albert Chan

What’s the Story?

This report presents the results of Coresight Research’s latest weekly survey of US consumers on the coronavirus outbreak, undertaken on July 15, 2020. We explore the trends we are seeing from week to week, following prior surveys on July 8, July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

Holiday Season Shopping

This week, we asked consumers about their expected shopping behaviors for the holiday season 2020. We asked respondents:

- About their expected overall holiday season spending, including gifts and expenses related to traveling and dining out, this year compared to last year.

- For those who expect to spend less in the holiday season, what categories they plan to spend less on—from 15 options (as well as “other” and “don’t know).

- Whether they agreed with any or all of 10 attitudinal and behavioral statements related to holiday-season shopping.

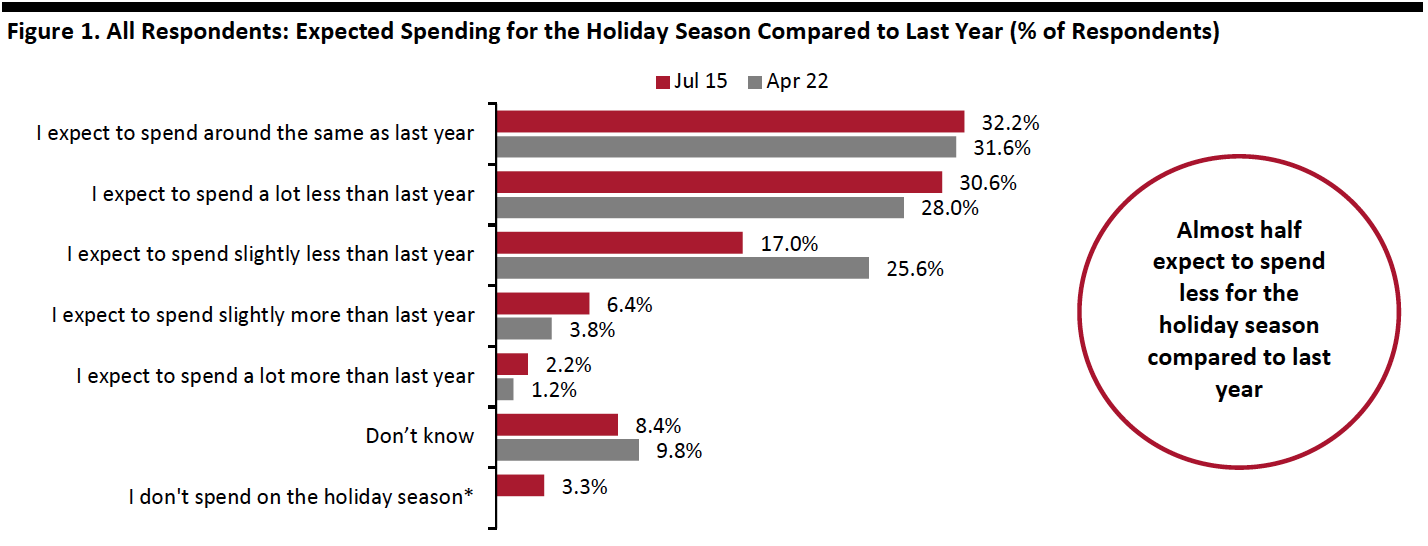

Almost Half Expect To Spend Less for the Holiday Season

Cuts in consumer spending in the wake of the coronavirus crisis are expected to carry over into the critical holiday season: Some 47.6% of respondents expect to spend less for the holiday season compared to last year, with 30.6% expecting to spend a lot less.

On the positive side, compared to the results from when we asked almost three months ago, we saw a six-percentage-point decline in the proportion of respondents expecting to spend less, which was at 53.6% in April. In addition, the proportion of respondents that plan to spend more than last year increased to 8.6% from 5.0% when we last asked the question.

Almost one-third expect their holiday spending to be the same as last year’s, and some 8.4% do not know how their spending will compare to 2019.

[caption id="attachment_113087" align="aligncenter" width="700"] *Not provided as an option on April 22

*Not provided as an option on April 22Base: US Internet users aged 18+

Source: Coresight Research[/caption]

