DIpil Das

Introduction

This report presents the results of Coresight Research’s latest weekly survey of US consumers on the coronavirus outbreak, undertaken on April 22. This report explores the trends we are seeing from week to week, following prior surveys on April 15, April 8, April 1, March 25 and March 17–18. We also compare selected metrics to our late-February consumer survey.Looking Beyond Lockdown

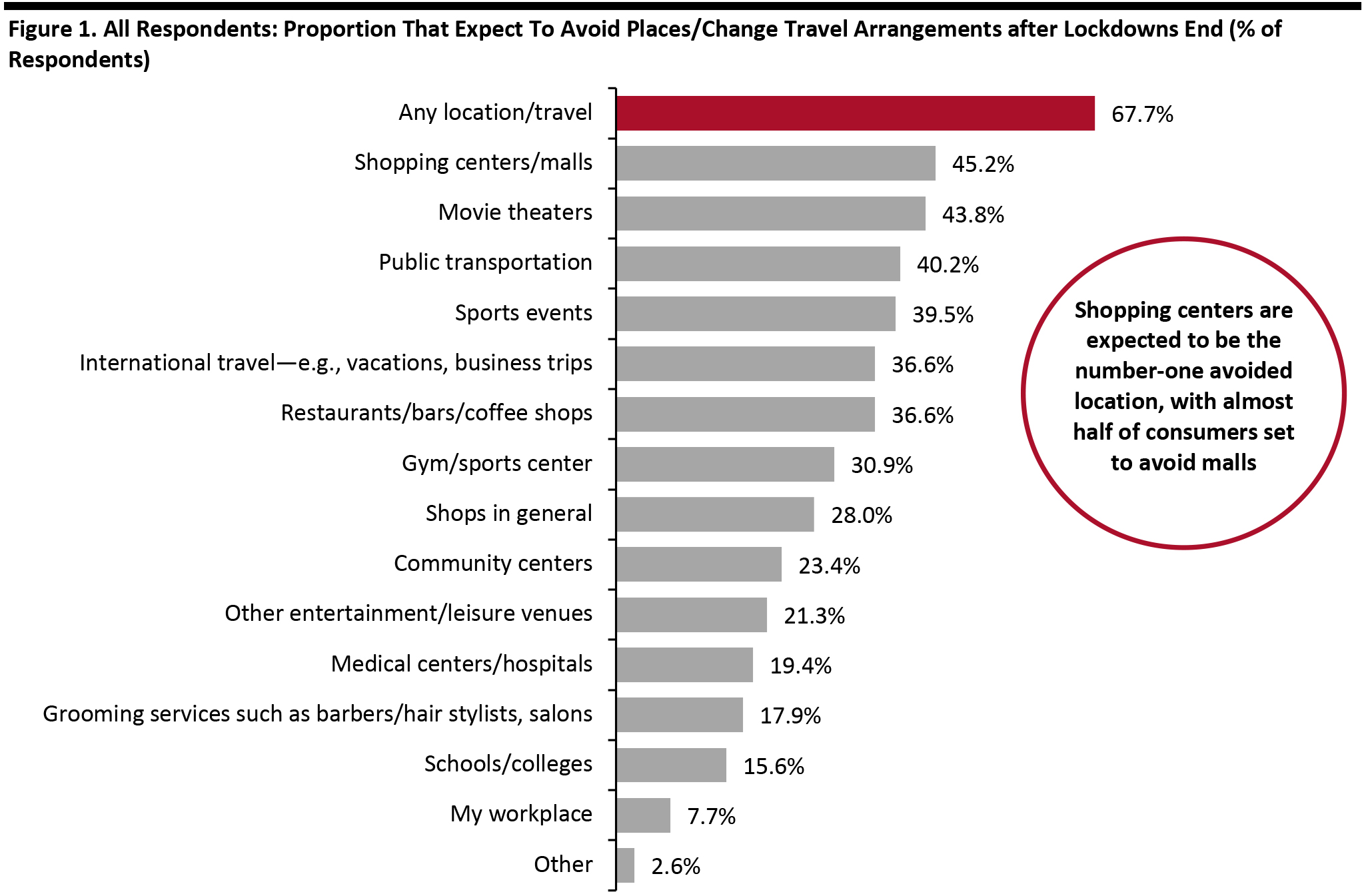

Shopping Centers Are the Number-One Location To Avoid Two-thirds of respondents expect to continue avoiding some kinds of public places or change some travel arrangements after lockdowns end. Alarmingly for many discretionary retailers, shopping centers/malls are the number-one place that respondents expect to avoid, with almost half of all consumers likely to steer clear of them. Our survey suggests that the crisis is likely to have more lasting impacts for traditional malls than for other types of retail locations. Shoppers may perceive off-mall centers such as open-air centers as safer—and these types of centers are also likely to benefit from the preponderance of nondiscretionary retailers such as supermarkets, versus the discretionary focus of enclosed malls. Our survey found that shops in general are expected to be much less avoided, reflecting the need for consumers to shop for essentials, more often in off-mall locations. [caption id="attachment_108330" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

