DIpil Das

Introduction

This report presents the results of Coresight Research’s latest survey of US consumers on the coronavirus outbreak, undertaken on April 1, and showing the trends we see from week to week following prior surveys on March 25 and March 17–18. We also compare selected metrics to our late-February consumer survey.Most Consumers Are Very Worried

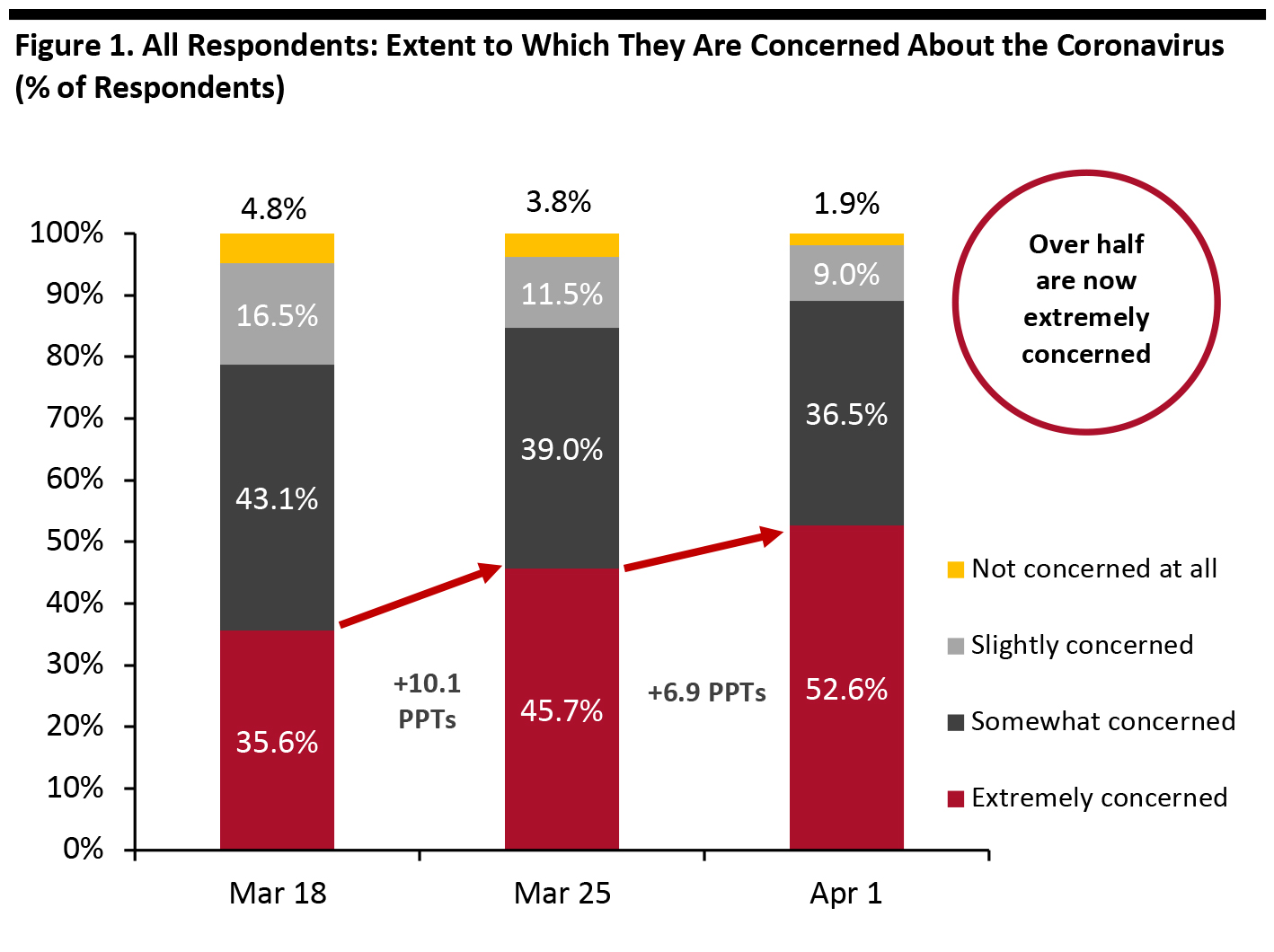

Over half of US consumers (52.6%) are now extremely concerned about the outbreak, up 6.9 percentage points in just a week. A total of 89% of respondents are now either somewhat or extremely concerned about the coronavirus, up from 85% a week earlier. [caption id="attachment_107094" align="aligncenter" width="700"] Not all week-over-week differences charted in this report are statistically significant

Not all week-over-week differences charted in this report are statistically significant Base: US Internet users aged 18+