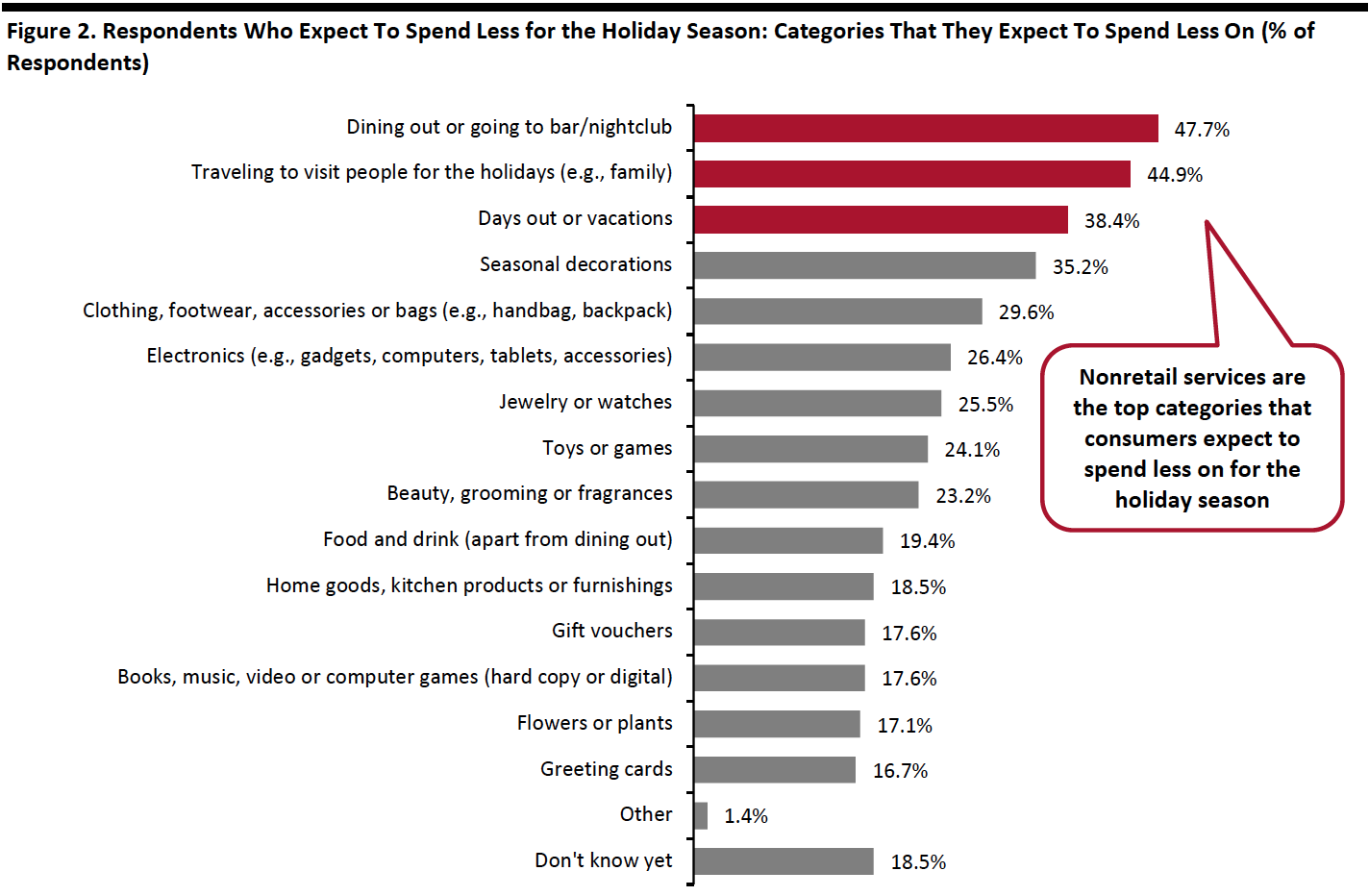

For those who expect to spend less for the holiday season, we found that:

- The top three categories in which consumers plan to spend less are associated with certain activities and so will hit nonretail spending—almost half said they will spend less on dining out or going to bars/nightclubs, followed by 44.9% who plan to cut their spending on traveling to visit other people and 38.4% who expect to spend less on vacations. This reflects declines in overall holiday-related activities due to Covid-19, and the service industries—including food service, entertainment and travel—are likely to be hit the hardest.

- Seasonal decorations comprised the top product category that consumers plan to spend less on, with 35.2% saying they expect to cut their spending on such products, followed by clothing, footwear and accessories (29.6%) and electronics (26.4%).

- We asked respondents to think about their spending overall—so cutbacks in retail categories will reflect not just shoppers cutting gift spending but the knock-on effects of Covid-19 restrictions. For example, consumers are likely to attend many fewer parties or celebration dinners, hitting sales of party clothing, beauty products and food and drink (whether bought as gifts for hosts or for catering to guests). Furthermore, fewer consumers are likely to be in their workplaces in December, which will impact sales of small gifts/cards for colleagues as well as of treat foods or special lunches.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who expect to spend less on the 2020 holiday season than they did last year

Source: Coresight Research[/caption]

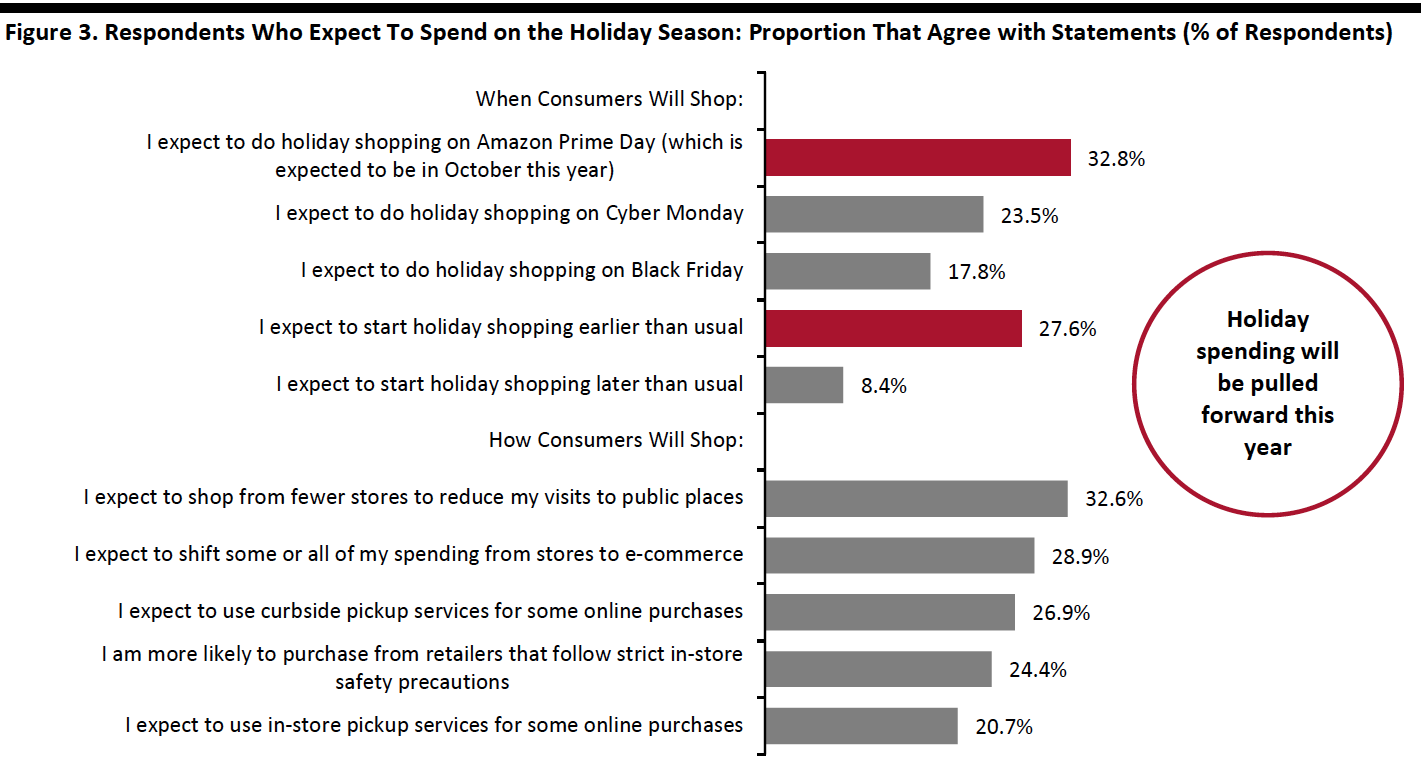

Prime Day To Capture More Holiday Spending from Traditional Holidays

Consumer spending for the holiday season will likely be pulled forward this year:

- Among those who plan to spend on the holiday season, one-third expect to shop on Amazon Prime Day—the highest rate of agreement for any of the options.