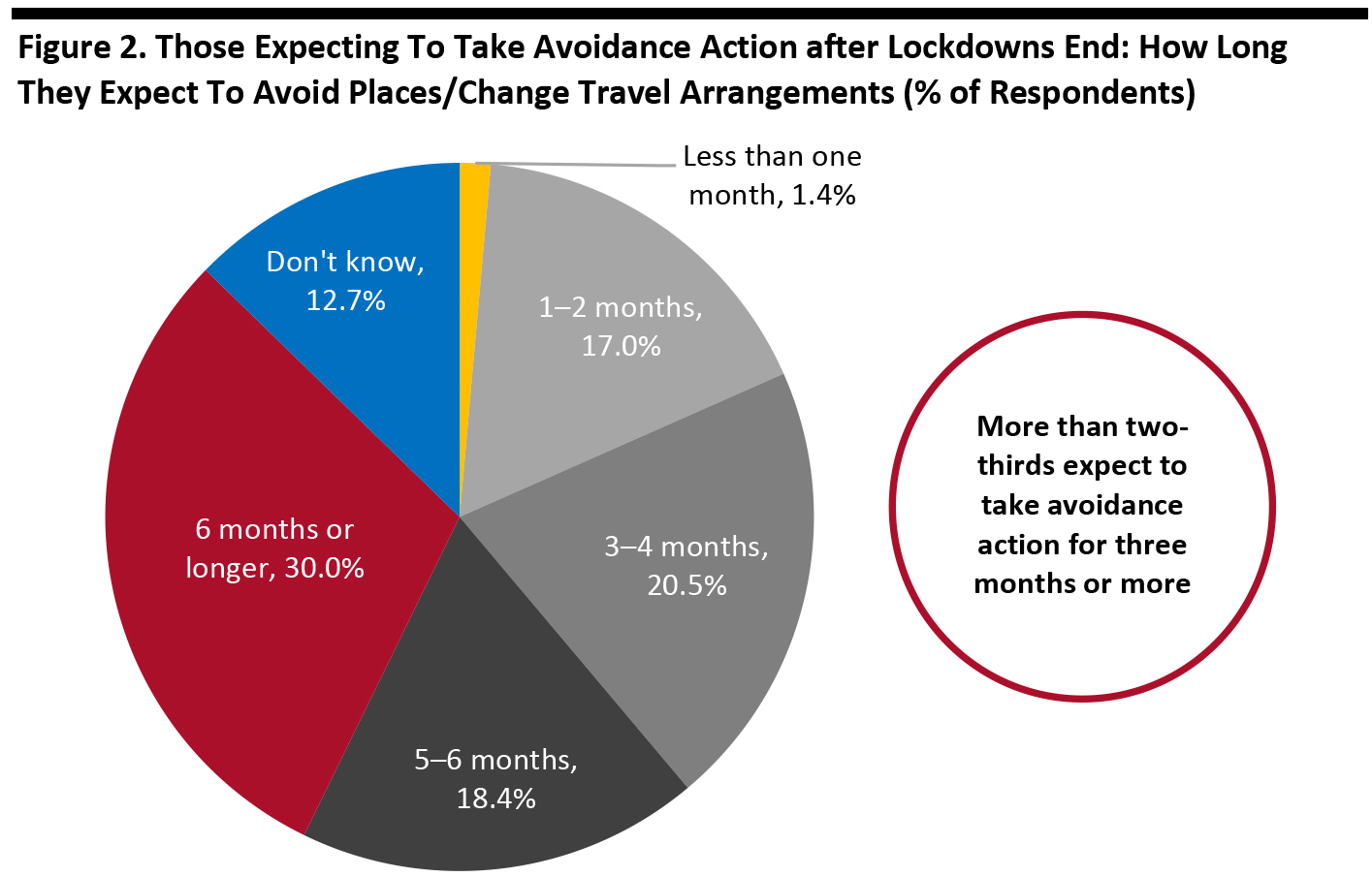

Source: Coresight Research [/caption] One in Three Expects To Retain Avoidance Behaviors for More Than Six Months We asked those respondents who expect to take such avoidance action how long they expect to be doing so for. Only a fraction of respondents think they will do so for less than one month. By far, the most popular option was more than six months. Again, these are alarming findings for discretionary brick-and-mortar retailers—they suggest avoidance of shopping centers will last into the holiday peak. In total, around 69% expect to take avoidance action for three months or longer.

- The percentages below are of those people who expect to take avoidance actions.

Base: US Internet users aged 18+ who expect to avoid places/change travel arrangements after lockdowns end

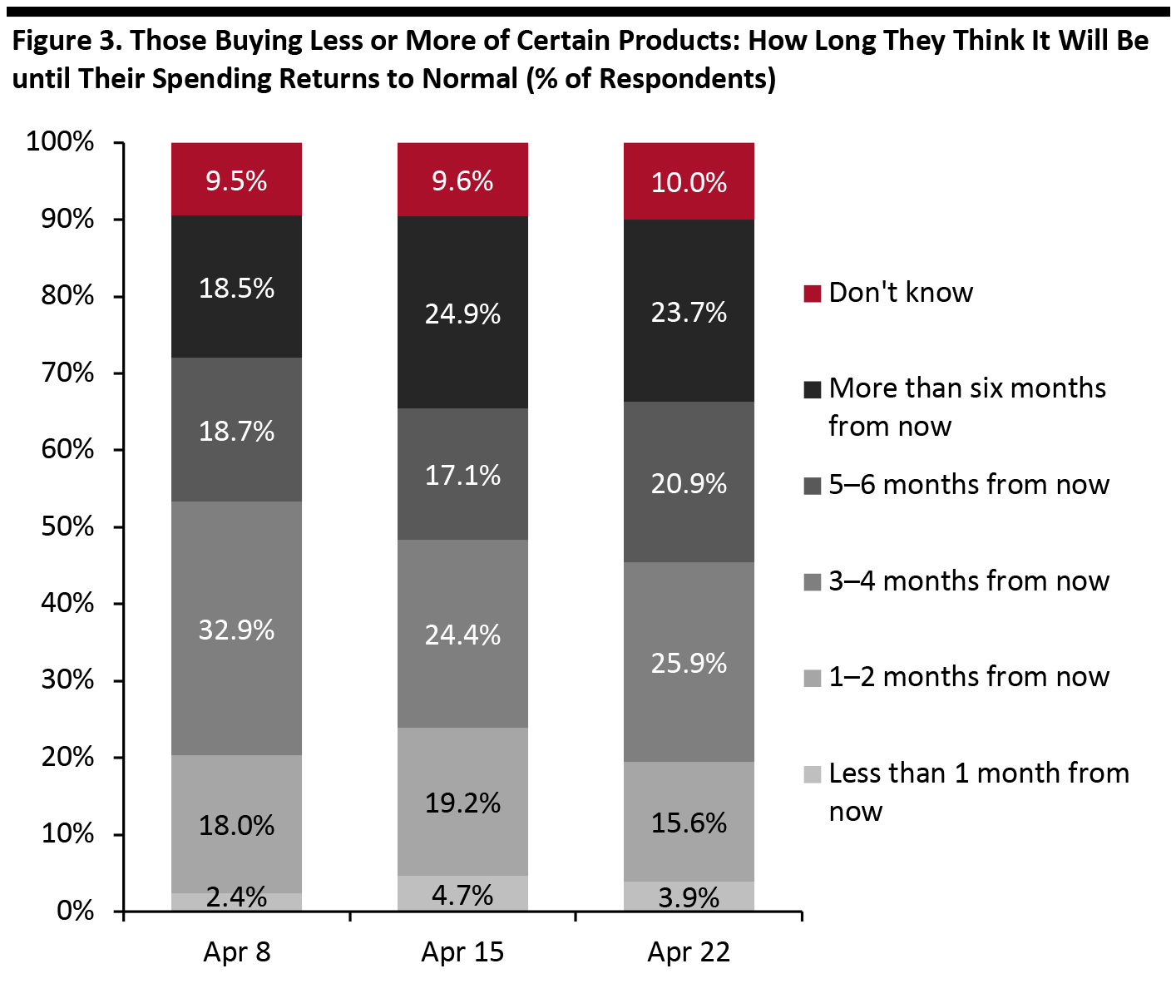

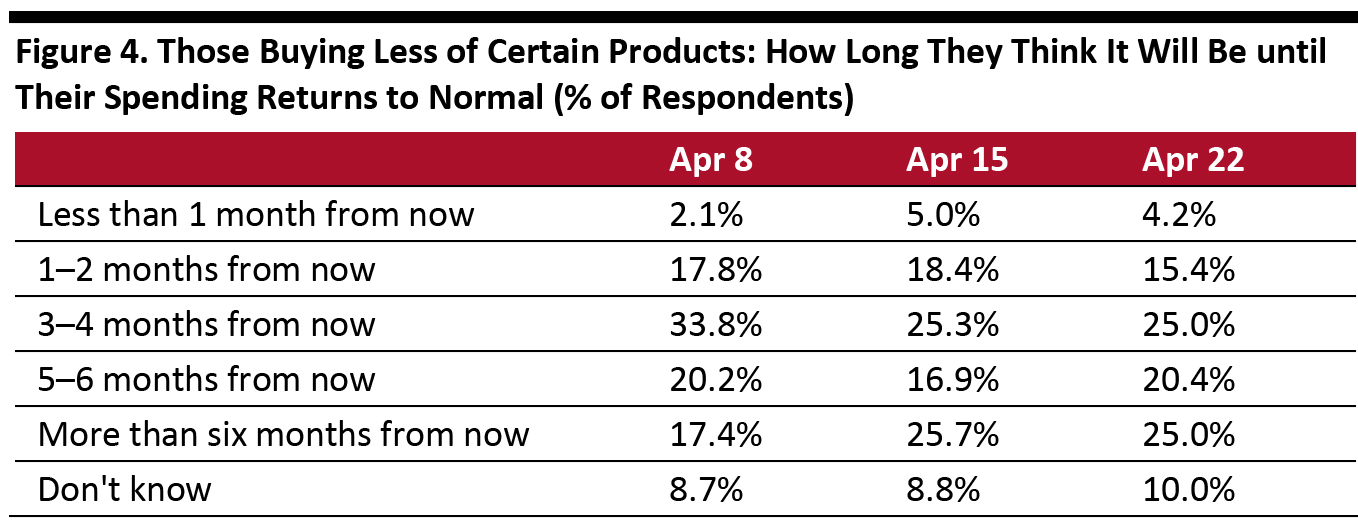

Base: US Internet users aged 18+ who expect to avoid places/change travel arrangements after lockdowns end Source: Coresight Research [/caption] One-Quarter Expect To Retain Changed Spending Patterns for More Than Six Months Underscoring the possible length of the recovery are consumers’ expectations for a bounce back to pre-crisis spending patterns. Among those who have changed their spending levels—either buying more or less of any categories—around one-quarter expect it to be more than six months before their spending patterns return to normal.

