albert Chan

We discuss select findings and compare them to those from prior weeks: June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

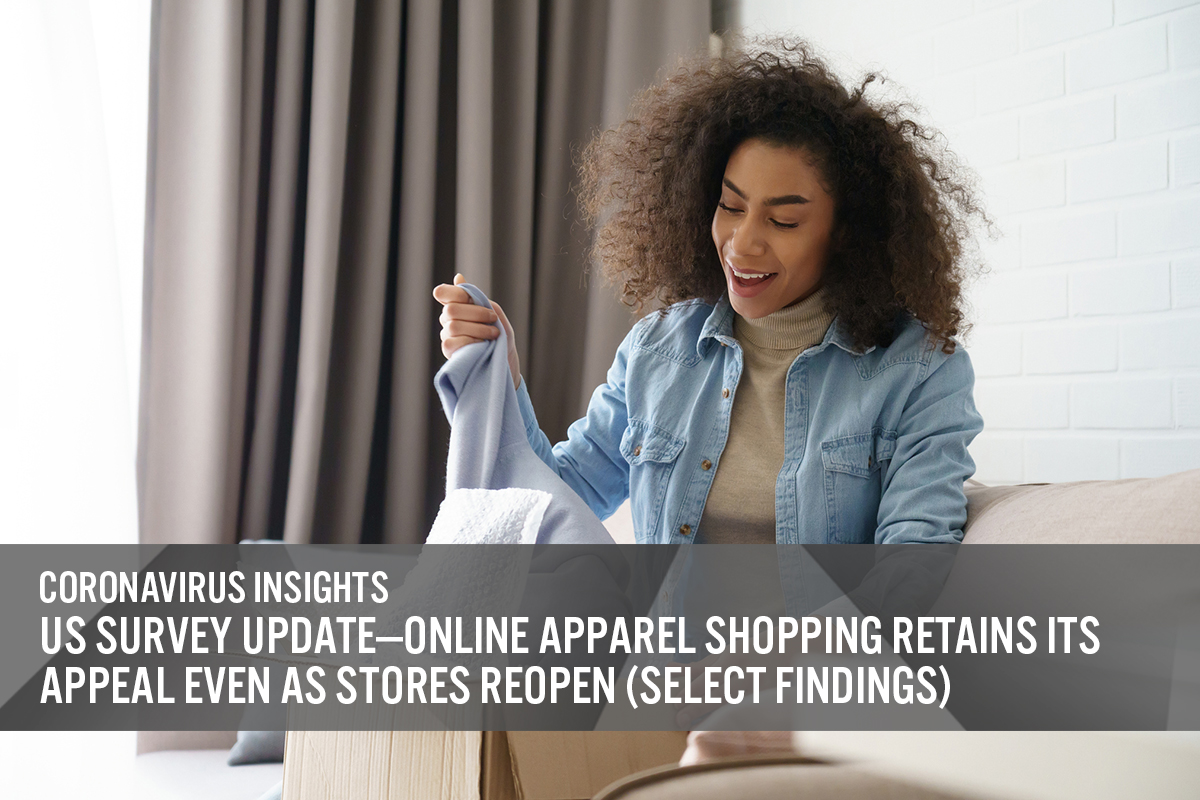

1. Online Apparel Shopping Maintains Its AppealConsumers continue to shop for apparel online even as lockdowns are being lifted and brick-and-mortar retail is reopening. The proportion of respondents buying more apparel online jumped in the first half of May and remained steady for following weeks, before increasing again this week to more than one-quarter of all respondents—representing a roughly 10-percentage-point increase from May 6.

[caption id="attachment_112154" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

We also asked about consumers’ activities over the past two weeks and their expectations for the next two weeks: Making online purchases of apparel topped the list of recent activities, with a little over one-third of all respondents reporting that they had bought clothing or footwear online in the past two weeks. In addition, expectations to buy apparel online in the next two weeks were consistent with last week’s findings.