- Amazon’s move to postpone Prime Day to October this year is expected to further distort the holiday calendar, in which shopping has traditionally started on Black Friday. Only 17.8% of respondents said they will do holiday shopping on Black Friday, and around one-quarter expect to do so on Cyber Monday. Prime Day could be the new Black Friday. Please see our separate report for a full preview of Prime Day.

- In addition, some 27.6% plan to start holiday shopping earlier this year, versus just 8.4% who expect to start later than usual.

The crisis is also changing how consumers will shop for the holiday season:

- Almost one-third expect to shop from fewer stores to reduce their trips to public spaces. The consolidation of shopping trips could translate to higher sales and traffic for retailers that offer a wide range of product categories and brands, such as mass merchants and warehouse clubs.

- Almost three in 10 (28.9%) plan to switch some or all of their holiday spending from stores to e-commerce this year. This figure is roughly in line with the proportion who expect to shop more online in the long term (which we discuss later in this report).

- Contact-light options will remain popular for holiday shopping: Some 26.9% expect to use curbside pickup services for some of their online purchases, and one-fifth plan to use in-store pickup services.

- Retailers will need to implement safety measures to draw consumers back to stores: One-quarter of respondents who expect to spend on the holiday season are more likely to purchase from retailers that follow strict in-store safety precautions.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who expect to spend on the holiday season

Source: Coresight Research[/caption]

What Shoppers Are Doing and Where They Are Going

More Consumers Bought Apparel and Beauty in the Past Two Weeks

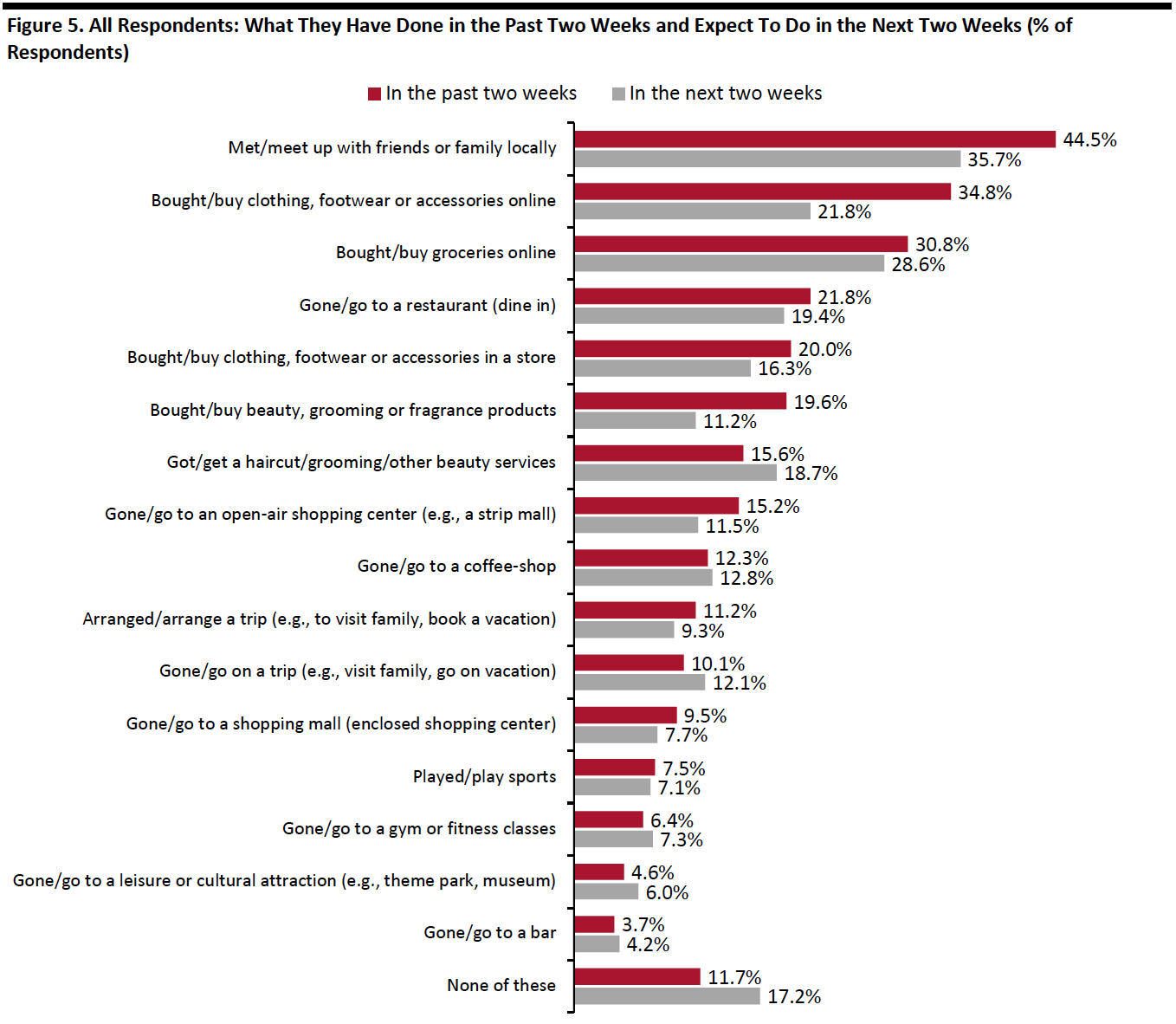

Each week, we ask consumers what they have done in the past two weeks. This week, we saw increases in the proportions of respondents for half of the 16 options we provided for activities done recently—although each was within the margin of error.

- More consumers had bought discretionary products including apparel and beauty in the past two weeks: Some 34.8% had bought apparel online, versus one-third last week. The proportion of respondents who had bought apparel in a store and had bought beauty in the past two weeks both increased slightly to one-fifth.

- The proportion of respondents who had bought groceries online remains solid, with three in 10 reporting that they had done so this week, versus 32.4% last week.