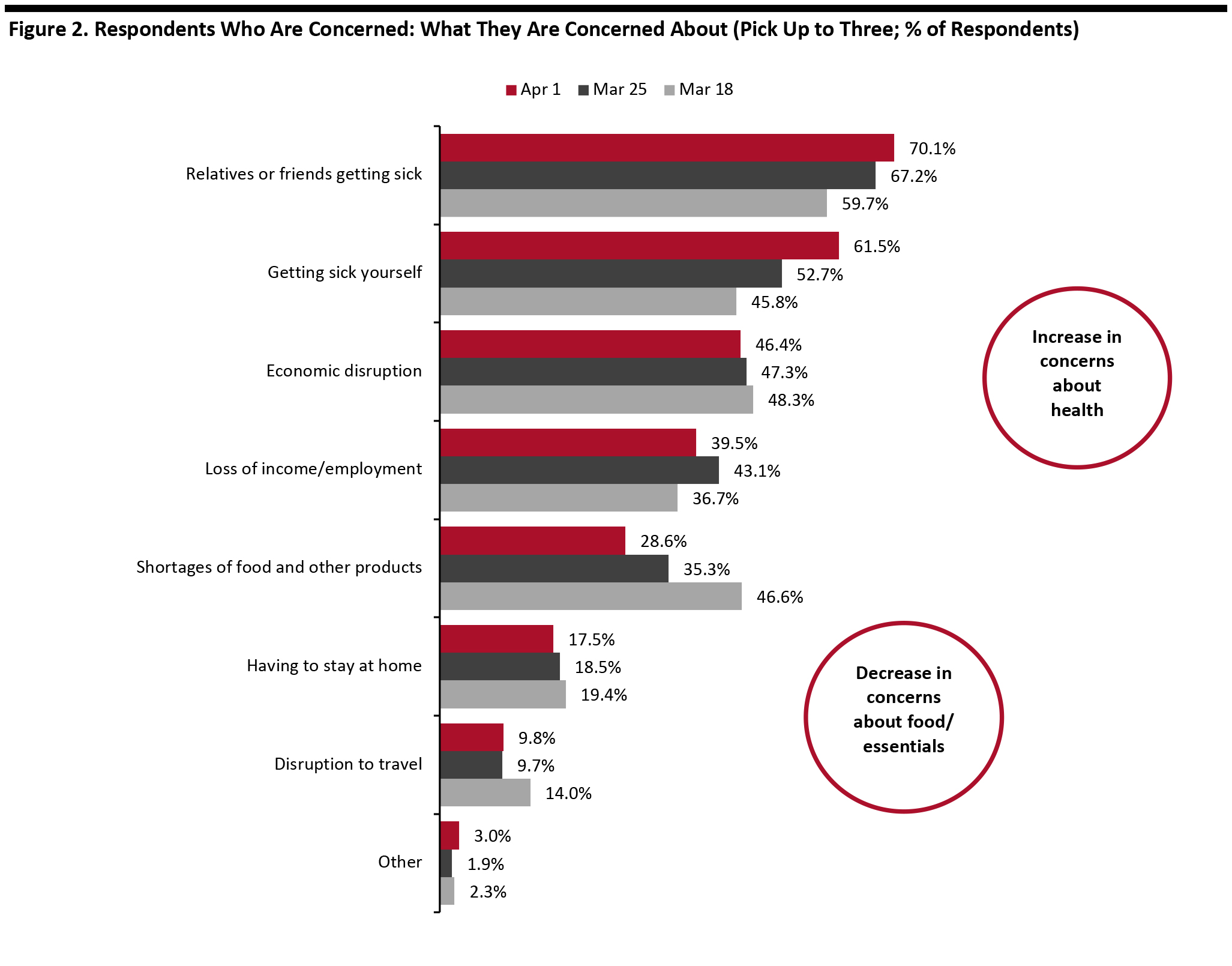

Source: Coresight Research [/caption] This week, we saw a big jump in the number of respondents worried about getting sick themselves—on the back of pessimistic news headlines about a likely forthcoming wave of hospitalizations. Concerns about food shortages continued to abate, reflecting that many consumers have sufficiently stockpiled and that they can see the food supply chains continue to operate and continue restocking quickly depleting shelves. [caption id="attachment_107095" align="aligncenter" width="700"]

Respondents could select up to three options

Respondents could select up to three options Base: US Internet users aged 18+ who are concerned about the coronavirus outbreak

Source: Coresight Research [/caption]

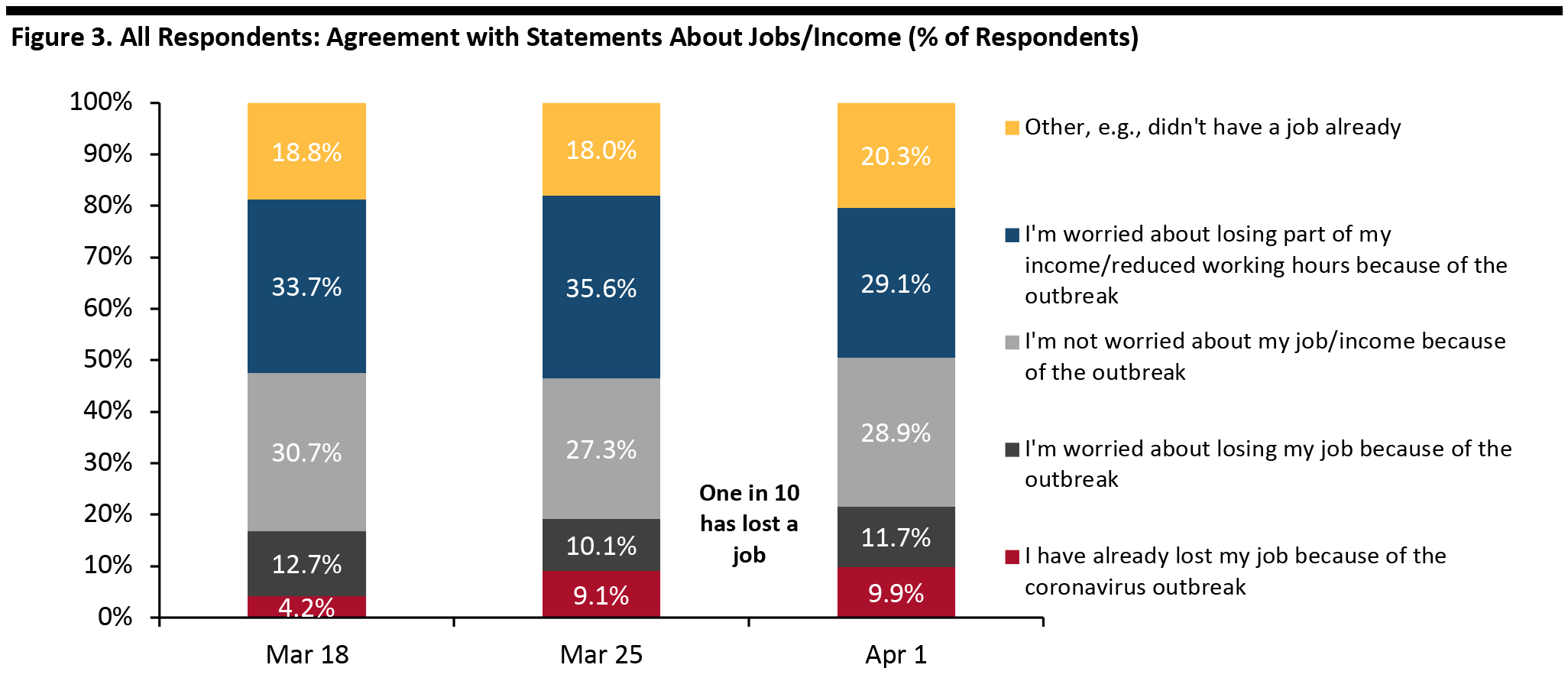

One in 10 Has Lost a Job

We asked respondents to choose from a selection of statements related to employment and income. One in 10 respondents now say they have lost their jobs, up slightly from 9.1% last week. By age, about 15% of the 18–29 and 30–44 age groups say they have already lost their jobs, while 6.7% of 45–60 year olds say they have lost their job, with the overall total depressed by just 3.0% of respondents aged over 60 saying the same. This week, a total of around 41% were worried about losing their job or part of their income, down from around 46% last week. [caption id="attachment_107096" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