- We show what consumers are buying more of and less of in a separate section, later in this report. We also asked respondents how long they think the severe impacts of the crisis will last; see later for findings.

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak Source: Coresight Research [/caption] [caption id="attachment_108333" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who are purchasing any products less, because of the coronavirus outbreak

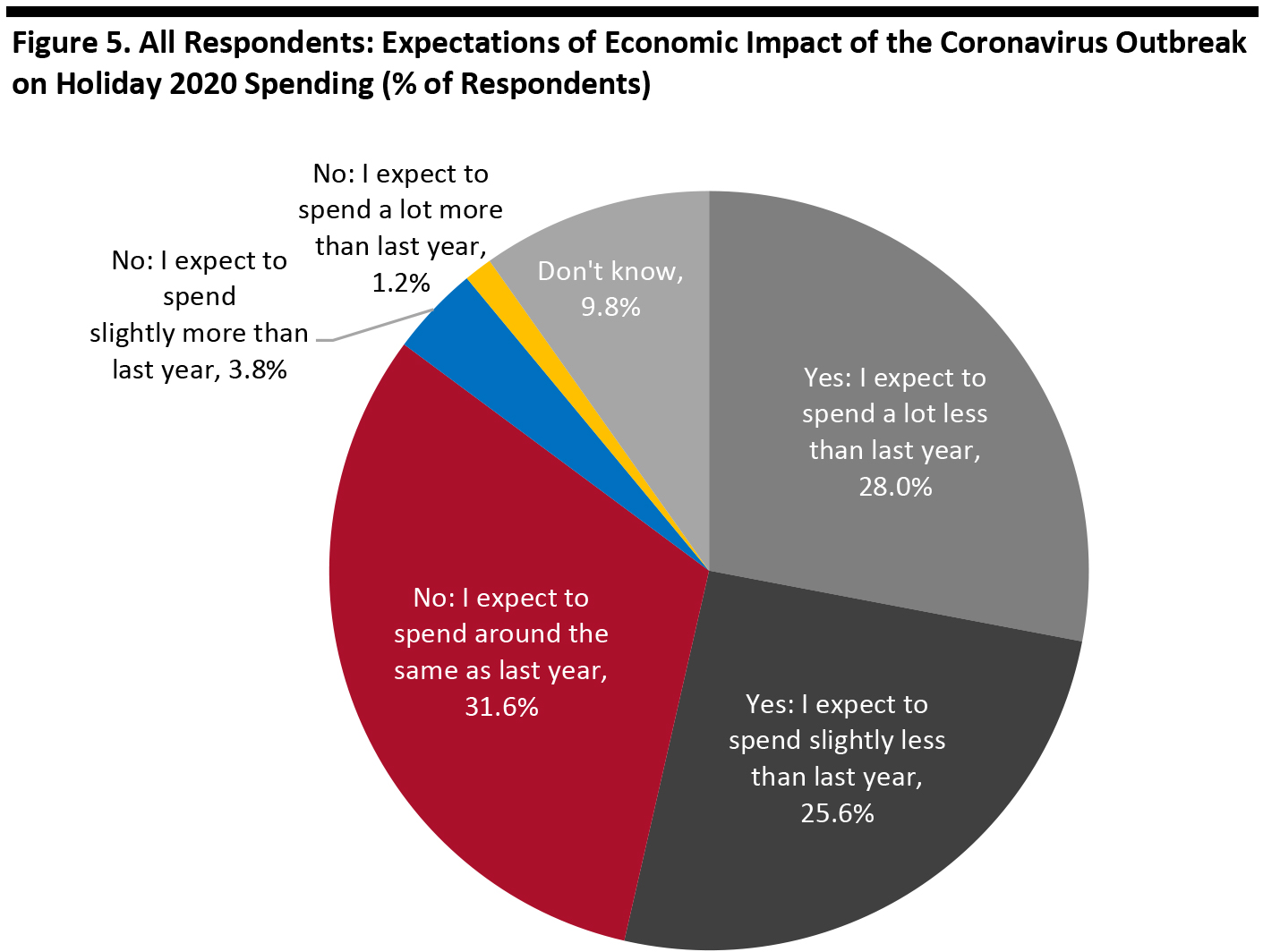

Base: US Internet users aged 18+ who are purchasing any products less, because of the coronavirus outbreak Source: Coresight Research [/caption] Over Half Expect To Spend Less for Holiday 2020 Due To Economic Impact We asked respondents to look ahead to the holiday season—and they did so with a strong degree of pessimism. Almost 54% of all respondents anticipate spending less on holiday this year than last, due to the economic impact of the outbreak—with 28% expecting to spend a lot less on holiday 2020 than holiday 2019. [caption id="attachment_108334" align="aligncenter" width="700"]

