern about the long-term impact of the crisis shows no signs of easing. This week, consumers’ expectations of the length of the crisis continued to rise after the increases in the past couple of weeks. Fully 69.2% now expect the severe impact of the outbreak to last more than six months from its start, up from 66.9% last week. As we are now three months since the crisis began, the proportion of respondents expecting the severe impact to last three months or more remained high at 92.1%, although it decreased slightly from 94.6% in last week. [caption id="attachment_111831" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ *Not provided as an option after April 15

**Not provided as an option after May 20

Source: Coresight Research [/caption]

Reviewing Trend Data in Purchasing Behavior

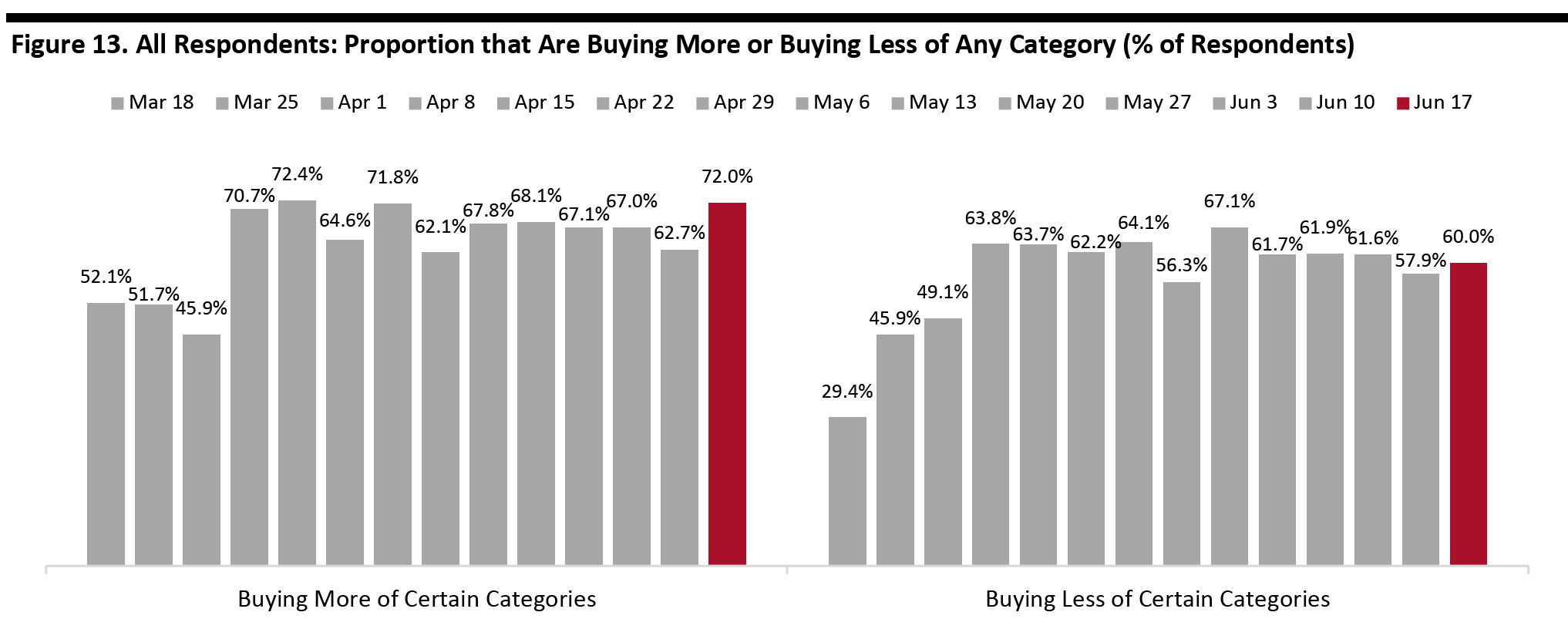

What They Are Buying More Of and Less Of This week, we noticed a surge of almost 10 percentage points in the proportion of respondents buying more of any category, to 72.0% from 62.7% last week. Those buying less remained relatively stable at 60.0% this week, versus 57.9% last week.- Note, buying more of certain categories and buying less of certain categories were not mutually exclusive options, so respondents could answer yes to both.