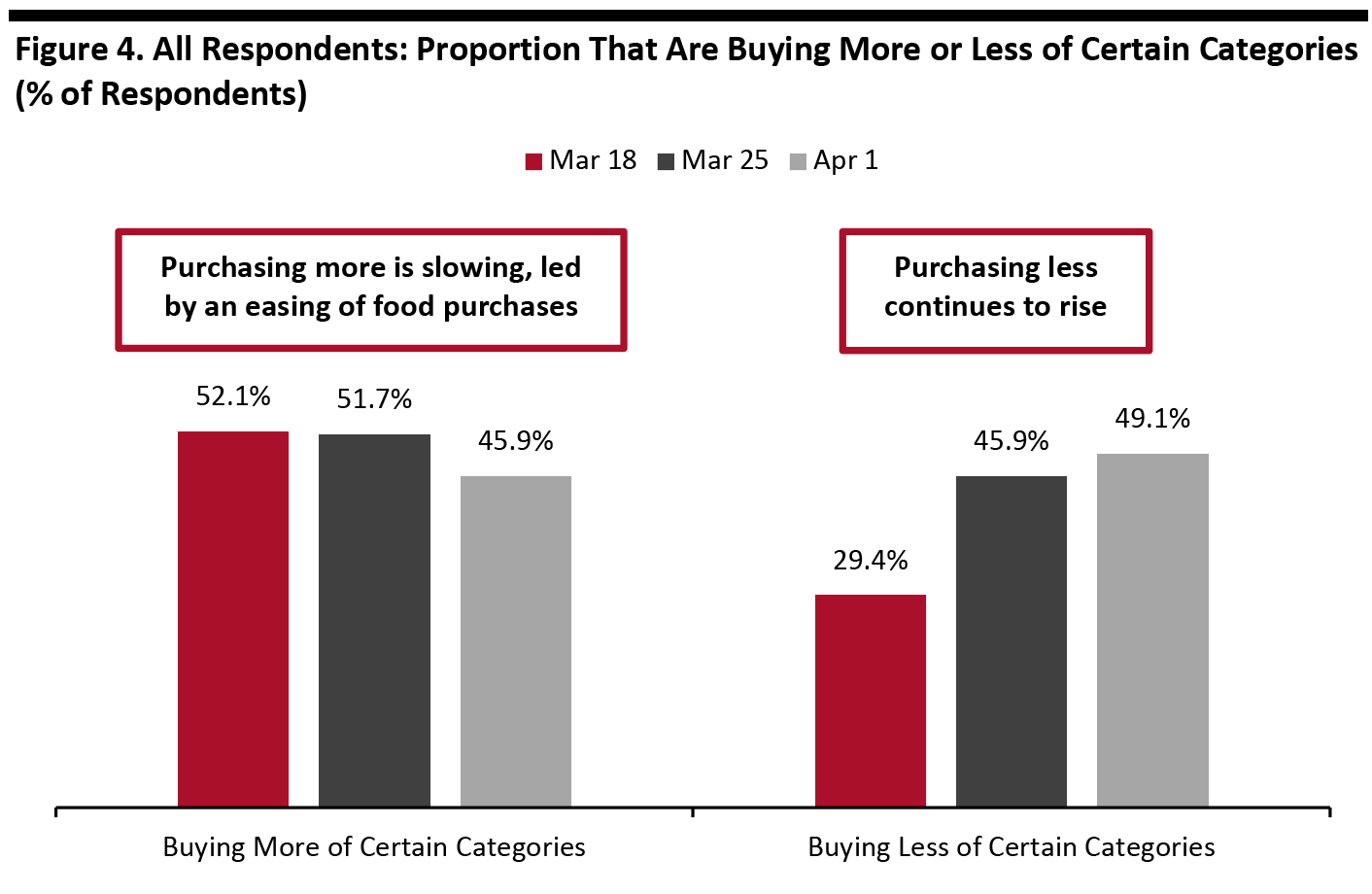

Half of Consumers Are Now Buying Less

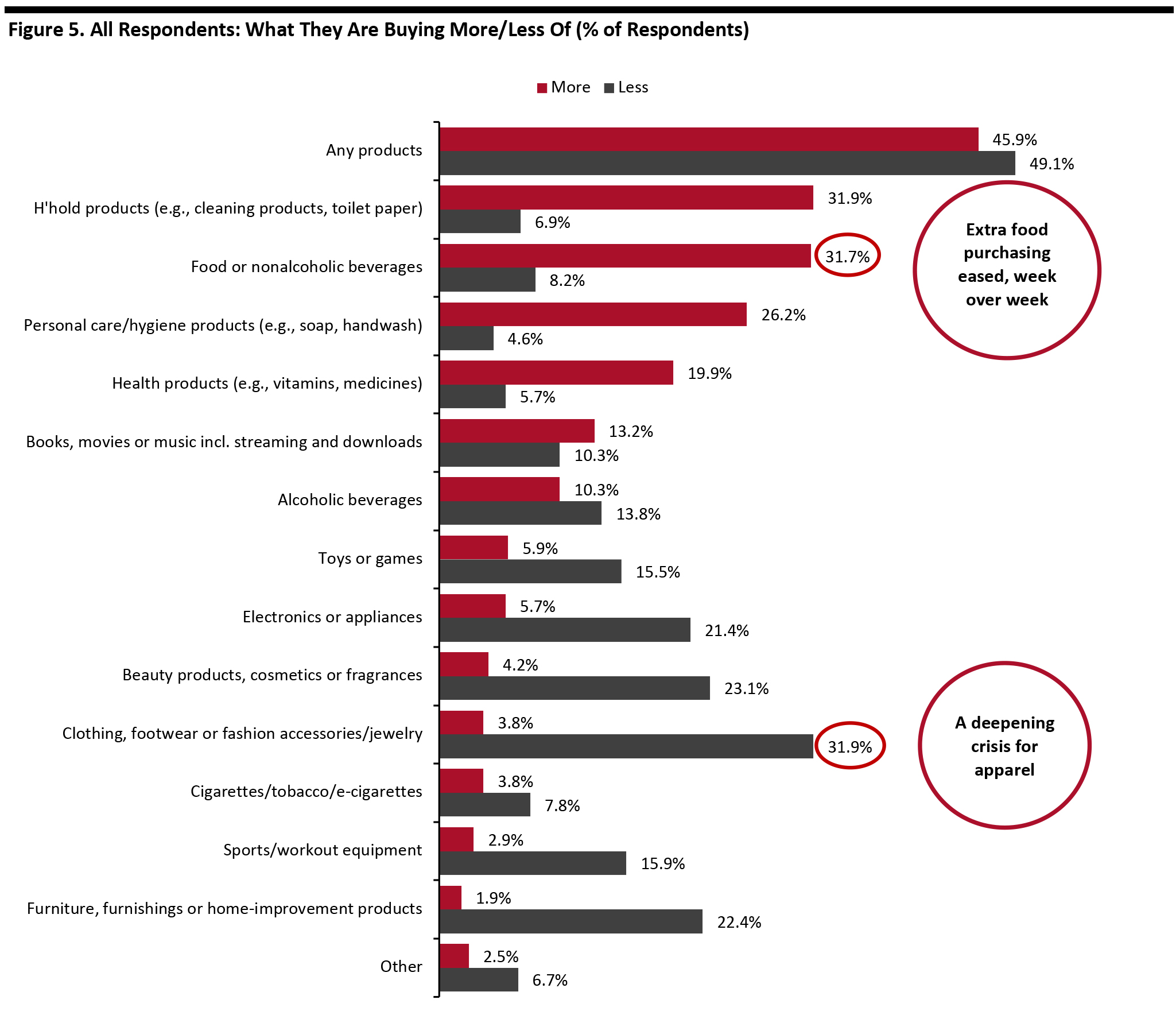

The proportion of those saying they were buying less of certain categories exceeded the proportion buying more of certain categories for the first time in this week’s survey. The results showed a sustained week-over-week increase in the proportion saying they buy less of certain categories, with half of respondents now saying they are cutting back in some areas. The decline in the proportion of those buying more of certain categories was led by a softening in the number buying more food (see below). Note that buying more of certain categories and buying less of certain categories were not mutually exclusive options and respondents could answer yes to both. [caption id="attachment_107097" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] More: Shoppers continue to buy more nondiscretionary or essential categories such as food, everyday household products, personal care and health products, but the percentages for food and health products decreased week over week—presumably because consumers have already stockpiled. Less: Almost one-third are now cutting apparel spend, up from just over one-quarter last week (see week-over-week comparisons in a later table). A large portion of respondents continued to say they are “spending less” on beauty products and furnishings/home-improvement. Ratio of less to more: Furnishings/home improvement again saw the greatest proportional disparity between buying less/more, with 12 times as many respondents answering “less” as answering “more”—the same ratio we recorded last week. Similarly, apparel remained consistent with the second highest less-to-more ratio at around eight to one. [caption id="attachment_107098" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