- The proportion of respondents who had gone to a restaurant in the past two weeks declined again this week. Some 21.8% had dined in a restaurant, down from 24.6% last week. This is the lowest level since we started asking the question one month ago and is in the context of some states having recently implemented shutdowns of in-door dining amid a resurgence of Covid-19. In addition, very few respondents had gone to a bar in the past two weeks.

- The proportions of respondents that visited both types of shopping centers—open-air and enclosed—dropped slightly after increases last week, aligned with the high avoidance rate we saw (which we discuss later in this report). A little over one in seven had gone to an open-air mall in the past two weeks, and one in 10 had visited an enclosed shopping center.

Respondents could select multiple options Base: US Internet users aged 18+ Source: Coresight Research

More Consumers Expect To Get a Haircut in the Next Two Weeks

Each week, we also ask consumers what they expect to do in the next two weeks, with a comparable set of options to those for the last two weeks. In the chart below, we compare these short-term expectations with recent actual behavior. We saw slightly higher proportions of consumers expecting to do a few non-shopping activities in the next two weeks than actual behavior in the past two weeks:

- Some 18.7% expect to get a haircut or other grooming service in the next two weeks, slightly up from 15.6% of those who had done so in the previous two weeks.

- Some 12.1% plan to go on a trip in the next two weeks, versus one in 10 that had done so in the past two weeks.

Expectations to do shopping-related activities are lower than actual recent behaviors, but we see this pattern often in our weekly surveys, and it partly reflects that consumers may not plan all their purchases in advance.

- In this context, expectations of buying groceries online look relatively solid, at 28.6% expecting to buy versus 30.8% that had bought.

- Some 21.8% expect to buy clothing or footwear online in the next two weeks, versus 16.3% expecting to do so in a store.

- As we show later, avoidance of public places, including shops, is increasing, and this is likely to hit in-store purchasing.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

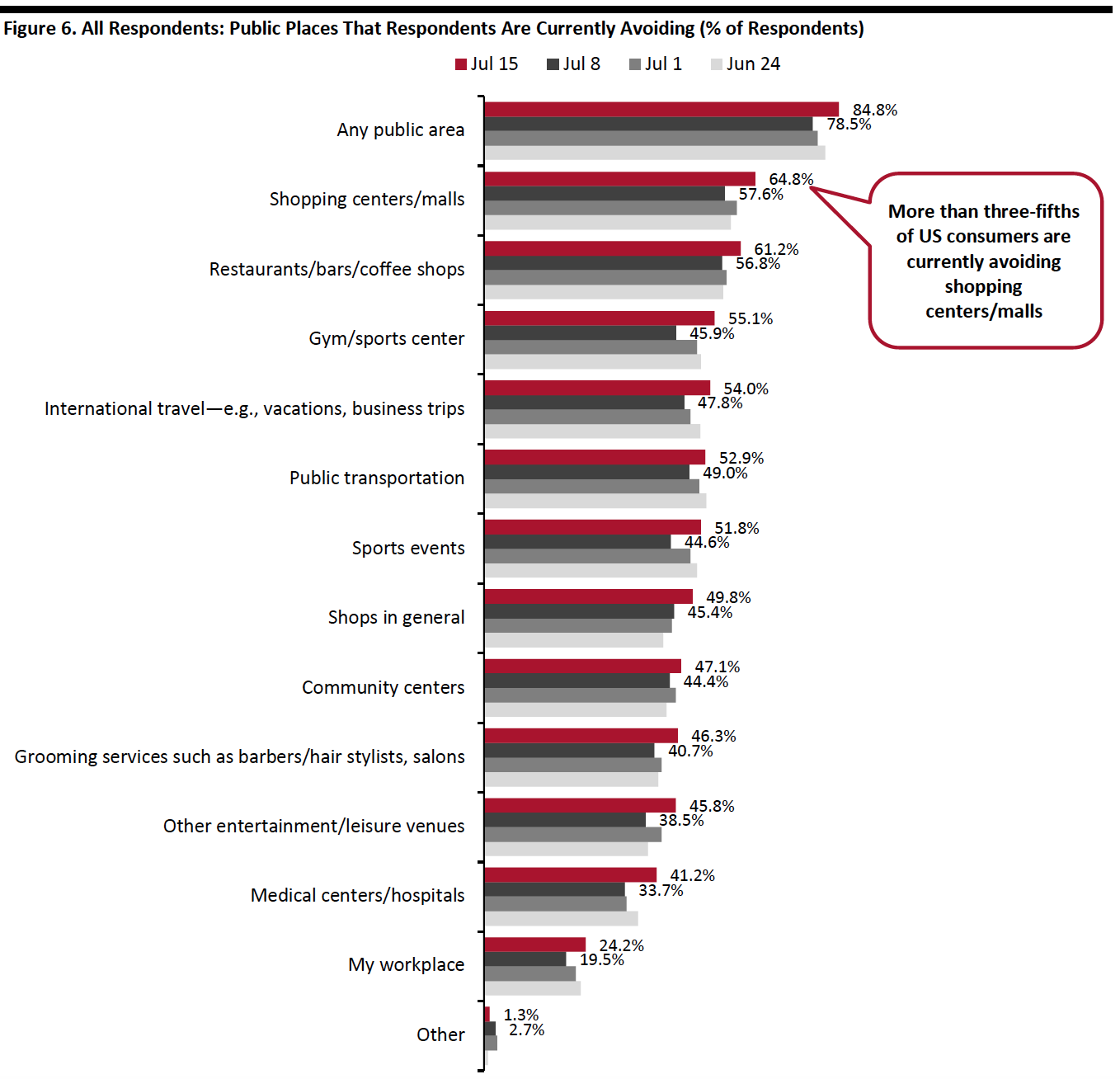

Over Eight In 10 Are Currently Avoiding Public Places

This week, the proportion of consumers avoiding any kind of public place spiked to 84.8% from 78.5% last week—the highest level in the past couple of weeks, reflecting consumers’ heightened concern about the resurgence of coronavirus cases in some states.

We saw week-over-week increases of avoidance in all of the 14 options provided:

- Shopping centers/malls remain the most-avoided places, with 64.8% reporting that they are currently avoiding these, up seven percentage points from last week.

- The proportion of respondents that are currently avoiding shops in general is on an upward trend, with half saying they are doing so this week.

- Avoidance of food-service locations came in at 61.2%, versus 56.8% last week.

