DIpil Das

We discuss selected findings and compare them to those from prior weeks: May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

Base: US Internet users aged 18+

Base: US Internet users aged 18+

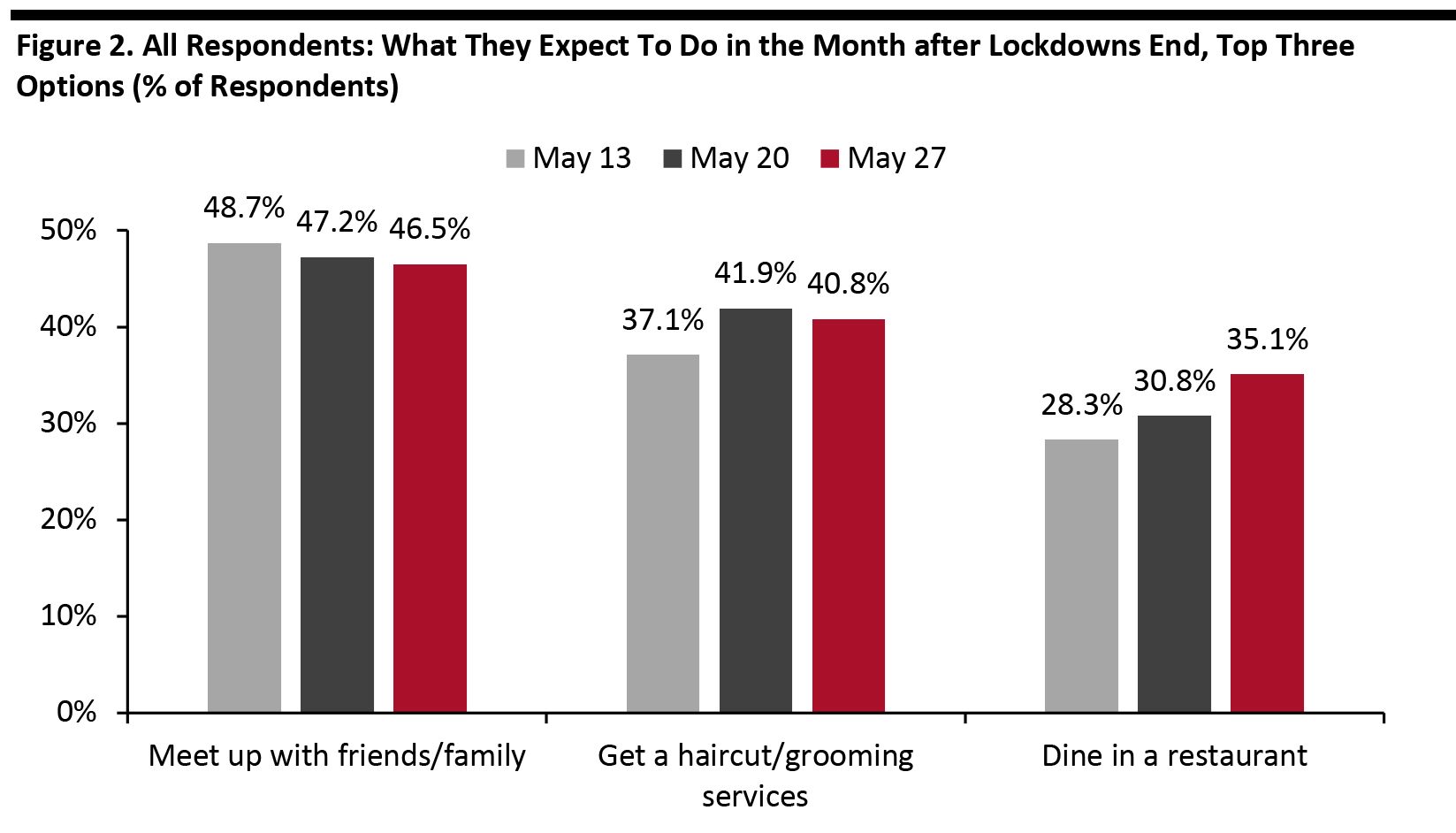

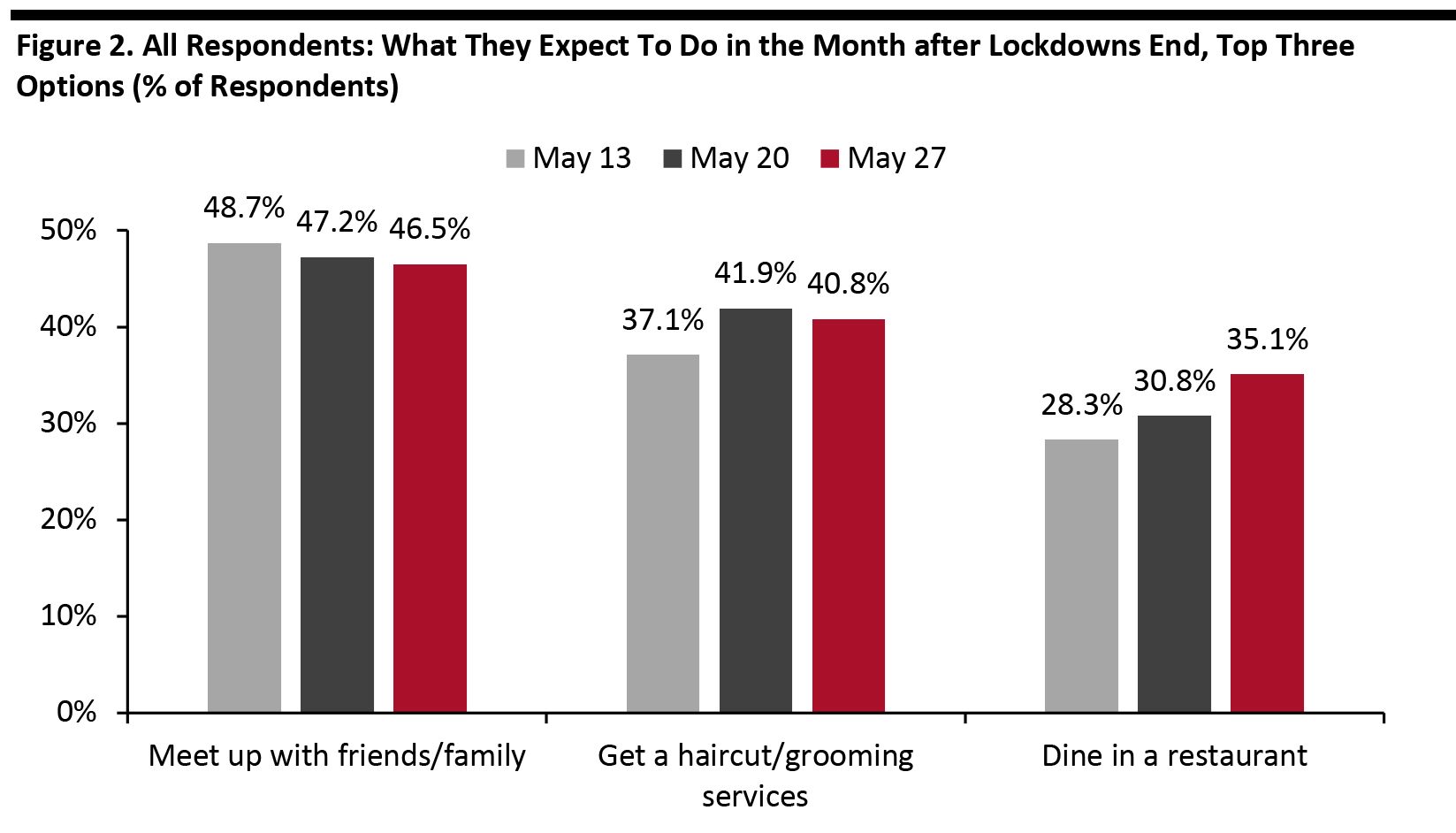

Source: Coresight Research [/caption] 2. Upward Trend for Expectation To Dine in a Restaurant This week, we saw mixed results in respondents expecting to take part in spending-related activities in the month after lockdowns end. We saw an uptick in the proportion of respondents expecting to go to food-service locations, albeit still within the margin of error. More than one-third expect to dine in a restaurant, compared to 30.8% last week, and almost one in five expect to go to a coffee shop, versus one in seven last week. This is aligned with the week-over-week decline in expected avoidance of food-service businesses (not charted below). However, all metrics related to discretionary retail purchases moderated or went down slightly, week over week. The absolute percentages for each activity are still relatively low, despite around 86% overall saying that they would do at least one of these things in the month after lockdowns end. Of all 15 options provided to respondents, almost half saw an uptick from last week, but all were marginal (under five percentage points), suggesting that the post-lockdown recovery will be gradual and sequential. Base: US Internet users aged 18+