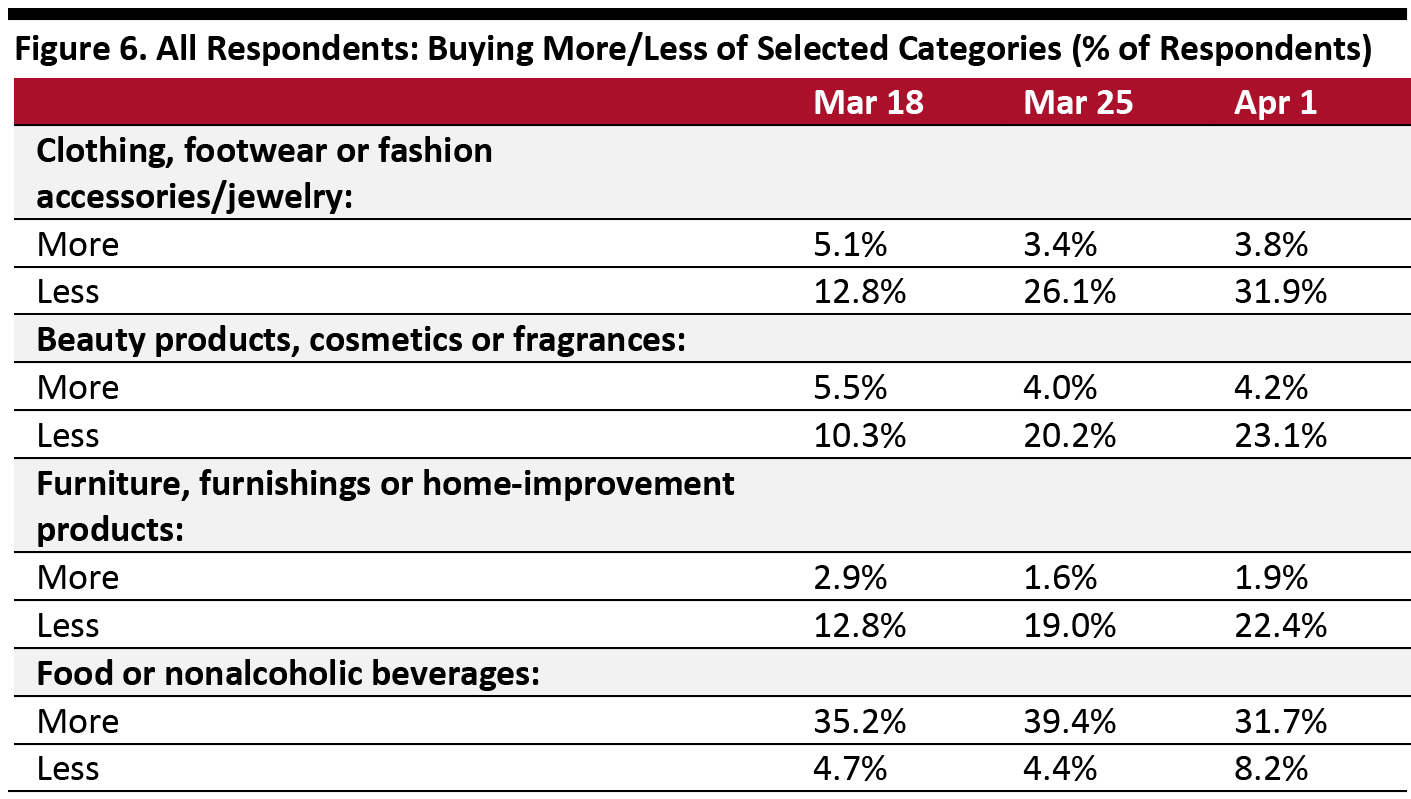

Source: Coresight Research [/caption] Shoppers Are Cutting Back More in Apparel and Beauty Our data suggest that apparel, beauty and home categories are seeing severe cutbacks—and that these have deepened over the past two weeks. Almost one-third of all respondents now say they now spend less on apparel versus just 4% spending more, while close to one-quarter are spending less on beauty and fragrances versus 4% spending more. Our surveys also suggest shoppers are now easing off on food purchases: many more are still buying more than buying less—but the trend is slowing. [caption id="attachment_107099" align="aligncenter" width="700"]

Base: US Internet users aged 18+

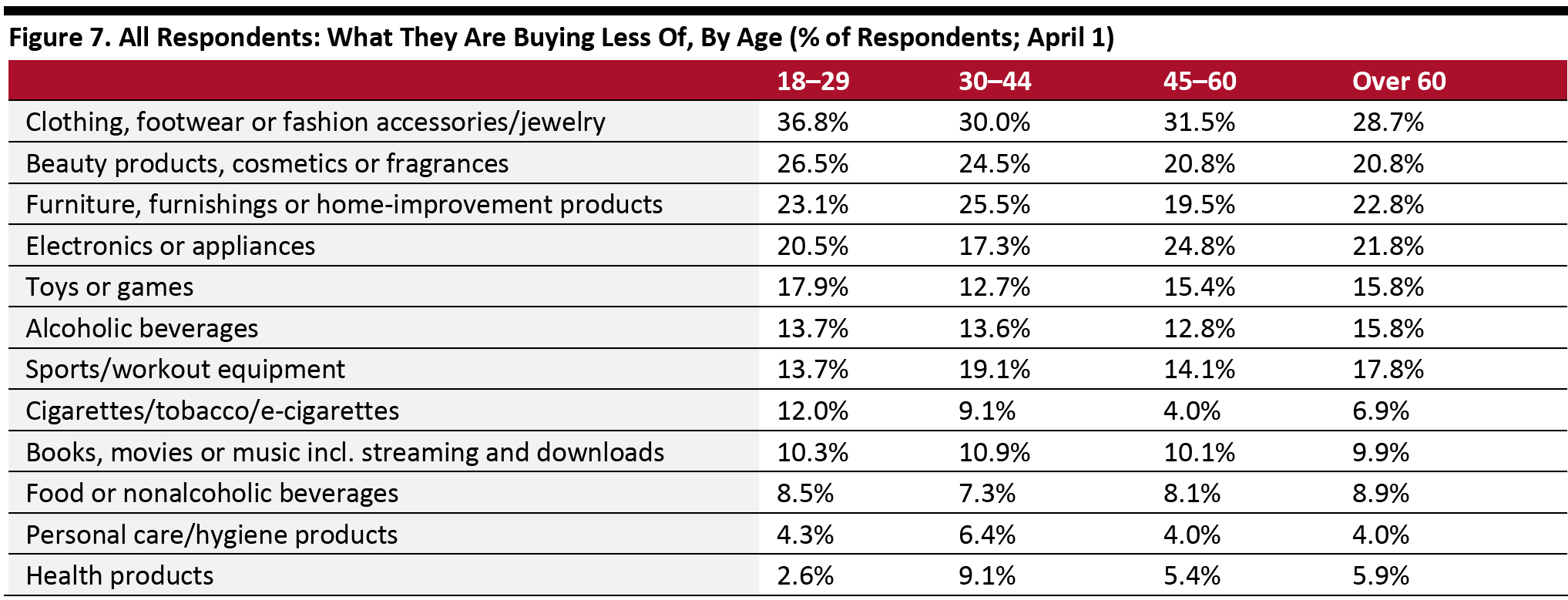

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Young Shoppers Curtail Fashion and Beauty Spend Focusing on categories in which shoppers say they are reducing their spending, young consumers are most likely to cut back on apparel or beauty—although they are also probably more likely to make regular purchases in these categories, which could be the basis for greater reduction. Cutting spending on home categories peaks among 30–44 year olds. [caption id="attachment_107100" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] In those categories people are buying less of, nearly twice as many respondents said they were buying less apparel, electronics/appliances and beauty products on March 25 than on March 17-18.