- Gyms/sporting centers saw the highest jump, of nine percentage points, in avoidance rate this week.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

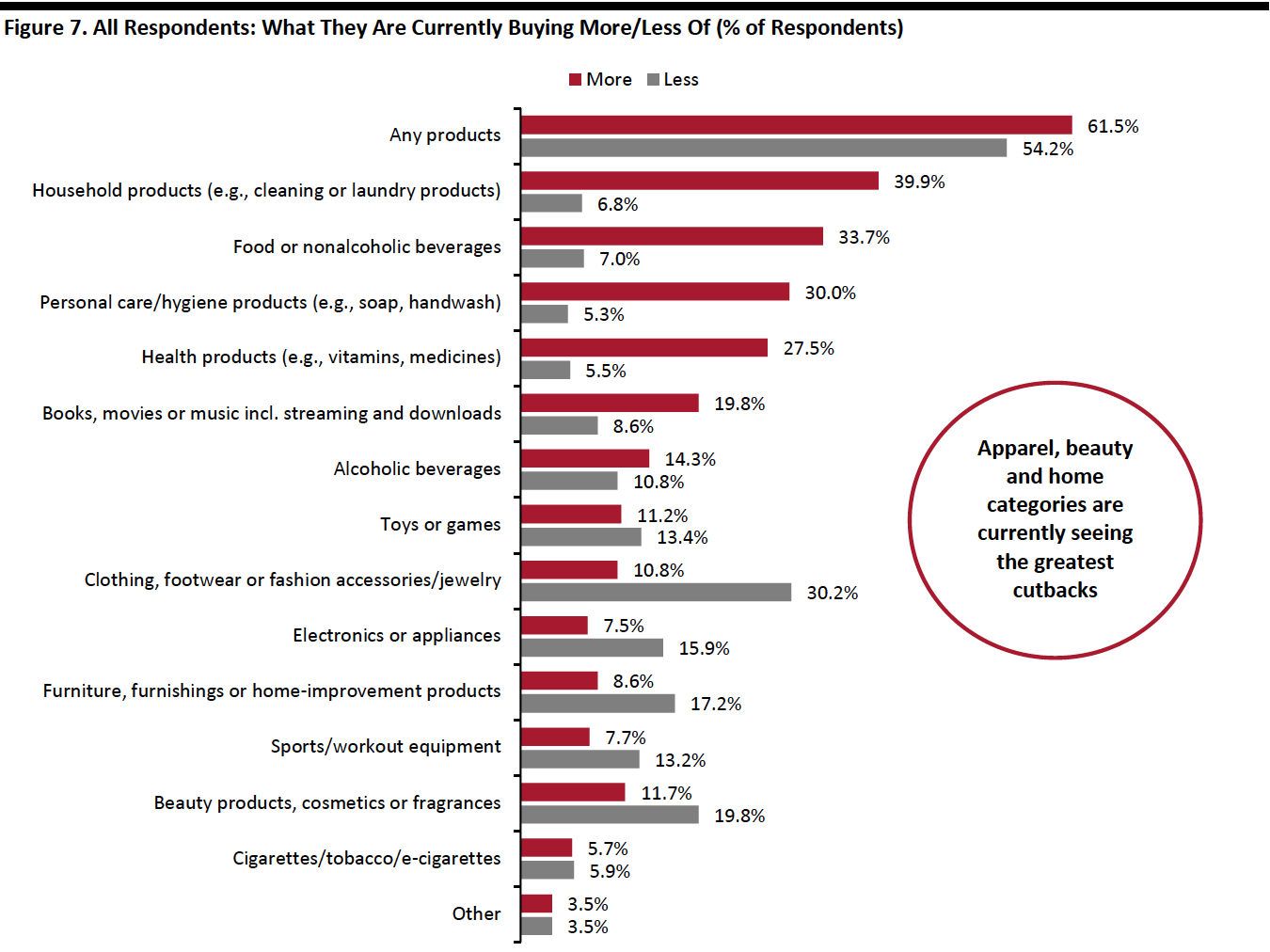

What They Are Currently Buying More Of and Less Of

The proportion of respondents who are currently buying more of any category slid a little this week, to 61.5% from 65.1% last week. We also saw slightly more respondents currently buying less, with 54.2% doing so, versus 51.2% last week.

- Buying more of certain categories and buying less of certain categories were not mutually exclusive options, so respondents could answer yes to both.

Buying more: Essentials, including household products and food, again topped the list of buying more. The proportion of consumers buying these products remained stable this week.

Buying less: The proportions of respondents buying less in discretionary categories increased slightly after reaching the lowest levels last week—this return to cutting spending is in the context of greater avoidance of malls and shops, noted above. Three in 10 are currently spending less on apparel, which is the most-cut category. This is followed by other discretionary categories, including beauty and furniture products (we show trended data in Figure 8).

Ratio of less to more: The ratios of the proportion of respondents buying less to the proportion buying more in apparel and electronics rose this week, after previously seeing downward trends: The ratio for apparel was 2.8 this week, versus 2.5 last week; and the ratio for electronics stood at 2.1, up from 1.2 last week. The ratio for beauty and home are consistent with last week, at 1.7 and 2.0, respectively.

[caption id="attachment_113097" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

Figure 8. All Respondents: Buying More/Less of Selected Categories (% of Respondents)

