albert Chan

We discuss select findings and compare them to those from prior weeks: July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

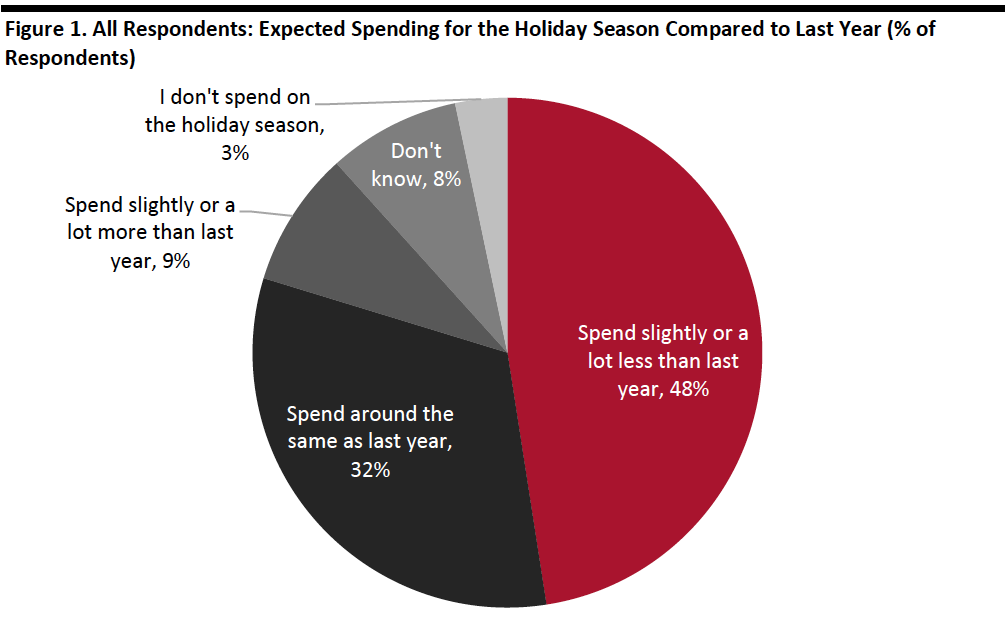

1. Almost Half of Consumers Expect To Spend Less for the Holiday SeasonThis week, we asked consumers questions about their expected shopping behaviors for the holiday season. Some 48% of respondents expect to spend less than last year on the holiday season, a much higher proportion than those who plan to spend more.

On the positive side, compared to the results from almost three months ago, we recorded a decline in the proportion of respondents expecting to spend less and a slight increase in the proportion that plan to spend more for the holiday season.

Among those who expect to spend less for the holiday season, the top categories to spend less on are food services: Almost half said they will spend less on dining out or going to bars/nightclubs, followed by more than two-fifths who plan to cut their spending on traveling to visit other people. This indicates that service industries—including food service, entertainment and travel—are likely to be hit the hardest during the holiday season.

The top three product categories in which consumers plan to cut their holiday spending are seasonal decorations, clothing and accessories, and electronics.

We asked respondents to think about their spending overall—so cutbacks in retail categories will reflect not just shoppers cutting gift spending but the knock-on effects of Covid-19 restrictions. For example, attending fewer or no parties, less dining out and less attendance in the workplace will hit retail spending.

- See our full report for complete results of how Covid-19 is expected to impact consumers’ holiday shopping behaviors.

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] 2. Pull-Forward of Holiday Spending This Year

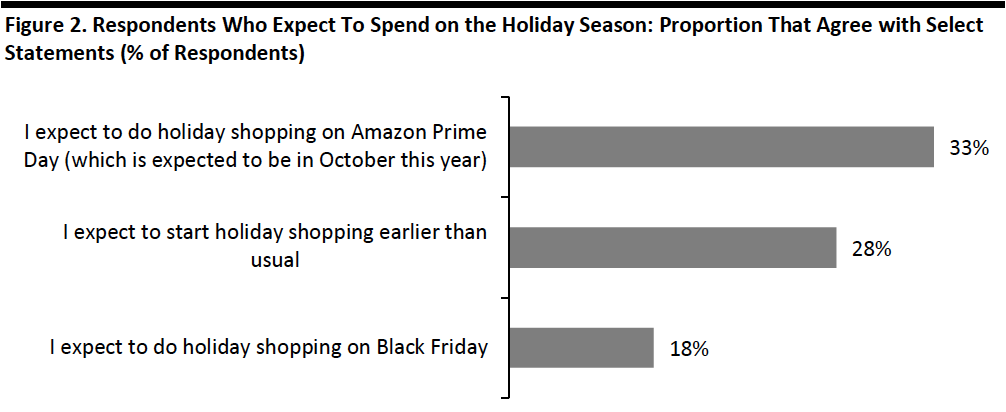

We also asked consumers whether they agreed with any or all of 10 attitudinal and behavioral statements related to holiday-season shopping.

We found that consumers’ holiday spending will likely be pulled forward this year:

- One-third of holiday shoppers expect to undertake holiday shopping on Amazon.com on Prime Day—many more than expect to shop on Black Friday or Cyber Monday. Amazon’s postponement of Prime Day to October is expected to further distort the traditional holiday calendar, which has typically seen holiday shopping begin on Black Friday.

- Some 28% said they will start their holiday shopping earlier than usual.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who expect to spend on the holiday season

Source: Coresight Research[/caption] 3. Avoidance Rate Spikes This Week

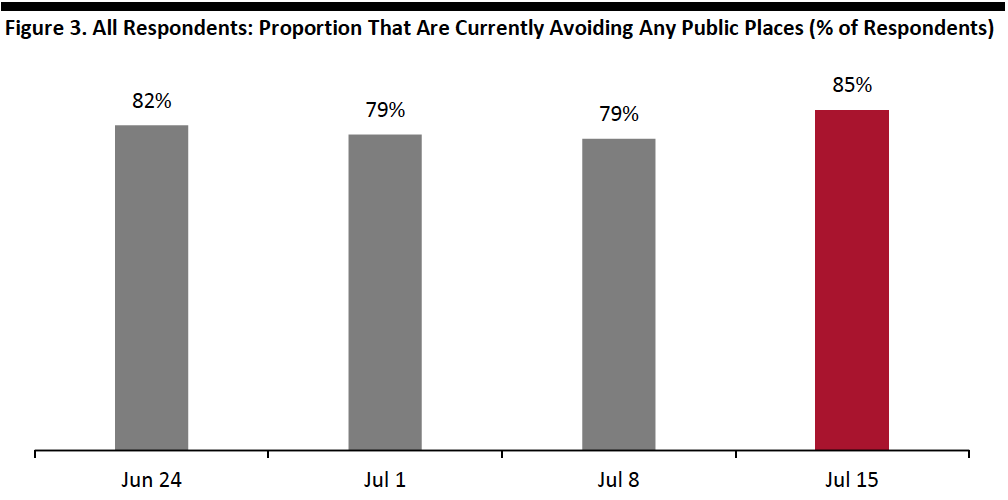

We saw the proportion of consumers avoiding any kind of public place spike to 85% this week, from 79% last week—reaching the highest level over the past couple of weeks, reflecting consumers’ heightened concern about the resurgence of coronavirus cases in some states.

Avoidance rates increased for all 14 options we provided:

- Shopping centers/malls remain the most-avoided places, with more than three-fifths of respondents reporting that they are currently avoiding these locations.

- The proportion of respondents that are currently avoiding shops in general is on a consistent upward trend.

- Gyms/sporting centers saw a nine-percentage-point jump in avoidance rate—the highest increase among all options.

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]