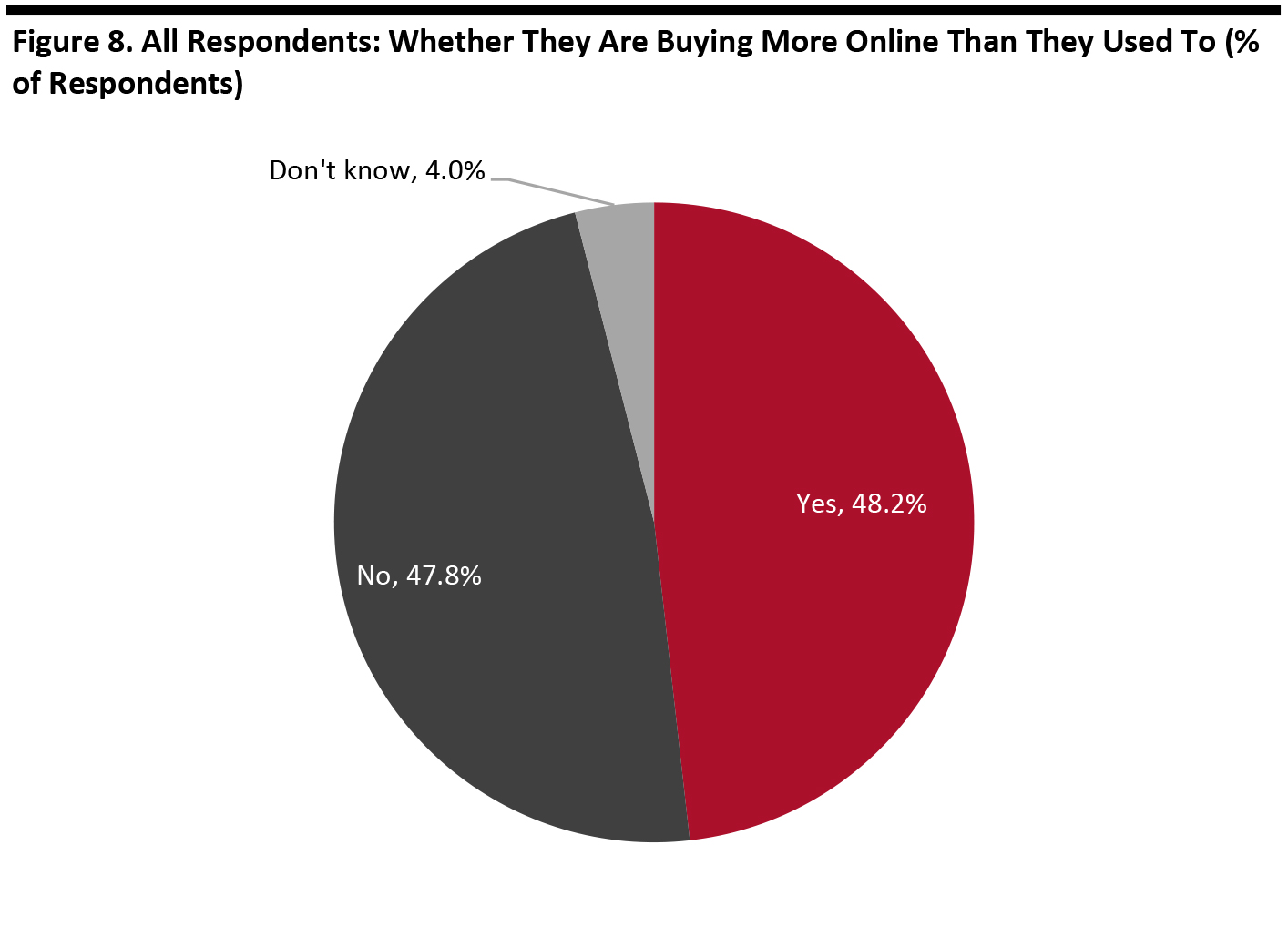

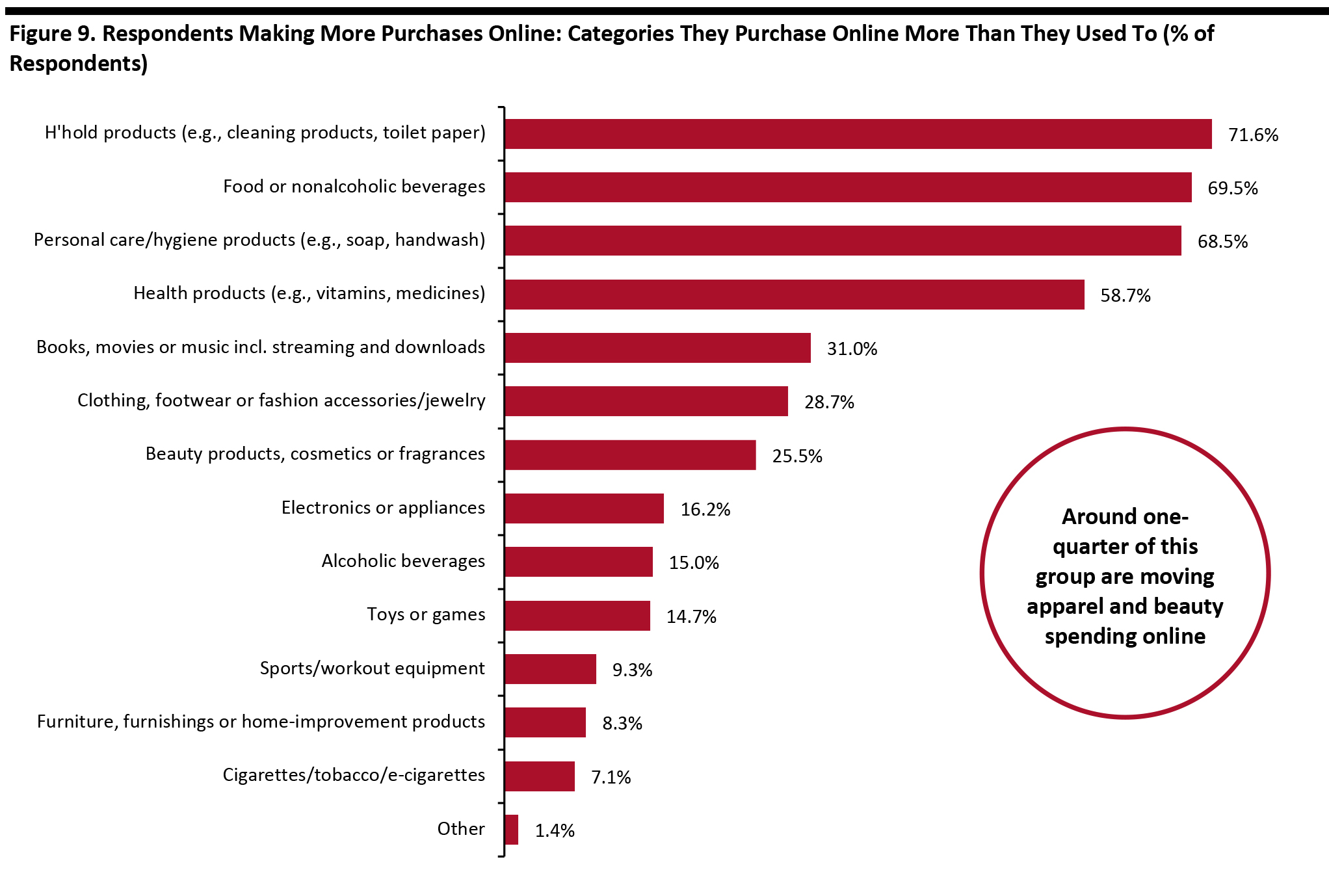

Half Are Switching Spending Online

Around half are making more purchases online than before the outbreak. [caption id="attachment_107101" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] In recent weeks we asked if consumers expect to buy more online should the outbreak continue, but, this week, we switched to asking what respondents are currently doing as the outbreak continues. Last week, 68.5% said they expect to buy more online if the outbreak continues. What They Are Buying More Of Online Among those buying more online, essentials such as food understandably lead the ranking. Roughly one-quarter of those making more purchases online are buying more apparel or beauty online, suggesting some sales transfer from closed stores—but this appears to fall far short of what is needed to offset the impact of store closures. Note the percentages below are of those expecting to buy more online. [caption id="attachment_107102" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who make more purchases online than they did before the coronavirus outbreak