[wpdatatable id=327]Base: US Internet users aged 18+ Source: Coresight Research

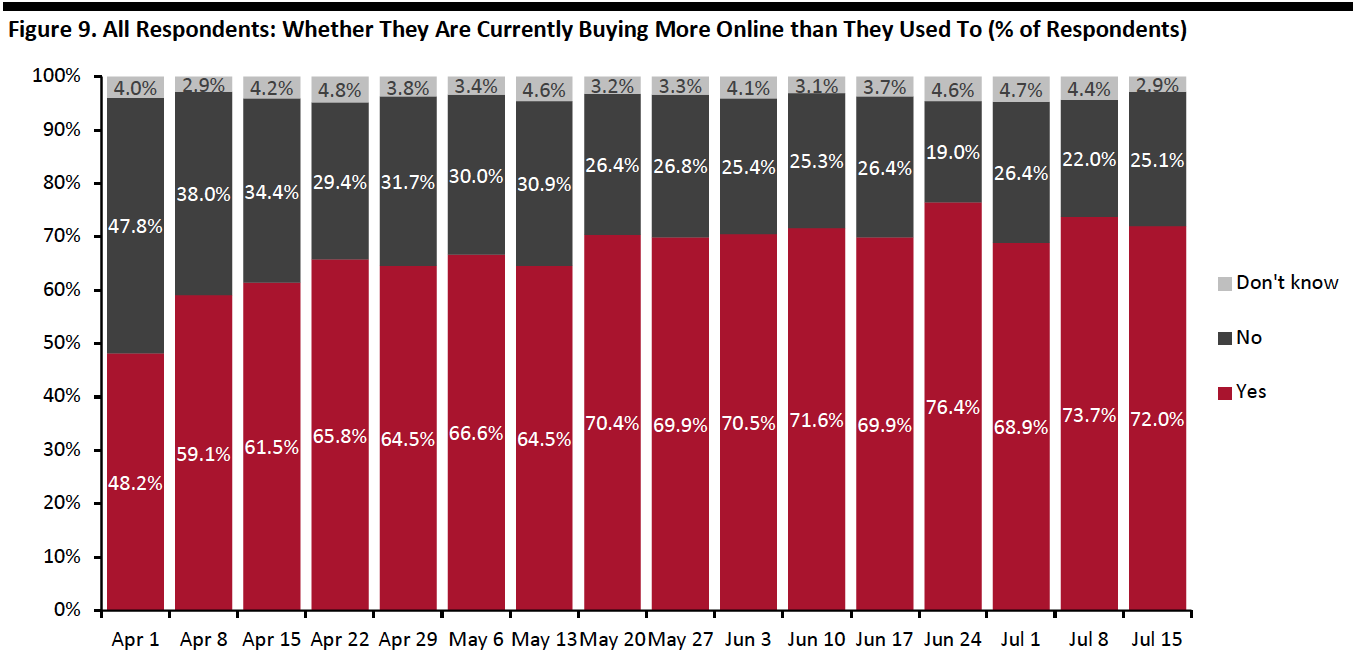

Over Seven in 10 Are Switching Spending Online

The proportion of consumers switching their spending to e-commerce dropped slightly, after fluctuating in the past couple of weeks. Some 72.0% of consumers stated that they are buying more online this week, versus 73.7% last week.

[caption id="attachment_113092" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

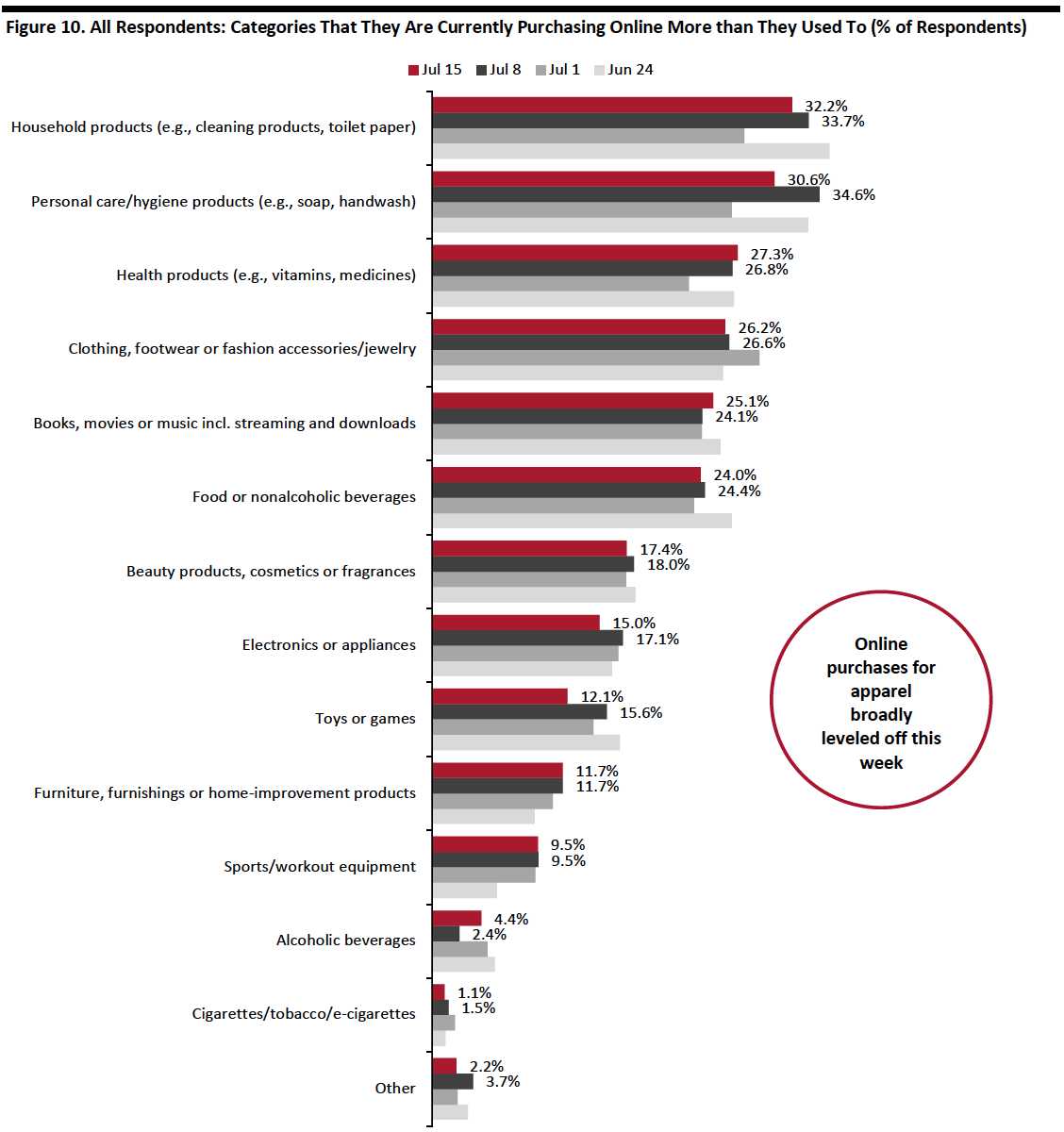

What Consumers Are Currently Buying More Of Online

This week, the week-over-week changes in the proportion of consumers that are currently buying more online than they used to in most categories are minimal. Household and personal care products continue to take the lead in online shopping, although the proportion of consumers currently buying more personal care products fell slightly.

We saw online purchases for discretionary categories—including apparel, beauty and home—remain stable this week: Some 26.8% are currently buying more apparel online than they used to; 17.4% are buying more beauty; and 11.7% are buying more home products.