Base: US Internet users aged 18+

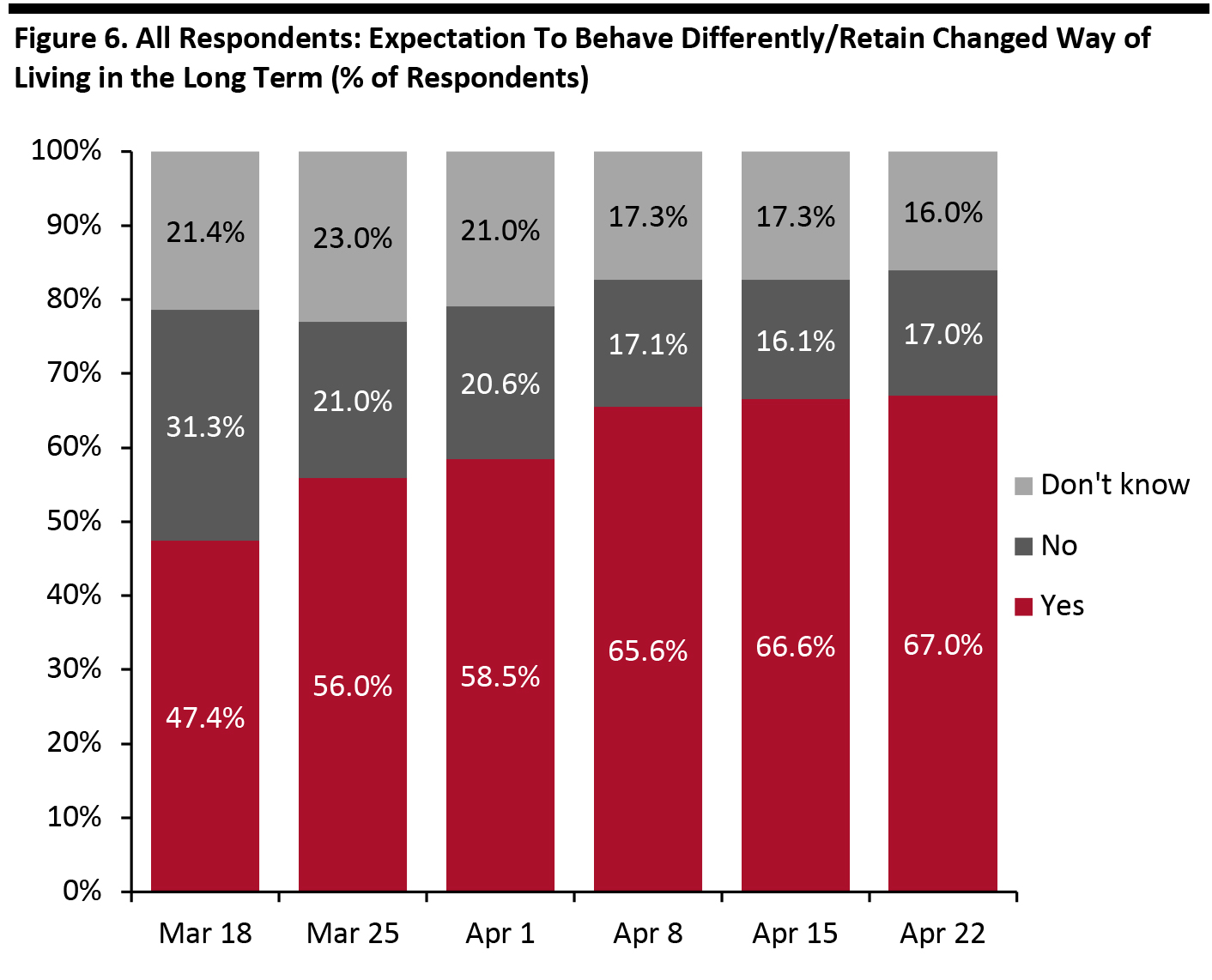

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Two-Thirds Expect To Retain Changed Behaviors for the Long Term Each week, we ask respondents whether they think they will keep some of the behaviors they have adopted during the coronavirus crisis. Two-thirds of all consumers now expect to retain some of these behaviors over the long term. [caption id="attachment_108335" align="aligncenter" width="700"]

Base: US Internet users aged 18+

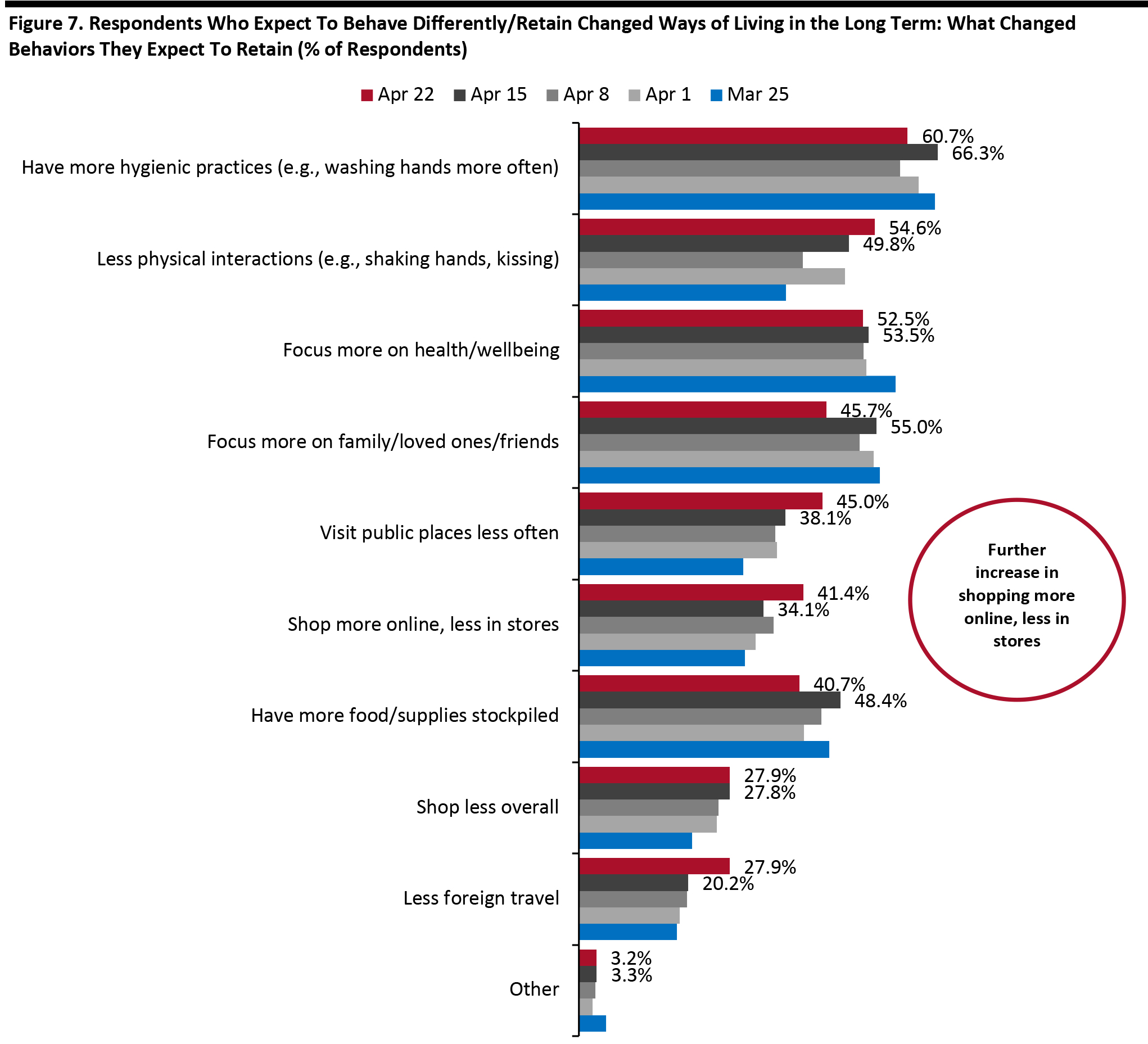

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Among those expecting to retain behaviors, better hygiene practices are routinely the number-one option. This week, we recorded a significant uplift in the proportion of respondents expecting to switch retail purchases from stores to e-commerce—this rose from 34.1% of those expecting to retain changed behaviors last week to 41.4% this week. This week’s metric equates to 27.8% of all respondents (representing consumers in general), up from 22.7% last week. This week, 27.9% said they expect to shop less overall. This equates to 21.3% of all respondents versus 18.5% last week.

- Note, the percentages below are of those people who expect to retain changed behaviors.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