Source: Coresight Research [/caption]

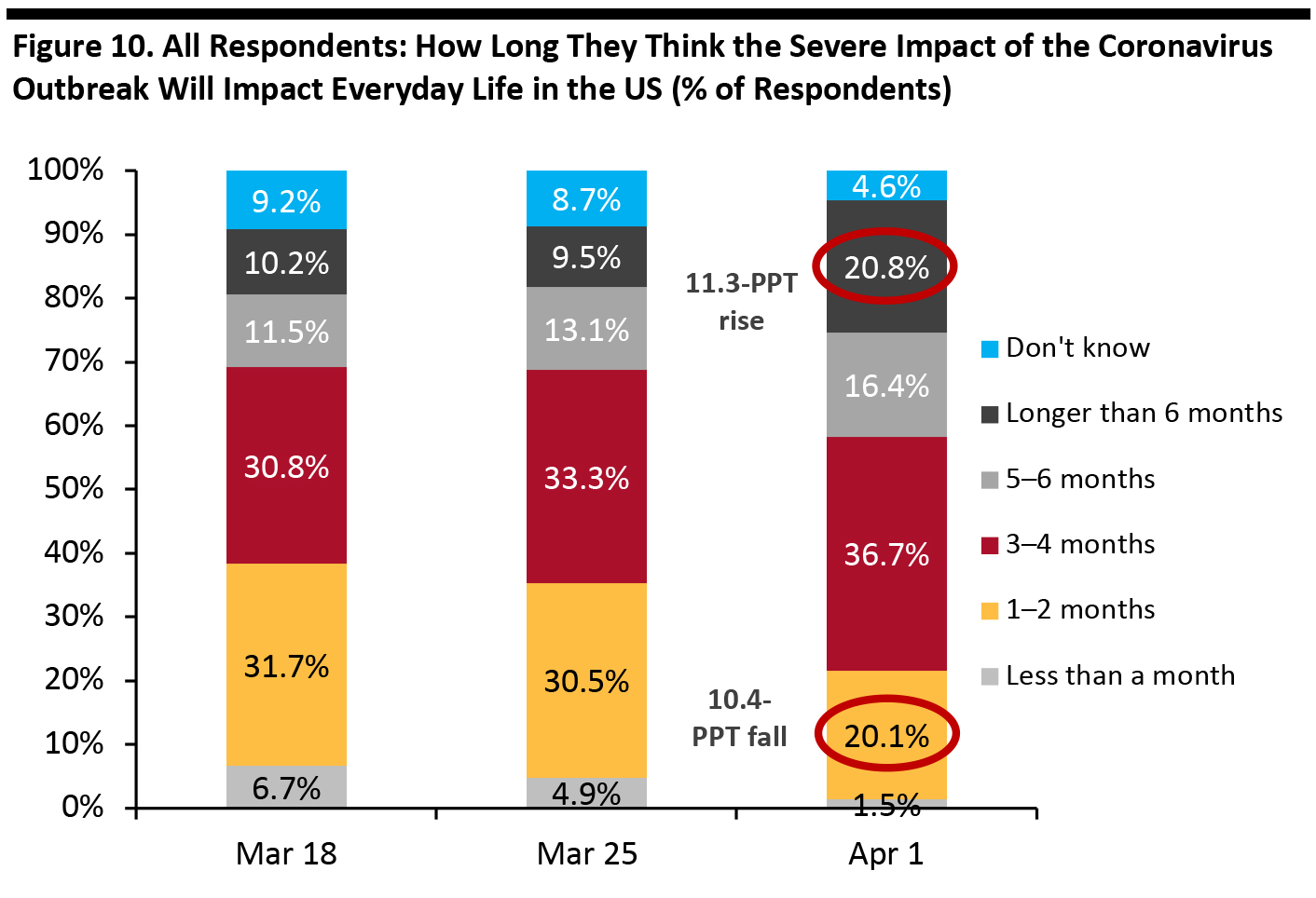

Three-Quarters Expect the Crisis To Last Three Months or More

Consumers are hunkering down for an extended crisis. This week, we saw a major, 11-percentage-point increase in the proportion expecting the severe impact of the outbreak to last more than six months: one in five consumers now hold this expectation. We saw a roughly equal decline in those expecting a duration of 1–2 months. Fully 74% now expect the severe impact to last three months or more, up from 56% last week. [caption id="attachment_107103" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