Base: US Internet users aged 18+

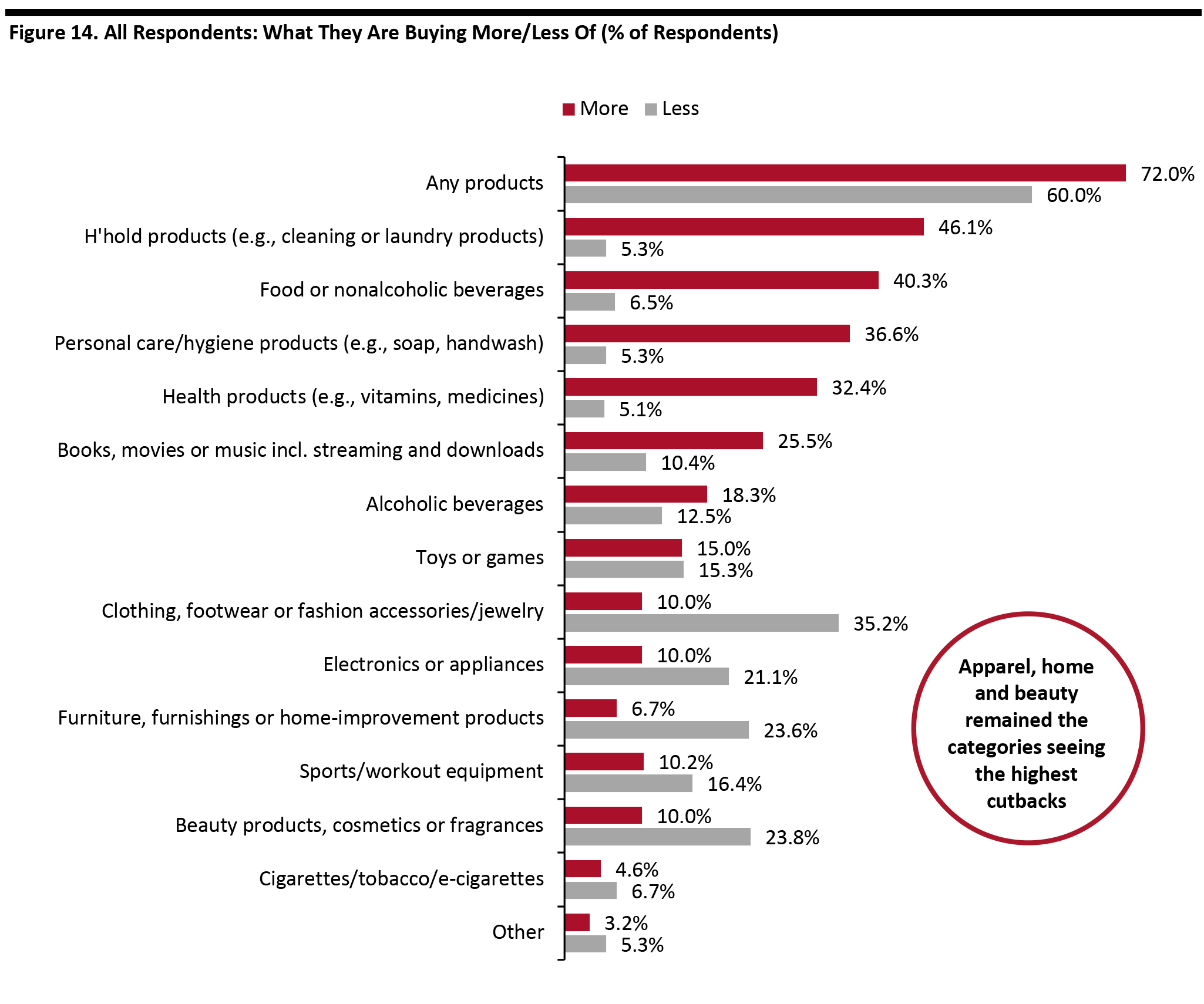

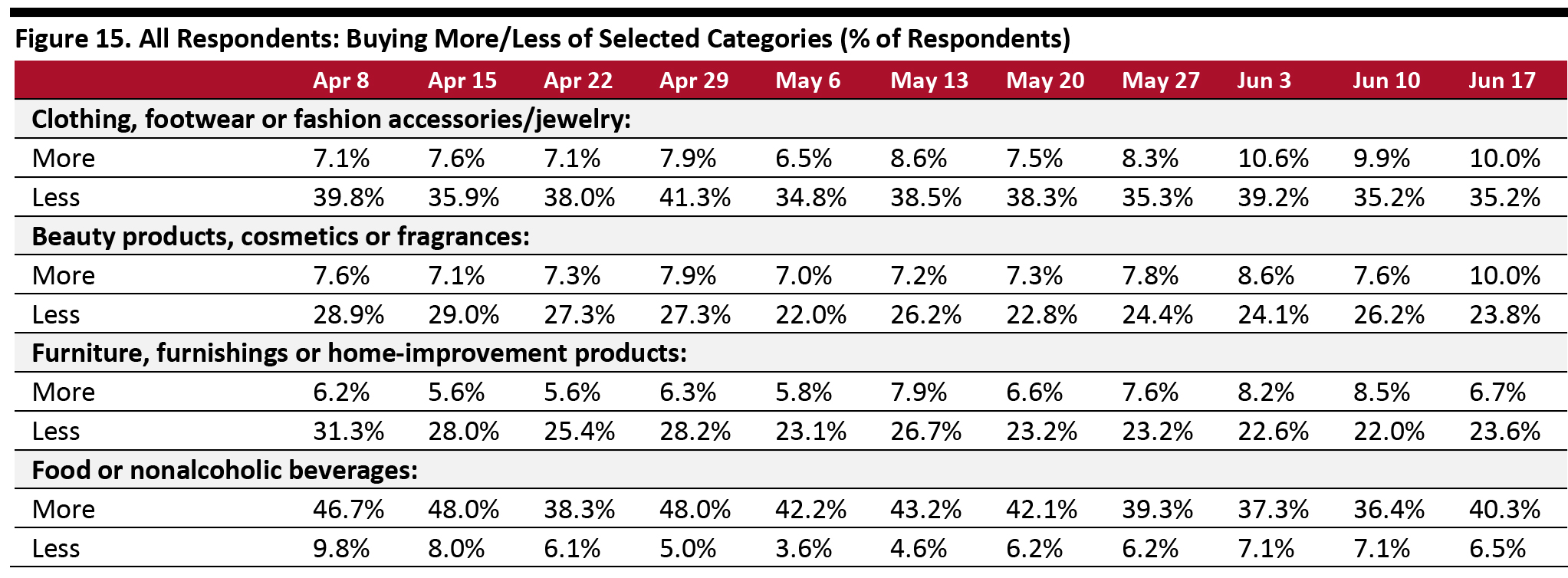

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Buying more: Essentials, including household products and food, continue to be the top categories that consumers are purchasing more of, and we noticed the week-over-week changes jumped back again after weeks of a downward trend. Buying less: Apparel remains the number-one category for cutbacks, with the proportion of respondents who are buying less in this category staying consistent at 35.2% this week (we show trended data in Figure 15). Furniture/home, beauty and electronics continue to be the next-most-cut categories, but while the proportion of respondents cutting furniture/home increased week over week, the proportion cutting beauty purchases dropped versus last week. Ratio of less to more: The ratio for clothing and footwear stood at 3.5 this week—consistent with last week. The ratio for furniture, furnishings and home improvement raised to 3.5 this week from 2.6 last week. Beauty products stood at 2.4 this week versus 3.5 last week, the lowest ratio we have seen since April. [caption id="attachment_111833" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption] [caption id="attachment_111834" align="aligncenter" width="700"]