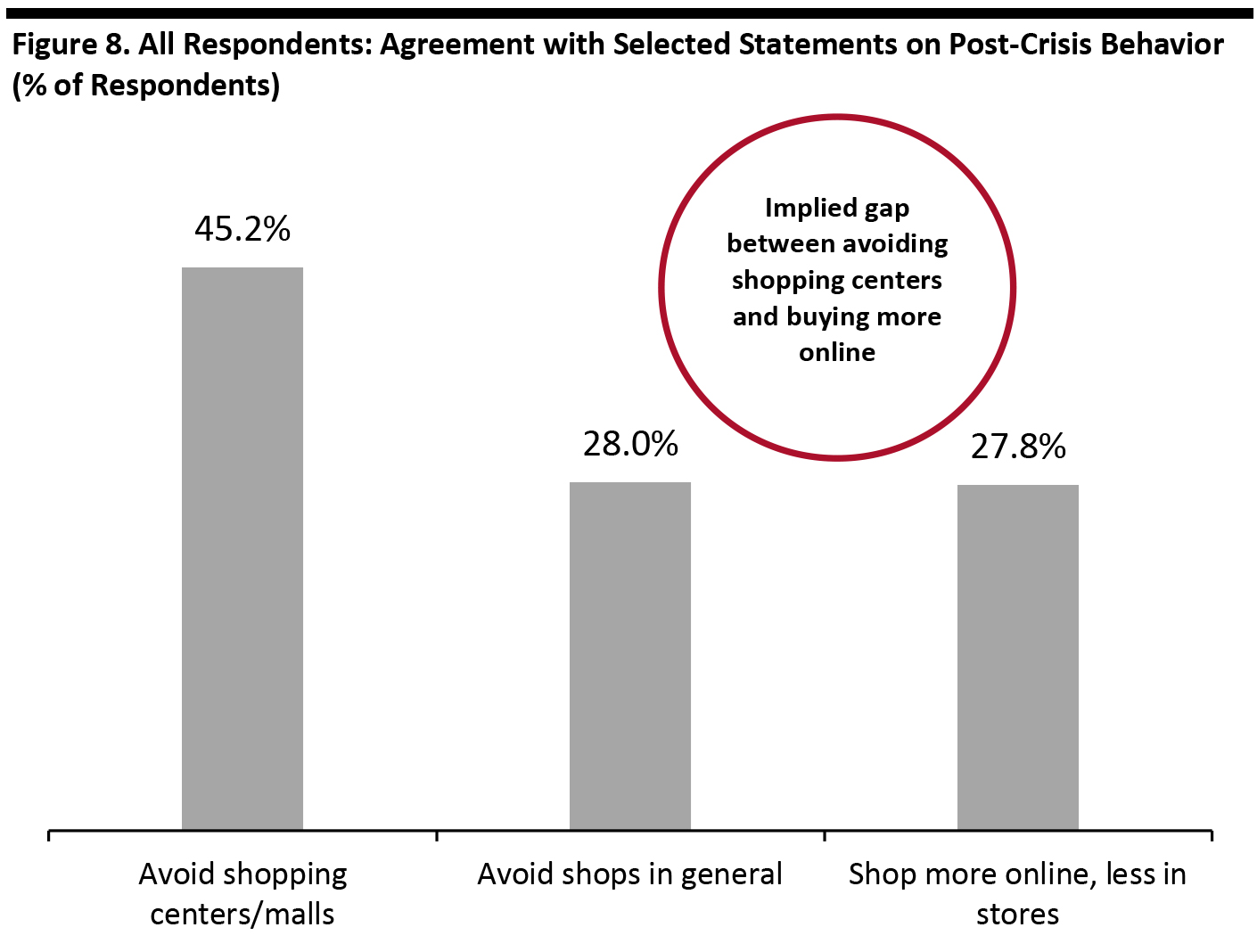

Source: Coresight Research [/caption] Looking at Channel-Switching Opportunities Below, we compare metrics from two of the charts shown earlier—and represented as a proportion of all respondents. We note the disparity between the proportion that expect to avoid shopping centers and the proportion that expect to shop more online, less in stores. Although a blunt comparison, we suggest some reasons for the difference:

- The data could imply that e-commerce will not fully recapture sales lost from fewer visits to physical stores; off-mall locations such as open-air centers and standalone stores are likely to gain, alongside e-commerce.

- It could also suggest current indecision among consumers, as they remain uncertain about their post-crisis behavior—they feel they should avoid higher-risk areas but have not yet fully settled on a switch to e-commerce. This implies that their post-crisis habits are yet to be determined, meaning that retailers and channels can help shape where and how consumers shop in the future.

Base: US Internet users aged 18+

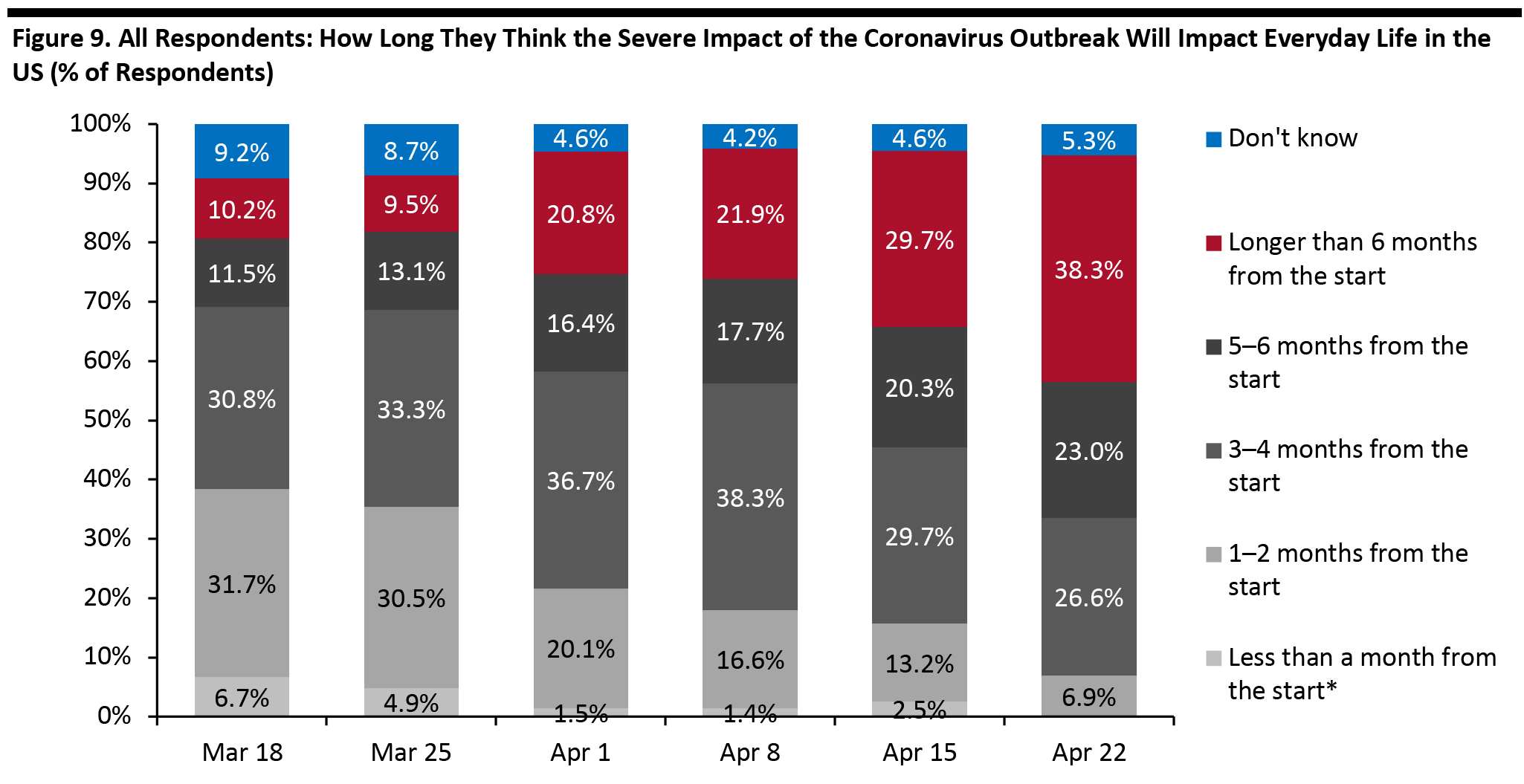

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Almost Four in 10 Consumers Expect the Crisis To Last More Than Six Months Consumers’ expectations of the length of the crisis jumped again this week. Some 38% now expect the severe impact of the outbreak to last more than six months from its start, up from around 30% last week. This timescale implies that the severe impacts will run up to the holiday season. Fully 88% now expect the severe impact to last three months or more, a leap from 80% last week. [caption id="attachment_108338" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ *Not provided as an option after April 15

Source: Coresight Research [/caption]

