DIpil Das

Introduction

Coresight Research surveyed US consumers about how the coronavirus was affecting their behavior on March 17-18 and again on March 25, 2020. In this report, we discuss the latest findings and compare them to those from March 17–18 survey. We also compare selected metrics to our late-February consumer survey.Consumers Are More Worried

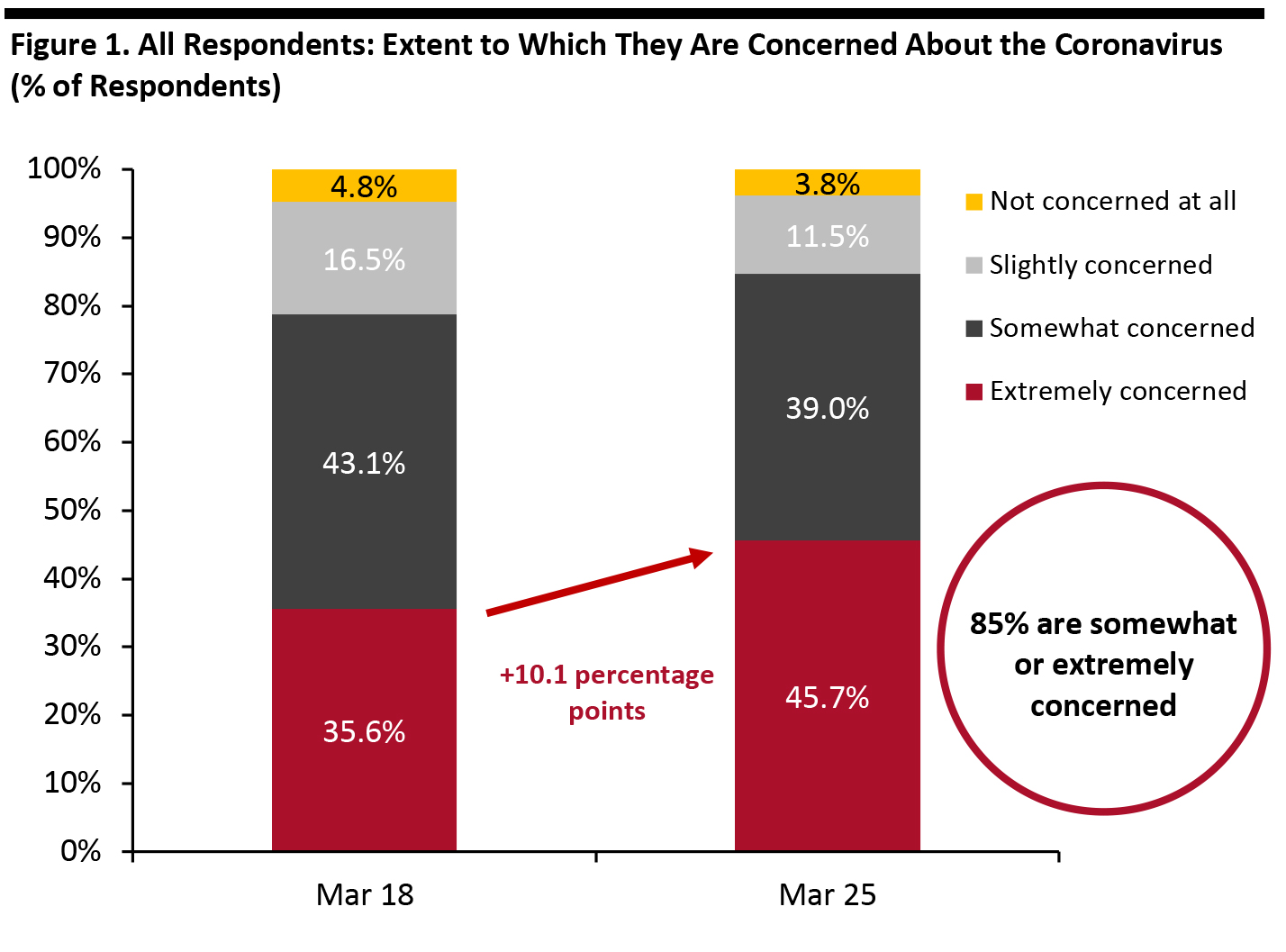

Almost half of US consumers (45.7%) are now extremely concerned about the outbreak, up 10 percentage points in just a week. A total of 85% of respondents are now either somewhat or extremely concerned about the coronavirus, up from 79% a week earlier. [caption id="attachment_106565" align="aligncenter" width="700"] Not all week-over-week differences charted in this report are statistically significant

Not all week-over-week differences charted in this report are statistically significant Base: US Internet users aged 18+