Base: US Internet users aged 18+

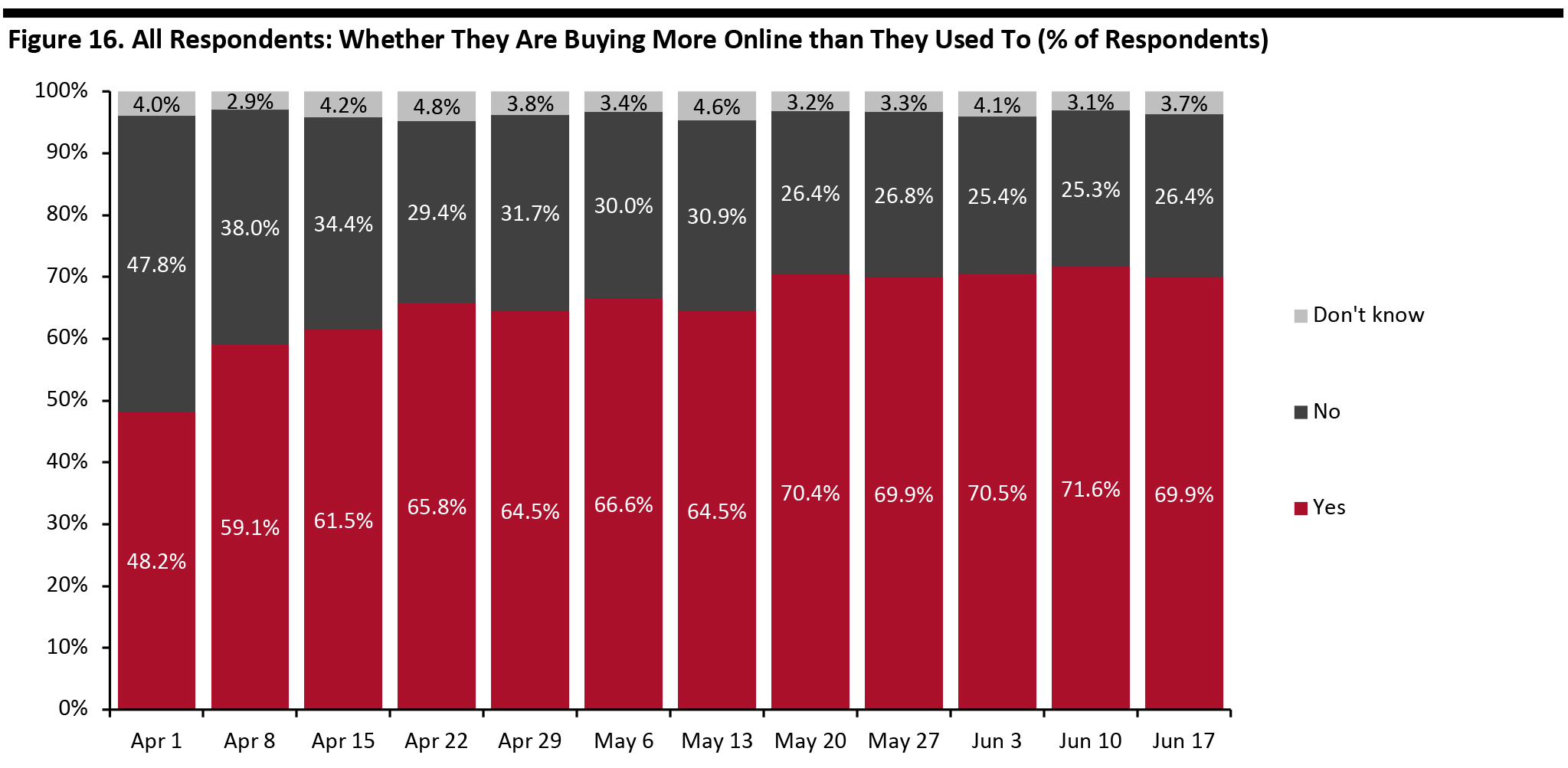

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Seven in 10 Are Switching Spending Online The proportion of consumers switching their spending to e-commerce remained high at around 70%, even though most states have eased or lifted lockdowns, with retail stores having begun to reopen from the beginning of May. Some 69.9% of consumers are buying more online this week, versus 71.6% last week. [caption id="attachment_111835" align="aligncenter" width="700"]