[caption id="attachment_113093" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

Reviewing Trend Data in Purchasing Behavior

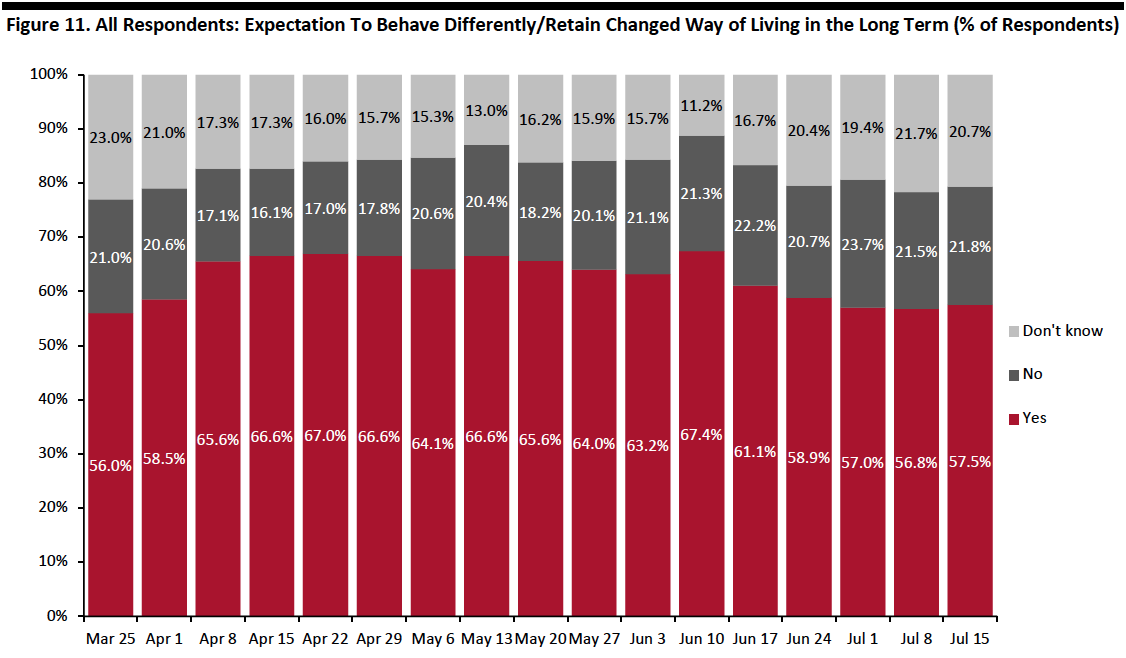

Fewer than Six in 10 Expect To Retain Changed Behaviors over the Long Term

Each week, we ask respondents whether they think they will keep some of the behaviors they have adopted during the coronavirus crisis. The proportion of respondents expecting to retain some changed behaviors has been consistent at around 57% over the past couple of weeks.

[caption id="attachment_113094" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

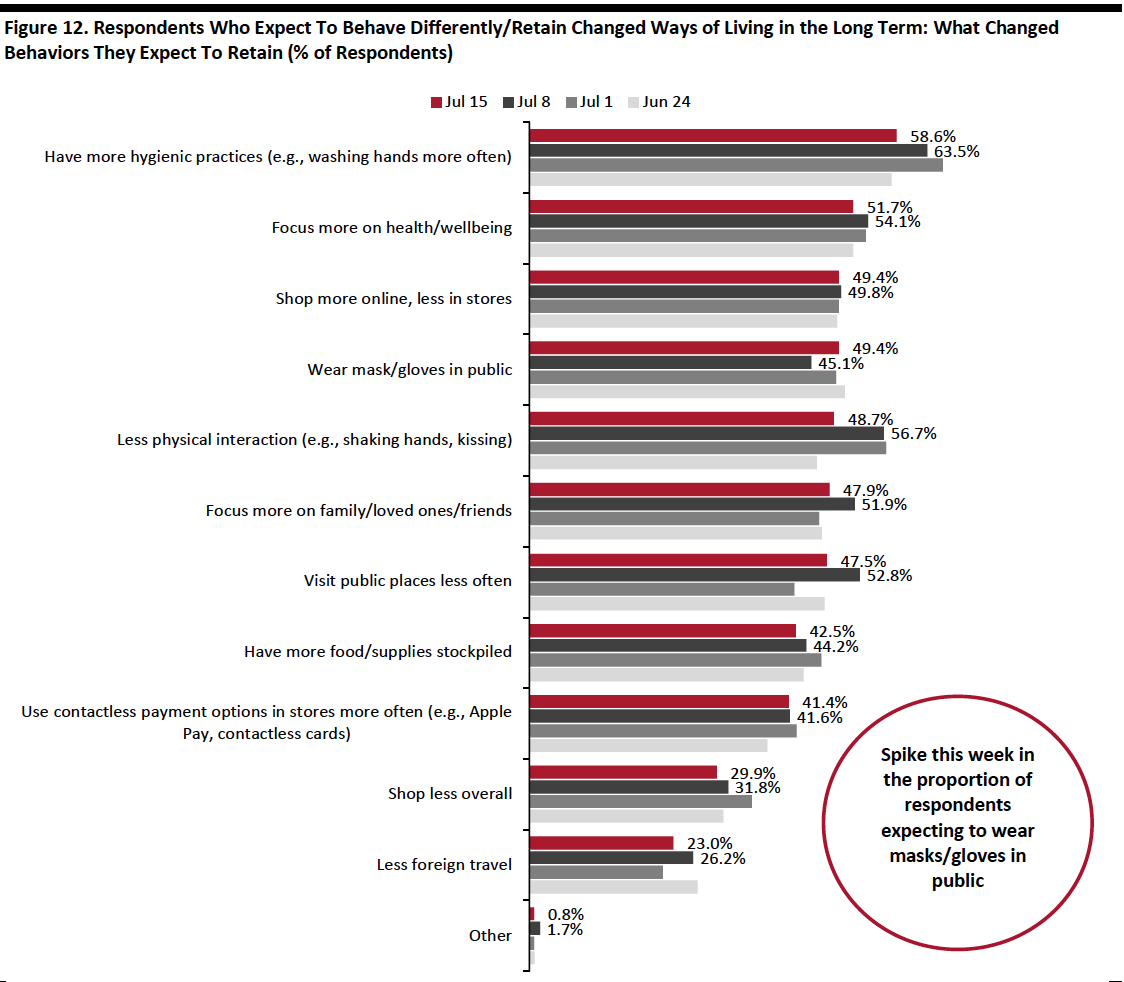

Among those expecting to retain changed behaviors, we noticed declines in the proportion of respondents selecting almost all the behavior options we provided. The proportion of consumers expecting to have less physical interaction in the long term saw the largest drop, down eight percentage points to 48.7% from 56.7% last week.