Base: US Internet users aged 18+

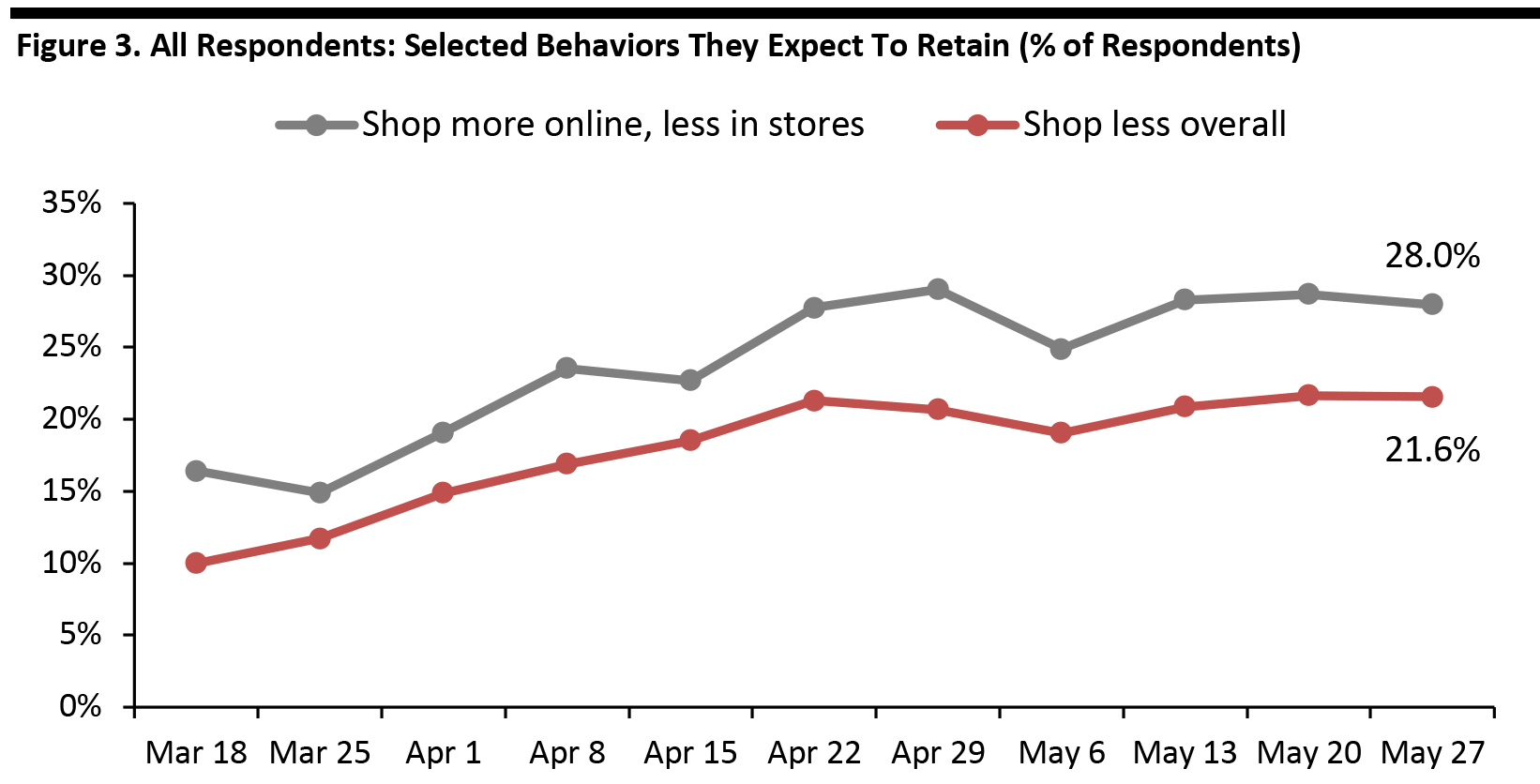

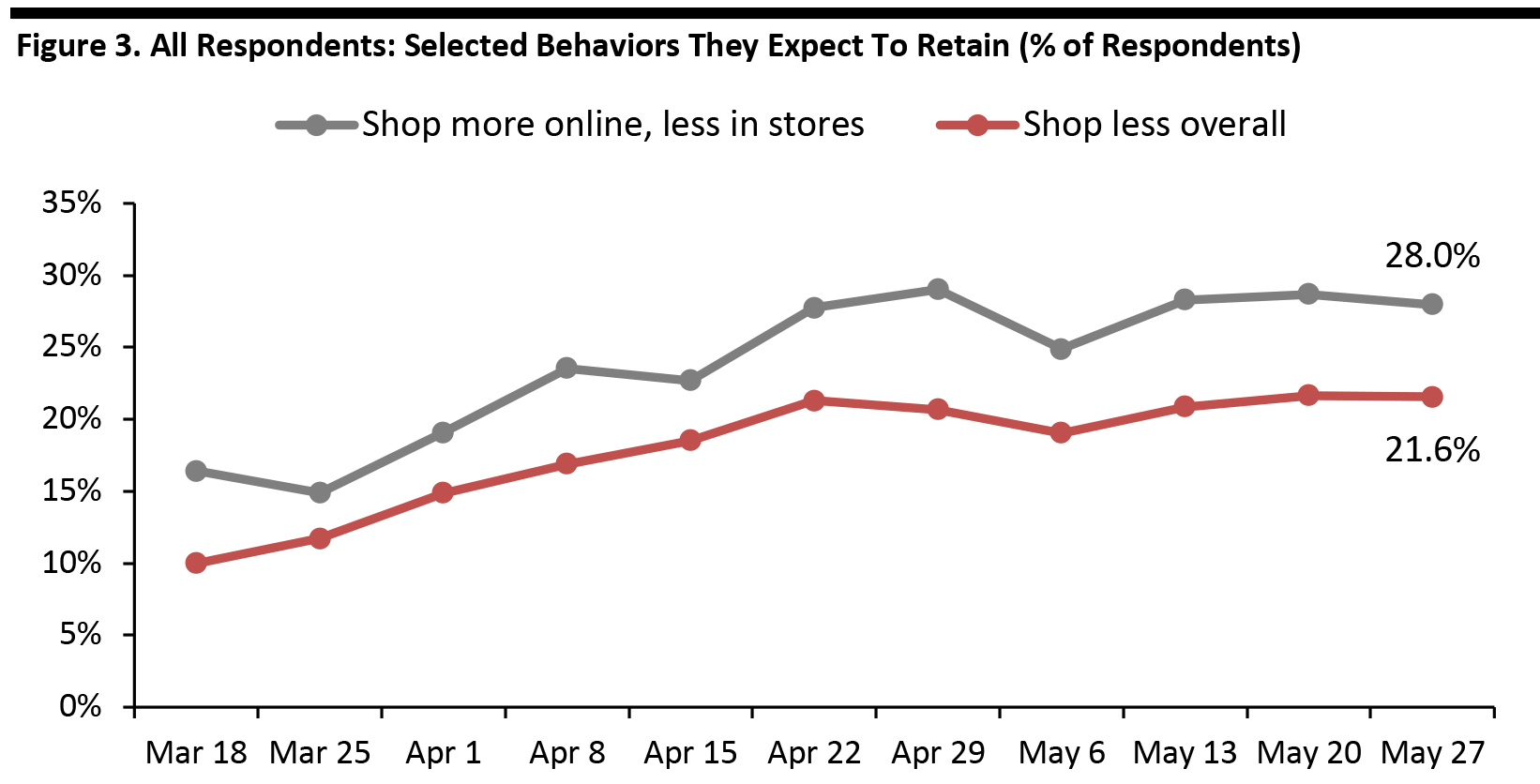

Source: Coresight Research [/caption] 3. Shoppers Are Realizing that Their Post-Crisis Behaviors Will Be Different Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. Consistently, two-thirds of respondents expect to keep some behaviors over the long term. Around 36% of all respondents expect to have less physical interaction and a little less than one-third of all respondents expect to visit public spaces less often, suggesting that consumers are becoming increasingly aware that social distancing will be necessary. In prior weeks, we have seen upward trends in expectations of changed shopping habits, although these metrics have leveled off in the past couple of weeks: Base: US Internet users aged 18+

Base: US Internet users aged 18+

Source: Coresight Research [/caption]