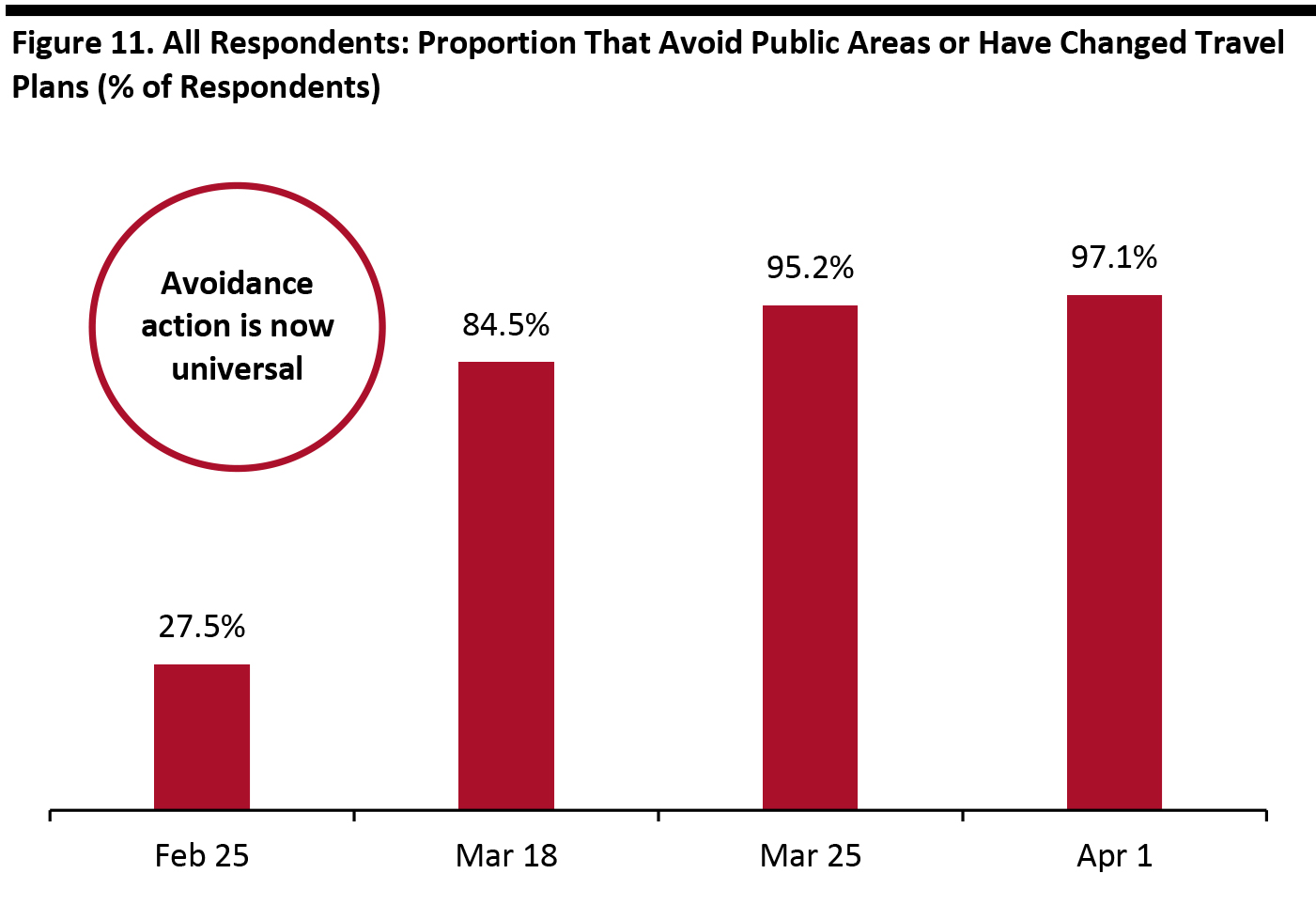

Almost All Consumers Now Taking Avoidance Actions

Avoidance action is now virtually universal, with 97% avoiding public places or not travelling. [caption id="attachment_107104" align="aligncenter" width="700"] Base: Internet users aged 18+

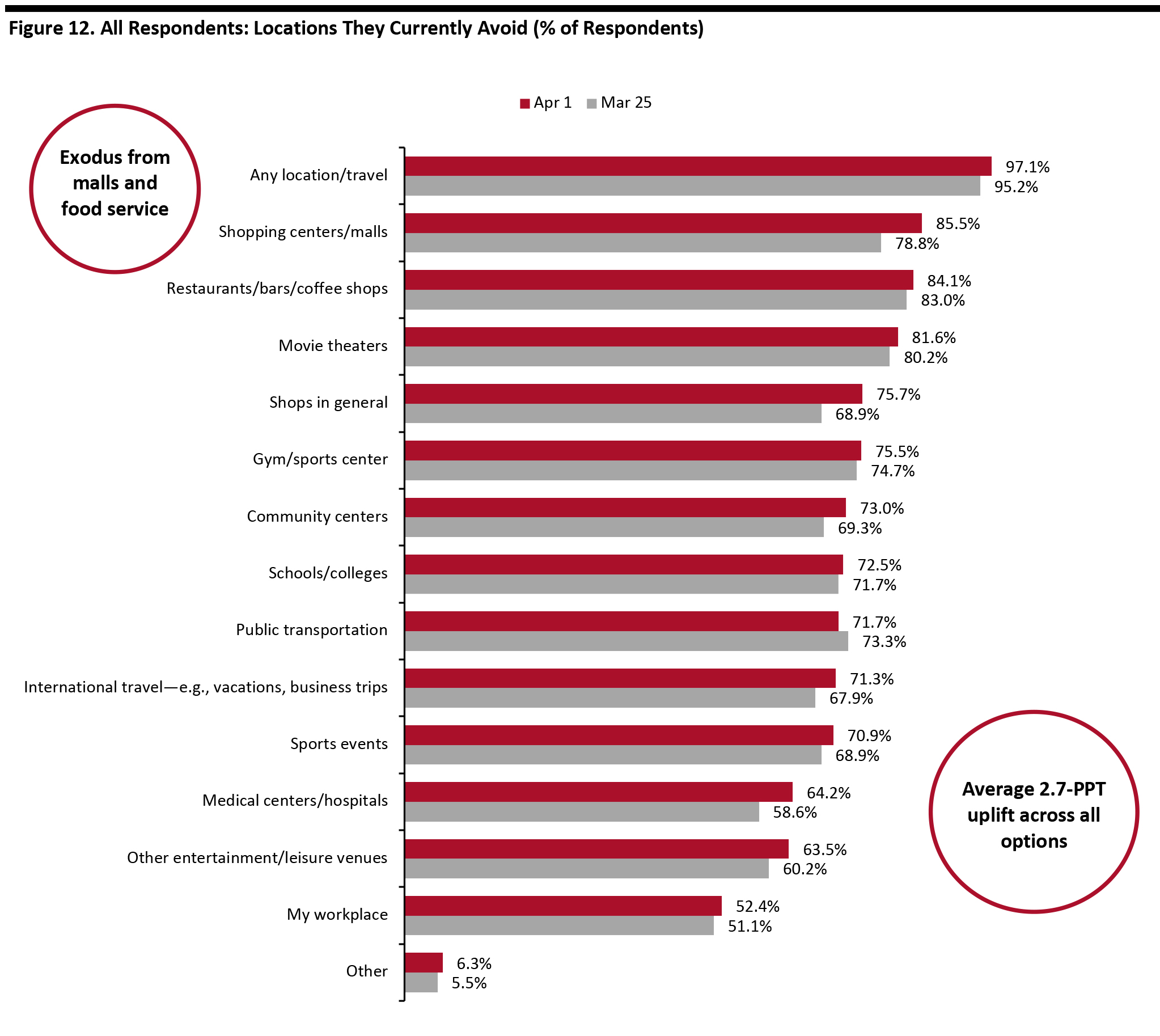

Base: Internet users aged 18+ Source: Coresight Research [/caption] This week, roughly 85% of respondents said they avoid food-service businesses and shopping centers. We saw an average 2.7-percentage-point increase across all the options week over week (except “Other”), versus a 16.7-percentage-point average increase last week. Shops in general remain less avoided than shopping malls—because malls are weighted toward discretionary retailers. [caption id="attachment_107105" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption]

