DIpil Das

Coresight Research’s latest survey of US consumers on the coronavirus outbreak was undertaken on April 22. In this report, we discuss the latest findings and compare them to those from prior weeks: April 15, April 8, April 1, March 25 and March 17–18.

Looking Beyond Lockdown: Three Key Learnings

This week, a number of metrics suggest that we will see long-term impacts on the scale and shape of retail demand, even once the crisis eases. Here, we highlight three key learnings from our research.

1. Mass avoidance of public spaces will continue after lockdowns end

Fully two-thirds of respondents told us that they expect to continue avoiding some kinds of public places or change some travel arrangements after lockdowns end. Our research implies that the crisis is likely to have more lasting impacts for traditional, enclosed malls than for other types of retail locations. Shoppers may perceive off-mall centers such as open-air centers as safer—and these types of centers are also likely to benefit from the preponderance of nondiscretionary retailers such as supermarkets, versus the discretionary focus of enclosed malls. However, all retail formats must be prepared for shopper caution even once businesses reopen.

See our full report for details of which types of locations shoppers expect to avoid post lockdown.

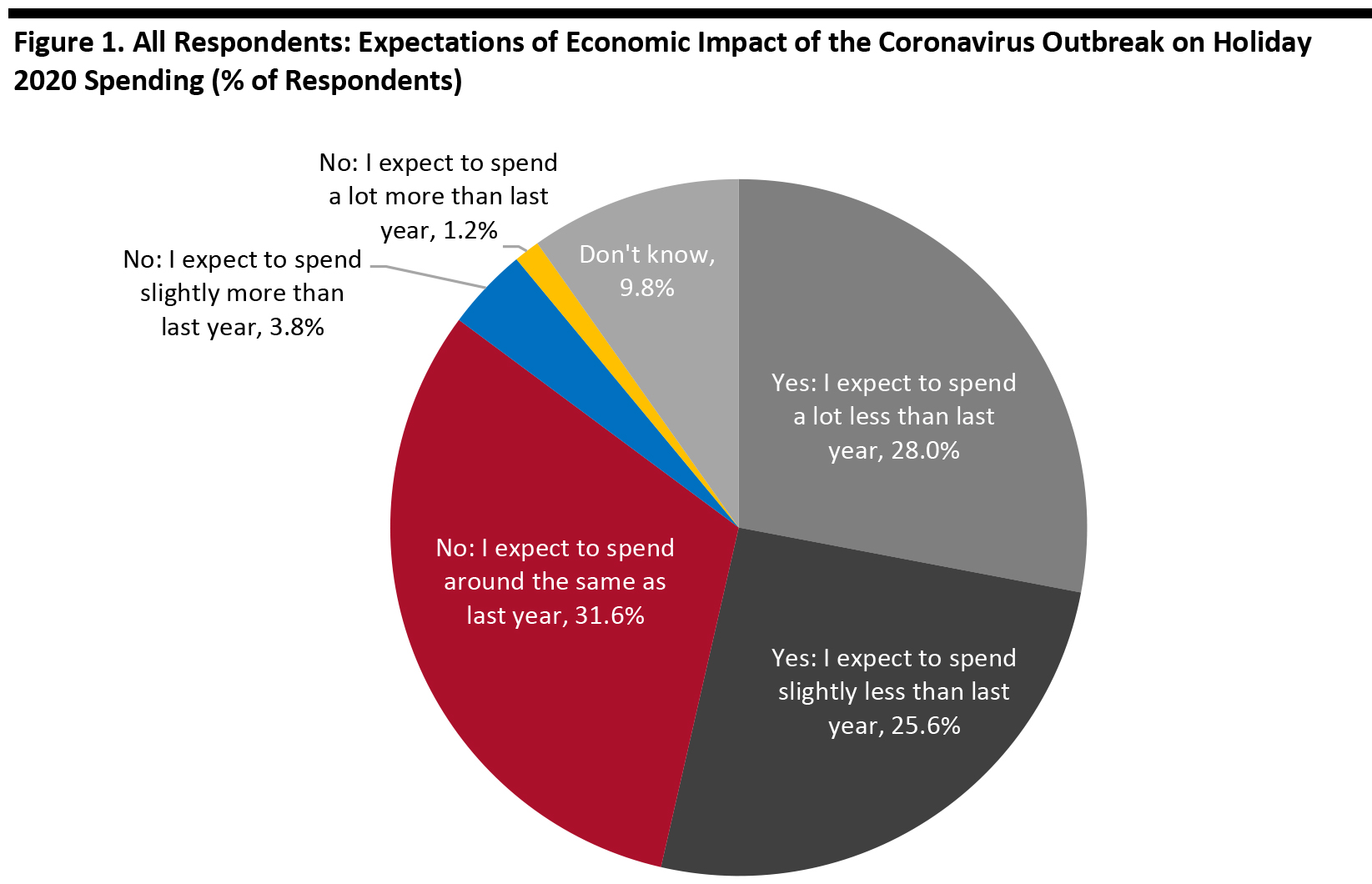

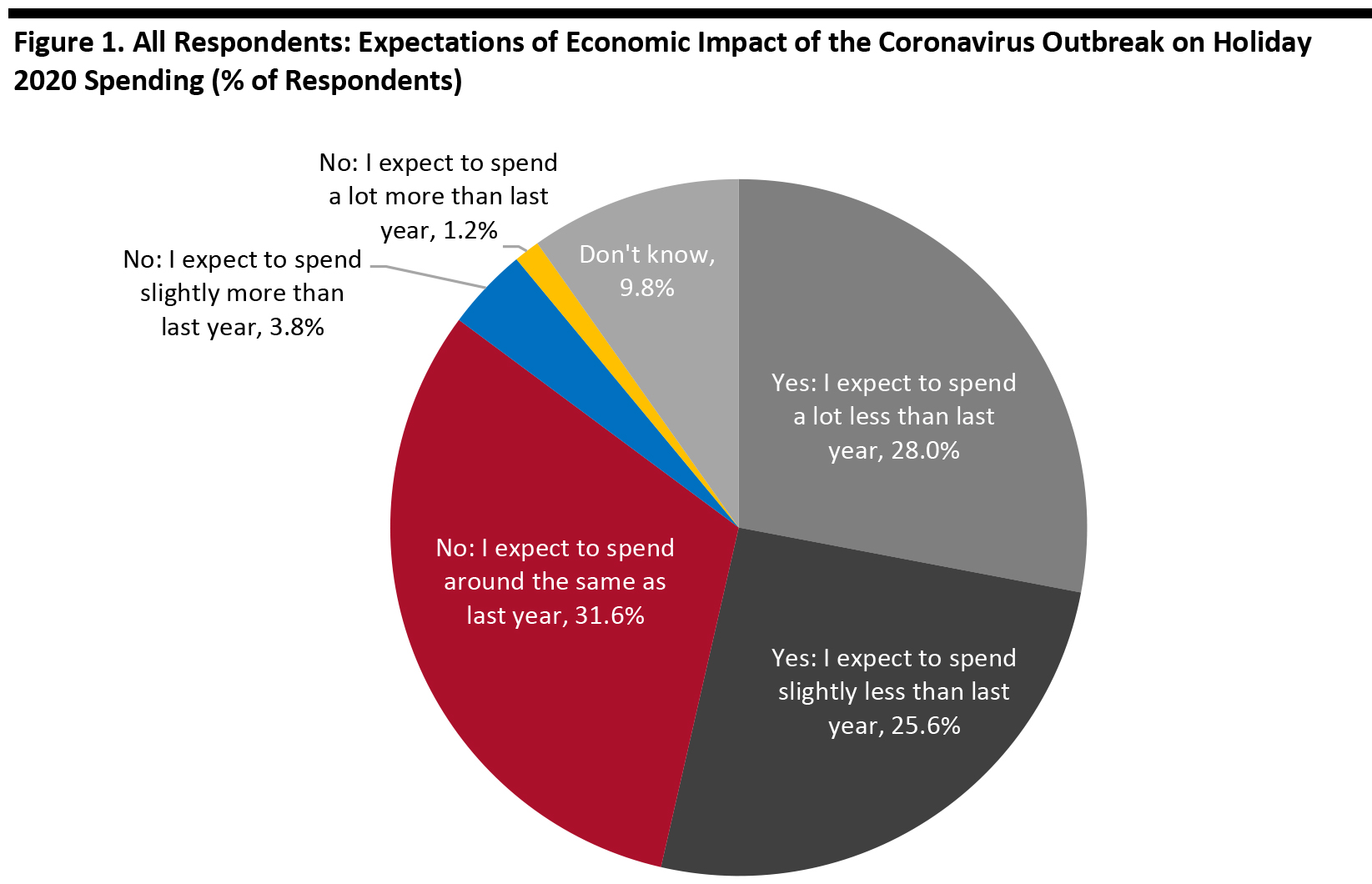

2. Clouds loom heavily over the holiday season

We asked respondents to look ahead to the holiday season—and they did so with a strong degree of pessimism. Almost 54% of all respondents anticipate spending less on holiday this year than last, due to the economic impact of the outbreak—with 28% expecting to spend a lot less on holiday 2020 than holiday 2019.