Life Beyond Lockdown: Three Learnings

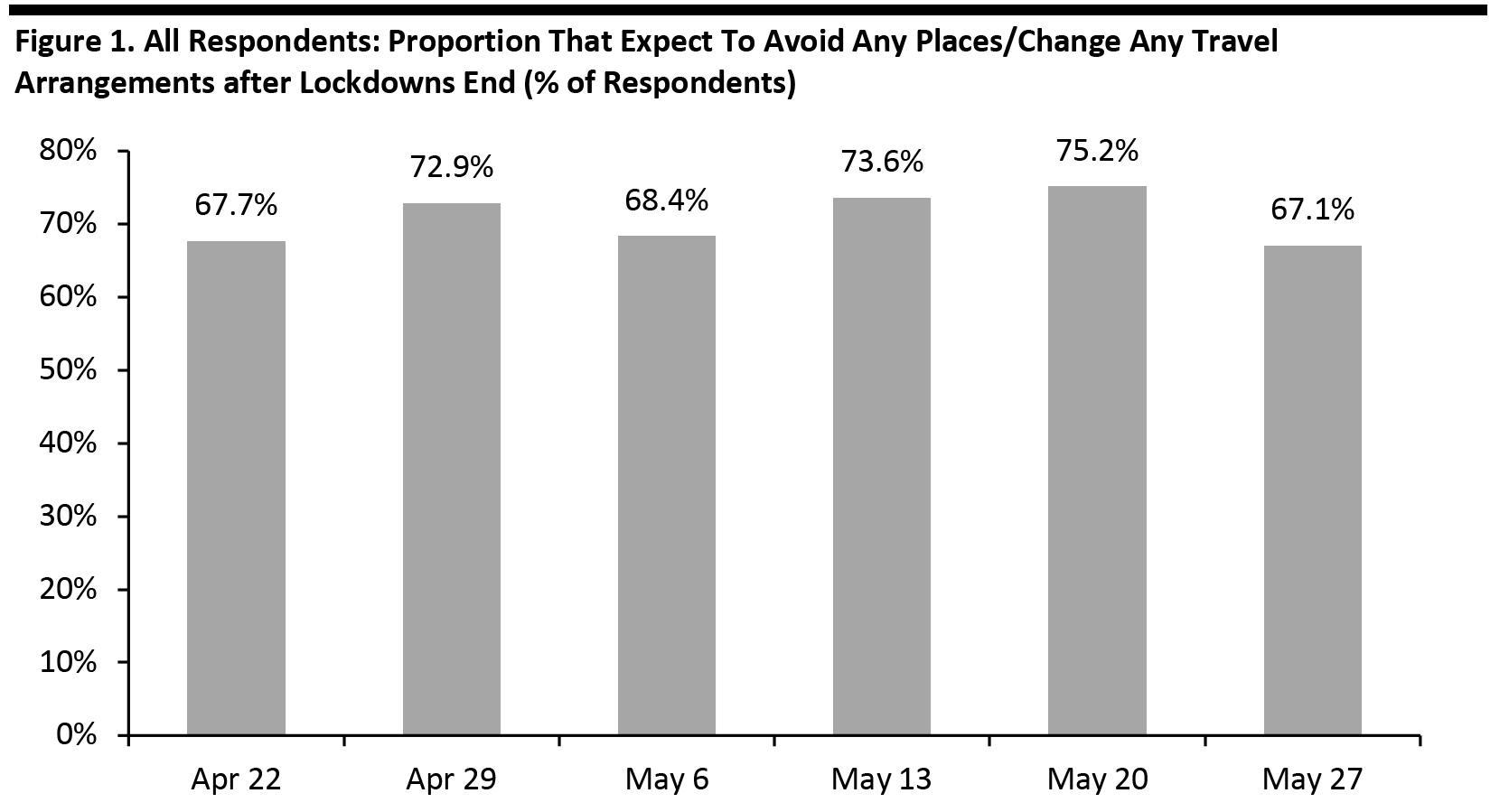

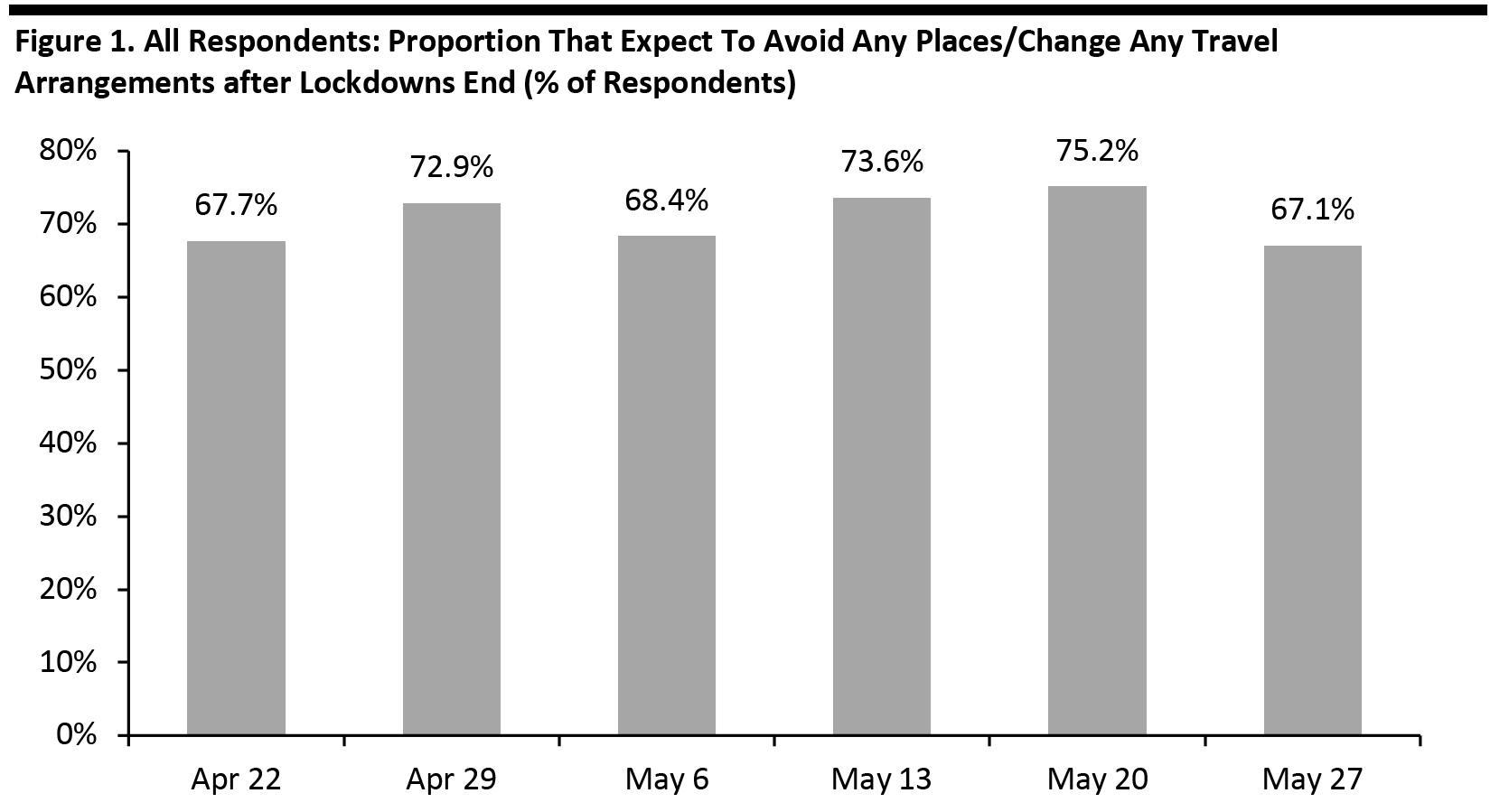

1. Consumers’ Concerns about Returning to Public Places Ease This week, 67.1% of all respondents anticipated avoiding some kind of public place or travel after lockdowns end. This compares to 75.2% last week and is the lowest proportion of respondents since we started asking the question. The notable change this week was in expected avoidance of movie theaters, which saw a decrease of almost eight percentage points. Restaurants/bars/coffee shops saw a week-over-week reduction of 7.5 percentage points. In a positive incremental change for retailers, shopping centers/malls saw a six-percentage-point decrease week over week. Less than half of all consumers now expect to avoid shopping centers/malls. In a further tentative sign of greater consumer optimism, we saw a slight week-over-week decline in how long respondents anticipate avoiding public places or changing travel arrangements. [caption id="attachment_110456" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 