Wearing masks/gloves in public is the only behavior that experienced an increase in the proportion of respondents this week, with almost half expecting to retain this behavior in the long term.

The proportion of respondents expecting to use contactless payment options in stores more often than they did previously moderated again this week at 41.4%.

[caption id="attachment_113095" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

Source: Coresight Research[/caption]

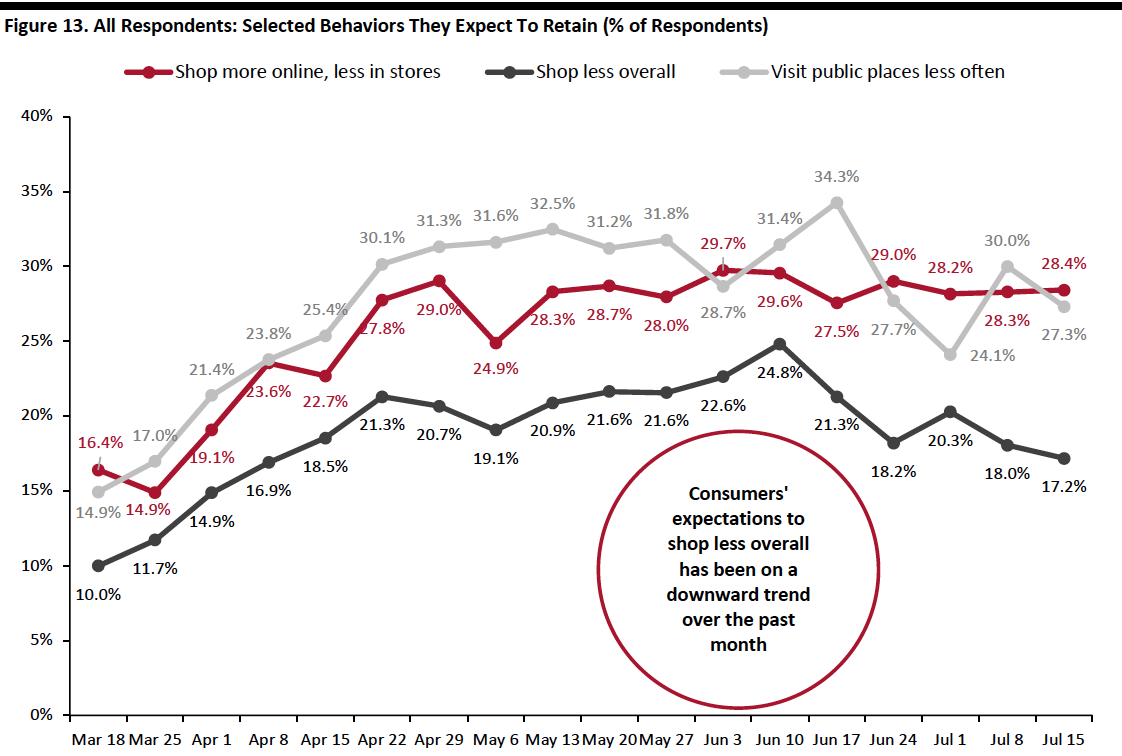

In the chart below, we show trended data in three of the metrics charted above. We represent these as a proportion of all respondents, to represent consumers overall, rather than as a proportion of those expecting to retain changed behaviors (which is what is charted above).

Rebased to all respondents, the proportion who expect to visit public places less often has been volatile over the past few weeks. Some 27.3% expect to do so this week, compared to three in 10 last week.

Representing an encouraging sign for retailers, the proportion of respondents who expect to shop less overall decreased again this week, to 17.2%. This figure was seven percentage points lower than the peak reached one month ago.

The proportion of consumers expecting to shop more online in the long term has plateaued in recent weeks, at around 28%.

[caption id="attachment_113096" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

What We Think

Implications for Brands and Retailers

As our survey suggests that consumers will be shopping early and spending less for the holiday season this year, brands and retailers should rethink their holiday strategies to gain sales during the most crucial time of the year.

- In a likely weak economic environment, we expect brands and retailers to see a highly promotional final quarter, which we expect to be kicked off by Amazon’s Prime Day in October. In this context, mass-market retailers should stand ready to compete with rivals on promotions and price. They can choose to jump on the Prime Day bandwagon by offering deep promotions shortly prior to and during the event. More ambitious retailers could consider creating their own shopping festivals, which could include collaborating on cross-sector events.

- Our survey confirms that shoppers expect to consolidate trips to physical stores to reduce their exposure to public places. This implies that multibrand, multicategory retailers will gain a head start in the holiday season. Mass merchants are likely to see strong demand on the back of this, supported by their price-aggressive positioning. This trend would also offer a little hope to badly hit department stores—these retailers must seize the chance to underscore their proposition to wary shoppers as one-stop holiday-shop destinations.

- Brands and retailers should be prepared to fulfill high volumes of online orders by managing inventories and deliveries efficiently. Contact-light options including in-store and curbside pickup are becoming popular among consumers. Brands and retailers should ensure a smooth and safe pickup experience, while looking to capitalize on incremental sales in the pickup process.

- Finally, safety concerns of in-store shopping are high, and store hygiene is a new factor for consumers in choosing where to shop. Brands and retailers must continue to implement the necessary safety precautions to draw consumers to the store.

Methodology

We surveyed respondents online on July 15 (454 respondents), July 8 (410 respondents), July 1 (444 respondents), June 24 (411 respondents), June 17 (432 respondents), June 10 (423 respondents), June 3 (464 respondents), May 27 (422 respondents), May 20 (439 respondents), May 13 (431 respondents), May 6 (446 respondents), April 29 (479 respondents), April 22 (418 respondents), April 15 (410 respondents), April 8 (450 respondents), April 1 (477 respondents), March 25 (495 respondents) and March 17–18 (1,152 respondents). The most recent results have a margin of error of +/- 5%, with a 95% confidence interval. Not all charted week-over-week differences may be statistically significant.