Base: US Internet users aged 18+

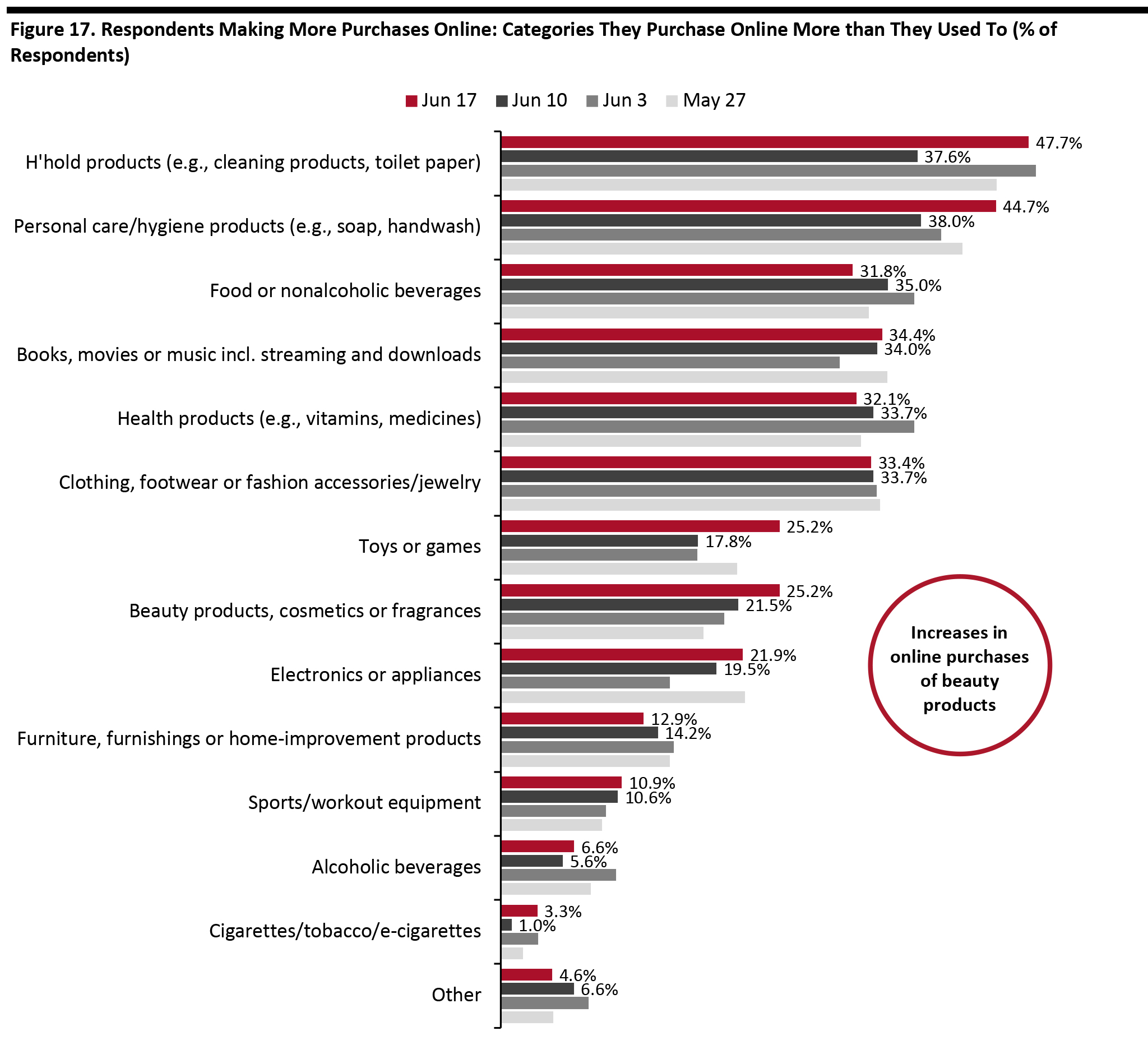

Base: US Internet users aged 18+ Source: Coresight Research [/caption] What Consumers Are Buying More Of Online Among the respondents making more purchases online, we saw a swing in the proportion of respondents buying household products online in recent weeks: Some 47.7% are buying these products online this week, jumping back up again from only 37.6% last week to the level we have seen previously. The proportion of consumers who are buying food online slid to 31.8% this week from 35.0% last week, echoing our earlier finding that fewer consumers are planning to purchase grocery online in the coming two weeks. In discretionary categories, we saw a stabilization in the proportion of consumers who are buying apparel online. Beauty and electronics, on the other hand, saw slight increases in the proportion of respondents buying more online. The figures below represent the proportions of respondents who are buying more online in general. Considered as a proportion of allrespondents (representing consumers in general), buying more apparel online stood at almost the same this week at around 24%, and buying more beauty online came at 17.6% versus 15.4% last week. [caption id="attachment_111836" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who make more purchases online than they did before the coronavirus outbreak

Source: Coresight Research[/caption]