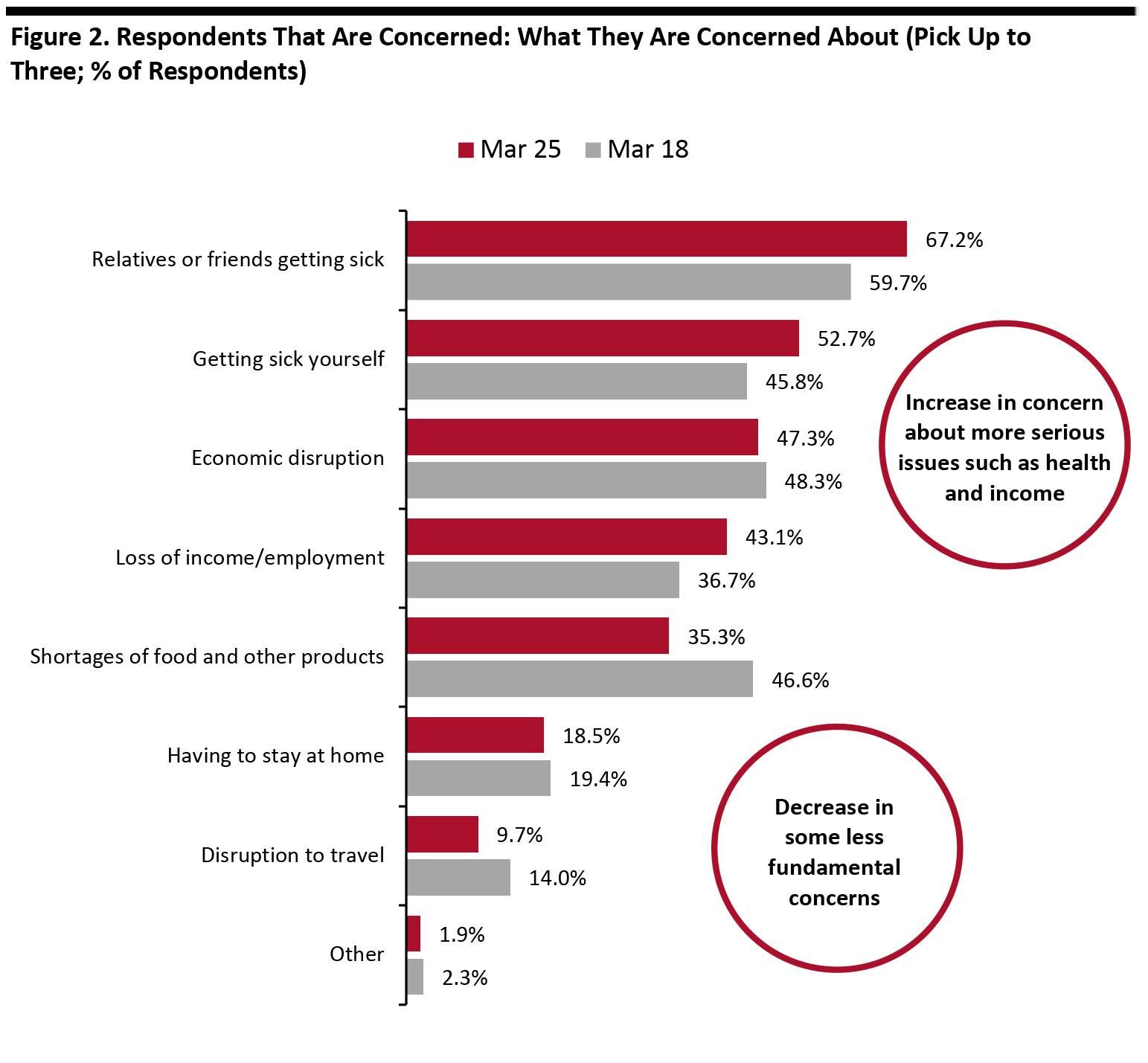

Source: Coresight Research [/caption] This week, we saw a jump in concern about relatives or friends getting sick—which remains more of a concern among respondents than getting sick themselves (although that also increased). The general trend was greater concern about more serious issues such as health and income and concerns about issues that may be less essential declined. In particular, we saw a significant increase in the proportion worried about losing income or employment. Concerns about food shortages fell—perhaps because consumers can see that food supply chains still operate sufficiently to continue restocking quickly depleting shelves, simply because they stockpiled already. [caption id="attachment_106601" align="aligncenter" width="700"]

Respondents could select up to three options

Respondents could select up to three options Base: US Internet users aged 18+ who are concerned about the coronavirus outbreak

Source: Coresight Research [/caption]

Two-Thirds Are Worried About Healthcare

We also asked all respondents whether they agreed with the statement “I am worried about the availability of healthcare services during the coronavirus outbreak” and found fully 63.6% agree, showing widespread concerns about healthcare resources during the pandemic.Employment and Income Concerns

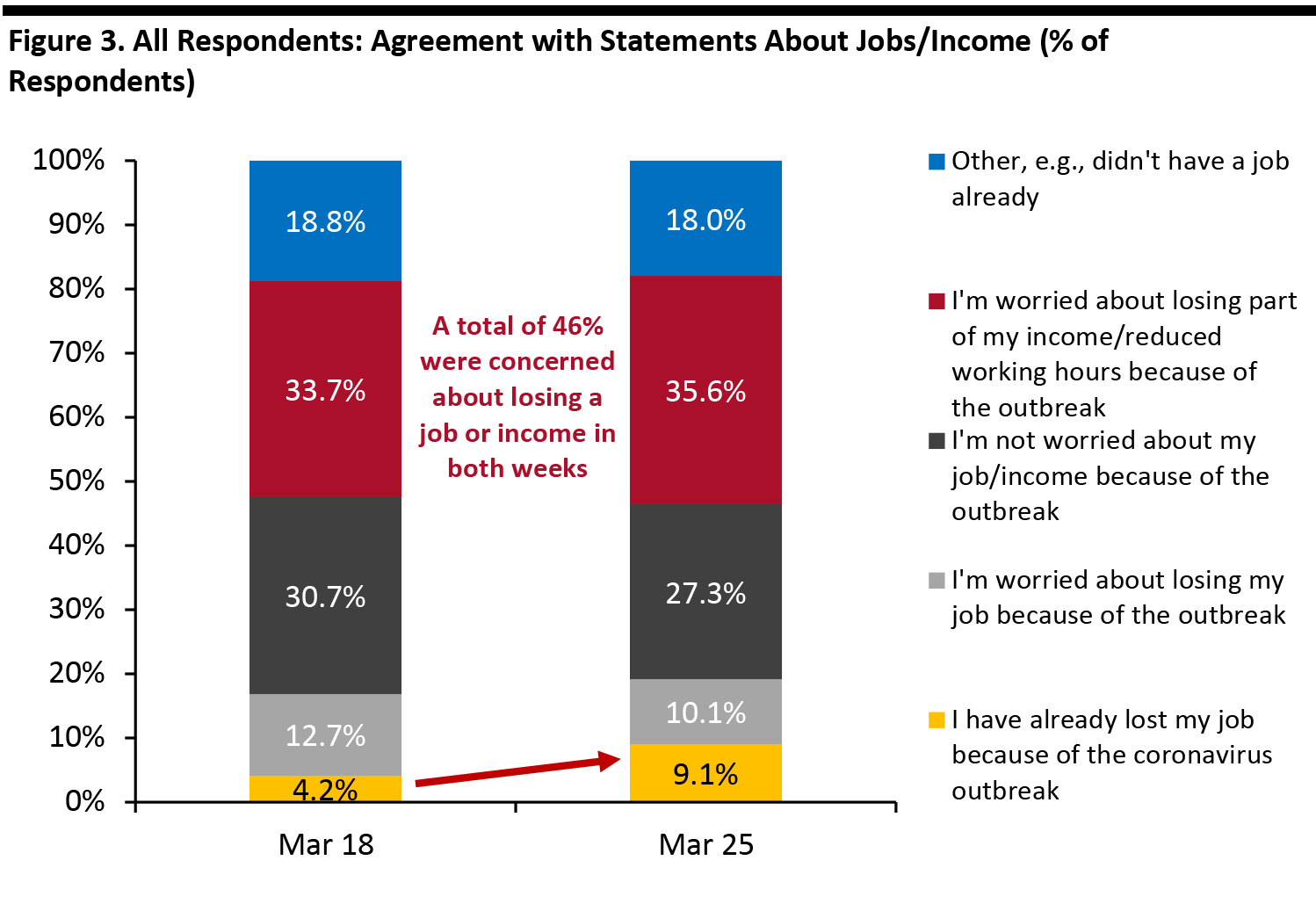

We asked respondents to choose from a selection of statements related to employment and income. Some 9.1% said they had already lost their job because of the coronavirus outbreak, up from 4.2% last week. And, more young people seem to be losing their jobs: 12% of 18—29 year olds say they lost their jobs, nearly three percentage points higher than the overall average. Although there were fluctuations in how much respondents worry about losing their jobs or part of their income week over week, the total for the two was broadly steady, with around 46% concerned about losing employment or income in both weeks. [caption id="attachment_106567" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