Reviewing Trend Data in Purchasing Behavior

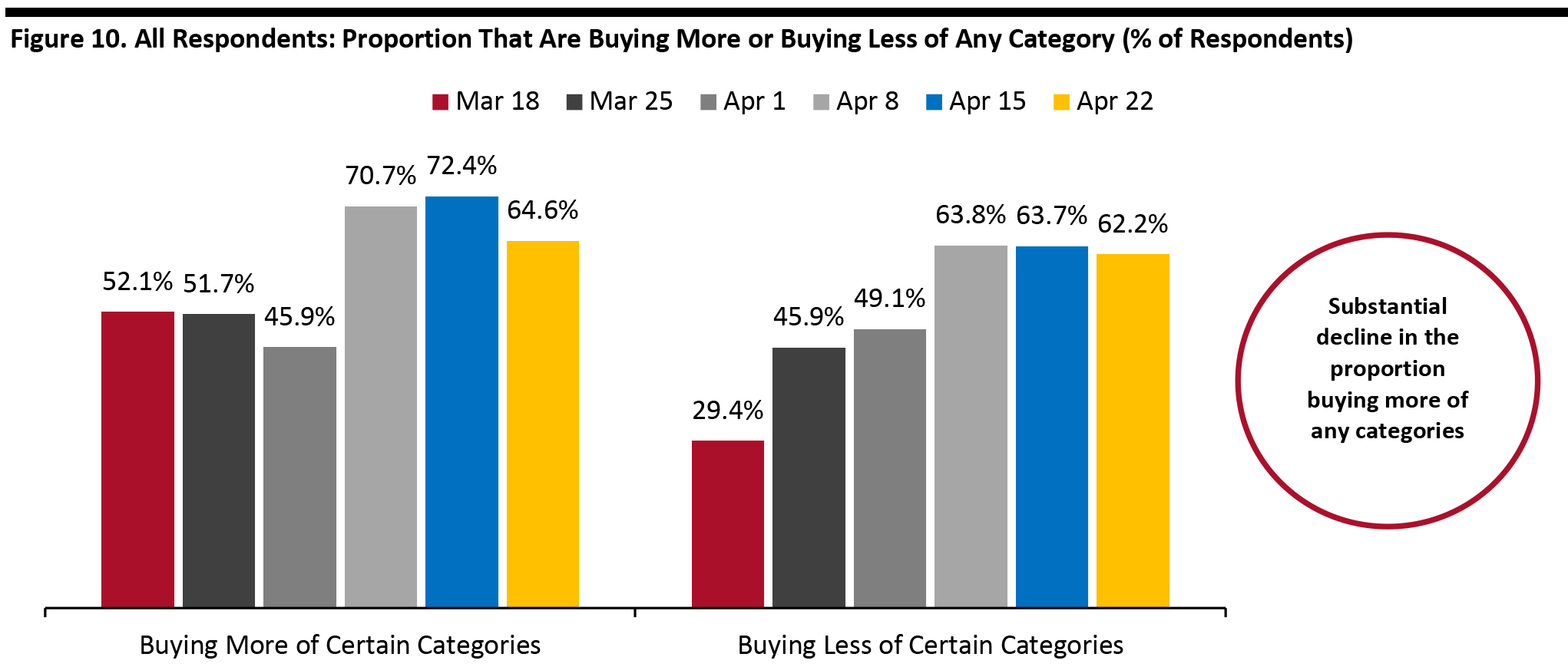

Two-thirds of consumers reported buying more of any category and 62% buying less in this week’s survey. This represents a significant moderation in the proportion buying more products—we provide trend data for key categories in a later table.- Note, buying more of certain categories and buying less of certain categories were not mutually exclusive options, so respondents could answer yes to both.