[caption id="attachment_108347" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

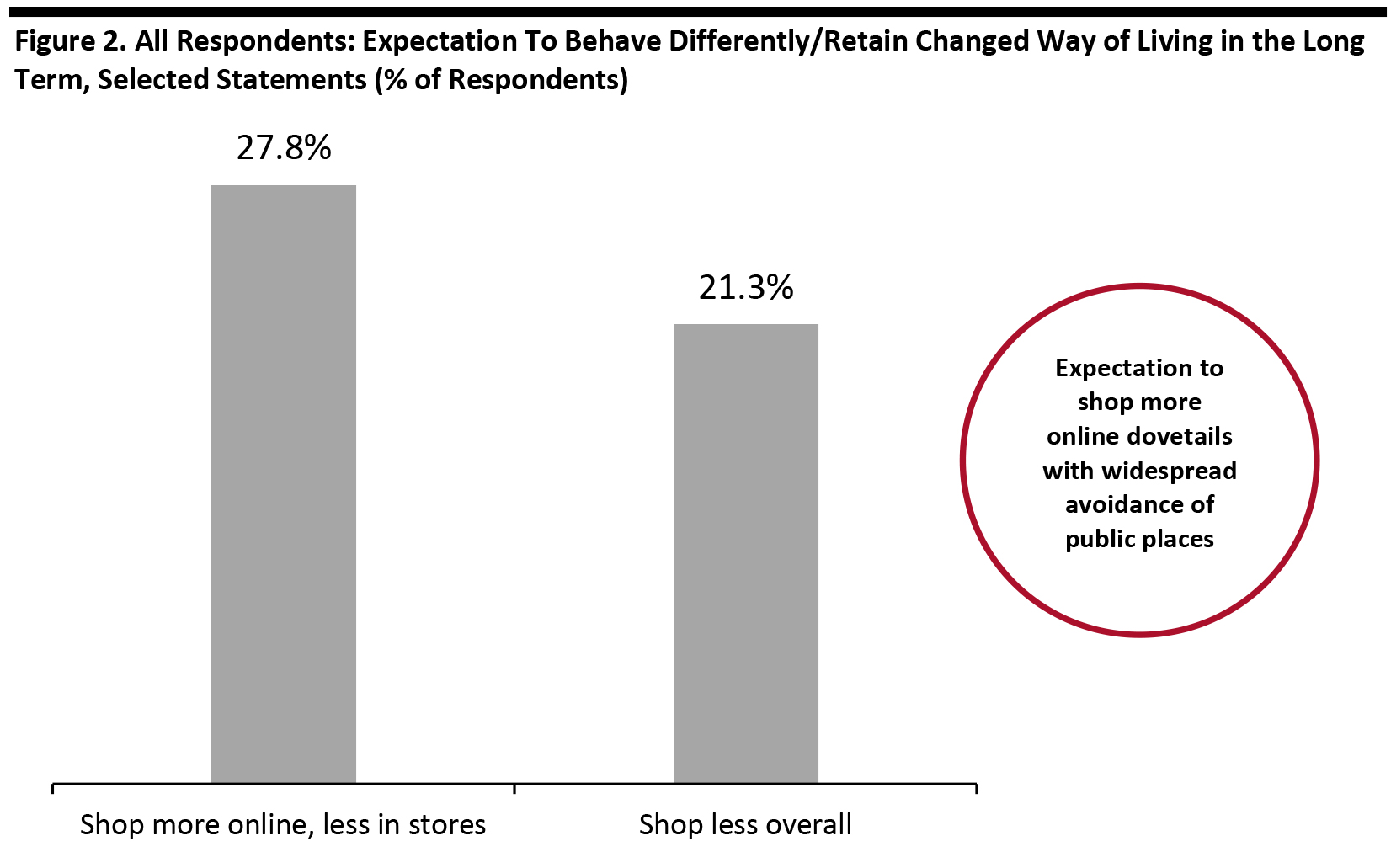

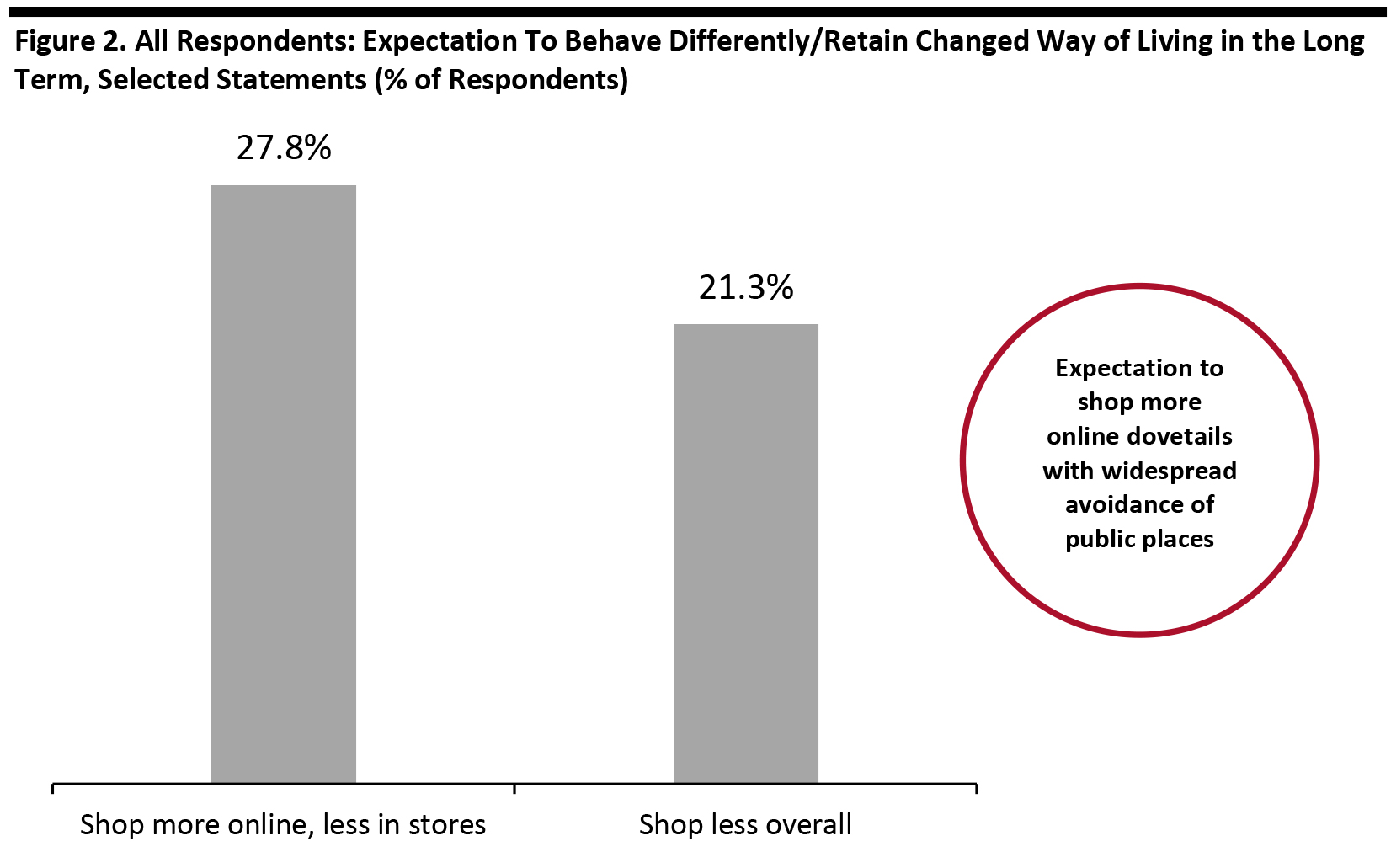

Source: Coresight Research [/caption] 3. Crisis fuels a switch to e-commerce—and possibly less spending over the long term Online retail is likely to enjoy a double benefit from the crisis: Not only will consumers have become accustomed to buying more online during the lockdown, but many shoppers will seek to avoid brick-and-mortar stores post lockdown too. Each week, we ask respondents which, if any, behaviors they will retain from the crisis period; this week, we recorded a significant uplift in the proportion expecting to switch retail purchases from stores to e-commerce. That metric stood at 27.8% of all respondents, up by around five percentage points week over week. We have also seen upward trends in expectations to shop less overall once the crisis ends, and this week 21.3% of all respondents said they expected to shop less—up by a little under three percentage points week over week. This aligns with many shoppers’ pessimistic outlook for holiday-season spending, noted above. [caption id="attachment_108348" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

Source: Coresight Research [/caption]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 3. Crisis fuels a switch to e-commerce—and possibly less spending over the long term Online retail is likely to enjoy a double benefit from the crisis: Not only will consumers have become accustomed to buying more online during the lockdown, but many shoppers will seek to avoid brick-and-mortar stores post lockdown too. Each week, we ask respondents which, if any, behaviors they will retain from the crisis period; this week, we recorded a significant uplift in the proportion expecting to switch retail purchases from stores to e-commerce. That metric stood at 27.8% of all respondents, up by around five percentage points week over week. We have also seen upward trends in expectations to shop less overall once the crisis ends, and this week 21.3% of all respondents said they expected to shop less—up by a little under three percentage points week over week. This aligns with many shoppers’ pessimistic outlook for holiday-season spending, noted above. [caption id="attachment_108348" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]