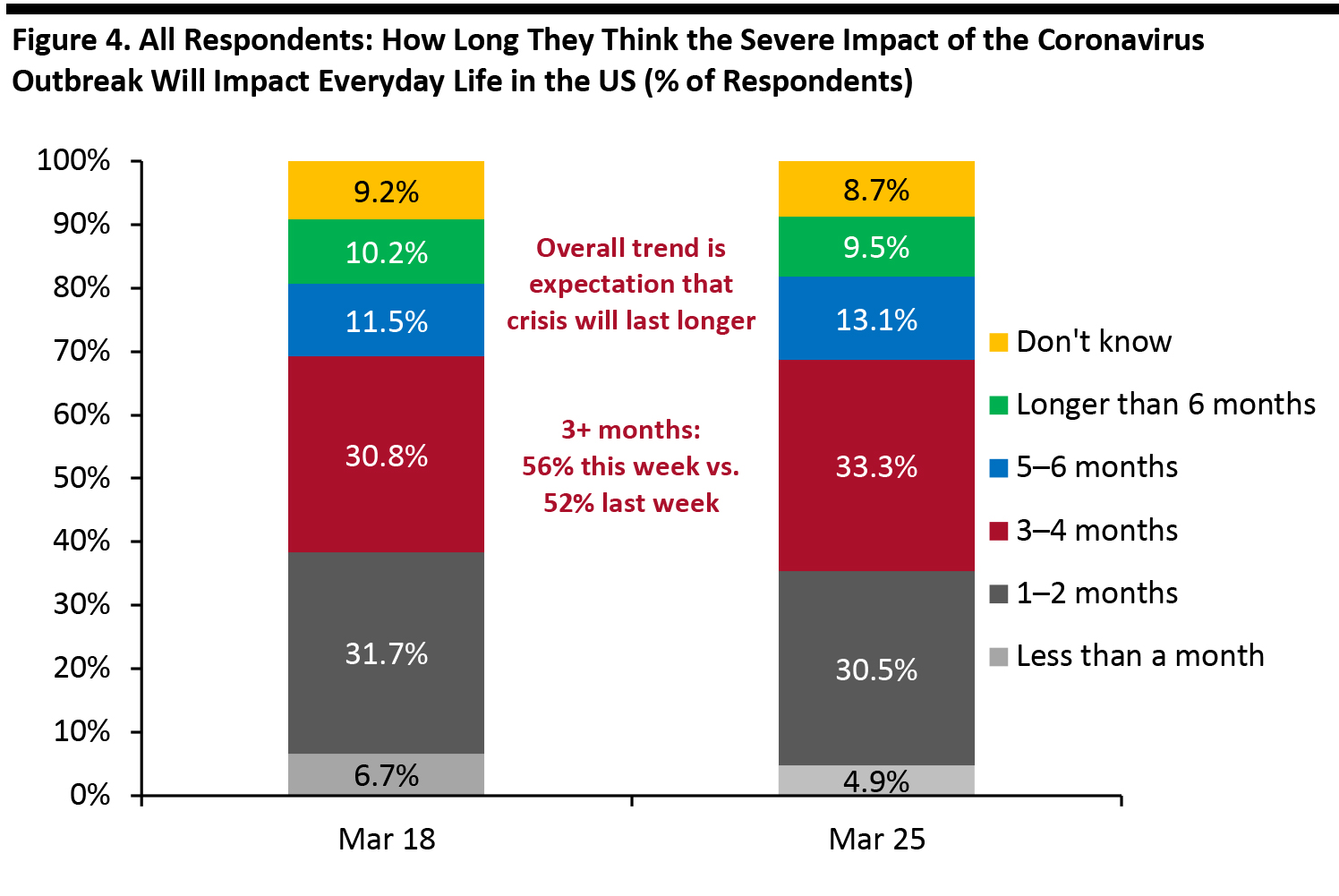

How Long They Expect the Crisis to Last

As in the previous week, the bulk of respondents think the severe impact of the coronavirus outbreak will last between one and four months. However, the total proportion expecting the crisis to last three months or more climbed slightly from 52% to 56%. Last week, our findings suggested many consumers are likely to batten down the hatches for the long haul; this week’s numbers reinforce that. [caption id="attachment_106568" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

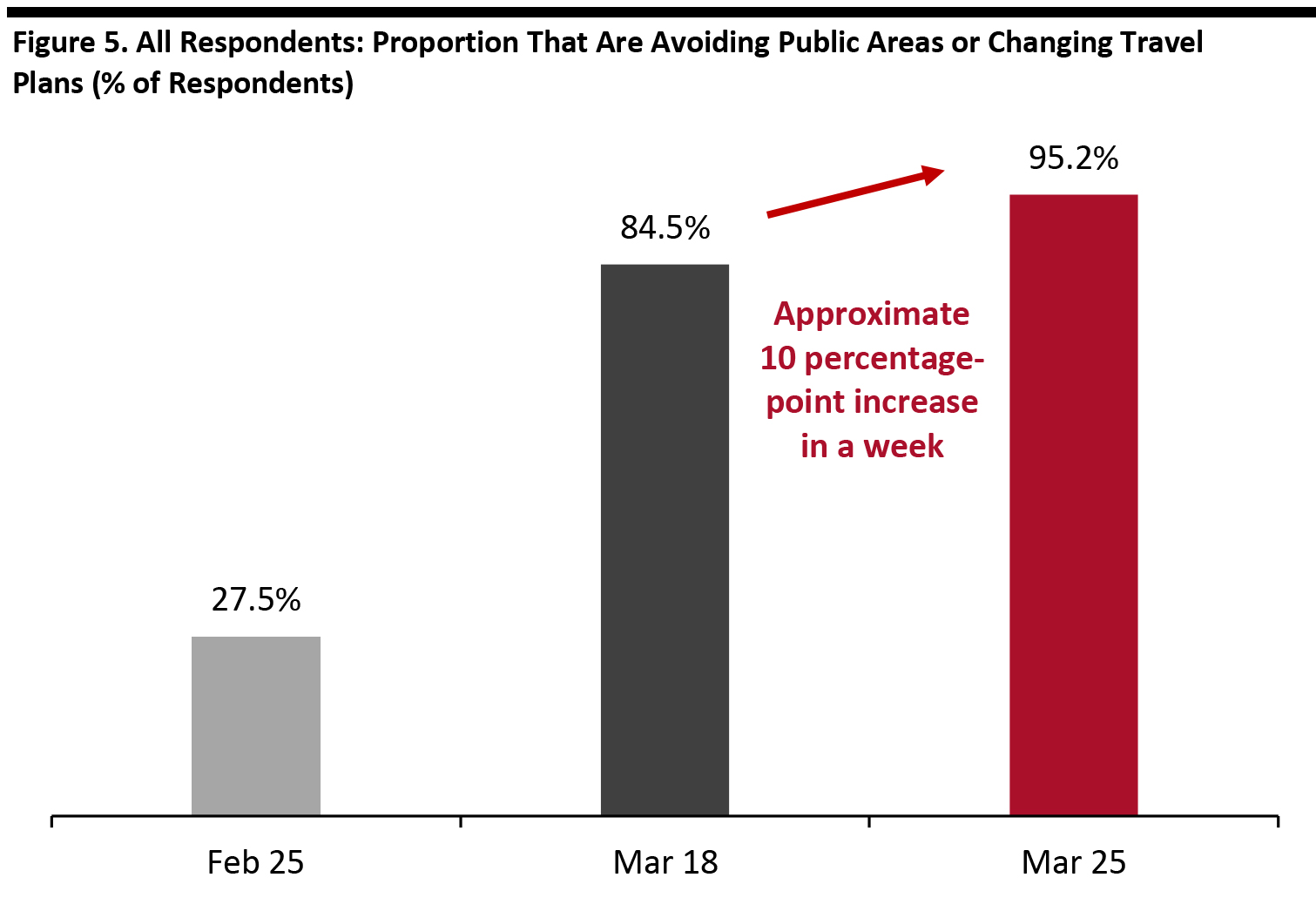

Almost All Consumers Now Taking Avoidance Actions

Fully 95% of respondents are now avoiding public areas or travel, up from around 85% when we surveyed consumers one week earlier. [caption id="attachment_106569" align="aligncenter" width="700"] Base: Internet users aged 18+

