DIpil Das

We discuss selected findings and compare them to those from prior weeks: April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

This week, we saw mixed messages: Consumers’ expectations of the length of the impact continued to increase. However, we saw a slight decrease in expected avoidance of public places and lower numbers of respondents saying they had cut spending on some discretionary categories.

Life Beyond Lockdown: Three Learnings

1. Slight moderation in expected avoidance of public places after lockdown

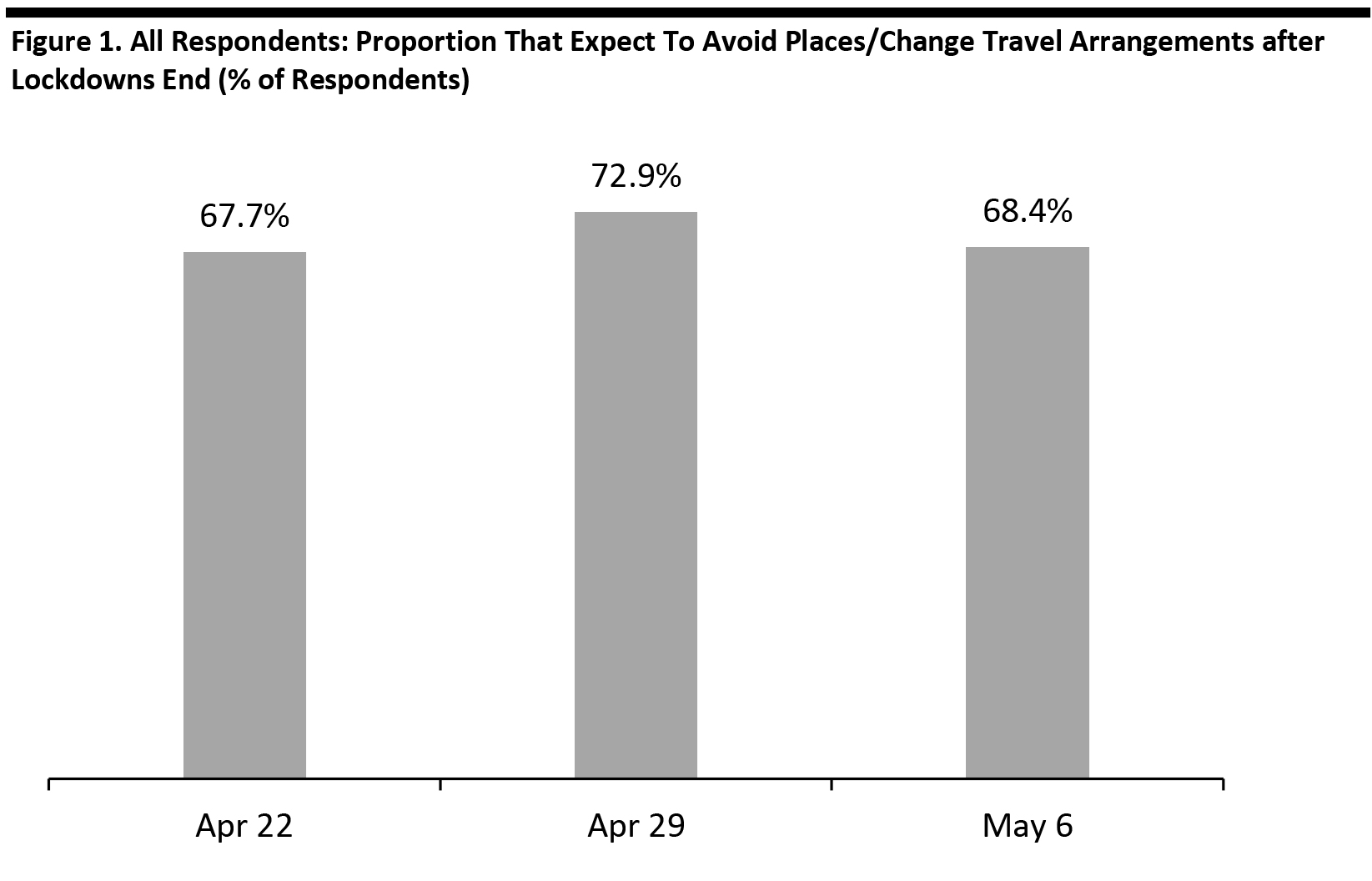

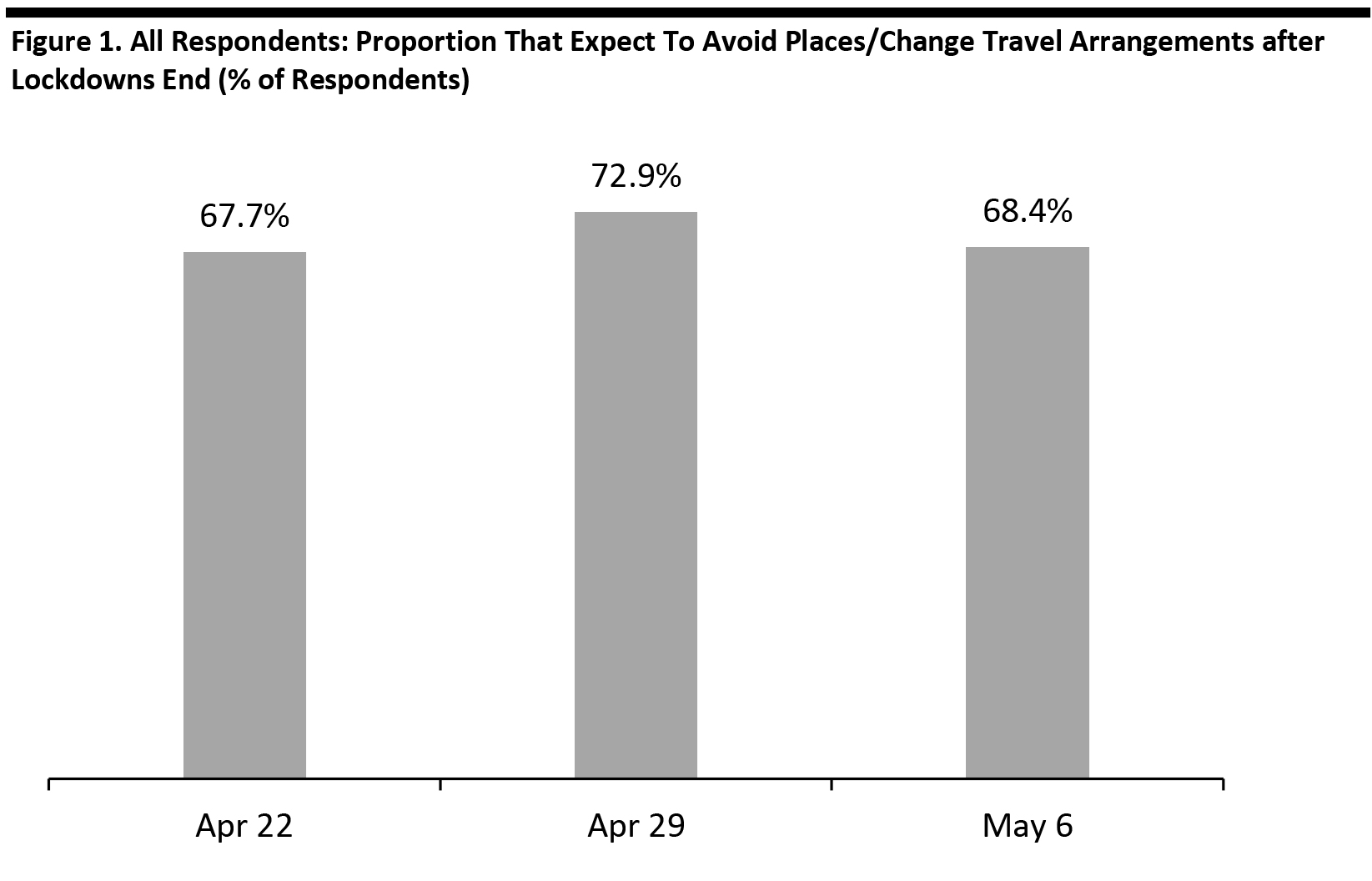

This week, 68.4% of all respondents anticipated avoiding some kind of public places or travel after lockdowns end. This was down from 72.9% last week and took levels back to approximately those of two weeks ago, so it is too early to call this out as a trend.

We saw some moderation in expectations to avoid most types of public spaces this week, including malls/shopping centers and shops in general. One exception was food-service locations, with a further increase in the proportion of respondents expecting to avoid restaurants, bars or coffee shops.

See our full report for details of which types of locations shoppers expect to avoid post lockdown and the week-over-week changes in expected avoidance of public places.