2. Upward Trend for Expectation To Dine in a Restaurant This week, we saw mixed results in respondents expecting to take part in spending-related activities in the month after lockdowns end. We saw an uptick in the proportion of respondents expecting to go to food-service locations, albeit still within the margin of error. More than one-third expect to dine in a restaurant, compared to 30.8% last week, and almost one in five expect to go to a coffee shop, versus one in seven last week. This is aligned with the week-over-week decline in expected avoidance of food-service businesses (not charted below). However, all metrics related to discretionary retail purchases moderated or went down slightly, week over week. The absolute percentages for each activity are still relatively low, despite around 86% overall saying that they would do at least one of these things in the month after lockdowns end. Of all 15 options provided to respondents, almost half saw an uptick from last week, but all were marginal (under five percentage points), suggesting that the post-lockdown recovery will be gradual and sequential.

- See our full report for a complete ranking of what consumers expect to do post lockdowns.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 3. Shoppers Are Realizing that Their Post-Crisis Behaviors Will Be Different Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. Consistently, two-thirds of respondents expect to keep some behaviors over the long term. Around 36% of all respondents expect to have less physical interaction and a little less than one-third of all respondents expect to visit public spaces less often, suggesting that consumers are becoming increasingly aware that social distancing will be necessary. In prior weeks, we have seen upward trends in expectations of changed shopping habits, although these metrics have leveled off in the past couple of weeks:

- Almost three in 10 of all respondents now expect to switch retail purchases from stores to e-commerce.

- A little over one-fifth of all respondents expect to shop less overall once the outbreak ends.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]