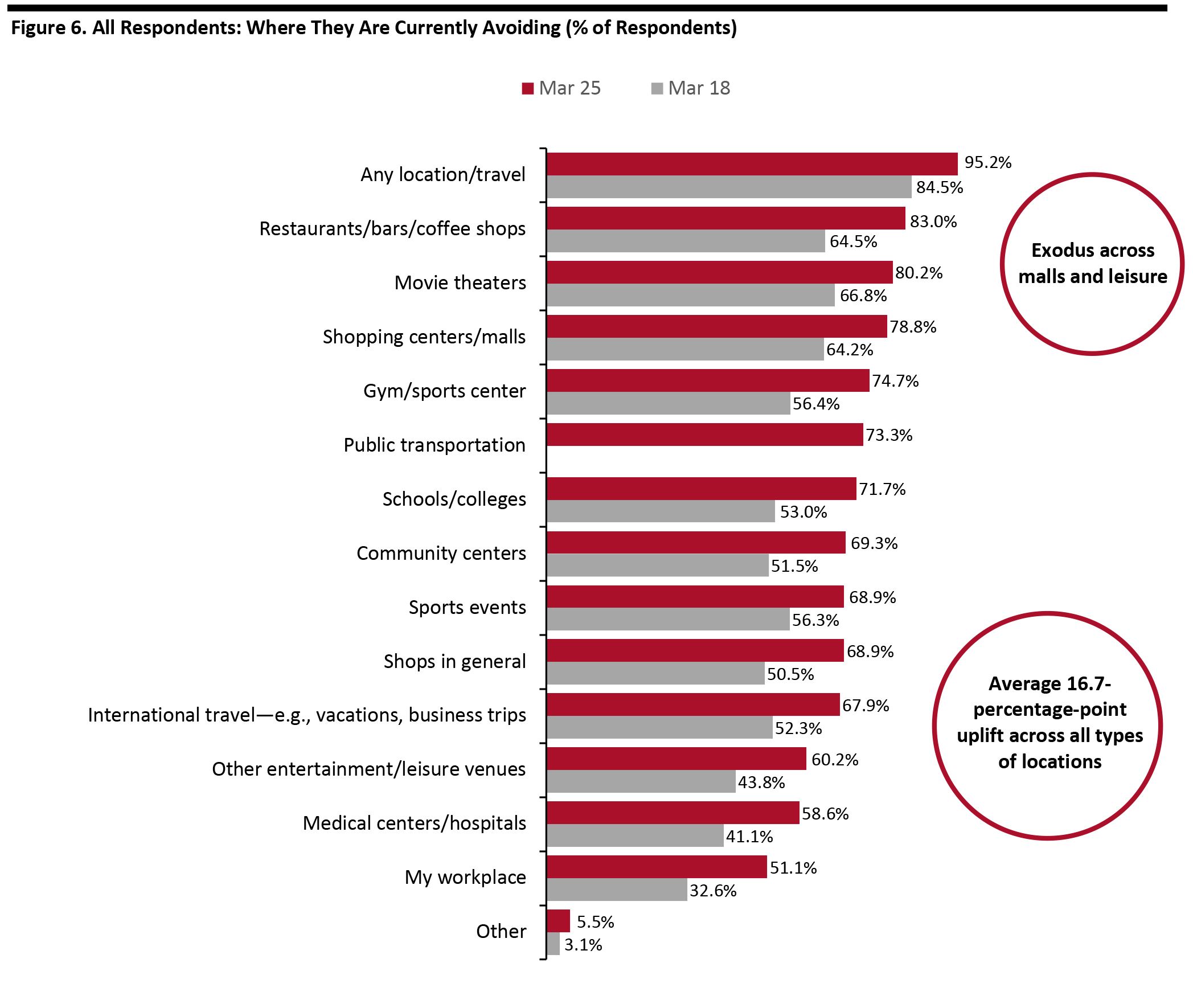

Base: Internet users aged 18+ Source: Coresight Research [/caption] This week, around 80% or more of respondents said they avoid food-service businesses, movie theaters and shopping centers. We saw an average 16.7-percentage-point increase across all the options (except “Other”), week over week. Shops in general continue to be significantly less avoided than shopping centers—showing malls are weighted toward discretionary retail rather than nondiscretionary stores such as grocery stores and drugstores. This week, Target confirmed it had seen “unusually strong” traffic month-to-date in March as shoppers flocked to buy groceries and essentials. [caption id="attachment_106570" align="aligncenter" width="700"]

Respondents could select multiple options. Note: Public transportation not asked on March 18

Respondents could select multiple options. Note: Public transportation not asked on March 18 Base: US Internet users aged 18+

Source: Coresight Research [/caption]