Base: US Internet users aged 18+

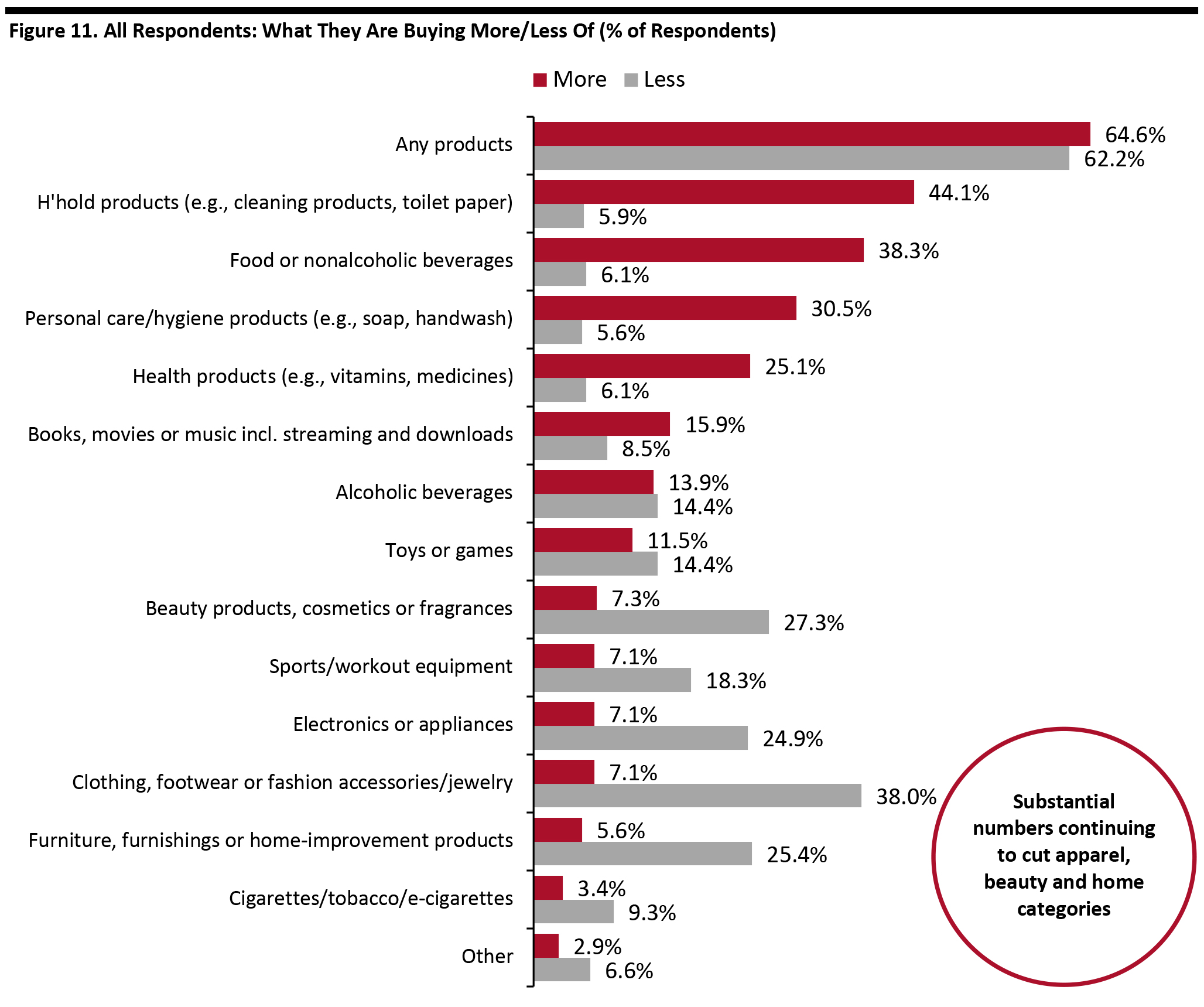

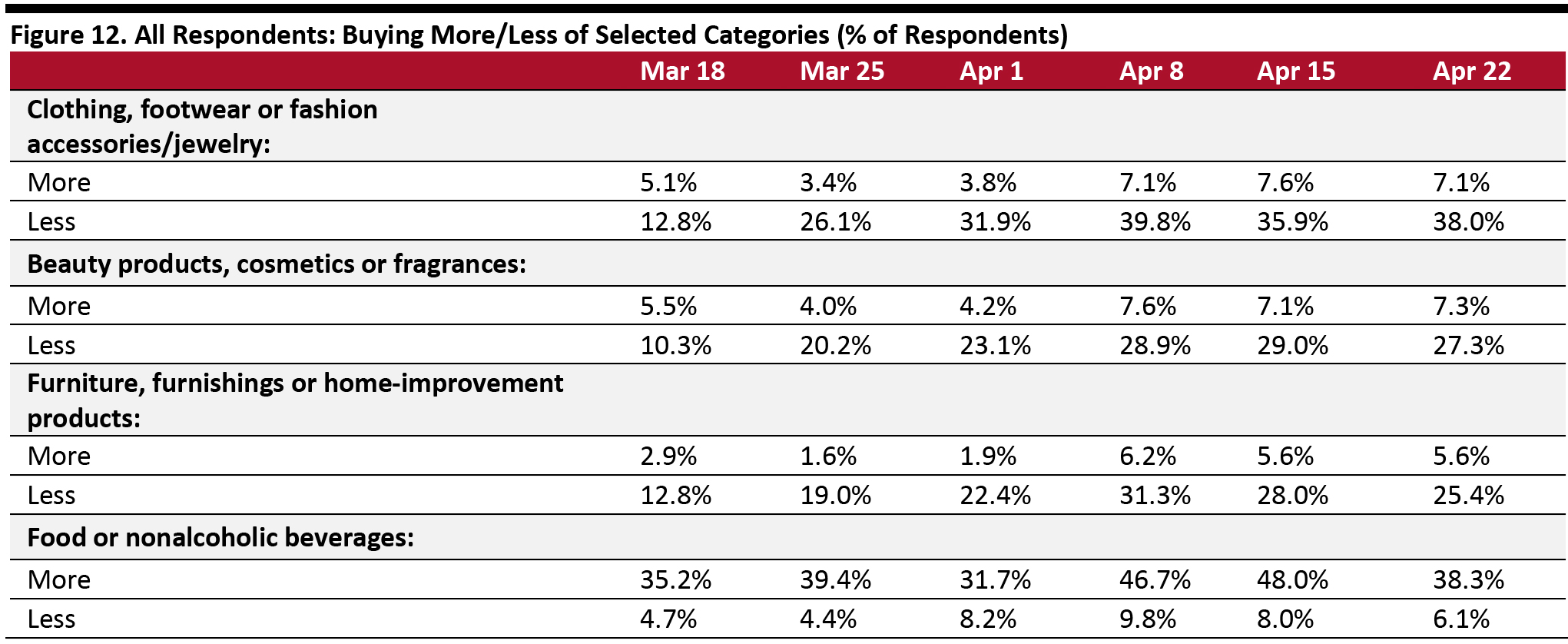

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Buying more: While food and other essentials continue to be net beneficiaries, this week we saw a meaningful slide in the proportion of all respondents saying they had bought more food—this metric fell almost 10 percentage points, to 38.3% from 48.0% last week. Buying less: Apparel continues to be the number-one category for cutbacks. Recently, we saw positive trends—a decline in the proportion buying less clothing or footwear and incremental increases in the proportion buying more. However, this week, those trends reversed very slightly. We break out week-over-week trend data in Figure 12. Ratio of less to more: The ratio of those purchasing less to those purchasing more for clothing and footwear stood at 5.4 this week versus 4.7 this week, versus 5.6 last week. Furniture, furnishings and home improvement stood at 4.5 this week, versus 5.0 last week. Beauty products stood at 3.7 this week, versus 4.1 last week. [caption id="attachment_108340" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption] [caption id="attachment_108341" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

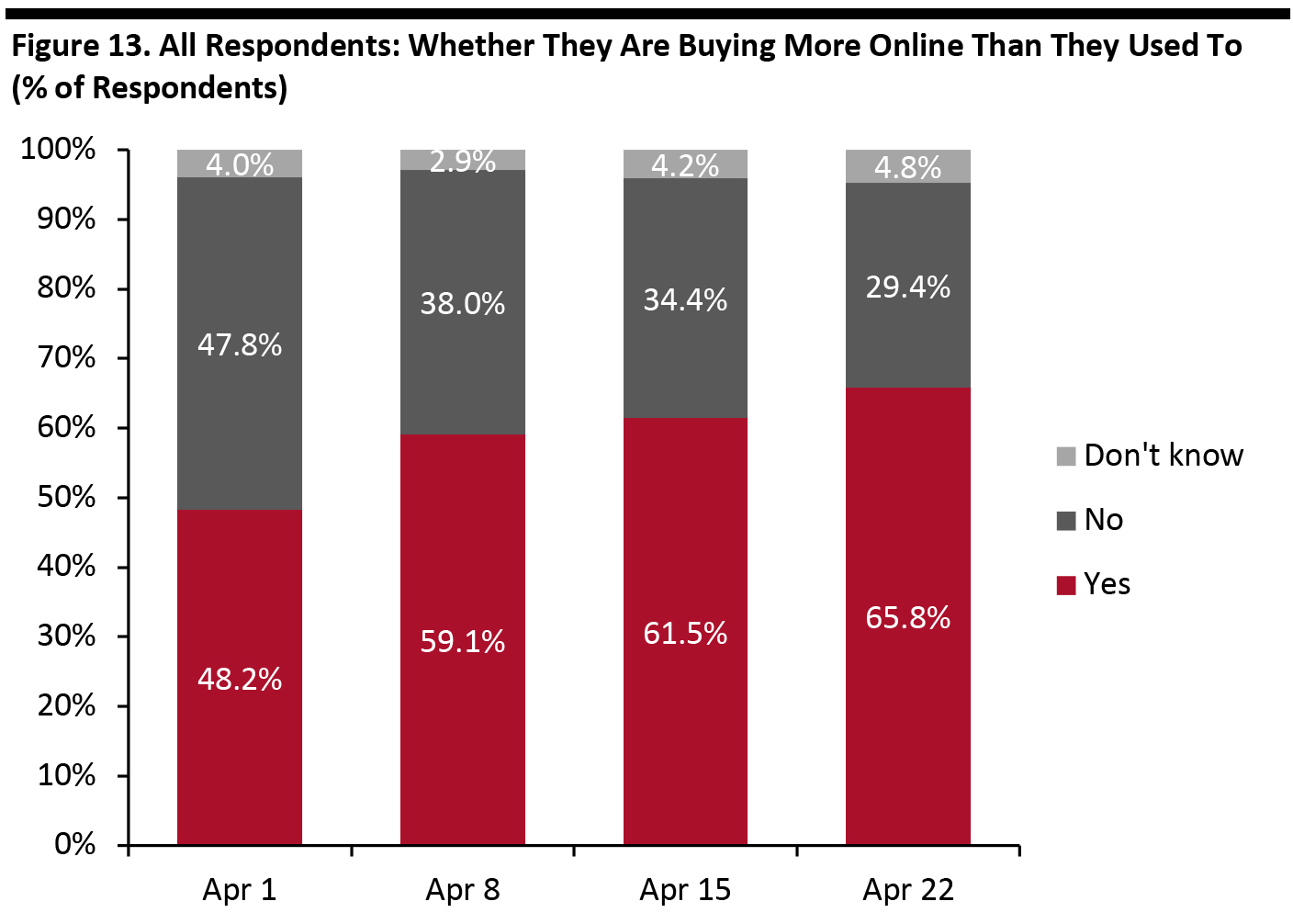

Two-Thirds Are Switching Spending Online

Almost two-thirds of consumers are making more purchases online than before the outbreak—once again, this metric was up week over week. [caption id="attachment_108342" align="aligncenter" width="700"] Base: US Internet users aged 18+