[caption id="attachment_109314" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

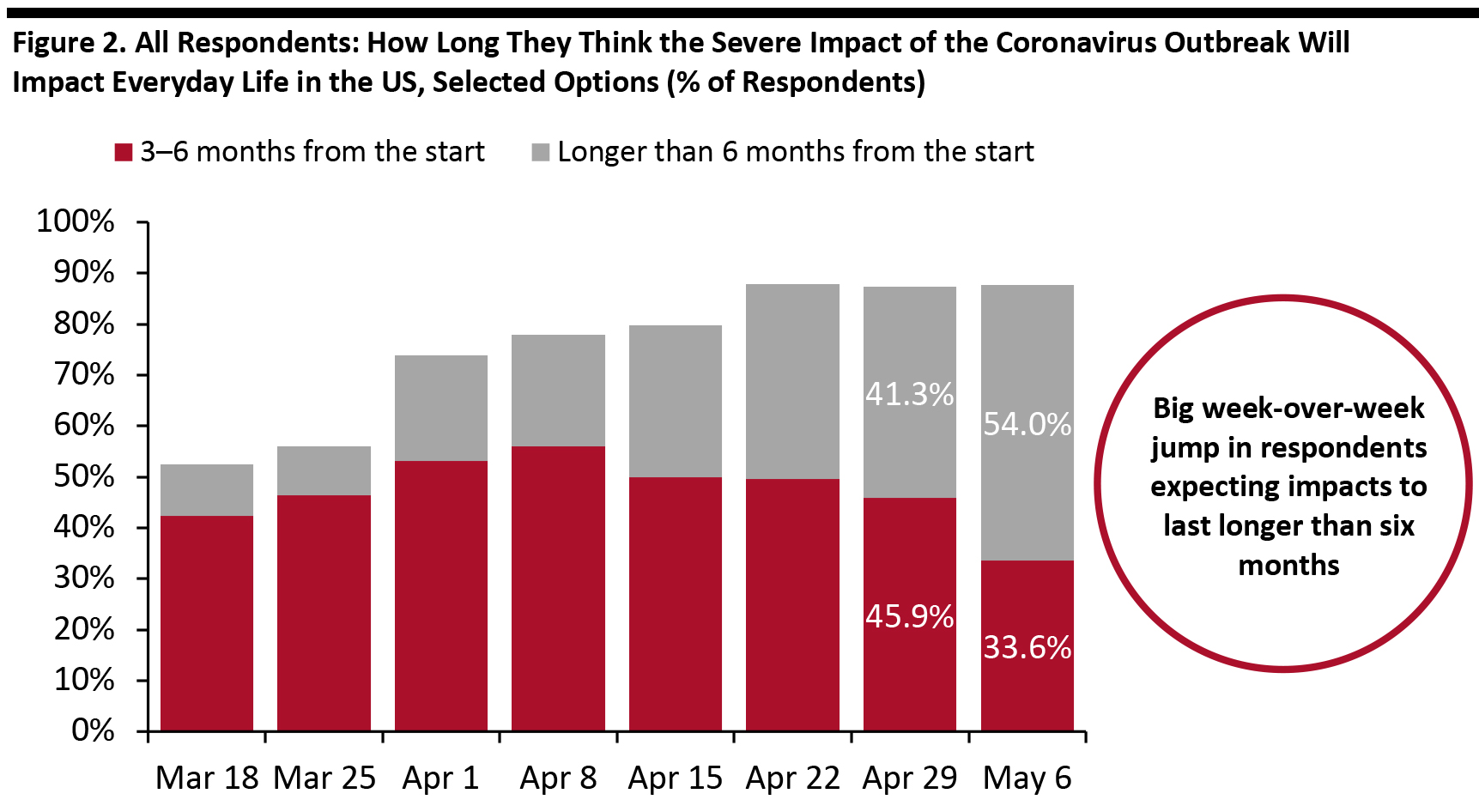

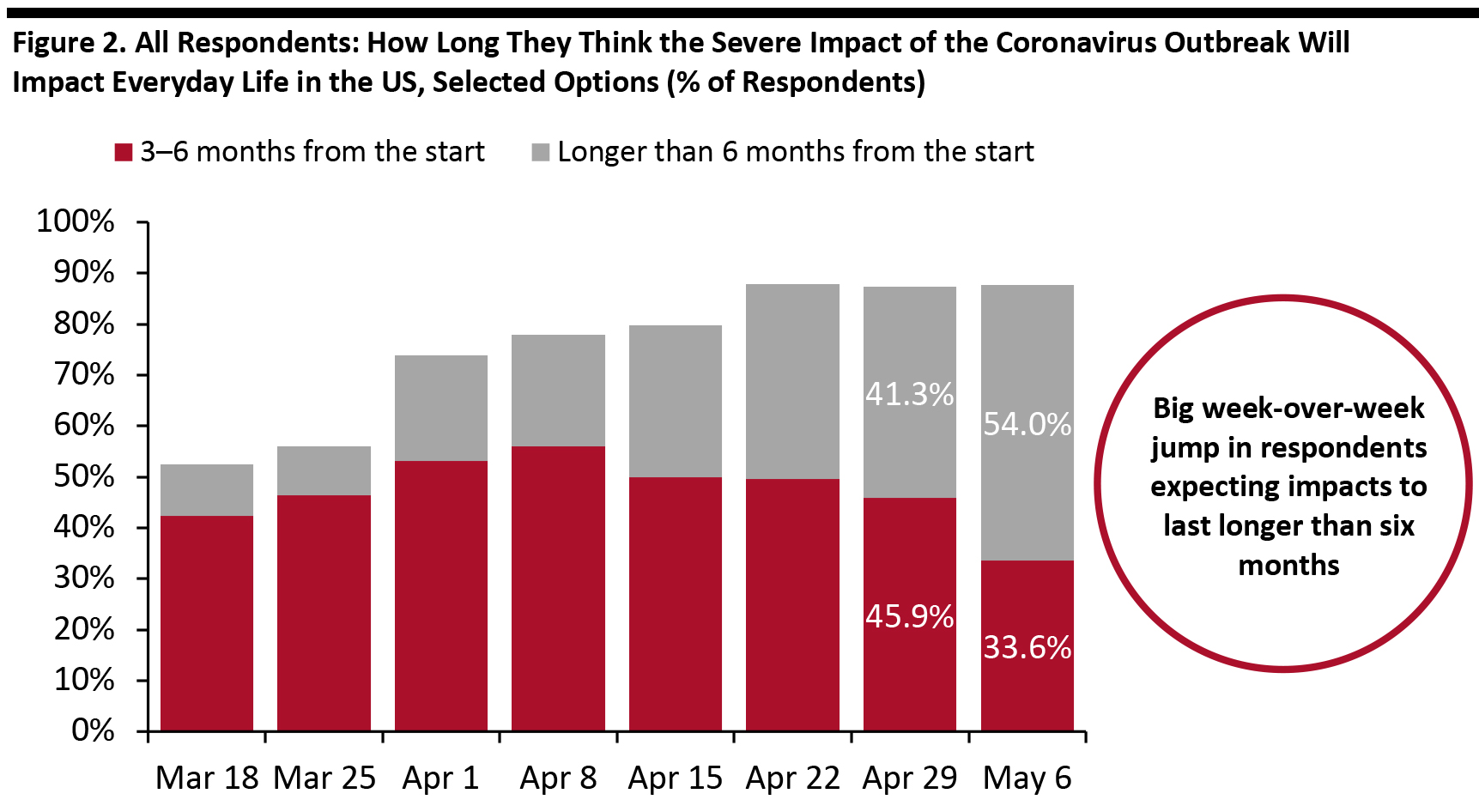

Source: Coresight Research [/caption] 2. Over half of respondents expect the severe impact to last over six months This week, consumers’ expectations of the length of the crisis jumped: Fully 54.0% now expect the severe impact of the outbreak to last more than six months from its start, up sharply from 41.3% last week. This timescale implies a widespread expectation that the severe impacts will run up to the holiday season. Some 87.7% expect the severe impact to last three months or more, broadly level with 87.3% last week. Echoing these expectations, we also saw week-over-week increases in how long respondents anticipate they will avoid public places and how long they expect to retain changed spending behaviors (not charted). [caption id="attachment_109315" align="aligncenter" width="700"] Selected options shown

Selected options shown

Base: US Internet users aged 18+

Source: Coresight Research [/caption] 3. Shifts in purchasing behavior: Improvements for apparel and home categories Each week, we ask respondents whether they are making more purchases or fewer purchases of any categories.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 2. Over half of respondents expect the severe impact to last over six months This week, consumers’ expectations of the length of the crisis jumped: Fully 54.0% now expect the severe impact of the outbreak to last more than six months from its start, up sharply from 41.3% last week. This timescale implies a