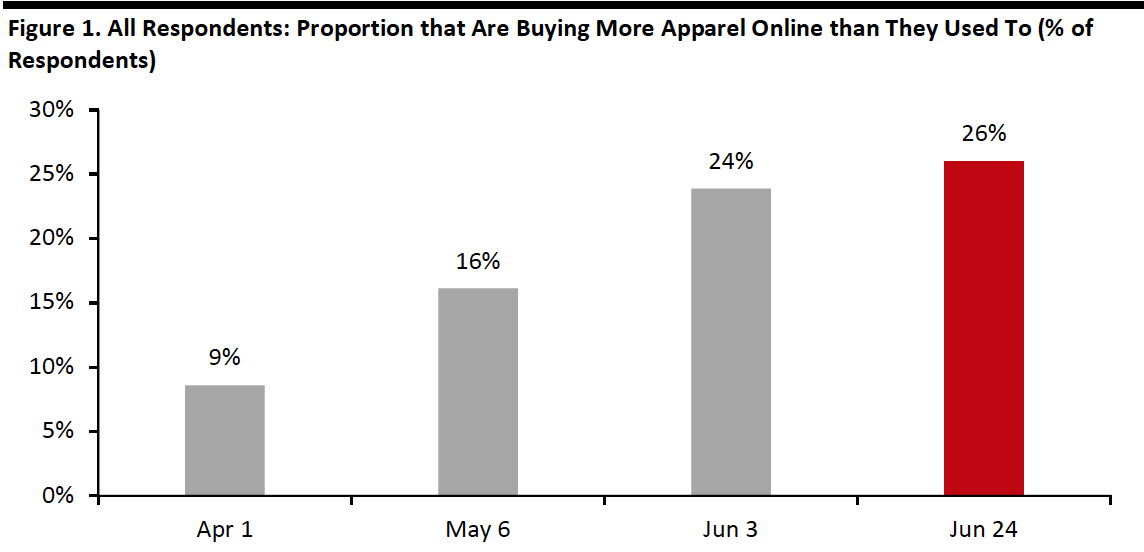

2. Eight in 10 Consumers Are Currently Avoiding Public PlacesWith many more businesses having reopened, we changed our “avoidance” question this week, from asking about the types of public places that respondents expect to avoid after lockdowns end to where they are currently avoiding.

Our findings show that consumers are still wary of visiting public places, with over 81.5% of respondents reporting that they are currently avoiding some type of public place.

Almost 59% stated that they are currently avoiding shopping centers/malls, making them the topmost avoided places. The leisure industry is also seeing large avoidance: More than half of respondents reported that they are avoiding food-service outlets and sports centers.

- See our full report for a complete ranking of which public places consumers are currently avoiding.

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] 3. Six in 10 Respondents Expect to Retain Changed Behaviors

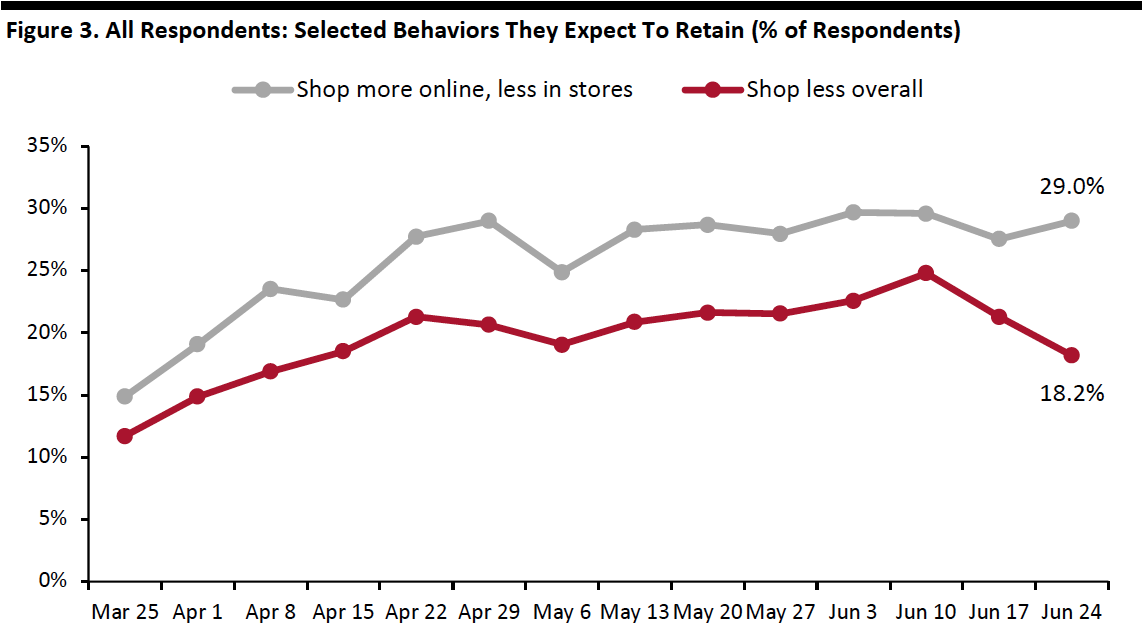

Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. This week, the proportion of respondents expecting to retain some changed behavior over the long term fell below 60% for the first time since April 8, with 58.9% expecting to do so over the long term.

The proportion of respondents expecting to wear gloves/masks leveled off following an upward trend, with half of respondents reporting this week that they expect to do so in the long term. In addition, we saw the proportion of respondents expecting to use contactless payment options decline this week following an upward trend from June 3.In addition, we saw slight decreases in expectations to shop less overall. Some 18.2% of respondents expect to shop less overall, versus 21.3% last week. Expectations of shopping more online increased slightly compared to the previous week.

[caption id="attachment_112156" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]