DIpil Das

Coresight Research surveyed US consumers about the impact of the coronavirus on their behavior on March 17–18 and again on March 25, 2020. In this report, we discuss the latest findings and compare them to our March 17–18 survey.

The recent findings show US consumers are more worried and that more are cutting purchases.

Consumers Are More Worried

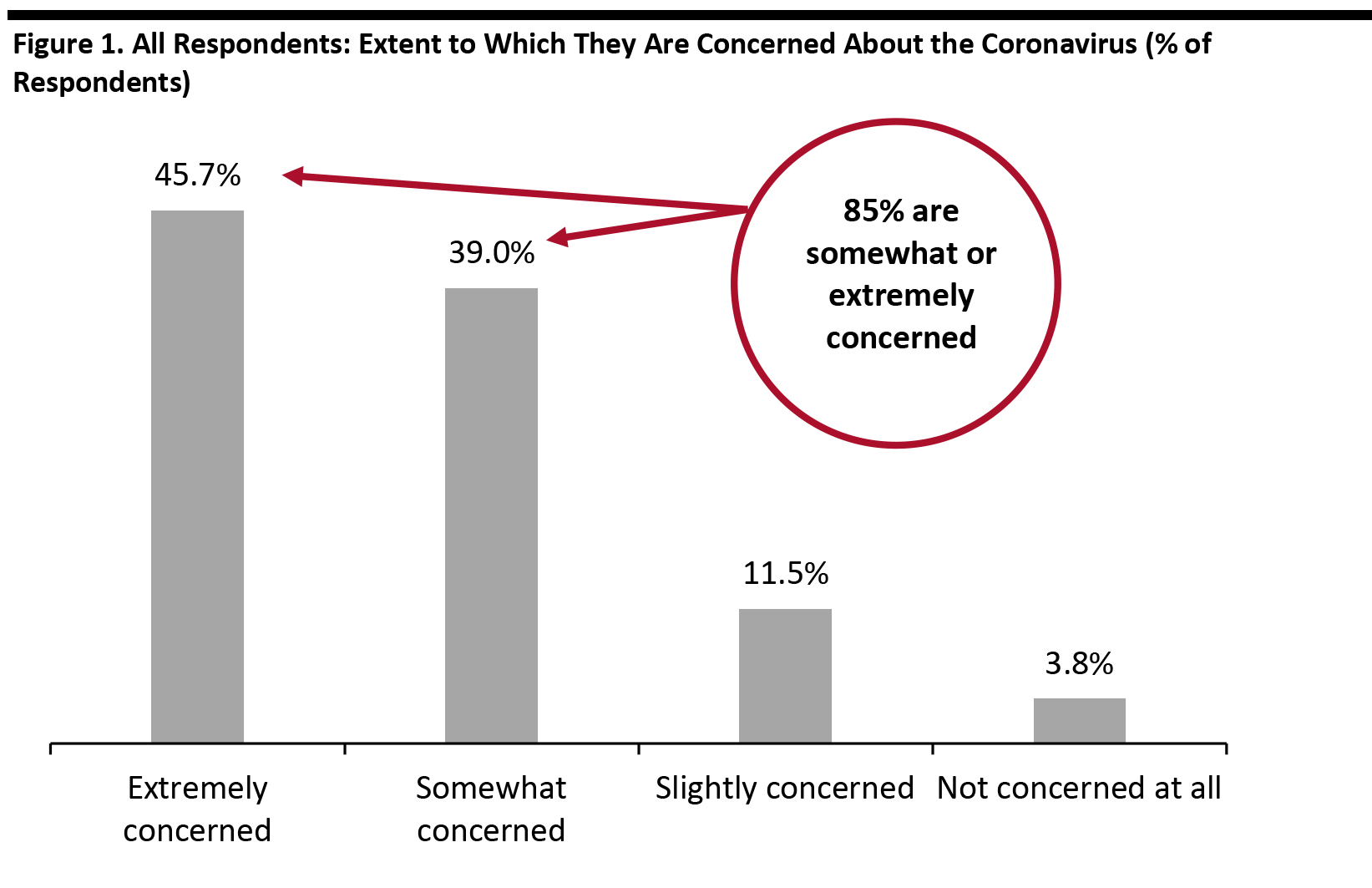

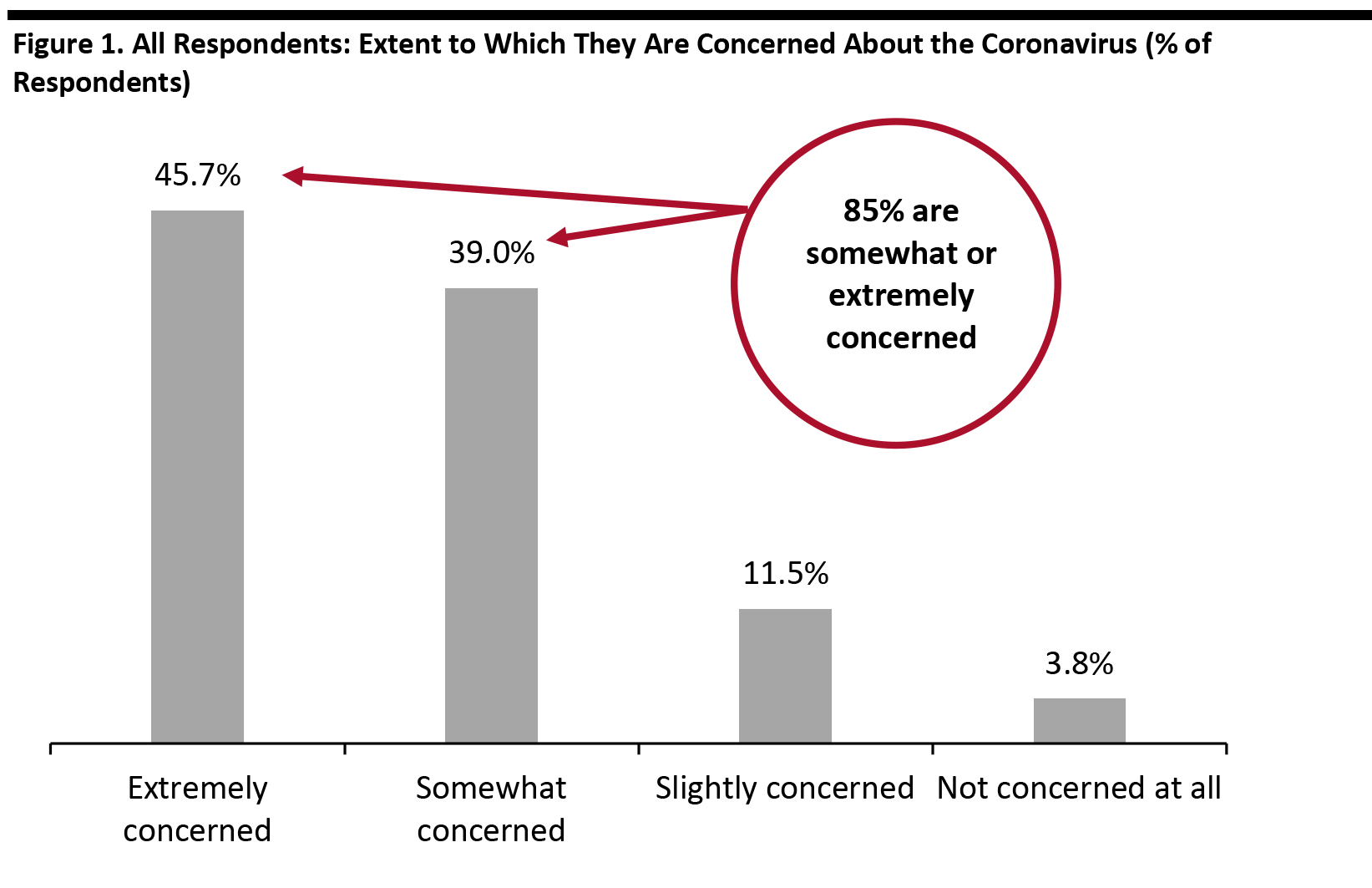

A total of 85% of respondents are somewhat or extremely concerned about the coronavirus, up from 79% one week earlier. Almost half of respondents are now extremely concerned about the pandemic, up around 10 percentage points over the prior week.