Half Think All Nonessential Stores Should Close

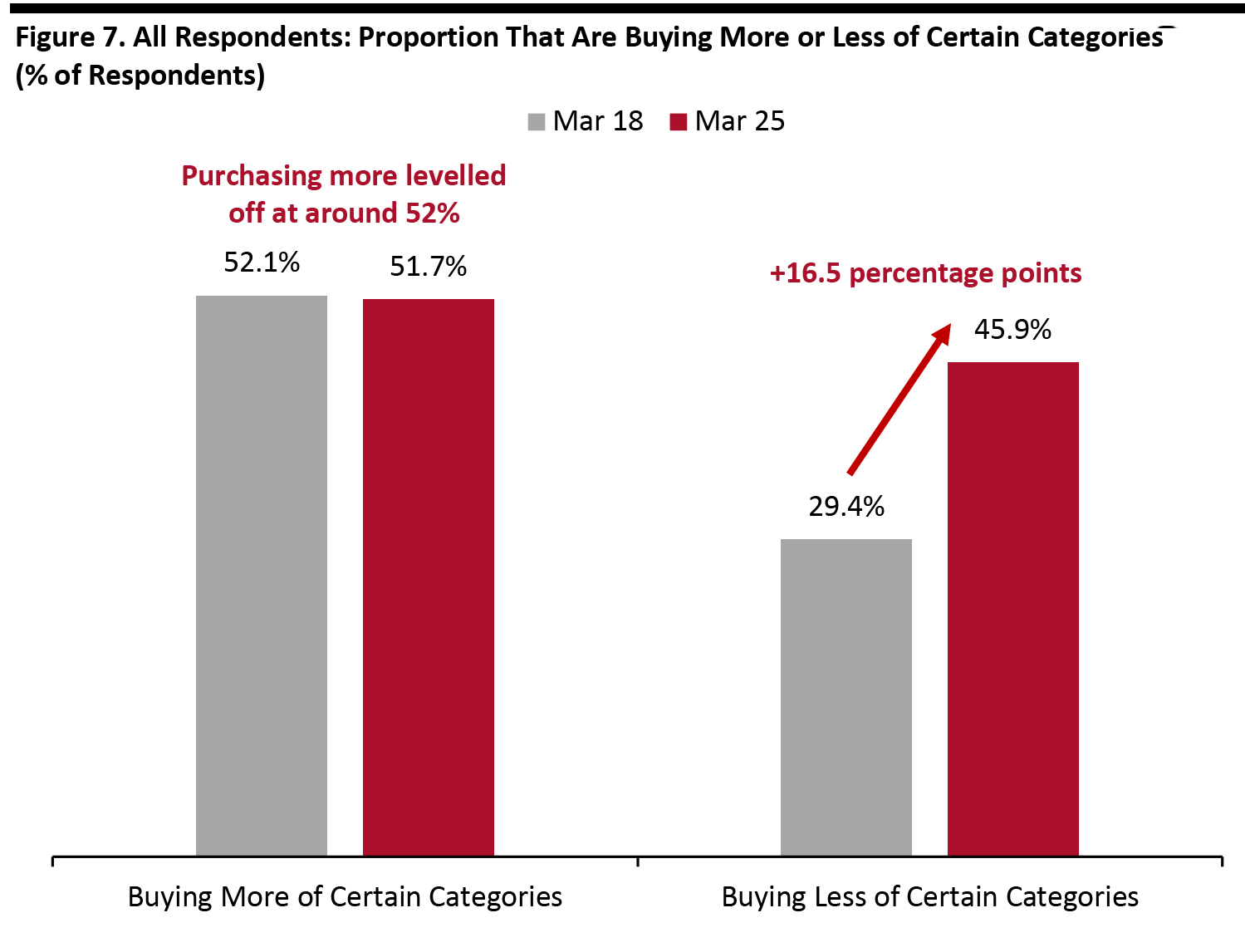

As more retailers shutter stores, we asked respondents if they agreed with the statement “All nonessential retailers in the US should be forced to close their stores because of coronavirus outbreak” and some 51% said they did.Buying More versus Buying Less

Just over half of all respondents say they are buying more of certain categories—level with last week. However, we saw a big week-over-week uptick in the proportion saying they buy less of certain categories, with almost half of respondents now saying they are cutting back in some areas. Note that buying more of certain categories and buying less of certain categories were not mutually exclusive options and respondents could answer yes to both. [caption id="attachment_106571" align="aligncenter" width="700"] Base: US Internet users aged 18+