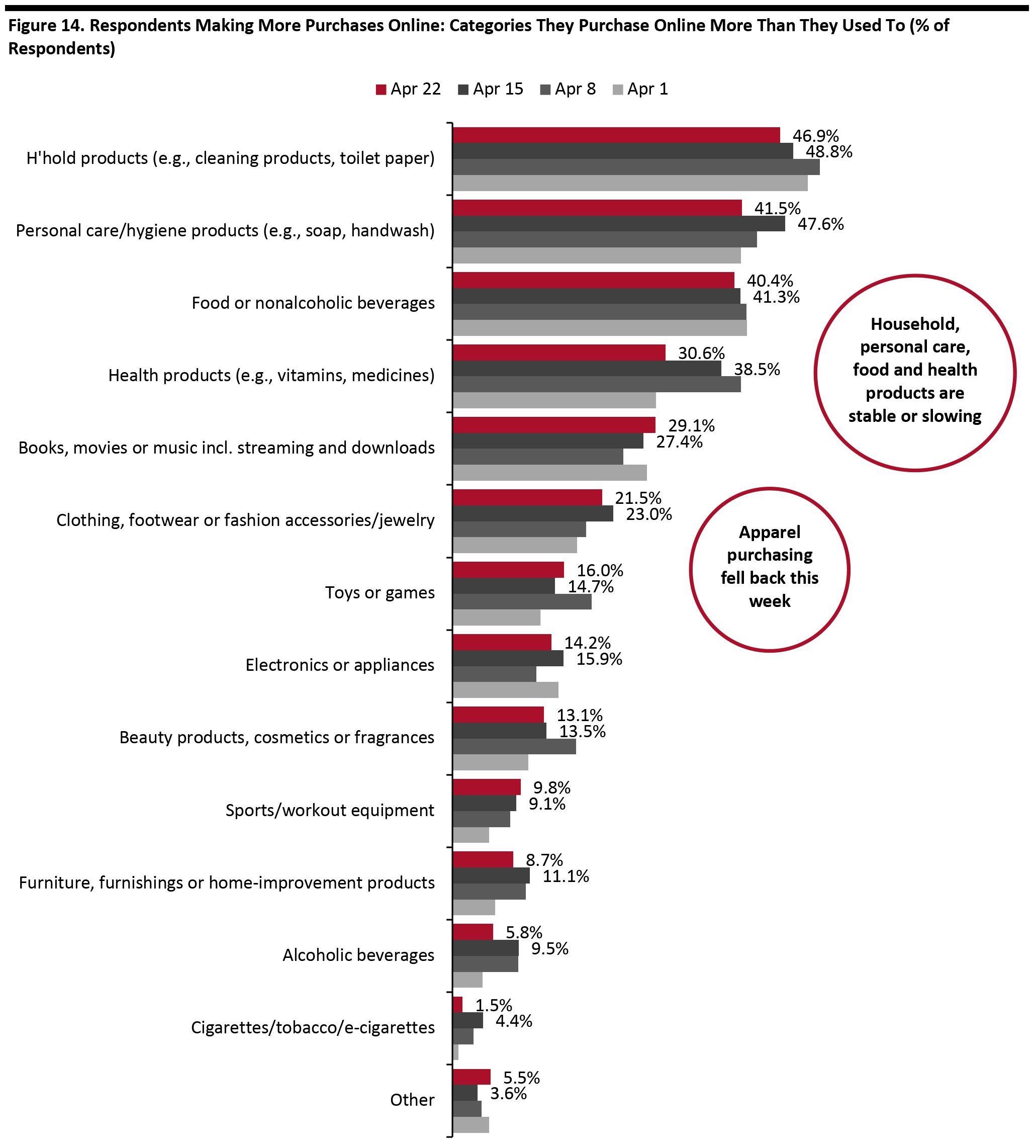

Base: US Internet users aged 18+ Source: Coresight Research [/caption] What They Are Buying More Of Online Among the respondents making more purchases online, we saw essential categories remain stable or decline this week—this included household products, personal care, food and health products. Echoing the abovementioned slide for apparel this week was an easing in the proportion buying apparel online more than they used to. However, the figures charted below are a proportion of those buying more of any categories online, and that metric is rising (as noted above). Considered as a proportion of all respondents (representing consumers in general), buying more apparel online remained broadly stable, at 14.1% this week versus 14.2% last week. [caption id="attachment_108343" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who make more purchases online than they did before the coronavirus outbreak

Source: Coresight Research [/caption]

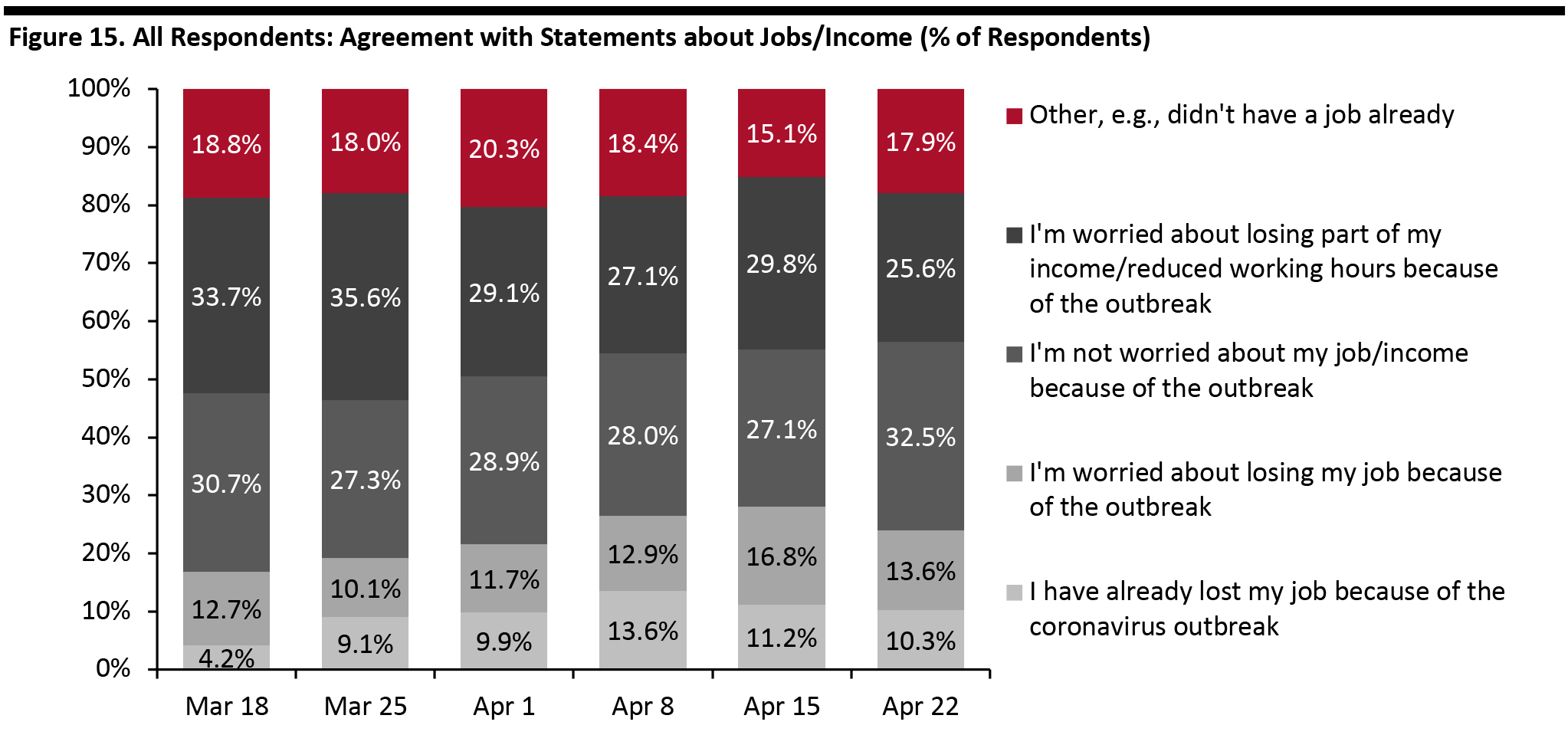

Concerns about Jobs and Income Ease

We asked respondents to choose from a selection of statements related to employment and income. This week, a total of 39.2% were worried about losing their job or part of their income, versus 46.6% last week. [caption id="attachment_108344" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]