[caption id="attachment_106580" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

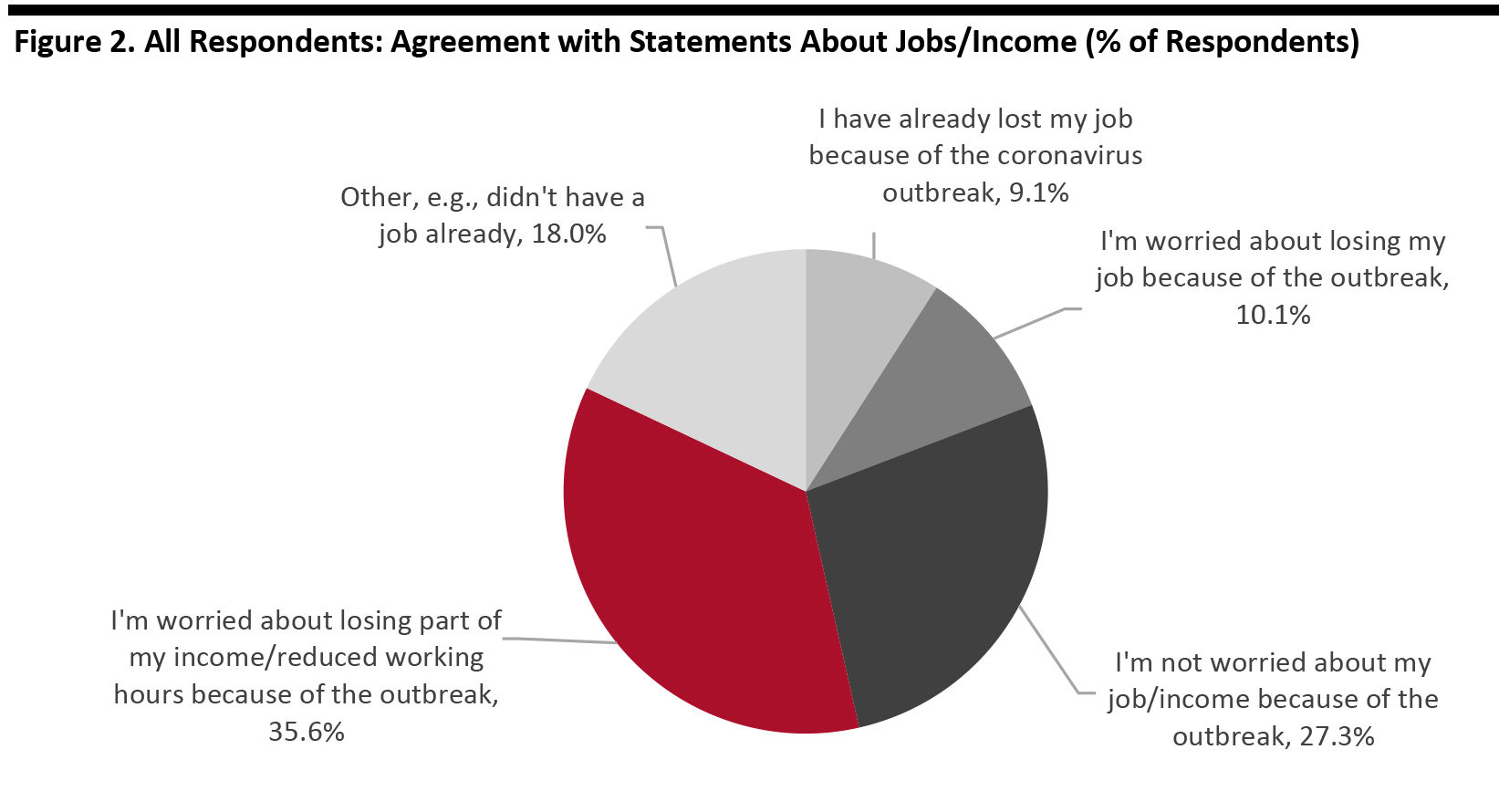

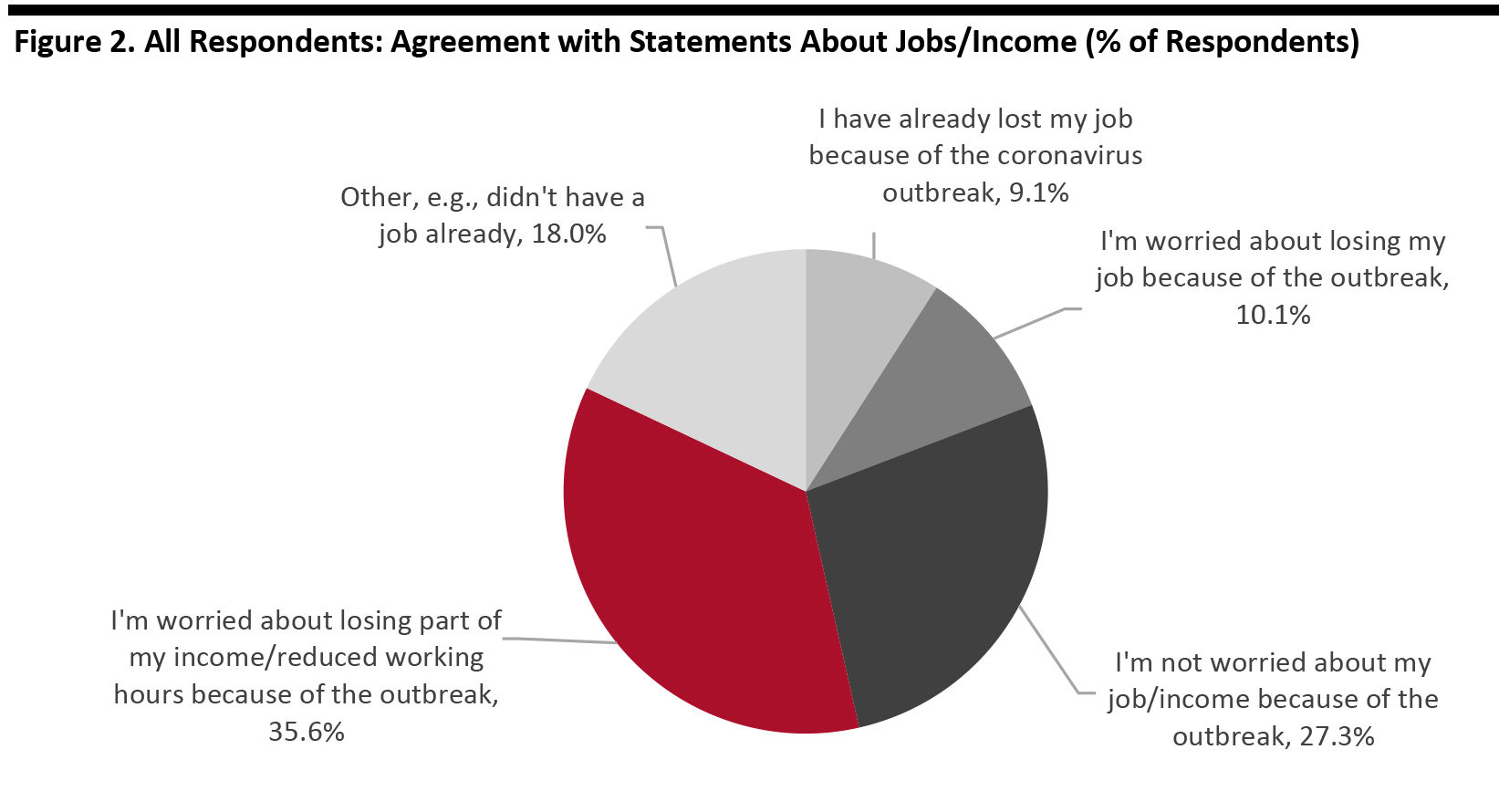

Source: Coresight Research [/caption] Concerns About Jobs and Income We asked respondents to choose from a selection of statements related to employment and income. · Some 9.1% said they had already lost their jobs because of the coronavirus outbreak, up from 4.2% last week. · Although we saw fluctuations in worries about losing jobs or losing part of their income week over week, the total for these two metrics was broadly steady, with around 46% concerned about losing employment or income in both weeks. The findings emphasize the economic retrenchment that we could see as shoppers curtail spending out of fear. [caption id="attachment_106581" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