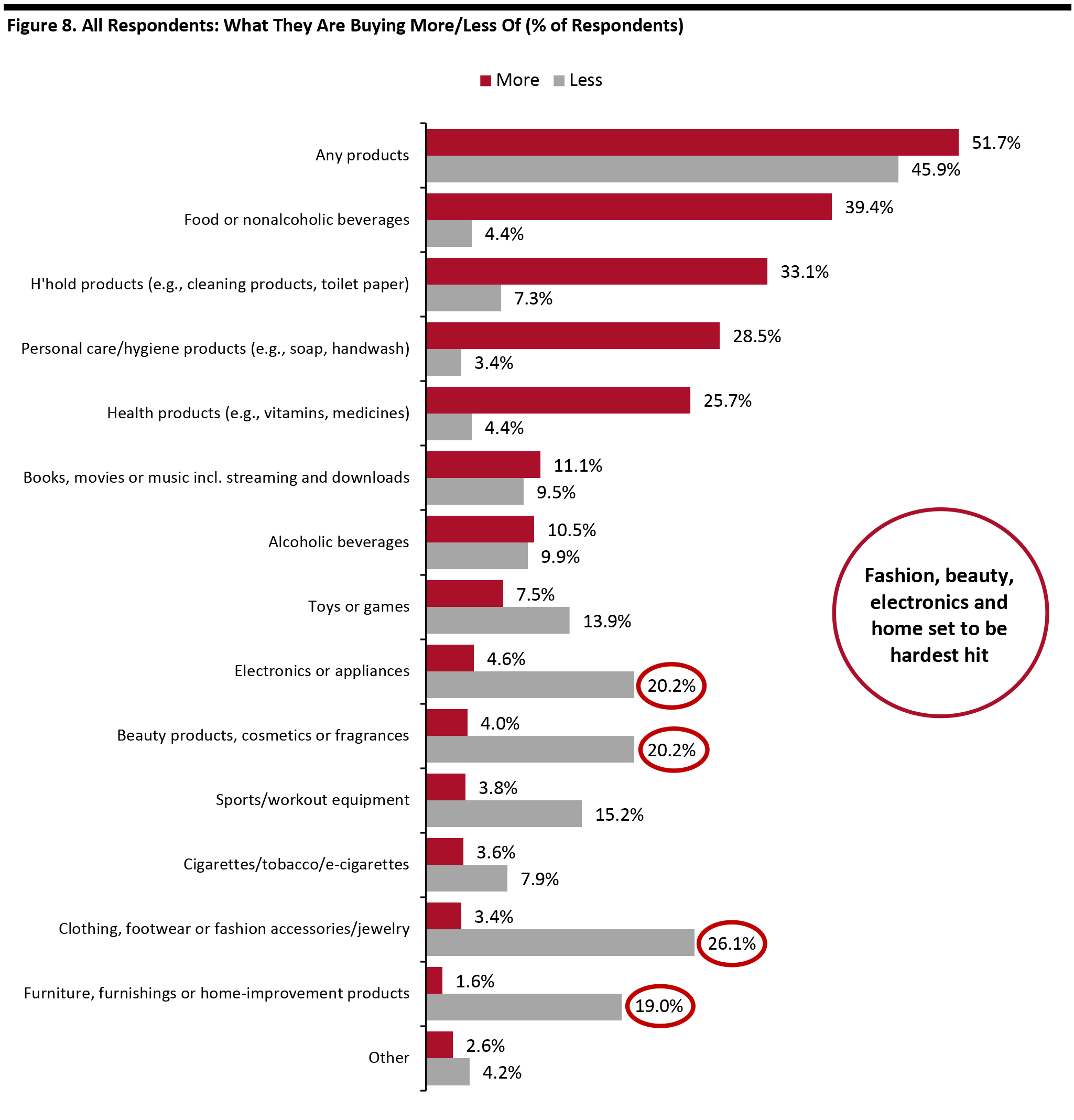

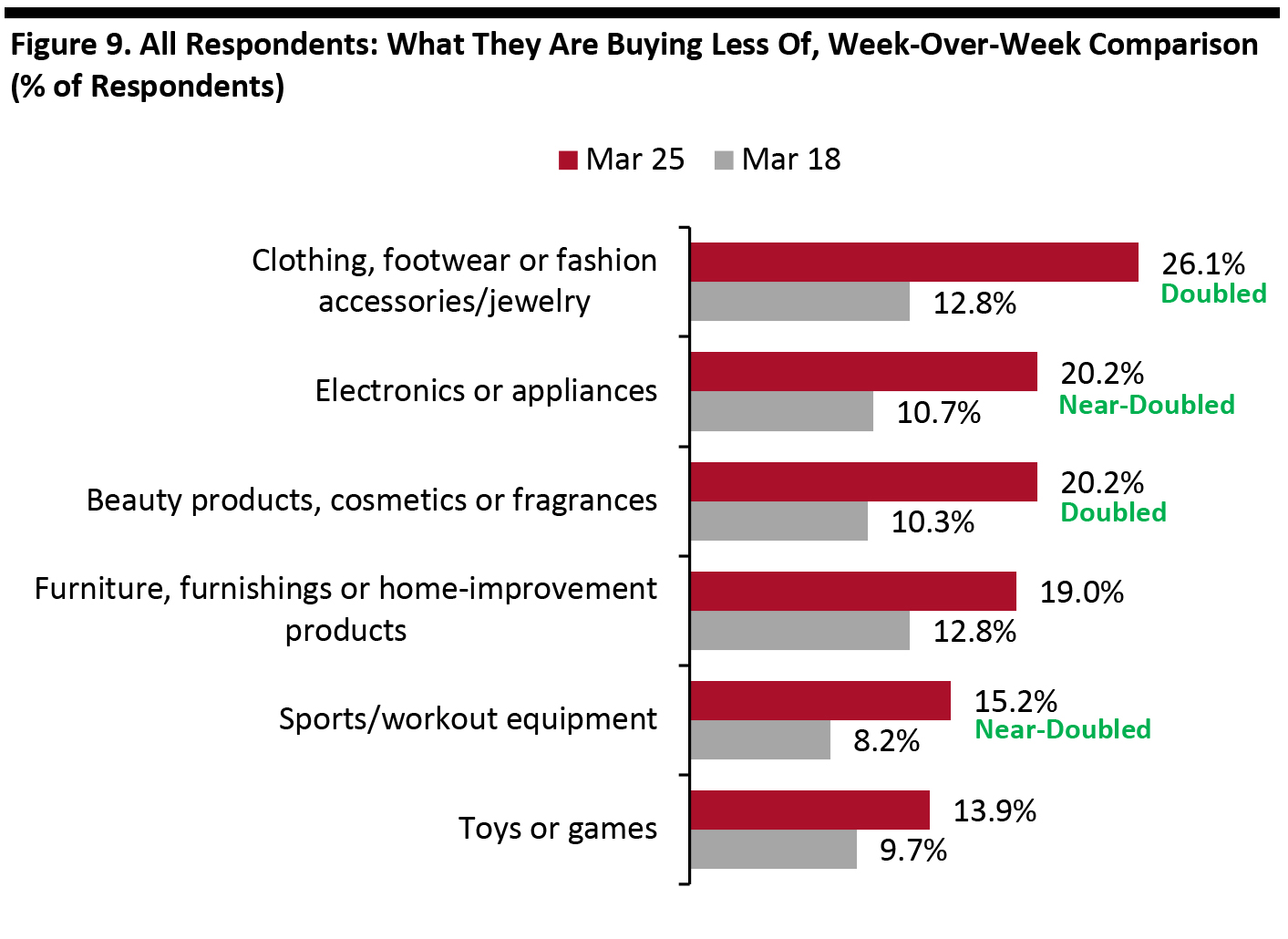

Base: US Internet users aged 18+ Source: Coresight Research [/caption] More: Unsurprisingly, nondiscretionary or essential categories such as food, everyday household products, personal care and health products saw the biggest jump. Almost 40% of all respondents said they buy more food and one-third said they buy more household products. Less: Apparel, electronics/appliances, beauty products and furnishings/home-improvement saw the greatest number of respondents saying they had reduced purchases. Ratio of Less to More: Furnishings/home improvement saw the greatest proportional disparity between buying less/more, with 12 times as many respondents answering “less” as answering “more.” Apparel saw the second highest less-to-more ratio, at almost eight to one. [caption id="attachment_106572" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption] In those categories people are buying less of, nearly twice as many respondents said they were buying less apparel, electronics/appliances and beauty products on March 25 than on March 17-18. [caption id="attachment_106573" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption]