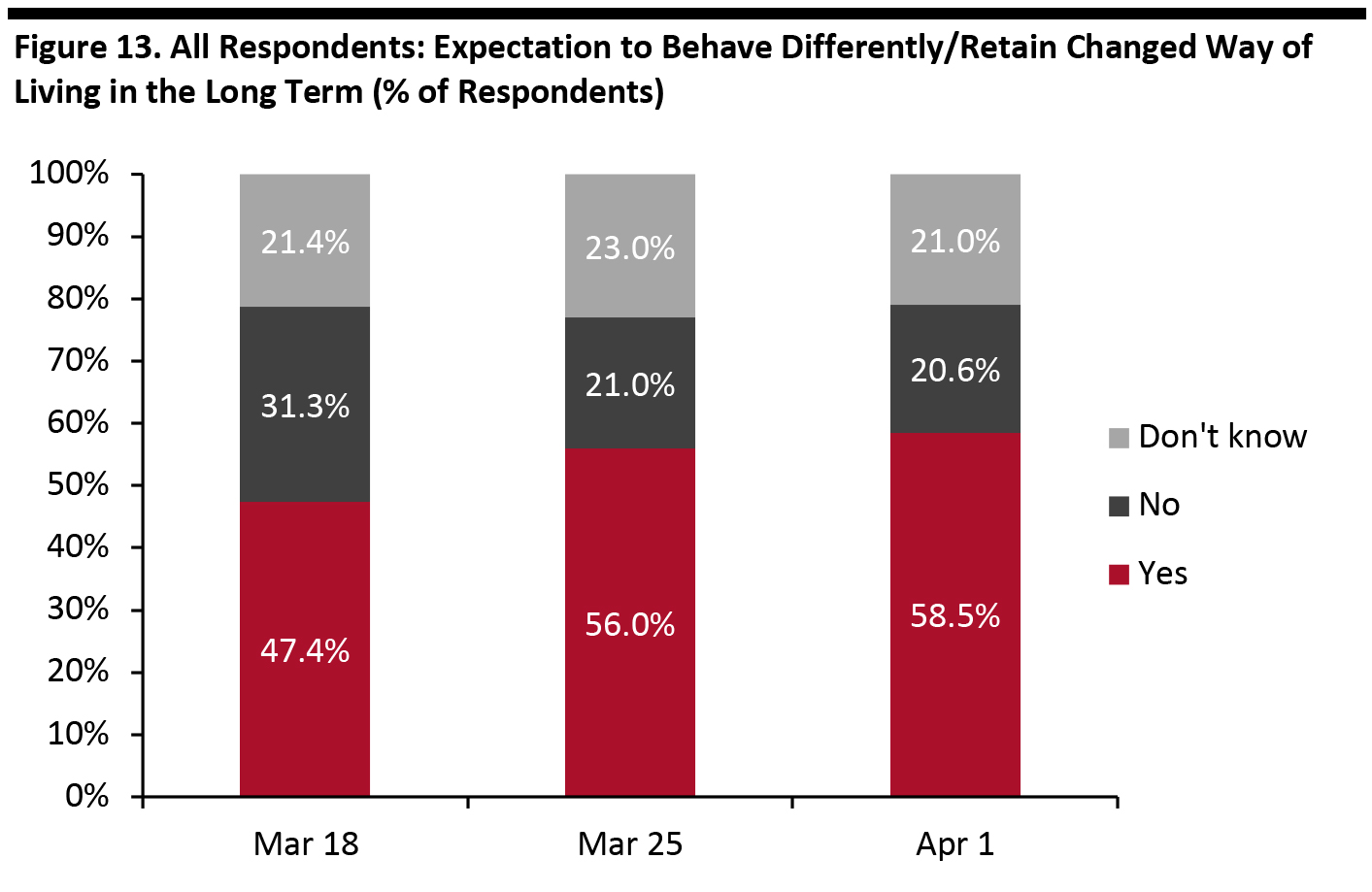

Over Half Expect To Retain Changes in Behavior

Each week, we ask respondents if they will retain changed behaviors after the crisis ends. This week, we saw a further increase in those expecting to do so, to almost six in 10. [caption id="attachment_107106" align="aligncenter" width="700"] Base: US Internet users aged 18+

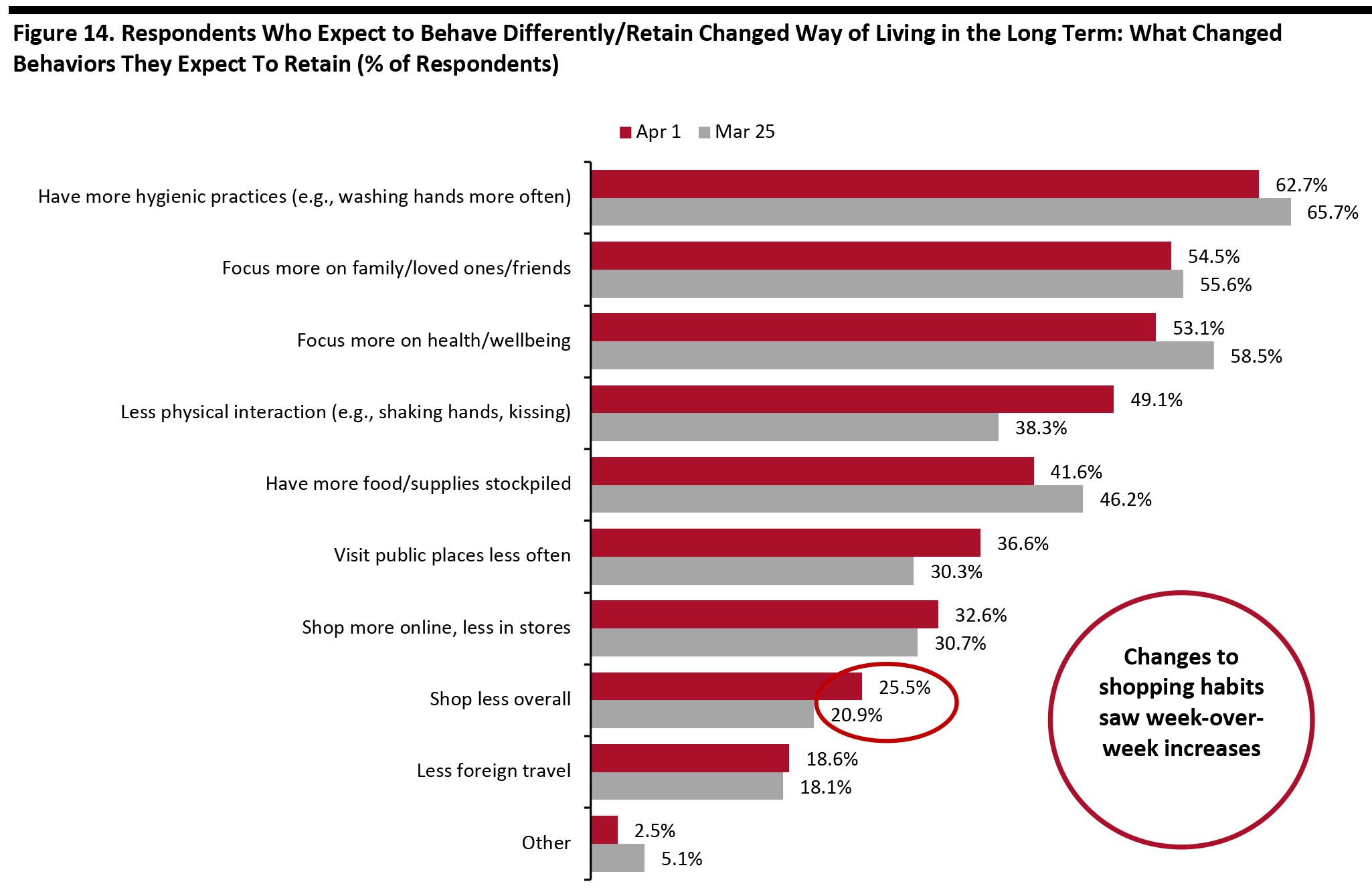

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Among those who expect to keep outbreak-driven behavior, prevention through better hygiene was the top behavior, consistent with prior weeks. However, focus more on family/loved ones/friends marginally overtook focus more on health/wellbeing this week. The option of “shop less overall” saw a slight increase this week. Roughly one-third of those expecting to make changes think they will shop more online, long term—this is equal to around 19% of all respondents (i.e., all consumers including those who say they do not expect to retain changed behavior). Note the percentages below are of those people who expect to retain changed behaviors. [caption id="attachment_107107" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

Source: Coresight Research [/caption]