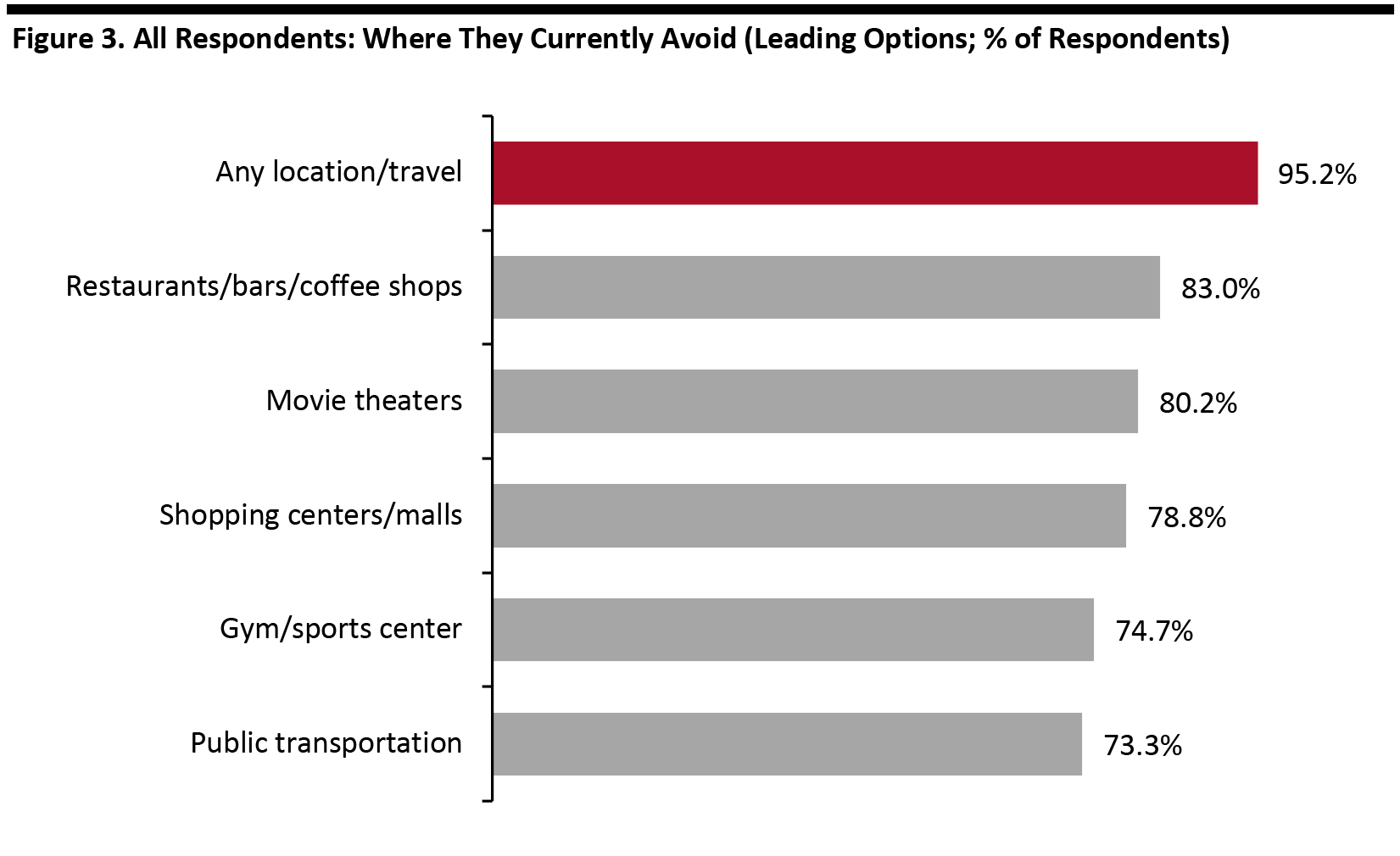

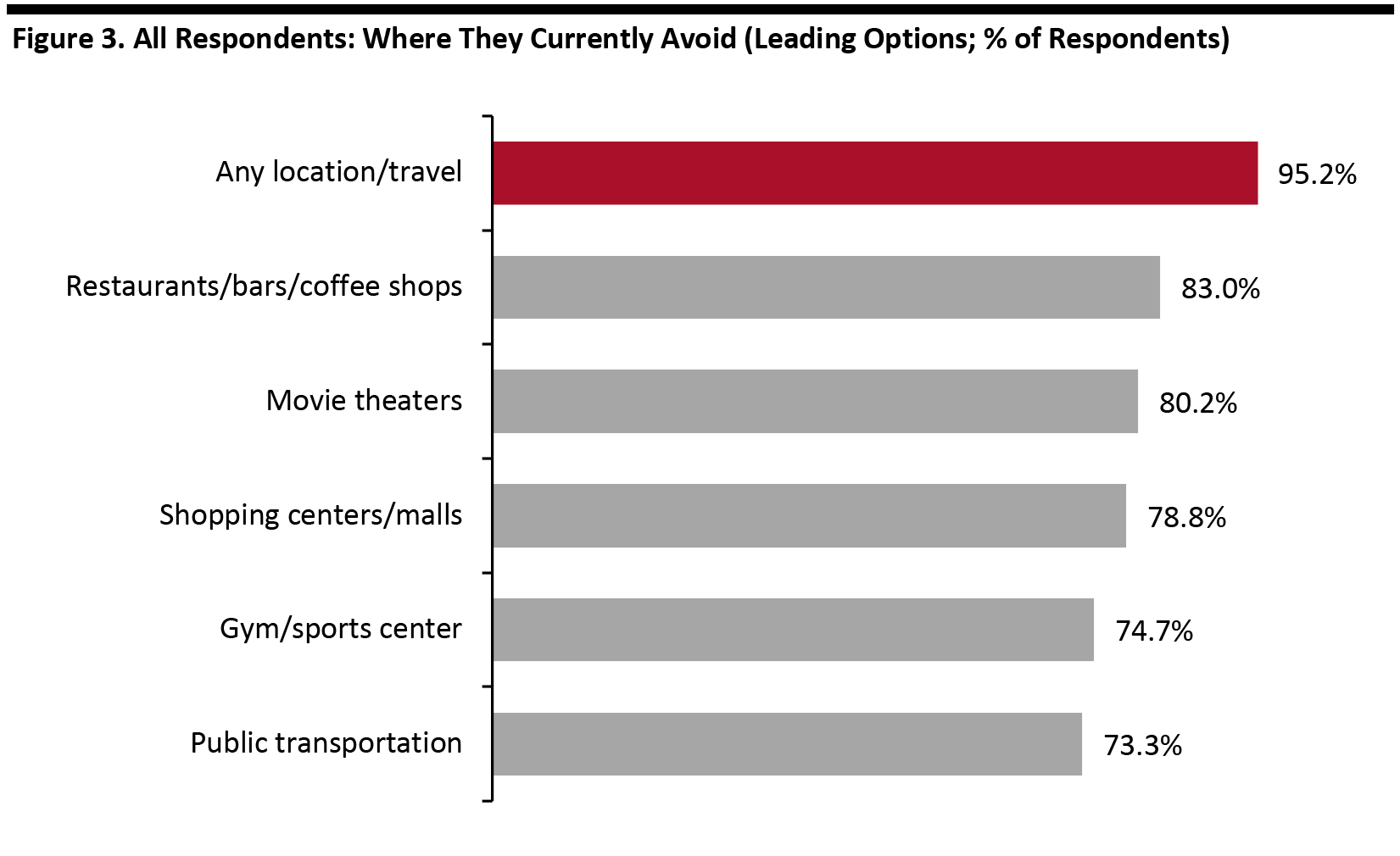

Source: Coresight Research [/caption] Changing Behaviors Just over half of all respondents say they now buy more of certain categories—level with last week. However, the proportion who say they buy less of certain categories increased considerably, with close to half of respondents saying they are cutting back in some areas. Base: US Internet users aged 18+

Base: US Internet users aged 18+

Source: Coresight Research [/caption]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Concerns About Jobs and Income We asked respondents to choose from a selection of statements related to employment and income. · Some 9.1% said they had already lost their jobs because of the coronavirus outbreak, up from 4.2% last week. · Although we saw fluctuations in worries about losing jobs or losing part of their income week over week, the total for these two metrics was broadly steady, with around 46% concerned about losing employment or income in both weeks. The findings emphasize the economic retrenchment that we could see as shoppers curtail spending out of fear. [caption id="attachment_106581" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Changing Behaviors Just over half of all respondents say they now buy more of certain categories—level with last week. However, the proportion who say they buy less of certain categories increased considerably, with close to half of respondents saying they are cutting back in some areas.

- Read the full report for full details, including in which categories respondents say they are purchasing more or less.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]