widespread expectation that the severe impacts will run up to the holiday season. Some 87.7% expect the severe impact to last three months or more, broadly level with 87.3% last week. Echoing these expectations, we also saw week-over-week increases in how long respondents anticipate they will avoid public places and how long they expect to retain changed spending behaviors (not charted). [caption id="attachment_109315" align="aligncenter" width="700"]

Selected options shown

Selected options shown Base: US Internet users aged 18+

Source: Coresight Research [/caption] 3. Shifts in purchasing behavior: Improvements for apparel and home categories Each week, we ask respondents whether they are making more purchases or fewer purchases of any categories.

- Apparel continues to be the number-one category for cutbacks, but this week we saw the proportion of respondents saying they have cut back ease to around 35%, from 41% last week.

- We also saw week-over-week reductions in the number of shoppers cutting purchases of some other discretionary categories, such as furniture and home.

- Around two-thirds of all consumers now report buying more online overall.

- Online shopper numbers for clothing and footwear leveled off this week, following an uptick in our April 29 survey.

- Online, furniture and home-improvement categories saw an upswing in shopper numbers this week, continuing a general upward trend and likely supported by seasonal demand for spring/summer home and outdoor-living products. Some 15.5% of those making more purchases online are buying more furniture, furnishings or home-improvement products online.