Switching Spending Online

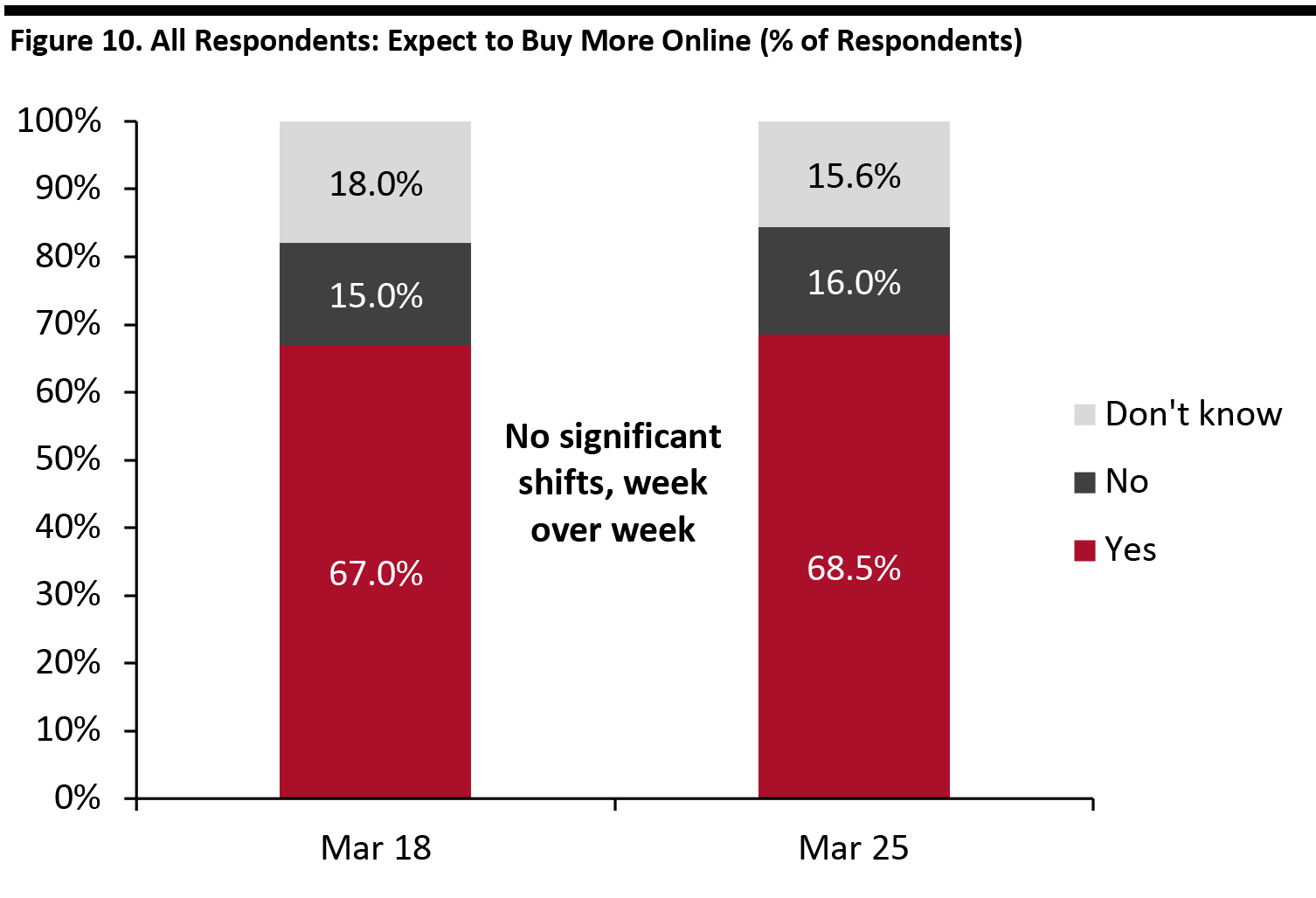

Around two-thirds expect to make more purchases online if the outbreak continues—staying roughly level week over week. [caption id="attachment_106574" align="aligncenter" width="700"] Base: US Internet users aged 18+

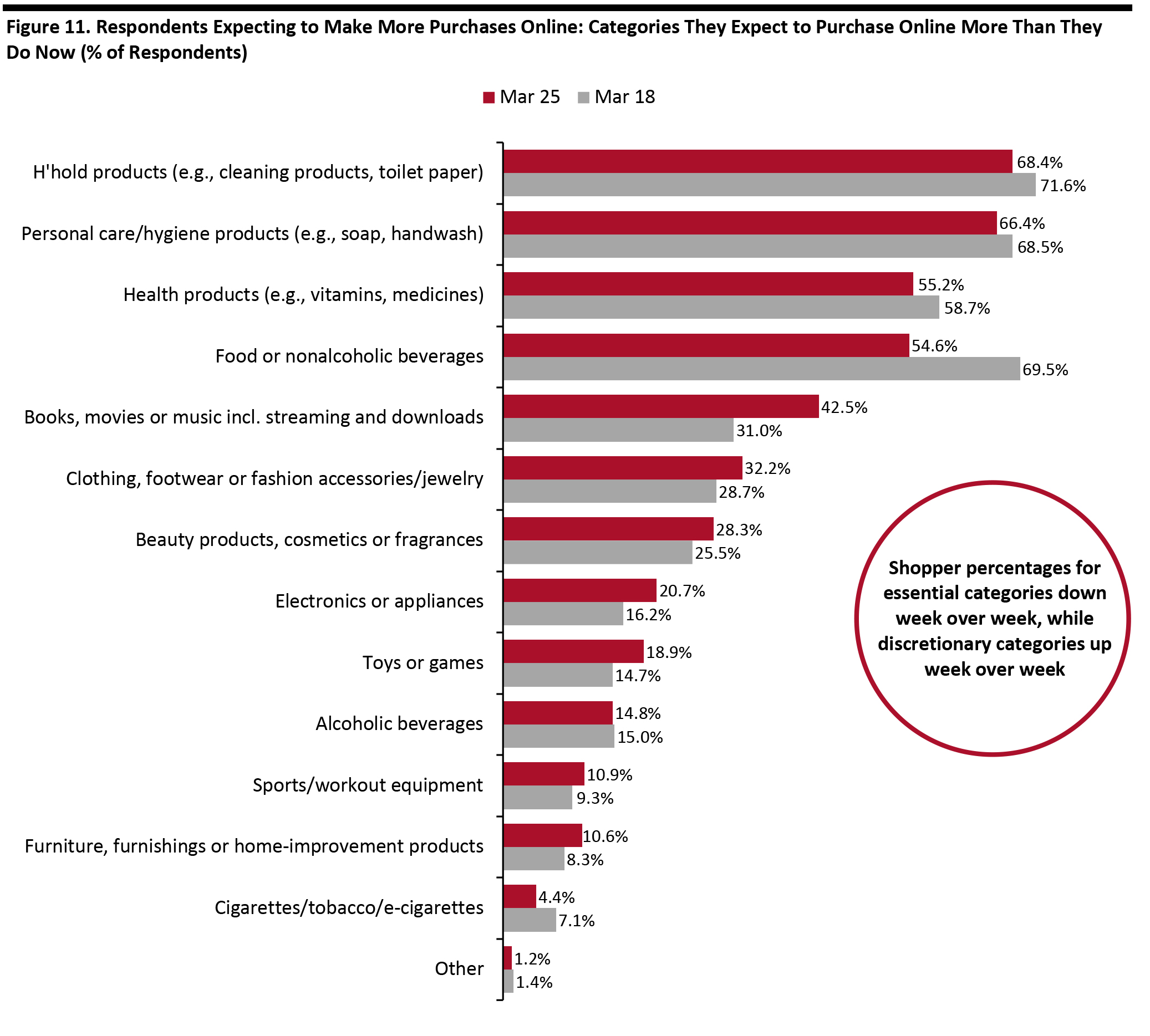

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Among those expecting to buy more, we saw a sharp week-over-week decline in how much people expect to buy food or beverages online—perhaps because many have stockpiled or are more confident they will be able to get groceries from physical stores. Across essential categories, the general trend was of an easing of expectations to buy online. In contrast, some discretionary categories saw an increased proportion expecting to buy online. Note the percentages below are of those expecting to buy more online. [caption id="attachment_106575" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to make more purchases online if the coronavirus outbreak continues than they do now

Source: Coresight Research [/caption]

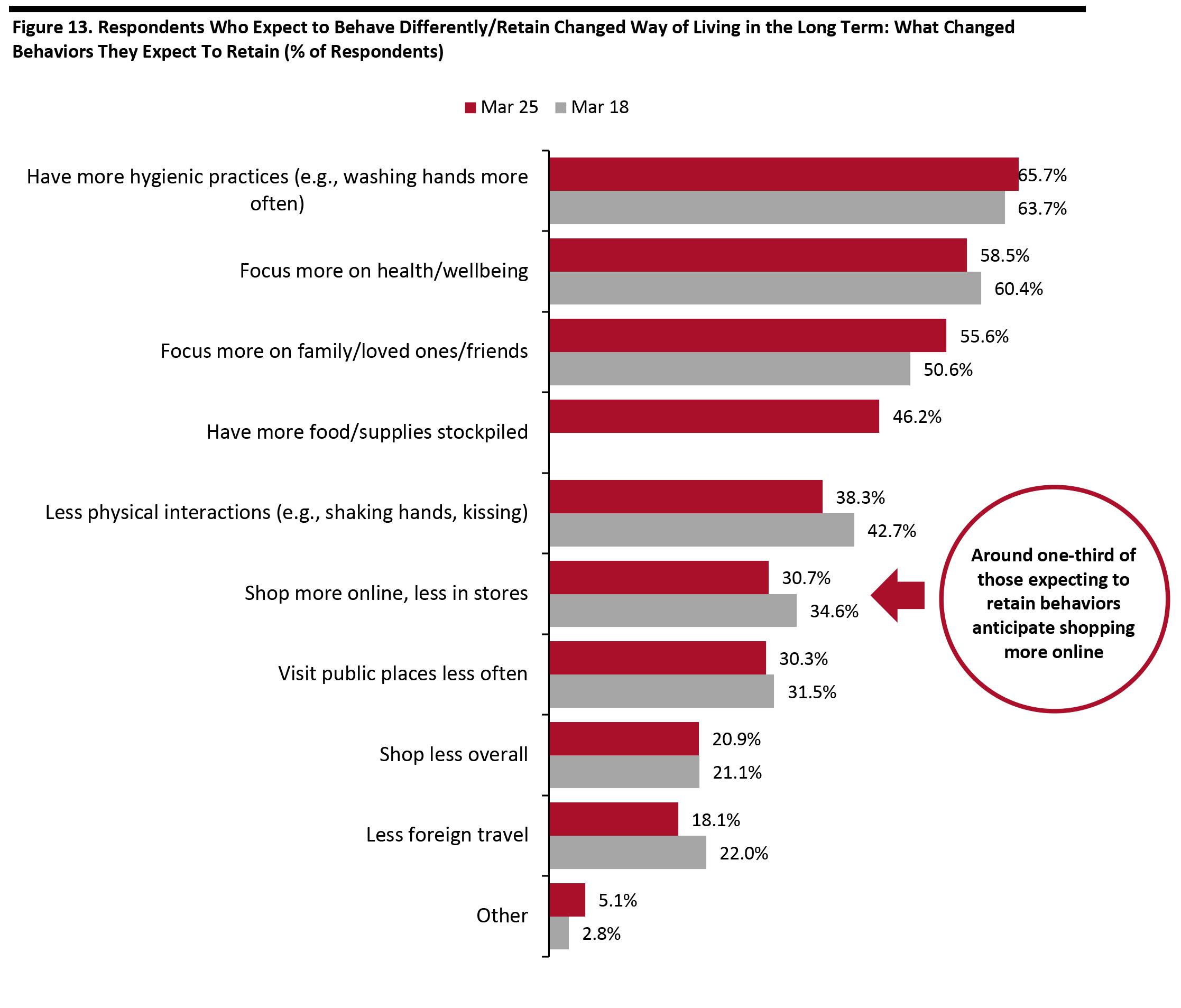

Long-Term Changes in Behavior

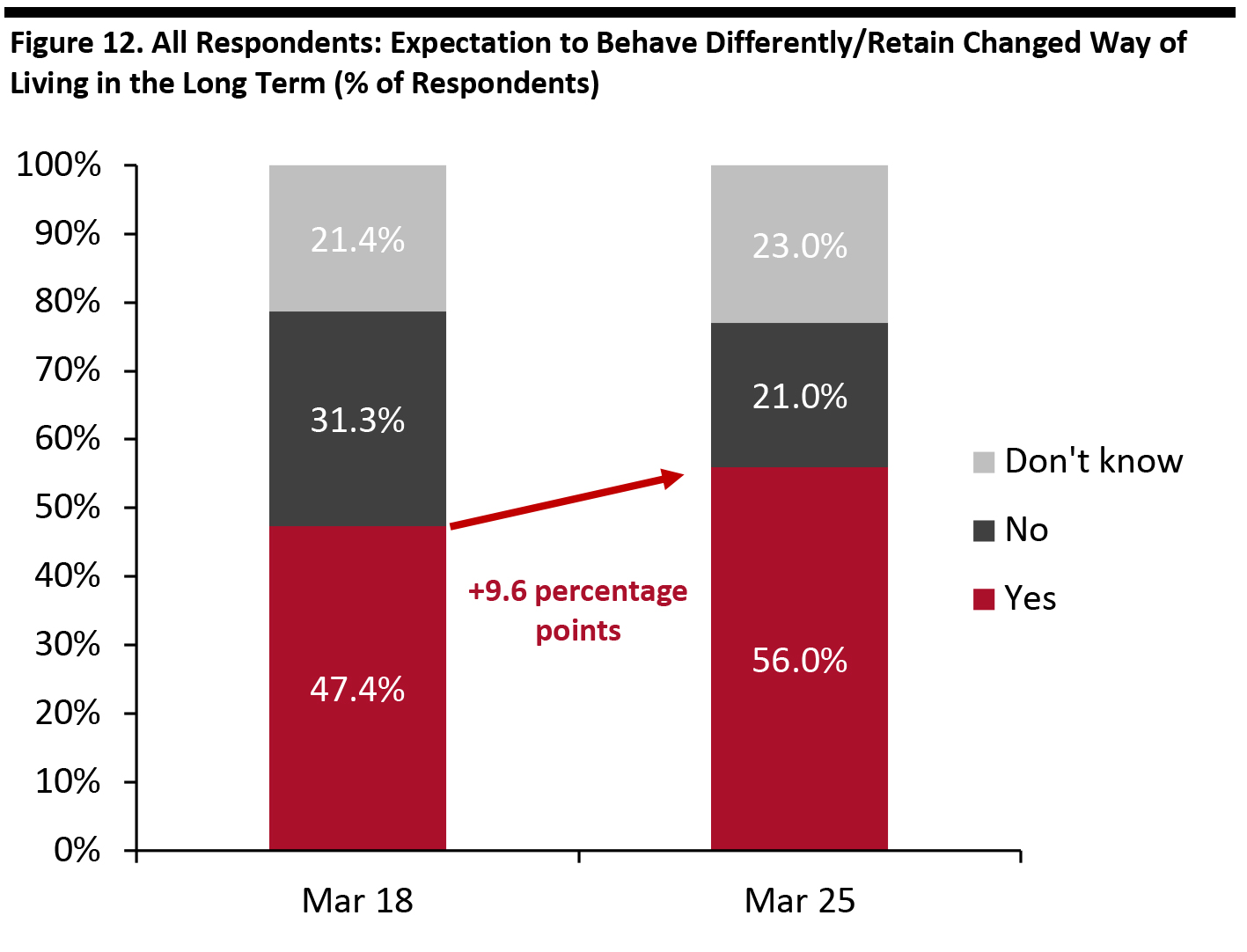

The proportion of consumers expecting to keep changed behaviors for the long haul increased meaningfully—up almost 10 percentage points week over week. [caption id="attachment_106576" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Among those who expect to keep outbreak-driven behavior, prevention through better hygiene and a focus on wellness remained the top responses. This week, we added the option of answering “having more food or supplies stockpiled at home”—and almost half of those expecting to retain changed behaviors chose this option. Roughly one-third of those expecting to make changes think they will shop more online, long term, equal to 17% of all respondents (which represent consumers in general). Note the percentages below are of those people who expect to retain changed behaviors. [caption id="attachment_106600" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

Source: Coresight Research [/caption] Finally, on a non-retail note, we asked respondents if they thought all international travel should be stopped (into or out of the US) because of the coronavirus outbreak, and 61.8% said they did.